Best Joint Ownership Auto Insurance in 2025 (Find the Top 10 Companies Here!)

Geico, USAA, and Progressive have the best joint ownership auto insurance. Geico's average minimum rate for joint ownership insurance is $45/mo. Joint owners who insure multiple vehicles at the same company could get a multiple-vehicle discount that saves drivers an average of 13% on auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Joint Ownership

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Joint Ownership

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Joint Ownership

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsGeico, USAA, and Progressive have the best joint ownership auto insurance.

How do I insure a car with two owners? The answer is joint ownership auto insurance. Our comprehensive guide breaks down joint car ownership agreements and insurance so you can feel confident in your coverage and learn about the tools you need to find the cheapest auto insurance companies.

Our Top 10 Company Picks: Best Joint Ownership Auto Insurance

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | 30% | Customer Service | Geico | |

| #2 | 25% | 25% | Competitive Rates | USAA | |

| #3 | 20% | 31% | Budgeting Tool | Progressive | |

| #4 | 25% | 20% | Additional Coverage | Nationwide |

| #5 | 10% | 20% | Safe Drivers | Travelers | |

| #6 | 20% | 20% | Accident Forgiveness | Liberty Mutual |

| #7 | 5% | 20% | Customizable Policies | Allstate | |

| #8 | 13% | 23% | Luxury Vehicles | Farmers | |

| #9 | 29% | 20% | Personalized Service | American Family | |

| #10 | 12% | 30% | Local Support | State Farm |

The best companies for joint ownership are listed below.

Ready to start shopping for affordable joint ownership auto insurance rates today? Enter your ZIP code in our free tool above to quickly find cheap joint ownership auto insurance.

- Geico offers the best auto insurance for joint ownership

- If you have a joint ownership policy, you may qualify for multiple-driver discounts

- All insurers offer the choice to add more than one driver onto a policy

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Pick Overall

Pros

- Customer Service: Geico has great reviews from the majority of its customers. Learn more in our Geico auto insurance review.

- Multi-Vehicle Discount: Geico offers a discounted rate if two or more cars are insured at Geico.

- Coverage Options: Add roadside assistance, gap insurance, and more to a joint ownership car insurance policy.

Cons

- In-Person Assistance: Most of Geico’s services are provided virtually, not in person.

- DUI Rates: Geico’s joint policies will be less economical if one driver has a DUI.

#2 – USAA: Best for Competitive Rates

Pros

- Competitive Rates: USAA’s rates are usually some of the cheapest available.

- Customer Service: USAA has scored highly. Learn more in our USAA review.

- Multi-Policy Discount: You can also buy a home or auto insurance policy in addition to car insurance.

Cons

- Physical Branches: Services are conducted virtually in most cases.

- Eligibility: Non-military or non-veteran drivers can’t purchase USAA auto insurance.

#3 – Progressive: Best for Budgeting Tools

Pros

- Budgeting Tools: A free Name Your Price tool is designed to help customers with budget constraints.

- Customer Loyalty Discounts: Joint policy owners who stick with Progressive will get rewards.

- Multi-Vehicle Discount: Insure more than one vehicle to save. Learn about all of Progressive’s discounts in our Progressive review.

Cons

- Snapshot Rate Increases: Progressive’s Snapshot program will raise rates in some states for poor driving.

- Customer Claim Reviews: Claims processing is not always satisfactory at Progressive.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Additional Coverage

Pros

- Additional Coverage: Nationwide offers additional coverages like roadside assistance. Find the full list in our Nationwide review.

- Pay-Per-Mile Insurance: SmartMiles by Nationwide is ideal for low-mileage drivers. Learn more in our SmartMiles review.

- Vanishing Deductibles: Your joint ownership policy deductibles will decrease if you stay claims-free.

Cons

- Higher Rates: Nationwide’s rates aren’t always the most competitive, especially for high-risk drivers.

- Telematics Tracking: If you aren’t comfortable with your driving data being tracked, you may want to opt out of Nationwide’s pay-per-mile insurance or usage-based discount.

