Best Glendale, California Auto Insurance in 2026 (Your Guide to the Top 10 Companies)

State Farm, Geico, and Progressive represent the best Glendale, California auto insurance options, offering reliable coverage starting at $78 per month. These companies are the top choices due to their competitive rates, customizable coverage options, and strong customer service tailored to local drivers needs.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Schimri Yoyo

Updated January 2025

Company Facts

Full Coverage in Glendale CA

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Glendale CA

A.M. Best

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

Company Facts

Full Coverage in Glendale CA

A.M. Best

Complaint Level

Pros & Cons

The best Glendale, California auto insurance providers are State Farm, Geico, and Progressive, offering top-rated coverage, competitive pricing, and reliable customer service.

State Farm stands out overall for its extensive programs and strong reputation for claims handling. Geico is known for its affordability, while Progressive excels with customizable plans.

Our Top 10 Company Picks: Best Glendale, California Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 15% B Customer Satisfaction State Farm

#2 10% A++ Cheap Rates Geico

#3 12% A+ Budgeting Tools Progressive

#4 20% A+ Local Presence Allstate

#5 13% A Flexible Policies Farmers

#6 12% A Unique Discounts Liberty Mutual

#7 7% A++ Military Members USAA

#8 14% A Comprehensive Coverage American Family

#9 13% A+ Vanishing Deductible Nationwide

#10 10% A+ AARP Benefits The Hartford

These companies offer the best options for drivers in Glendale, California. Gain insights from our guide titled, “What is auto insurance?”

Enter your ZIP code above to explore which companies have the cheapest auto insurance rates for you.

- State Farm leads with top coverage for Glendale drivers

- Geico offers budget-friendly rates for Glendale, California

- Progressive provides customizable plans for local needs

#1 – State Farm: Top Overall Pick

Pros

- Bundling Benefits: In Glendale, California, State Farm offers an impressive 15% discount for policy bundling, making it an attractive choice for those looking to consolidate their insurance.

- Low-Mileage Discount: Drivers in Glendale can reap the rewards of a significant discount if they maintain low annual mileage, promoting safer driving habits while saving on premiums.

- Varied Coverage Choices: State Farm offers tailored coverage options for Glendale residents, ensuring the ideal fit. Read “State Farm Auto Insurance Review” for more insights.

Cons

- Limited Multi-Policy Discount: Although State Farm offers a bundling discount, it may not be as substantial compared to rivals in the Glendale market, potentially leaving some savings on the table.

- Premium Pricing: While discounts are available, certain coverage levels can still yield relatively higher premiums, which may deter cost-conscious drivers in Glendale.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Cheap Rates

Pros

- Affordable Premiums: Geico shines in Glendale, California, with some of the lowest average premiums in the area, making it an ideal option for budget-conscious drivers.

- Superior A.M. Best Rating: Holding an A++ rating, Geico is recognized for its financial strength, providing peace of mind to policyholders in Glendale.

- User-Friendly Tools: Glendale residents appreciate Geico’s easy online policy management and claims filing. Discover savings in our full guide titled, “Geico Auto Insurance Review.”

Cons

- Limited Local Presence: While Geico offers competitive rates, its less robust local presence in Glendale may result in reduced customer service interactions compared to more established companies.

- Fewer Coverage Options: Geico’s streamlined approach means fewer customizable coverage options, which might not cater to every specific need of Glendale drivers.

#3 – Progressive: Best for Budgeting Tools

Pros

- Innovative Budgeting Features: Progressive offers unique budgeting tools that help Glendale drivers manage their premiums effectively, making insurance more accessible.

- Competitive A.M. Best Rating: With an A+ rating, Progressive guarantees Glendale residents reliability in claims. Explore our offerings in the guide titled, “Progressive Auto Insurance Review.”

- Flexibility in Coverage: Progressive’s wide array of coverage choices allows Glendale drivers to tailor their policies according to personal preferences and budgets.

Cons

- Discount Variability: While Progressive provides a 12% bundling discount, the actual savings may fluctuate significantly based on individual circumstances in Glendale.

- Claims Process Complexity: Some users in Glendale have reported that navigating the claims process can be intricate, potentially causing frustration during critical times.

#4 – Allstate: Best for Local Presence

Pros

- Substantial Bundling Discounts: Allstate provides a notable 20% discount for bundling policies, making it particularly appealing for Glendale residents looking to save.

- Community Engagement: Allstate’s strong local presence in Glendale boosts customer service, offering personalized support. For detailed insights, check our guide titled, “Allstate Auto Insurance Review.”

