Best Ford Escape Auto Insurance in 2025 (Find the Top 10 Companies Here)

The best Ford Escape auto insurance comes from Progressive, State Farm, and Allstate, with rates starting at $80 per month. These companies are top picks for their pricing and reliable service. This article discusses the average insurance cost for Ford Escape, helping you find affordable coverage options.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Ford Escape

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Ford Escape

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews

Company Facts

Full Coverage for Ford Escape

A.M. Best Rating

Complaint Level

Pros & Cons

The best Ford Escape auto insurance providers are Progressive, State Farm, and Allstate, with rates starting at $80 per month. These companies deliver competitive pricing and outstanding service, making them top choices for Ford Escape car insurance. Selecting the right insurer can lead to substantial savings and peace of mind.

This article also covers factors affecting Ford Escape car insurance costs, such as the driver location, auto insurance rates by age and safety ratings.

Our Top 10 Company Picks: Best Ford Escape Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 12% A+ Tech-Savvy Drivers Progressive

#2 17% B Comprehensive Coverage State Farm

#3 10% A+ Personalized Service Allstate

#4 25% A++ Online Resources Geico

#5 20% A+ Safe-Driver Rewards Nationwide

#6 10% A+ Local Support Farmers

#7 5% A Customizable Policies Liberty Mutual

#8 10% A Customer Service American Family

#9 8% A++ Competitive Rates Travelers

#10 10% A Affordable Rates The General

Understanding these elements, including the average insurance cost for Ford Escape, helps owners choose the most affordable and suitable coverage options for their needs. Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- Ford Escape receives high crash test ratings, boosting safety

- Discounts for safety features can help reduce costs for Ford Escape owners

- Progressive is the top pick for competitive pricing and service

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Competitive Pricing: Progressive offers one of the lowest rates at $150 per month for Ford Escape insurance, making it an attractive option for budget-conscious drivers seeking comprehensive coverage. (Read More: Progressive Auto Insurance Discounts).

- Tech-Savvy Discounts: With features like Snapshot, Progressive rewards safe driving behavior, potentially lowering your Ford Escape insurance costs even further based on real-time driving data.

- Flexible Coverage Options: Progressive provides customizable policy options, allowing Ford Escape owners to tailor their coverage to include essential protections such as roadside assistance and rental car reimbursement.

Cons

- Customer Service Challenges: Some customers report slower response times and difficulties with claims processing, which could impact peace of mind for Ford Escape drivers after an accident.

- Limited Local Agents: While Progressive excels online, it may lack a strong local agent presence, making personalized service less accessible for Ford Escape owners who prefer face-to-face interactions.

#2 – State Farm: Best for Comprehensive Coverage

Pros

- Robust Mobile App: State Farm’s mobile app offers easy access to policy management and claims filing, making it convenient for Ford Escape owners to handle their insurance on the go.

- Multi-Policy Discounts: By bundling your Ford Escape insurance with home or other policies, you can benefit from significant discounts, enhancing overall affordability without sacrificing coverage quality. For discounts read our State Farm auto insurance discounts.

- Comprehensive Coverage Options: State Farm offers a range of coverages including collision, liability, and comprehensive, ensuring that Ford Escape drivers can fully protect their vehicle against various risks.

Cons

- Higher Premiums: While State Farm provides excellent service, the monthly premium of $160 may be higher than some competitors, which could be a deciding factor for cost-sensitive Ford Escape owners.

- Complex Quote Process: Some users find the quote process complicated, which might deter potential customers looking for a straightforward insurance experience for their Ford Escape.

#3 – Allstate: Best for Personalized Service

Pros

- Personalized Service: Allstate is known for its dedicated agents who provide tailored insurance solutions, ensuring that Ford Escape drivers can easily understand their coverage needs and options.

- Unique Discounts: Allstate offers various discounts such as the Drivewise program, rewarding Ford Escape owners for safe driving habits, which can significantly lower overall insurance costs.

