Best Rome, Georgia Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

For the best Rome, Georgia auto insurance, the leading providers are State Farm, USAA, and Geico, with rates starting at $95 per month. These companies stand out for their affordability, customer service, and coverage options, making them ideal choices for drivers in Rome, Georgia.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Rome Georgia

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Rome Georgia

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Rome Georgia

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe best Rome, Georgia auto insurance providers are State Farm, USAA, and Geico, offering the most competitive rates starting at $95 per month.

State Farm stands out as the top pick overall for its exceptional blend of affordability and coverage. USAA and Geico also provide great value with their tailored options and strong customer service.

Our Top 10 Company Picks: Best Rome, Georgia Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Teen Drivers | State Farm | |

| #2 | 30% | A++ | Military Savings | USAA | |

| #3 | 15% | A++ | Affordable Rates | Geico | |

| #4 | 20% | A++ | Customer Service | Auto-Owners | |

| #5 | 15% | A++ | Coverage Variety | Travelers | |

| #6 | 10% | A+ | High-risk Drivers | Progressive | |

| #7 | 25% | A+ | Infrequent Drivers | Allstate | |

| #8 | 20% | A+ | Customer Support | Nationwide |

| #9 | 12% | A | Custom Coverage | Liberty Mutual |

| #10 | 15% | A | Customer Satisfaction | Farmers |

By comparing these top choices, you can find the ideal policy to meet your needs in Rome, Georgia. Get a better grasp by checking out our article titled, “Georgia minimum auto insurance requirements.“

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool above to compare your rates against the top insurers.

