Best Anaheim, California Auto Insurance in 2025 (Top 10 Companies Ranked)

Farmers, Geico, and USAA are industry leaders for the best Anaheim, California auto insurance, with monthly rates as low as $120. These top insurers offer cost-saving programs and excellent support. Compare quotes to find affordable coverage that meets state laws and your needs on Orange County roads.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Anaheim California

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Anaheim California

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Anaheim California

A.M. Best Rating

Complaint Level

Pros & Cons

For as low as $120 per month, top insurers like Farmers, Geico, and USAA rated the best Anaheim, California auto insurance companies. This comprehensive guide delves into the best auto insurance companies serving Anaheim residents, highlighting their strengths, weaknesses, and competitive edge.

Do all auto insurance companies offer the same thing? This guide explores the differences, analyzing pricing, premium plans, and discounts.

Our Top 10 Company Picks: Best Anaheim, California Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 20% A Comprehensive Coverage Farmers

#2 25% A++ Affordable Rates Geico

#3 10% A++ Military Discounts USAA

#4 20% A Personalized Service American Family

#5 25% A+ Strong Discounts Allstate

#6 20% B Nationwide Presence State Farm

#7 25% A Flexible Options Liberty Mutual

#8 8% A++ Extensive Network Travelers

#9 12% A+ Competitive Pricing Progressive

#10 10% A+ Customer Satisfaction Erie

Whether you’re a budget-conscious driver or seeking premium protection, this in-depth comparison will help you make an informed decision about your specific needs in the vibrant city of Anaheim. Find the best auto insurance company near you by entering your ZIP code into our free quote tool above.

- Learn the Anaheim, CA drivers insurance cost factors

- Farmers’ the best auto insurance company in Anaheim

- Average auto insurance rates in Anaheim, CA for senior drivers are $190 per month

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Farmers: Top Overall Pick

Pros

- Balanced Premium Structure: In Anaheim, Farmers offers monthly rates of $340, striking a balance between comprehensive protection and affordability. This pricing appeals to residents seeking robust coverage without excessive financial strain. See more details in our page titled Farmers auto insurance review.

- Flexible Payment Plans: Various payment options and plans are available for Anaheim policyholders, accommodating different budgeting needs and preferences.

- Cost-Saving Programs: Policyholders in Anaheim can leverage Farmers’ array of discount initiatives, such as multi-policy and safe driver incentives. These opportunities allow for significant premium reductions while maintaining extensive protection.

Cons

- Above-Average Costs: With a $340 monthly rate in Anaheim, Farmers falls on the pricier end of the spectrum. This could deter budget-conscious individuals seeking more economical insurance options in the area.

- Underdeveloped Digital Interface: Farmers’ online tools for Anaheim customers may lag behind competitors in terms of sophistication and user-friendliness. This shortcoming can frustrate tech-savvy policyholders attempting to manage their accounts or access information efficiently.

#2 – Geico: Best for Affordable Rates

Pros

- Budget-Friendly Pricing: As stated in our Geico auto insurance review page, Geico provides Anaheim residents with competitive monthly rates of $300, positioning itself as an economical choice. This pricing strategy enables drivers to secure quality protection without financial strain in a city known for its high living costs.

- Streamlined Online Experience: Policyholders in Anaheim enjoy access to Geico’s advanced digital platforms, facilitating effortless policy management, quote requests, and claims processing. This efficiency particularly benefits busy residents who prefer handling insurance matters swiftly and conveniently.

- Savings Opportunities: Anaheim drivers can take advantage of Geico’s various discount programs, including incentives for safe driving and multi-vehicle policies. These offerings can result in substantial cost reductions, enhancing the overall value proposition.

Cons

- Scarce Physical Offices: Geico’s limited brick-and-mortar presence in Anaheim may inconvenience those who prefer face-to-face interactions or require in-person assistance. This scarcity could impact the level of personalized service available to local policyholders.

- Impersonal Support System: Despite competitive rates, Geico’s customer service in Anaheim may lack the individualized attention some policyholders desire. Residents seeking more specialized support might find the experience less satisfactory compared to insurers with a stronger local footprint.

