Best Salt Lake City, Utah Auto Insurance in 2024 (Find the Top 10 Companies Here)

Choose from top insurers like State Farm, Geico, and Progressive for the best Salt Lake City, Utah auto insurance at unbeatable rates starting at $58/month. They are known for their local presence, and exceptional budgeting tools. Get cheap car insurance in Salt Lake City from these providers and save now.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

17,759 reviews

17,759 reviewsCompany Facts

Full Coverage in Salt Lake City

A.M. Best Rating

Complaint Level

Pros & Cons

17,759 reviews

17,759 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Salt Lake City

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,128 reviews

13,128 reviewsCompany Facts

Full Coverage in Salt Lake City

A.M. Best Rating

Complaint Level

Pros & Cons

13,128 reviews

13,128 reviews

You can secure the best Salt Lake City, Utah auto insurance from top names like State Farm, Geico, and Progressive, with rates starting at $58 a month. State Farm ranked the highest due to its solid reputation for dependability.

This article unveils the best rates and protection for you and your car in the Beehive State’s capital. We’ll walk you through how to choose an auto insurance company that fits your unique needs and budget. Learn local cost factors, minimum requirements, and money-saving tips.

Our Top 10 Company Picks: Best Salt Lake City, Utah Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 7% B Local Presence State Farm

#2 12% A++ Low Rates Geico

#3 15% A+ Budgeting Tools Progressive

#4 18% A+ Extensive Coverage Allstate

#5 13% A Bundling Options American Family

#6 10% A Military Focus Farmers

#7 20% A++ Military Focus USAA

#8 8% A Flexible Policies Liberty Mutual

#9 14% A++ Policy Customization Travelers

#10 11% A+ Vanishing Deductible Nationwide

Whether downtown or in the Wasatch Range, find the perfect balance of protection and affordability for Salt Lake City. Get fast and cheap auto insurance in Salt Lake City, UT today with our quote comparison tool above.

- State Farm’s the top pick for auto insurance in Salt Lake City

- The average rate in Salt Lake City auto insurance is $352 per month

- Minimum coverage is required to drive legally in Utah

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Economic Shield: State Farm’s $150 monthly rate in Salt Lake City aligns with local averages, offering Utah drivers affordable coverage without compromising on quality. See more details in State Farm auto insurance discounts.

- Youth-Friendly Pricing: In Salt Lake City, State Farm excels with competitive rates for drivers under 25, making it an attractive choice for Utah’s younger motorists navigating the city’s roads.

- Home and Auto Bundling: Salt Lake City homeowners can potentially slash their auto insurance costs by combining policies with State Farm, leveraging the company’s strong presence in Utah’s property market.

Cons

- Outdated Online Experience: State Farm’s digital resources for Salt Lake City policyholders may frustrate tech-savvy Utah drivers accustomed to more advanced online platforms.

- Standard Claims Handling: Some Salt Lake City drivers report that State Farm’s claims process meets but doesn’t exceed expectations, potentially disappointing those seeking exceptional service in Utah’s market.

#2 – Geico: Best for Low Rates

Pros

- Wallet-Friendly Rates: Geico’s $140 monthly premium for Salt Lake City drivers undercuts the city’s average, offering substantial savings for budget-conscious Utah motorists. See more details in Geico auto insurance review.

- Cutting-Edge Digital Tools: Salt Lake City’s tech-savvy population benefits from Geico’s advanced online platform and mobile app, streamlining policy management for Utah drivers.

- Savings Opportunities Galore: Geico presents Salt Lake City residents with numerous ways to reduce premiums, from safe driving incentives to vehicle safety feature rewards, helping Utah policyholders maximize their savings.

Cons

- Scarce Physical Offices: Geico’s minimal brick-and-mortar presence in Salt Lake City may frustrate Utah drivers who prefer discussing complex insurance matters face-to-face.

- One-Size-Fits-All Approach: Some Salt Lake City policyholders find that Geico’s standardized strategies may not fully address Utah-specific driving concerns or unique coverage requirements.

#3 – Progressive: Best for Budgeting Tools

Pros

- Behavior-Based Discounts: Progressive’s Snapshot program enables Salt Lake City drivers to earn savings based on their actual road habits, potentially rewarding Utah’s cautious motorists with lower rates. See more details in Progressive auto insurance review.

- Credit-Challenged Driver Ally: In Salt Lake City, Progressive stands out by offering more affordable options for drivers with less-than-perfect credit, increasing accessibility in Utah’s credit-sensitive insurance landscape.

- Gig Economy Protection: Salt Lake City’s growing rideshare community benefits from Progressive’s specialized insurance, addressing crucial coverage gaps for Utah’s Uber and Lyft drivers.

Cons

- Slightly Higher Premiums: At $155 monthly, Progressive’s rates in Salt Lake City edge above the city average, potentially deterring Utah drivers focused on securing the lowest possible premiums.

- Inconsistent User Experiences: Some Salt Lake City policyholders report varying satisfaction levels with Progressive’s support, indicating potential challenges in Utah’s demanding insurance market.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Extensive Coverage

Pros

- Personalized Local Support: Allstate’s significant presence in Salt Lake City ensures that Utah drivers have access to individualized, in-person assistance for their unique insurance needs. See more details in Allstate auto insurance review.

