Best Mitsubishi Mirage Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

State Farm, USAA, and Progressive are the top picks for the best Mitsubishi Mirage auto insurance, with rates starting at $38/mo. These winning companies offer competitive pricing, extensive coverage options, and a range of discounts, ensuring that Mirage owners get the most value for their insurance needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Mitsubishi Mirage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Mitsubishi Mirage

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Mitsubishi Mirage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, USAA, and Progressive offer some of the most affordable options for the best Mitsubishi Mirage auto insurance, with rates starting at $38 per month.

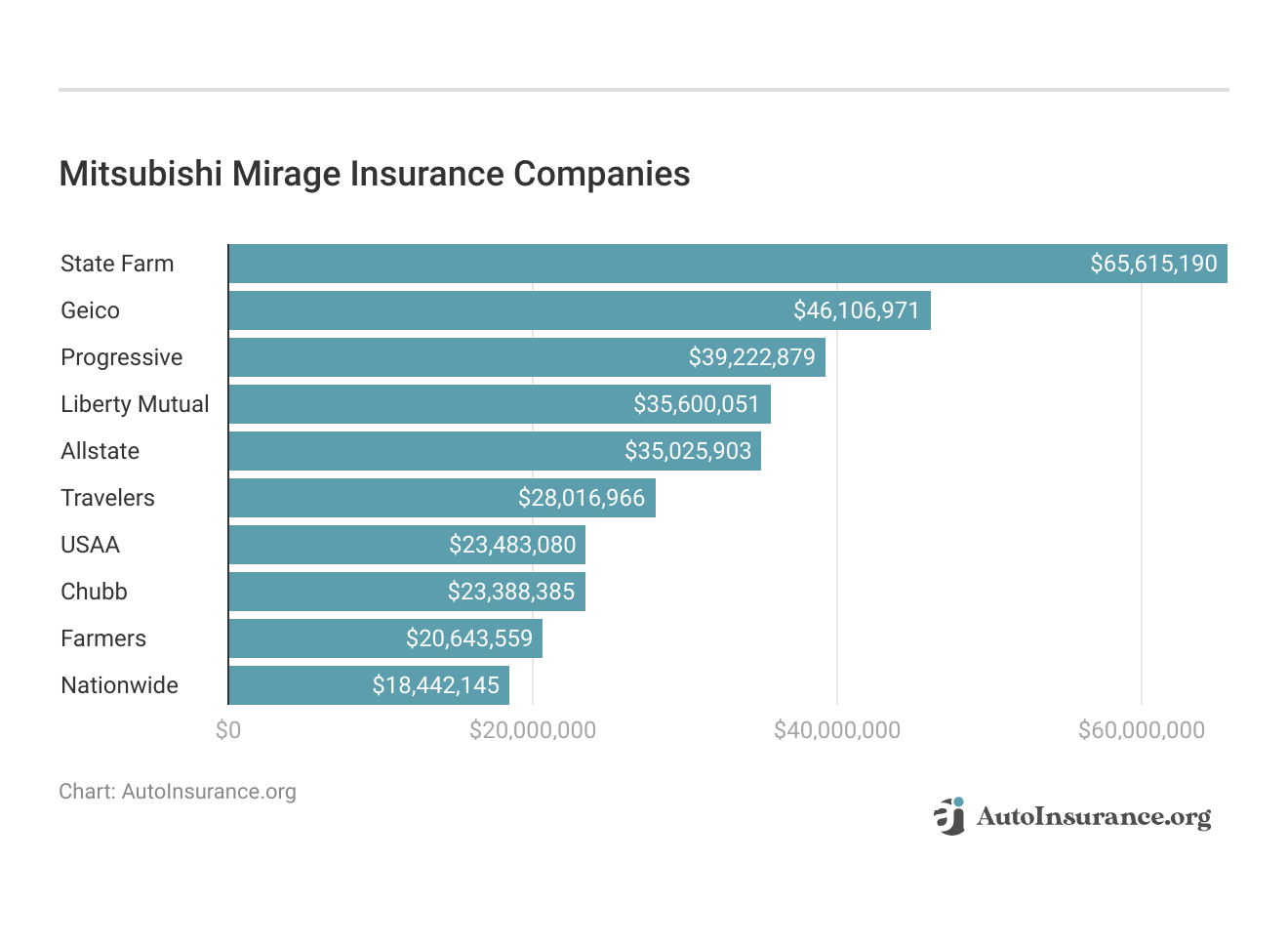

Our Top 10 Company Picks: Best Mitsubishi Mirage Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A++ | Many Discounts | State Farm | |

