Best Ocala, Florida Auto Insurance in 2025 (See the Top 10 Companies Here)

Allstate, Progressive, and Travelers have the best Ocala, Florida auto insurance, offers coverage starting at just $80 per month. These insurers provide comprehensive coverage, significant discount options, and strong customer service, making them the best choices in Ocala, Florida.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Ocala Florida

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Ocala Florida

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Ocala Florida

A.M. Best Rating

Complaint Level

Pros & Cons

Allstate, Progressive, and Travelers have the best Ocala, Florida auto insurance, with affordable rates starting at $80 per month.

These companies excel in offering exceptional service and auto insurance discounts to ask for, guaranteeing the best value for Ocala drivers.

Our Top 10 Company Picks: Best Ocala, Florida Auto Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A+ Comprehensive Coverage Allstate

#2 12% A+ Discount Options Progressive

#3 8% A++ Strong Service Travelers

#4 25% A Competitive Pricing Liberty Mutual

#5 25% A++ Low Rates Geico

#6 20% B Nationwide Availability State Farm

#7 10% A+ High Satisfaction Erie

#8 20% A Customizable Policies American Family

#9 10% A++ Military Benefits USAA

#10 25% A Extensive Coverage Farmers

Comparing quotes from these providers can help you identify the most cost-effective and reliable coverage by evaluating their pricing, comprehensive coverage options, and available discounts.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code above.

- Allstate is the top pick offers best coverage with competitive pricing and discounts

- Compare quotes to find the most affordable rates, starting from $80/month

- These companies excel in reliability and offer affordable rates

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Allstate: Top Overall Pick

Pros

- Broad Coverage Options: Allstate offers comprehensive coverage in Ocala, Florida, which includes protection against a wide range of risks, ensuring robust financial security.

- Strong Customer Service: With a reputation for excellent customer service in Ocala, Florida, Allstate provides helpful support when managing claims and policies.

- Local Agent Availability: Allstate’s network of local agents in Ocala, Florida can offer personalized assistance and advice tailored to your specific needs. Read more in our review of Allstate.

Cons

- Higher Premiums: Comprehensive coverage with Allstate may come with higher premiums compared to other providers in Ocala, Florida.

- Limited Discounts: Allstate may not offer as many discount options in Ocala, Florida as some of its competitors, potentially affecting overall cost savings.

#2 – Progressive: Best for Discount Options

Pros

- Variety of Discounts: Progressive provides a wide range of discount options in Ocala, Florida, which can significantly reduce your overall auto insurance costs.

- Affordable Rates: By leveraging discounts, Progressive can offer some of the most competitive rates for auto insurance in Ocala, Florida. Learn more in our Progressive review.

- Flexible Coverage Plans: Progressive’s discount options allow for customizable coverage plans to fit your needs and budget in Ocala, Florida.

Cons

- Complex Discount Structure: The discount system at Progressive can be complex, which might make it challenging to fully understand all available savings in Ocala, Florida.

- Inconsistent Customer Service: While Progressive offers good discounts, customer service experiences in Ocala, Florida can vary and may not always meet expectations.

#3 – Travelers: Best for Strong Service

Pros

- Excellent Customer Support: Travelers is known for strong service in Ocala, Florida, providing reliable support and assistance throughout your policy term.

- Efficient Claims Processing: Travelers offers effective and efficient claims processing in Ocala, Florida, ensuring quicker resolution of issues, which you can learn about in our Travelers review.

- Local Expertise: The presence of knowledgeable agents in Ocala, Florida enhances the quality of service and personalized advice provided.

Cons

- Higher Cost for Premiums: Strong service from Travelers may come with higher premium costs in Ocala, Florida compared to other providers.

- Limited Discounts: Travelers might offer fewer discount opportunities in Ocala, Florida, which could affect the affordability of their coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Competitive Pricing

Pros

- Affordable Premiums: Liberty Mutual offers competitive pricing for auto insurance in Ocala, Florida, making it a cost-effective choice for many drivers.

- Value for Coverage: The pricing structure ensures you receive good value for the coverage provided in Ocala, Florida, which you can check out in our Liberty Mutual review.

- Customizable Policies: Liberty Mutual allows you to tailor your policy to meet your specific needs while keeping prices competitive in Ocala, Florida.

