Best Salem, Oregon Auto Insurance in 2025 (Check Out the Top 10 Companies)

The best Salem, Oregon auto insurance options are Geico, State Farm, and Progressive, with starting rates around $70 per month. These providers offer a range of coverage options and discounts tailored to local drivers. Explore how these companies can help you find the right policy for your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Salem OR

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Salem OR

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Salem OR

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best Salem, Oregon auto insurance is offered by Geico, State Farm, and Progressive, providing affordable rates and comprehensive coverage options.

With starting rates as low as $70 per month, these top providers excel in customer service, discounts, and flexible policies tailored to diverse needs. Dive deeper into “Auto Insurance Premium Defined” with our complete resource.

Geico stands out as the best company for rates, offering competitive pricing and robust coverage features. Whether you’re a new driver or looking to switch providers, these companies deliver excellent value in Salem.

Our Top 10 Company Picks: Best Salem, Oregon Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | A++ | Many Discounts | Geico | |

| #2 | 18% | B | Cheap Rates | State Farm | |

| #3 | 7% | A+ | Budgeting Tools | Progressive | |

| #4 | 14% | A+ | Numerous Discounts | Allstate | |

| #5 | 9% | A | Personalized Service | Farmers | |

| #6 | 20% | A | Custom Policies | Liberty Mutual |

| #7 | 25% | A++ | Military Benefits | USAA | |

| #8 | 11% | A+ | Strong Discounts | Nationwide |

| #9 | 15% | A++ | Solid Coverage | Travelers | |

| #10 | 6% | A | Strong Support | American Family |

Explore your car insurance options by entering your ZIP code above and finding which companies have the lowest rates.

- Geico, State Farm, and Progressive lead Salem auto insurance options

- Rates start at just $70 per month, providing affordability for drivers

- Each company offers excellent coverage and customer service tailored to needs

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Drivers in Salem, OR, have a great option for a budget-friendly car insurance since Geico offers some of the most competitive pricing of insurance.

- Diverse Discounts: Residents in Salem, OR, can benefit from a wide array of discounts, including multi-policy, safe driver, and military discounts, which can lead to savings for qualified policyholders.

- Customizable Coverage: As highlighted in our Geico auto insurance review, Salem drivers can customize their coverage based on their needs

Cons

- Local Agent: Some Salem, OR, drivers who value in-person encounters for getting help on their insurance may not be satisfied with this because the local agent is limited in this area.

- Claims Processing: Certain customers in Salem reported dissatisfaction because of the delay in processing claims, which can lead to a transfer to another company.

#2 – State Farm: Best for Coverage Options

Pros

- Choices for Coverage: State Farm offers a wide variety of coverage types tailored for Salem, OR, including rental car reimbursement, rideshare coverage, and emergency roadside assistance.

- Loyalty Discount: Loyalty discounts are provided to customers who have been insured for a long period of time as a privilege provided by the company, according to State Farm auto insurance review.

- Payment Plans: The Drive Safe & Save program in Salem, OR, provides a telematics-based discount for customers who demonstrate safe driving behaviors.

Cons

- Higher Premiums: Some young drivers in Salem, OR, may pay high rates compared to other companies because of not enough driving experience.

- Limited Online Resources: Because of its outdated program, the online experience may not be as simple as with other insurers, which might be frustrating tech-savvy customers in Salem, OR.

#3 – Progressive: Best for Comparison Tools

Pros

- Comparison Tools: Name Your Price lets drivers in Salem compare quotes and get the insurance that’s right for them.

- Customizable Plans: In Salem, OR residents can customize policies to fit their budget and coverage wants, like comprehensive, collision, gap and ridesharing.

- Snapshot Program: Progressive’s Snapshot program, is an opportunity for drivers in Salem, Oregon that monitor driving habits and offers discounts based on safe driving practices.

Cons

- Elevated Rates: For Salem, Oregon, drivers with prior collisions or moving infractions, Progressive may impose higher premiums, making it a less desirable option for high-risk clients.

- Policy Fees: Imposes fees for certain policy adjustments in Salem which could inconvenience those who need to modify their coverage options, according to Progressive auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Coverage Plans

Pros

- Coverage Plans: Allstate offers a range of protective plans in Salem, OR, including accident forgiveness, safe driving bonuses, and new car replacement coverage.