- Diverse Coverage Plans: Residents can choose from a variety of plans designed to suit local needs, ensuring comprehensive protection against various risks.

Cons

- Higher Base Premiums: Allstate’s initial premium rates might be steeper than competitors, which could pose a challenge for budget-conscious Glendale drivers.

- Discount Limitations: Despite attractive bundling options, other discount opportunities may not be as competitive compared to leading insurers in Glendale.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Flexible Policies

Pros

- Customizable Coverage Options: Farmers offers a range of flexible policies tailored for Glendale, California, allowing drivers to select the coverage that best meets their needs.

- Competitive A.M. Best Rating: With an A rating, Farmers ensures financial reliability, providing comfort to its Glendale clientele. Dive into our article called, “Farmers Auto Insurance Review.”

- Discount Opportunities: A 13% bundling discount is available, enhancing affordability for those in Glendale who wish to consolidate their insurance needs.

Cons

- Complex Pricing Structure: Farmers’ diverse offerings may result in a complicated pricing structure, potentially leading to confusion for some Glendale customers.

- Service Variability: Customer service experiences can vary significantly among agents, affecting satisfaction levels for Glendale policyholders.

#6 – Liberty Mutual: Best for Unique Discounts

Pros

- Distinctive Discounts: Liberty Mutual offers unique discount opportunities for Glendale residents, including savings for new car safety features and multiple policies.

- Solid A.M. Best Rating: With an A rating, Liberty Mutual assures its customers in Glendale of financial stability and reliability. Uncover details in our guide titled, “Liberty Mutual Auto Insurance Review.”

- Personalized Coverage: Policyholders can enjoy customized coverage plans that cater specifically to their individual needs in Glendale.

Cons

- Average Premiums: While discounts are available, Liberty Mutual’s premium rates may still be considered average, which could deter some price-sensitive drivers in Glendale.

- Online Experience Limitations: Some users report that the online tools are not as user-friendly, complicating policy management for Glendale residents.

#7 – USAA: Best for Military Members

Pros

- Unmatched Discounts for Military: USAA offers exceptional discounts exclusively for military members in Glendale, California, making it a leading choice for this community.

- Top-Tier A.M. Best Rating: With an A++ rating, USAA is renowned for its financial strength and commitment to serving its members effectively.

- Comprehensive Coverage Plans: USAA provides extensive coverage options that address the unique needs of military families in Glendale. Gain insights from our guide titled, “USAA Auto Insurance Review.”

Cons

- Membership Restrictions: Only available to military members and their families, USAA’s offerings may not be accessible to the broader Glendale population.

- Limited Local Agents: The absence of local agents may lead to challenges in personalized service for Glendale members.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Comprehensive Coverage

Pros

- Thorough Coverage Options: American Family excels in providing comprehensive coverage plans tailored for Glendale drivers, ensuring all potential risks are covered.

- A.M. Best Rating: With an A rating, American Family offers reliable service backed by financial strength, giving Glendale residents confidence in their choice.

- Bundling Discounts: A 14% discount for bundling policies is available, allowing for greater savings for Glendale families. For further details, see our guide titled, “American Family Auto Insurance Review.”

Cons

- Moderate Premiums: Some may find American Family’s premiums to be on the higher side compared to competitors in Glendale.

- Claims Handling Delays: Reports of delays in claims processing can be a source of frustration for Glendale policyholders.

#9 – Nationwide: Best for Vanishing Deductible

Pros

- Unique Vanishing Deductible Feature: Nationwide’s innovative vanishing deductible program rewards safe driving, particularly appealing for Glendale residents aiming to lower costs.

- A.M. Best Rating: Nationwide’s A+ rating ensures stability and reliability for Glendale customers. Read our guide titled, “Nationwide Auto Insurance Review” for more information.

- Flexible Payment Plans: Offering a variety of payment options, Nationwide makes it easier for Glendale drivers to manage their premiums effectively.

Cons

- Limited Discounts: While the vanishing deductible is an attractive feature, overall discounts may not be as competitive as those offered by other insurers in Glendale.

- Service Inconsistency: Customer service experiences can vary, which may affect satisfaction among Glendale policyholders.

#10 – The Hartford: Best for AARP Benefits

Pros

- Exclusive AARP Discounts: The Hartford provides unique discounts for AARP members, making it a favorable option for seniors in Glendale.

- A.M. Best Rating: With an A+ rating, The Hartford is recognized for its reliability and financial strength, instilling confidence in Glendale residents.

- Comprehensive Coverage Options: The Hartford offers plans for Glendale’s senior community. See our guide for details tilted, “The Hartford Auto Insurance Review.”