Cons

- Potential for Rate Increases: Liberty Mutual’s competitive pricing may be subject to rate increases over time in Ocala, Florida.

- Limited Customer Service: While prices are competitive, customer service experiences in Ocala, Florida might not always be as robust as other providers.

#5 – Geico: Best for Low Rates

Pros

- Affordable Rates: Geico is known for offering some of the lowest auto insurance rates in Ocala, Florida, which helps in reducing overall insurance costs.

- Easy Online Access: Geico’s online platform provides a convenient way to manage your policy and make changes in Ocala, Florida.

- Numerous Discounts: Geico offers various discounts, which can further lower rates in Ocala, Florida. Read our Geico review to learn what else is offered.

Cons

- Basic Coverage Options: Geico’s focus on low rates might limit the range of coverage options available in Ocala, Florida.

- Customer Service Limitations: Customer service quality can be inconsistent, with some users in Ocala, Florida experiencing difficulties with support.

#6 – State Farm: Best for Nationwide Availability

Pros

- Wide Availability: State Farm’s nationwide presence ensures reliable auto insurance coverage in Ocala, Florida, with a strong network of agents.

- Comprehensive Coverage: The company offers a variety of coverage options suited to different needs in Ocala, Florida.

- Local Agent Access: State Farm’s local agents in Ocala, Florida provide personalized service and support, which is covered in our State Farm review.

Cons

- Higher Premiums: State Farm’s nationwide availability may come with higher premiums compared to other providers in Ocala, Florida.

- Discount Availability: The range of discounts available in Ocala, Florida may be limited compared to competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Erie: Best for High Satisfaction

Pros

- Customer Satisfaction: Erie consistently receives high customer satisfaction ratings in Ocala, Florida, indicating strong service and support.

- Reliable Coverage: The company provides reliable auto insurance coverage with a focus on customer needs in Ocala, Florida.

- Good Claim Handling: Erie is known for efficient and effective claims handling in Ocala, Florida, which you can read more about in our review of Erie.

Cons

- Limited National Presence: Erie’s coverage might be less extensive outside Ocala, Florida, which could be a concern if you travel frequently.

- Higher Costs: High satisfaction comes with potentially higher costs for auto insurance in Ocala, Florida compared to some other providers.

#8 – American Family: Best for Customizable Policies

Pros

- Flexible Policy Options: American Family offers highly customizable auto insurance policies in Ocala, Florida, allowing you to tailor coverage to your specific needs.

- Good Customer Service: Known for excellent customer service, American Family provides strong support to drivers in Ocala, Florida. Discover our American Family review for a full list.

- Variety of Coverage Add-Ons: The company offers various add-ons and optional coverages in Ocala, Florida, enhancing the flexibility of your policy.

Cons

- Potentially Higher Premiums: Customizable policies may come with higher premiums in Ocala, Florida compared to more standardized plans.

- Complex Policy Management: The extensive range of customization options can make managing your policy more complex in Ocala, Florida.

#9 – USAA: Best for Military Benefits

Pros

- Exclusive Military Benefits: USAA provides specialized benefits and discounts for military personnel in Ocala, Florida, reflecting their commitment to serving the military community.

- Highly Competitive Rates: USAA offers some of the best rates available in Ocala, Florida for eligible members.

- Excellent Customer Service: Known for outstanding service, USAA delivers top-notch support to its members in Ocala, Florida. For a complete list, read our USAA review.

Cons

- Limited Eligibility: USAA’s benefits are available only to military members and their families in Ocala, Florida, which limits its accessibility.

- Coverage Restrictions: There may be limitations on certain types of coverage or policy options for non-military members in Ocala, Florida.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Extensive Coverage

Pros

- Broad Coverage Options: Farmers provides extensive auto insurance coverage in Ocala, Florida, ensuring comprehensive protection. Find out more in our Farmers review.

- Customizable Policies: The company offers customizable policies that can be tailored to various needs and preferences in Ocala, Florida.

- Strong Local Presence: Farmers’ agents in Ocala, Florida, are well-equipped to assist with personalized insurance solutions.

Cons

- Higher Costs: Extensive coverage options may result in higher premiums compared to more basic plans in Ocala, Florida.

- Varied Customer Experience: While coverage is extensive, customer service experiences in Ocala, Florida can be inconsistent depending on the agent.