- Safe Driving Incentives: Salt Lake City motorists can benefit from Allstate’s Drivewise program, earning rewards for cautious road behavior and potentially reducing their premiums in Utah’s competitive market.

- Tailored Policy Options: Allstate offers Salt Lake City residents numerous ways to customize their coverage, allowing Utah drivers to address specific local risks and personal preferences.

Cons

- Premium Price Point: With a monthly rate of $160, Allstate ranks among the costlier options for Salt Lake City drivers, challenging Utah residents seeking more budget-friendly protection.

- Overwhelming Discount Maze: Some Salt Lake City policyholders find Allstate’s myriad of savings options confusing, potentially missing out on cost-cutting opportunities in Utah’s price-sensitive market.

#5 – American Family: Best for Bundling Options

Pros

- Balanced Local Pricing: American Family’s $150 monthly premium aligns with Salt Lake City’s average, offering Utah drivers a mid-range option that balances cost and protection. See more details in American Family auto insurance review.

- Household-Oriented Policies: Salt Lake City’s family-centric communities benefit from American Family’s tailored options, addressing the unique needs of Utah households with multiple drivers.

- Entrepreneur-Friendly Approach: American Family’s small business insurance expertise adds value for Salt Lake City’s business owners, offering potential savings for Utah’s entrepreneurs.

Cons

- Limited Utah Footprint: American Family’s smaller presence in Salt Lake City may result in fewer local representatives compared to larger insurers, potentially impacting accessibility for Utah policyholders.

- Dated Digital Interface: Some Salt Lake City customers report that American Family’s online tools and mobile app fall short of expectations, potentially frustrating tech-savvy Utah drivers.

#6 – Farmers: Best for Military Focus

Pros

- Budget-Conscious Choice: Farmers’ $145 monthly rate in Salt Lake City falls below the city average, offering Utah drivers a cost-effective option for robust protection. See more details in Farmers auto insurance review.

- Diverse Vehicle Expertise: Salt Lake City’s varied vehicle ownership, from off-road adventurers to classic car enthusiasts, benefits from Farmers’ ability to address Utah’s unique automotive landscape.

- Adaptable Payment Options: Farmers gives Salt Lake City residents various ways to pay, including usage-based plans, catering to Utah’s diverse driving patterns and financial situations.

Cons

- Unpredictable Claims Process: Some Salt Lake City policyholders report fluctuating satisfaction with Farmers’ claims handling, potentially impacting overall value in Utah’s competitive insurance scene.

- Intricate Policy Structure: Farmers’ multi-tiered system may confuse some Salt Lake City drivers, complicating policy navigation in Utah’s already complex insurance environment.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – USAA: Best for Military Focus

Pros

- Unrivaled Local Pricing: USAA’s $135 monthly premium stands as the most affordable in Salt Lake City, offering exceptional value for eligible military members and their families in Utah. See more details in USAA auto insurance review.

- Service Member Focused: Salt Lake City’s significant military population benefits from USAA’s specialized options, addressing unique needs like deployment and frequent moves common in Utah’s service community.

- Exemplary Claims Handling: USAA consistently earns top marks for claims management in Salt Lake City, ensuring smooth experiences for Utah policyholders during stressful post-accident periods.

Cons

- Exclusive Membership: USAA’s services are restricted to military members and their families, excluding a large portion of Salt Lake City’s general population from these competitive rates.

- Minimal Physical Presence: USAA’s primarily digital approach may challenge Salt Lake City policyholders who prefer in-person interactions, potentially complicating complex insurance matters for Utah members.

#8 – Liberty Mutual: Best for Flexible Policies

Pros

- Flexible Policy Design: Liberty Mutual enables Salt Lake City drivers to fine-tune their coverage, addressing specific needs from mountain excursions to urban commuting unique to Utah’s diverse landscape. See more details in Liberty Mutual auto insurance review.

- First-Accident Shield: Salt Lake City policyholders can add protection against rate increases after their first at-fault incident, offering peace of mind on Utah’s varied roadways.

- Educator Appreciation: Liberty Mutual recognizes Salt Lake City’s teaching community with special benefits, acknowledging the importance of Utah’s educators through tailored options.

Cons

- Mid-Range Local Pricing: At $150 monthly, Liberty Mutual’s rates in Salt Lake City align with the city average, potentially limiting its appeal for Utah drivers seeking the most economical choices.

- Inconsistent Local Reputation: Some Salt Lake City customers report varying experiences with Liberty Mutual’s service quality, indicating potential challenges in meeting Utah’s high insurance standards.

#9 – Travelers: Best for Policy Customization

Pros

- Attractive Local Rates: Travelers’ $148 monthly premium in Salt Lake City falls slightly below the city average car insurance in Utah, offering Utah drivers a cost-effective choice for solid protection. See more details in Travelers auto insurance review.

- Green Vehicle Incentives: Salt Lake City’s eco-conscious drivers benefit from Travelers’ hybrid and electric vehicle discounts, aligning with Utah’s growing focus on sustainable transportation.