- Comprehensive Claims Support: Allstate has a reputation for robust claims support, giving Ford Escape owners confidence that they will receive help promptly after an accident. Learn more about their Grants in our Allstate auto insurance review.

Cons

- Higher Average Rates: At $165 per month, Allstate’s insurance rates may not be the most competitive for Ford Escape drivers seeking budget-friendly options.

- Limited Coverage Options in Some Areas: Depending on your location, certain Allstate coverage options may not be available, which can restrict customization for Ford Escape insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Geico: Best for Online Resources

Pros

- Lowest Monthly Premium: As mentioned in our Geico auto insurance review, Geico offers the lowest rate at $148 per month for Ford Escape insurance, making it an ideal choice for budget-conscious drivers who still want solid coverage.

- User-Friendly Digital Tools: Geico’s mobile app and website provide easy access to policy management and claims filing, which is especially convenient for Ford Escape owners who prefer online interactions.

- Strong Financial Ratings: Geico boasts excellent financial strength ratings, ensuring that Ford Escape drivers can trust the company to handle claims and pay out when needed.

Cons

- Limited Local Agent Support: Geico primarily operates online, which might not appeal to Ford Escape drivers who prefer the reassurance of face-to-face service from local agents.

- Fewer Discount Options: Compared to some competitors, Geico offers fewer discounts, which may limit potential savings for Ford Escape drivers who are looking to lower their insurance costs.

#5 – Nationwide: Best for Safe-Driver Rewards

Pros

- Diverse Coverage Options: Nationwide provides a variety of coverage options tailored for Ford Escape owners, including comprehensive, collision, and liability, ensuring broad protection against various risks.

- Strong Customer Satisfaction Ratings: With positive feedback from customers regarding claims processing and support, Ford Escape drivers can feel assured that their insurance needs will be met effectively.

- Multi-Policy Discounts: In our Nationwide auto insurance review, Nationwide encourages bundling policies, allowing Ford Escape owners to save money by combining their auto insurance with homeowners or renters insurance.

Cons

- Average Pricing: At $155, Nationwide’s rates may not be the lowest available, which could be a drawback for Ford Escape drivers focused on minimizing their insurance expenses.

- Limited Availability in Some States: Depending on your location, Nationwide may have restrictions on certain coverage options, which can limit choices for Ford Escape owners.

#6 – Farmers: Best for Local Support

Pros

- Local Agent Support: Farmers provides access to local agents who can offer personalized advice and assistance, beneficial for Ford Escape drivers needing tailored insurance solutions. Check out this page Farmers auto insurance review to know more details.

- Comprehensive Coverage Packages: Farmers offers extensive coverage packages for Ford Escape owners, including options like roadside assistance and rental car coverage, enhancing overall protection.

- Strong Community Presence: Farmers is known for its community involvement, which can appeal to Ford Escape drivers who value local engagement and support in their insurance choices.

Cons

- Higher Average Rates: With a premium of $158, Farmers’ rates may be above the market average, which could deter budget-conscious Ford Escape owners from choosing this provider.

- Complex Policy Structure: Some customers find Farmers’ policies complex, making it challenging to fully understand coverage specifics, potentially leading to gaps in understanding for Ford Escape insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Insurance Options: Liberty Mutual offers extensive customization options for Ford Escape insurance, allowing owners to tailor coverage to their unique needs and driving habits.

- Accident Forgiveness Program: For policyholders who maintain a clean driving record, Liberty Mutual’s accident forgiveness can prevent premium increases after a first accident, which is beneficial for Ford Escape drivers.

- Strong Customer Service: In our Liberty Mutual auto insurance review, Liberty Mutual has a reputation for good customer service, providing Ford Escape owners with reliable support throughout the insurance process.

Cons

- Higher Premium Costs: At $170 per month, Liberty Mutual is one of the more expensive options for Ford Escape insurance, which may not appeal to budget-focused consumers.

- Limited Discounts: Compared to competitors, Liberty Mutual may offer fewer discount opportunities, limiting potential savings for Ford Escape owners looking to reduce their insurance expenses.