- Digital Tools: Salem, OR drivers can take advantage the ability to manage their insurance coverage and policy using a website and mobile app, as per Allstate auto insurance review.

- Payment Options: Salem, OR, policyholders appreciate Allstate’s variety of payment options, making it convenient to manage and pay premiums on their own terms.

Cons

- Higher Premiums: Allstate’s rates in Salem may deter budget-conscious consumers because rates may be higher than some other providers.

- Digital Experience: Although Allstate has digital tools, some Salem OR customers report that the app and website functionalities could be improved for a better user experience.

#5 – Farmers: Best for Discount Programs

Pros

- Discount Programs: As noted in our Farmers auto insurance review, reductions like those offered for combining vehicle and house insurance create special savings potential for Salem, OR, residents.

- Claims Reputation: Farmers are known for efficient claims handling, which gives drivers in Salem peace of mind and a reliable support system during accidents or emergencies.

- Educational Resources: This company provides the customer with the resources needed and educates them to better understand the protection and coverage they get.

Cons

- Online Tools: Their online tools are outdated compared to their competitors, which can be disappointing for people in Salem, OR, who prefer managing their accounts through an app or website.

- Customer Service: Drivers in Salem, OR, are having problems with inconsistent service and higher rates, which is leading them to look for another company.

#6 – Liberty Mutual: Best for Flexible Coverage

Pros

- Flexible Coverage: This company can provide different types of coverage in Salem, depending on the customer’s demand for coverage that they can afford and suit their needs.

- Diverse Discounts: This company can provide better rates since it offers a discount to customers in Salem who combine their insurance with other policies.

- Accident Forgiveness: The insurer in Salem OR benefits from the fact that their rates will not be affected and will not go up after the first accident, which can help to lessen anxiety during recovery.

Cons

- Higher Premium: Some customers in Salem, OR, may be disappointed by the higher rates, leading them to consider a more affordable price from rivals who can also help them with their coverage needs.

- Local Agent: Salem, OR, offers few possibilities for in-person support, which might be challenging for clients who prefer in-person conversations, as noted in our Liberty Mutual auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – USAA: Best for Military Membership

Pros

- Military Membership: USAA is a great option for Salem, OR, residents with military ties because of its special advantages for service members and their families.

- Competitive Rates: As noted in our USAA auto insurance review, it provides low rates for eligible drivers in Salem, OR, especially military members and their families, while ensuring quality coverage.

- Generous Discounts: Members get access to benefits, such as rewards for safe driving, extra savings for Salem locals, and promotion of reasonably priced insurance.

Cons

- Eligibility Restrictions: This is only available to military personnel, veterans, and their families; non-military residents of Salem may need to begin searching for other insurance choices.

- Physical Locations: Because there aren’t many physical locations in Salem, OR, clients may find it more difficult to get help in person and rely instead on phone or internet support.

#8 – Nationwide: Best for Coverage Options

Pros

- Coverage Options: Drivers in Salem, OR, can choose their insurance from basic to comprehensive and can also come with a discount when other policies are combined.

- Payment Plans: The company provides payment options that allow drivers in Salem, OR, to choose whether monthly or annual plans will help them manage their budget.

- Numerous Discounts: According to a Nationwide auto insurance review, bundling discounts can make insurance costs low for drivers in Salem, OR, promoting smart financial planning.

Cons

- Higher Premiums: Younger drivers in Salem, OR, might find another competitor because they pay higher premiums than other companies based on their driving experience.

- Customer Support: Sometimes, responses from processing claims are delayed, which affects the insurer, causes frustration, and affects the coverage decision of drivers in Salem, Oregon.

#9 – Travelers: Best for Competitive Rates

Pros

- Competitive Rates: Many drivers in Salem might see this as an advantage, as the company can provide competitive rates that meet their expectations compared to other providers.

- Digital Tools: Drivers in Salem, OR, can manage their policies and make payments using an online platform, which is better because they don’t need to leave home to manage their accounts.

- Claims Handling: This company is well known for processing claims, which builds trust with Salem, Oregon, drivers because of their timely and reliable assistance.

