Best Porsche 718 Cayman Auto Insurance in 2025 (Check Out These 10 Companies)

Secure the best Porsche 718 Cayman auto insurance with Chubb, Amica, and Geico, offering rates starting at $100 per month. These top providers deliver excellent coverage, competitive pricing, and outstanding service. For the best insurance for Porsche Cayman, these companies lead the way.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

82 reviews

82 reviewsCompany Facts

Full Coverage for Porsche 718 Cayman

A.M. Best Rating

Complaint Level

Pros & Cons

82 reviews

82 reviews 768 reviews

768 reviewsCompany Facts

Full Coverage for Porsche 718 Cayman

A.M. Best Rating

Complaint Level

Pros & Cons

768 reviews

768 reviews

Company Facts

Full Coverage Porsche 718 Cayman

A.M. Best Rating

Complaint Level

Pros & Cons

The best Porsche 718 Cayman auto insurance rates come from Chubb, Amica, and Geico, with coverage starting at just $100 per month. For those asking, “How much is insurance for a Porsche?” these top providers offer competitive pricing and comprehensive coverage. Chubb stands out as the top pick overall for the best value.

Aside from identifying the best Porsche 718 Cayman auto insurance providers, the article also addresses key strategies for comparing rates. If you’re wondering, “How do I compare auto insurance?” the guide offers insights into evaluating options and finding the best deals for your needs.

Our Top 10 Company Picks: Best Porsche 718 Cayman Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 12% A++ Premium Coverage Chubb

#2 25% A+ Customer Service Amica

#3 25% A++ Competitive Rates Geico

#4 20% B Reliable Service State Farm

#5 12% A+ Varied Discounts Progressive

#6 20% A+ Comprehensive Options Nationwide

#7 10% A++ Excellent Service USAA

#8 25% A+ Coverage Variety Allstate

#9 20% A Good Service Farmers

#10 25% A User-Friendly Liberty Mutual

Uncover affordable auto insurance rates from the top providers by entering your ZIP code above.

- Compare coverage to find the best Porsche 718 Cayman insurance

- Chubb offers top rates and coverage for your Porsche 718 Cayman

- Explore discounts like new vehicle and safety features to save more

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Chubb: Top Overall Pick

Pros

- Comprehensive Coverage Options: Chubb offers a wide range of coverage options tailored to the unique needs of Porsche 718 Cayman owners, including high-value vehicle protection and agreed value policies, ensuring full replacement without depreciation.

- Exceptional Customer Service: Known for its superior customer service, Chubb provides dedicated agents for Porsche 718 Cayman drivers who understand the specific requirements of luxury sports car insurance, ensuring personalized and prompt assistance.

- High Claims Satisfaction: As outlined in our Chubb auto insurance review, Chubb has a reputation for high claims satisfaction, making it easier for Porsche 718 Cayman owners to get their claims processed quickly and efficiently, minimizing downtime and inconvenience.

Cons

- Higher Premiums: At $300 per month, Chubb’s insurance rates for the Porsche 718 Cayman are among the highest, which may not be affordable for all owners, especially those looking for budget-friendly options.

- Limited Discounts: Chubb offers fewer discounts compared to other providers, which can make it harder for Porsche 718 Cayman owners to reduce their insurance costs through common discount programs.

#2 – Amica: Best for Customer Service

Pros

- Competitive Rates: With a monthly premium of $250, Amica offers a more affordable option for Porsche 718 Cayman owners, providing comprehensive coverage at a lower cost.

- Top-Rated Customer Service: Amica is well-known for its excellent customer service, providing Porsche 718 Cayman owners with reliable support and efficient claims handling.

- Dividend Policies: As mentioned in Amica auto insurance review, Amica offers dividend policies that return a portion of the premium to policyholders, potentially reducing the overall cost of insurance for Porsche 718 Cayman owners.

Cons

- Limited Availability: Amica’s services are not available in all states, which can be a drawback for Porsche 718 Cayman owners living in areas where Amica does not operate.

- Fewer Specialized Coverage Options: Compared to some competitors, Amica may offer fewer specialized coverage options tailored specifically for high-value vehicles like the Porsche 718 Cayman.

