Best Kia Sportage Auto Insurance in 2025 (Find the Top 10 Companies Here)

Geico, State Farm, and Progressive have the best Kia Sportage auto insurance, offering protective add-on coverages, saving opportunities, and reliable service across the U.S. Minimum coverage for a Kia Sportage starts at just $28/mo, and full coverage rates start at just $99/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Kia Sportage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Kia Sportage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Kia Sportage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsGeico, State Farm, and Progressive have the best Kia Sportage auto insurance for most customers.

Most drivers will be able to find cheap Kia auto insurance at the top companies, as Kia Sportage insurance rates are cheaper than the average vehicle.

Our Top 10 Company Picks: Best Kia Sportage Auto Insurance

| Company | Rank | UBI Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Competitive Rates | Geico | |

| #2 | 30% | B | Reliable Coverage | State Farm | |

| #3 | 30% | A+ | Flexible Options | Progressive | |

| #4 | 30% | A++ | Member Benefits | USAA | |

| #5 | 30% | A++ | Extensive Discounts | Travelers | |

| #6 | 40% | A+ | Broad Coverage | Nationwide |

| #7 | 30% | A | Customer Satisfaction | American Family | |

| #8 | 30% | A | Customizable Plans | Liberty Mutual |

| #9 | 30% | A | Personal Service | Farmers | |

| #10 | 30% | A+ | Comprehensive Policies | Allstate |

Continue reading to learn about the top companies and how you can save money on Kia Sportage insurance rates.

You can start comparing quotes for Kia Sportage insurance rates from some of the best auto insurance companies by using our free online tool now.

- Geico has the best Kia Sportage car insurance policies

- Good drivers can save as much as $44 per month by earning policy discounts

- Kia Sportage insurance costs around $20 less per month than the average vehicle

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Pick Overall

Pros

- Competitive Rates: On average, Geico has some of the most affordable Kia Sportage rates. Read our Geico review to learn more about rates.

- User-Friendly App: Geico’s online app allows Kia Sportage customers to file claims, request assistance, and more.

- Roadside Assistance: Geico’s roadside assistance is available in most states for Kia Sportage owners.

Cons

- UBI Program Availability: Geico’s good driver discount isn’t available in all states, so some Kia Sportage owners won’t be able to save as much.

- Operates Virtually: Kia Sportage customers won’t have access to local agents.

#2 – State Farm: Best for Reliable Coverage

Pros

- Reliable Coverage: Kia Sportage customers should find State Farm’s coverage reliable and widely available.

- Local Support: Kia Sportage customers can get assistance from a local State Farm agent. Find out more in our review of State Farm.

- Bundling Discount: Kia Sportage insurance can be bundled with other insurance types from State Farm.

Cons

- Online Management: Kia Sportage customers will have to reach out to agents in most situations, as online management is limited.

- Financial Stability: Kia Sportage policyholders should be aware State Farm was recently downgraded to a lower financial rating.

#3 – Progressive: Best for Flexible Options

Pros

- Flexible Options: Progressive has flexible coverage options for Kia Sportage cars, which you can read about in our Progressive review.

- Snapshot Program: Kia Sportage rates will be cheaper if customers earn discounts with the Snapshot program.

- Budgeting Tool: Customers can use the Name Your Price to calculate Kia Sportage rates.

Cons

- Snapshot Rate Increases: Poor driving could increase Kia Sportage car insurance rates.

- Discount Availability: Some Kia Sportage discounts, like Snapshot, won’t be available in every state.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Member Benefits

Pros

- Member Benefits: Kia Sportage owners will get benefits for shopping and traveling as USAA members.

- Availability: USAA Kia Sportage insurance is sold across the country. Find out more about USAA’s availability in our review of USAA.

- Discount Opportunities: Customers can reduce their Kia Sportage Rates by bundling, having good grades, and more.

Cons

- Exclusive Eligibility: Kia Sportage customers must be veterans, military, or veteran/military family members.

- Virtual Assistance: USAA doesn’t have many local agents to assist Kia Sportage customers.

#5 – Travelers: Best for Extensive Discounts

Pros

- Extensive Discounts: Travelers has an IntelliDrive program that rewards good driving, bundling discounts, and many more for Kia Sportage customers.

