Best Atlanta, Georgia Auto Insurance in 2025 (Compare the Top 10 Companies)

For the best Atlanta, Georgia auto insurance, State Farm, Farmers, and Geico offer the top options, with rates as low as $110 per month. These companies provide cheap car insurance in Atlanta, ensuring excellent coverage at affordable rates. Keep reading to learn more and have options that best fit your budget.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Atlanta Georgia

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Atlanta Georgia

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Atlanta Georgia

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

The best Atlanta, Georgia auto insurance are offered by top companies like State Farm, Farmers, and Geico with rates starting as low as $110 per month.

We’ll help you find affordable car insurance in Atlanta. When you find yourself on the bustling streets of Atlanta, like Peachtree Road or the Downtown Connector, you need solid coverage that accounts for every essential detail.

Our Top 10 Company Picks: Best Atlanta, Georgia Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 20% B Broad Coverage State Farm

#2 20% A Local Agents Farmers

#3 25% A++ Competitive Rates Geico

#4 25% A+ Extensive Discounts Allstate

#5 10% A+ Customer Service Erie

#6 12% A+ Flexible Policies Progressive

#7 10% A++ Military Focus USAA

#8 25% A Customizable Plans Liberty Mutual

#9 8% A++ Comprehensive Coverage Travelers

#10 20% A Strong Reputation American Family

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code above in our free quote comparison tool.

- State Farm stands out as the best auto insurance company in Atlanta, Georgia

- Explore the auto insurance discounts available for policyholders in Atlanta, Georgia

- Learn how much the required minimum insurance coverage cost

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Budget-Friendly Premiums: As outlined in our State Farm auto insurance review they offer average monthly premium of $340 in Atlanta positions them as an economical choice for auto insurance in the metro area.

- Customizable Policy Options: With State Farm, Atlanta drivers can select from various coverage levels and add-ons to craft a policy that aligns with their unique needs.

- Robust Local Presence: State Farm’s extensive network of Atlanta-based representatives ensures policyholders have easy access to personalized service and support when filing claims or seeking guidance.

Cons

- Steeper Rates for Inexperienced Drivers: Atlanta’s less experienced drivers may find State Farm’s premiums less budget-friendly compared to some other providers.

- Fewer Specialized Discounts: State Farm may offer a more limited selection of discounts for certain Atlanta demographics compared to competitors, potentially impacting affordability for some residents.

#2 – Farmers: Best for Local Agents

Pros

- Varied Discount Selections: Atlantans insured with Farmers can take advantage of multiple discount opportunities, such as safe driver and policy bundling discounts, to help manage premium costs.

- Extensive Rep Network: With a strong presence across Atlanta, Farmers provides localized, one-on-one support through knowledgeable agents who understand the unique needs of area drivers. See more details in our page titled Farmers auto insurance review.

- Robust Policy Options: Farmers offers Atlanta residents a comprehensive range of coverage options and supplemental features, like roadside assistance and rental car coverage, to bolster protection.

Cons

- Above-Average Premiums: At an average of $355 monthly, Farmers’ premiums trend higher than some competitors in Atlanta, which could be a consideration for cost-conscious drivers.

- Multifaceted Policy Choices: While advantageous for some, the breadth of coverage options and add-ons available through Farmers may overwhelm Atlanta drivers seeking more straightforward policy choices.

#3 – Geico: Best for Competitive Rates

Pros

- Wallet-Friendly: As mentioned in our Geico auto insurance review, they boasts Atlanta’s lowest average monthly premium at $320, making it a top choice for drivers seeking maximum savings on auto insurance.

- Convenient Digital Tools: Atlanta policyholders can easily manage their Geico coverage, access important documents, and file claims using the insurer’s user-friendly mobile app and online portal.

- Ample Discount Selections: Geico provides Atlanta drivers with a wide array of potential discounts, such as good driver and multi-vehicle price breaks, to help reduce out-of-pocket premium costs.

Cons

- Narrower Local Footprint: Compared to some competitors, Geico has a smaller brick-and-mortar presence in Atlanta, which may limit opportunities for face-to-face interactions with agents.