- Best Rome, Georgia auto insurance rates start at $95 per month

- State Farm offers top coverage options for Rome, Georgia drivers

- Compare USAA and GEICO for affordable, tailored insurance plans

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

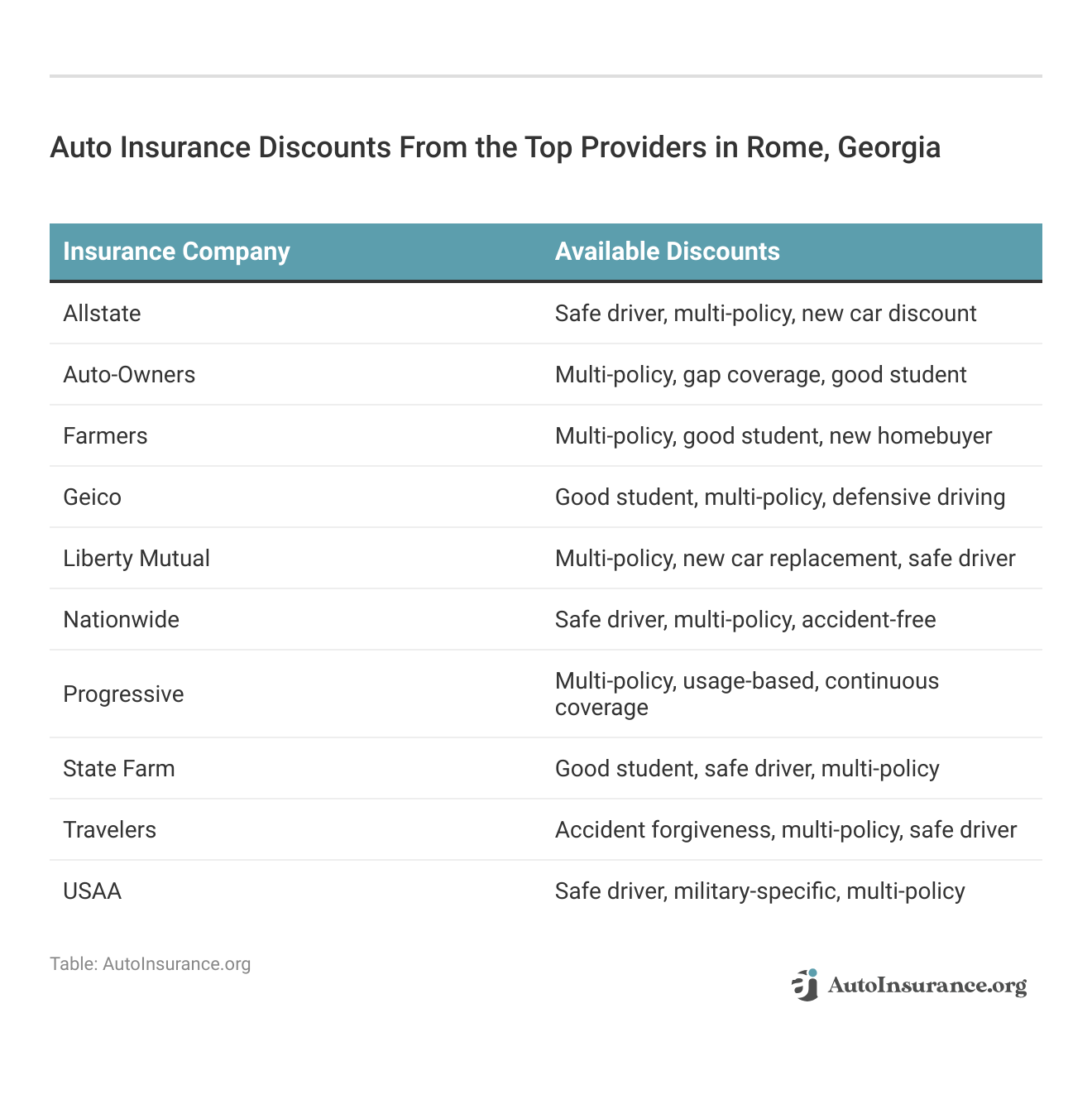

#1 – State Farm: Top Overall Pick

Pros

Pros

- Teen Driver Discounts: Offers substantial discounts tailored specifically for young and inexperienced Rome, Georgia drivers, including a 17% bundling discount, making it an appealing option for families with teen drivers.

- Wide Range of Coverage Options: Comprehensive plans that can be customized to suit the unique needs of Rome, Georgia policyholders, ensuring they receive the protection they need.

- Strong Local Presence: Numerous local agents in Rome, Georgia provide personalized service, making it easier for residents to manage their insurance needs. Access the complete picture in our “State Farm Auto Insurance Review.”

- User-Friendly App: Offers an easy-to-use mobile app that allows Rome, Georgia policyholders to manage their policies, file claims, and access roadside assistance quickly.

Cons

- Higher Premiums for Some Drivers: Rates can be higher for Rome, Georgia drivers with a history of accidents or traffic violations, potentially making it less affordable for those with less-than-perfect driving records.

- Limited Bundling Savings: While bundling is available, the 17% discount may not be as competitive for Rome, Georgia policyholders compared to other insurers offering higher discounts.

- Mixed Customer Service Reviews: Some Rome, Georgia policyholders have reported inconsistent service quality, which could be a drawback for those seeking reliable customer support.

#2 – USAA: Best for Military Savings

Pros

Pros

- Exceptional Military Discounts: Provides significant savings for Rome, Georgia military members and their families, with a 30% bundling discount, making it a top choice for those connected to the armed forces.

- Top-Tier Financial Strength: The A++ A.M. Best rating assures Rome, Georgia policyholders of the company’s strong financial stability and ability to meet claims obligations.

- Excellent Customer Satisfaction: Highly rated for customer service and claims processing, USAA is known for providing exceptional support to Rome, Georgia policyholders.

- Affordable Rates for Members: Generally offers lower premiums for eligible Rome, Georgia drivers, making it an affordable option for military families.

Cons

- Membership Restrictions: Only available to military members, veterans, and their families, limiting availability for the general public in Rome, Georgia who may not qualify for coverage.