#3 – USAA: Best for Military Discounts

Pros

- Unmatched Affordability: As highlighted in USAA auto insurance review, USAA offers Anaheim’s military community the lowest monthly rate of $280, providing top-tier coverage at a fraction of competitors’ costs. This pricing allows service members and their families to secure comprehensive protection without financial burden.

- Military-Focused Coverage: Anaheim’s military policyholders benefit from USAA’s specialized insurance options, including liability, collision, and comprehensive plans. These offerings are meticulously designed to address the unique needs and lifestyles of service members and their dependents.

- Exceptional Member Support: USAA’s customer support in Anaheim is renowned for its dedication to military members, providing empathetic and efficient assistance. This approach ensures that the local military community receives prompt, effective support for all insurance-related matters.

Cons

- Exclusive Membership: USAA’s services in Anaheim are restricted to military personnel and their families, significantly limiting accessibility. This exclusivity prevents many residents from accessing USAA’s competitive rates and specialized services, regardless of interest.

- Limited Branch Accessibility: The scarcity of USAA’s physical offices in Anaheim may pose challenges for policyholders who prefer in-person interactions or need to address complex insurance issues face-to-face. This limitation could impact convenience for some local members.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – American Family: Best for Personalized Service

Pros

- Flexible Policy Customization: American Family offers Anaheim residents a wide spectrum of coverage options, enabling drivers to tailor their policies precisely. This adaptability ensures protection aligns perfectly with individual needs and driving patterns.

- Good Driver Discounts: Safe drivers in Anaheim can benefit from American Family’s good driver discounts, which reward responsible driving habits with lower premiums.

- Robust Local Network: American Family maintains a strong presence in Anaheim with numerous agents and offices. This local focus provides residents easy access to personalized guidance and face-to-face support, enhancing the overall customer experience. (Read More: American Family Auto Insurance Review).

Cons

- Limited Digital Tools: The company’s online tools and mobile app may not be as advanced or user-friendly as those of some competitors, impacting the convenience for tech-savvy users.

- Varied Service Quality: While offering local service in Anaheim, the consistency of American Family’s customer support can fluctuate depending on specific agents or offices. This variability may lead to mixed experiences for policyholders, potentially affecting overall satisfaction.

#5 – Allstate: Best for Strong Discounts

Pros

- Accident Forgiveness Program: Allstate’s accident forgiveness program prevents rates from increasing after a first accident, providing added peace of mind for Anaheim policyholders concerned about potential rate hikes.

- Generous Discount Structure: Anaheim policyholders can benefit from Allstate’s numerous cost-saving initiatives, such as multi-policy and safe driving incentives. These programs offer significant potential for premium reductions, enhancing affordability despite higher base rates. Learn more about their discounts in our Allstate auto insurance review.

- Roadside Assistance and Safe Driving Benefits: Allstate includes roadside assistance in their policies, offering support for emergencies such as flat tires and breakdowns. The company provides benefits for safe driving, which can further reduce costs for responsible drivers in Anaheim.

Cons

- Higher Rate Spectrum: Allstate’s monthly premiums in Anaheim, averaging $330, position it among the pricier options locally. This higher cost could be a significant deterrent for budget-conscious residents seeking more affordable insurance solutions.

- Limited Discounts for Certain Vehicle Types: Discounts may be less generous for certain types of vehicles or high-risk drivers in Anaheim, potentially leading to higher premiums for some policyholders.

#6 – State Farm: Best for Nationwide Presence

Pros

- Innovative Mobile App: The State Farm mobile app offers convenient features for managing policies, filing claims, and accessing roadside assistance, enhancing the overall customer experience with modern technology for Anaheim drivers.

- Comprehensive Coverage Array: In Anaheim, State Farm provides a diverse selection of insurance options, enabling residents to construct policies that accurately reflect their individual needs and risk profiles.

- Extensive Discount Catalog: State Farm presents Anaheim policyholders with numerous cost-saving opportunities, including safe driver and multi-car incentives. These programs can lead to substantial premium reductions, enhancing the overall value proposition for local residents. For discounts, read our State Farm auto insurance discounts.