- Inconsistent Claim Experiences: Some Atlanta policyholders have reported frustration with Geico’s claims process, citing concerns about timeliness and overall satisfaction with the resolution.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Extensive Discounts

Pros

- Well-Rounded Coverage: Allstate’s Atlanta policyholders can choose from an extensive selection of coverage options, including hard-to-find protections like new car replacement and accident forgiveness.

- Localized Support: With numerous agents throughout Atlanta, Allstate offers a personalized, hands-on approach to choosing coverage and navigating the claims process.

- Abundant Discounts: Allstate provides Atlanta drivers with a generous selection of discounts, from price breaks for safe driving to savings for bundling policies, which can noticeably lower premium costs. Learn more in our Allstate auto insurance review.

Cons

- Premium Pricing: With an average monthly premium of $330, Allstate’s rates are costlier than some other Atlanta providers, potentially deterring budget-sensitive shoppers.

- Unpredictable Policyholder Support: Allstate’s customer service standards in Atlanta can be hit-or-miss, with some policyholders expressing discontent with the insurer’s response times and claims handling procedures.

#5 – Erie: Best for Customer Service

Pros

- Reasonable Costs: As outlined in Erie auto insurance review, Erie offers Atlanta drivers affordable coverage options, with an average monthly premium of $310.

- Comprehensive Policy Options: Erie’s Atlanta policyholders can take advantage of a full suite of coverage choices, including extras like roadside assistance and rental car protection.

- Superior Policyholder Care: Erie consistently receives high marks from Atlanta customers for their attentive, efficient service and smooth claims experiences.

Cons

- Constrained Availability: Erie’s coverage offerings may be limited in certain parts of Atlanta, making it difficult for some drivers to access the insurer’s well-regarded policies.

- Restricted Payment Flexibility: Compared to some Atlanta competitors, Erie may offer fewer choices when it comes to premium payment schedules and methods.

#6 – Progressive: Best for Flexible Policies

Pros

- Cost-Effective Coverage: Progressive’s average monthly premium of $305 makes it one of Atlanta’s most affordable auto insurance options. Learn more in our Progressive auto insurance review.

- Customizable Coverage: Atlanta drivers can pick and choose from Progressive’s many coverage options to build a policy that fits their unique needs and budget.

- Potential Rate Reductions: Progressive’s Snapshot program rewards Atlanta policyholders who demonstrate safe driving habits with the opportunity to save even more on their premiums.

Cons

- Fluctuating Service Quality: Some Atlanta customers have reported inconsistencies in Progressive’s claims handling and overall service, which may be a consideration for those who prioritize a seamless experience.

- Possible Premium Hikes: While Progressive’s rates start low, Atlanta policyholders should be aware that their premiums may increase over time based on their driving record and other factors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – USAA: Best for Military Focus

Pros

- Unbeatable Military Rates: As mentioned in our USAA auto insurance review, USAA offers an exceptionally low average monthly premium of $290 for qualified Atlanta military families and veterans.

- Top-Tier Customer Care: Atlanta policyholders consistently praise USAA for their attentive, efficient service and smooth claims process.

- Military-Centric Coverage: USAA provides a full array of coverage options tailored to the unique needs of Atlanta’s military community, including benefits specifically designed for deployment and relocation.

Cons

- Membership Limitations: USAA’s coverage is exclusively available to Atlanta’s active duty and retired military members, their spouses, and their children, limiting accessibility for civilians.

- Digital-Centric Service: USAA does not maintain a network of local agents in Atlanta, which may be a drawback for policyholders who prefer face-to-face interactions for insurance matters.

#8 – Liberty Mutual: Best for Customizable Plans

Pros

- Personalized Policy Options: As mentioned in our Liberty Mutual auto insurance review, they offer Atlanta drivers the flexibility to customize their coverage with a wide range of options and add-ons, ensuring a just-right fit.

- Hands-On Agent Assistance: Liberty Mutual’s network of Atlanta-based agents provides personalized support to help policyholders navigate coverage choices, claims, and more.

- Potential Rate Reductions: Atlanta drivers may be able to lower their Liberty Mutual premium by taking advantage of the insurer’s numerous discounts, including price breaks for safe driving and bundling policies.

