Best Corona, New York Auto Insurance in 2025 (Find the Top 10 Companies Here)

The best providers for Corona, New York auto insurance are American Family, Farmers, and Travelers, with competitive starting rates of $70 per month. Corona, New York residents favor these companies for their affordable rates, broad coverage, and tailored programs for diverse needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

2,235 reviews

2,235 reviewsCompany Facts

Full Coverage in Corona NY

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews

Company Facts

Full Coverage in Corona NY

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage in Corona NY

A.M. Best Rating

Complaint Level

Pros & Cons

American Family, Farmers, and Travelers top the list for the best auto insurance in Corona, New York, thanks to their unmatched coverage, affordability, and tailored programs.

American Family excels with family-focused policies and multi-policy savings, Farmers offers flexible options, and Travelers provides comprehensive coverage with extensive discounts.

Our Top 10 Company Picks: Best Corona, New York Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 19% A Claims Service American Family

#2 17% A Personalized Service Farmers

#3 20% A++ Bundling Policies Travelers

#4 22% A+ Driver Discounts Allstate

#5 15% A Add-on Coverages Liberty Mutual

#6 23% B Local Agents State Farm

#7 24% A++ Military Focus USAA

#8 16% A+ Snapshot Program Progressive

#9 21% A++ Competitive Rates Geico

#10 25% A+ SmartRide Discounts Nationwide

Together, these companies provide unbeatable choices for securing reliable and cost-effective auto insurance in Corona, New York. Dive into our article called, “What are the benefits of auto insurance?”

Find your cheapest auto insurance quotes by entering your ZIP code above into our free comparison tool.

- American Family is the top pick with family-focused policies

- Farmers offers flexible options for drivers in Corona, New York

- Travelers provides comprehensive coverage and local discounts

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – American Family: Top Overall Pick

Pros

- Outstanding Claims Support: American Family provides strong claims assistance, ensuring prompt and empathetic service for residents of Corona, New York.

- Significant Bundling Savings: Customers in Corona, New York, can save up to 19% by bundling multiple insurance policies with American Family, boosting affordability.

- Solid A.M. Best Rating: American Family’s A rating assures Corona, NY policyholders of its financial stability and reliability. Discover more in our guide titled, “American Family Auto Insurance Review.”

Cons

- Higher Premiums: American Family’s premiums in Corona, New York, can be higher compared to other insurers.

- Limited Coverage Choices: In Corona, New York, American Family may offer fewer coverage options, limiting customization for some customers.

#2 – Farmers: Best for Personalized Service

Pros

- Highly Customized Service in Corona, New York: Farmers is known for tailoring insurance solutions to meet the specific needs of individuals in Corona, New York, ensuring personalized coverage.

- Competitive Bundling Discount: Offers a 17% discount for bundled policies, promoting savings and comprehensive coverage. Gain insights from our guide titled, “Farmers Auto Insurance Review.”

- A.M. Best Rating of A: With an A rating from A.M. Best, Farmers demonstrates strong financial stability, reassuring customers in Corona, New York, of dependable claims management.

Cons

- Moderate Premium Rates in Corona, New York: Despite bundling discounts, premiums may be higher than those of some competitors, affecting cost-effectiveness in Corona, New York.

- Restricted Add-on Options in Corona, New York: Farmers may offer fewer add-on coverages compared to other providers, limiting customization for Corona, New York residents.

#3 – Travelers: Best for Bundling Policies

Pros

- Exceptional Bundling Savings: Travelers offers a 20% discount for bundling multiple policies in Corona, New York, enhancing value and savings.

- Outstanding Financial Strength: With an A++ rating from A.M. Best, Travelers is financially strong and reliable for handling complex claims in Corona, New York.

- Wide Range of Coverage Options: Travelers provides extensive coverage options to meet various needs in Corona, New York. For further details, see our guide titled, “Travelers Auto Insurance Review.”

Cons

- Possibly Higher Premiums: Bundling discounts aside, Travelers’ premiums in Corona, New York, may still be high for some coverage levels.

- Potential Limitations in Personalized Service: Travelers’ personalized service in Corona, New York, may not be as thorough as some competitors’, affecting customization.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Driver Discounts

Pros

- Generous Driver Discounts: Allstate offers attractive driver discounts in Corona, New York, significantly lowering premiums for safe drivers.

- Highest Bundling Discount Available: Allstate provides the highest bundling discount of 22% in Corona, New York, maximizing savings for multiple policies.

- Strong A.M. Best Rating of A+: Allstate’s A+ rating assures Corona, New York policyholders of financial stability and reliable coverage. Uncover details in our guide titled, “Allstate Auto Insurance Review.”

Cons

- Higher Base Premiums: Allstate’s base premiums in Corona, New York, may be high despite discounts, affecting overall affordability.

- Complex Discount Structure: The complex discount system might be confusing for policyholders in Corona, New York, making it hard to fully optimize savings.

#5 – Liberty Mutual: Best for Add-on Coverages

Pros

- Extensive Add-on Coverages: Liberty Mutual offers a wide range of add-ons, letting customers in Corona, New York, customize their insurance with extra protection.

- Competitive Bundling Discount: A 15% discount for bundling multiple policies in Corona, New York, enhances coverage value and encourages comprehensive protection.

- Solid A.M. Best Rating of A: Liberty Mutual’s A rating from A.M. Best reflects strong financial stability for Corona, NY residents. Uncover details in our guide titled, “Liberty Mutual Auto Insurance Review.”

Cons

- Lower Bundling Discount: The 15% bundling discount in Corona, New York, is modest compared to competitors, possibly affecting overall savings.

- Potential Premium Increases for Add-ons: Add-on coverages may lead to higher premiums in Corona, New York, impacting cost-effectiveness.

#6 – State Farm: Best for Local Agents

Pros

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – USAA: Ideal for Military Focused

Pros

- Outstanding Bundling Discounts: USAA offers a notable 24% discount for bundling policies, benefiting military families in Corona, New York.