Unlocking Savings: A Comprehensive Guide to Ocala, Florida Auto Insurance Rates

Ocala, Florida Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $100 $215

American Family $100 $210

Erie $95 $195

Farmers $100 $205

Geico $80 $175

Liberty Mutual $105 $225

Progressive $90 $190

State Farm $85 $182

Travelers $95 $200

USAA $90 $190

Ocala’s Essential Auto Coverage: Understanding the Basics of Minimum Insurance

In Ocala, Florida, state laws require drivers to meet the minimum auto insurance requirements by state to ensure financial responsibility in the event of an accident.

Allstate offers the best overall auto insurance coverage in Ocala, combining exceptional service with competitive pricing.Jeff Root Licensed Insurance Agent

The minimum coverage requirements include bodily injury liability with limits of $10,000 per person and $20,000 per accident, as well as property damage liability with a minimum of $10,000. These coverage levels are designed to help protect you and others on the road.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Customized Auto Insurance Rates in Ocala: Age, Gender, and Marital Status Insurance

Auto insurance rates in Ocala, Florida are affected by age, gender, and marital status. See how demographics impact the annual cost of insurance. For more details, check out our guide titled “Auto Insurance Rates by Age.”

Ocala, Florida Auto Insurance Monthly Rates by Age, Gender & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $306 | $293 | $266 | $271 | $1,032 | $1,115 | $308 | $23 |

| Geico | $228 | $229 | $214 | $214 | $407 | $508 | $251 | $18 |

| Liberty Mutual | $232 | $232 | $214 | $214 | $476 | $726 | $232 | $18 |

| Nationwide | $205 | $202 | $183 | $189 | $488 | $601 | $225 | $16 |

| Progressive | $278 | $262 | $239 | $256 | $782 | $857 | $334 | $21 |

| State Farm | $140 | $140 | $128 | $128 | $402 | $512 | $155 | $166 |

| USAA | $110 | $108 | $103 | $102 | $374 | $433 | $137 | $102 |

The table compares monthly auto insurance rates in Ocala, Florida, by age, gender, and provider. Younger drivers, particularly 17-year-olds, face higher costs, with males generally paying more than females. USAA consistently offers the lowest rates across all age groups.

Custom Auto Insurance Solutions for Teen Drivers

In Ocala, Florida, auto insurance rates for 17-year-old drivers can vary significantly depending on the provider and gender of the driver. Understanding these differences is crucial for young drivers and their families when selecting the most cost-effective insurance plan.

Ocala, Florida Teen Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| Allstate | $306 | $293 |

| Geico | $228 | $229 |

| Liberty Mutual | $232 | $232 |

| Nationwide | $205 | $202 |

| Progressive | $278 | $262 |

| State Farm | $140 | $140 |

| USAA | $110 | $108 |

In Ocala, Florida, monthly auto insurance rates for 17-year-olds vary by provider, with rates ranging from $108 to $306. Male rates are generally slightly lower or equal to female rates, with State Farm and Liberty Mutual offering identical rates for both genders.

By comparing rates across different providers, 17-year-old drivers in Ocala can find the best value for their needs. With some companies offering nearly identical rates for both genders, it’s essential to shop around to secure the most affordable coverage. Check out our ranking of the top providers: Cheap Auto Insurance for 17-Year-Olds

Premier Auto Insurance Solutions for Seniors in Ocala, Florida

Ocala, Florida Senior Auto Insurance Monthly Rates by Age, Gender, & Provider

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| Allstate | $308 | $23 |

| Geico | $251 | $18 |

| Liberty Mutual | $232 | $18 |

| Nationwide | $225 | $16 |

| Progressive | $334 | $21 |

| State Farm | $155 | $166 |

| USAA | $137 | $102 |

60-year-old female drivers in Ocala often face higher auto insurance rates than males. Allstate, for example, charges $308 for women versus $23 for men, with similar disparities seen across most providers. However, State Farm and USAA offer more consistent pricing between genders.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ocala’s Auto Insurance Tailored to Your Driving History: A Unique Approach

In Ocala, Florida, auto insurance rates can vary widely depending on your driving history and choice of provider. Understanding these differences can help you find the most cost-effective coverage. For more details, check out our resource titled “How Auto Insurance Companies Check Driving Records.”