- Loyalty Rewards Program: Travelers incentivizes Salt Lake City’s safe drivers with a diminishing deductible option, potentially reducing out-of-pocket costs over time for Utah policyholders.

Cons

- Sparse Local Representation: Travelers’ smaller footprint in Salt Lake City may result in fewer in-person options, potentially impacting personalized assistance for Utah policyholders seeking face-to-face interactions.

- Challenging Quote Process: Some Salt Lake City residents report difficulties in obtaining accurate online estimates from Travelers, complicating comparisons in Utah’s competitive insurance landscape.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Nationwide: Best for Vanishing Deductible

Pros

- Shrinking Deductible Feature: Salt Lake City drivers can benefit from Nationwide’s diminishing deductible option, potentially lowering their out-of-pocket expenses as they maintain a clean driving record in Utah. See more details in Nationwide auto insurance review.

- Annual Coverage Review: Nationwide offers Salt Lake City policyholders yearly insurance check-ups, ensuring Utah drivers maintain optimal protection as their circumstances evolve.

- Furry Friend Protection: Nationwide includes pet injury coverage in its collision protection, appealing to Salt Lake City’s animal lovers and addressing a unique concern for Utah’s four-legged companions.

Cons

- Higher Than Average Costs: At $155 monthly, Nationwide’s rates in Salt Lake City slightly exceed the city norm, potentially dissuading cost-conscious Utah drivers seeking the most affordable protection.

- Variable Local Feedback: Some Salt Lake City policyholders report inconsistent experiences with Nationwide’s support and claims processing, indicating potential irregularities in Utah’s demanding insurance market.

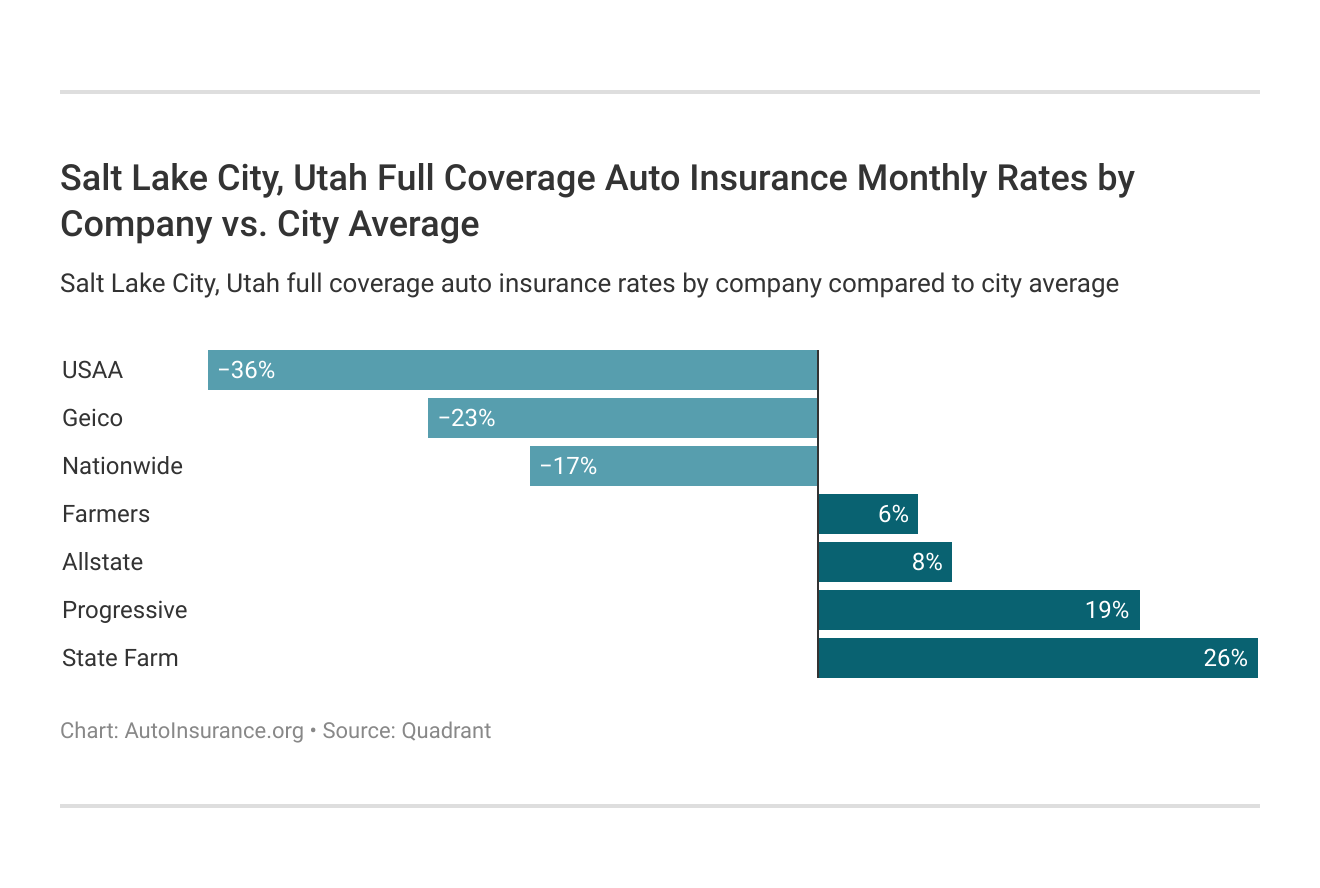

Salt Lake City, UT Cheapest Auto Insurance Companies

In Salt Lake City, Utah, auto insurance rates vary by provider and coverage level, reflecting the city’s diverse driving conditions and needs. Whether you’re opting for minimum coverage or full protection, finding the right insurer can make a significant difference in your monthly costs.