Cons

- Customer Service: Drivers of Salem, OR, have dissatisfaction with the agent’s lack of attentiveness, which affects customer satisfaction, according to Travelers auto insurance review,

- Office Access: Travelers have fewer local offices, making in-person visits less accessible for Salem, OR residents, which may lead them to rely more on digital tools or phone support instead.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Discount Opportunities

Pros

- Discount Opportunities: American Family offers savings for Salem drivers, such as those for bundling insurance, safe driving, and more, to reduce the cost of their premiums.

- Coverage Options: Provides a wide choice of insurance policies, allowing Salem, OR, drivers to obtain specialized coverage, which will help them get the coverage they need and for their budget.

- Digital Tools: As noted in our American Family auto insurance review, Salem, OR drivers can easily manage their policies and submit claims online using their website and mobile app.

Cons

- Higher Premiums: The fact that American Family’s prices might be greater than those of certain rivals could put off Salem drivers who are concerned about their budget.

- Local Agent: While many brokers offer top-notch assistance, some clients have complained about inconsistent support, which has affected certain Salem, OR drivers’ satisfaction ratings.

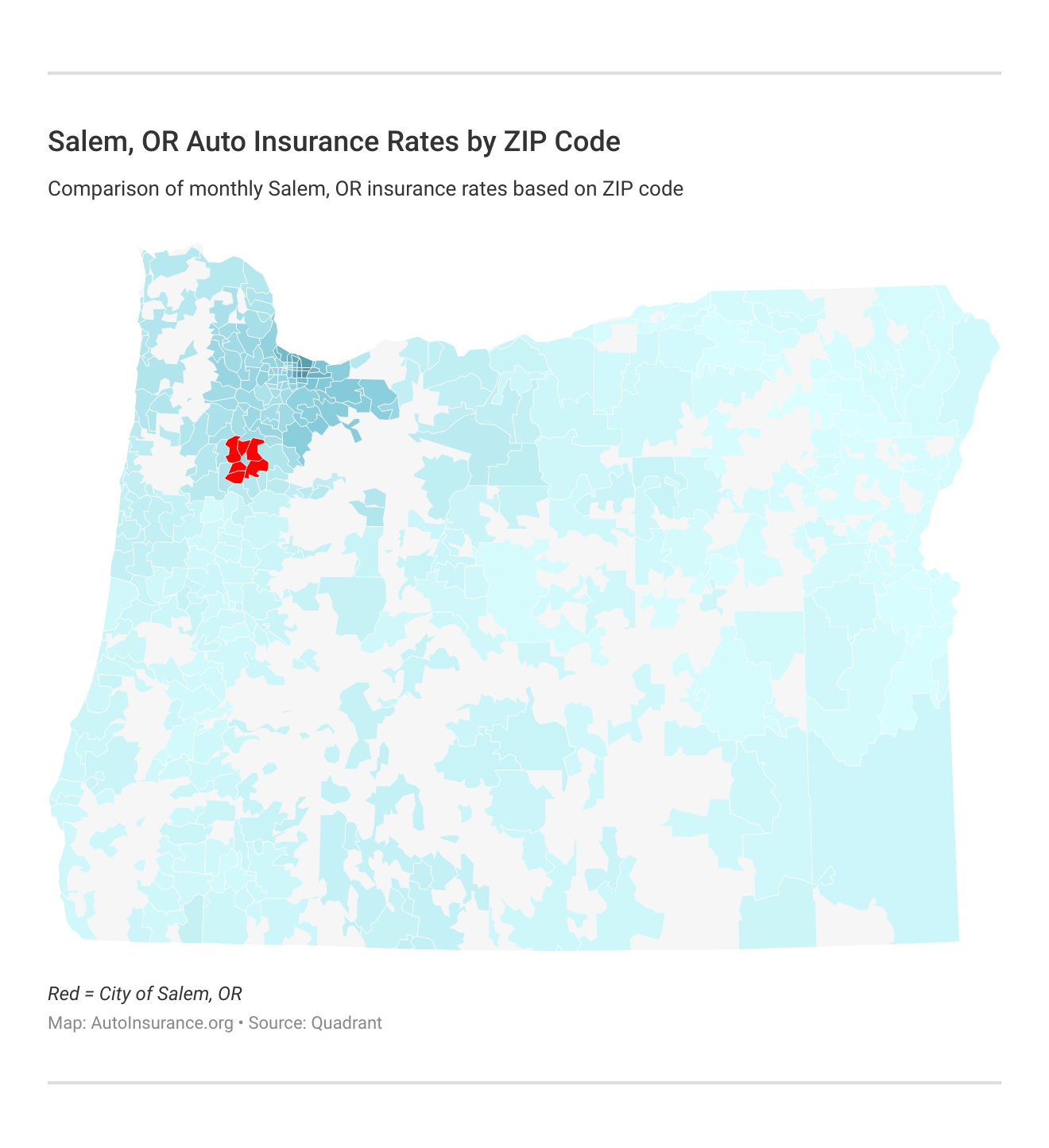

Salem, OR Car Insurance Rates by ZIP Code

You may obtain the greatest coverage at a cost that suits your budget by looking into auto insurance prices in Salem, Oregon. In this article, we’ve broken down monthly auto insurance quotes by ZIP code so you can compare prices across different neighborhoods. Discover our comprehensive guide to “Auto insurance rates by ZIP code” for additional insights.

Salem, Oregon Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $85 | $170 | |

| $76 | $155 | |

| $90 | $180 | |

| $75 | $150 | |

| $88 | $175 |

| $78 | $155 |

| $70 | $140 | |

| $80 | $160 | |

| $82 | $165 | |

| $72 | $145 |

Whether you’re a new driver or looking to switch providers, understanding these rates can empower you to make informed decisions about your insurance needs.

Auto Insurance Discounts From the Top Providers in Salem, Oregon

| Insurance Company | Available Discounts |

|---|---|

| Safe Driving, Multi-Policy, New Car | |

| Good Student, Multi-Policy, Safety Features | |

| Home and Auto, Good Student, Bundling | |

| Good Driver, Multi-Policy, Military | |

| Multi-Policy, Safe Driver, New Vehicle |