Cons

- Limited Coverage Options for High-Risk Drivers: State Farm may have fewer specialized coverage options for high-risk Anaheim drivers or unique vehicle types, which could result in higher premiums or less tailored insurance solutions.

- Support Bottlenecks: Some Anaheim policyholders report experiencing delays or difficulties when seeking assistance from State Farm. These issues can be particularly problematic for residents requiring prompt help with claims or policy adjustments, potentially impacting overall satisfaction.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Flexible Options

Pros

- Tailored Policy Design: Liberty Mutual offers Anaheim drivers highly adaptable coverage options. This flexibility allows residents to create insurance plans that precisely match their unique requirements, driving habits, and financial constraints. Read more details in our Liberty Mutual auto insurance review page.

- Diverse Discount Portfolio: Anaheim policyholders can access a wide array of cost-saving opportunities from Liberty Mutual, catering to various driver profiles. These incentives can significantly reduce premium costs, making comprehensive coverage more accessible.

- Accessible Local Representation: Liberty Mutual maintains a robust presence in Anaheim, with numerous local agents and offices. This network provides policyholders with convenient access to personalized guidance and face-to-face support, enhancing the overall insurance experience.

Cons

- Premium Price Point: At $340 per month, Liberty Mutual’s rates in Anaheim rank among the higher options in the market. This pricing may deter cost-conscious residents prioritizing more economical insurance solutions.

- Uneven Service Quality: Some Anaheim policyholders report inconsistent experiences with Liberty Mutual’s customer support. This variability can be frustrating, especially for those requiring frequent assistance or dealing with complex insurance matters.

#8 – Travelers: Best for Extensive Network

Pros

- Educational Resources: Travelers offers a wealth of educational resources and tools on their website for residents in Anaheim, including insurance guides and risk management tips, helping policyholders make informed decisions about their coverage. Read more details in our page titled Travelers auto insurance review.

- Robust Savings Programs: Anaheim policyholders can capitalize on Travelers’ numerous discount initiatives, ranging from safe driver to multi-policy incentives. These programs offer significant potential for premium reductions, enhancing the overall value of coverage.

- Financial Stability Assurance: Travelers’ strong financial ratings provide peace of mind to Anaheim policyholders. This fiscal strength ensures the company’s ability to reliably handle claims and maintain consistent protection, even during economic downturns.

Cons

- Above-Average Cost Structure: With monthly premiums averaging $325 in Anaheim, Travelers’ rates fall on the higher end of the local market. This pricing may be a significant consideration for residents seeking more affordable options in the area.

- Potential Coverage Gaps: Some Anaheim policyholders have noted that Travelers’ standard policies may not include certain types of coverage or endorsements that are available through other insurers, potentially leading to gaps in protection.

#9 – Progressive: Best for Competitive Pricing

Pros

- 24/7 Customer Service: Progressive provides round-the-clock customer support, ensuring that Anaheim policyholders can receive assistance whenever needed, which is particularly valuable for addressing urgent issues or inquiries. Check out Progressive auto insurance review for more details.

- Snapshot Program for Additional Savings: Progressive’s Snapshot program rewards safe driving habits with potential discounts based on driving behavior, allowing Anaheim policyholders to earn additional savings through responsible driving.

- Extensive Discount Opportunities: Progressive presents Anaheim policyholders with various cost-saving programs, such as multi-vehicle and safe driver incentives. These opportunities enable residents to further reduce their insurance expenses while maintaining robust protection.

Cons

- Complex Policy Language: Some customers have reported that Progressive’s policy documents and terms can be complex, requiring careful review to fully understand coverage details and exclusions.

- Limited Digital Capabilities: Progressive’s online tools for Anaheim customers may not match the sophistication of some competitors. This limitation can frustrate tech-savvy residents who prefer managing their policies and claims through advanced, user-friendly digital platforms.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Erie: Best for Customer Satisfaction

Pros

- Personalized Policy Creation: As stated in Erie auto insurance review, they offer Anaheim drivers a comprehensive range of coverage options, facilitating highly personalized policies. This customization ensures that residents can secure insurance that precisely matches their unique requirements and driving patterns.