- Limited Physical Locations: With fewer local offices, Rome, Georgia policyholders who prefer in-person service may find it less convenient. Discover what lies beyond with our “USAA Auto Insurance Review.”

- Strict Eligibility Criteria: The exclusive nature of membership means that many Rome, Georgia residents are not eligible for the competitive rates and benefits offered by USAA.

#3 – Geico: Best for Affordable Rates

Pros

Pros

- Affordable Rates: Known for offering some of the lowest premiums in the market, Geico provides Rome, Georgia policyholders with budget-friendly insurance options, including a 15% bundling discount.

- Strong Financial Stability: The A++ rating from A.M. Best gives Rome, Georgia drivers confidence in Geico’s financial strength and ability to handle claims. Gain a deeper understanding through our “Geico Auto Insurance Review.”

- Easy Online Tools: User-friendly website and mobile app make it easy for Rome, Georgia drivers to manage their policies, file claims, and access important information at their convenience.

- Discounts for Various Groups: Offers a variety of discounts for Rome, Georgia policyholders, including savings for federal employees, good students, and others, making it a versatile option for different demographics.

Cons

- Limited Coverage Options: Geico offers fewer add-on coverage options compared to other providers, which may limit customization for Rome, Georgia policyholders with specific insurance needs.

- Customer Service Can Be Lacking: Some Rome, Georgia policyholders have reported long wait times and less personalized service, which could be a drawback for those valuing direct customer support.

- High Rates for High-Risk Drivers: Geico may be more expensive for Rome, Georgia drivers with poor driving records, making it less ideal for those with a history of accidents or violations.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Auto-Owners: Best for Customer Service

Pros

Pros

- Excellent Customer Service: Highly rated for personalized and responsive customer support, Auto-Owners is a great choice for Rome, Georgia policyholders looking for attentive service, along with a 20% bundling discount.

- Bundling Discounts: Offers significant savings when bundling home and auto insurance, making it an attractive option for Rome, Georgia homeowners looking to consolidate their insurance policies.

- Strong Financial Stability: A++ rating from A.M. Best, indicating strong financial strength, which provides peace of mind to Rome, Georgia drivers regarding the company’s reliability.

- Wide Agent Network: Numerous local agents are available in Rome, Georgia for in-person assistance, offering a more personal touch for those who prefer face-to-face interactions.

Cons

- Limited Online Features: Auto-Owners may offer less robust online tools compared to competitors, which could be inconvenient for Rome, Georgia policyholders who prefer managing their policies digitally.

- Availability: Coverage options may not be as widely available in all areas of Rome, Georgia, potentially limiting choices for some residents. Unlock additional information in our “Auto-Owners Auto Insurance Review.”

- Higher Premiums: Generally higher rates for comprehensive coverage could make it more expensive for Rome, Georgia policyholders, particularly those seeking extensive protection.

#5 – Travelers: Best for Coverage Variety

Pros

Pros

- Diverse Coverage Options: Extensive variety of coverage options and add-ons, including a 15% bundling discount, making it a flexible choice for Rome, Georgia drivers with varied insurance needs.

- Strong Financial Rating: The A++ A.M. Best rating provides Rome, Georgia policyholders with confidence in Travelers’ financial reliability and claims-paying ability.

- Good Bundling Discounts: Competitive discounts for bundling multiple policies, making it easier for Rome, Georgia homeowners and drivers to save on their insurance.

- Strong Reputation: Well-regarded for handling claims efficiently, providing Rome, Georgia drivers with the assurance of responsive and effective claims service. Gain insights by reading our article titled, “Travelers Auto Insurance Review.”

Cons

- Higher Rates for Some Drivers: Premiums may be higher than other companies, particularly for high-risk Rome, Georgia drivers, making it less affordable for those with a history of accidents or violations.

- Complex Policy Structures: Some Rome, Georgia policyholders find their policy structures confusing, which could be a drawback for those seeking straightforward insurance options.