#8 – American Family: Best for Customer Service

Pros

- Flexible Coverage Options: American Family provides a wide range of coverage options tailored for Ford Escape owners, ensuring comprehensive protection against accidents, theft, and damages.

- Strong Discount Program: American Family auto insurance review highlights the variety of discounts available, including safe driver and bundling discounts, Ford Escape drivers can reduce their premiums significantly.

- Excellent Customer Support: American Family is known for responsive customer service, ensuring that Ford Escape owners receive assistance quickly when they have questions or need to file a claim.

Cons

- Average Premiums: While competitive, American Family’s average rate of $152 may not be the lowest available, which could be a consideration for cost-conscious Ford Escape drivers.

- Limited Availability in Some Regions: Depending on where you live, certain coverage options or discounts may not be available, which could limit choices for Ford Escape insurance.

#9 – Travelers: Best for Competitive Rates

Pros

- Robust Coverage Options: Travelers offers comprehensive policies that cover a range of incidents, making it suitable for Ford Escape owners seeking thorough protection against accidents and theft.

- Strong Online Tools: Travelers provides an efficient online platform for managing policies and filing claims, making it easy for Ford Escape drivers to access their insurance information conveniently.

- Competitive Discounts: As outlined in our Travelers auto insurance review, Travelers has various discount options available, including multi-policy discounts, which can significantly reduce costs for Ford Escape owners who bundle their insurance.

Cons

- Higher Average Premium: At $157, Travelers’ rates may not be the most competitive in the market, which might deter some Ford Escape owners looking for more budget-friendly options.

- Mixed Customer Service Reviews: While some customers report positive experiences, others have noted inconsistencies in claims handling, which could impact trust for Ford Escape drivers during critical times.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – The General: Best for Affordable Rates

Pros

- Affordable Premiums: As mentioned in our The General auto insurance review, The General offers competitive rates, with an average premium of $165 for Ford Escape insurance, making it a viable option for drivers looking for cost-effective coverage.

- Specializes in High-Risk Drivers: The General caters to drivers with less-than-perfect records, making it a good choice for Ford Escape owners who may have past incidents affecting their insurance rates.

- Flexible Payment Plans: With various payment plan options available, The General allows Ford Escape drivers to manage their premiums conveniently according to their budget.

Cons

- Limited Coverage Options: The General may not offer as extensive a range of coverage options compared to larger insurers, which could leave some Ford Escape drivers wanting more comprehensive protection.

- Mixed Customer Satisfaction: Customer reviews are varied, with some expressing dissatisfaction with claims processing speed and customer service quality, which might be concerning for Ford Escape owners needing reliable support.

Ford Escape Insurance Cost

Insuring a Ford Escape typically costs around $1,170 annually, which breaks down to about $98 monthly. This cost can vary based on the provider and coverage options selected.

The table below compares monthly rates for minimum and full coverage car insurance for a Ford Escape from various providers.

Ford Escape Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $88 $165

American Family $82 $152

Farmers $86 $158

Geico $78 $148

Liberty Mutual $90 $170

Nationwide $83 $155

Progressive $80 $150

State Farm $85 $160

The General $89 $165

Travelers $87 $157

By comparing rates from various insurers, Ford Escape owners can find the most suitable coverage for their needs. This careful selection helps ensure both financial protection and peace of mind.

Read More: How to Compare Auto Insurance

Comparing Ford Escape Insurance Rates to Other Crossovers

The chart below details how Ford Escape insurance rates compare to other crossovers like the Hyundai Kona, Subaru Crosstrek, and FIAT 500X.

Ford Escape Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Ford Escape | $23 | $37 | $26 | $98 |

| Hyundai Kona | $23 | $42 | $26 | $103 |

| Subaru Crosstrek | $27 | $43 | $28 | $108 |

| FIAT 500X | $21 | $42 | $38 | $116 |

| Kia Sportage | $23 | $39 | $31 | $107 |

| Lincoln MKX | $25 | $50 | $33 | $121 |

| Ford EcoSport | $23 | $42 | $31 | $109 |

By comparing insurance rates across various crossover models, you can identify the most affordable options for your Ford Escape. Exploring online quotes and discounts can further help you secure the best insurance rates available.

