Best Nacogdoches, Texas Auto Insurance in 2024 (Check Out the Top 10 Companies)

For the best Nacogdoches, Texas auto insurance, Amica, USAA, and Auto-Owners are the best insurers, with rates beginning at only $50 per month. These insurers deliver both competitive pricing and extensive coverage, ensuring that Nacogdoches, Texas insurance remains both budget-friendly and dependable.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

768 reviews

768 reviewsCompany Facts

Full Coverage in Nacogdoches Texas

A.M. Best Rating

Complaint Level

Pros & Cons

768 reviews

768 reviews 6,435 reviews

6,435 reviewsCompany Facts

Full Coverage in Nacogdoches Texas

A.M. Best Rating

Complaint Level

Pros & Cons

6,435 reviews

6,435 reviews 563 reviews

563 reviewsCompany Facts

Full Coverage in Nacogdoches Texas

A.M. Best Rating

Complaint Level

Pros & Cons

563 reviews

563 reviewsFor the best Nacogdoches, Texas auto insurance at $50 per month, the top picks are Amica, USAA, and Auto-Owners. These providers offer competitive rates and comprehensive coverage tailored to your needs.

Before you buy Nacogdoches, Texas auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Nacogdoches, Texas auto insurance quotes.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Amica: Top Overall Pick

Pros

- Excellent Customer Service: Amica is renowned for its customer service, often rated as offering the best Nacogdoches, Texas auto insurance for responsive and reliable support. Read more through our Amica auto insurance review.

- High Discount Potential: With a range of discounts available, Amica offers some of the best Nacogdoches, Texas auto insurance rates for those who qualify for multiple discounts.

- Strong Financial Stability: The company’s A+ rating from A.M. Best indicates financial strength, ensuring they provide some of the best Nacogdoches, Texas auto insurance in terms of reliability.

Cons

- Higher Premiums for Some Drivers: Amica’s rates may be higher for high-risk drivers, which can detract from being the best Nacogdoches, Texas auto insurance option for those with poor driving records.

- Limited Availability of Discounts: Compared to other providers, Amica may offer fewer discount options, which could affect its standing as the best Nacogdoches, Texas auto insurance choice for maximizing savings.

#2 – USAA: Best for Military Benefits

Pros

- Excellent Customer Satisfaction: USAA consistently receives high ratings for customer service, making it a top choice for the best Nacogdoches, Texas auto insurance in terms of customer support.

- Competitive Rates: Generally offers lower rates for eligible members, making it one of the best Nacogdoches, Texas auto insurance options for military families seeking cost-effective coverage.

- Comprehensive Coverage Options: USAA provides a range of coverage options, enhancing its reputation as one of the best Nacogdoches, Texas auto insurance providers for diverse needs.

Cons

- Eligibility Restrictions: USAA’s services are only available to military members and their families, which limits its appeal as the best Nacogdoches, Texas auto insurance for the general public.

- Limited Availability: Not available in all states, which can be a drawback for those seeking the best Nacogdoches, Texas auto insurance but who might be relocating or traveling. Learn more through our USAA auto insurance review.

#3 – Auto-Owners: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Known for offering extensive coverage options, Auto-Owners is a strong candidate for the best Nacogdoches, Texas auto insurance for those needing comprehensive protection.

- High Customer Satisfaction: With positive reviews for customer service and claims processing, Auto-Owners provides some of the best Nacogdoches, Texas auto insurance in terms of customer experience.

- Personal Service: Known for personalized service through local agents, Auto-Owners delivers some of the best Nacogdoches, Texas auto insurance for those valuing face-to-face interaction.

Cons

- Limited Online Tools: Auto-Owners’ online tools and mobile app features are less developed, which might detract from its status as the best Nacogdoches, Texas auto insurance for tech-savvy users.

- Availability: Not available in all states, limiting its potential to be the best Nacogdoches, Texas auto insurance option for those who move frequently. Find more details through our Auto-Owners auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Erie: Best for Affordable Rates

Pros

- Affordable Rates: Erie is known for its competitive pricing, often providing some of the best Nacogdoches, Texas auto insurance rates for cost-conscious drivers. Dive in more through our Erie auto insurance review.

- Strong Coverage Options: Offers a range of coverage options, including new car replacement, making it a top contender for the best Nacogdoches, Texas auto insurance for comprehensive protection.

- Regional Focus: With strong regional coverage, Erie provides localized service that can be among the best Nacogdoches, Texas auto insurance options for regional customers.

Cons

- Coverage Availability: Coverage options may vary significantly by state, potentially impacting Erie’s status as the best Nacogdoches, Texas auto insurance provider for those moving or traveling.

- Limited National Presence: Not available in all states, which may limit its effectiveness as the best Nacogdoches, Texas auto insurance for those seeking broader coverage options.