#3 – Geico: Best for Competitive Rates

Pros

- Affordable Premiums: As mentioned in our Geico auto insurance review, the company offers a competitive rate of $230 per month, making it one of the more affordable options for Porsche 718 Cayman insurance.

- Wide Range of Discounts: Geico provides numerous discounts that can help Porsche 718 Cayman owners save on their premiums, including safe driver and multi-policy discounts.

- Strong Financial Stability: Geico’s strong financial backing ensures that claims are paid promptly and reliably, giving Porsche 718 Cayman owners peace of mind.

Cons

- Basic Coverage Options: Geico may not offer as many specialized coverage options for high-value vehicles like the Porsche 718 Cayman, which could be a limitation for owners seeking comprehensive protection.

- Average Customer Service: While Geico is known for affordability, its customer service ratings are average compared to competitors, which might be a concern for Porsche 718 Cayman owners needing high-quality support.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Reliable Service

Pros

- Wide Network of Agents: As mentioned in our State Farm auto insurance review, State Farm has a vast network of local agents who can provide personalized service to Porsche 718 Cayman owners, ensuring they get the coverage suited to their needs.

- Comprehensive Coverage Options: State Farm offers a variety of coverage options that can be tailored to the specific requirements of Porsche 718 Cayman owners, including options for high-value vehicles.

- Discount Opportunities: State Farm offers a variety of discounts, including safe driver and multi-policy savings, which can significantly reduce your Porsche 718 Cayman insurance costs.

Cons

- Moderate Premiums: At $260 per month, State Farm’s insurance rates are higher than some competitors, which may not be the best option for budget-conscious Porsche 718 Cayman owners.

- Mixed Customer Service Reviews: While some customers report positive experiences, others have noted inconsistencies in customer service quality, which can be a drawback for Porsche 718 Cayman owners expecting premium service.

#5 –Progressive: Best for Varied Discounts

Pros

- Competitive Pricing: As mentioned in Progressive auto insurance review, Progressive offers a competitive rate of $240 per month for Porsche 718 Cayman insurance, making it an affordable option for many owners.

- Snapshot Program: Progressive’s Snapshot program can help Porsche 718 Cayman owners save on their premiums by monitoring and rewarding safe driving habits.

- Wide Range of Discounts: Progressive offers numerous discounts, such as multi-car and homeowner discounts, which can help reduce insurance costs for Porsche 718 Cayman owners.

Cons

- Claims Handling Issues: Some customers have reported issues with Progressive’s claims handling process, which can be a concern for Porsche 718 Cayman owners needing efficient claims service.

- Basic Coverage Options: Progressive may not offer as many specialized coverage options for high-value vehicles like the Porsche 718 Cayman, which could limit comprehensive protection.

#6 – Nationwide: Best for Comprehensive Options

Pros

- Strong Coverage Options: Nationwide offers robust coverage options that can be customized to meet the specific needs of Porsche 718 Cayman owners, including high-value vehicle coverage.

- Vanishing Deductible: Nationwide’s vanishing deductible program rewards safe driving by reducing the deductible over time, which can benefit Porsche 718 Cayman owners.

- Financial Stability: With strong financial ratings, Nationwide ensures reliable claims processing and financial security for Porsche 718 Cayman owners. For more information, read our Nationwide auto insurance review.

Cons

- Higher Premiums: At $270 per month, Nationwide’s insurance rates are higher than some competitors, which may not be ideal for budget-conscious Porsche 718 Cayman owners.

- Average Customer Service: Nationwide’s customer service ratings are average, which might be a drawback for Porsche 718 Cayman owners expecting top-tier service and support.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – USAA: Best for Excellent Service

Pros

- Lowest Premiums: As outlined in USAA auto insurance review, the company offers the lowest monthly premium at $210, making it the most affordable option for Porsche 718 Cayman insurance among the listed providers.

- Excellent Customer Service: USAA is renowned for its exceptional customer service, providing Porsche 718 Cayman owners with reliable support and efficient claims handling.

- Wide Range of Discounts: USAA offers numerous discounts, including safe driver and military-related discounts, which can further reduce insurance costs for Porsche 718 Cayman owners.

Cons

- Eligibility Restrictions: USAA is only available to military members and their families, which limits access for many Porsche 718 Cayman owners.

- Limited Specialized Coverage Options: USAA may offer fewer specialized coverage options for high-value vehicles like the Porsche 718 Cayman compared to some competitors.