#5 – Travelers: Best for Safe Drivers

Pros

- Safe Drivers: Travelers offers lower rates and discount opportunities to safe drivers.

- Coverage Options: Travelers sells less common coverages like rideshare insurance. See what else is offered in our Travelers review.

- Multi-Policy Discount: Save on joint ownership insurance by purchasing home insurance too.

Cons

- High-Risk Rates: Drivers with bad driving records will want to shop at other companies for more affordable rates.

- IntelliDrive Rate Increases: Poor drivers could see rate increases instead of decreases with the IntelliDrive program.

#6 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Joint car owners can qualify if both drivers have been accident-free for a while.

- Coverage Options: Liberty Mutual offers less common coverages like better car replacement. Learn what else is offered in our Liberty Mutual review.

- Discount Opportunities: Save with multi-vehicle discounts, bundling discounts, and more.

Cons

- Claims Satisfaction: Liberty Mutual struggles with claim satisfaction ratings.

- High-Risk Rates: Joint owners with DUIs or multiple accidents will likely find rates to be higher.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Allstate: Best for Customizable Policies

Pros

- Customizable Policies: Joint owners have plenty of customization options at Allstate.

- Milewise Insurance: Pay-per-mile coverage for low-mileage customers. Learn more in our Allstate Milewise review.

- Discount Options: Save with multi-vehicle discounts, multi-policy discounts, and others.

Cons

- Customer Ratings: Allstate has more than a fair share of customer complaints.

- Young Driver Rates: Allstate is expensive for teens buying auto insurance. Read more about rates in our Allstate review.

#8 – Farmers: Best for Luxury Vehicles

Pros

- Luxury Vehicles: Farmers sells great coverage options for luxury vehicles.

- Discount Variety: Farmers has several opportunities for joint-owners to save. See what discounts are offered in our Farmers review.

- Local Agents: Farmers does offer local support in some states.

Cons

- High-Risk Rates: Rates tend to be slightly more expensive than the average, especially for high-risk drivers.

- Customer Reviews: Some reviewers have been dissatisfied with the level of customer service they received.

#9 – American Family: Best for Personalized Service

Pros

- Personalized Service: American Family’s local agents can help provide personalized service on joint policy car insurance.

- Discount Variety: American Family offers everything from youth discounts to accident forgiveness.

- Coverage Options: There is a good selection for joint ownership auto insurance policies. Read our American Family review to see what is offered.

Cons

- Availability: Policies may not be sold in a joint-owners state.

- High-Risk Rates: Affordability may not be as competitive for higher-risk drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – State Farm: Best for Local Support

Pros

- Local Support: Local agents can provide support to joint owners.

- Discount Variety: State Farm offers everything from good student discounts to paperless discounts.

- Coverage Options: State Farm has gap insurance and more. For a full list, read our State Farm review.

Cons

- Online Tools: There may be fewer online functions because most services are provided through local agents.

- Credit Score Rates: State Farm does increase rates in some states if joint owners have poor credit scores.

The Basics of Joint Ownership Auto Insurance

What is joint ownership auto insurance, and who needs joint ownership auto insurance? A joint auto insurance policy is when two people living at the same property share an auto insurance policy.

Anyone living at the same residence can combine auto insurance, whether they are an unmarried couple or roommates.

Learn more: Best Auto Insurance for Unmarried Couples

Why would I need a joint ownership policy? While no one necessarily needs it, a joint ownership policy is a practical way to save money, as it costs less than two separate policies. You can quickly get quotes for joint ownership policies directly from companies like Geico.

Do both owners of a car need insurance? Yes, which is why it’s good idea to have a joint policy if two people own or share a car, as everyone driving the car will need to be insured.

How to Get a Joint Auto Insurance Policy

Can I get a joint car insurance policy easily? Absolutely. The information needed to get a joint ownership policy will the same as if you were applying for a policy yourself. You will need vehicle information, driver information, and driver history information.

When you apply for a policy, you will be given the option to add other car insurance household members. You can also choose to add a driver to an existing policy rather than buy a new one together. For example, you could cancel car insurance the other driver already has and add them to your existing policy or vice versa (read more: How to Cancel Auto Insurance).

