Allstate vs. Farmers Auto Insurance in 2025 (Compare Rates & Policies Here!)

Compare Allstate vs. Farmers auto insurance, with minimum rates from $87 and $76 per month, ideal for safe and high-risk drivers seeking reliable car insurance coverage. Allstate and Farmers specializes in accident forgiveness and offers exclusive custom equipment coverage for modified vehicles.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,072 reviews

3,072 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsExplore Allstate vs. Farmers auto insurance to see how accident forgiveness and custom equipment coverage can help different types of drivers.

Allstate’s forgiveness program is great if you’ve got a clean record but worry about a first mistake raising your rate. Farmers works better for high-risk drivers since they’re more forgiving with tickets or accidents.

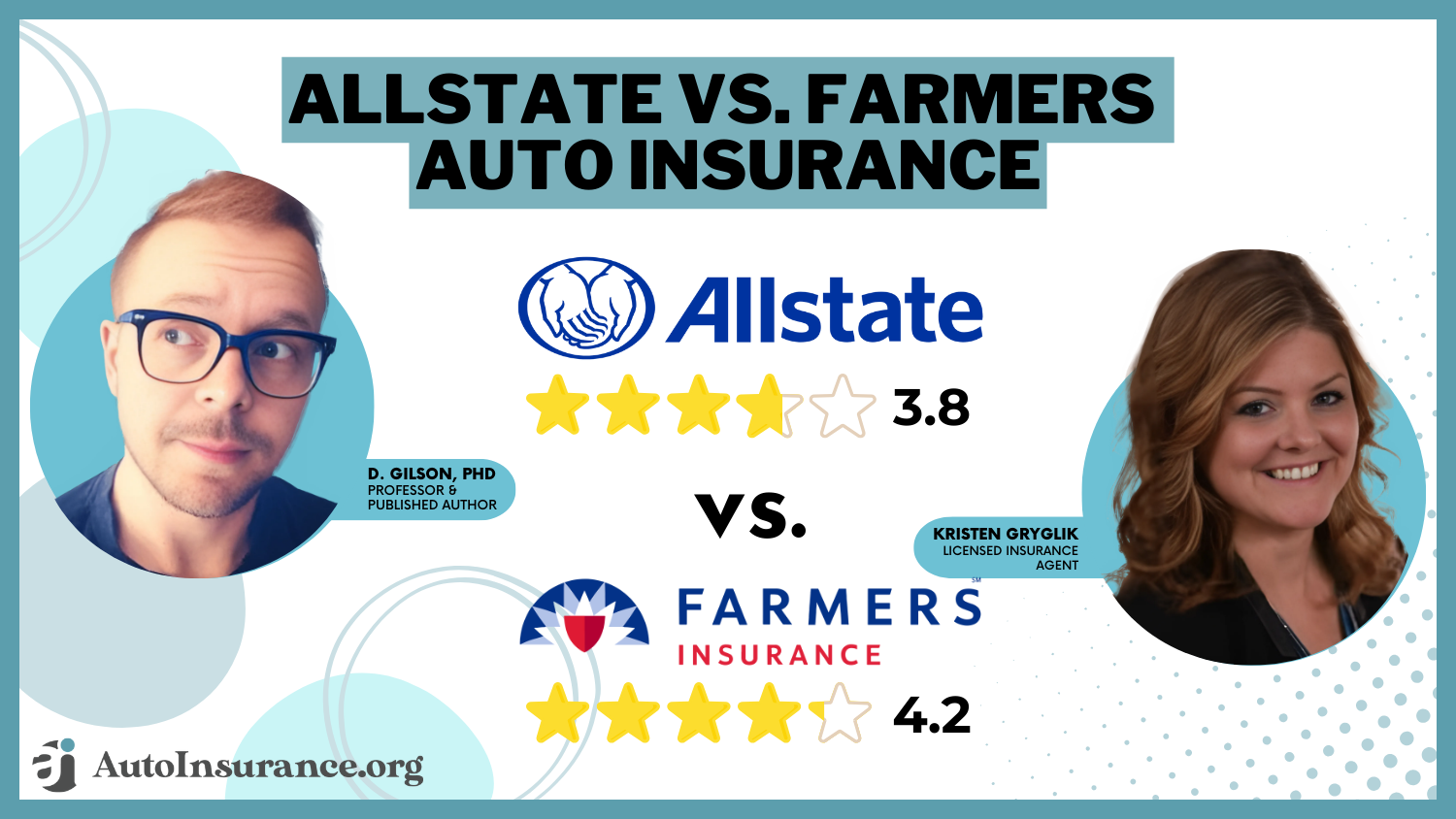

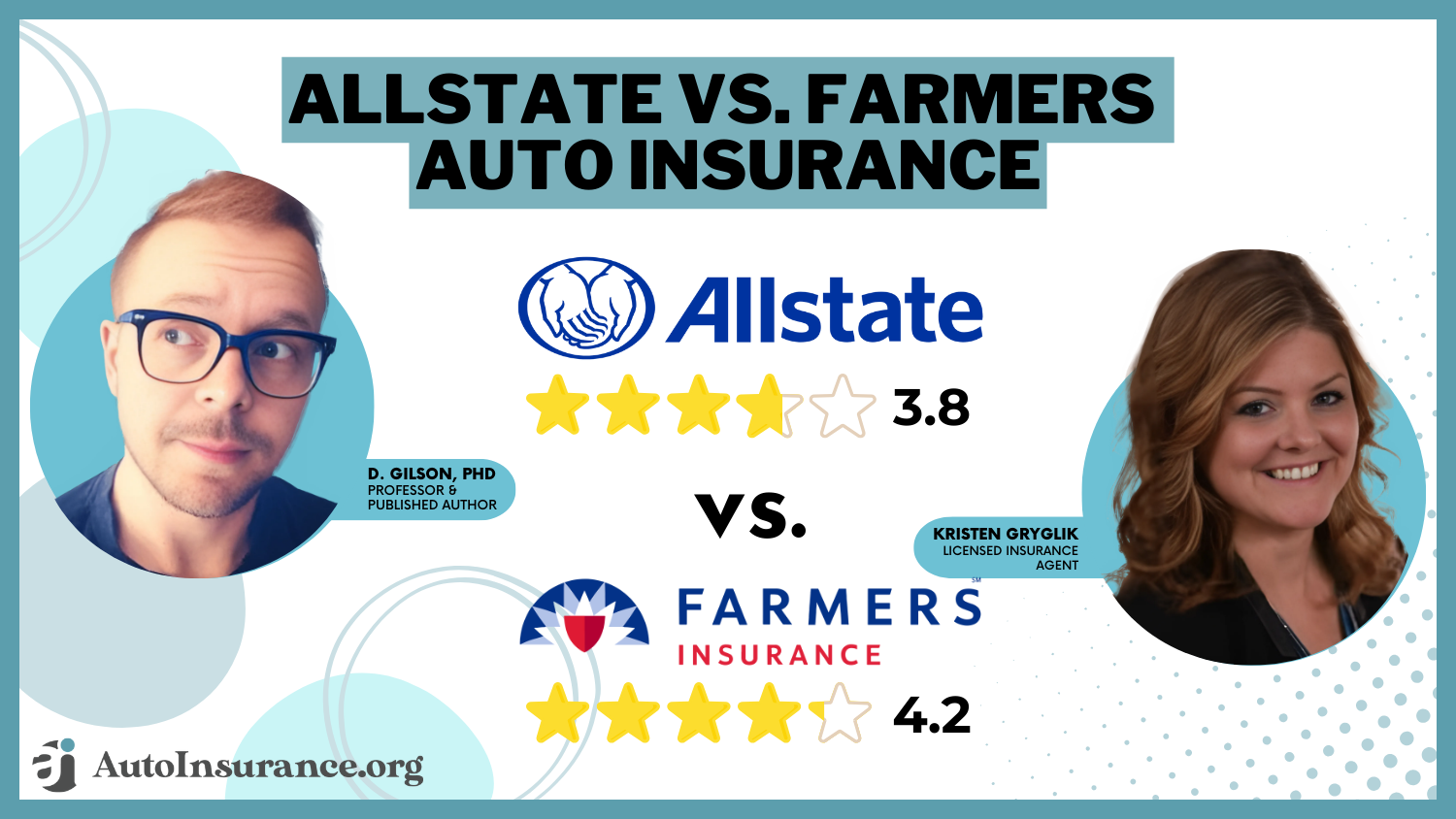

Allstate vs. Farmers Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 3.8 | 4.2 |

| Business Reviews | 4.0 | 4.0 |

| Claim Processing | 3.0 | 3.3 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 3.5 | 4.1 |

| Customer Satisfaction | 2.0 | 2.0 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.4 | 4.3 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.4 | 5.0 |

| Savings Potential | 3.9 | 4.5 |

| Allstate | Farmers |

Both companies get solid reviews and strong financial scores. Depending on your driving history, one might save you a lot more than the other.

- Allstate vs. Farmers auto insurance includes exclusive coverage perks

- Allstate offers accident forgiveness for first-time at-fault drivers

- Farmers covers custom equipment for modified and upgraded vehicles

For information about each of the individual companies, check out our Allstate auto insurance review and our Farmers auto insurance review.