- Financial Stability: Kia Sportage policies will be in good hands at Travelers, as the company has an A++ rating from A.M. Best.

- Coverage Options: Kia Sportage policies can include extras like new car replacement. For a full list, visit our Travelers review.

Cons

- IntelliDrive Rate Increases: Kia Sportage rates could increase in some states if drivers drive poorly.

- Mixed Customer Satisfaction: Based on previous reviews from customers, not all Kia Sportage customers will be happy with customer service.

#6 – Nationwide: Best for Broad Coverage

Pros

- Broad Coverage: Nationwide has broad coverage options for Kia Sportages. Learn more in our Nationwide review.

- Accident Forgiveness: Kia Sportage rates won’t increase after some customers’ first accident.

- Bundling Discount: Kia Sportage owners can also buy home or renters insurance with their auto insurance.

Cons

- Availability: Kia Sportage insurance isn’t sold in a few states.

- Local Agents Not Widely Available: Most services provided to Kia Sportage customers will be virtual.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – American Family: Best for Customer Satisfaction

Pros

- Customer Satisfaction: Kia Sportage customers should receive good service, as American Family has local agents.

- Coverage Options: Kia Sportage policies can have extras like roadside assistance added.

- Bundling Discount: Kia Sportage policies can be bundled with other insurance types. Learn more by visiting our American Family review.

Cons

- Availability: Kia Sportage insurance is not available in all states.

- Claims Handling: Kia Sportage claims may be delayed, according to customer reviews.

#8 – Liberty Mutual: Best for Customizable Plans

Pros

- Customizable Plans: Kia Sportage plans can be personalized with adjustable deductibles and coverages.

- Available Discounts: There are good driver discounts, bundling discounts, and more for Kia Sportage customers.

- 24/7 Support: Kia Sportage customers have access to a 24/7 support line for customers. Read our Liberty Mutual review to learn more.

Cons

- Customer Service: With some negative reviews, some Kia Sportage customers will be unhappy with customer service.

- UBI Discount Availability: Kia Sportage customers may not have Liberty Mutual’s usage-based discount in their state.

#9 – Farmers: Best for Personal Service

Pros

- Personal Service: Local Farmers agents are available to provide personalized service to Kia Sportage owners.

- Coverage Options: Farmers offers less common add-ons to Kia Sportage customers, such as new car replacement.

- Bundling Discount: Renters or home insurance can be added to Kia Sportage plans. Find out more in our Farmers review.

Cons

- Higher Rates: Kia Sportage rates are higher at Farmers than at most of the other companies on our list.

- Customer Satisfaction: Based on previous customer service reviews, not all Kia Sportage customers will be completely satisfied with services.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Allstate: Best for Comprehensive Policies

Pros

- Comprehensive Policies: Kia Sportage owners can insure their vehicles with fully comprehensive policies at Allstate.

- Mileage-Based Rates: Milewise offers mileage-based rates to Kia Sportage drivers.

- Bundling Discount: Kia Sportage plans can be bundled with other insurance. Learn more in our Allstate review.

Cons

- Higher Rates: Allstate is the most expensive company on our list for Kia Sportage cars.

- Customer Complaints: Kia Sportage services may not be the best at Allstate, as Allstate has a higher number of complaints.

Kia Sportage Insurance Cost

The average full coverage Kia Sportage auto insurance cost is $1,280 a year or $107 a month, which is affordable for most drivers.

Kia Sportage Auto Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $107 |

| Discount Rate | $63 |

| High Deductibles | $92 |

| High Risk Driver | $227 |

| Low Deductibles | $134 |

| Teen Driver | $390 |

However, rates will vary based on what coverage you choose for your Kia Sportage. The table below shows the average rates of the top Kia Sportage companies.

Kia Sportage Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $46 | $160 |

| American Family | $42 | $140 |

| Farmers | $45 | $155 |

| Geico | $29 | $101 |

| Liberty Mutual | $44 | $150 |

| Nationwide | $40 | $135 |

| Progressive | $36 | $125 |

| State Farm | $34 | $119 |

| Travelers | $37 | $130 |

| USAA | $28 | $99 |

Full coverage includes comprehensive and collision insurance, which provide extra protection to Kia Sportage vehicles (Read More: Collision vs. Comprehensive Auto Insurance Explained).