#8 – Allstate: Best for Coverage Variety

Pros

- Comprehensive Coverage Options: Allstate offers a variety of coverage options tailored to the needs of Porsche 718 Cayman owners, including high-value vehicle protection and accident forgiveness.

- Strong Financial Stability: Allstate’s strong financial backing ensures reliable claims processing and financial security for Porsche 718 Cayman owners.

- Good Driver Discounts: Allstate provides discounts for good driving habits, which can help Porsche 718 Cayman owners save on their insurance premiums. Learn more about their discounts in our Allstate auto insurance review.

Cons

- Higher Premiums: At $280 per month, Allstate’s insurance rates are higher than many competitors, which may not be suitable for budget-conscious Porsche 718 Cayman owners.

- Mixed Customer Service Reviews: Some customers have reported inconsistencies in Allstate’s customer service, which can be a concern for Porsche 718 Cayman owners needing reliable support.

#9 – Farmers: Best for Good Service

Pros

- Strong Coverage Options: Farmers offers comprehensive coverage options that can be customized for Porsche 718 Cayman owners, including high-value vehicle coverage.

- Accident Forgiveness: Farmers provides accident forgiveness, which can prevent premium increases after an accident for Porsche 718 Cayman owners. Check out this page Farmers auto insurance review to know more details.

- Wide Range of Discounts: Farmers offers various discounts, such as multi-policy and safe driver discounts, which can help reduce insurance costs for Porsche 718 Cayman owners.

Cons

- Higher Premiums: At $290 per month, Farmers’ insurance rates are among the highest, which may not be ideal for budget-conscious Porsche 718 Cayman owners.

- Average Customer Service: Farmers’ customer service ratings are average, which might be a drawback for Porsche 718 Cayman owners expecting top-tier service and support.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for User-Friendly

Pros

- Comprehensive Coverage Options: Liberty Mutual offers a wide range of coverage options tailored to the needs of Porsche 718 Cayman owners, including high-value vehicle protection and accident forgiveness.

- Better Car Replacement: Liberty Mutual’s Better Car Replacement program can provide a newer car if your Porsche 718 Cayman is totaled, offering enhanced peace of mind.

- Good Driver Discounts: As mentioned in our Liberty Mutual auto insurance review, the company provides discounts for good driving habits, which can help Porsche 718 Cayman owners save on their insurance premiums.

Cons

- Higher Premiums: At $275 per month, Liberty Mutual’s insurance rates are higher than many competitors, which may not be suitable for budget-conscious Porsche 718 Cayman owners.

- Mixed Customer Service Reviews: Some customers have reported inconsistencies in Liberty Mutual’s customer service, which can be a concern for Porsche 718 Cayman owners needing reliable support.

Porsche 718 Cayman Insurance Cost

The table below compares monthly rates for minimum and full coverage car insurance for a Porsche 718 Cayman from various providers.

Porsche 718 Cayman Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $140 $280

Amica $120 $250

Chubb $150 $300

Farmers $145 $290

Geico $110 $230

Liberty Mutual $142 $275

Nationwide $135 $270

Progressive $125 $240

State Farm $130 $260

USAA $100 $210

The cost of insuring a Porsche 718 Cayman varies significantly across different providers, with USAA offering the most affordable rates for both minimum and full coverage. Getting multiple auto insurance quotes from these companies can help you find the best deal to suit your coverage needs.

Porsche 718 Cayman Auto Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Average Rate | $169 |

| Discount Rate | $99 |

| High Deductibles | $146 |

| High Risk Driver | $360 |

| Low Deductibles | $213 |

| Teen Driver | $617 |

Porsche 718 Cayman insurance rates can vary widely based on factors such as deductibles and driver risk levels. Comparing these rates can help you choose the most cost-effective coverage for your needs.

Read More: Vanishing Deductible Defined

Why Porsche 718 Caymans Expensive to Insure

The chart below details how Porsche 718 Cayman insurance rates compare to other sports cars like the Cadillac ATS-V, Porsche 718 Boxster, and Kia Stinger.