- Limited Local Presence: With fewer physical locations, Rome, Georgia policyholders who prefer in-person service may find it less convenient to access support.

#6 – Progressive: Best for High-Risk Drivers

Pros

Pros

- High-Risk Driver Coverage: Specializes in affordable coverage for high-risk Rome, Georgia drivers, offering a 10% bundling discount, which is a significant benefit for those with a challenging driving history.

- Snapshot Program: Offers usage-based insurance with potential savings for safe driving, providing Rome, Georgia drivers with personalized rates based on their driving habits. Explore further details in our article titled, “Progressive Auto Insurance Review.”

- Extensive Online Tools: Comprehensive website and mobile app features make it easy for Rome, Georgia policyholders to manage their policies, file claims, and track their driving habits.

- Customizable Coverage Options: Progressive offers a wide range of add-ons and optional coverages, allowing Rome, Georgia drivers to tailor their policies to meet their specific needs.

Cons

- Mixed Customer Service Reviews: Some Rome, Georgia policyholders report inconsistent service quality, which could be a concern for those valuing reliable customer support.

- Higher Rates for Low-Risk Drivers: Premiums may be higher for Rome, Georgia drivers with clean records, making it less competitive for those with a good driving history.

- Varied Claims Experience: Rome, Georgia policyholders have reported differing experiences with the claims process, which could be a drawback for those seeking a consistently smooth claims experience.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Allstate: Best for Infrequent Drivers

Pros

Pros

- Infrequent Driver Discounts: Offers specialized savings for Rome, Georgia drivers who don’t drive often, including a 25% bundling discount, making it an ideal option for low-mileage drivers.

- Good Financial Strength: A+ rating from A.M. Best gives Rome, Georgia policyholders confidence in Allstate’s financial reliability and ability to handle claims.

- Strong Local Agent Network: Extensive network of agents providing personalized service to Rome, Georgia policyholders, ensuring a more tailored insurance experience.

- Safe Driving Bonuses: Additional discounts for maintaining a clean driving record, encouraging safe driving habits among Rome, Georgia drivers. Uncover additional insights in our article called, “Allstate Auto Insurance Review.”

Cons

- Higher Premiums for Some Drivers: Can be more expensive for younger or high-risk Rome, Georgia drivers, potentially making it less affordable for these groups.

- Mixed Customer Satisfaction: Some Rome, Georgia policyholders report dissatisfaction with claims processing and overall service quality.

- Complex Discount Structure: Discounts can be difficult for Rome, Georgia policyholders to navigate, potentially leading to confusion when trying to maximize savings.

#8 – Nationwide: Best for Customer Support

Pros

Pros

- Strong Customer Support: Known for excellent customer service, Nationwide is a solid choice for Rome, Georgia policyholders looking for reliable support, combined with a 20% bundling discount.

- On Your Side Review: Provides an annual review to help Rome, Georgia policyholders adjust their coverage to better suit their needs, ensuring they aren’t paying for unnecessary coverage.

- Vanishing Deductible: Offers a unique benefit where the deductible decreases for every year of safe driving, providing additional savings for Rome, Georgia drivers.

- Wide Coverage Options: Extensive options for custom coverage allow Rome, Georgia policyholders to tailor their policies precisely to their needs. Discover more by delving into our article entitled, “Nationwide Auto Insurance Review.”

Cons

- Higher Premiums for High-Risk Drivers: Nationwide may charge more for Rome, Georgia drivers with poor driving records, making it less competitive for these individuals.

- Limited Availability of Discounts: Rome, Georgia policyholders may find fewer discount options compared to other insurers, potentially leading to higher overall costs.

- Mixed Online Experience: The website and mobile app have received mixed reviews from Rome, Georgia policyholders, which could be a concern for those who prefer managing their policies online.

