Best Puyallup, Washington Auto Insurance in 2025 (Find the Top 10 Companies Here)

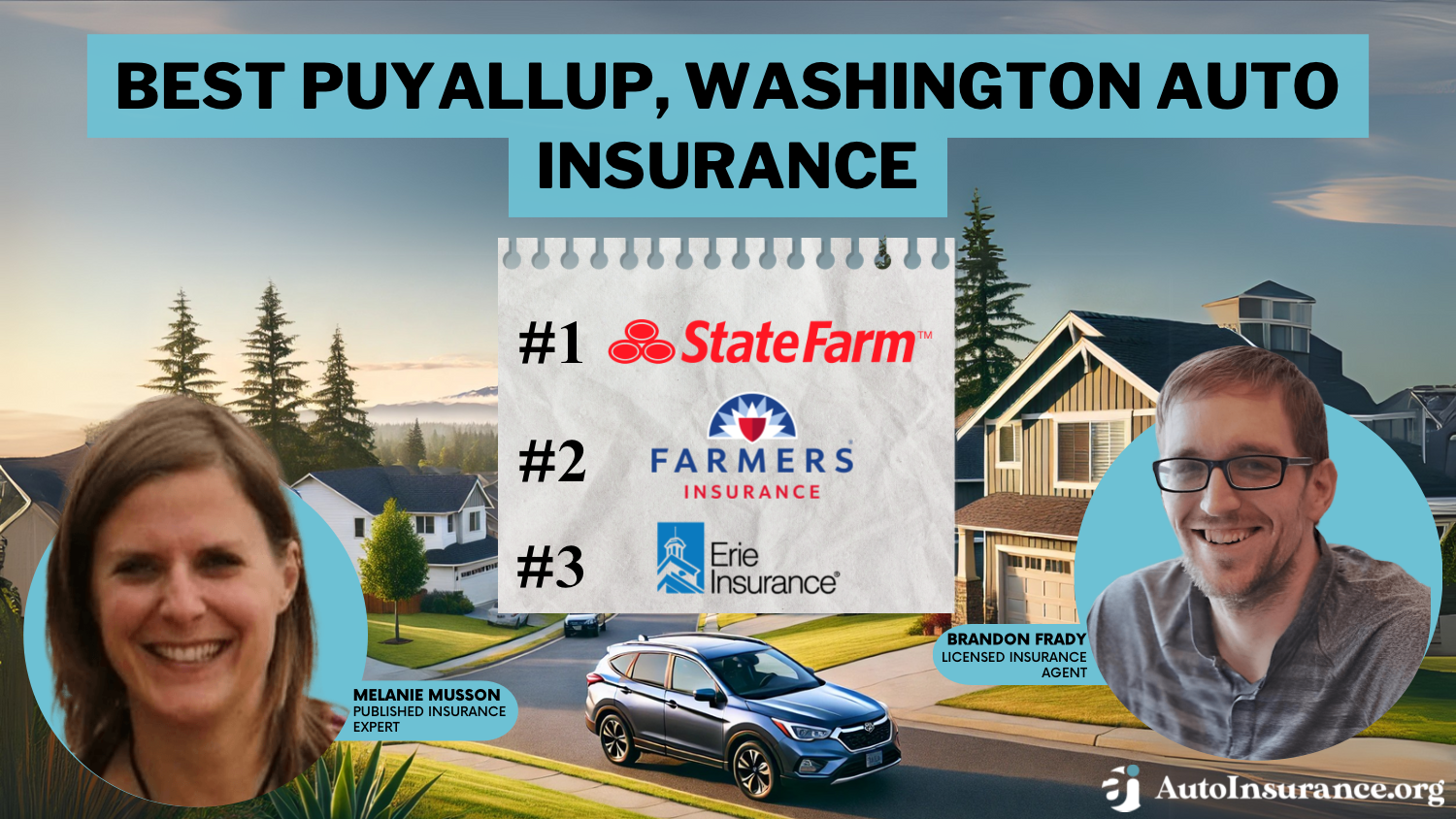

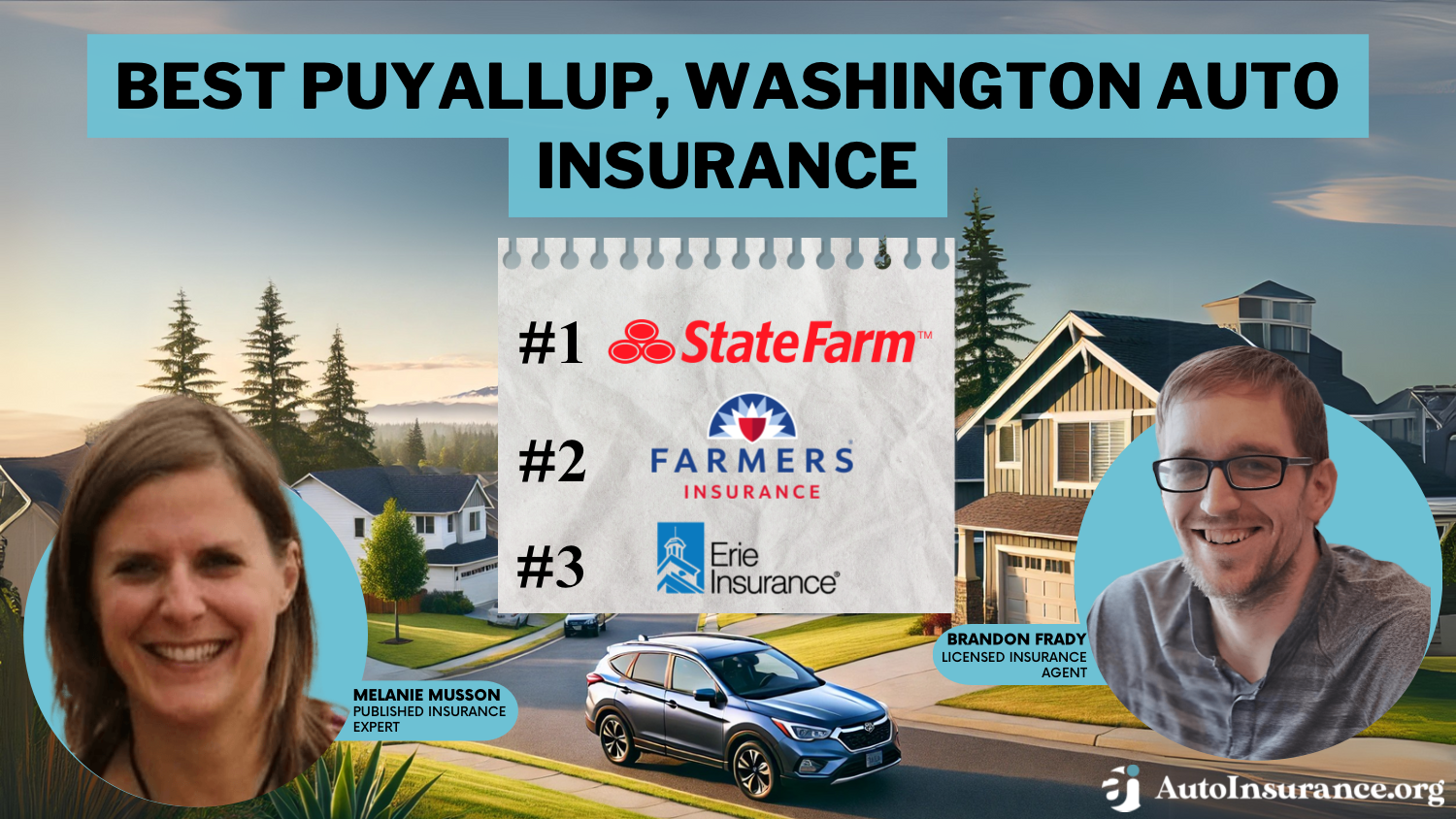

The best Puyallup, Washington auto insurance companies are State Farm, Farmers, and Erie, offering rates at $59 per month. State Farm provides personalized service and flexible coverage, while Erie is known for financial stability and discounts, making it a reliable local choice.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Puyallup WA

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Puyallup WA

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage in Puyallup WA

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsState Farm, Farmers, and Erie provide the best Puyallup, Washington auto insurance, starting at just $59 per month for optimal coverage options.