Ocala, Florida Auto Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $422 | $503 | $558 | $468 |

| Geico | $200 | $256 | $382 | $314 |

| Liberty Mutual | $242 | $309 | $443 | $325 |

| Nationwide | $250 | $273 | $365 | $276 |

| Progressive | $329 | $486 | $409 | $441 |

| State Farm | $203 | $240 | $221 | $221 |

| USAA | $148 | $183 | $270 | $155 |

Monthly auto insurance rates vary by provider and driving record. USAA offers the lowest rates overall, with $148 for a clean record and $183 for one accident. Rates rise with violations, especially DUI, with Allstate being the most expensive at $558 for a DUI. State Farm provides stable rates across different records.

By comparing rates from different providers like USAA, Geico, and Allstate, you can make an informed decision that fits your needs and budget. Keep your driving record clean to secure the best rates and save on insurance costs.

Understanding Ocala Auto Insurance Rates Post-DUI: A Comprehensive Guide

Insurance premiums can differ significantly among providers due to the elevated risk and potential expenses linked to a DUI on your record, so here’s a comparison of monthly rates from top insurers to assist you in choosing high-risk auto insurance.

Ocala, Florida DUI Auto Insurance Cost

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $1,075 |

| Geico | $461 |

| Liberty Mutual | $332 |

| Nationwide | $432 |

| Progressive | $416 |

| State Farm | $423 |

| Travelers | $471 |

Auto insurance monthly rates following a DUI vary significantly by provider. Allstate charges the highest at $1,075, while Geico offers the lowest rate at $461. Other options include Liberty Mutual at $332, Nationwide at $432, Progressive at $416, State Farm at $423, and Travelers at $471.

Ocala Auto Insurance: Personalized Premiums Reflecting Your Credit Score

When shopping for auto insurance in Ocala, Florida, your credit history can significantly influence your rates. Here’s a quick overview of how different providers stack up based on your credit score. For more details, check out our resource “Does auto insurance cover shopping cart damage?”

Ocala, Florida Auto Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| Allstate | $351 | $431 | $681 |

| Geico | $191 | $254 | $420 |

| Liberty Mutual | $256 | $312 | $421 |

| Nationwide | $242 | $268 | $363 |

| Progressive | $322 | $385 | $542 |

| State Farm | $164 | $199 | $301 |

| USAA | $110 | $151 | $308 |

Auto insurance rates differ by credit history and provider. USAA offers the lowest rates across all credit levels, starting at $110 for good credit. In contrast, Allstate is the most expensive, with rates up to $681 for bad credit.

Understanding how credit affects your auto insurance costs can help you make more informed decisions. For the best rates, consider providers like USAA, especially if you have good credit, while noting that companies like Allstate may be pricier across the board.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Discover Your Auto Insurance Rates: Ocala, FL ZIP Code Breakdown

Auto insurance rates by ZIP code in Ocala, Florida can vary. Compare the annual cost of auto insurance by ZIP code in Ocala, Florida to see how car insurance rates are affected by location.

Ocala, Florida Auto Insurance Monthly Rates by ZIP Code

| ZIP Code | Rates |

|---|---|

| 34470 | $247 |

| 34471 | $249 |

| 34472 | $248 |

| 34473 | $248 |

| 34474 | $249 |

| 34475 | $243 |

| 34476 | $244 |

| 34479 | $245 |

| 34480 | $244 |

| 34481 | $244 |

| 34482 | $241 |

Auto insurance rates in Ocala, Florida, vary slightly by ZIP code. For example, ZIP codes 34470 and 34471 have rates around $247 to $249 per month, while 34475 and 34480 are slightly lower at $243 and $244 respectively. Most ZIP codes in Ocala, including 34472, 34473, 34474, 34476, 34479, 34481, show rates between $244 and $249.

Ocala Auto Insurance Rates: How Your Commute Impacts Your Premium

Explore auto insurance options in Ocala, Florida, where monthly rates vary significantly based on annual mileage and provider.