| Multi-Policy, Good Student, Safe Driver |

| Snapshot, Multi-Policy, Homeowner | |

| Safe Driver, Multi-Policy, Student | |

| Home and Auto, Multi-Policy, Hybrid Vehicle | |

| Safe Driving, Multi-Policy, Vehicle Storage |

Understanding monthly car insurance rates by ZIP code in Salem, OR, is essential for finding the right coverage for your needs. Comparing rates across different areas can help you identify potential savings and make informed choices.

Salem, Oregon Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Uninsured Motorist Coverage | A | Essential in a state with high uninsured rates. |

| Collision Coverage | A- | Provides strong protection against accidents. |

| Comprehensive Coverage | B+ | Good coverage for non-collision events like theft. |

| Liability Coverage | B | Meets state minimum requirements; could be improved with higher limits. |

| Personal Injury Protection | B | Covers medical expenses, but options may vary. |

ZIP codes will play a major role in your car insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly Salem auto insurance rates by ZIP code below:

Be sure to explore your options, as many insurance providers offer discounts and customizable policies to help you secure the best deal for your unique situation.

Salem, OR Car Insurance Rates vs. Top US Metro Car Insurance Rates

Car insurance rates can vary significantly from state to state and within different metropolitan areas. This analysis compares car insurance rates in Salem, OR, with those in some of the top U.S. metro areas.

When you bundle, you don’t have to pick 😉 #NFLDraft pic.twitter.com/LL0aBcY0Dm

— GEICO (@GEICO) April 27, 2023

Understanding these differences can provide valuable insights into the local insurance market and help you identify whether you’re getting a competitive rate or have room for improvement. For further details, check out our in-depth “Minimum Auto Insurance Requirements by State” article.

You might wonder how my auto insurance rates in Salem compare to those of other top U.S. metro areas. We’ve got your answer below.

Salem, OR Auto Insurance vs. Top US Metro Auto Insurance Rates

| City | Monthly Rate |

|---|---|

| State Average | $270 |

| Salem, OR | $306 |

| Chicago | $378 |

| Houston | $398 |

| Los Angeles | $445 |

| New York | $624 |

Comparing Salem, OR, car insurance rates with those of top U.S. metros reveals important insights into how local factors influence insurance costs. Understanding these differences allows you to evaluate your coverage better and explore options offering better rates or enhanced benefits.