Porsche 718 Cayman Auto Insurance Monthly Rates vs. Other Vehicles

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Audi R8 | $50 | $112 | $33 | $207 |

| Audi TT RS | $35 | $65 | $28 | $139 |

| Cadillac ATS-V | $34 | $70 | $33 | $150 |

| Ford Mustang | $29 | $60 | $35 | $139 |

| Kia Stinger | $28 | $52 | $38 | $132 |

| Porsche 718 Boxster | $37 | $79 | $28 | $156 |

| Porsche 718 Cayman | $38 | $84 | $33 | $169 |

The Porsche 718 Cayman is more expensive to insure compared to other sports cars due to higher costs for comprehensive and collision coverage. It’s essential to consider these factors when budgeting for insurance on a high-performance vehicle like the Porsche 718 Cayman.

Read More: Best Kia Stinger Auto Insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Influencing the Cost of Porsche 718 Cayman Insurance

The Porsche 718 Cayman trim and model you choose can significantly impact the total price you will pay for insurance coverage. Higher trims with more advanced features and powerful engines tend to have higher insurance premiums due to their increased repair and replacement costs.

Additionally, the age of the vehicle plays a crucial role, as newer models generally cost more to insure than older ones due to their higher market value and the cost of newer parts.

The driver’s age and driving history also influence the insurance rates. Younger drivers and those with a history of violations typically face higher premiums.Travis Thompson LICENSED INSURANCE AGENT

Location is another key factor, as areas with higher theft rates or more traffic congestion can lead to increased insurance costs. Finally, the level of coverage you choose, such as opting for comprehensive and collision coverage, will also affect your overall insurance expenses.

Age of the Vehicle

Older Porsche 718 Cayman models generally cost less to insure. For example, auto insurance for a newer Porsche 718 Cayman costs more compared to an older model, showing a slight decrease in insurance costs for older models.

Porsche 718 Cayman Auto Insurance Monthly Rates by Age of the Vehicle

| Model Year | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Porsche 718 Cayman | $44 | $94 | $40 | $178 |

| 2023 Porsche 718 Cayman | $42 | $91 | $38 | $175 |

| 2022 Porsche 718 Cayman | $41 | $89 | $37 | $172 |

| 2021 Porsche 718 Cayman | $40 | $87 | $36 | $170 |

| 2020 Porsche 718 Cayman | $39 | $86 | $35 | $169 |

| 2019 Porsche 718 Cayman | $39 | $85 | $34 | $169 |

| 2018 Porsche 718 Cayman | $38 | $84 | $33 | $169 |

| 2017 Porsche 718 Cayman | $37 | $82 | $35 | $167 |

Insuring older Porsche 718 Cayman models can lead to noticeable savings due to lower comprehensive and collision costs. Understanding how the age of your vehicle affects insurance rates can help you make more informed financial decisions.

Driver Age

Driver age can have a significant impact on Porsche 718 Cayman auto insurance rates. For instance, a 30-year-old driver may pay $7 more each month for Porsche 718 Cayman auto insurance than a 40-year-old driver.

Porsche 718 Cayman Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $617 |

| Age: 18 | $543 |

| Age: 20 | $383 |

| Age: 30 | $176 |

| Age: 40 | $169 |

| Age: 45 | $162 |

| Age: 50 | $154 |

| Age: 60 | $151 |

Driver age significantly affects Porsche 718 Cayman insurance rates, with younger drivers typically facing much higher premiums. Older drivers often benefit from lower insurance costs, reflecting their generally lower risk profiles.

Driver Location

Where you live can have a large impact on Porsche 718 Cayman insurance rates. For example, drivers in Los Angeles may pay $145 a month more than drivers in Indianapolis.

Porsche 718 Cayman Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Chicago, IL | $223 |

| Columbus, OH | $140 |

| Houston, TX | $265 |

| Indianapolis, IN | $144 |

| Jacksonville, FL | $245 |

| Los Angeles, CA | $289 |

| New York, NY | $267 |

| Philadelphia, PA | $226 |

| Phoenix, AZ | $196 |

| Seattle, WA | $164 |

Your location can greatly affect the cost of insuring a Porsche 718 Cayman, with significant variations between cities. Drivers in high-cost areas like Los Angeles may face much higher premiums compared to those in less expensive locations.

Your Driving Record

Your driving record can have an impact on the cost of Porsche 718 Cayman auto insurance. Teens and drivers in their 20’s see the highest jump in their Porsche 718 Cayman auto insurance rates with violations on their driving record.