Adding Drivers Who Don’t Live at Your Residence

Can I add someone to my car insurance that doesn’t live with me? This is a bit trickier, as the general answer is no. Exceptions are if someone regularly uses your car, such as a child that moved away for college but comes home on the weekends.

Listing an incorrect address is a form of soft fraud unless you can prove you will suffer a financial loss on a vehicle at a different address. Fraudulent addresses could result in your auto insurance company dropping you or denying a claim.Daniel Walker Licensed Insurance Agent

Insurers take listing the wrong address seriously, as the Insurance Information Institute (III) estimates that insurance fraud costs $40 billion per year.

So what can you save, and how does joint ownership auto insurance work? Keep reading to find out.

Cost of Joint Auto Insurance Policies

Who offers joint ownership auto insurance? All insurers offer the option to add more than one driver onto a policy. This means you can get a joint auto insurance policy with any insurance agency. At the best companies for joint ownership insurance, average rates are as follows:

Joint Ownership Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $69 | $190 |

| American Family | $82 | $264 |

| Farmers | $74 | $228 |

| Geico | $45 | $109 |

| Liberty Mutual | $62 | $180 |

| Nationwide | $56 | $142 |

| Progressive | $54 | $124 |

| State Farm | $98 | $328 |

| Travelers | $59 | $165 |

| USAA | $48 | $120 |

What determines rates in a joint ownership policy? The main factors that affect auto insurance rates are:

- Demographics: How old you are matters to insurers, as younger drivers are more likely to get into an accident. Adding your teenager to your car insurance policy will raise your rates.

- Driving History: Offenses on either driver’s record will raise rates on a joint ownership policy.

- Location: Insurers will consider local crime, crashes in your area, and more to assess risk.

- Vehicle: Sports car auto insurance will cost more than minivan insurance due to risk factors.

The best way to save money on a joint auto insurance policy is to get joint ownership auto insurance quotes and look for discounts.