Puyallup, Washington, requires auto insurance coverage of 25/50/10. A thorough review of Washington auto insurance can help you find compliant options that fit your budget.

Our Top 10 Company Picks: Best Puyallup, Washington Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 13% | B | Many Discounts | State Farm | |

| #2 | 10% | A | Local Agents | Farmers | |

| #3 | 15% | A+ | 24/7 Support | Erie |

| #4 | 12% | A | Online App | AAA |

| #5 | 18% | A++ | Military Savings | USAA | |

| #6 | 16% | A++ | Custom Plan | Geico | |

| #7 | 14% | A+ | Usage Discount | Nationwide |

| #8 | 11% | A++ | Accident Forgiveness | Travelers | |

| #9 | 17% | A+ | Innovative Programs | Progressive | |

| #10 | 9% | A+ | Add-on Coverages | Allstate |

Taking the time to evaluate these factors can lead to significant savings and peace of mind, knowing you’ve chosen the right policy for your needs.

Before you buy Puyallup, Washington auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free Puyallup, Washington auto insurance quotes.

- Explore the best Puyallup, Washington auto insurance starting at just $59/month

- State Farm is the top pick, offering personalized service and flexible coverage

- Puyallup drivers should compare multiple providers to find the most affordable rates

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Many Discounts: State Farm offers a range of discounts, including a 13% bundling discount, making it one of the best Puyallup, Washington auto insurance options for savings.

- High Rank: Ranked #1 among providers, reflecting its strong reputation and reliability for the best Puyallup, Washington auto insurance. Discover more at “State Farm Auto Insurance Review.”

- A.M. Best Rating: Holds a B rating, indicating good financial stability, which is crucial for the best Puyallup, Washington auto insurance.

Cons

- Limited Multi-Policy Discounts: The 13% bundling discount may be lower than some competitors, potentially affecting the overall cost of the best Puyallup, Washington auto insurance.

- Basic Coverage Options: This provider may not offer as many specialized coverage options as other providers, limiting choices for the best Puyallup, Washington auto insurance.

#2 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers provide personalized service through local agents, which can be beneficial for customized coverage. Find out more about local agents at “Farmers Auto Insurance Review.”

- Strong A.M. Best Rating: It holds an A rating, indicating strong financial stability, which is essential for securing the best Puyallup, Washington auto insurance.

- Good Bundling Discount: This company offers a 10% bundling discount, helping to reduce the cost of auto insurance.

Cons

- Higher Rates for Some Drivers: Premiums might be higher for drivers with poor credit or high-risk profiles, impacting the affordability of auto insurance.

- Mixed Customer Service Reviews: Some customers report inconsistent experiences with customer service, which can affect overall satisfaction.

#3 – Erie: Best for 24/7 Support

Pros

- 24/7 Support: Erie provides round-the-clock customer support, ensuring assistance whenever needed.

- High A.M. Best Rating: Holds an A+ rating, reflecting financial solid stability and reliability. See more about the best ratings at “Erie Auto Insurance Review.”

- Generous Bundling Discount: This company offers a 15% bundling discount, which helps customers obtain the best Puyallup, Washington auto insurance at lower premiums.

Cons

- Limited Availability: Erie’s services are not available in all states, which may limit access to the best Puyallup, Washington auto insurance for some drivers.

- Less Advanced Online Tools: Online management tools may not be as advanced as those of larger competitors, affecting convenience.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – AAA: Best for Online App

Pros

- Online App: AAA offers a user-friendly online app for managing policies and filing claims, enhancing convenience. Read more about the online app at “AAA Auto Insurance Review.”