Salt Lake City, Utah Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $75 $160

American Family $68 $150

Farmers $62 $145

Geico $60 $140

Liberty Mutual $66 $150

Nationwide $67 $155

Progressive $70 $155

State Farm $65 $150

Travelers $64 $148

USAA $58 $135

Ensure your coverage meets both your budget and safety requirements. Compare these rates to make an informed decision that fits your lifestyle in the heart of Utah.

Read More: Can a private auto insurance company meet my needs?

Salt Lake City, UT Auto Insurance Requirement

Residing in Salt Lake City necessitates adherence to Utah’s distinct automobile insurance regulations to ensure legal compliance. In Utah, every driver must have, at the very least, these minimums:

- $25,000 per person and $65,000 per incident for bodily injury liability

- $15,000 per incident for property damage

- $3,000 in personal injury protection (PIP) coverage

Read More: Does auto insurance cover private property?

In Utah, a no-fault insurance state, drivers must carry Personal Injury Protection (PIP). It’s the law. But wise folks think beyond the basics. They seek extra coverage.

It brings a calm to the mind and keeps your wallet safe. We have discovered the cheapest car insurance in Salt Lake City. Read our guide on the best Salt Lake City, UT auto insurance and make a smart, local choice.

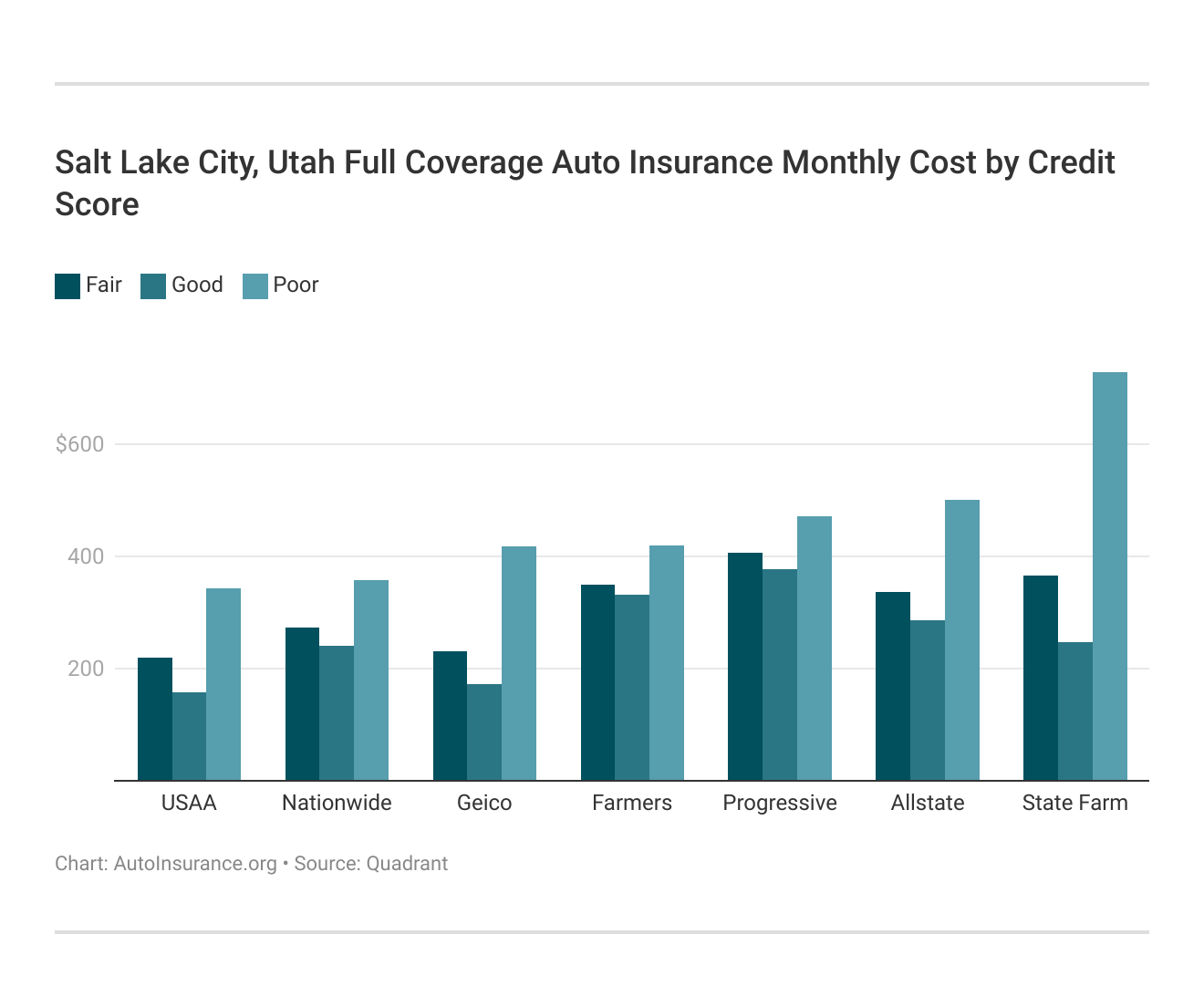

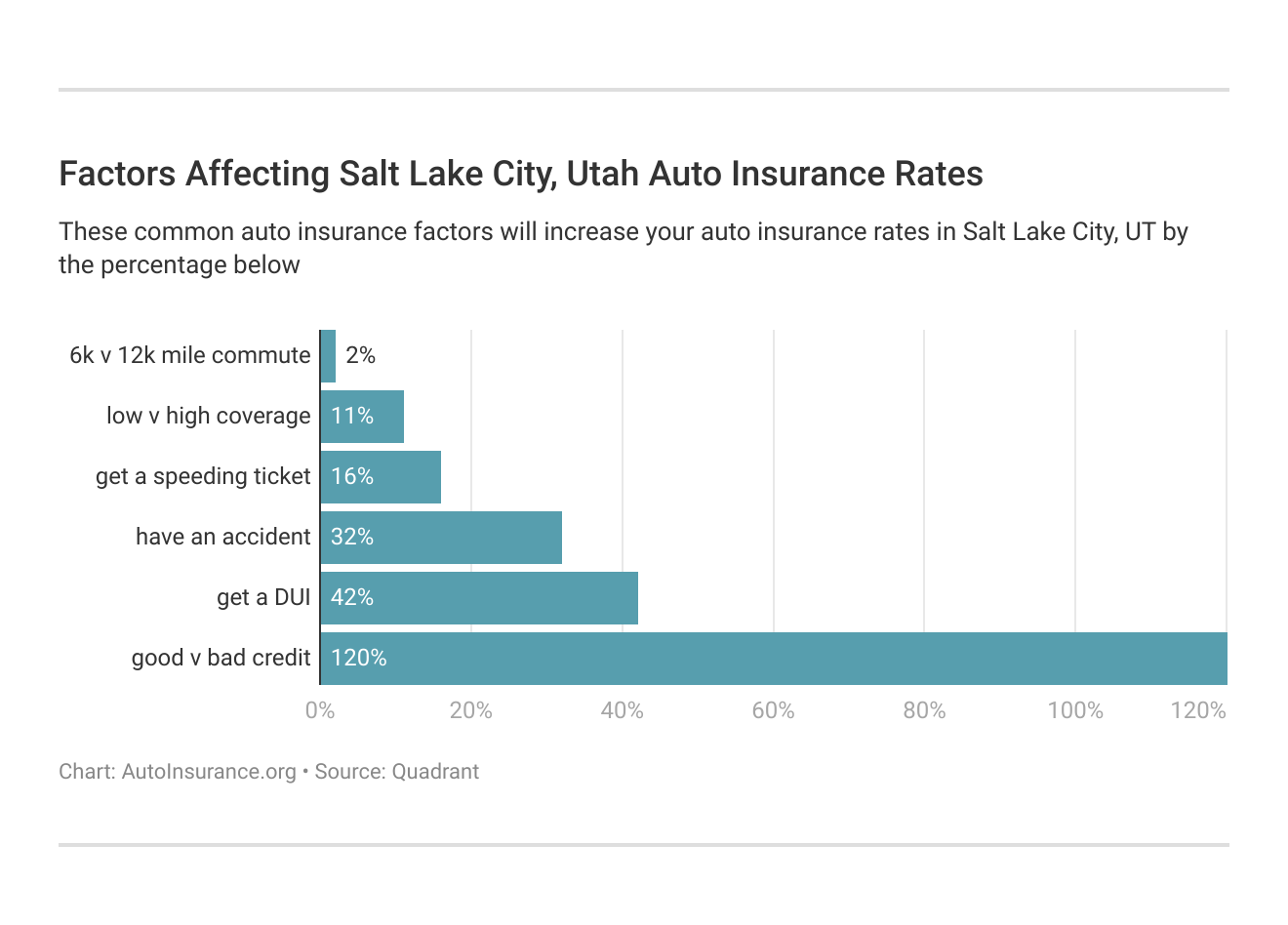

These averages can function as a foundational reference point for you. The rates you encounter in Salt Lake City will be influenced by a range of variables, including your age, gender, marital status, and credit score.