- Top-Tier A++ Rating: USAA’s A++ rating ensures reliable coverage and efficient claims for military personnel in Corona, New York. Dive into our article called, “USAA Auto Insurance Review.”

- Specialized Coverage: USAA’s insurance solutions are tailored to military needs, providing suitable coverage for customers in Corona, New York.

Cons

- Eligibility Restrictions: USAA’s benefits are limited to military members and their families, restricting access for non-military residents in Corona, New York.

- Higher Costs for Extras: Optional coverages or extensions may be more expensive, affecting cost-effectiveness for some customers in Corona, New York.

#8 – Progressive: Best for Snapshot Program

Pros

- Innovative Snapshot Program: Progressive’s Snapshot program provides personalized discounts based on driving behavior for residents in Corona, NY.

- 16% Bundling Discount: Customers in Corona can enjoy a 16% discount for bundling multiple policies, making insurance more affordable.

- A+ Rating from A.M. Best: Progressive’s A+ rating ensures financial stability and reliability for customers in Corona. Unlock details in our article, “Best Progressive Auto Insurance Discounts.”

Cons

- Inconsistent Savings with the Snapshot Program: Discounts from the Snapshot program can vary widely based on driving habits, leading to unpredictable savings for some drivers in Corona, New York.

- Potentially Less Favorable Discounts for Low-Mileage Drivers: Discounts for low-mileage usage might not be as competitive in Corona, New York, possibly affecting savings for low-mileage drivers.

#9 – Geico: Best for Competitive Rates

Pros

- Competitive Rates: Geico offers affordable insurance in Corona, New York, with high-quality coverage.

- 21% Bundling Discount: Save more with a 21% discount on bundled policies in Corona, New York.

- A++ Rating: Geico’s A++ rating ensures reliable service for customers in Corona, New York. Access detailed insights in our guide titled, “Best Geico Auto Insurance Discounts.”

Cons

- Less Personalized Service: Competitive rates might mean less personalized service in Corona, New York.

- Higher Premiums for Specialized Coverage: Specialized coverage may cost more in Corona, New York.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Nationwide: Best for SmartRide Discounts

Pros

- Generous SmartRide Discounts: Corona, New York residents benefit from significant savings with Nationwide’s SmartRide program for safe driving.

- 25% Bundling Discount: Bundling multiple policies with Nationwide offers significant savings for customers in Corona, New York. Dive into our article called, “Nationwide Auto Insurance Review.”

- A+ Rating from A.M. Best: Nationwide’s A+ rating ensures strong financial stability and reliable coverage for Corona, New York residents.

Cons

- Variable SmartRide Savings: Discounts from the SmartRide program can vary based on driving behavior, leading to inconsistent savings for drivers in Corona, New York.

- Potentially Higher Costs for Add-Ons: Additional coverage rates might be higher with Nationwide compared to other insurers in Corona, New York.

Monthly Auto Insurance Rates for Corona, NY: Minimum vs. Full Coverage

When comparing monthly auto insurance rates in Corona, New York, the table highlights significant variations among providers for both minimum and full coverage.

Corona, New York Auto Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$90 $160

$85 $140

$95 $155

$75 $140

$95 $165

$80 $150

$80 $150

$85 $145

$88 $145

$70 $130

For minimum coverage, USAA offers the most competitive rate at $70, while Allstate’s rate is the highest at $90. In the full coverage category, American Family provides the lowest rate at $140, contrasting with Liberty Mutual’s highest rate of $165.

Auto Insurance Discounts From the Top Providers for Corona, New York

| Insurance Company | Available Discounts |

|---|---|

| Safe driver, Multi-policy, New car, Early signing, Good student | |

| Multi-policy, Safe driver, Good student, Auto pay, Loyalty | |

| Multi-policy, Safe driver, Homeowner, Good student, Pay-in-full | |

| Multi-policy, Safe driver, Military, Anti-theft, Good student | |

| Multi-policy, Military, New car, Early shopper, Good student |

| Multi-policy, Accident-free, Paperless, Defensive driving, Good student |

| Multi-policy, Snapshot usage-based, Good student, Continuous insurance | |

| Multi-policy, Safe driver, Good student, Vehicle safety, Anti-theft | |

| Multi-policy, Safe driver, Homeowner, Hybrid/electric vehicle, Good student | |

| Military, Loyalty, Safe driver, Good student, Multi-vehicle |

These rates reflect the varying costs for different coverage levels and can help drivers choose the most cost-effective option based on their needs. Uncover details in our guide titled, “Auto Insurance for Different Types of Drivers.”

Minimum Auto Insurance in Corona, New York

Corona, New York auto insurance laws require that you have at least the New York minimum auto insurance to be financially responsible in the event of an accident. Take a look at the required auto insurance in Corona, New York.

Corona, New York Auto Insurance Monthly Rates by Coverage Requirements

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person and $50,000 per accident |

| Property Damage Liability | $10,000 minimum |

Meeting the minimum auto insurance requirements in Corona, New York, is vital for drivers to ensure comprehensive protection and adherence to legal standards. To be compliant, drivers must secure liability coverage with limits of $25,000 per person and $50,000 per accident for bodily injury, alongside a minimum of $10,000 for property damage.

Corona, New York faces significant auto-related risks, with high accident rates and a notable percentage of uninsured drivers impacting insurance claims and costs.

This report provides statistics on auto accidents and insurance claims in Corona, New York. It highlights key factors such as yearly accidents, claims, average claim amounts, and the percentage of uninsured drivers, offering valuable insights into the local driving environment.