- Targeted Discount Programs: Anaheim policyholders can leverage Erie’s various cost-saving initiatives, particularly those rewarding safe driving and multi-policy bundling. These programs enable residents to significantly reduce their insurance expenses while maintaining extensive protection.

- Dedicated Local Support: Erie maintains a strong local presence in Anaheim, with a network of knowledgeable agents. This localized approach provides policyholders with individualized service and in-person support, enhancing the overall customer experience.

Cons

- Moderate Price Range: With monthly premiums averaging $320 in Anaheim, Erie’s rates fall in the mid-range of local options. This pricing may be a consideration for residents primarily focused on finding the most economical insurance solutions available.

- Underdeveloped Online Resources: Erie’s digital tools and platforms for Anaheim customers may lag behind more tech-forward competitors. This limitation can be frustrating for residents who prefer managing their insurance matters efficiently through modern, user-friendly online interfaces.

Auto Insurance Costs in Anaheim, California

Motorists in search of cheap car insurance in Anaheim, CA can enhance their decision-making process by comparing rates among various providers.

This table presents a comparative analysis of monthly premiums for both minimum and comprehensive coverage options provided by these prominent insurance providers.

Anaheim, California Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $155 $330

American Family $150 $320

Erie $150 $320

Farmers $160 $340

Geico $140 $300

Liberty Mutual $165 $340

Progressive $140 $310

State Farm $145 $310

Travelers $160 $325

USAA $120 $280

While USAA offers the most competitive rates, it’s important to note that availability may be limited to military members and their families. Comprehensive auto insurance, which falls under full coverage, provides broader protection against various risks, albeit at a higher cost.

Whether you’re heading to Disneyland or managing everyday activities in Anaheim, it’s crucial to have the appropriate insurance. But what does it mean to be “properly insured” in California?

When selecting the best car insurance in Anaheim, there are specific criteria that need to be fulfilled. The state has set minimum requirements to ensure drivers can pay for expenses if they get into an accident. Let’s delve deeper.

- Property Damage Liability: $5,000 per accident

- Bodily Injury Liability: $15,000 per person and $30,000 per accident

Remember, while having these minimums keeps you legal, the best auto insurance in Anaheim often goes beyond these basics. It’s about finding the right balance of coverage and cost that works for you.