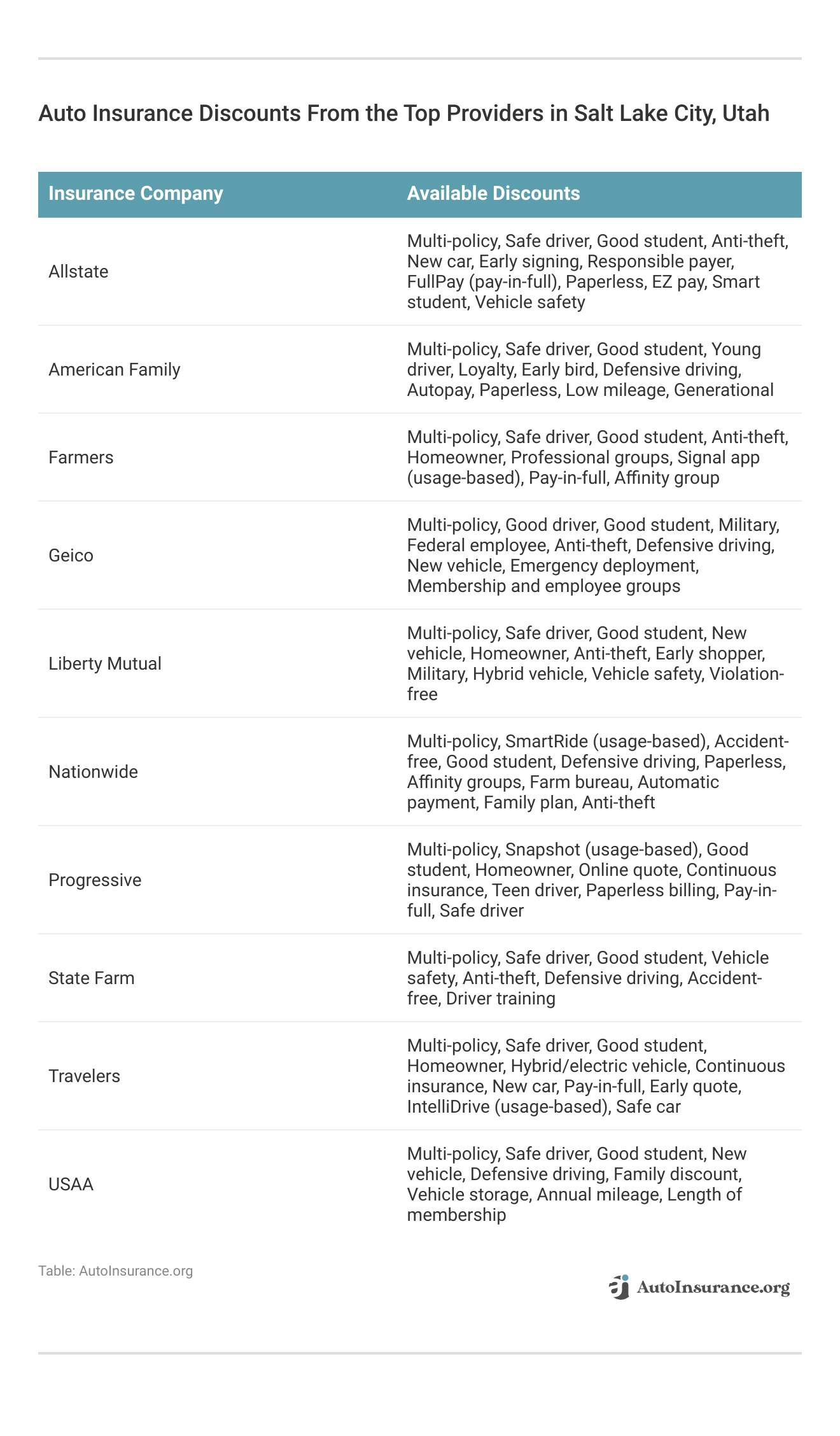

As you explore the scenic beauty of Utah’s capital, these auto insurance discounts from leading providers can help you stay protected at a great price.

These discounts can help you secure the coverage you need at a price that suits your budget. Take advantage of these offers from the these companies to ensure you’re protected as you explore everything this unique city has to offer.

Finding the best Salt Lake City, UT auto insurance has never been easier or more rewarding.Michelle Robbins LICENSED INSURANCE AGENT

Whether your credit score is stellar or needs improvement, finding cheap car insurance in Salt Lake City varies by provider—check out these key differences.

No matter where you stand on the credit score spectrum, knowing which insurers offer the best rates can help you find cheap car insurance in Salt Lake City that fits your budget. Whether you’re cruising past the Great Salt Lake or navigating the city streets, these insights empower you to make informed decisions and secure the coverage you need.