Corona, New York Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Total Accidents Per Year | 3,800 |

| Total Claims Per Year | 3,200 |

| Average Claim Size | $5,200 |

| Percentage of Uninsured Drivers | 14% |

| Vehicle Theft Rate | 650 thefts/year |

| Traffic Density | High |

| Weather-Related Incidents | Low |

The statistics reveal a high volume of auto accidents and claims in Corona, emphasizing the importance of insurance coverage in an area with a significant percentage of uninsured drivers. Additionally, the vehicle theft rate underscores the need for heightened security measures for vehicles in this densely populated region.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

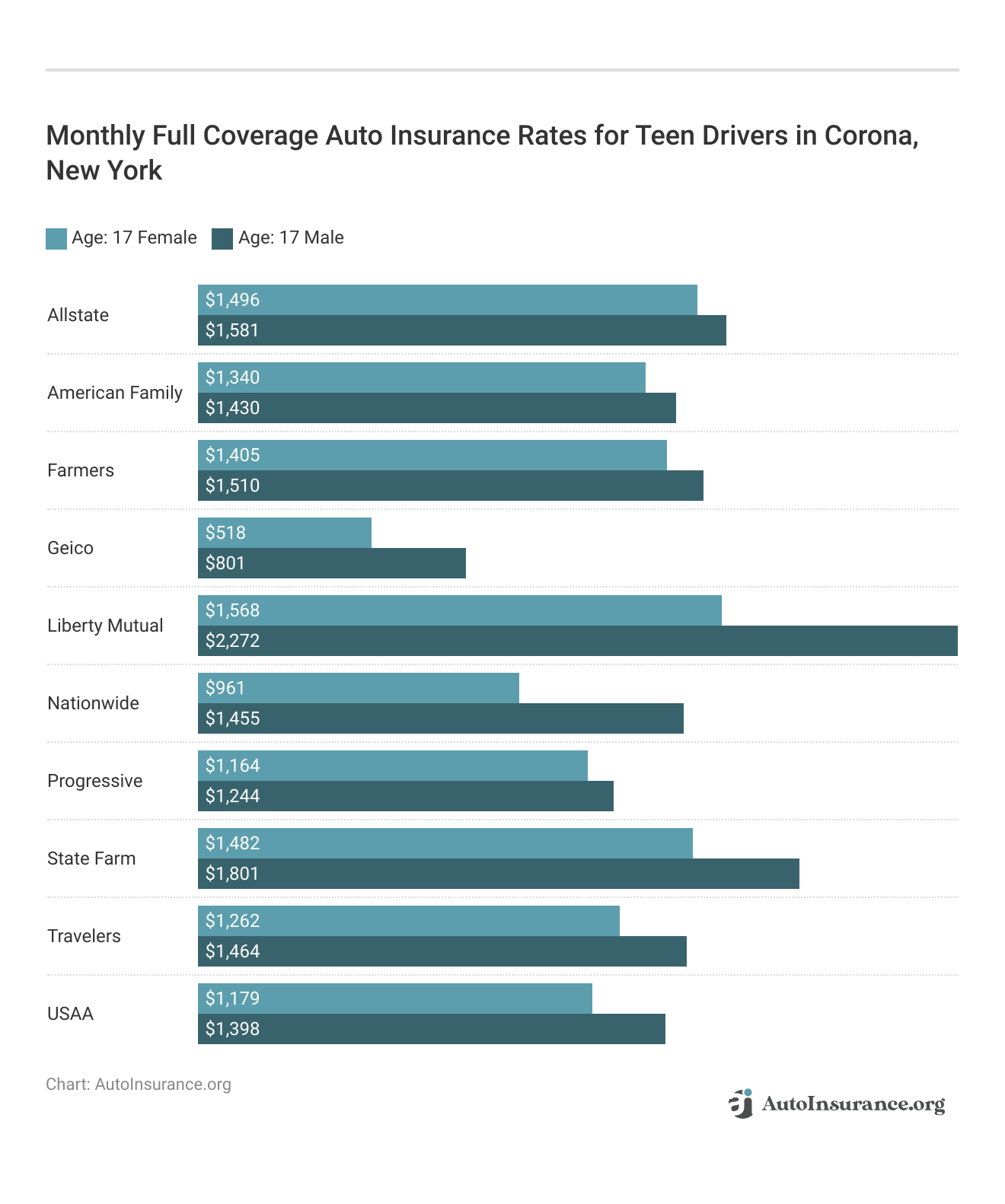

Affordable Auto Insurance in Corona, New York: Rates by Age, Gender, and Marital Status

Auto insurance rates in Corona, New York are affected by age, gender, and marital status. See how demographics impact the monthly cost of insurance.

Monthly Full Coverage Auto Insurance Rates by Provider, Age, & Gender in Corona, New York

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $1,496 | $1,581 | $463 | $454 | $496 | $454 | $476 | $479 | |

| $1,340 | $1,430 | $505 | $527 | $468 | $452 | $421 | $429 | |

| $1,405 | $1,510 | $532 | $555 | $482 | $470 | $439 | $448 | |

| $518 | $801 | $224 | $230 | $251 | $241 | $241 | $238 | |

| $1,568 | $2,272 | $802 | $852 | $802 | $802 | $746 | $746 |

| $961 | $1,455 | $522 | $678 | $522 | $522 | $490 | $490 |

| $1,164 | $1,244 | $457 | $415 | $374 | $334 | $287 | $295 | |

| $1,482 | $1,801 | $567 | $586 | $513 | $513 | $451 | $451 | |

| $1,262 | $1,464 | $580 | $578 | $565 | $539 | $508 | $523 | |

| $1,179 | $1,398 | $371 | $411 | $287 | $282 | $261 | $262 |

Understanding these demographic influences not only sheds light on the factors affecting your insurance costs but also empowers you to make informed decisions. Gain insights from our guide titled, “Best Auto Insurance by Age.”

By exploring the interplay between these variables, you can better navigate the path to finding the most cost-effective insurance solutions tailored to your unique profile, ultimately balancing affordability with adequate coverage.

Corona, New York’s auto insurance landscape is influenced by several factors, including vehicle theft, traffic density, and seasonal weather risks, which impact premiums for local drivers.

Corona, New York Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Vehicle Theft Rate | C | Moderate vehicle theft rate, slightly above the national average for urban areas |

| Traffic Density | C | High traffic density, common in densely populated New York City neighborhoods |

| Weather-Related Risks | B | Low risk, but occasional snowstorms and heavy rain may increase risks seasonally |

| Average Claim Size | B | Claims are generally average compared to other parts of New York City |

| Uninsured Drivers Rate | C | Higher-than-average rate of uninsured drivers, typical in urban New York areas |

Overall, Corona faces moderate vehicle theft, high traffic density, and a higher rate of uninsured drivers, while weather-related risks and claim sizes remain manageable. These factors contribute to the area’s mixed insurance rating.