#5 – State Farm: Best for Reliable Network

Pros

- Extensive Network: With a large network of local agents, State Farm provides some of the best Nacogdoches, Texas auto insurance for personalized service and coverage options, as mentioned in our State Farm auto insurance review.

- Reliable Coverage: Known for offering extensive coverage options, State Farm stands out as one of the best Nacogdoches, Texas auto insurance providers for comprehensive protection.

- Discount Opportunities: State Farm offers numerous discounts, including multi-policy and safe driver discounts, making it a top choice for the best Nacogdoches, Texas auto insurance in terms of savings.

Cons

- Higher Premiums for Some: State Farm’s premiums can be higher for drivers with poor records, which may detract from its reputation as the best Nacogdoches, Texas auto insurance for high-risk drivers.

- Variable Customer Service: The quality of customer service can vary depending on the local agent, potentially affecting its standing as the best Nacogdoches, Texas auto insurance provider for consistent service.

#6 – Nationwide: Best for Flexible Policies

Pros

- Good Discounts: Provides a variety of discounts, including safe driving and multi-vehicle savings, positioning Nationwide as one of the best Nacogdoches, Texas auto insurance providers for maximizing discounts.

- Strong Online Tools: Nationwide’s advanced online tools and mobile app enhance its reputation as one of the best Nacogdoches, Texas auto insurance providers for digital management.

- Financial Strength: With strong financial ratings from A.M. Best, Nationwide provides reliable coverage, making it one of the best Nacogdoches, Texas auto insurance choices for financial stability.

Cons

- Inconsistent Coverage: Coverage options and availability can vary by state, which might impact Nationwide’s standing as the best Nacogdoches, Texas auto insurance provider for consistent coverage.

- Premium Increases: Some customers report frequent premium increases, which could affect its reputation as the best Nacogdoches, Texas auto insurance in terms of affordability. For more information, read our Nationwide auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Extensive Discounts

Pros

- Extensive Discounts: Liberty Mutual offers a range of discounts, including those for safety features and bundling, making it a leading choice for the best Nacogdoches, Texas auto insurance in terms of savings.

- Customizable Coverage: Provides options to tailor policies to individual needs, positioning Liberty Mutual as a top provider for the best Nacogdoches, Texas auto insurance with personalized coverage.

- Strong Customer Service: Positive reviews for customer support contribute to Liberty Mutual’s reputation as one of the best Nacogdoches, Texas auto insurance providers, as outlined in our Liberty Mutual auto insurance review.

Cons

- Higher Premiums: Rates can be higher compared to some competitors, potentially affecting Liberty Mutual’s reputation as the best Nacogdoches, Texas auto insurance for affordability.

- Customer Service Variability: The quality of customer service can vary, which might impact Liberty Mutual’s standing as the best Nacogdoches, Texas auto insurance provider for consistent support.

#8 – Progressive: Best for Customizable Policies

Pros

- Customizable Policies: Progressive offers extensive options for policy customization, making it a strong contender for the best Nacogdoches, Texas auto insurance for those seeking flexible coverage. As mentioned in our Progressive auto insurance review.

- User-Friendly Tools: Progressive’s innovative tools, like the Name Your Price tool, enhance its reputation as one of the best Nacogdoches, Texas auto insurance options for budget management.

- Broad Coverage Options: Includes a wide range of coverage options and add-ons, positioning Progressive as one of the best Nacogdoches, Texas auto insurance providers for comprehensive protection.

Cons

- Mixed Customer Service: Customer service ratings can be inconsistent, which may impact Progressive’s standing as the best Nacogdoches, Texas auto insurance provider for service quality.

- Complex Pricing: The pricing structure can be complex, potentially affecting its reputation as the best Nacogdoches, Texas auto insurance for straightforward pricing.

#9 – The Hartford: Best for AARP Benefits

Pros

- Excellent for AARP Members: The Hartford offers tailored insurance plans and discounts for AARP members, making it one of the best Nacogdoches, Texas auto insurance providers for seniors and retirees.

- Comprehensive Coverage Options: Provides a wide range of coverage options and add-ons, making it one of the best Nacogdoches, Texas auto insurance choices for those seeking extensive protection.

- Accident Forgiveness: Offers accident forgiveness as part of its policies, which enhances its reputation as one of the best Nacogdoches, Texas auto insurance providers for maintaining low rates after an accident.

Cons

- Higher Premiums: Some customers may find The Hartford’s premiums to be higher compared to competitors, potentially impacting its status as the best Nacogdoches, Texas auto insurance for affordability. Read more through our The Hartford auto insurance review.