Ocala, Florida Auto Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $474 | $502 |

| Geico | $287 | $290 |

| Liberty Mutual | $319 | $340 |

| Nationwide | $291 | $291 |

| Progressive | $416 | $416 |

| State Farm | $214 | $229 |

| USAA | $187 | $191 |

In Ocala, FL, monthly auto insurance rates range from $187 with USAA to $474 with Allstate for 6,000 miles. For 12,000 miles, rates are $191 with USAA and $502 with Allstate. Geico, Liberty Mutual, Nationwide, Progressive, and State Farm also offer varying rates.

For the most accurate and personalized rates, consider contacting the providers directly. Your best deal may vary based on your specific needs and driving habits. To learn more, check out our detailed resource on insurance titled “Reasons Auto Insurance Costs More for Young Drivers.”

Unlocking the Secrets: Key Elements Affecting Auto Insurance Premiums in Ocala, FL

There are a lot of reasons why auto insurance rates in Ocala, Florida are higher or lower than in other cities. These include traffic and the number of vehicle thefts in Ocala, Florida.

Allstate delivers the top auto insurance value in Ocala with superior coverage and excellent customer support.Michelle Robbins Licensed Insurance Agent

Many local factors may affect your Ocala auto insurance rates. To understand fully, refer to our detailed analysis titled “Does auto insurance cover vehicle theft?”

Ocala Auto Theft

More theft means higher auto insurance rates because auto insurance companies are paying more in claims. According to the FBI’s annual Ocala, Florida auto theft statistics, there have been 179 auto thefts in the city.

Ocala Commute Time

Cities in which drivers have a longer average commute time tend to have higher auto insurance costs. The average Ocala, Florida commute length is 20.4 minutes according to City-Data.

Ocala Traffic

How does Ocala, Florida rank for traffic? According to Inrix Ocala, Florida is the 807th most congested worldwide.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

A Comprehensive Guide to Ocala, Florida Auto Insurance Quotes

Ocala drivers can find affordable auto insurance with top providers like Allstate, Progressive, and Travelers, starting at about $80 per month. To get the best deal, use a ZIP code-based comparison tool. Minimum coverage in Ocala includes $10,000 for bodily injury per person and $10,000 for property damage.

Full coverage costs between $175 and $225 monthly. Discounts are available, and rates vary based on age, gender, driving record, and local factors like auto theft and commute length. Comparing quotes will help you find the most cost-effective option. To expand your knowledge, check out our resource titled “Male vs. Female Auto Insurance Rates.”

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Frequently Asked Questions

What are the best auto insurance rates in Ocala, Florida?

The best auto insurance rates in Ocala, Florida, are offered by companies like Allstate, Progressive, and Travelers. Rates can start as low as $80 per month depending on coverage and discounts.

How can I find cheap auto insurance in Ocala, Florida?

To find cheap auto insurance in Ocala, Florida, compare quotes from multiple insurance providers. Look for discounts, such as safe driver or multi-policy savings, and consider adjusting your coverage level to reduce costs.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

What is the minimum auto insurance required in Ocala, Florida?

In Ocala, Florida, the minimum auto insurance requirements are 10/20/10, which includes $10,000 for bodily injury per person, $20,000 for bodily injury per accident, and $10,000 for property damage.

To expand your knowledge, refer to our comprehensive handbook titled “Bodily Injury Liability (BIL) Auto Insurance Defined.”

How much is liability-only auto insurance in Ocala, Florida?

Liability-only auto insurance in Ocala, Florida, typically costs between $80 and $105 per month, depending on your driving history and the insurance provider.

What are the top insurance companies in Ocala, Florida?

The top insurance companies in Ocala, Florida, include Allstate, Progressive, and Travelers. These providers are known for their strong coverage options and customer service.

How much is full coverage auto insurance in Ocala, Florida?

Full coverage auto insurance in Ocala, Florida, generally costs between $175 and $225 per month, depending on the provider and the specifics of your policy.

For a comprehensive overview, explore our detailed resource titled “Can you view your auto insurance policy online?”

Where can I get auto insurance quotes in Ocala, Florida?

You can get auto insurance quotes in Ocala, Florida, from various sources including online comparison tools, insurance company websites, and local insurance agents.

Is direct auto insurance available in Ocala, Florida?

Yes, direct auto insurance is available in Ocala, Florida. Companies like Geico and Progressive offer direct insurance options, allowing you to get quotes and manage your policy online.