#9 – Liberty Mutual: Best for Custom Coverage

Pros

Pros

- Custom Coverage Options: Liberty Mutual offers a variety of customizable plans, allowing Rome, Georgia policyholders to tailor their insurance to their specific needs, along with a 12% bundling discount.

- Accident Forgiveness: Provides Rome, Georgia drivers with accident forgiveness, ensuring that their first accident doesn’t lead to a rate increase, which is a significant advantage for those concerned about premium hikes.

- New Car Replacement: Offers a new car replacement option for Rome, Georgia policyholders, which replaces a totaled car with a brand new one of the same make and model. For further details, consult our article named, “Liberty Mutual Auto Insurance Review.”

- Strong Financial Rating: The A rating from A.M. Best indicates solid financial strength, providing Rome, Georgia policyholders with confidence in the company’s ability to meet claims obligations.

Cons

- Higher Premiums for Some Drivers: Liberty Mutual may charge higher premiums for Rome, Georgia drivers with a history of accidents or traffic violations, making it less affordable for these drivers.

- Mixed Customer Service Reviews: Some Rome, Georgia policyholders report inconsistent experiences with customer service, which could be a concern for those who prioritize responsive support.

- Limited Discounts: The available discounts, including the 12% bundling discount, may not be as generous as those offered by other insurers, potentially leading to higher overall costs for Rome, Georgia policyholders.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Customer Satisfaction

Pros

Pros

- Customer Satisfaction: Farmers is well-regarded for its focus on customer service, making it a reliable choice for Rome, Georgia policyholders looking for consistent support, along with a 15% bundling discount.

- Comprehensive Coverage Options: Offers a wide range of coverage options and endorsements, allowing Rome, Georgia drivers to customize their policies according to their specific needs.

- Strong Local Presence: Numerous local agents in Rome, Georgia provide personalized service, ensuring that policyholders have access to in-person support when needed.

- Discounts for Safe Driving: Provides additional savings for Rome, Georgia drivers who maintain a clean driving record, encouraging safe driving habits. Deepen your understanding with our article called, “Farmers Auto Insurance Review.”

Cons

- Higher Premiums for Some Drivers: Farmers may be more expensive for high-risk Rome, Georgia drivers, potentially making it less affordable for those with a history of accidents or traffic violations.

- Limited Online Tools: The online tools and app may not be as advanced as those offered by competitors, which could be a drawback for Rome, Georgia policyholders who prefer managing their policies digitally.

- Mixed Claims Experience: Some Rome, Georgia policyholders report varying experiences with the claims process, which could be a concern for those seeking a seamless claims experience.

Factors Affecting Auto Insurance Rates in Rome, Georgia

Auto insurance rates in Rome, GA, can be affected by factors like commute times and traffic congestion. In Rome, the average commute is 22.5 minutes, and the city is ranked 18th in global traffic congestion, which can lead to higher costs for auto insurance in Rome, GA.

Full coverage auto insurance provides extensive protection compared to minimum coverage, including liability, collision, and comprehensive coverage. For those seeking auto insurance quotes in Rome, options like Allstate Insurance Rome GA offer various rates. For instance, Allstate Rome GA charges $118 for minimum coverage and $174 for full coverage.

Rome, Georgia Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $118 | $174 |

| Auto-Owners | $110 | $145 |

| Farmers | $113 | $167 |

| Geico | $106 | $157 |

| Liberty Mutual | $112 | $163 |

| Nationwide | $109 | $160 |

| Progressive | $115 | $170 |

| State Farm | $104 | $166 |

| Travelers | $108 | $159 |

| USAA | $95 | $128 |

Meanwhile, Geico Rome GA offers $106 for minimum and $157 for full coverage. For competitive rates, including cheap auto insurance Rome GA, exploring options with car insurance agents in Rome or checking auto insurance quotes in Monroe can be beneficial.