Cons

- Age-Related Limitations: The focus on AARP members may exclude younger drivers in Glendale who are seeking competitive rates.

- Higher Base Rates: Initial premiums may be higher compared to other companies, which could be a barrier for cost-conscious consumers in Glendale.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Monthly Auto Insurance Rates in Glendale, California

Understanding the monthly auto insurance rates in Glendale, California, is essential for making informed decisions about coverage options. The following table outlines the rates for minimum and full coverage provided by various insurance companies, highlighting the affordability and value available to local drivers.

Glendale, California Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$95 $175

$86 $160

$82 $155

$78 $150

$87 $170

$88 $165

$84 $160

$90 $170

$85 $160

$80 $155

In Glendale, auto insurance rates vary among providers, with Geico offering the most competitive minimum coverage rate at $78 per month, making it an attractive option for budget-conscious drivers. For full coverage, Allstate has the highest rate at $175, while Geico again provides a cost-effective solution at $150.

Other notable providers include American Family, Farmers, and State Farm, which present a balanced mix of affordability and comprehensive coverage, ensuring that residents can find policies tailored to their specific needs without breaking the bank.

Conway, Arkansas Auto Insurance Discounts From the Top Providers

| Insurance Company | Available Discounts |

|---|---|

| Safe Driver, Multi-Policy, Early Signing, New Car, Good Student, Anti-Theft Device, Paperless, Auto-Pay | |

| Multi-Policy, Good Student, Loyalty, Early Bird, Teen Safe Driver, Defensive Driving, Auto-Pay, Paperless | |

| Signal App Discount, Multi-Policy, Good Student, Safe Driver, Vehicle Safety, Homeowner, E-Policy | |

| Multi-Policy, Safe Driver, Good Student, Military, Federal Employee, Anti-Theft Device, Vehicle Safety Features | |

| Multi-Policy, Early Shopper, Homeowner, Paperless, New Car, Safe Driver, Anti-Theft Device, Good Student |

| Multi-Policy, Paperless, SmartRide, SmartMiles, Defensive Driving, Anti-Theft, Accident-Free, Good Student |

| Multi-Policy, Multi-Car, Safe Driver, Good Student, Homeowner, Continuous Insurance, Snapshot Discount | |

| Safe Driver, Good Student, Multi-Policy, Multi-Car, Defensive Driving Course, Anti-Theft Device, Vehicle Safety | |

| Multi-Policy, Homeownership, Hybrid/Electric Car, Good Student, Safe Driver, Early Quote, New Car | |

| Military Service, Good Student, Family Legacy, New Vehicle, Multi-Policy, Defensive Driving, Loyalty |

Glendale, California auto insurance is less expensive than other major Californian cities despite being only a six-mile drive from Los Angeles. Secure cheap auto insurance in Glendale, California by reading through our guide and learning how to comparison shop.

Monthly Glendale, California Auto Insurance Rates by ZIP Code

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly Glendale, California auto insurance rates by ZIP Code below:

Auto insurance rates in Glendale, California can vary significantly depending on the ZIP code. Factors such as local crime rates and traffic patterns, which are assessed by ZIP code, play a key role in determining monthly premiums for drivers in the area.

Glendale, California Auto Insurance Rates vs. Top US Metros

If you’re curious about how auto insurance rates in Glendale, California compare to those in other major US metro areas, the information is provided below.

The comparison of auto insurance rates in Glendale, California, with those in other top US metro areas provides insight into how Glendale’s rates measure up. This analysis allows residents to better understand their local insurance costs relative to other major cities. To discover more about the company, visit our guide titled, “Full Coverage Auto Insurance.”

When you’re ready to buy Glendale, California auto insurance, enter your ZIP code into our free quote tool above.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Cheapest Auto Insurance Company in Glendale, California

The cheapest Glendale, California auto insurance company is USAA. Rates average around $313 per month. However, premiums vary from person to person.

Glendale, California Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Weather-Related Risks | A | Low risk due to mild weather conditions |

| Average Claim Size | B+ | Claims are moderate, with average payouts around $4,700 |

| Traffic Density | B | High traffic density contributes to higher accident rates |

| Vehicle Theft Rate | B- | Moderate theft rate, slightly above state average |

| Uninsured Drivers Rate | C+ | Higher than average rate of uninsured drivers (around 14%) |

USAA only sells policies to military personnel. Liberty Mutual is the best choice for civilian Glendale residents.

We’ve provided a comparison of the best auto insurance rates in Glendale, California, along with how those rates measure up against the state average.