While some drivers may want to opt out of full coverage so they have cheaper monthly rates, a car accident could cost them more money in the long run.

Kia Sportage Rates Compared to Other Brands

The chart below details how Kia Sportage insurance rates compare to other crossovers like the Toyota RAV4, Kia Niro, and Lincoln MKT.

Kia Sportage Auto Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Total |

|---|---|---|---|---|

| Kia Sportage | $23 | $39 | $31 | $107 |

| Toyota RAV4 | $23 | $40 | $33 | $109 |

| Kia Niro | $24 | $40 | $33 | $110 |

| Lincoln MKT | $31 | $52 | $38 | $136 |

| Chevrolet Equinox | $26 | $44 | $31 | $114 |

| FIAT 500X | $21 | $42 | $38 | $116 |

| Nissan Rogue | $22 | $43 | $37 | $117 |

A Kia Sportage is one of the cheaper cars on the market to insure, so if your Kia rates are high, make sure you are comparing quotes from the best companies for Kias.

Factors That Affect Kia Sportage Insurance Rates

There are several factors that affect your auto insurance rates. For example, the Kia Sportage trim and model you choose can impact the total price you will pay for Kia Sportage auto insurance coverage.

Age of the Vehicle

Older Kia Sportage models generally cost less to insure. For example, auto insurance for a 2024 Kia Sportage costs $108 per month, while 2010 Kia Sportage insurance costs are $90 per month.

Kia Sportage Auto Insurance Monthly Rates by Model Year & Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2024 Kia Sportage | $25 | $41 | $32 | $108 |

| 2023 Kia Sportage | $25 | $40 | $32 | $108 |

| 2022 Kia Sportage | $24 | $40 | $31 | $108 |

| 2021 Kia Sportage | $24 | $40 | $31 | $107 |

| 2020 Kia Sportage | $23 | $39 | $31 | $107 |

| 2019 Kia Sportage | $22 | $38 | $33 | $106 |

| 2018 Kia Sportage | $21 | $37 | $33 | $105 |

| 2017 Kia Sportage | $21 | $36 | $35 | $105 |

| 2016 Kia Sportage | $20 | $35 | $36 | $104 |

| 2015 Kia Sportage | $19 | $34 | $37 | $103 |

| 2014 Kia Sportage | $18 | $31 | $38 | $100 |

| 2013 Kia Sportage | $17 | $29 | $38 | $98 |

| 2012 Kia Sportage | $17 | $26 | $38 | $95 |

| 2011 Kia Sportage | $16 | $24 | $38 | $92 |

| 2010 Kia Sportage | $15 | $23 | $39 | $90 |

Older cars that are depreciated in value may be able to carry just minimum state coverage, which also reduces rates further.

Driver Age

Driver age can have a significant impact on Kia Sportage auto insurance rates. As an example, a 40-year-old driver could pay $135 less each month for their Kia Sportage auto insurance compared to a 20-year-old driver.

Kia Sportage Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $580 |

| Age: 18 | $390 |

| Age: 20 | $242 |

| Age: 30 | $111 |

| Age: 40 | $107 |

| Age: 45 | $103 |

| Age: 50 | $97 |

| Age: 60 | $95 |

Younger drivers pay much more for Kia Sportage insurance, as driving inexperience makes them more likely to crash and file a claim.

Young drivers shopping for affordable Kia Sportage auto insurance should make sure they are applying for young driver discounts, such as defensive driver discounts or good student discounts.Brandon Frady Licensed Insurance Agent

Once younger drivers hit age 25, they should start seeing a decrease in rates if they have a clean driving record.

Driver Location

Where you live can have a large impact on Kia Sportage insurance rates. For example, drivers in New York may pay $65 a month more than drivers in Seattle.

Kia Sportage Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $182 |

| New York, NY | $169 |

| Houston, TX | $167 |

| Jacksonville, FL | $155 |

| Philadelphia, PA | $143 |

| Chicago, IL | $141 |

| Phoenix, AZ | $124 |

| Seattle, WA | $104 |

| Indianapolis, IN | $91 |

| Columbus, OH | $89 |

Areas with more crashes, crime, dangerous weather, and other risk factors will have higher auto insurance rates on average.