- Strong A.M. Best Rating: Holds an A rating, indicating solid financial stability for the best Puyallup, Washington auto insurance.

- Competitive Bundling Discount: This provides a 12% bundling discount, making the best Puyallup, Washington auto insurance affordable.

Cons

- Higher Premiums for Some Drivers: Premiums may be higher for those with poor credit or high-risk profiles, potentially affecting the cost.

- Limited Regional Availability: Services might not be available in all areas, restricting access to the best Puyallup, Washington auto insurance.

#5 – USAA: Best for Military Savings

Pros

- Military Savings: Offers exceptional rates and benefits for military members and their families, including an 18% bundling discount, making it a top choice.

- Top A.M. Best Rating: Holds an A++ rating, demonstrating superior financial stability. Find out why “USAA Auto Insurance Review” has the best rating.

- High Rank: Ranked #5 among providers, reflecting its strong market position and customer satisfaction in providing the best Puyallup, Washington auto insurance.

Cons

- Eligibility Restrictions: Services are only available to military members, veterans, and their families, limiting access to the best Puyallup, Washington auto insurance.

- Higher Premiums for High-Risk Drivers: Premiums can be higher for drivers with poor credit or high-risk profiles, impacting the overall cost.

#6 – Geico: Best for Custom Plan

Pros

- Custom Plan Options: Geico offers customizable plans that allow you to tailor coverage to specific needs. Learn more about custom plan options at “Geico Auto Insurance Review.”

- Excellent A.M. Best Rating: Holds an A++ rating, indicating strong financial stability, which is essential for the best Puyallup, Washington auto insurance.

- Generous Bundling Discount: This policy provides a 16% bundling discount, making it a cost-effective option for the best Puyallup, Washington auto insurance.

Cons

- Limited Specialized Coverage: This may not offer as many specialized coverage options as other providers.

- Mixed Customer Service Feedback: Some customers report variable experiences with customer service, which can impact satisfaction.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: This company offers a usage-based discount, which can help reduce premiums based on driving habits. Find out more about the usage discount at “Nationwide Auto Insurance Review.”

- Strong A.M. Best Rating: Holds an A+ rating, reflecting financial solid stability for securing the best auto insurance.

- Competitive Bundling Discount: Provides a 14% bundling discount, helping to lower the cost of the best Puyallup, Washington auto insurance.

Cons

- Higher Rates for Some Drivers: Premiums may be higher for drivers with less favorable credit histories, impacting the affordability of auto insurance.

- Variable Claims Processing: Some customers report mixed experiences with the claims process, affecting overall satisfaction.

#8 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Offers accident forgiveness, which can help prevent rate increases after your first at-fault accident. Learn more at “Travelers Auto Insurance Review.”

- Excellent A.M. Best Rating: It holds an A++ rating, ensuring financial stability for the best Puyallup, Washington auto insurance.

- Competitive Bundling Discount: This provides an 11% bundling discount, making the best Puyallup, Washington auto insurance affordable.

Cons

- Higher Premiums for High-Risk Drivers: Premiums might be higher for drivers with poor credit or high-risk profiles, impacting the cost.

- Mixed Customer Reviews: Some customers report inconsistent experiences with claims processing, affecting satisfaction.

#9 – Progressive: Best for Innovative Programs

Pros

- Innovative Programs: Known for offering innovative programs and coverage options, such as usage-based insurance, which can enhance auto insurance.

- Strong A.M. Best Rating: Holds an A+ rating, indicating solid financial stability for the best Puyallup, Washington auto insurance.

- Generous Bundling Discount: This company offers a 17% bundling discount, which can significantly reduce premiums for the best Puyallup, Washington auto insurance.

Cons

- Variable Premiums: Premiums can fluctuate based on personal factors, leading to less predictability. Learn more about variable premiums at “Progressive Auto Insurance Review.”