| #2 | 10% | A++ | Military Savings | USAA | |

| #3 | 12% | A+ | Online Convenience | Progressive | |

| #4 | 25% | A | Customizable Polices | Liberty Mutual |

| #5 | 20% | A+ | Usage Discount | Nationwide |

| #6 | 25% | A+ | Add-on Coverages | Allstate | |

| #7 | 20% | A | Local Agents | Farmers | |

| #8 | 8% | A++ | Accident Forgiveness | Travelers | |

| #9 | 25% | A++ | Custom Plan | Geico | |

| #10 | 25% | A | Online App | AAA |

Explore your options to secure the best value for your insurance investment. You can start comparing quotes for Mitsubishi Mirage insurance rates from some of the best auto insurance companies by using our free online tool now.

- State Farm, USAA, and Progressive offer the lowest rates for Mitsubishi Mirage

- State Farm is the top pick for its competitive pricing and comprehensive coverage

- Compare quotes to find the best value and coverage for your Mitsubishi Mirage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: State Farm offers some of the most affordable rates for Mitsubishi Mirage owners, making it a cost-effective choice, as highlighted in the State Farm auto insurance review.

- Discounts: Multiple discount options, including multi-policy, good student, and safe driver discounts, can significantly reduce premiums for Mitsubishi Mirage owners.

- Comprehensive Coverage: Offers extensive coverage options tailored to the needs of Mitsubishi Mirage drivers, including collision, comprehensive, and liability coverage.

Cons

- Customer Service: Mixed reviews on customer service experiences, with some Mitsubishi Mirage customers reporting dissatisfaction with claim handling and responsiveness.

- Local Agent Dependency: Quality of service can vary depending on the local agent, leading to inconsistent customer experiences for Mitsubishi Mirage owners.

#2 – USAA: Best for Exclusive Membership Benefits

Pros

- Exclusive Membership Benefits: Only available to military members and their families, providing specialized services and discounts tailored to Mitsubishi Mirage insurance needs.

- Affordable Rates: Competitive pricing for Mitsubishi Mirage insurance, often lower than many other insurers, as mentioned in the USAA auto insurance review.

- Comprehensive Coverage Options: Offers a wide range of coverage options, including liability, collision, and comprehensive coverage, suitable for Mitsubishi Mirage owners.

Cons

- Eligibility Restrictions: Limited to military members, veterans, and their families, excluding the general public from Mitsubishi Mirage insurance.

- Limited Physical Locations: Fewer local offices than other insurance companies, which some Mitsubishi Mirage owners may find inconvenient.

#3 – Progressive: Best for Competitive Pricing

Pros

- Competitive Pricing: Offers inexpensive premiums for a range of coverage levels at competitive rates for Mitsubishi Mirage insurance.

- Comprehensive Coverage Options: Wide range of coverage options tailored to Mitsubishi Mirage owners, including liability, collision, and comprehensive coverage.

- Discount Opportunities: Various discounts available, including multi-policy, homeowner, and safe driver discounts, helping to reduce overall Mitsubishi Mirage insurance costs.

Cons

- Customer Service: Mixed reviews on customer service quality, with some Mitsubishi Mirage customers reporting dissatisfaction with claim handling and support, according to Progressive auto insurance review.

- Price Variability: Rates can vary significantly based on individual factors, leading to potential inconsistencies in Mitsubishi Mirage insurance premium costs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Available to prevent rate increases after the first accident, helping to keep Mitsubishi Mirage premiums stable even after an incident, according to Liberty Mutual auto insurance review.

- Discounts: Offers a variety of discounts, including multi-policy, safe driver, and vehicle safety discounts, which can significantly lower premiums for Mitsubishi Mirage insurance.

- New Car Replacement: Provides new car replacement if the Mitsubishi Mirage is totaled within the first year or the first 15,000 miles, offering added protection for new car owners.

Cons

- Higher Rates: For Mitsubishi Mirage drivers on a tight budget, premiums may be more than those of other competitors, making it less economical.

- Customer Satisfaction: Reviews of customer service and claims management are conflicting, with some Mitsubishi Mirage owners citing poor support and responsiveness.