- Limited Discounts for Non-AARP Members: The best Nacogdoches, Texas auto insurance discounts are heavily geared toward AARP members, which might limit benefits for those not associated with the organization.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Geico: Best for Competitive Pricing

Pros

- Affordable Rates: Geico is known for its low rates, often making it one of the best Nacogdoches, Texas auto insurance options for budget-conscious drivers. Learn more through our Geico auto insurance review.

- Strong Discounts: Offers various discounts, including multi-vehicle and good driver discounts, contributing to its reputation as the best Nacogdoches, Texas auto insurance for savings.

- Financial Stability: With a strong financial rating from A.M. Best, Geico ensures reliability, making it a solid choice for the best Nacogdoches, Texas auto insurance in terms of stability.

Cons

- Basic Coverage Options: Geico’s coverage options may be less comprehensive compared to some competitors, which could impact its status as the best Nacogdoches, Texas auto insurance for extensive protection.

- Customer Service: Reviews about customer service can be mixed, potentially affecting Geico’s reputation as the best Nacogdoches, Texas auto insurance provider for service quality.

Cheapest Categorized Auto Insurance in Nacogdoches, Texas

By examining the cheapest options within specific categories, such as minimum coverage, full coverage, or insurance for high-risk drivers, you can identify the company that offers the most affordable rates tailored to your situation.

This approach ensures that you not only save money but also receive the coverage that best meets your needs. Additionally, knowing when to buy more than minimum auto insurance is crucial, as situations like financing a vehicle or living in areas prone to accidents may require more comprehensive coverage to fully protect your assets.