Top Auto Insurance Options for Teen Drivers in Corona, New York

Finding best teen auto insurance in Corona, New York is a challenge. Take a look at the monthly teen auto insurance rates in Corona, New York.

The labyrinthine details of teen auto insurance rates, remember that the quest for affordability and adequacy often involves balancing nuanced considerations.

Nationwide’s SmartRide program offers valuable discounts for safe drivers, providing significant savings on premiums in Corona, New York.Kristen Gryglik Licensed Insurance Agent

Ultimately, the pursuit of the best insurance is not merely about finding the lowest rate but about ensuring comprehensive protection amidst a sea of complex choices.

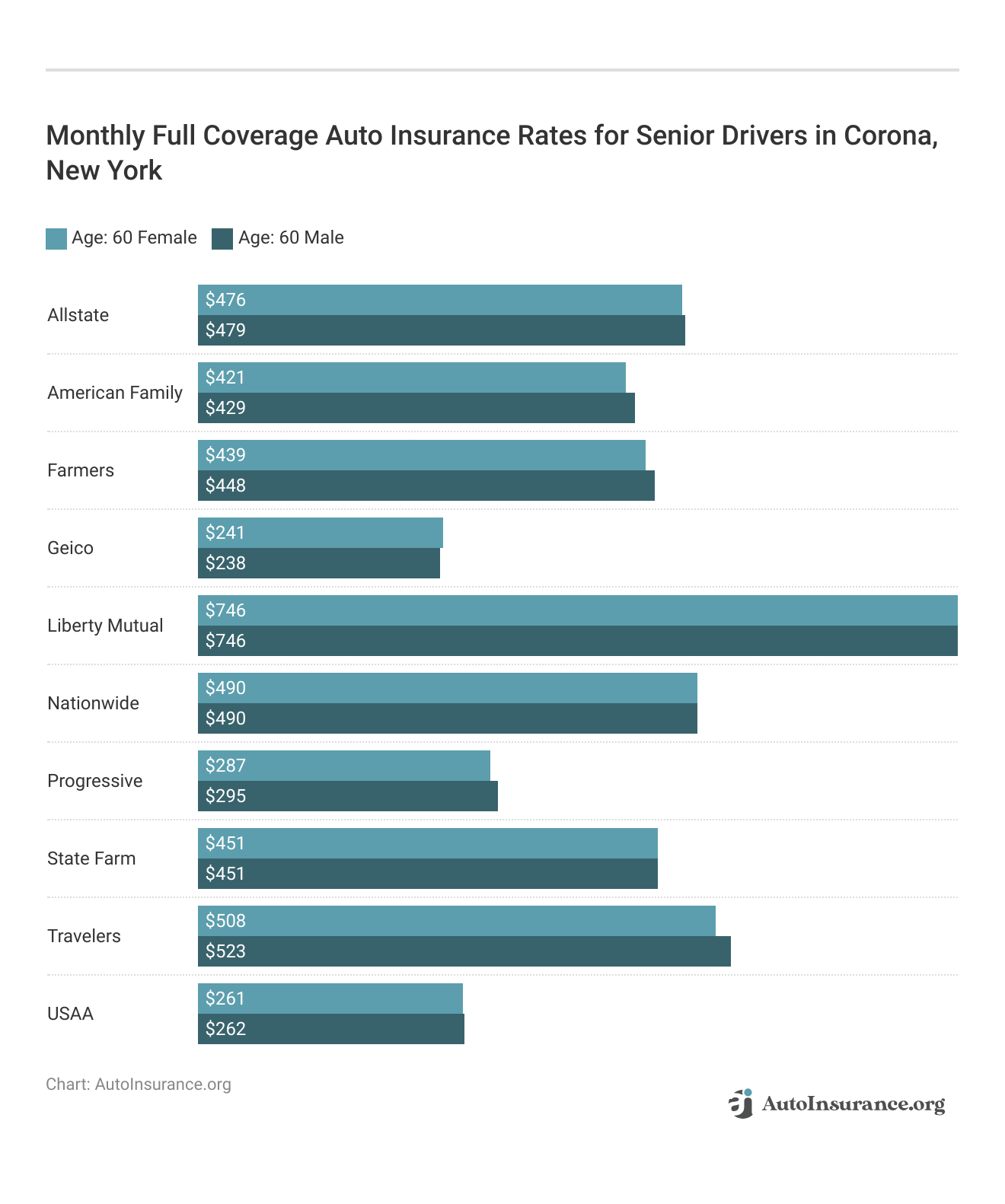

Top-Rated Auto Insurance for Seniors in Corona, New York

Take a closer look at the typical monthly auto insurance rates for senior drivers in Corona, New York, to better understand the costs older drivers might face.

Navigating this diverse and multifaceted market requires a discerning eye and a strategic approach, ultimately leading to the most fitting and financially prudent insurance choices for seasoned drivers.