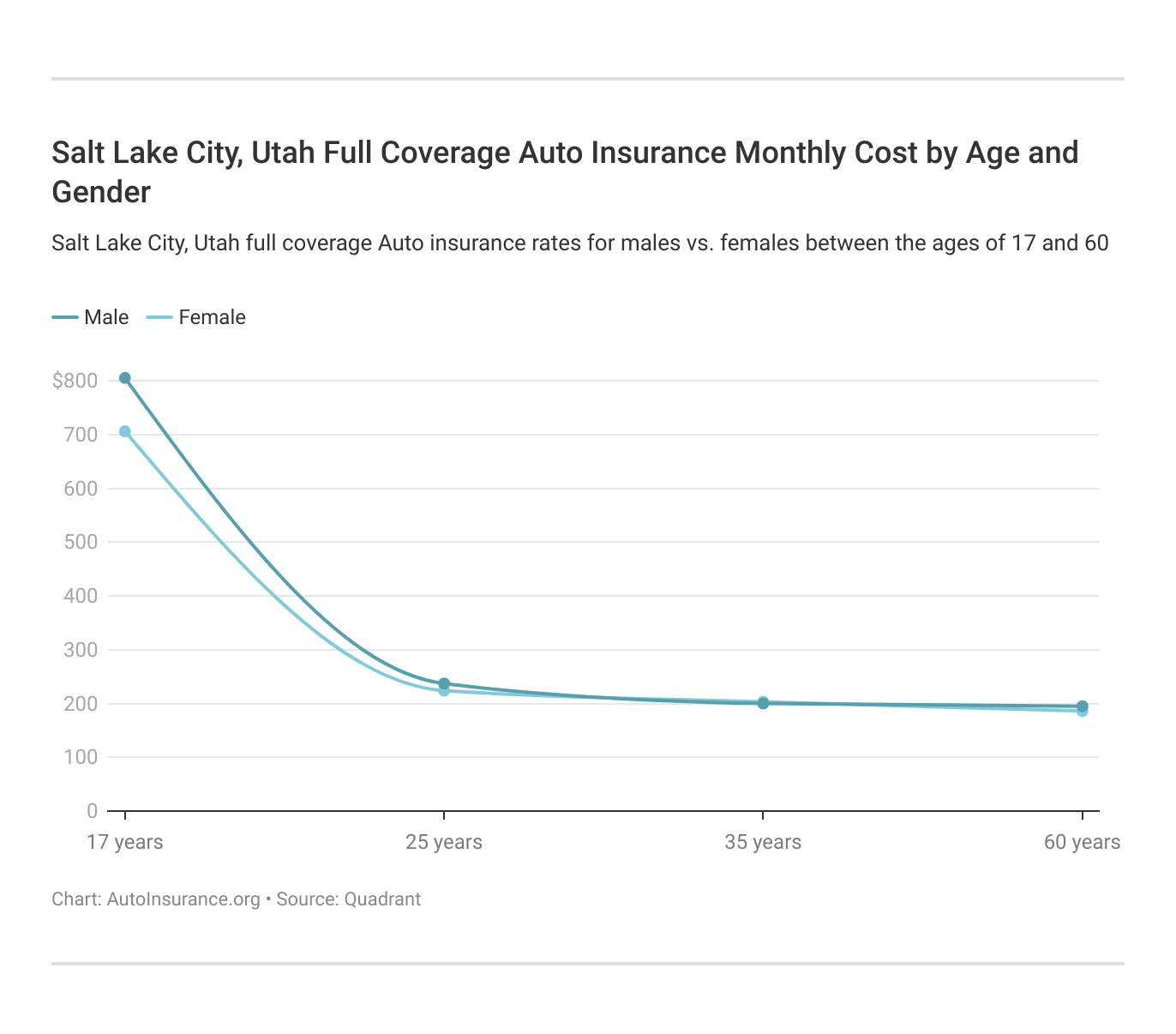

In Salt Lake City, the years you’ve lived change what you pay to insure your car. The young ones, they get the short end.

The city looks at whether you’re a man or a woman when they set the price too. So, see what the residents in Salt Lake City pay each month for auto insurance, broken down by age and gender.