Salem, Oregon Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Annual Accidents | $1,200 |

| Average Claims per Year | $800 |

| Percentage of Claims | 66.70% |

| Fatal Accidents | 12 |

| Injury Accidents | 300 |

As you consider your insurance needs, remember that shopping around and leveraging available discounts can lead to significant savings, ensuring you have the protection you need at a price that works for you. If you want to start shopping for affordable Salem OR auto insurance, enter your ZIP code in the free tool on this page to get your first quote.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Finding the Most Affordable Auto Insurance in Salem, OR

The most economical auto insurance rates are provided by USAA and State Farm in Salem, OR. Due to their competitive pricing and extensive coverage options, both companies are well-liked by drivers on a tight budget. Military members and their families are usually eligible for reduced rates from USAA, which offer special savings that can drastically lower premiums.

On the other hand, State Farm is recognized for its extensive network of agents and personalized service, allowing customers to tailor their policies to fit their specific needs. By exploring these two options, residents of Salem can secure quality coverage without breaking the bank. Learn more by visiting our detailed “Companies With the Cheapest Teen Auto Insurance” section.

Frequently Asked Questions

What are the minimum requirements for auto insurance in Oregon?

In Oregon, drivers must have liability insurance that meets specific minimum coverage limits. This typically includes bodily injury and property damage liability. Understanding these requirements is essential to ensuring compliance with state laws.

How much is a no-insurance ticket in Salem, OR?

Receiving a ticket for driving without insurance in Salem can result in significant fines. If you’re caught driving without insurance, you can expect a fine ranging from $135 to $1,000. The presumptive fine is typically around $265, which may vary based on circumstances. However, drivers should be prepared for hefty penalties and potential insurance rate increases when they obtain coverage.

Do I need full coverage on a financed car in Salem, OR?

If your car is financed, lenders usually require you to carry full coverage, including comprehensive and collision insurance. This protects you and the lender in case of an accident or damage to the vehicle.

Explore our detailed analysis on “Full Coverage Auto Insurance Defined” for additional information.

What are the typical insurance car fees in Salem, OR?

Insurance car fees can vary widely based on factors such as the driver’s age, driving history, and the type of vehicle. It’s best to shop for quotes to find competitive rates in Salem.