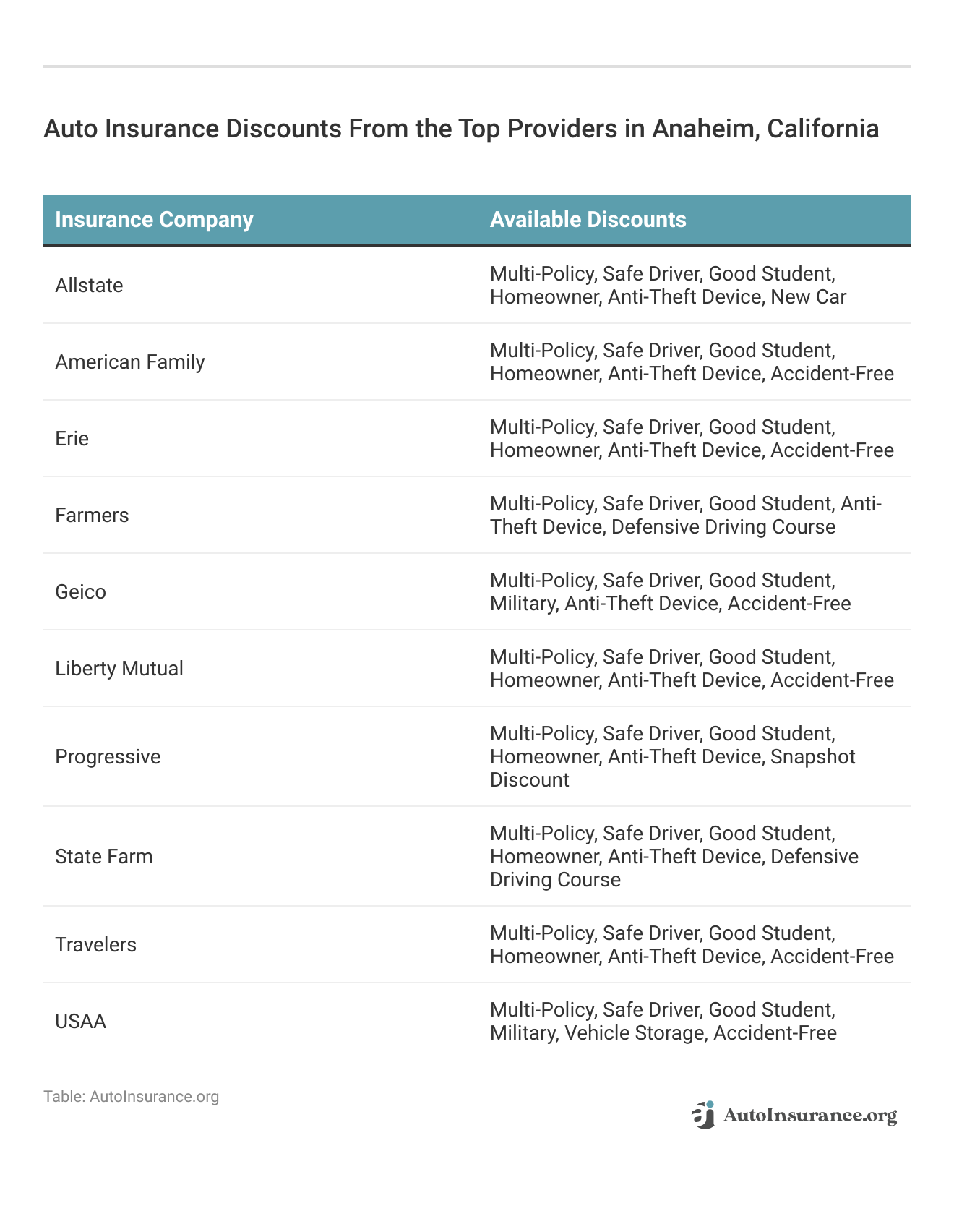

The table above shows the best discounts from major insurance companies, so policyholders can see where they can save money.

There are often discounts available for advanced safety features in vehicles, low annual mileage, and participation in defensive driving courses.Michelle Robbins LICENSED INSURANCE AGENT

Even though many companies offer similar discounts, how much you save can be different for each person. It’s a good idea for drivers to talk to insurance companies to see how these discounts work for them and to find more ways to save money on their insurance.

What Determines Auto Insurance Rates in Anaheim, CA

Auto insurance rates in Anaheim, California, are influenced by a multitude of factors, distinguishing them from those in other cities.

Key determinants include traffic conditions and the prevalence of vehicle thefts within Anaheim. A range of local variables can thus impact your auto insurance premiums in this area.

Anaheim Auto Insurance and Auto Theft Risks

Anaheim may be famous for its magical attractions, but it faces real-world issues like auto theft, with 1,373 reported cases in a single year, impacting local drivers and insurance premiums. High theft rates lead to increased claims, often resulting in higher insurance costs.

That’s why it’s essential to consider comprehensive coverage when shopping for car insurance in Anaheim.

Now, you might be wondering, “Does auto insurance pay if my car is stolen?” The answer is yes, but with a catch. Your run-of-the-mill liability policy won’t cut it here. You’ll need a coverage to protect yourself if your car decides to take an unauthorized joyride with a less-than-savory character.

The Role of Commute Time in Anaheim Auto Insurance

Anaheim’s average commute time of 28.9 minutes impacts more than just your morning routine – it can also affect your Anaheim insurance rates. Longer commutes often mean higher premiums, as insurers see increased road time as a greater risk.