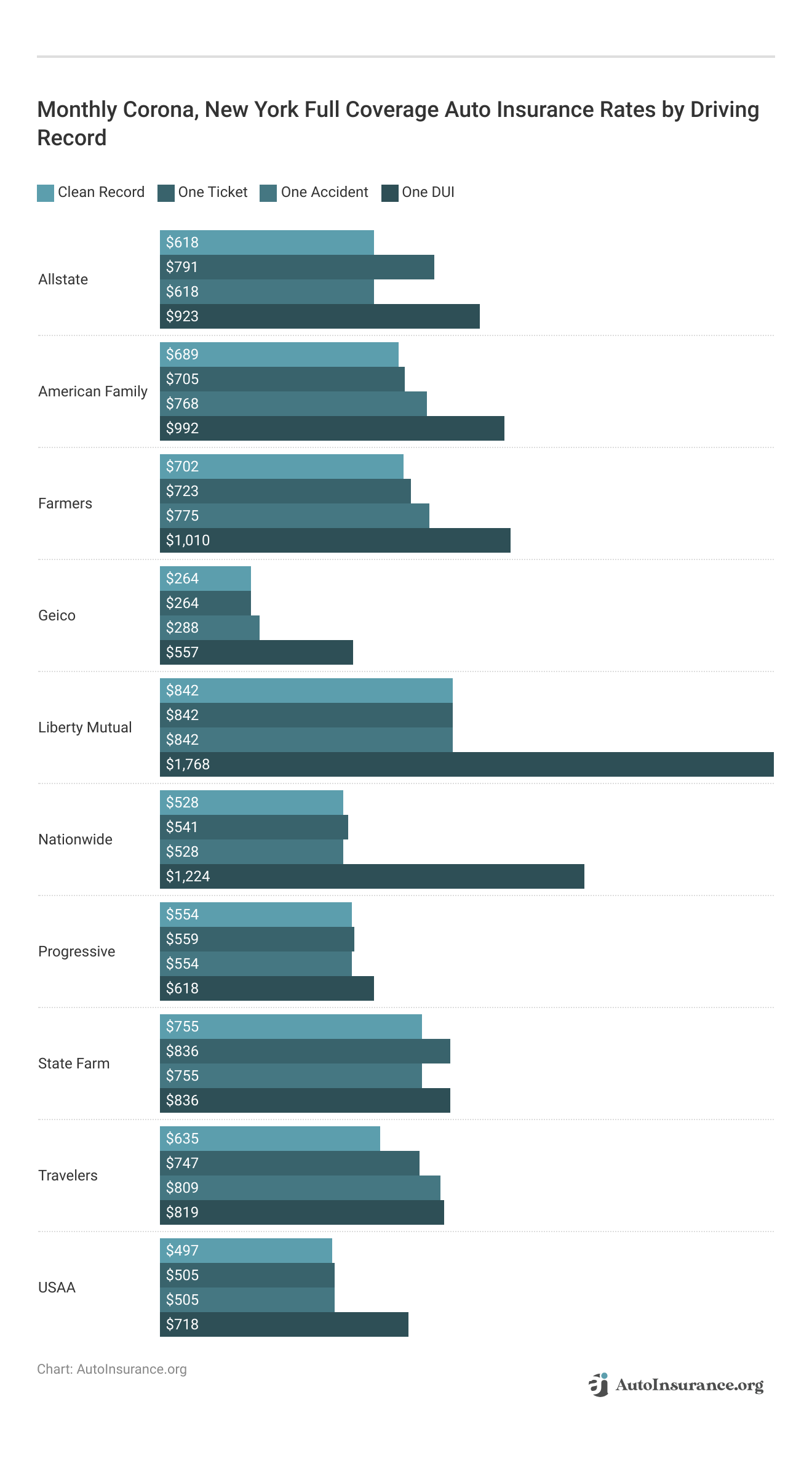

Top Auto Insurance Options in Corona, New York Based on Driving History

Driving record has a big impact on your auto insurance rates. See the monthly auto insurance rates for a lousy record in Corona, New York compared to the monthly auto insurance rates with a clean record in Corona, New York.

Optimal Auto Insurance Rates in Corona, New York Following a DUI

Finding best auto insurance after a DUI in Corona, New York is not easy. Compare the monthly rates for DUI auto insurance in Corona, New York to find the best deal.