Your Glendale, California auto insurance quotes from these companies may look different depending on your age and driving record. For more information, check out our complete guide titled, “Top 7 Factors That Affect Auto Insurance Rates.”

However, your gender, credit history, and other non-driving factors cannot impact your insurance costs in the state of California.

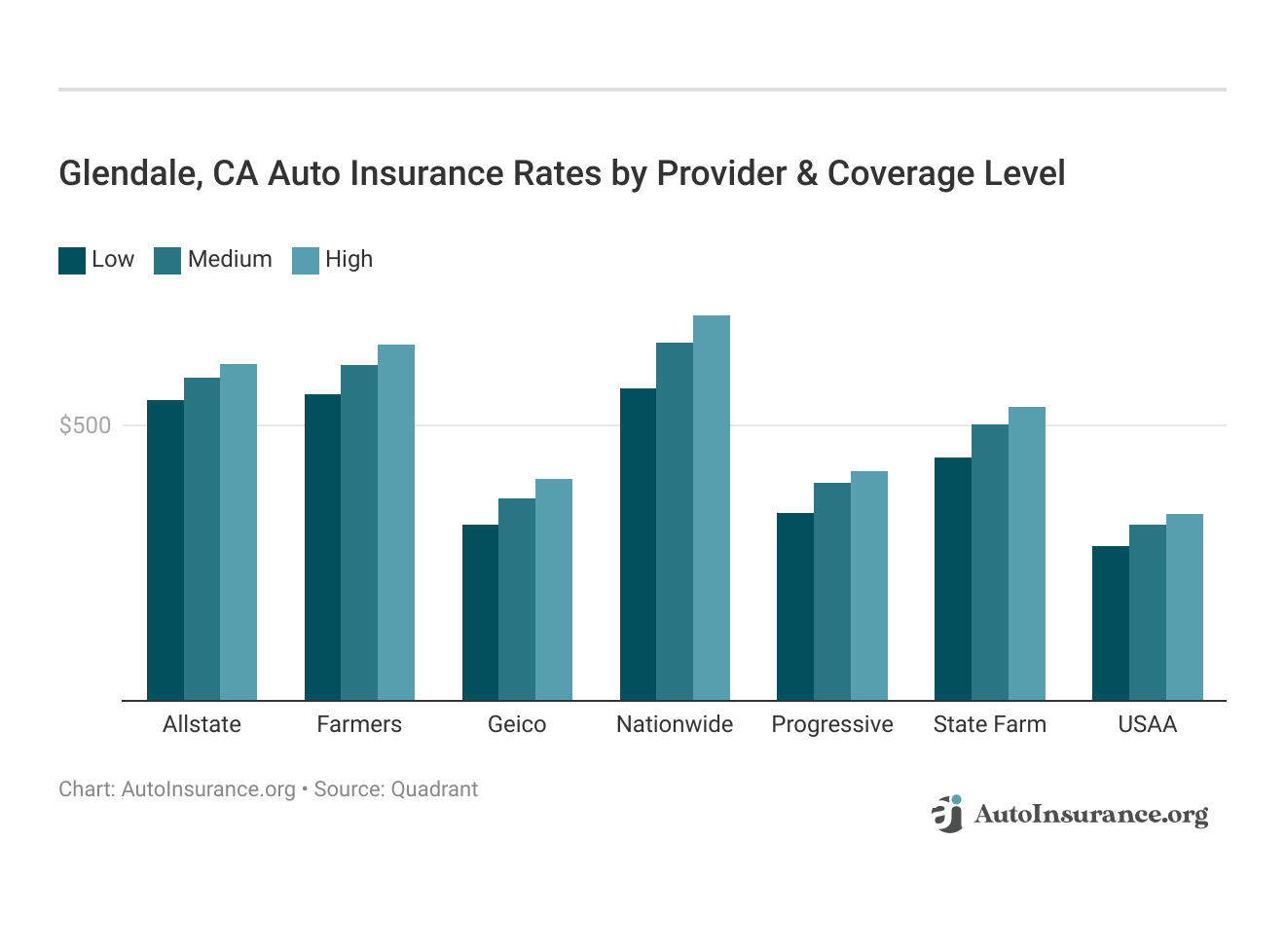

While non-driving factors cannot influence your insurance costs, the coverage level you require will affect your Glendale, California auto insurance rates.

Purchasing only the California minimum limits will be cheaper than a full coverage policy in Glendale.