Your Driving Record

Your driving record can have an impact on the cost of Kia Sportage auto insurance. Teens and drivers in their 20’s see the highest jump in their Kia Sportage auto insurance rates with violations on their driving record.

Kia Sportage Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $580 | $740 | $1,020 | $700 |

| Age: 18 | $390 | $560 | $810 | $480 |

| Age: 20 | $242 | $370 | $640 | $320 |

| Age: 30 | $111 | $160 | $290 | $140 |

| Age: 40 | $107 | $150 | $280 | $135 |

| Age: 45 | $103 | $145 | $270 | $130 |

| Age: 50 | $97 | $140 | $260 | $125 |

| Age: 60 | $95 | $135 | $250 | $120 |

If drivers have an especially bad driving record, the state may require them to purchase high-risk auto insurance, which will raise Kia Sportage auto insurance rates significantly.

If drivers can’t find an insurance company that will sell them high risk car insurance, they may have to apply for coverage through their state.

Kia Sportage Safety Ratings

The Kia Sportage’s safety ratings will affect your Kia Sportage auto insurance rates. See the chart below:

Kia Sportage Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Kia Sportage has decent safety ratings from the IIHS, which means it should do better in a crash at keeping passengers safe.

Kia Sportage Crash Test Ratings

If the Kia Sportage crash test ratings are good, you could have lower Kia Sportage insurance rates. See Kia Sportage crash test results below:

Kia Sportage Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Kia Sportage SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2024 Kia Sportage SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Kia Sportage SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Kia Sportage SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Kia Sportage SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Kia Sportage SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Kia Sportage SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Kia Sportage SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Kia Sportage SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Kia Sportage SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Kia Sportage SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Kia Sportage SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Kia Sportage SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Kia Sportage SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Kia Sportage SUV FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Kia Sportage SUV AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2016 Kia Sportage SUV FWD | 4 stars | 5 stars | 5 stars | 4 stars |

| 2016 Kia Sportage SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

All of the Kia Sportage model years scored the same. While frontal and rollover scores could be better, the overall safety ratings for the Kia are excellent.

Kia Sportage Safety Features

Having a variety of safety features on your Kia Sportage can help lower your Kia Sportage insurance costs. The Kia Sportage’s safety features include:

Kia Sportage Safety Features

| Feature |

|---|

| Blind Spot Monitor |

| Brake Assist |

| Child Safety Locks |

| Cross-Traffic Alert |

| Daytime Running Lights |

| Driver Air Bag |

| Electronic Stability Control |

| Front Head Air Bag |

| Front Side Air Bag |

| Integrated Turn Signal Mirrors |

| Lane Departure Warning |

| Lane Keeping Assist |

| Passenger Air Bag |

| Rear Head Air Bag |

| Traction Control |

| 4-Wheel ABS |

| 4-Wheel Disc Brakes |

Some car insurance companies will give automatic discounts for safety features in Kia Sportages.

Kia Sportage Insurance Loss Probability

Review the Kia Sportage auto insurance loss probability rates for collision, property damage, comprehensive, PIP, MedPay, and bodily injury.

Kia Sportage Auto Insurance Loss Probability by Coverage Type

| Coverage | Loss |

|---|---|

| Collision | -18% |

| Property Damage | 0% |

| Comprehensive | -34% |

| Personal Injury | 13% |

| Medical Payment | 27% |

| Bodily Injury | 9% |

A lower percentage score means lower Kia Sportage auto insurance costs; higher percentages mean higher Kia Sportage auto insurance costs.