Read More: Fiat Auto Insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Impacting the Cost of Ford Escape Insurance

The trim and model of your Ford Escape play a significant role in determining your insurance premium. Newer models or higher trims often come with advanced safety features, which can lower rates, while more expensive models may result in higher coverage costs due to their increased value.

Additionally, factors that affect auto insurance rates such as your driving history, location, and coverage level further influence the overall cost of insurance, making it essential to evaluate these aspects when selecting your policy.

Age of the Vehicle

The average Ford Escape auto insurance rates are higher for newer models. For example, auto insurance for a 2020 Ford Escape costs $97, while 2010 Ford Escape insurance costs are $80, a difference of $206.

Ford Escape Auto Insurance Monthly Rates by Year & Coverage Type

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Ford Escape | $23 | $37 | $26 | $98 |

| 2023 Ford Escape | $22 | $35 | $28 | $97 |

| 2022 Ford Escape | $21 | $35 | $28 | $96 |

| 2021 Ford Escape | $21 | $34 | $30 | $96 |

| 2020 Ford Escape | $20 | $33 | $30 | $94 |

| 2019 Ford Escape | $19 | $32 | $31 | $93 |

| 2018 Ford Escape | $18 | $29 | $32 | $91 |

| 2017 Ford Escape | $17 | $28 | $32 | $89 |

| 2016 Ford Escape | $17 | $25 | $33 | $85 |

Newer Ford Escape models tend to have higher insurance premiums due to their increased value and advanced features. Understanding these costs can help owners make informed decisions when selecting their insurance coverage

Driver Age

Driver age can have a significant effect on Ford Escape auto insurance rates. For example, 20-year-old drivers pay $119 more for their Ford Escape auto insurance each year than 30-year-old drivers.

Ford Escape Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 18 | $320 |

| Age: 20 | $280 |

| Age: 30 | $160 |

| Age: 40 | $140 |

| Age: 50 | $130 |

| Age: 60 | $120 |

Younger drivers, especially teens and those in their twenties, face significantly higher insurance rates for their Ford Escape. This highlights the importance of considering driver age when budgeting for auto insurance costs.

Driver Location

Where you live can have a large impact on Ford Escape insurance rates. For example, drivers in Los Angeles may pay $14 more than drivers in Houston.

Ford Escape Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $200 |

| Columbus, OH | $180 |

| Houston, TX | $220 |

| Indianapolis, IN | $190 |

| Jacksonville, FL | $210 |

| Los Angeles, CA | $260 |

| New York, NY | $270 |

| Philadelphia, PA | $230 |

| Phoenix, AZ | $200 |

| Seattle, WA | $195 |

The location of Ford Escape owners plays a crucial role in determining insurance rates, with significant variations observed between cities. Understanding these differences can help drivers make more informed choices when selecting their insurance provider.

Your Driving Record

Your driving record can have an impact on the cost of Ford Escape auto insurance. Teens and drivers in their 20’s see the highest jump in their Ford Escape auto insurance rates with violations on their driving record.

Ford Escape Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 18 | $320 | $400 | $480 | $370 |

| Age: 20 | $280 | $350 | $420 | $330 |

| Age: 30 | $160 | $200 | $240 | $185 |

| Age: 40 | $140 | $175 | $210 | $160 |

| Age: 50 | $130 | $160 | $190 | $150 |

| Age: 60 | $120 | $150 | $180 | $140 |

Maintaining a clean driving record is essential for minimizing insurance costs on your Ford Escape. Drivers, particularly younger ones, should be aware that violations can lead to significantly higher premiums.

Read More: Do I have to declare speeding points on my insurance?