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Deductible decreases for every year of safe driving, rewarding good driving habits and reducing out-of-pocket expenses in case of a claim for Mitsubishi Mirage owners.

- Comprehensive Coverage: Offers a variety of coverage options tailored to Mitsubishi Mirage owners, including liability, collision, and comprehensive coverage, as noted in the Nationwide auto insurance review.

- SmartRide Program: Usage-based insurance program that rewards safe driving habits with discounts, potentially leading to significant savings for Mitsubishi Mirage owners.

Cons

- Higher Rates: Can be more expensive than some competitors, making it less attractive for Mitsubishi Mirage owners seeking the lowest premiums.

- Limited Online Tools: Online services and tools are not as advanced as some other insurers, which might be a drawback for tech-savvy Mitsubishi Mirage customers.

#6 – Allstate: Best for Comprehensive Coverage Options

Pros

- Comprehensive Coverage Options: Wide range of options for coverage, including roadside assistance, comprehensive, liability, and collision insurance, specifically designed for the Mitsubishi Mirage.

- Discounts: Offers a diverse range of discounts, such as multi-policy savings, anti-theft incentives, and safe driver reductions, all of which can significantly decrease premiums for Mitsubishi Mirage owners.

- Drivewise Program: Usage-based insurance program that rewards safe driving habits with discounts, potentially leading to significant savings for Mitsubishi Mirage owners.

Cons

- Higher Premiums: Tends to cost more than rival insurance plans, which can deter owners of Mitsubishi Mirages looking for the lowest possible premiums., as noted in the Allstate auto insurance review.

- Mixed Customer Reviews: There may be variations in the level of service provided by Mitsubishi Mirage customers who express dissatisfaction with the way claims are handled and the customer care provided.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Customized Coverage

Pros

- Customized Coverage: Provides a wide array of tailored coverage choices for Mitsubishi Mirage, encompassing liability, collision, comprehensive, and even roadside assistance options, allowing for flexible protection plans.

- Discounts: A multitude of discount possibilities, such as good driver incentives, multi-policy bundling, and anti-theft deductions, can substantially reduce the insurance costs for Mitsubishi Mirage owners, as detailed in our article titled, “Farmers Auto Insurance Discounts.”

- Accident Forgiveness: Available to prevent rate increases after the first accident, helping to keep Mitsubishi Mirage premiums stable even after an incident.

Cons

- Higher Rates: For Mitsubishi Mirage drivers who are on a tight budget, the premiums may be more than those of other insurers.

- Customer Service: Reviews of customer service quality are mixed, with some Mitsubishi Mirage owners expressing discontent with support and claims handling.

#8 – Travelers: Best for Competitive Rates

Pros

- Competitive Rates: Offers competitive pricing for Mitsubishi Mirage insurance, often providing affordable premiums for various coverage levels, as highlighted in the Travelers auto insurance review.

- Comprehensive Coverage: A broad spectrum of coverage choices meticulously crafted for Mitsubishi Mirage owners, featuring liability, collision, comprehensive, and rental reimbursement options for diverse protection needs.

- IntelliDrive Program: Usage-based insurance program that rewards safe driving habits with discounts, potentially leading to significant savings for Mitsubishi Mirage owners.

Cons

- Limited Availability: Not available in all states, which can be a drawback for some Mitsubishi Mirage customers.

- Mixed Customer Reviews: There may be variations in the level of service provided by Mitsubishi Mirage customers who express dissatisfaction with the way claims are handled and the customer care provided.

#9 – Geico: Best for Reasonably Priced

Pros

- Reasonably Priced: Renowned for providing some of the most affordable prices for insurance for Mitsubishi Mirages, making it an economical option.

- Discounts: Wide range of discounts, including for good driving, multi-policy, and vehicle safety, which can help reduce overall Mitsubishi Mirage insurance costs.

- User-Friendly Online Tools: Excellent online tools and mobile app for managing Mitsubishi Mirage insurance policies and claims, making it easy for customers to access their information and services.

Cons

- Customer Service: Mixed reviews on customer service experiences, with some Mitsubishi Mirage customers reporting dissatisfaction with claim handling and responsiveness, as noted in the Geico auto insurance review.