Kia Sportage Finance and Insurance Cost

If you are financing a Kia Sportage, you will pay more if you purchase Kia Sportage auto insurance at the dealership, so be sure to shop around and compare Kia Sportage auto insurance quotes from the best companies using our free tool below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Kia Sportage Insurance

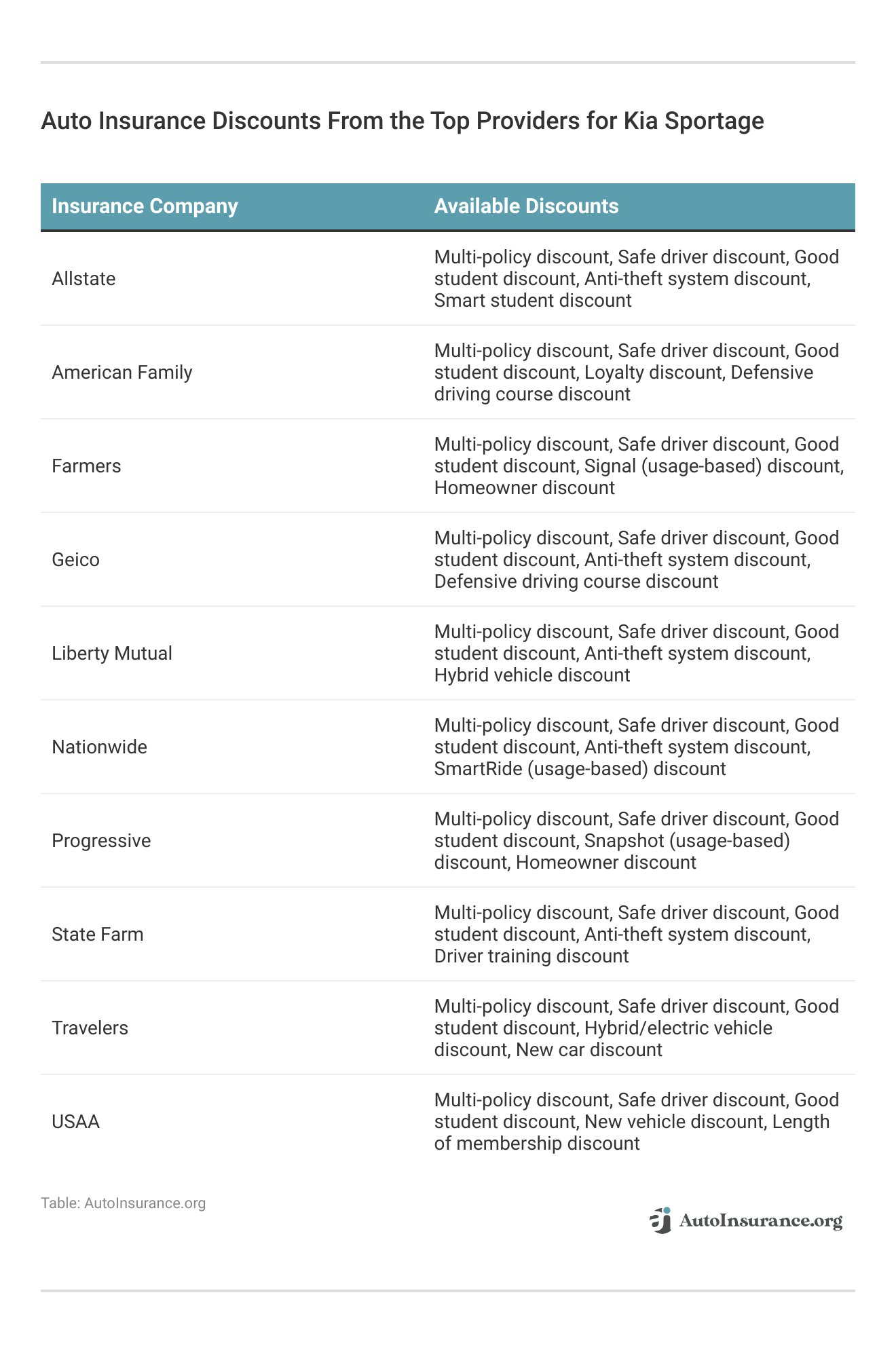

Drivers looking to save on insurance for their Kia Sportage should apply for auto insurance discounts. Some of the discounts to look for at the top companies include:

There are several other ways you can save even more on your Kia Sportage insurance rates. Take a look at the following five tips:

- Consider Kia Sportage insurance costs before buying a Kia Sportage.

- Drive your Kia Sportage safely.

- Save money on young driver Kia Sportage insurance by mentioning grades or GPA.

- Park your Kia Sportage somewhere safe, like a garage or private driveway.