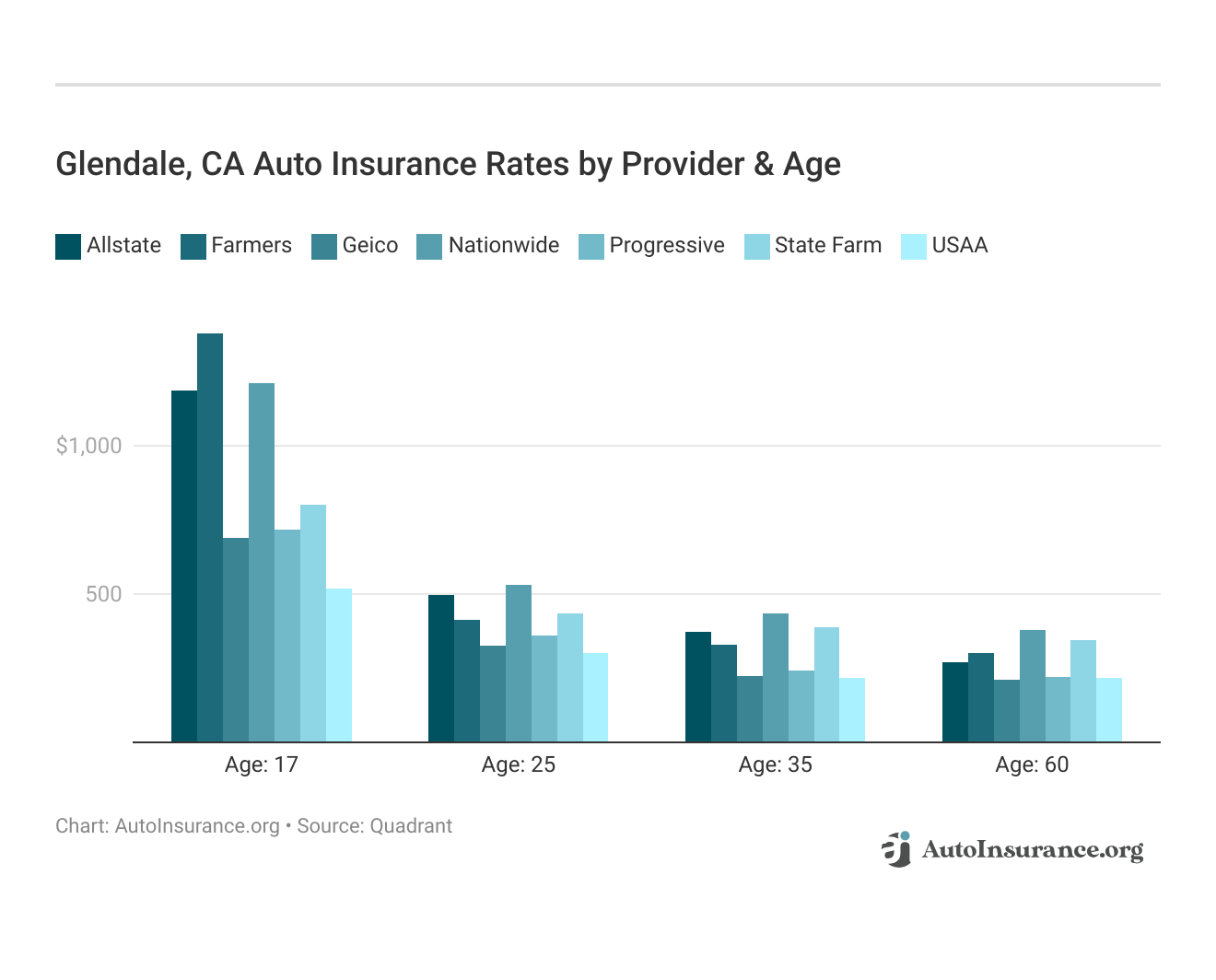

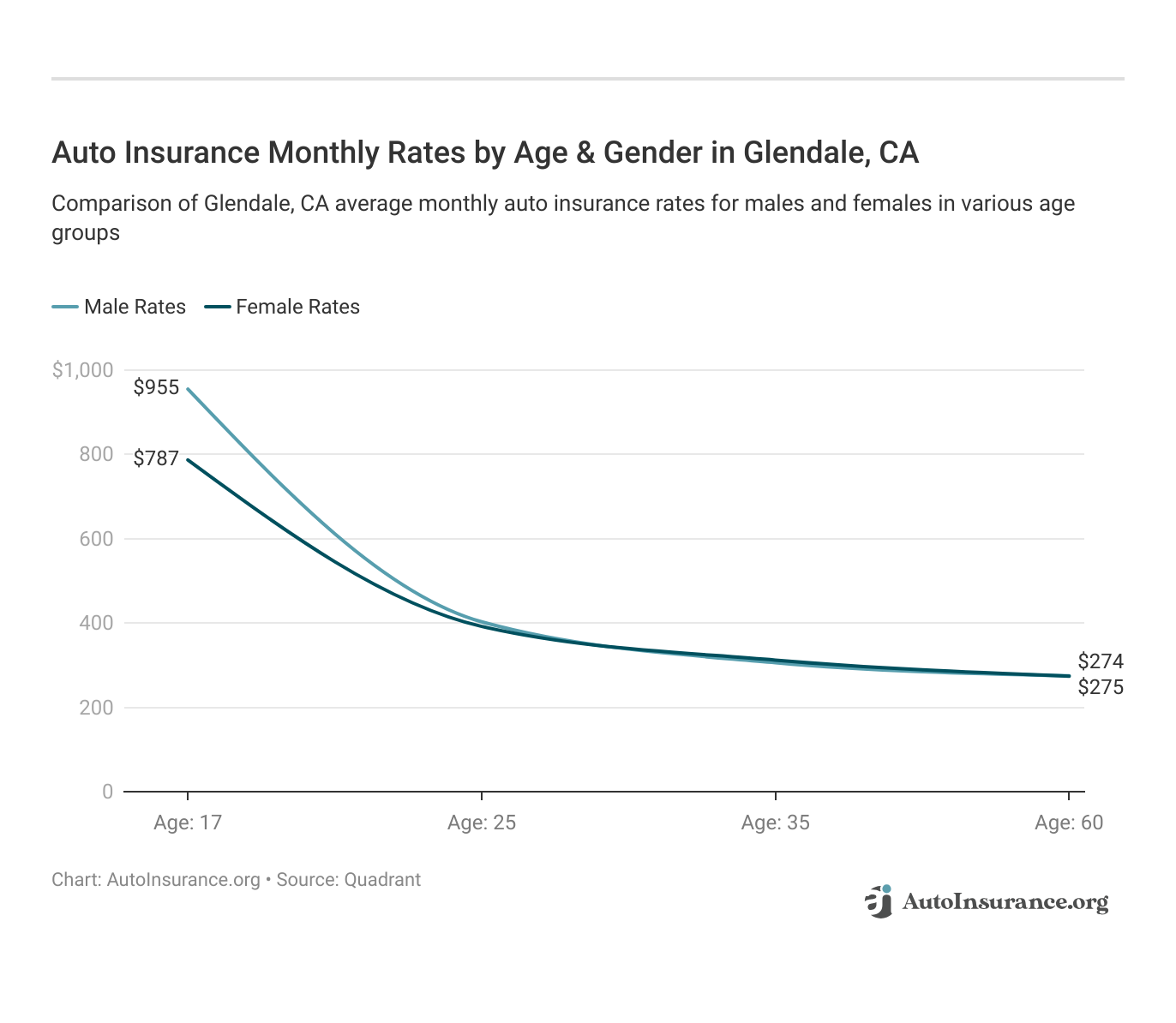

Glendale, California auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

Your coverage level will play a major role in your Glendale auto insurance rates. Find the cheapest Glendale, California auto insurance rates by coverage level below:

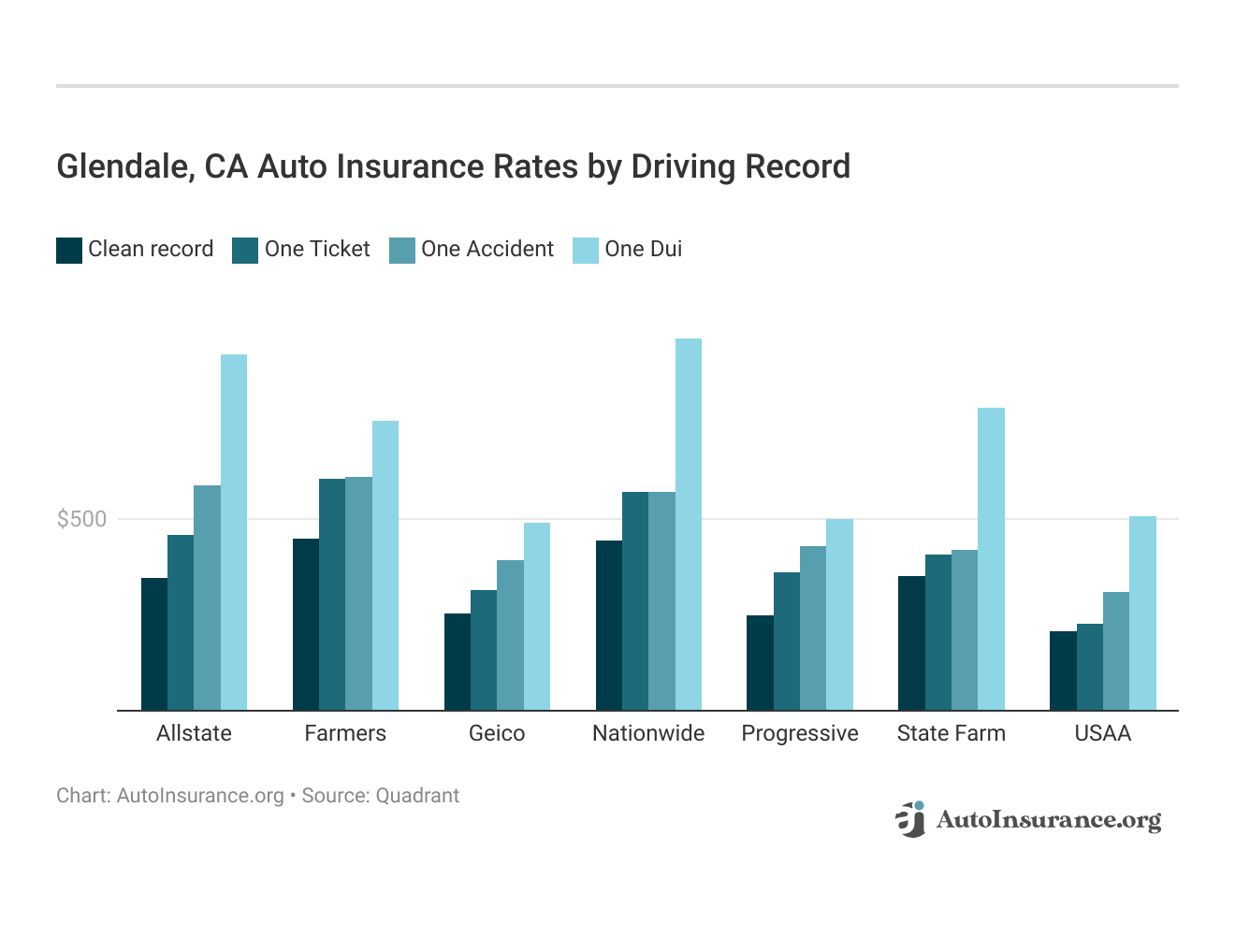

Your driving record will play a major role in your Glendale auto insurance rates. For example, other factors aside, a Glendale, California DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Glendale, California auto insurance rates by driving record.

Factors affecting auto insurance rates in Glendale, California may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Glendale, California auto insurance.

These states are no longer using gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a major factor because young drivers are often considered high-risk. CA does use gender, so check out the average monthly auto insurance rates by age and gender in Glendale, California.

In conclusion, while states like Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania no longer consider gender in calculating auto insurance rates, age remains a key factor, particularly for young drivers who are deemed high-risk.

However, in California, gender is still used in determining rates, as shown by the average monthly auto insurance rates in Glendale, California.

Required Auto Insurance Coverage in Glendale, California

Residents of Glendale must carry at least the California minimum legal auto insurance requirements.

California requires the following limits:

- $15,000 per person and $30,000 per accident in bodily injury liability coverage.

- $5,000 in property damage liability coverage.

California is an at-fault state. If you are liable for causing an accident, you and your insurance provider are responsible for covering all associated damages.

The following statistics outline auto accident and insurance claim data for Glendale, California. This information includes key metrics such as the annual number of accidents, claims, average claim size, and the percentage of uninsured drivers, providing valuable insights into the local driving environment.

Glendale, California Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Total Accidents Per Year | 3,800 |

| Total Claims Per Year | 3,200 |

| Average Claim Size | $5,200 |

| Percentage of Uninsured Drivers | 15% |

| Vehicle Theft Rate | 1,100 thefts/year |

| Traffic Density | High |

| Weather-Related Incidents | Low |

Glendale faces a significant number of auto accidents and claims each year, coupled with a high vehicle theft rate and a notable percentage of uninsured drivers. These factors underscore the importance of comprehensive insurance coverage and enhanced safety measures for residents.

Explore insurance savings in our full guide titled, “How to Compare Auto Insurance Quotes.”

Factors That Impact Auto Insurance Rates in Glendale, California

The nearby congested Los Angeles traffic heavily influences Glendale auto insurance rates. According to INRIX, Los Angeles is the sixth most congested city in America and is only six miles away from Glendale.