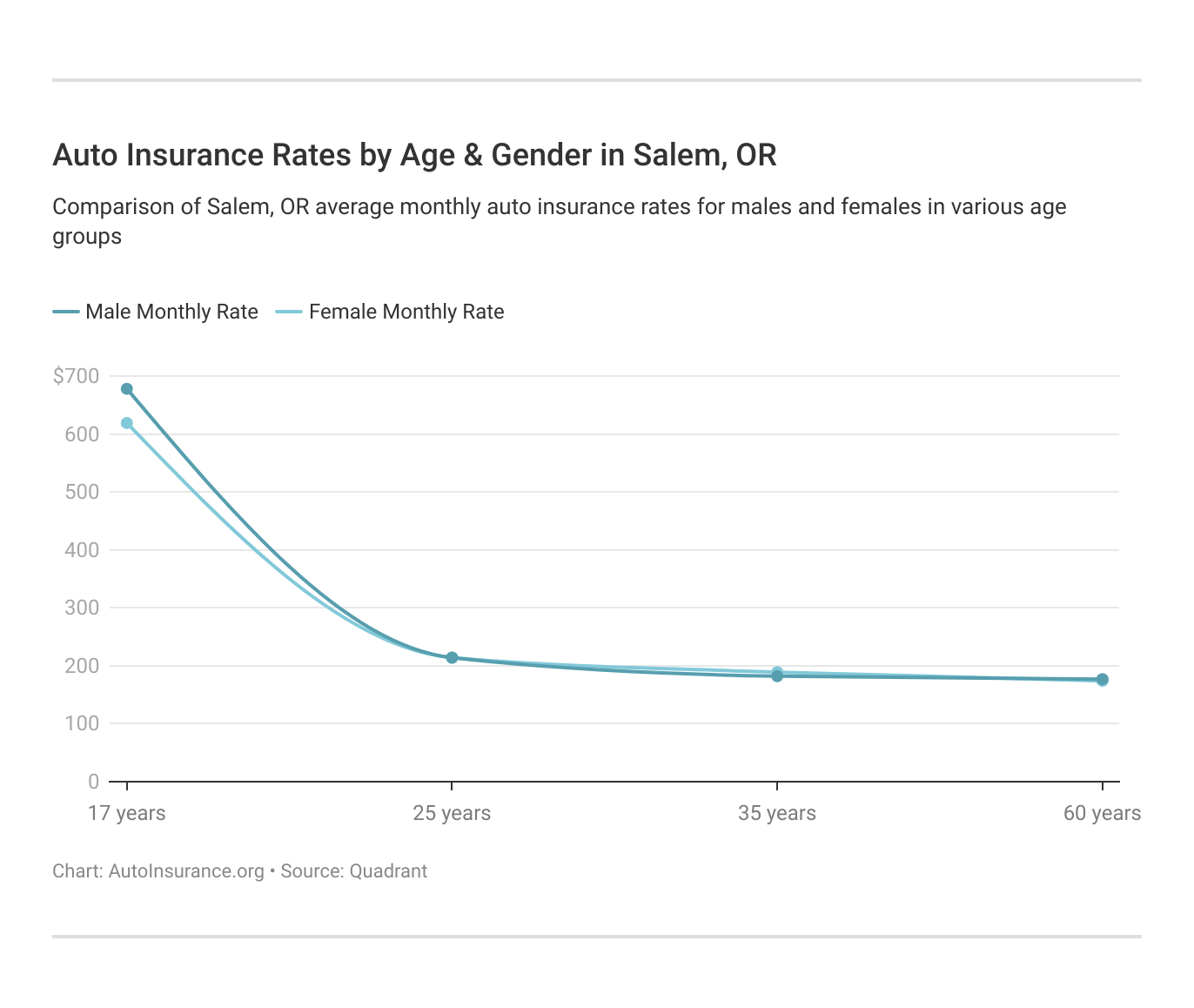

How much is insurance for a 16-year-old boy in Salem, OR?

Insurance for teenage drivers, especially 16-year-old boys, tends to be higher due to their inexperience. They may pay an average monthly cost of $196 for car insurance. Parents should expect to pay more for coverage and may want to explore discounts or programs that encourage safe driving.

Is it illegal to not have car insurance in Salem?

Yes, it is illegal to drive without insurance in Salem. The state has strict penalties for uninsured drivers, including fines and potential legal repercussions.

How much is insurance for a new driver in Salem, OR?

Insurance rates for new drivers in Salem can be higher than average due to their lack of driving experience, which could cost an average of $145 per month. Factors such as the type of vehicle and safety features can help lower costs.

Get more insights by reading our expert “How to Get Fast and Free Auto Insurance Quotes” advice.

Which age group pays the most for car insurance in Salem, OR?

Typically, younger drivers, particularly those aged 16 to 25, face the highest insurance rates in Salem due to their higher risk profiles. As drivers gain experience, rates generally decrease.

Is insurance required to register a car in Salem?

Yes, proof of insurance is required to register a vehicle in Salem. Without adequate coverage, you cannot complete the registration process.

When did car insurance become mandatory in Salem?

Car insurance became mandatory in Oregon in 1983. Since then, drivers must carry at least the minimum liability coverage to operate a vehicle legally.

Learn more by visiting our detailed “What are the recommended auto insurance coverage level” section.

Is title insurance required in Salem?

Title insurance is not required for auto insurance but may be necessary when buying a home or property. Standard auto insurance is mandated by law for vehicles.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Do most states have a minimum car insurance requirement?

Yes, most states in the U.S. have established minimum car insurance requirements to protect drivers and others on the road. These vary by state, so it’s crucial to understand Oregon’s specific rules.

How long do I have to get insurance after buying a car in Salem?

In Oregon, you generally have 30 days after purchasing a vehicle to secure insurance. To avoid penalties, it’s wise to have coverage before driving the car off the lot.

For more information, explore our informative “What does proper auto insurance cover?” page.

Can I insure a car not in my name in Salem, OR?

Yes, you can insure a car not registered in your name in Salem. However, you must provide the insurer with the necessary information about the vehicle and its owner.

What is the lowest form of car insurance in Salem?

The lowest form of car insurance is typically liability coverage, which meets the state’s minimum requirements. While it’s the most affordable option, it may not provide adequate protection in all situations.

How can I find the best insurance deals in Salem?

The best way to discover competitive insurance rates is to get quotations from several providers. This allows you to check coverage options and find the most affordable premiums tailored to your needs.

Continue reading our full “Auto Insurance Premium Defined” guide for extra tips.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.