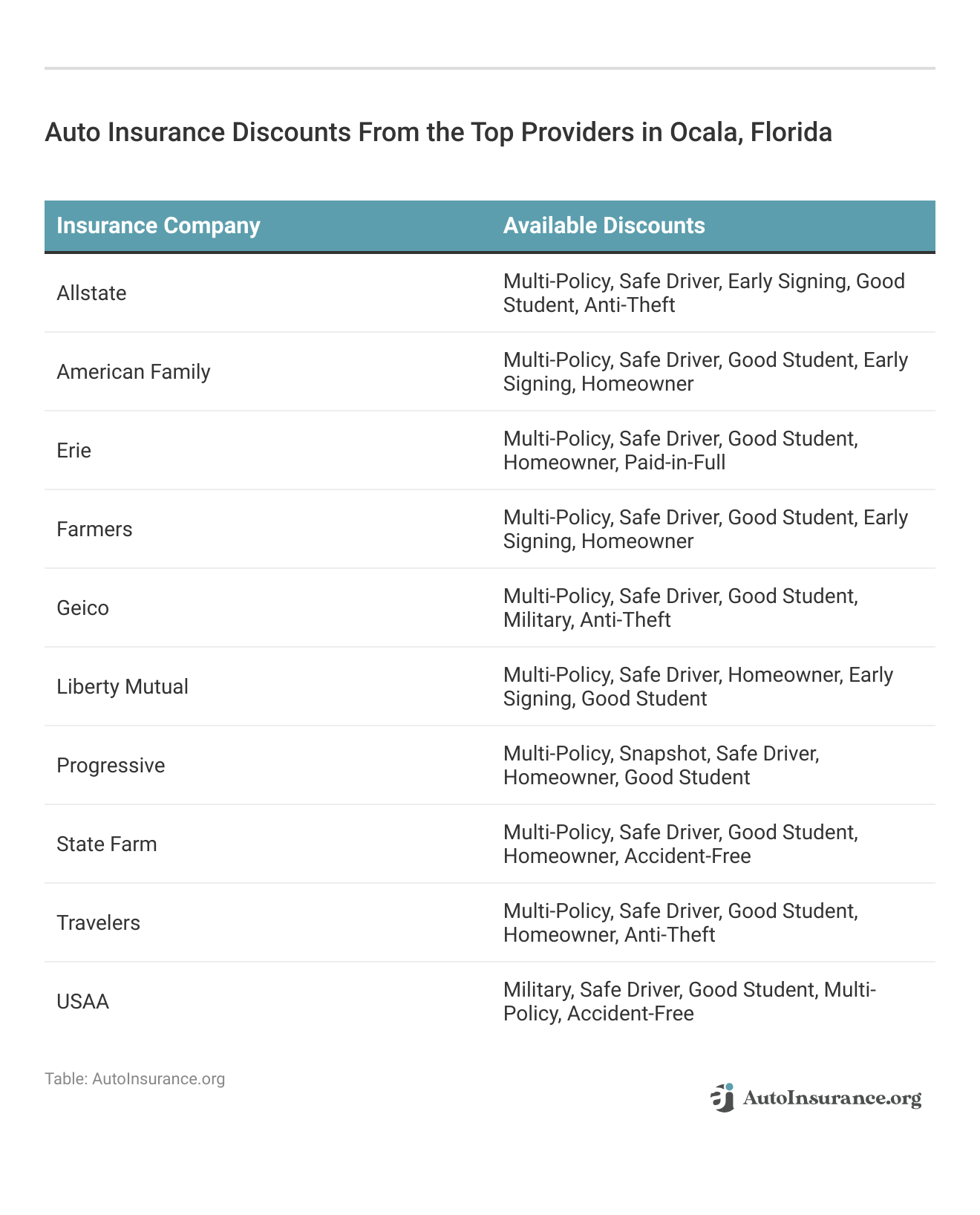

Can I find discounts on auto insurance in Ocala, Florida?

Yes, many insurance companies in Ocala offer discounts on auto insurance. Common discounts include those for safe driving, bundling multiple policies, good student discounts, and more.

Explore our list of the leading providers: Best Good Student Auto Insurance Discounts

What factors affect the cost of auto insurance in Ocala, Florida?

Factors that affect auto insurance costs in Ocala include your age, driving record, credit history, coverage level, and local factors such as auto theft rates and commute length.

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.