Cons

- Elevated Premium Costs: At an average of $365 per month, Liberty Mutual’s rates are the highest among top providers in Atlanta, which may put their policies out of reach for budget-conscious drivers.

- Mixed Service Reviews: Some Atlanta customers have reported uneven experiences with Liberty Mutual’s claims service and support, ranging from smooth interactions to frustrating delays.

#9 – Travelers: Best for Comprehensive Coverage

Pros

- Reasonably-Priced Policies: As outlined in our Travelers auto insurance review, Travelers offers competitive auto insurance rates in Atlanta, Georgia, with an average monthly premium of $340, providing a cost-effective option for many drivers.

- Extensive Coverage Selections: Atlanta policyholders can choose from Travelers’ broad array of coverage options and add-ons, like accident forgiveness and roadside assistance, to secure well-rounded protection.

- Potential Savings Opportunities: Travelers provides numerous discounts to help Atlanta drivers save on premiums, including price breaks for safe driving records and price reductions for insuring multiple vehicles.

Cons

- Elevated Rates for Certain Drivers: Travelers may charge steeper premiums for Atlanta motorists with a history of at-fault accidents or moving violations compared to other providers’ high-risk rates.

- Sluggish Claims Experiences: Some Atlanta policyholders have expressed frustration with the efficiency and outcome of Travelers’ claims process.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Strong Reputation

Pros

- Affordable Coverage Options: American Family offers reasonably priced auto insurance in Atlanta, Georgia, with an average monthly premium of $350, making it a competitive choice for budget-conscious drivers.

- Regional Expertise: With a solid presence throughout Atlanta, American Family’s local agents offer the kind of in-depth knowledge that comes from serving their community. (Read More: American Family Auto Insurance Review).

- Varied Discount Options: American Family provides Atlanta drivers with an array of discount opportunities, from price breaks for maintaining a clean driving record to savings for bundling policies.

Cons

- Steeper Premiums Than Some: While American Family’s rates are moderate, budget-conscious Atlanta drivers can likely find cheaper coverage with other local providers.

- Less Adaptable Policies: American Family may offer fewer opportunities to customize coverage compared to competitors in Atlanta, which could be limiting for policyholders with very specific needs.

Understanding Minimum Auto Insurance Requirements in Atlanta, Georgia

When it comes to getting the right auto insurance in Atlanta, Georgia, it is important to have a clear understanding of the costs that come with different coverage levels. Take a look at the table below for a straightforward breakdown of monthly insurance rates from the top companies:

Atlanta, Georgia Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $135 $330

American Family $140 $350

Erie $125 $310

Farmers $140 $355

Geico $120 $320

Liberty Mutual $145 $365

Progressive $115 $305

State Farm $130 $340

Travelers $130 $340

USAA $110 $290

It is required by state regulations in Atlanta, Georgia to have at least the minimum auto insurance coverage to show financial responsibility in the event of an accident. Here is a breakdown of the essential auto insurance coverage in Atlanta, Georgia:

- $25,000 for property damage liability coverage

- $25,000 for bodily injuries per person

- $50,000 for total bodily injury per accident

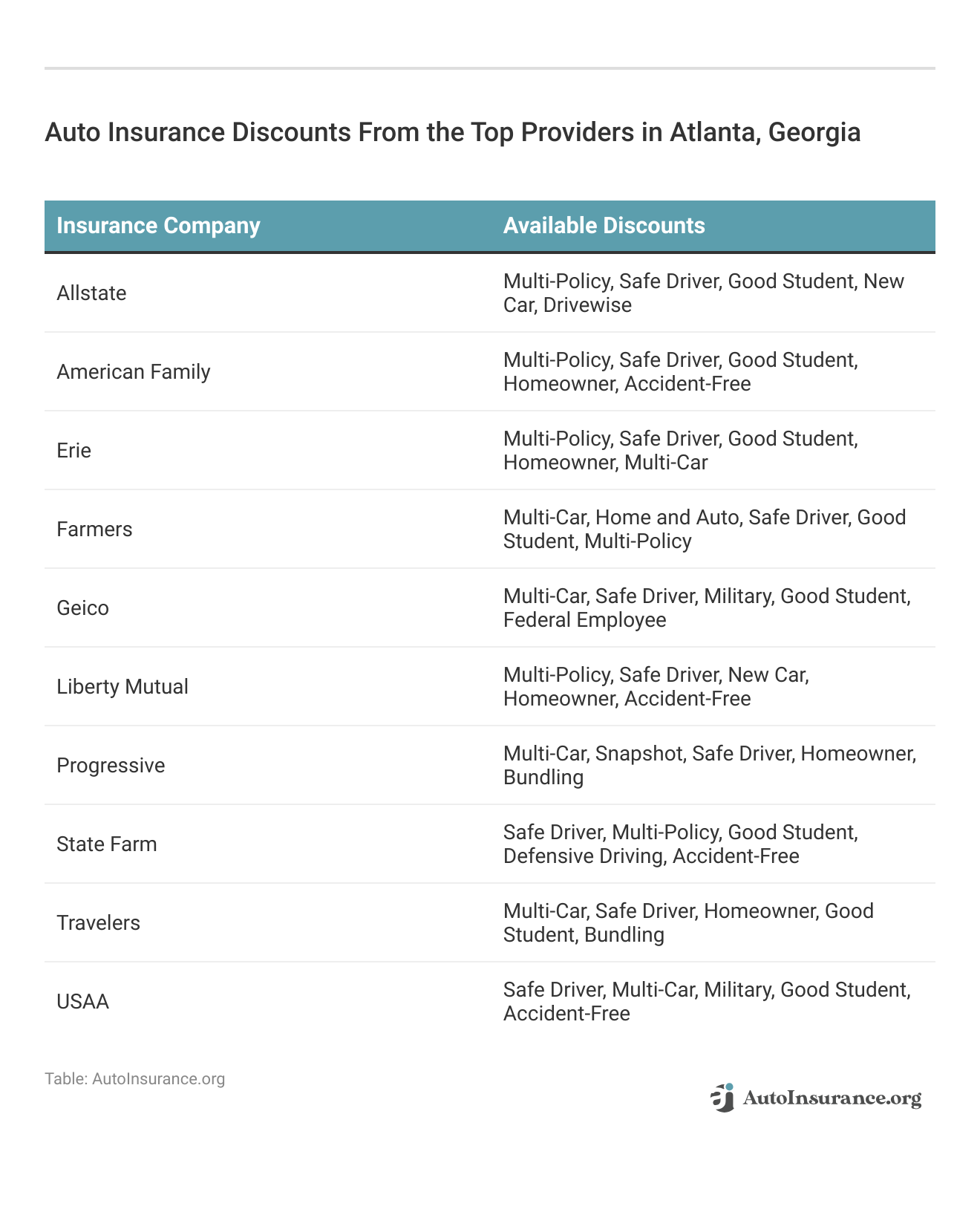

Explore the available discounts from top auto insurance companies in Atlanta, Georgia, to significantly reduce your premiums. Discover savings tailored to your needs.

These discounts from major insurance providers in Atlanta, Georgia offer car owners valuable opportunities to save money while maintaining comprehensive coverage and road safety.

Your Commute Affects Insurance Costs in Atlanta, GA

Are you driving daily to your job, sending your kids to school, or doing groceries. Use the table below to compare how different commute lengths can lead to more affordable insurance options tailored to your driving habits.

Atlanta, Georgia Full Coverage Auto Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $416 | $435 |

| Geico | $325 | $336 |

| Liberty Mutual | $1,057 | $1,057 |

| Nationwide | $688 | $688 |

| Progressive | $479 | $479 |

| State Farm | $341 | $341 |

| USAA | $282 | $309 |

If you frequently travel on the I-285 perimeter or find yourself stuck in traffic on Peachtree Street, your daily commute may be causing your insurance expenses to increase. If you’re a driver who doesn’t spend much time on the road, low mileage auto insurance discount might be the perfect option for you.