- Improve your credit score.

Kia Sportage owners can also compare car insurance quotes from several different Kia Sportage car insurance companies to find a lower rate.

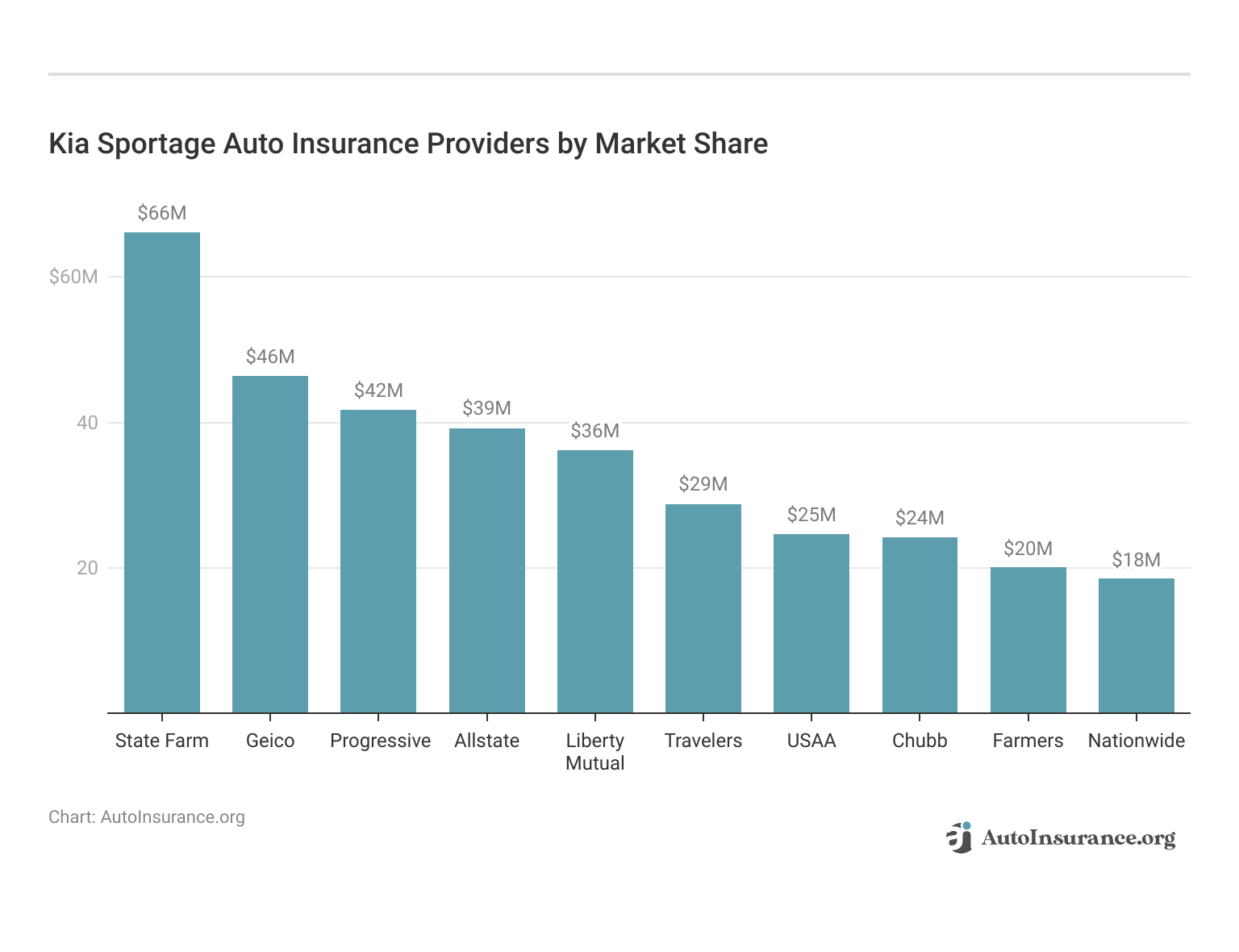

Kia Sportage Insurance Companies’ Market Share

Several top auto insurance companies offer competitive rates for the Kia Sportage rates based on factors like discounts for safety features. Take a look at this list of top auto insurance companies that are popular with Kia Sportage drivers organized by market share.