Porsche 718 Cayman Auto Insurance Monthly Rates by Age & Driving History

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $617 | $681 | $754 | $895 |

| Age: 18 | $543 | $599 | $662 | $828 |

| Age: 20 | $383 | $416 | $478 | $627 |

| Age: 30 | $176 | $192 | $231 | $359 |

| Age: 40 | $169 | $184 | $220 | $341 |

| Age: 45 | $162 | $177 | $211 | $325 |

| Age: 50 | $154 | $168 | $200 | $309 |

| Age: 60 | $151 | $164 | $195 | $299 |

Maintaining a clean driving record is crucial for keeping Porsche 718 Cayman insurance costs down, especially for younger drivers. Accidents and violations can substantially increase premiums, highlighting the importance of safe driving habits.

Crash Test Ratings

Crash test ratings play a significant role in determining Porsche 718 Cayman insurance premiums. Poor ratings can lead to higher insurance costs due to increased risk assessments.

Porsche 718 Cayman Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Porsche 718 Cayman T 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2024 Porsche 718 Cayman S 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2024 Porsche 718 Cayman GTS 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2024 Porsche 718 Cayman GT4 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2024 Porsche 718 Cayman 6 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2024 Porsche 718 Cayman 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2023 Porsche 718 Cayman T 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2023 Porsche 718 Cayman S 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2023 Porsche 718 Cayman GTS 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2023 Porsche 718 Cayman GT4 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2023 Porsche 718 Cayman 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2022 Porsche 718 Cayman T 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2022 Porsche 718 Cayman S 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2022 Porsche 718 Cayman GTS 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2022 Porsche 718 Cayman GT4 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2022 Porsche 718 Cayman 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2021 Porsche 718 Cayman T 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2021 Porsche 718 Cayman S 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2021 Porsche 718 Cayman GTS 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2021 Porsche 718 Cayman GT4 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2021 Porsche 718 Cayman 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2020 Porsche 718 Cayman T 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2020 Porsche 718 Cayman S 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2020 Porsche 718 Cayman GTS 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2020 Porsche 718 Cayman GT4 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2020 Porsche 718 Cayman 6 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2020 Porsche 718 Cayman 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2019 Porsche 718 Cayman T 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2019 Porsche 718 Cayman S 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2019 Porsche 718 Cayman GTS 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2019 Porsche 718 Cayman GT4 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2019 Porsche 718 Cayman 2 DR RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2018 Porsche 718 Cayman S 3 HB RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2018 Porsche 718 Cayman 3 HB RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2017 Porsche 718 Cayman S 3 HB RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

| 2017 Porsche 718 Cayman 3 HB RWD | 5 Stars | 5 Stars | 4 Stars | 5 Stars |

Currently, the Porsche 718 Cayman lacks comprehensive crash test ratings, which can impact insurance rates. Ensuring the vehicle’s safety features and reliability remains a crucial factor in evaluating overall insurance costs.

Porsche 718 Cayman Safety Features

The numerous safety features of the Porsche 718 Cayman help contribute to lower insurance rates. The 2020 Porsche 718 Cayman has the following safety features:

- Air bags and Porsche side impact protection system (POSIP)

- Four-piston aluminum monobloc fixed calipers

- Bi-xenon headlights with integrated led daytime running lights

The advanced safety features of the Porsche 718 Cayman, including airbags and the Porsche side impact protection system, can contribute to lower insurance rates. Enhanced safety technology helps mitigate risks and may result in more favorable insurance premiums.

Porsche 718 Cayman Finance and Insurance Cost

If you are financing a Porsche 718 Cayman, you will pay more if you purchase Porsche 718 Cayman auto insurance at the dealership, so be sure to shop around and compare Porsche 718 Cayman auto insurance quotes from the best companies using our free tool below.

Read More: Do I need full coverage insurance to finance a car?

Ways to Save on Porsche 718 Cayman Insurance

There are many ways that you can save on Porsche 718 Cayman car insurance. Below are five actions you can take to find cheap Porsche 718 Cayman auto insurance rates.

- Tell your insurer about different drivers or uses for your Porsche 718 Cayman.

- Compare Porsche 718 Cayman quotes online.

- Get Porsche 718 Cayman auto insurance through Costco.