Safety Ratings

The Ford Escape’s safety ratings will affect your Ford Escape auto insurance rates. See the chart below:

Ford Escape Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Ford Escape’s strong safety ratings contribute positively to insurance premiums, often resulting in lower costs for drivers. Investing in a vehicle with high safety standards can lead to both enhanced protection and financial savings on insurance.

Crash Test Ratings

The Ford Escape’s crash test ratings play a crucial role in determining auto insurance costs, reflecting the vehicle’s safety performance. See Ford Escape crash test results below:

Ford Escape Crash Test Ratings

| Vehicle | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Ford Escape | 5 stars | 5 stars | 5 stars | 4 stars |

| 2023 Ford Escape | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Ford Escape | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Ford Escape | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Ford Escape | 5 stars | 5 stars | 5 stars | 4 stars |

With consistently high ratings across various models, the Ford Escape offers both security and potential savings on insurance premiums. This makes it a smart choice for safety-conscious drivers looking to lower their insurance expenses.

Ford Escape Safety Features

Having a variety of safety features on your Ford Escape can help lower your Ford Escape insurance costs. The Ford Escape’s safety features include:

- The Ford Escape includes a comprehensive airbag system with driver, passenger, front head, rear head, and front side airbags for optimal protection.

- It is equipped with 4-wheel ABS, brake assist, electronic stability control, and traction control for enhanced safety and stability.

- Daytime running lights and a blind spot monitor improve visibility and safety on the road.

- Lane departure warning, lane keeping assist, and cross-traffic alert provide additional driver assistance.

- Child safety locks are included to ensure the safety of young passengers.

The robust safety features of the Ford Escape not only enhance driver and passenger protection but can also contribute to lower insurance premiums. Investing in a vehicle with advanced safety technology is a smart choice for both safety and financial savings.

Loss Probability

The Ford Escape’s insurance loss probability varies for each form of coverage. The lower percentage means lower Ford Escape auto insurance rates; higher percentages mean higher Ford Escape auto insurance rates.

Ford Escape Auto Insurance Loss Probability

| Coverage | Loss |

|---|---|

| Collision | -20% |

| Property Damage | -9% |

| Comprehensive | -17% |

| Personal Injury | -6% |

| Medical Payment | -6% |

| Bodily Injury | -8% |

Understanding the loss probability associated with different coverage types can help Ford Escape owners make informed decisions about their insurance. Lower loss rates typically lead to reduced premiums, making it beneficial to choose wisely.

Ford Escape Finance and Insurance Cost

When financing a Ford Escape, lenders often mandate higher levels of coverage, such as comprehensive and collision insurance, to protect their investment. This requirement ensures that the vehicle is fully covered in case of theft, damage, or accidents.

It’s crucial to shop around for the best auto insurance rates, as premiums can vary significantly between providers.Travis Thompson LICENSED INSURANCE AGENT

Utilizing online comparison tools can help you find competitive rates tailored to your specific needs, ultimately saving you money while meeting your financing obligations.

Read More: 10 Best Companies for Bundling Home and Auto Insurance

Be sure to consider discounts for features like safety technologies and bundling options with other insurance policies to enhance savings.

Ways to Save on Ford Escape Insurance

There are many ways that you can save on Ford Escape auto insurance to get the best value possible. Below are five scenarios you can explore to help keep your Ford Escape auto insurance rates low.