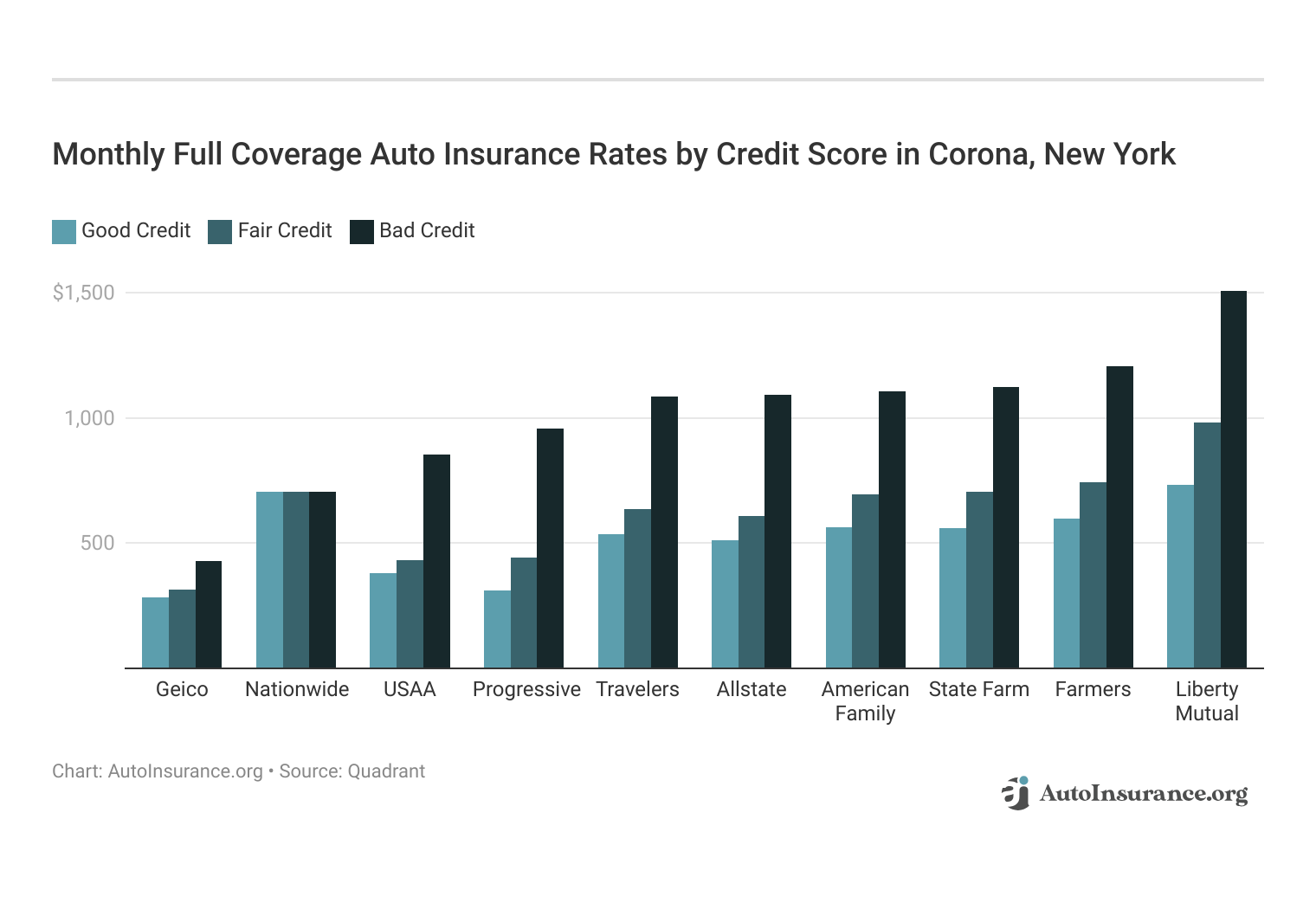

Top Auto Insurance Options in Corona, New York Based on Credit History

Credit history can have a major effect on the cost of auto insurance. See how Corona, New York monthly auto insurance rates by credit history compare.

This divergence underscores the profound impact that driving behavior exerts on insurance costs, encapsulating a broader spectrum of risk assessment and financial implications.

The interplay between driving history and insurance premiums becomes ever more evident, highlighting the critical role of a clean record in securing optimal coverage. To discover more about the company, visit our guide titled, “How Credit Scores Affect Auto Insurance Rates.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Premier Auto Insurance Rates in Corona, New York According to ZIP Code

Auto insurance rates by ZIP code in Corona, New York can vary. Compare the monthly cost of auto insurance by ZIP code in Corona, New York to see how auto insurance rates are affected by location.

The variance in monthly insurance costs across different ZIP codes underscores a complex interplay of factors, from neighborhood risk profiles to localized regulatory impacts. As you traverse this intricate mosaic, understanding how your specific location impacts insurance rates becomes essential, unveiling a deeper insight into the cost dynamics of auto insurance.

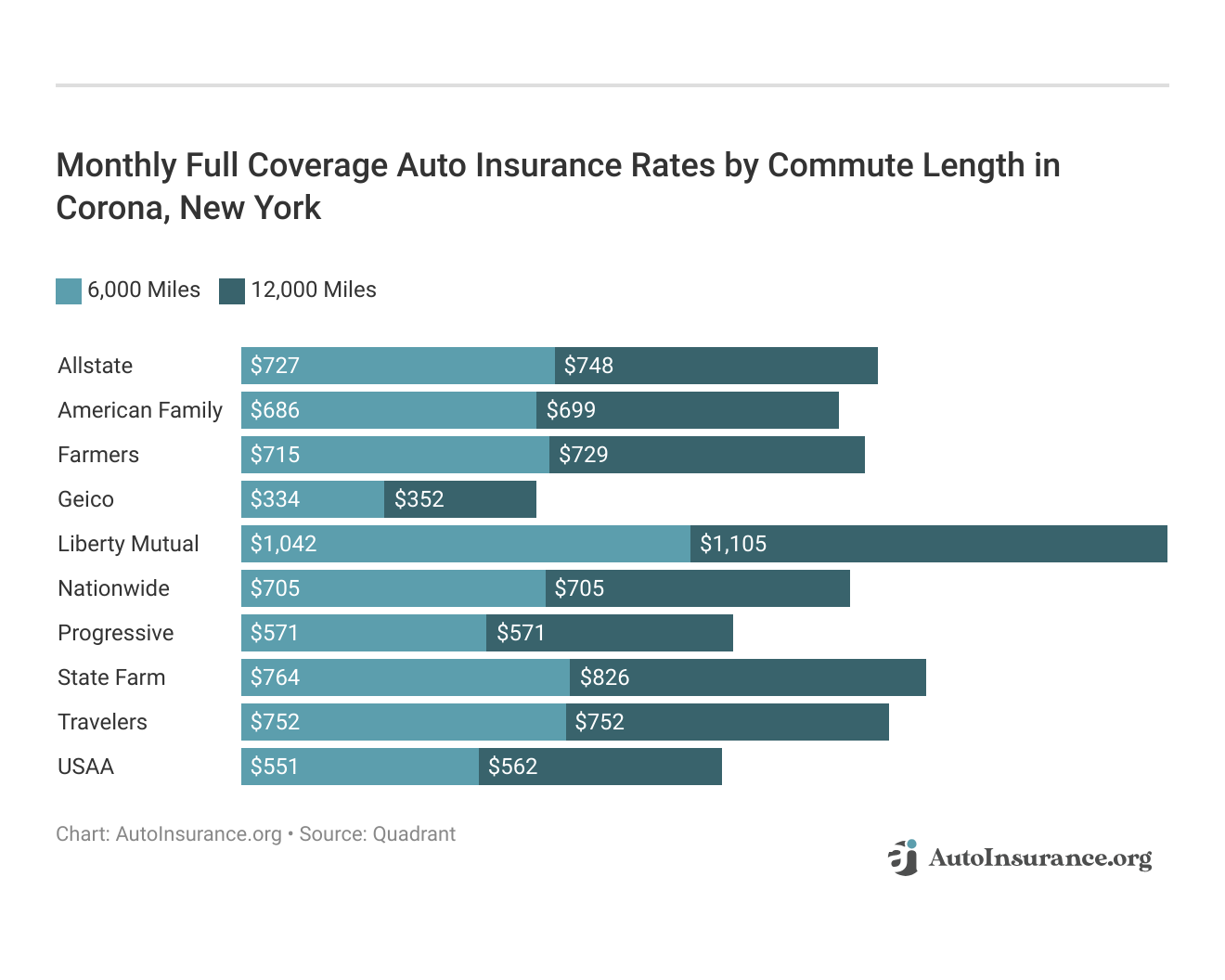

Optimal Auto Insurance Rates in Corona, New York Based on Commute Distance

Commute length and monthly mileage affect Corona, New York auto insurance. Find the best monthly Corona, New York auto insurance by commute length. For more information, check out our complete guide titled, “Most Expensive Commutes in America.”