Evaluate insurance options with these in mind to let you select coverage that best suits your driving style and financial goals. Try to customize your policy to match how and where you drive, this can optimize both savings and protection as well.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Auto Insurance Rates are Set in Atlanta, GA

Auto insurance rates in Atlanta, Georgia are shaped by a variety of local conditions like high traffic volumes, frequent vehicle thefts, and other city-specific elements these conditions contributes highly to your auto insurance rates. Knowing these local influences can help you better anticipate your insurance expenses in Atlanta.

Commute Time and its Effect on Auto Insurance in Atlanta

Atlanta, Georgia’s average commute is 27.2 minutes, according to City-Data. Drivers who have longer average commute times often face higher auto insurance costs. For further details, check out our article titled “Most Expensive Commutes in America.”

How Atlanta Traffic Influences Auto Insurance Rates

Inrix data shows Atlanta, Georgia, ranks 174th globally for traffic congestion. The city wrestles with heavy traffic, marked by regular delays and long commutes. These troubles underscore Atlanta’s struggle with congestion against other major cities around the world.

The Effect of Driving History on Auto Insurance Costs in Atlanta, GA

Driving through the crowded streets of Atlanta is no easy task. It’s hard to keep a clean driving record in such a busy place. But you have to, if you want to keep your insurance costs down, especially near the dangerous stretch of I-75.

If you have infractions or a clean record, you should know how they affect your monthly costs. This table compares insurance rates for drivers with different records to show how your history affects your rates.

Atlanta, Georgia Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| Allstate | $348 | $544 | $367 | $442 |

| Geico | $218 | $271 | $249 | $584 |

| Liberty Mutual | $801 | $1,097 | $1,067 | $1,260 |

| Nationwide | $530 | $622 | $643 | $959 |

| Progressive | $372 | $666 | $433 | $443 |

| State Farm | $310 | $372 | $341 | $341 |

| USAA | $226 | $287 | $252 | $418 |

A spotless driving record can lead to more affordable premiums, while traffic violations like DUIs, speeding, or accidents can cause your rates to spike.

Auto Insurance Rates After a DUI in Atlanta, Georgia

If you have DUI, your rates will get higher. See our table below to check how much your auto insurance rates would be once you have a DUI record.

Atlanta, Georgia Full Coverage Auto Insurance Rates After a DUI

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $442 |

| Geico | $584 |

| Liberty Mutual | $1,260 |

| Nationwide | $959 |

| Progressive | $443 |

| State Farm | $341 |

| USAA | $418 |

As you can see it can be difficult to get the cheapest car insurance in GA once you have a DUI record, but there are still options to consider. Try to compare rates from various insurers, so you can identify the best deal for your circumstances. For more information, read our article titled “DUI Defined.”

Credit History Impact on Auto Insurance Rates in Atlanta, Georgia

In Atlanta, the economy is as varied as the people living there, which means residents have all sorts of credit scores. These scores play a big role in how much they pay for car insurance. If you’ve got good credit, you’re likely to get better rates.

Atlanta, Georgia Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $551 | $384 | $342 |

| Geico | $431 | $282 | $279 |

| Liberty Mutual | $1,512 | $929 | $728 |

| Nationwide | $819 | $665 | $581 |

| Progressive | $537 | $467 | $433 |

| State Farm | $484 | $301 | $239 |

| USAA | $384 | $271 | $232 |

Drivers with strong credit profiles often enjoy lower monthly rates, while those with lower scores may see higher costs. The table above highlights how different credit tiers affect insurance pricing in the city.

Your credit history significantly influences auto insurance rates in Atlanta. Evaluating different insurance providers can help you find the best rates based on your credit situation.

Read More: Does not paying your auto insurance affect credit?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Atlanta, Georgia: Auto Insurance Premiums by ZIP Code

ZIP codes in Atlanta plays a heavy role in auto insurance. You can use this guide if you are moving to Atlanta to know which ZIP codes can help you reduce your auto insurance rates.

Auto insurance rates by ZIP code can help you get the cheapest auto insurance in GA. In order to illustrate how location affects insurance rates, the table below displays the monthly costs of auto insurance in several Atlanta, Georgia ZIP codes.