Companies With Cheapest Auto Insurance in Nacogdoches, Texas

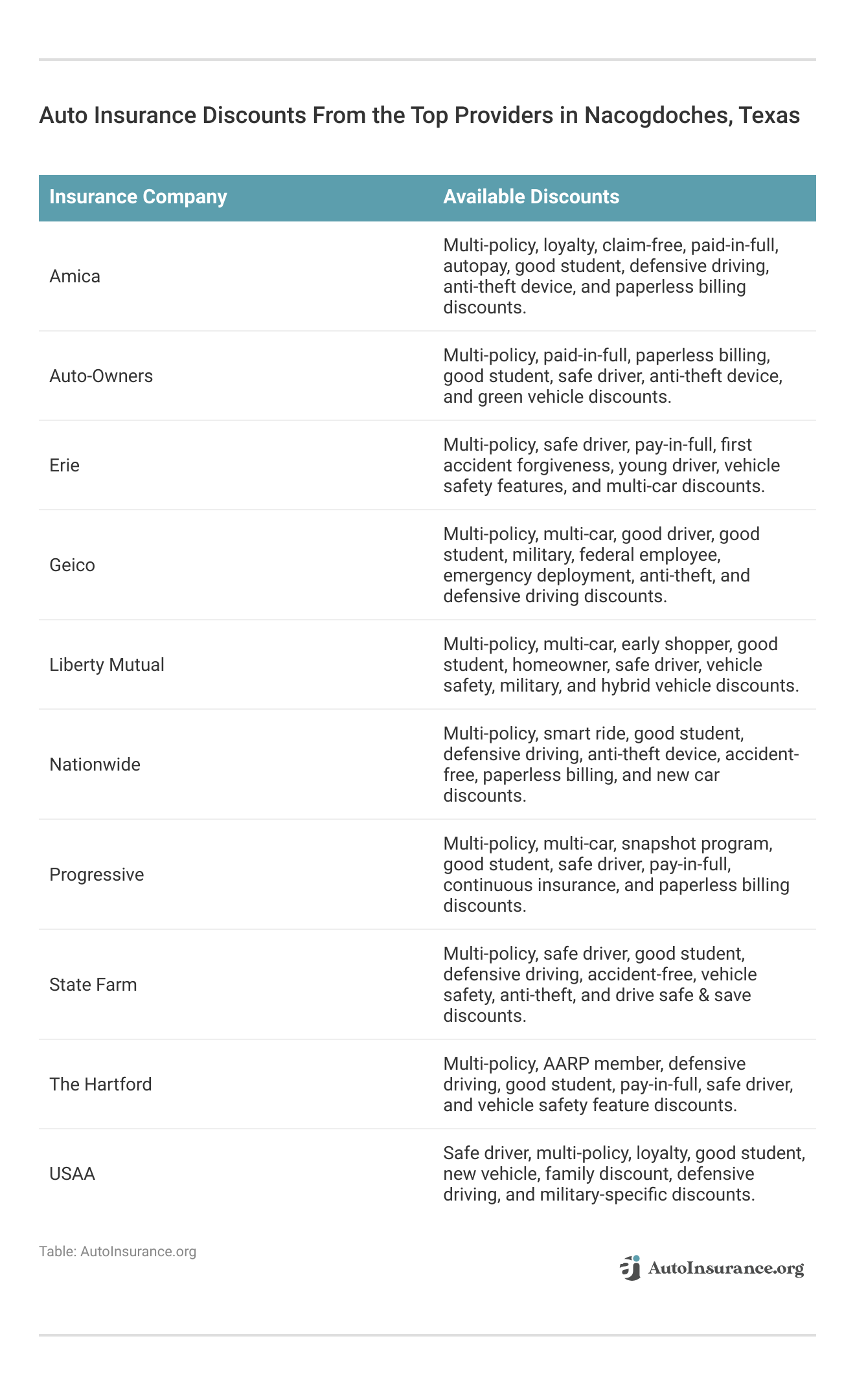

When searching for the cheapest auto insurance in Nacogdoches, Texas, it’s important to compare different providers to find the best rates.

Several companies in Nacogdoches offer competitive pricing, but the actual cost of coverage can vary based on individual factors such as driving history, vehicle type, and coverage needs.

Understanding the difference between car make and car model is crucial when obtaining insurance quotes, as the make refers to the brand of the vehicle, while the model specifies the specific type or design.

By comparing quotes from various companies, drivers can find the best monthly rates that fit their budget while ensuring they have the necessary coverage to meet their needs. Enter your ZIP code now to begin comparing.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Features of Nacogdoches, Texas Auto Insurance Rates Premium

Auto insurance rates in Nacogdoches, Texas, can vary significantly due to a combination of local factors. One of the key influences is the rate of vehicle theft in the city.

Schimri Yoyo

Licensed Agent & Financial Advisor

Another factor is the average commute time for drivers in Nacogdoches. Longer commute times often correlate with higher insurance rates due to the increased risk of accidents during extended periods on the road.

In Nacogdoches, the average commute time is 17.4 minutes, which can influence the overall cost of auto insurance. Additionally, for those considering leasing a vehicle in this area, it’s important to ask, “Is full coverage auto insurance required to lease a car?”

This requirement is common, as leasing companies typically mandate full coverage to protect their investment, further impacting insurance costs. Together, these elements, among others, play a crucial role in determining the auto insurance premiums for drivers in Nacogdoches.

Nacogdoches, Texas Auto Insurance Quotes Review

Many insurers offer a “best good student auto insurance discount” that could significantly lower your premium if you or a student on your policy maintains good grades.

Ty Stewart

Licensed Insurance Agent

Before you buy Nacogdoches, Texas auto insurance, make sure you compare rates from multiple companies to find the best coverage for your needs.

Enter your ZIP code below to get free Nacogdoches, Texas auto insurance quotes and see how much you can save with this discount.

Frequently Asked Questions

What should I do if I’m involved in an auto accident in Nacogdoches, Texas?

Prioritize safety, gather information from involved parties, document the scene, notify the police if needed, and report the incident to your insurance provider.

Can I suspend auto insurance coverage if not using my vehicle in Nacogdoches, Texas?

Some insurers allow coverage suspension or reduction during non-use periods. Contact your insurer for details. Enter your ZIP code now to begin.

Does auto insurance cover rental cars in Nacogdoches, Texas?

Coverage varies among policies. Some include rental cars, while others require extra coverage. For a quick comparison, consider getting an instant auto insurance quote comparison.

What’s the difference between collision coverage and comprehensive coverage?

Collision covers vehicle damages from collisions, while comprehensive covers non-collision incidents like theft or fire.

Can I use personal auto insurance for business purposes in Nacogdoches, Texas?

Generally, personal insurance doesn’t cover business use. You may need commercial auto insurance. Enter your ZIP code now to begin.

Does Nacogdoches, Texas require uninsured/underinsured motorist coverage?

Yes, it’s required to protect against drivers without insurance or insufficient coverage.

How changing address affect auto insurance can influence your premium, as your insurer will adjust rates based on the safety and risk factors of your new location.

Which auto insurance provider is highlighted as the best for AARP members in Nacogdoches, Texas?

The Hartford is noted as the best for AARP members, offering tailored insurance plans and discounts. It provides strong customer service and comprehensive coverage options for seniors.

What are the top three auto insurance companies in Nacogdoches, Texas offering competitive rates starting at $50 per month?

The top three providers are Amica, USAA, and Auto-Owners. They are recognized for their competitive pricing and extensive coverage. Enter your ZIP code now to begin.

Which insurance company is noted for its strong online tools and user-friendly digital management?

Geico stands out for its efficient online tools and user-friendly digital management.

It’s an excellent choice for those who prefer managing their insurance digitally and offers a good driver auto insurance discount for maintaining a clean driving record.

What factor significantly influences auto insurance rates in Nacogdoches, Texas according to the article?

Vehicle theft rates and average commute times significantly influence auto insurance rates in Nacogdoches. Higher rates of vehicle theft and longer commutes typically lead to increased premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.