- Make sure you’re raising a safe driver

- Pay your Ford Escape insurance rates upfront

- Compare Ford Escape insurance rates online

- Compare Ford Escape insurance rates for free online

- Apply for your full, unrestricted license as soon as you’re eligible

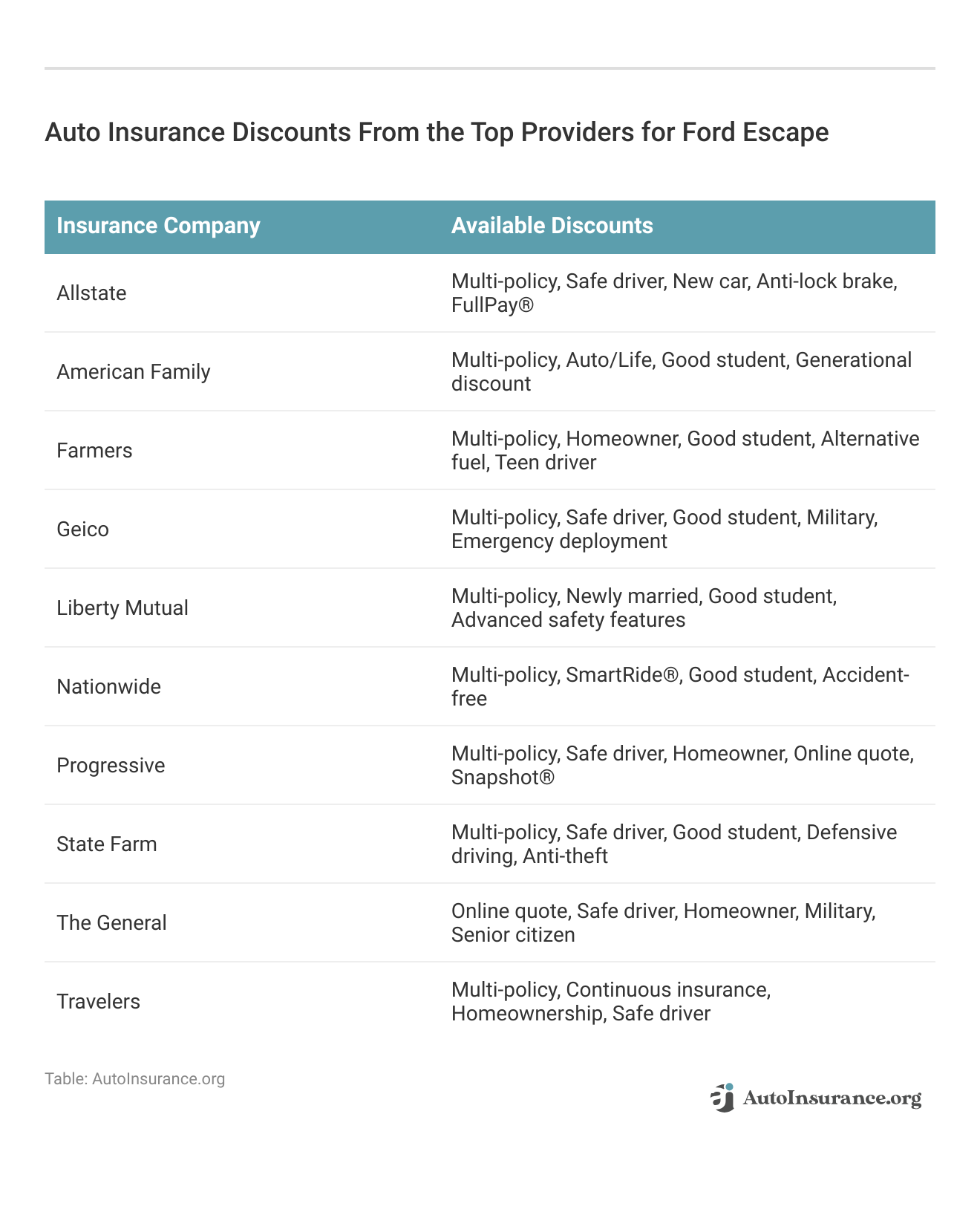

Discover the variety of car insurance discounts offered by top providers for Ford Escape to help you save on your premiums.

These discounts from top insurance providers for Ford Escape offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Ford Escape Insurance Companies

Several top auto insurance companies offer competitive rates for the Ford Escape rates based on factors like discounts for safety features. Take a look at this list of top auto insurance companies that are popular with Ford Escape drivers organized by market share.