- Local Agent Support: Limited local agent support compared to other insurers, which might be a drawback for Mitsubishi Mirage owners who prefer in-person service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – AAA: Best for Member Benefits

Pros

- Member Benefits: Offers additional benefits to AAA members, including travel and roadside assistance, providing extra value beyond just Mitsubishi Mirage auto insurance, as detailed in the AAA auto insurance review.

- Discounts: A plethora of discount opportunities, ranging from good driving incentives and multi-policy savings to vehicle safety enhancements, can significantly reduce insurance costs for Mitsubishi Mirage owners.

- Comprehensive Coverage: Extensive coverage options tailored to Mitsubishi Mirage owners, including liability, collision, comprehensive, and rental reimbursement coverage.

Cons

- Membership Requirement: Requires AAA membership for Mitsubishi Mirage insurance services, which might be an additional cost for some customers.

- Higher Rates: Premiums may exceed those of some competitors, potentially rendering it less appealing for Mitsubishi Mirage owners who are in search of the most economical insurance rates.

Understanding the Cost of Insurance for Your Mitsubishi Mirage

When it comes to insuring your Mitsubishi Mirage, understanding the associated costs can help you make informed decisions and find the best coverage. Read our extensive guide on “Types of Auto Insurance” for more knowledge.

Mitsubishi Mirage Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $54 | $162 |

| $56 | $167 | |

| $59 | $183 | |

| $69 | $209 | |

| $38 | $121 |

| $67 | $189 |

| $69 | $206 | |

| $48 | $138 | |

| $90 | $286 | |

| $54 | $170 |

This guide delves into the factors influencing insurance premiums for the Mitsubishi Mirage, offering insights into average rates, key coverage options, and ways to save on your policy. The average Mitsubishi Mirage auto insurance rates are $1,248 a year or $104 a month.

By grasping the nuances of Mitsubishi Mirage insurance costs, you can better navigate your options and secure a policy that balances coverage and affordability.

Mitsubishi Mirage Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Discount Rate | $61 |

| High Deductibles | $90 |

| Average Rate | $104 |

| Low Deductibles | $131 |

| High Risk Driver | $222 |

| Teen Driver | $380 |

Use the information provided to compare rates, evaluate coverage, and choose the best insurance plan for your Mitsubishi Mirage, ensuring peace of mind on the road.

Insuring a Mitsubishi Mirage Can Be Expensive: A Comprehensive Analysis

The chart below details how Mitsubishi Mirage insurance rates compare to other subcompact hatchbacks like the Volkswagen Golf R, Volkswagen Beetle, and Ford Focus RS.

Mitsubishi Mirage Auto Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Mitsubishi Mirage | $20 | $37 | $33 | $104 |

| Volkswagen Golf R | $31 | $55 | $33 | $132 |

| Volkswagen Beetle | $23 | $45 | $28 | $108 |

| Ford Focus RS | $28 | $55 | $33 | $129 |

| Volkswagen Golf | $26 | $50 | $33 | $121 |

| Honda Fit | $22 | $43 | $22 | $96 |

You may, therefore, take a few steps to locate the most affordable Mitsubishi insurance quotes online. Dive deeper into “Compare Car Insurance Rates” with our complete resource.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Key Factors Mitsubishi Mirage for Insurance

The Mitsubishi Mirage trim and model you choose can impact the total price you will pay for Mitsubishi Mirage insurance coverage. For further details, check out our in-depth “Factors That Affect Auto Insurance Rates” article.

Age of the Vehicle

Older Mitsubishi Mirage models typically have lower insurance costs. For instance, insuring a 2018 Mitsubishi Mirage averages $104 monthly, whereas insurance for a 2014 Mitsubishi Mirage is about $100 per month.

Mitsubishi Mirage Auto Insurance Monthly Cost by Model Year & Coverage Type

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Mitsubishi Mirage | $23 | $40 | $31 | $110 |

| 2023 Mitsubishi Mirage | $22 | $39 | $31 | $108 |

| 2022 Mitsubishi Mirage | $21 | $38 | $32 | $106 |

| 2021 Mitsubishi Mirage | $21 | $37 | $32 | $105 |

| 2020 Mitsubishi Mirage | $20 | $37 | $33 | $104 |

| 2018 Mitsubishi Mirage | $20 | $37 | $33 | $104 |

| 2017 Mitsubishi Mirage | $20 | $36 | $35 | $104 |

| 2015 Mitsubishi Mirage | $18 | $34 | $37 | $102 |

| 2014 Mitsubishi Mirage | $17 | $31 | $38 | $99 |

This leads in a $4 monthly difference, which illustrates how older vehicles typically have lower premiums because of things like lower overall value and less repair bills.