When searching for the best Anaheim, California auto insurance, consider your commute and look for providers offering usage-based programs that could help offset these factors, potentially saving you money despite the extra time behind the wheel.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Your Driving History and Anaheim Auto Insurance Rates

This table illustrates how driving records impact full coverage auto insurance rates in Anaheim from various providers. Car insurance agents in Anaheim can help explain these differences and find the best coverage for your specific situation.

Anaheim, California Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| Allstate | $237 | $396 | $310 | $625 |

| Farmers | $314 | $427 | $423 | $530 |

| Geico | $171 | $265 | $212 | $332 |

| Liberty Mutual | $219 | $293 | $232 | $265 |

| Nationwide | $288 | $369 | $369 | $624 |

| Progressive | $156 | $266 | $225 | $309 |

| State Farm | $262 | $312 | $304 | $589 |

| Travelers | $194 | $322 | $289 | $372 |

| USAA | $151 | $225 | $166 | $368 |

It’s evident that accidents, DUIs, and tickets can significantly increase insurance premiums. How long does an accident affect your car insurance rate? Typically, incidents remain on your record for three to five years, but the impact on rates may decrease over time if you maintain a clean driving record.

DUI Impact on Anaheim, California Auto Insurance Rates

DUI conviction can dramatically increase auto insurance premiums in Anaheim, as shown in this table of monthly rates. When seeking car insurance quotes in Anaheim after a DUI, it’s crucial to compare offers from these companies to find the most affordable option.

Anaheim, California Full Coverage Auto Insurance Rates After a DUI

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $625 |

| Farmers | $530 |

| Geico | $332 |

| Liberty Mutual | $265 |

| Nationwide | $624 |

| Progressive | $309 |

| State Farm | $589 |

| Travelers | $372 |

| USAA | $368 |

While Liberty Mutual appears to have the lowest rates for drivers with a DUI, individual circumstances may vary. It’s important to note that these increased rates typically persist for several years, emphasizing the long-term financial impact of driving under the influence.

Location Affects Anaheim, CA Auto Insurance Rates

Location plays a crucial role in determining insurance premiums within Anaheim, as illustrated by this ZIP code breakdown. These differences reflect varying risk factors such as crime rates, traffic patterns, and accident frequencies in different neighborhoods.

Anaheim, California Full Coverage Auto Insurance Rates by ZIP Code

| ZIP Code | Monthly Rates |

|---|---|

| 92801 | $454 |

| 92802 | $445 |

| 92804 | $459 |

| 92805 | $440 |

| 92806 | $429 |

| 92807 | $418 |

| 92808 | $415 |

| 92809 | $423 |

| 92899 | $422 |

While the 92807 ZIP code appears to have the lowest rates, it’s important to provide accurate address information to your insurer. Can your car be registered at a different address than where you live? While possible in some cases, it’s generally advised to register your vehicle at your primary residence to ensure proper coverage and avoid potential legal issues.

How Age and Provider Choice Impacts Anaheim, CA Auto Insurance

Auto insurance premiums in Anaheim vary significantly based on age and gender, as shown in this table below. For those seeking the cheapest teen driver auto insurance in California, comparing quotes from multiple insurers is crucial.

Anaheim, California Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $709 | $10,675 | $3,830 | $4,165 | $3,020 | $3,011 | $2,209 | $2,217 |

| Farmers | $734 | $14,329 | $3,279 | $3,655 | $2,766 | $2,766 | $2,513 | $2,513 |

| Geico | $462 | $5,632 | $2,616 | $2,669 | $1,821 | $1,822 | $1,712 | $1,712 |

| Liberty Mutual | $416 | $5,354 | $2,578 | $2,617 | $2,300 | $2,165 | $2,156 | $2,082 |

| Nationwide | $742 | $9,817 | $4,138 | $4,079 | $3,462 | $3,300 | $3,039 | $2,859 |

| Progressive | $401 | $5,802 | $2,589 | $2,785 | $1,792 | $1,845 | $1,528 | $1,813 |

| State Farm | $534 | $7,955 | $3,827 | $3,946 | $3,455 | $3,455 | $3,090 | $3,090 |

| Travelers | $459 | $6,258 | $3,412 | $3,324 | $2,612 | $2,521 | $2,314 | $2,290 |

| USAA | $372 | $4,492 | $2,706 | $2,556 | $1,955 | $1,850 | $1,908 | $1,914 |

When looking for the best car insurance in Anaheim, consider factors beyond just price, such as coverage options and customer service. Remember that rates can change over time, so it’s wise to review your policy periodically and shop around for better deals.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Annual Mileage Impact on Anaheim Auto Insurance Rates