- Customer Service Concerns: Some customers report issues with customer service, affecting their overall experience.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Allstate: Best for Add-on Coverages

Pros

- Add-on Coverages: This policy provides a range of add-on coverages, allowing you to customize your policy to better suit your needs for the best auto insurance.

- Strong A.M. Best Rating: Holds an A+ rating, reflecting strong financial stability. Discover the best ratings at “Allstate Auto Insurance Review.”

- Competitive Bundling Discount: This company offers a 9% bundling discount, helping to reduce the overall cost of the best auto insurance.

Cons

- Higher Premiums for Younger Drivers: Premiums can be higher for younger drivers compared to some other providers, potentially impacting the affordability of the best auto insurance.

- Mixed Customer Service Feedback: Some customers report issues with customer service, which can affect overall satisfaction with the best Puyallup, Washington auto insurance.

Cheap Puyallup, Washington Auto Insurance by Age and Gender

Puyallup, Washington, auto insurance laws require that you have at least the minimum amount of insurance to be financially responsible in the event of an accident. This aligns with the state’s car insurance requirements to ensure adequate coverage.

Puyallup, Washington Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $64 | $132 |

| $76 | $146 | |

| $73 | $140 |

| $59 | $144 | |

| $63 | $147 | |

| $69 | $138 |

| $72 | $140 | |

| $66 | $136 | |

| $72 | $135 | |

| $70 | $149 |

Auto insurance rates in Puyallup, Washington, are affected by age, gender, and marital status. See how demographics impact the monthly cost of insurance and discover the potential savings available to you.

Puyallup, Washington Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $767 | $891 | $218 | $225 | $206 | $202 | $190 | $200 | |

| $711 | $967 | $187 | $248 | $187 | $187 | $171 | $171 | |

| $444 | $477 | $242 | $251 | $192 | $197 | $175 | $199 | |

| $354 | $461 | $274 | $198 | $161 | $164 | $151 | $151 | |

| $1,009 | $1,111 | $188 | $204 | $177 | $193 | $158 | $186 |

| $391 | $474 | $169 | $183 | $141 | $144 | $131 | $136 |

| $774 | $865 | $181 | $179 | $152 | $142 | $137 | $139 | |

| $483 | $610 | $187 | $215 | $164 | $164 | $148 | $148 | |

| $478 | $563 | $137 | $150 | $108 | $106 | $104 | $104 |

For example, younger drivers and those with less driving experience may face higher premiums, while married individuals and older drivers often enjoy lower rates. Generally, insurance premiums are influenced by factors such as age, marital status, and driving history.

Puyallup, Washington Auto Insurance Discounts by Provider

| Insurance Company | Discount Percentage | Discount Program |

|---|---|---|

| 12% | Anti-Theft Discount |

| 9% | Early Signing Discount | |

| 15% | Multi-Policy Discount |

| 10% | Good Student Discount | |

| 16% | Defensive Driving Discount | |

| 14% | Accident-Free Discount |

| 17% | Pay-in-Full Discount | |

| 13% | Safe Driver Discount | |

| 11% | Homeowners Discount | |

| 18% | Military Service Discount |

Additionally, having a clean driving record and multiple policies can further reduce insurance costs, as many insurers offer significant discounts for both safe driving and bundling various types of coverage.

By choosing the best yearly premium auto insurance, you can lock in these discounts for the long term, ensuring stable, affordable rates throughout the year.

Cheap Puyallup, Washington Auto Insurance by Driving Record

Your driving record has a significant impact on your auto insurance rates. Those with a history of traffic violations or accidents typically face higher premiums.

Compare the monthly auto insurance rates for drivers with a bad record in Puyallup, Washington, to those with a clean record to understand the difference in costs.