- Remove unnecessary insurance once your Porsche 718 Cayman is paid off.

- Buy an older Porsche 718 Cayman.

Read More: Auto Insurance for Different Types of Drivers

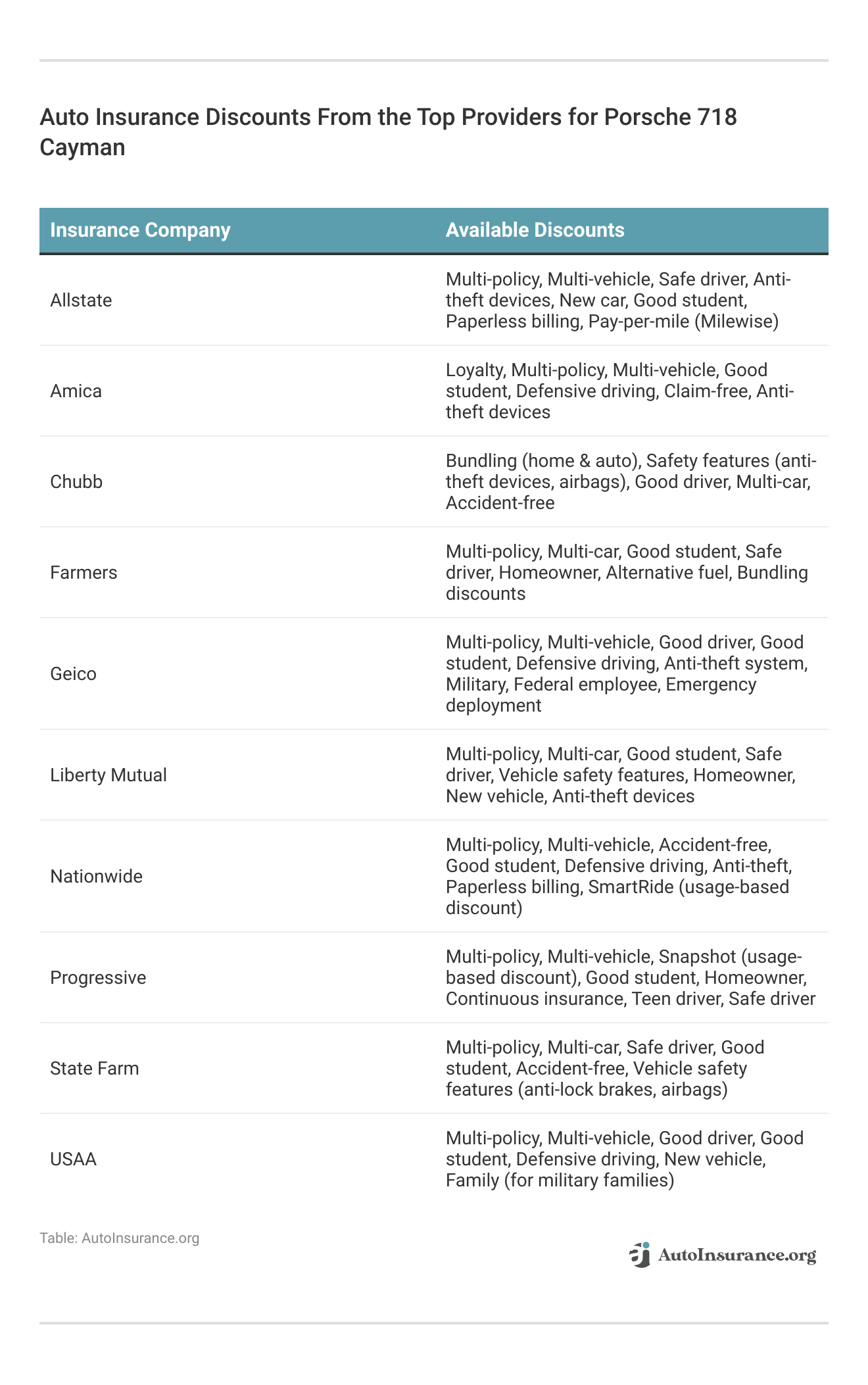

Discover the variety of car insurance discounts offered by top providers for Porsche 718 Cayman to help you save on your premiums.