Comparing quotes from car insurance companies in Rome or nearby cities like Dublin GA or Macon GA will help you find the best rates. Additionally, direct auto insurance Rome GA provides a straightforward option for those seeking convenience. Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

Cheap Rome, Georgia Auto Insurance by Driving Record

Your driving record has a significant effect on your auto insurance premiums. In Rome, Georgia, your driving history is a key factor used by car insurance companies to set your rates. This means that if you have a clean driving record, you are likely to receive lower auto collision rates compared to those with a less favorable record.

Whether you’re searching for car insurance in Rome, car insurance quotes Rome GA, or cheap car insurance Rome GA, your driving history plays a critical role in the cost you will face.

View this post on Instagram

For those exploring various options, comparing rates from different car insurance companies in Lagrange, car insurance Dublin GA, or car insurance quotes in Dublin can provide a broader perspective. Additionally, if you’re looking for affordable options in other areas, consider cheap car insurance Macon GA or direct auto insurance Warner Robins GA.

When seeking coverage, you might also explore local options such as the insurance agency in Rome or insurance companies in Rome Georgia. For personalized quotes, check car insurance quotes in Rome and car insurance Rome GA to find the best rates for your needs. For additional insights, refer to our article titled, “Do points affect auto insurance rates?“

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Cheapest Rome, Georgia Auto Insurance Companies

When it comes to finding affordable auto insurance in Rome, Georgia, the monthly rates can make a significant difference. Geico provides the most budget-friendly option with an average monthly rate of $233, followed by USAA at $258 and State Farm at $309. These companies offer competitive rates that can help keep your insurance costs manageable.

In contrast, Liberty Mutual is the most expensive, with an average monthly rate of $810. Progressive and Allstate also have higher rates, at $382 and $362 per month, respectively. Nationwide falls in between with an average monthly rate of $523.

Minimum Auto Insurance in Rome, Georgia

Frequently Asked Questions

What are the top auto insurance providers in Rome, Georgia?

The top providers are State Farm, USAA, and Geico, which are known for their competitive rates and comprehensive coverage options. Delve into the specifics in our article called, “Best Georgia Auto Insurance.“

Which auto insurance company is considered the best overall in Rome, GA?

State Farm is the top pick overall for its blend of affordability, coverage, and customer service. Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

What makes USAA a great choice for auto insurance in Rome, Georgia?

USAA offers the best rates for military families and has a reputation for excellent customer service.

How does Geico stand out among auto insurance providers in Rome, GA?

Geico is known for its affordable rates and user-friendly online tools, making it a popular choice for budget-conscious drivers. Enhance your knowledge by reading our article named, “Georgia Minimum Auto Insurance Requirements.“

What are the benefits of choosing auto-owners for auto insurance in Rome, GA?

Auto-Owners is praised for its exceptional customer service and customizable policies, though rates may be higher for some drivers.

Why might Travelers be a good option for auto insurance in Rome, Georgia?

Travelers offer a wide range of coverage options, providing flexibility to tailor policies to individual needs.

What makes Progressive a suitable choice for high-risk drivers in Rome, GA?

Progressive is known for its extensive discounts and coverage options, making it a viable option for high-risk drivers. Uncover more by delving into our article entitled, “Georgia Farm Bureau Auto Insurance Review.“

How can Allstate benefit infrequent drivers in Rome, Georgia?

Allstate provides various coverage options that are useful for drivers who don’t drive frequently, potentially offering savings.

What does Nationwide offer to drivers in Rome, GA, in terms of customer support?

Nationwide is recognized for its strong customer support, helping drivers with personalized service and assistance. Shield your business from financial setbacks. Enter your ZIP code below to shop for cheap commercial insurance rates from top providers near you.

Why might Farmers be a good choice for auto insurance in Rome, Georgia?

Farmers are noted for high customer satisfaction and comprehensive coverage options, making it a reliable choice for many drivers. Expand your understanding with our article called, “Best Gainesville, Georgia Auto Insurance.“

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros Pros

Pros