Enter your ZIP code now to compare prices and find the most affordable insurance options tailored to your specific demographic profile.

| Insurance Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| $302 | $382 | $340 | $426 | |

| $283 | $363 | $348 | $420 | |

| $225 | $281 | $280 | $303 | |

| $185 | $236 | $185 | $350 | |

| $344 | $434 | $394 | $442 |

| $172 | $233 | $188 | $293 |

| $260 | $408 | $314 | $303 | |

| $240 | $289 | $265 | $265 | |

| $160 | $233 | $189 | $293 |

Additionally, consider how maintaining a clean driving record over time can lead to reduced premiums and potential discounts, further influencing your overall insurance expenses in Puyallup.

Puyallup, Washington Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Total Accidents Per Year | 1,250 |

| Total Claims Per Year | 950 |

| Average Claim Size | $5,800 |

| Percentage of Uninsured Drivers | 12% |

| Vehicle Theft Rate | 210 thefts/year |

| Traffic Density | Medium |

| Weather-Related Incidents | Low |

A comprehensive auto insurance claim can also affect your rates, so it’s crucial to manage claims carefully. Finding cheap auto insurance in Puyallup can seem like a difficult task, but all of the information you need is right here.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheap Puyallup, Washington Auto Insurance by Credit History

Credit history can have a significant effect on the cost of auto insurance, as insurers often use credit scores to gauge risk and determine premiums. Maintaining a good credit score can help lower your insurance rates, as it reflects responsible financial behavior.

We’ll cover factors that affect auto insurance rates in Puyallup, Washington, including driving record, credit, commute time, and more. Explore how monthly auto insurance rates in Puyallup, Washington, vary based on credit history to understand how a good or poor credit score can influence your insurance costs.

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| $449 | $344 | $295 | |

| $417 | $341 | $303 | |

| $331 | $251 | $234 | |

| $285 | $228 | $205 | |

| $577 | $355 | $278 |

| $264 | $206 | $193 |

| $354 | $316 | $294 | |

| $385 | $231 | $179 | |

| $276 | $202 | $178 |

Additionally, improving your credit score over time may help you secure better rates and reduce your overall insurance expenses. Insurers view a higher credit score as a sign of lower risk, which can result in more competitive premiums.

Cheap Puyallup, Washington Auto Insurance Rates by Commute

Commute length and annual mileage impact Puyallup, Washington auto insurance rates, as insurers often factor in how much you drive when calculating premiums.

For comprehensive coverage, explore “Insurance for Different Types of Drivers,” which is tailored to various driving habits and distances.

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $363 | $363 | |

| $346 | $361 | |

| $272 | $272 | |

| $236 | $242 | |

| $403 | $403 |

| $221 | $221 |

| $321 | $321 | |

| $257 | $272 | |

| $217 | $221 |

Longer commutes or higher annual mileage can lead to higher rates due to the increased risk of accidents. To find the cheapest monthly auto insurance in Puyallup, Washington, consider how your commute length and driving habits influence your rates and explore options that align with your driving patterns.

Additionally, look for insurers that offer discounts for low-mileage drivers or flexible coverage plans that fit your specific driving needs. See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Compare Puyallup, Washington Auto Insurance Quotes

Before you buy Puyallup, Washington auto insurance, make sure you compare rates from multiple companies to find the best deal. This includes evaluating monthly auto insurance premiums to ensure you get the most affordable and suitable coverage for your needs.

Schimri Yoyo Licensed Agent & Financial Advisor

When considering car insurance in Washington, it’s essential to ensure that your policy meets the state’s minimum liability coverage requirements. Alongside this, reading a comprehensive State auto insurance review can help you evaluate the best options that balance affordability and coverage.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Puyallup, Washington Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Average Claim Size | B+ | Below average |

| Traffic Density | B | Low congestion |

| Weather-Related Risks | B- | Occasional heavy rains |

| Vehicle Theft Rate | C+ | Moderate theft rate |

| Uninsured Drivers Rate | C | High uninsured rate |

By comparing multiple providers, you can discover tailored options that fit your budget and coverage needs. Many insurers offer discounts for safe driving, bundling policies, or completing defensive driving courses, which can help lower your premiums.

Don’t let your high-risk status deter you from finding the right coverage—take advantage of online tools and resources to make the search more accessible and efficient.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What are the mandatory auto insurance requirements in Puyallup, WA?