These discounts from top insurance providers for the Porsche 718 Cayman offer valuable opportunities for car owners to save money while maintaining comprehensive coverage and safety on the road.

In particular, the new vehicle auto insurance discount can be a significant factor in reducing premiums for owners of newer Porsche 718 Cayman models. By taking advantage of these discounts, you can ensure both cost savings and optimal protection for your vehicle.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Porsche 718 Cayman Insurance Companies

The best auto insurance companies for Porsche 718 Cayman car insurance rates will offer competitive rates, discounts, and account for the Porsche 718 Cayman’s safety features. The following list of car insurance companies outlines which companies hold the highest market share.

Top 10 Porsche 718 Cayman Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66.1 million | 9% |

| #2 | Geico | $46.3 million | 6% |

| #3 | Progressive | $41.7 million | 5% |

| #4 | Liberty Mutual | $39.2 million | 5% |

| #5 | Allstate | $36.1 million | 5% |

| #6 | Travelers | $28.7 million | 4% |

| #7 | USAA | $24.6 million | 3% |

| #8 | Chubb | $24.1 million | 3% |

| #9 | Farmers | $20.0 million | 2% |

| #10 | Nationwide | $18.4 million | 2% |

Choosing the right insurance provider for your Porsche 718 Cayman involves considering companies that offer competitive rates and substantial market share. The top insurers not only provide favorable rates but also valuable discounts, ensuring that you get comprehensive coverage tailored to your vehicle’s needs.

Compare Free Porsche 718 Cayman Insurance Quotes Online

Comparing quotes for Porsche 718 Cayman insurance has never been easier with our free online tool. By entering your details, you can quickly access and compare rates from top insurance companies, helping you find the most affordable and comprehensive coverage for your Porsche 718 Cayman.

Don’t miss out on potential savings—discover cheap Porsche auto insurance options and gain insights into Porsche Cayman insurance costs today. This way, you can make an informed decision that suits both your budget and your vehicle’s needs.

Use our free comparison tool below to see what auto insurance quotes look like in your area.

Frequently Asked Questions

What makes Chubb the top pick for Porsche 718 Cayman auto insurance?

Chubb offers competitive rates starting at $150 per month, comprehensive coverage, and high customer satisfaction, making it the best choice for Porsche 718 Cayman insurance.

How does the cost of Porsche 718 Cayman insurance compare to other sports cars?

The chart shows that Porsche 718 Cayman insurance rates are higher compared to other sports cars like the Cadillac ATS-V, Porsche 718 Boxster, and Kia Stinger.

Read More: Best Auto Insurance for Sports Cars

What is the average cost of Porsche 718 Cayman auto insurance?

The average cost of Porsche 718 Cayman auto insurance is $2,026 per year or $169 per month. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

What are the typical coverage options for Porsche 718 Cayman insurance?

Coverage options for Porsche 718 Cayman insurance usually include liability, comprehensive, and collision coverage, tailored to protect the high-value vehicle and its advanced features.

What factors impact the cost of Porsche 718 Cayman insurance?

The cost of Porsche 718 Cayman insurance is influenced by factors such as the age of the vehicle, driver age, driver location, and driving record.

Read More: Non-Driving Factors That Affect Auto Insurance Rates

How does the Porsche 718 Cayman’s value affect its insurance rates?

The Porsche 718 Cayman’s high value and performance features typically result in higher insurance rates due to increased repair and replacement costs compared to standard vehicles.

How do safety features affect Porsche 718 Cayman insurance rates?

The Porsche 718 Cayman’s numerous safety features contribute to lower insurance rates. These safety features can help reduce the cost of insurance coverage.

Are there any discounts available for Porsche 718 Cayman insurance?

Yes, discounts such as multi-policy savings, safe driver discounts, and vehicle safety feature discounts are often available and can help reduce the overall cost of insurance for a Porsche 718 Cayman.

What are some ways to save on Porsche 718 Cayman insurance?

There are several ways to save on Porsche 718 Cayman insurance, including comparing quotes from multiple insurance companies, maintaining a clean driving record, and taking advantage of available discounts.

Read More: How to Lower Your Auto Insurance Rates

Is full coverage mandatory for a Porsche 718 Cayman?

While not legally required, full coverage is highly recommended for Porsche 718 Cayman owners to safeguard against significant financial loss due to accidents or other incidents.

Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.