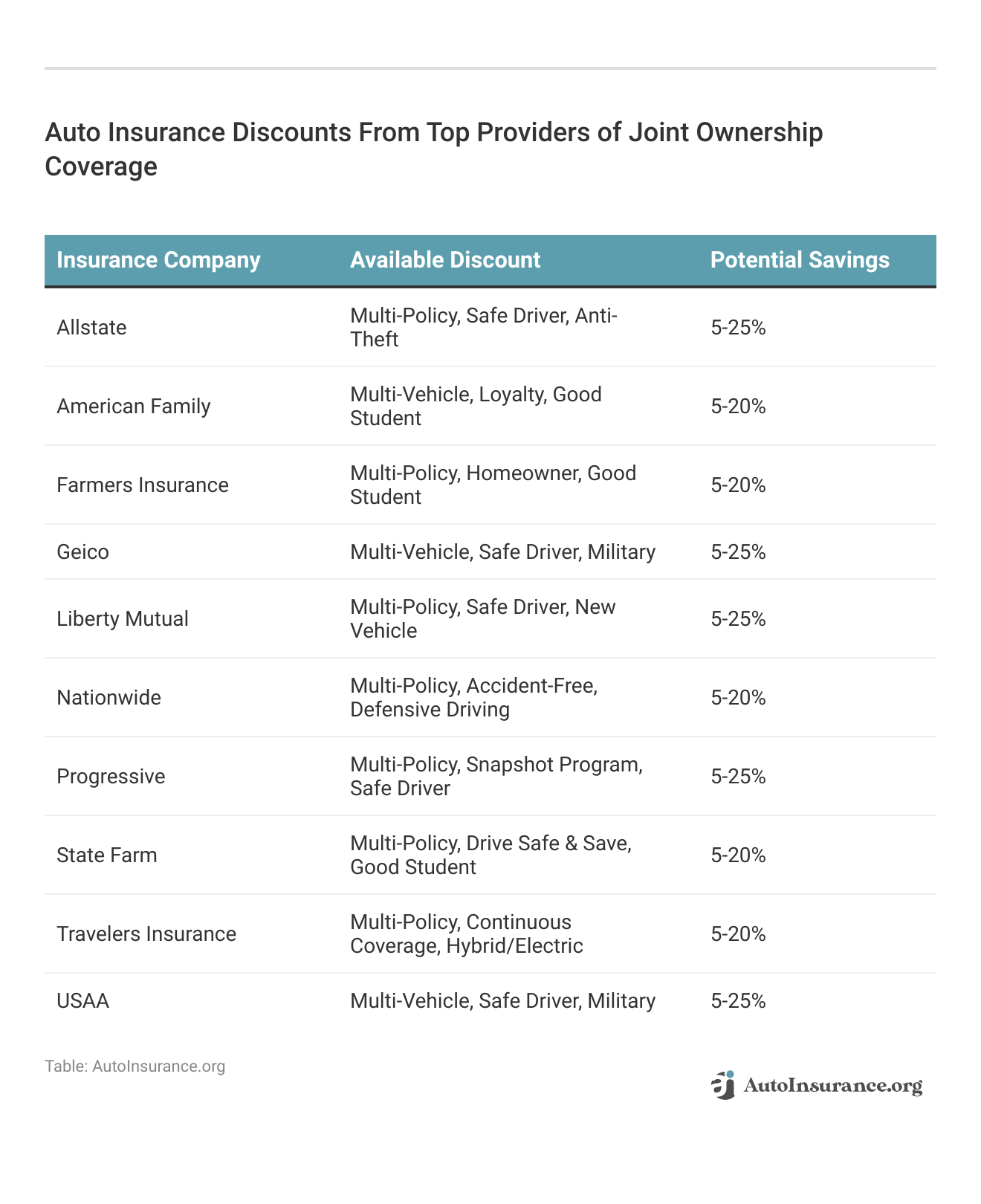

Joint Ownership Discounts

If you have a co-owner auto insurance policy, you will qualify for a multiple-driver discount (if offered). You may also qualify for a multiple-vehicle discount if there is more than one car on your policy. Take a look at the average savings for multiple vehicle discounts below.

Multi-Vehicle Auto Insurance Discount Percentage by Provider

| Insurance Company | Savings Percentage |

|---|---|

| Allstate | 20% |

| American Family | 20% |

| Amica | 15% |

| Country Financial | 15% |

| Farmers | 10% |

| Geico | 25% |

| Liberty Mutual | 10% |

| MetLife | 12% |

| Nationwide | 20% |

| Progressive | 10% |

| Safe Auto | 15% |

| Safeco | 15% |

| State Farm | 20% |

| The General | 15% |

| The Hanover | 5% |

| The Hartford | 5% |

| Travelers | 8% |

| USAA | 10% |

Drivers can save an average of 13 percent with a multiple-vehicle discount. The best companies for joint auto insurance also offer additional discounts.

Make sure to view our complete list of auto insurance discounts to find other ways to save on your joint ownership policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros & Cons of Joint Vehicle Ownership Insurance

What should I look for in joint ownership auto insurance? You should be looking at the pros and cons of joint ownership to see if it’s the right fit for you. To help you make a decision, we’ve listed the main pros and cons below.

- Pros:

- In most cases, a joint ownership policy will save you money due to a multiple-vehicle or multiple-driver discount.

- Having a joint policy makes it easier to keep track of policy information in the household.

- Cons:

- Rates may still be high if one driver needs high-risk auto insurance (read more: Best Auto Insurance Companies for High-Risk Drivers).

- Getting a joint ownership policy is complicated if one driver doesn’t live at the same address.

In most cases, the pros outweigh the cons, as long as the price of combined insurance isn’t greater than two separate policies.

The Final Word on the Best Auto Insurance for Joint Ownership

Geico, USAA, and Progressive are the best auto insurance companies for joint ownership. When it comes to co-owning a car and insurance, it is important for all parties to be properly insured. Before you buy joint ownership car insurance, though, make sure you shop around to find the best deal.