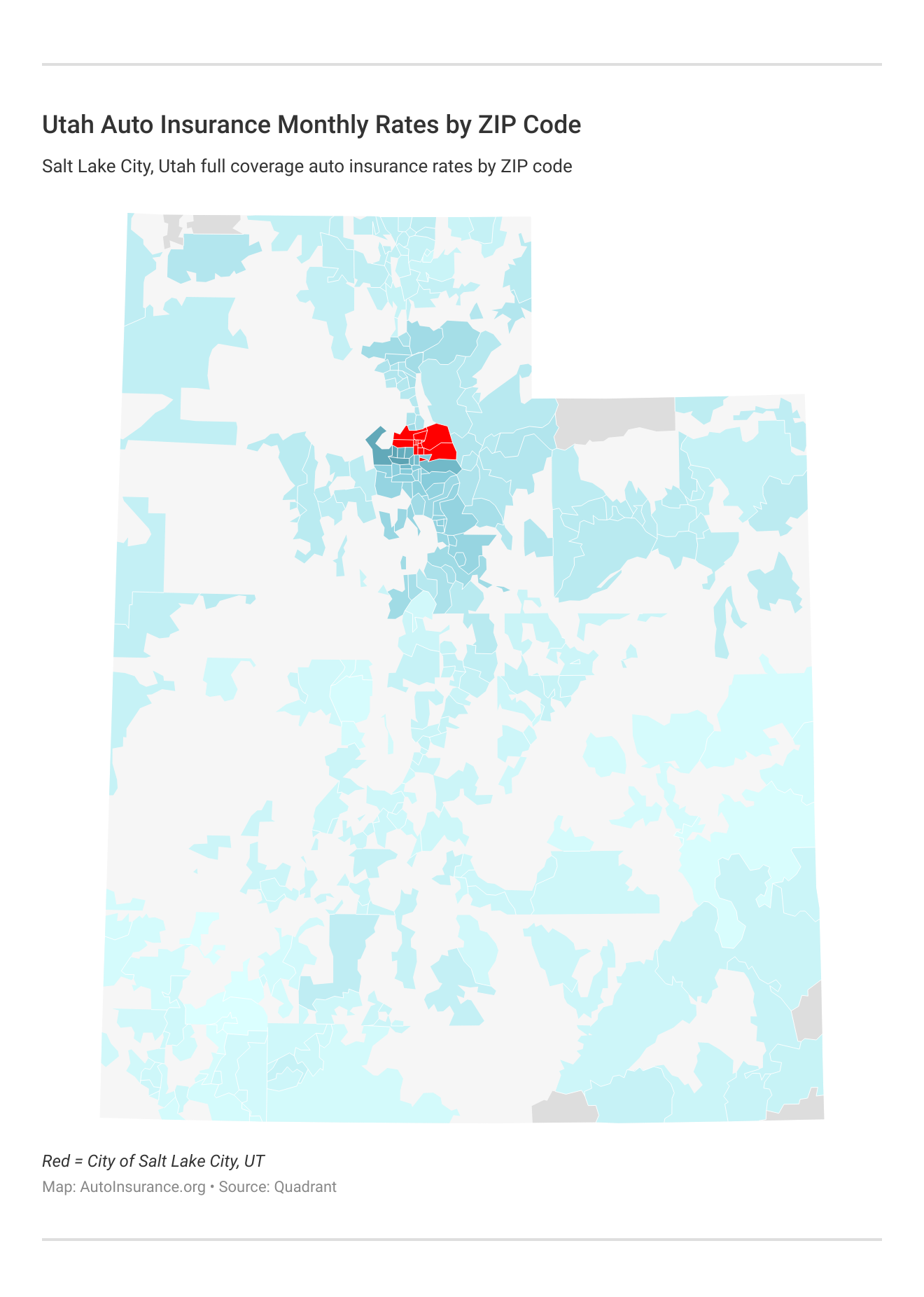

Where you live matters for your auto insurance. Crime and traffic weave their way into the rates, all tied to your ZIP code. Below, you’ll find what it costs each month for auto insurance in Salt Lake City, UT, based on your ZIP code.

As you hunt for the best Salt Lake City, Utah auto insurance, remember: your location is more than just a point on the map. It’s a chapter in your insurance narrative, influencing your insurance rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Salt Lake City, UT Car Insurance Rates vs. Top US Metro Car Insurance Rates

The city of residence significantly influences car insurance premiums. Therefore, it is essential to compare auto insurance in Salt Lake City, UT, with those in other prominent metropolitan areas across the United States.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Frequently Asked Questions

How can I find discounts on auto insurance in Salt Lake City, UT?

You can find car insurance discounts on auto insurance in Salt Lake City by bundling policies, maintaining a clean driving record, taking advantage of multi-car discounts, and enrolling in defensive driving courses. Some insurers also offer discounts for good students, military members, and safe driving habits.

Is it necessary to purchase full coverage auto insurance in Salt Lake City, UT?

While full coverage auto insurance is not mandatory in Salt Lake City, it is recommended if you want comprehensive protection for your vehicle, especially if it’s financed or leased. Full coverage includes both collision and comprehensive insurance, covering a wider range of incidents than minimum liability.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes in Salt Lake City, UT.

How does driving behavior impact auto insurance rates in Salt Lake City, UT?

Driving behavior significantly impacts your auto insurance rates in Salt Lake City. Safe drivers with no traffic violations or accidents typically pay lower premiums. Insurers may also use telematics devices to monitor your driving habits, offering discounts for safe driving practices.

What should I do if I’m involved in an accident in Salt Lake City, UT?

If you’re involved in an accident in Salt Lake City, ensure everyone’s safety first and call emergency services if needed. Exchange information with the other driver, document the scene with photos, and notify your insurance company as soon as possible to begin the claims process.

Can I get temporary car insurance in Salt Lake City, UT?

Yes, you can get temporary car insurance in Salt Lake City if you need coverage for a short period, such as renting a car or borrowing one from a friend. Temporary policies are typically available for periods ranging from a few days to several months, depending on your needs.

What factors can affect the cost of auto insurance in Salt Lake City, UT?

Factors such as age, driving record, gender, and even Salt Lake City weather can all influence the cost of car insurance in Salt Lake City, UT.

Which companies offer the cheapest auto insurance rates in Salt Lake City, UT?

USAA and Geico are among the cheapest auto insurance providers in Salt Lake City, UT. More information is available for Geico in our Geico auto insurance review.

What are the minimum auto insurance requirements in Salt Lake City, UT?

Drivers in Salt Lake City, Utah, are required to have at least the bare minimum of liability coverage.

How does credit score affect auto insurance rates in Salt Lake City, UT?

In Salt Lake City car insurance, your credit score can play a significant role in determining your car insurance costs, except in states where credit-based discrimination is prohibited.

What are some external factors that can impact auto insurance rates in Salt Lake City, UT?

External factors such as city traffic, crime rates (including auto theft), and Salt Lake City weather conditions can influence auto insurance rates in the area. Use our free comparison tool below to see what Salt Lake City insurance quotes look like in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.