Atlanta, Georgia Full Coverage Auto Insurance Rates by ZIP Code

| ZIP Code | Monthly Rates |

|---|---|

| 30303 | $549 |

| 30304 | $551 |

| 30305 | $459 |

| 30306 | $463 |

| 30307 | $469 |

| 30308 | $460 |

| 30309 | $460 |

| 30310 | $555 |

| 30311 | $545 |

| 30312 | $534 |

| 30313 | $531 |

| 30314 | $564 |

| 30315 | $555 |

| 30316 | $537 |

| 30317 | $511 |

| 30318 | $534 |

| 30319 | $446 |

| 30326 | $459 |

| 30327 | $462 |

| 30331 | $537 |

| 30334 | $556 |

| 30336 | $495 |

| 30337 | $518 |

| 30339 | $453 |

| 30340 | $499 |

| 30341 | $486 |

| 30342 | $442 |

| 30345 | $484 |

| 30349 | $529 |

| 30354 | $521 |

| 30360 | $495 |

| 30361 | $479 |

| 30363 | $460 |

| 30369 | $484 |

Choosing to live in places like Buckhead or Midtown Atlanta can drive up your insurance costs. These areas, thick with traffic and rife with car thefts, make for steeper premiums.

To find out if you can get the cheapest auto insurance in Georgia, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Frequently Asked Questions

What should I do if I’m involved in an accident in Atlanta, GA?

If you’re involved in an accident in Atlanta, GA, first ensure everyone’s safety and call 911 if necessary. Exchange information with the other driver(s), document the scene with photos, and notify your insurance company as soon as possible to start the claims process.

What are the average auto insurance rates in Atlanta, GA?

The average auto insurance rates in Atlanta, GA are around $517 per month.

What is the minimum auto insurance coverage required in Atlanta, GA?

To comply with Georgia auto insurance laws, the minimum auto insurance coverage required in Atlanta is 25/50/25, which means $25,000 in bodily injury liability coverage per person, $50,000 in bodily injury liability coverage per accident, and $25,000 in property damage liability coverage.

How can I find the best cheap auto insurance in Atlanta, Georgia?

To find the best cheap car insurance in Atlanta, Georgia, it is recommended to compare quotes from multiple companies. By comparing rates, you can find affordable options that suit your needs.

Get fast and cheap auto insurance in GA today with our quote comparison tool below.

Does GA require full coverage insurance?

Georgia requires a minimum of 25/50/25 coverage, but full coverage is not mandatory. However, it’s often recommended for better protection.

Who has the lowest car insurance rates in Georgia?

To find the cheapest car insurance in Georgia, it’s advisable to compare rates from various companies, as prices can vary based on your driving record, location, and coverage needs.

Do auto insurance rates in Atlanta vary by ZIP code?

Yes, auto insurance rates in Atlanta can vary based on ZIP code. Different areas may have different risk factors and claim statistics, which can affect the rates offered by insurance companies.

Read More: Auto Insurance Rates by ZIP Code

How can I lower my auto insurance rates in Atlanta, GA?

To lower your auto insurance rates in Atlanta, GA, consider raising your deductible, bundling policies, maintaining a clean driving record, and taking advantage of available discounts such as those for safe driving, low mileage, or being a good student.

Can I get auto insurance in Atlanta, GA if I have a bad driving record?

Yes, you can get car insurance Atlanta, GA even if you have a bad driving record, but it may come with higher premiums. Shopping around and comparing quotes from different insurers can help you find more affordable options, even with a less-than-perfect record.

Is it possible to get auto insurance in Atlanta, GA without a credit check?

While most insurers in Atlanta, GA use credit scores to help determine rates, some companies offer no-credit-check insurance policies. However, these policies may come with higher premiums, so it’s important to compare your options carefully.

How does the cost of living in Atlanta, GA affect auto insurance rates?

The cost of living in Atlanta, GA can indirectly affect auto insurance rates. Higher costs for repairs, medical expenses, and other factors associated with a higher cost of living may lead to higher insurance premiums in the area. Additionally, higher traffic congestion and accident rates in larger cities can also contribute to increased rates.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.