In Glendale, State Farm stands out not only for its $85 minimum coverage but also for its exceptional claims support.Jeff Root Licensed Insurance Agent

The average commute length for Glendale drivers is equivalent to the national average of 26 minutes, as reported by City-Data.

Fortunately, auto theft statistics in Glendale are average to low, balancing out your insurance costs. The Federal Bureau of Investigation (FBI) reported 317 vehicle thefts in 2017.

That is a rate of 156.6 car theft incidents for every 100,000 people. Discover more by exploring our in-depth guide titled, “Factors That Affect Auto Insurance Rates.”

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Essentials of Auto Insurance in Glendale, California

Glendale auto insurance costs are higher than average because of the city’s proximity to Los Angeles.

Fortunately, Glendale folks do not pay rates as high as the auto insurance in Los Angeles, CA. Auto insurance in San Diego, CA is also higher on average than in Glendale.

Auto insurance in San Jose, CA is close to Glendale’s costs but still not quite as low.

You can secure cheap Glendale, California auto insurance quotes by comparing rates from the multiple providers listed above.

Recieve affordable Glendale, California auto insurance rates from companies near you for free by entering your ZIP code into our quote tool below.

Frequently Asked Questions

What is Glendale, California Auto Insurance?

Glendale, California Auto Insurance refers to the auto insurance coverage available to residents of Glendale, California. It provides financial protection and coverage for vehicles against potential risks, damages, and liabilities.

For additional details, explore our comprehensive resource titled, “Does auto insurance cover broken side mirrors?”

What types of auto insurance coverage are available in Glendale, California?

Glendale, California offers a variety of auto insurance coverage options. Liability coverage helps cover damages and injuries to others if you’re at fault in an accident, while collision coverage pays for repairs or replacement if your vehicle is damaged in a crash.

Comprehensive coverage protects against non-collision damages like theft or natural disasters. Personal Injury Protection (PIP) covers medical expenses and lost wages for you and your passengers, regardless of fault. Uninsured/Underinsured Motorist coverage offers protection if you’re in an accident with a driver lacking sufficient insurance.

Are there any specific auto insurance requirements in Glendale, California?

Yes, Glendale, California, follows the auto insurance requirements set by the state of California. Drivers in Glendale are required to carry minimum liability insurance coverage, which includes $15,000 bodily injury liability per person, $30,000 bodily injury liability per accident, and $5,000 property damage liability per accident. Additional coverage may be recommended for better protection.

How can I find affordable auto insurance in Glendale, California?

To find affordable auto insurance in Glendale, California, start by shopping around and getting quotes from multiple providers to compare rates and coverage. Take advantage of available discounts, such as those for safe driving, bundling policies, or vehicle safety features.

Maintaining a clean driving record can also help lower premiums. Consider increasing deductibles to reduce your premium, though this may result in higher out-of-pocket costs if you file a claim. Finally, review your coverage needs and adjust limits or remove unnecessary coverage to reduce overall costs.

Are there any local insurance requirements specific to Glendale, California?

While Glendale, California follows the auto insurance requirements set by the state of California, there are no additional local insurance requirements specific to Glendale.

To find out more, explore our guide titled, “Minimum Auto Insurance Requirements by State.”

Where can I purchase auto insurance in Glendale, California?

Auto insurance can be purchased from various sources in Glendale, California. You can contact insurance agents or brokers, visit their offices, or utilize online platforms to obtain quotes and purchase coverage. Many insurance companies also offer the option to purchase insurance directly from their websites or over the phone.

Can I use my auto insurance outside of Glendale, California?

Yes, your auto insurance coverage typically extends beyond Glendale, California. Your coverage is valid within the state of California and may also provide limited coverage when driving in other states within the United States. However, it’s essential to review the terms and conditions of your specific insurance policy to understand the extent of coverage while traveling outside Glendale.

What should I consider when choosing auto insurance in Glendale, California?

When selecting auto insurance in Glendale, California, prioritize coverage types suited for local driving conditions, discounts specific to the area, accessibility of local agents, and the insurer’s financial strength as rated by A.M. Best to ensure long-term reliability.

How can I find the most affordable auto insurance in Glendale, California?

To find affordable auto insurance in Glendale, California, compare quotes from multiple providers, explore local discounts like safe driving or low mileage, and bundle your policies with home or renter’s insurance to get the best possible rate.

To learn more, explore our comprehensive resource on, “How much car insurance do I need?”

What types of coverage are commonly included in auto insurance policies in Glendale, California?

Are there specific discounts available for auto insurance in Glendale, California?

Why is A.M. Best rating important for auto insurance in Glendale, California?

How can I lower my auto insurance rates in Glendale, California?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.