Driving distance plays a key role in determining premiums for Anaheim car insurance, as revealed in this provider comparison. The table showcases how insurers adjust their rates based on whether a policyholder drives 6,000 or 12,000 miles annually.

Anaheim, California Full Coverage Auto Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $353 | $431 |

| Farmers | $384 | $463 |

| Geico | $223 | $268 |

| Liberty Mutual | $232 | $273 |

| Nationwide | $364 | $461 |

| Progressive | $217 | $261 |

| State Farm | $354 | $380 |

| Travelers | $265 | $324 |

| USAA | $210 | $245 |

As an auto insurance policyholder, it’s crucial to accurately report your expected annual mileage to ensure fair pricing. While USAA offers the lowest rates in both categories, eligibility restrictions apply, so it’s wise to obtain quotes from multiple insurers to find the best balance of coverage and cost for your specific driving habits

To find out if you can get cheap auto insurance in Anaheim, CA, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Frequently Asked Questions

Why do I need auto insurance in Anaheim, CA?

Auto insurance is required in Anaheim, CA, as it is in most states. It helps protect you financially in case of an accident or damage to your vehicle. Additionally, it provides liability auto insurance coverage if you cause injury or property damage to others while driving.

What types of auto insurance coverage are available in Anaheim, CA?

Anaheim, CA offers various types of auto insurance coverage, including liability insurance, collision insurance, comprehensive insurance, uninsured/underinsured motorist coverage, medical payments coverage, and personal injury protection (PIP). Each type of coverage serves different purposes and offers specific benefits.

How much auto insurance coverage do I need in Anaheim, CA?

The minimum auto insurance requirements in Anaheim, CA are liability insurance with limits of at least $15,000 for injury or death per person, $30,000 for injury or death per accident, and $5,000 for property damage. However, it’s advisable to consider higher coverage limits to adequately protect yourself and your assets.

What other types of auto insurance coverage should I consider in Anaheim, CA?

Besides minimum liability, consider collision and comprehensive coverage for vehicle damage, uninsured/underinsured motorist coverage, and medical payments coverage.

How are auto insurance rates determined in Anaheim, CA?

Rates depend on factors like your driving record, age, gender, vehicle type, location, and coverage choices.

How can I find the best auto insurance rates in Anaheim, CA?

Compare quotes from multiple insurers, seek discounts, maintain a clean driving record, and review your coverage needs to find the best rates.

Use our free comparison tool below to see what auto insurance quotes look like in your area.

Are there any specific factors in Anaheim, CA that can affect my auto insurance rates?

Yes, certain factors can influence your auto insurance in Anaheim, CA. These may include the frequency of accidents and thefts in your neighborhood, the density of traffic, and local weather conditions. Insurance companies assess these factors when determining premiums for drivers in specific locations.

What discounts are available for auto insurance in Anaheim, CA?

In Anaheim, you may qualify for discounts such as safe driver discounts, multi-policy discounts, and discounts for anti-theft devices. Ask your insurer about specific discounts for which you might be eligible to lower your premium.

Read More: Auto Insurance Discounts to Ask

Can I use my auto insurance coverage outside of Anaheim, CA?

Yes, in most cases, your auto insurance coverage extends beyond Anaheim, CA. However, it’s essential to review your policy to understand the terms and conditions, especially if you frequently drive outside the state or country. Some policies may have limitations or require additional coverage for out-of-state or international travel.

What should I do in case of an auto accident in Anaheim, CA?

Ensure safety, exchange information with others involved, document the scene, report the accident to your insurer, seek medical attention, and follow the claims process.

Get started on comparing full coverage auto insurance in anaheim rates by entering your ZIP code below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.