Before you decide to buy Farmers vs. Allstate insurance, enter your ZIP code to start comparing multiple companies in your area to find the cheapest rates.

Allstate vs. Farmers Auto Insurance Premium Costs

This table shows Allstate’s and Farmers’ full coverage premiums for auto insurance by age and gender. Men who are 16 years old pay the highest among the rates of teen drivers.

Farmers provides somewhat lower rates, and premiums start to drop at thirty years old. Farmers always offers men and women reduced rates at age sixty.

Allstate vs. Farmers Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $868 | $1,156 |

| Age: 16 Male | $910 | $1,103 |

| Age: 30 Female | $240 | $228 |

| Age: 30 Male | $252 | $239 |

| Age: 45 Female | $231 | $199 |

| Age: 45 Male | $228 | $198 |

| Age: 60 Female | $214 | $171 |

| Age: 60 Male | $220 | $183 |

Farmers offers somewhat cheaper rates, and premiums start to decline after age 30. Farmers auto insurance frequently offers lower rates for men and women at age 60.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Allstate vs. Farmers Auto Insurance Rates by Driving Record

The full coverage costs of Allstate and Farmers insurance are contrasted by driving records in the table below. In every category, Farmers stays less expensive, particularly for drivers with DUIs. The difference in DUI costs is $110, whereas the difference for a clean record is $30. Compared to Farmers, Allstate’s rates increase more precipitously following violations.

Allstate vs. Farmers Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $228 | $198 |

| One Accident | $321 | $282 |

| One Ticket | $268 | $247 |

| One DUI | $385 | $275 |

Why is Farmers auto insurance for drivers with a DUI so expensive? Regardless of whether you choose Allstate vs. Farmers, your auto insurance rates will increase if you get a speeding ticket, cause an accident, or get a DUI. The more infractions on your driving record, the more of a liability you are.

Allstate vs. Farmers Average Annual Auto Insurance Rates by Driving Record

| Driving Record | Allstate Average Annual Rates | Farmers Average Annual Rates |

|---|---|---|

| Clean Driving Record | $3,819.90 | $3,460.60 |

| With One Speeding Violation | $4,483.51 | $3,025.74 |

| With One Accident | $4,987.68 | $3,722.75 |

| With One DUI | $6,260.73 | $4,330.24 |

Farmers is much more forgiving than Allstate when it comes to having traffic violations on your driving record. If you choose Allstate and you get a speeding ticket, cause an accident, or get a DUI, your auto insurance rates will increase by 17% to 63%. See how drivers secure cheap auto insurance after a DUI despite violations.

Alternatively, with Farmers, your auto insurance rates increase by only 8% to 25%. If you need auto insurance for high-risk drivers, Farmers is surely the better option.

Compare Allstate vs. Farmers Auto Insurance Financial Strength

Below, we list ratings for Allstate and Farmers insurance from the top agencies that judge the credibility of all auto insurance companies. A.M. Best scores companies based on their ability to meet their ongoing insurance obligations, such as balancing premiums collected and claims paid. The highest score A.M. Best awards is Superior A++.

Consumer Reports collects annual data from its subscribers regarding customer satisfaction with the claims process, step by step. In its 2017 survey, 27 insurance companies were rated, and scores ranged from 86 to 96.

The National Association of Insurance Commissioners (NAIC) calculates a complaint ratio based on the total number of customers vs. the total number of complaints. In 2017, the national average complaint ratio was one. The lower the ratio, the better.

Insurance Business Ratings & Consumer Reviews: Allstate vs. Farmers

| Agency | ||

|---|---|---|

| Score: 691 / 1,000 Avg. Satisfaction | Score: 706 / 1,000 Lower-Than-Average Satisafaction |

|

| Score: A+ Excellent Business Practices | Score: A Good Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 82/100 High Customer Satisfaction |

|

| Score: 1.45 Avg. Complaints | Score: 1.70 More Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength | Score: A Excellent Financial Strength |

Allstate earns higher marks from A.M. Best and J.D. Power. Farmers receives stronger consumer scores from Consumer Reports. Farmers also shows a higher complaint ratio than Allstate, despite competitive service ratings.

Allstate has a better financial strength score. Farmers has a lower score than Allstate, though its score is still considered good. If you aren’t happy with your choice, you can easily cancel Allstate or Farmers auto insurance.