Delving into this complex interplay reveals how critical it is to align your commute with the most cost-effective coverage options, ultimately guiding you to the optimal insurance rates tailored to your driving patterns.

Best Auto Insurance Rates in Corona, New York by Coverage Level

The coverage level you choose significantly impacts your auto insurance costs in Corona, New York. Explore the comparison of monthly auto insurance rates in Corona, New York based on different coverage levels.

Corona, New York Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Traffic Density | A- | High traffic but well-managed congestion |

| Average Claim Size | B+ | Claims are slightly above the national average |

| Uninsured Drivers Rate | B+ | Lower-than-average rate of uninsured drivers |

| Vehicle Theft Rate | B | Moderate vehicle theft rate compared to nearby areas |

| Weather-Related Risks | B | Moderate risk due to occasional storms and flooding |

This dynamic interplay underscores the need to carefully balance coverage needs with financial considerations, illuminating the path to finding the optimal insurance solution tailored to both your protection requirements and budget constraints.

For further details, see our guide titled, “What are the recommended auto insurance coverage levels?”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best in Class: Auto Insurance Categories in Corona, New York

Compare the best auto insurance companies in Corona, New York in each category to find the company with the best rates for your personal needs. Obtain detailed insights by reading our guide titled, “How Insurance Providers Determine Rates.”

Best Corona, New York Auto Insurance Providers by Driver Profile

| Driver Profile | Insurance Company |

|---|---|

| Teenagers | |

| Seniors | |

| Clean Record | |

| One Accident | |

| One DUI | |

| One Ticket |

This granular analysis not only highlights the best rates but also underscores the complex interplay of coverage features, customer service, and financial stability.

By delving into this detailed comparison, you unearth the ideal insurer that harmonizes with both your personal needs and financial expectations, navigating the multifaceted world of auto insurance with greater clarity.

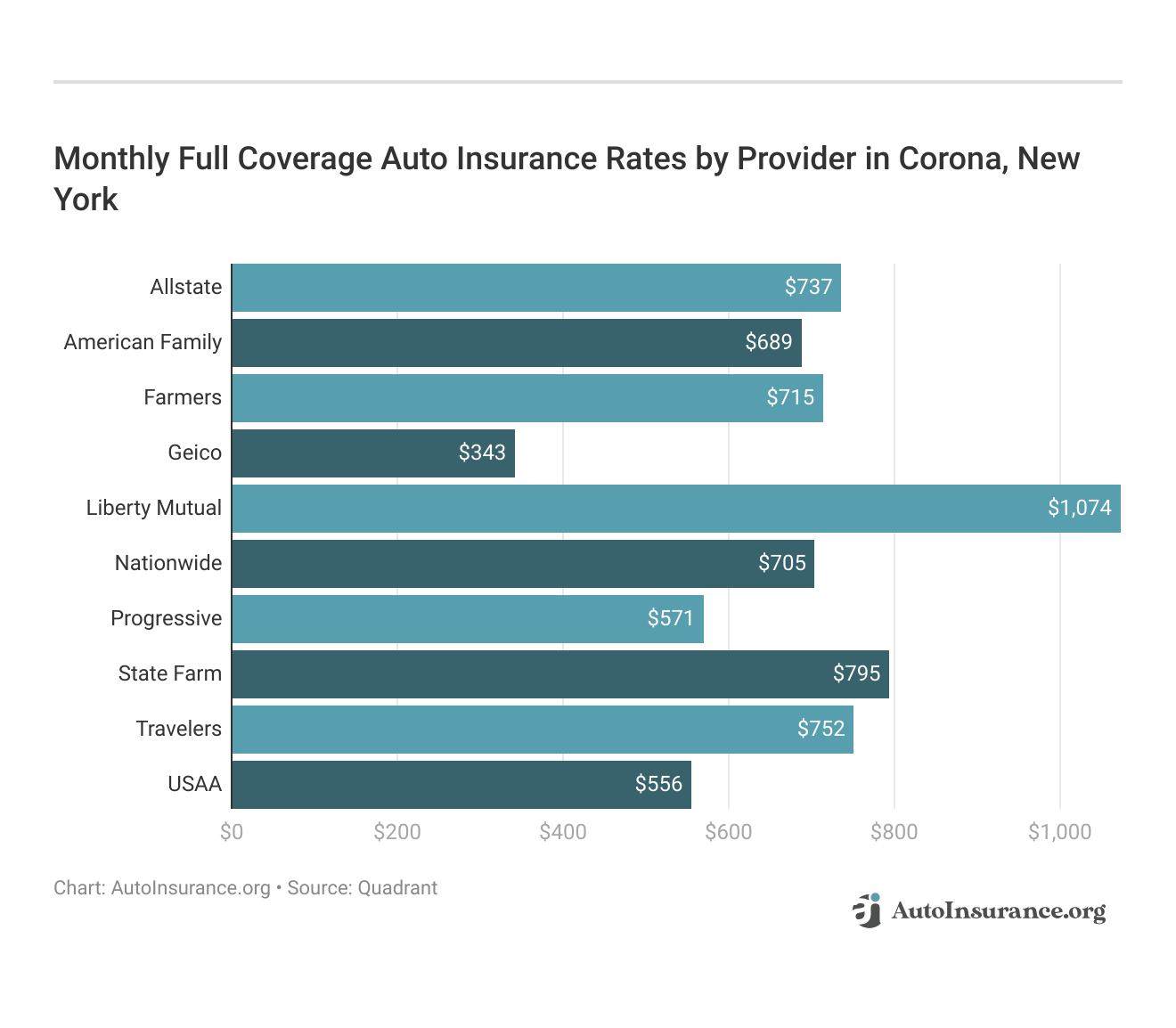

Leading Auto Insurance Providers in Corona, New York

Explore the most affordable auto insurance companies in Corona, New York by comparing the top providers to uncover the best monthly rates. Gain insights from our guide titled, “Does the price of a car affect auto insurance rates?”