Top 10 Ford Escape Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65,615,190 | 9.30% |

| #2 | Geico | $46,106,971 | 6.60% |

| #3 | Progressive | $39,222,879 | 5.60% |

| #4 | Liberty Mutual | $35,600,051 | 5.10% |

| #5 | Allstate | $35,025,903 | 5.00% |

| #6 | Travelers | $28,016,966 | 4.00% |

| #7 | USAA | $23,483,080 | 3.30% |

| #8 | Chubb | $23,388,385 | 3.30% |

| #9 | Farmers | $20,643,559 | 2.90% |

| #10 | Nationwide | $18,442,145 | 2.60% |

When selecting insurance for your Ford Escape, it’s beneficial to compare quotes from these leading providers to find the best rates and coverage options.

Read More: Chubb Auto Insurance Review

By considering discounts for safety features and other factors, you can ensure you’re getting the most value for your insurance investment. Compare free Ford Escape insurance quotes online, get started on comparing full coverage auto insurance rates by entering your ZIP code below.

Frequently Asked Questions

Does the color of a Ford Escape affect insurance rates?

The color of a vehicle, which is one of the auto insurance myths, does not directly affect insurance rates. Insurance companies primarily consider factors such as the vehicle’s make, model, year, engine size, safety features, and the driver’s profile. The color of the vehicle is not a significant factor in determining insurance premiums.

Can I transfer my current auto insurance policy to a new Ford Escape?

Yes, you can typically transfer your current auto insurance policy to a new Ford Escape. When you purchase a new vehicle, contact your insurance provider and provide them with the necessary information about the Ford Escape, such as its make, model, and vehicle identification number (VIN). Your insurance company will make the required adjustments to your policy and provide you with the updated coverage details and premium amount.

Can I use my personal auto insurance to cover business use of my Ford Escape?

In most cases, personal auto insurance policies do not cover vehicles used for business purposes. If you use your Ford Escape for business activities such as deliveries, ride-sharing, or transporting goods, you may need to obtain a separate commercial auto insurance policy. It’s important to inform your insurance provider about the intended business use of your vehicle to ensure you have the appropriate coverage.

How much is insurance on a Ford Escape?

Insurance on a Ford Escape typically costs around $98 per month, varying based on factors like driver age, location, driving history, and the model year of the vehicle.

Is it more expensive to insure a new Ford Escape compared to an older model?

Generally, insuring a new Ford Escape can be slightly more expensive compared to insuring an older model. Newer vehicles often have higher values, which can result in higher insurance premiums. Additionally, newer models may have more advanced technology and safety features, which could potentially increase the cost of repairs or replacement parts. However, other factors such as the driver’s profile, location, and insurance history will also play a role in determining the overall insurance premium.

What types of coverage are available for a Ford Escape?

Various types of coverage are available for a Ford Escape, including:

- Liability Coverage: This covers bodily injury and property damage liability if you are at fault in an accident.

- Collision Coverage: This covers the cost of repairs or replacement if your Ford Escape is damaged in a collision.

- Comprehensive Coverage: This covers non-collision related damages such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): This covers medical expenses and other related costs if you or your passengers are injured in an accident.

- Uninsured/Underinsured Motorist Coverage: Uninsured motorist property damage (UMPD) coverage covers damages caused by another driver who does not have insurance or has insufficient coverage.

Choosing the right insurance coverage for your Ford Escape ensures comprehensive protection against various risks, including liability, collision, and uninsured drivers.

What factors can affect the insurance premium for a Ford Escape?

Insurance premiums for a Ford Escape can be affected by the driver’s age, location, model year, safety features, driving record, and annual mileage. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Is comprehensive coverage necessary for a Ford Escape?

While not required, comprehensive coverage is recommended for a Ford Escape as it protects against non-collision incidents like theft, vandalism, and natural disasters, potentially saving you significant costs.

Is auto insurance mandatory for a Ford Escape?

Yes, auto insurance is mandatory for all vehicles, including the Ford Escape. In most countries and states, it is a legal requirement to have at least a minimum level of auto insurance coverage to operate a vehicle on public roads.

How do crash test ratings affect Ford Escape insurance premiums?

Higher crash test ratings can lead to lower insurance premiums for the Ford Escape, as they indicate better safety performance, reducing the risk for insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.