Do you want to save on a joint ownership policy today? Enter your ZIP code in our free tool below to get multiple joint ownership car insurance quotes today.

Frequently Asked Questions

What is joint ownership auto insurance?

Joint ownership auto insurance refers to an insurance policy taken out on a vehicle that is jointly owned by two or more individuals. Car insurance with two names on titles provides coverage for the vehicle and the owners in case of accidents, theft, or other damages.

Who can be covered under a joint ownership auto insurance policy?

In general, the individuals who are considered joint owners of the vehicle can be covered under the joint ownership auto insurance policy with joint ownership endorsement. This typically includes the names of all owners listed on the vehicle’s title or registration.

What types of coverage are available for joint ownership auto insurance?

Joint ownership auto insurance policies typically offer the same coverage options as individual auto insurance policies. This can include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage.

The specific coverage options can be tailored based on the needs and preferences of the joint owners (read more: How much car insurance do I need?).

How are premiums and deductibles determined for joint ownership auto insurance?

Premiums and deductibles for joint ownership auto insurance are typically determined based on several factors, including the driving records, ages, and other characteristics of the joint owners. Insurance companies may consider the individual risk profiles of each owner and calculate the premiums and deductibles accordingly.

Can joint ownership auto insurance be more cost-effective compared to individual policies?

Joint ownership auto insurance has the potential to be more cost-effective compared to individual policies, especially if the joint owners qualify for multi-car or multi-policy discounts.

By insuring multiple vehicles or combining multiple insurance policies with the same provider, joint owners may be eligible for discounted rates, resulting in potential cost savings. Shop for affordable car insurance for joint ownership today by entering your ZIP into our free quote tool.

How are claims handled under a joint ownership auto insurance policy?

When filing a claim under a joint ownership auto insurance policy, the process typically involves all joint owners listed on the policy. The claim may require information and cooperation from all owners, including details of the incident, documentation, and any relevant evidence (read more: How to File an Auto Insurance Claim).

The insurance company will guide the joint owners through the claims process and assess the coverage based on the policy terms and conditions.

Can joint ownership auto insurance cover non-owner drivers?

Joint ownership auto insurance generally covers drivers who have permission from the joint owners to operate the vehicle. However, it’s important to review the specific terms and conditions of the policy to understand any limitations or restrictions regarding non-owner drivers. Some policies may require the inclusion of additional drivers or impose restrictions on who is covered.

What happens if joint owners have different coverage needs or preferences?

If joint owners have different coverage needs or preferences, it’s important to discuss and find a common ground to ensure all parties are adequately protected. Joint ownership auto insurance policies can often be customized to accommodate different coverage options for each owner. Working with an insurance agent or provider can help navigate the process and find a suitable solution that meets the needs of all joint owners.

Can a car be registered in one name and insured in another?

The answer is usually no. In most states, the registered owner also has to be the insurer. The exception is if you can prove you have a financial interest in the vehicle because the loss of the vehicle would financially affect you (read more: How to Get Insurance for a Car Not in Your Name).

Do you have to be the registered owner of the vehicle to insure it? Usually, you do, though in some cases, there are exceptions.

Who owns a car when two names are on the title?

When you have car insurance with two names on the title, both of the names on the title are considered owners. However, the wording is important when it comes to joint ownership of a car title.

If there is an “and” between the names, it means both parties need to sign off to sell a car. If there is an “or,” either party can sell the car.

Can two names be on a car registration?

Yes, there can be two names on a car registration form.

Can I have a car in my name under my parent’s insurance?

Unless your parent’s name is a co-signer on the vehicle, you will have to purchase your own insurance. There are a lot of factors that weigh into whether you are covered under your parents’ insurance (read more: Does auto insurance cover my child under my policy?).

What is a joint ownership coverage endorsement?

A joint ownership coverage endorsement is a form generally used for when an unmarried couple living together or related people, other than a married couple, living in separate homes who need auto insurance for the same vehicle.

Is a co-signer responsible for auto insurance?

Being a co-signer is a financial responsibility. A co-signer does not necessarily need to be listed on the auto insurance policy unless they are going to be driving the car.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.