In Puyallup, Washington, drivers must carry liability insurance to meet state-mandated minimums. These include $25,000 for injury per person, $50,000 total per accident, and $10,000 for property damage. This covers injuries or damages to others if you’re at fault. For added protection, comprehensive or collision coverage can protect your vehicle against theft, natural disasters, or at-fault accidents.

What types of auto insurance coverage are available in Puyallup, WA?

The common types of auto insurance coverage available in Puyallup, WA, include liability coverage, which is mandatory and covers injuries and property damage to others, as well as optional coverages like collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage. Enter your ZIP code into our free auto insurance quote comparison tool below to protect your vehicle at the best prices.

Is auto insurance mandatory in Puyallup, WA?

Yes, auto insurance is mandatory in Puyallup, WA, as it is in the rest of Washington state. The state requires drivers to carry a minimum amount of liability coverage to protect against financial responsibility for injuries or property damage caused by an accident.

Many drivers seek out the cheapest auto insurance companies to affordably meet these requirements. These companies offer competitive rates while still complying with the state’s minimum coverage laws.

What should I do if I have an accident in Puyallup, WA?

If you have an accident in Puyallup, WA, first ensure everyone’s safety and call for medical assistance if needed. Then, exchange information with the other driver(s) and gather evidence, such as photos of the scene and contact information for witnesses. Finally, report the incident to your insurance company as soon as possible to begin the claims process.

Can I purchase additional auto insurance coverage in Puyallup, WA?

Yes, you can purchase additional auto insurance coverage beyond the minimum requirements in Puyallup, WA. Optional coverages like collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage can provide enhanced protection for your vehicle and yourself.

How can I find the best auto insurance in Puyallup, WA?

To find the best auto insurance in Puyallup, WA, consider these steps:

- Shop around and compare quotes from multiple insurance companies.

- Assess the coverage options, limits, and deductibles offered by each insurer.

- Check the financial stability and reputation of the insurance companies.

- Read customer reviews and ratings to evaluate their customer service.

- Take into account any discounts or special features that may be available.

For more extensive coverage, adding comprehensive auto insurance can offer protection against theft, natural disasters, and other non-collision-related damages.

How can I find the best auto insurance rates in Puyallup, Washington?

To find the best auto insurance rates in Puyallup, Washington, start by comparing quotes from multiple insurance providers. Consider factors like bundling discounts, coverage options, and the company’s A.M. Best rating. Use online tools and resources to get detailed comparisons and explore providers that offer the best Puyallup, Washington auto insurance based on your specific needs.

What factors affect my auto insurance premiums in Puyallup, Washington?

Several factors can influence your auto insurance premiums in Puyallup, Washington, including your driving history, credit score, type of vehicle, and coverage levels. Local conditions, such as traffic patterns and the frequency of vehicle thefts, can also impact rates. For the best Puyallup, Washington auto insurance, it’s essential to understand these factors and choose a policy that aligns with your driving profile and needs.

Are there discounts available for auto insurance in Puyallup, Washington?

Yes, many auto insurance providers in Puyallup, Washington, offer various discounts. Standard discounts include bundling multiple policies, safe driver discounts, and usage-based discounts. To get the best Puyallup, Washington auto insurance rates, inquire about available discounts when obtaining quotes and consider how they can lower your overall premium.

If you’re insuring a young driver, it’s worth exploring the “Best Auto Insurance Companies for Teens,” as they often provide tailored discounts for good grades, safe driving programs, and other teen-specific incentives that can significantly reduce costs.

What should I look for in a good auto insurance provider in Puyallup, Washington?

When selecting an auto insurance provider in Puyallup, Washington, look for a company with a solid financial rating, competitive rates, and a range of coverage options. Consider customer reviews and the provider’s reputation for handling claims.

Additionally, check for discounts and benefits that can help you get the best Puyallup, Washington, auto insurance for your needs. See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.