Kia Sportage Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

State Farm has one of the largest market shares in the U.S., followed by Geico and Progressive. For another look at these companies’ market shares, take a look at the table below.

Bear in mind that a large market share doesn’t automatically make a company the best. When looking for the best auto insurance companies for Kia Sportages, you’ll also want to consider their rates, coverages, and reviews.

Finding the Best Kia Sportage Insurance for You

Geico, State Farm, and Progressive have some of the best auto insurance for Kia Sportage cars. However, we recommend comparing the top companies and getting a few quotes to find the best fit for you (Read More: How to Evaluate Auto Insurance Quotes).

Ready to shop for cheap Kia Sportage auto insurance? Save on your Kia Sportage insurance rates by using our free comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is Kia Sportage auto insurance?

Kia Sportage auto insurance refers to the insurance coverage specifically designed for the Kia Sportage SUV model. It provides financial protection in case of accidents, damages, theft, or other incidents involving the Kia Sportage.

Is auto insurance mandatory for a Kia Sportage?

Yes, auto insurance is mandatory for all vehicles, including the Kia Sportage. The specific insurance requirements may vary depending on your location and local regulations. It’s important to comply with the legal requirements and have the necessary insurance coverage for your Kia Sportage.

What types of coverage are available for Kia Sportage auto insurance?

Kia Sportage auto insurance typically offers a range of coverage options. These may include liability coverage (which is often required by law), collision coverage (for damages caused by collisions), comprehensive coverage (for non-collision-related damages like theft or vandalism), uninsured/underinsured motorist coverage, and personal injury protection (PIP) coverage (Learn More: How much car insurance do I need?).

How can I find affordable auto insurance for my Kia Sportage?

To find affordable auto insurance for your Kia Sportage, it’s recommended to shop around and obtain quotes from multiple insurance providers. Factors such as your driving record, age, location, and the coverage options you choose can affect the cost of insurance.

Comparing quotes, considering available discounts, and maintaining a good driving record can help you find more affordable rates. Enter your ZIP in our free tool today for cheap Kia Sportage insurance quotes.

Are there any discounts available specifically for Kia Sportage auto insurance?

While specific discounts can vary among insurance providers, many companies offer discounts that may apply to Kia Sportage auto insurance. These could include discounts for safety features installed in the Kia Sportage, good driver discounts, multi-policy discounts (if you bundle your auto insurance with other policies), or loyalty discounts. It’s recommended to inquire about available discounts when obtaining insurance quotes.

Can I use my Kia Sportage auto insurance for off-road use?

Most standard auto insurance policies are designed to cover the vehicle’s use on public roads. Off-road use of your Kia Sportage, such as driving on trails or in rugged terrains, may not be covered under a standard auto insurance policy.

It’s important to review your policy or contact your insurance provider to understand the limitations and exclusions regarding off-road use. If you frequently engage in off-road activities, you may need to consider specialized insurance options (Read More: Best Auto Insurance for Off-Road Vehicles).

Does the size or model year of the Kia Sportage affect insurance rates?

The size and model year of the Kia Sportage can potentially have an impact on insurance rates. Generally, larger vehicles like SUVs may have higher insurance premiums due to factors such as potential repair costs and increased damage to other vehicles in an accident.

Newer model years may also have higher insurance premiums due to the cost of replacement parts. However, the specific details can vary, so it’s best to consult with insurance providers to understand how these factors can impact your rates.

What should I do if I need to file an auto insurance claim for my Kia Sportage?

If you need to file an auto insurance claim for your Kia Sportage, you should contact your insurance provider as soon as possible. They will guide you through the claims process and provide instructions on what information or documentation is required. Be prepared to provide details about the incident, such as the date, time, location, and any necessary supporting evidence, such as photographs or witness statements.

Are Kia Sportage cheap to insure?

Kia Sportages are usually cheap to insure. If your Kia Sportage insurance rates are high, read our article on how to lower your auto insurance rates.

Is a Kia Sportage a reliable car?

Yes, Kia Sportages are considered reliable cars.

Is Kia Sportage high maintenance?

Kia Sportage vehicles are lower maintenance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.