Driver Age

The age of the driver has a big impact on Mitsubishi Mirage insurance costs; younger drivers typically pay higher rates. For instance, a driver who is thirty years old might pay about $55 more a year than a motorist who is forty years old for their Mitsubishi Mirage insurance.

Mitsubishi Mirage Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $380 |

| Age: 18 | $320 |

| Age: 20 | $236 |

| Age: 30 | $109 |

| Age: 40 | $104 |

| Age: 45 | $100 |

| Age: 50 | $95 |

| Age: 60 | $93 |

This discrepancy results from the fact that insurance companies usually consider younger drivers to be higher risk because of things like inexperience and accident history, which raises premiums.

Driver Location

Frequently Asked Questions

What is the insurance cost for Mitsubishi Mirage?

The insurance cost for Mitsubishi Mirage typically varies based on several factors including location, driving history, and coverage options.

What is the best category of Mitsubishi Mirage auto insurance?

The best category of Mitsubishi Mirage auto insurance often depends on your specific needs, such as comprehensive or liability coverage.

What are the best Mitsubishi Mirage auto insurance options available?

The best Mitsubishi Mirage auto insurance options include those that offer competitive rates, extensive coverage, and strong customer service.

Explore our detailed analysis on “Affordable Auto Insurance” for additional information.

What is the cheapest Mitsubishi Mirage auto insurance type?

The cheapest Mitsubishi Mirage auto insurance type generally includes basic liability coverage, though prices can vary by provider and location.

What is the best Mitsubishi Mirage insurance for the price?

The best Mitsubishi Mirage insurance for the price provides a balance of affordability and comprehensive coverage, offering good value for your premium.

What is the best insurance type for Mitsubishi Mirage?

The best insurance type for Mitsubishi Mirage usually includes a combination of liability, collision, and comprehensive coverage to ensure complete protection.

Expand your understanding with our thorough “Comprehensive Auto Insurance Defined” overview.

What provides the best Mitsubishi Mirage auto insurance coverage?

The best Mitsubishi Mirage auto insurance coverage includes policies that offer high limits on liability, comprehensive protection, and additional benefits like roadside assistance.

What is the most expensive Mitsubishi Mirage auto insurance type?

The most expensive Mitsubishi Mirage auto insurance type often includes full coverage with high limits and additional features such as rental car reimbursement.

What is the most expensive form of Mitsubishi Mirage insurance?

The most expensive form of Mitsubishi Mirage insurance typically involves premium coverage options such as full comprehensive and collision insurance.

Discover our comprehensive guide to “Full Coverage Auto Insurance Defined” for additional insights.

What is the most basic Mitsubishi Mirage insurance?

The most basic Mitsubishi Mirage insurance generally includes minimum liability coverage required by law, which offers limited protection.

Who offers the cheapest Mitsubishi Mirage insurance for seniors?

Insurance providers known for offering competitive rates for seniors include companies like State Farm and Geico, but rates can vary based on individual circumstances.

What is the best value to insure a Mitsubishi Mirage?

The best value to insure a Mitsubishi Mirage is achieved by comparing quotes from multiple providers to find a policy that offers comprehensive coverage at an affordable price.

For further details, check out our in-depth “Compare Cheap Online Auto Insurance Quotes” article.

What is the lowest Mitsubishi Mirage insurance group?

The lowest Mitsubishi Mirage insurance group usually refers to the insurance group classification, which indicates the cost and risk associated with insuring the vehicle.

Is fully comprehensive Mitsubishi Mirage car insurance worth it?

Fully comprehensive Mitsubishi Mirage car insurance is worth it if you want extensive coverage that includes protection against theft, vandalism, and non-collision incidents.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

How can I renew my Mitsubishi Mirage insurance online?

You can renew Mitsubishi Mirage insurance online by logging into your insurance provider’s website or using their mobile app to manage your policy.

Where can I get an instant quote for Mitsubishi Mirage insurance?

An instant quote for Mitsubishi Mirage insurance can be obtained through online comparison tools or directly from insurance company websites.

For more information, explore our informative “Where to Compare Auto Insurance Rates” page.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.