As you dissect the monthly rates from leading companies, the interplay of cost efficiency and coverage quality emerges, offering a multifaceted view of affordable options. Each provider’s unique pricing strategy reflects a broader spectrum of financial implications, underscoring the importance of a meticulous comparison.

Navigate this complex terrain with informed precision to secure the most advantageous insurance deal for your circumstances.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare best auto insurance quotes near you.

Frequently Asked Questions

Can auto insurance rates vary by ZIP code in Corona, New York?

Yes, auto insurance rates can vary by ZIP code in Corona, NY. Factors such as population density, crime rates, and accident statistics in a specific area can influence insurance premiums.

How does credit history affect auto insurance rates in Corona, New York?

Credit history can have a major effect on auto insurance rates in Corona, NY. Insurance companies may consider credit scores when determining premiums. Poor credit history may lead to higher rates, while good credit history can result in lower rates.

What are the auto insurance rates after a DUI in Corona, New York?

Auto insurance rates can significantly increase after a DUI in Corona, NY. Each insurance company may have different rates, but generally, a DUI conviction can result in higher premiums due to the increased risk associated with impaired driving.

How does driving record affect auto insurance rates in Corona, New York?

Your driving record has a significant impact on auto insurance rates in Corona, NY. Having a clean driving record with no accidents or violations typically results in lower premiums. However, having a history of accidents, DUI, or speeding violations can increase your insurance rates.

For additional details, explore our comprehensive resource titled, “Auto Insurance Premium Defined.”

How are senior auto insurance rates in Corona, New York?

Senior auto insurance rates in Corona, NY can vary depending on the insurance company and other factors. Generally, rates may decrease for seniors compared to younger age groups. However, rates can still be influenced by individual factors such as driving record and type of vehicle.

What are the auto insurance rates for teen drivers in Corona, New York?

Auto insurance rates for teen drivers in Corona, NY can be higher compared to other age groups. The rates vary depending on the insurance company and other factors. For example, a single 17-year-old female may have different rates than a single 17-year-old male. It’s best to compare quotes to find the most affordable options.

What is auto insurance in Corona, New York?

Auto insurance in Corona, New York, provides coverage for vehicle damage, liability, and personal injury, tailored to local regulations and risks in the area.

How can I find affordable auto insurance in Corona, New York?

To find affordable auto insurance in Corona, New York, compare quotes from multiple insurers, look for discounts such as safe driver or multi-policy, and consider adjusting coverage limits and deductibles.

To find out more, explore our guide titled, “What is a good deductible for auto insurance?”

What factors influence auto insurance rates in Corona, New York?

Rates in Corona, New York, are influenced by factors like your driving history, vehicle type, coverage options, and local factors such as traffic density and accident rates.

What should I look for when choosing Corona auto insurance in New York?

When choosing auto insurance in Corona, New York, consider coverage options, customer service reputation, rates, and any local-specific add-ons like rental reimbursement or roadside assistance.

Are there specific discounts available for Corona auto insurance in New York?

Yes, you can find discounts like good driver, good student, and multi-car discounts. Additionally, some insurers offer savings for installing anti-theft devices or completing defensive driving courses in New York.

How do I file a claim with Corona auto insurance in New York?

To file a claim, contact your insurance provider, provide details about the incident, such as location and time, and submit any required documentation. Most insurers have specific procedures for accidents occurring in New York.

To learn more, explore our comprehensive resource on, “Accident Forgiveness Defined.”

What affects Queens auto insurance rates, specifically in Corona, New York?

In Corona, New York, rates are affected by factors such as your driving record, age, type of vehicle, coverage levels, and specific local risks like high traffic congestion and accident frequency.

How can I get the best auto insurance rates in Queens, including Corona, New York?

To get the best rates in Queens, including Corona, compare multiple quotes, maintain a clean driving record, take advantage of local discounts, and consider bundling your auto insurance with other policies.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Why might auto insurance rates be higher in Corona, Queens, New York?

Rates can be higher in Corona due to factors like a higher likelihood of accidents, theft rates, and the overall cost of repairs in the New York area.

Which is the best insurance for a new car in Corona, New York?

In Corona, New York, popular choices for comprehensive auto insurance for new cars include State Farm, Geico, Allstate, Progressive, and Nationwide. These providers are known for their comprehensive coverage options, competitive rates, and customer service tailored to the needs of drivers in New York.

Obtain detailed insights by reading our guide titled, “Comprehensive Auto Insurance Defined.”

Which type of insurance is best for new drivers in Corona, New York?

For new drivers in Corona, New York, companies like Geico, State Farm, and Progressive often provide some of the most affordable rates. For young drivers, joining a family insurance policy can significantly lower costs. However, once they move out of the family home, they will typically need to secure their own individual policy.

How to get lower auto insurance in Corona, New York?

To lower auto insurance rates in Corona, New York, you can increase your deductible, look for discounts specific to New York residents, compare quotes from various insurers in the area, maintain a clean driving record, participate in safe driving programs available in New York, take a state-approved defensive driving course, explore different payment options, and work on improving your credit score.

What insurance company is most reliable in Corona, New York?

In Corona, New York, reliable auto insurance providers include State Farm, Geico, Allstate, and USAA. These companies have strong reputations for reliability, customer satisfaction, and claims handling in the New York area.

What is the best coverage for auto insurance in Corona, New York?

For drivers in Corona, New York, it’s recommended to have at least 100/300/100 liability coverage to ensure adequate protection. Comprehensive, collision, and gap coverages are also advised to protect your vehicle, especially in areas with high traffic and accident rates like New York City.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.