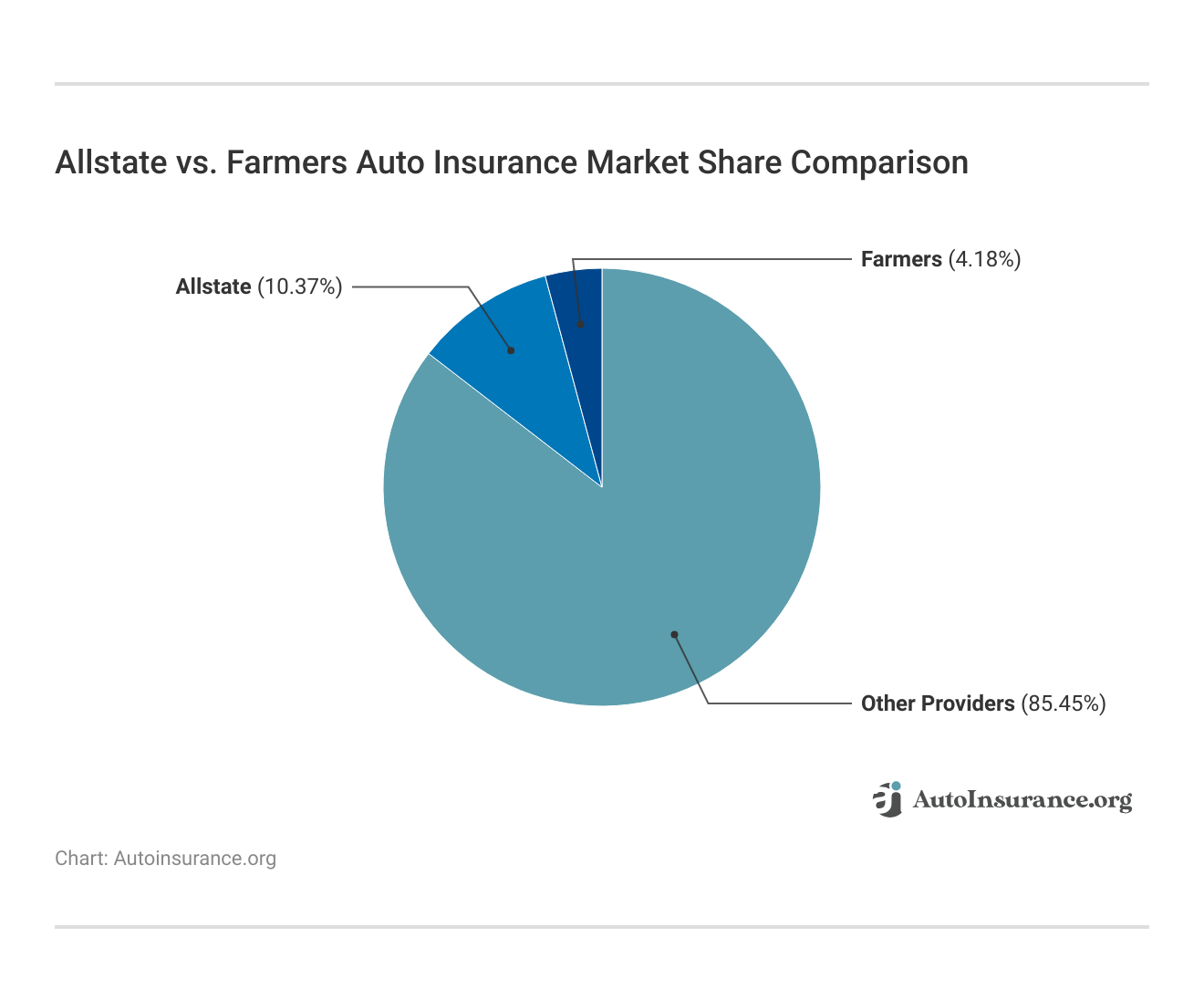

The table highlights the market share differences in the Allstate vs. Farmers auto insurance comparison. Allstate controls 10.37% of the auto insurance market, while Farmers holds just 4.18%.

A significant 85.45% is distributed among other providers, showing strong competition. Allstate has a noticeably larger market footprint than Farmers.

Auto Insurance Discount Comparison Between Allstate and Farmers

Auto insurance companies offer different types of discounts, so it’s important to shop around. Let’s examine Allstate and Farmers auto insurance discounts.

Allstate vs. Farmers Auto Insurance Discounts

| Discounts | Allstate (%) | Farmers (%) |

|---|---|---|

| Adaptive Headlights | No | Yes |

| Anti-lock Brakes | 10 | Yes |

| Anti-Theft | 10 | Yes |

| Claim Free | 35 | Yes |

| Continuous Coverage | No | Yes |

| Daytime Running Lights | 2 | Yes |

| Defensive Driver | 10 | Yes |

| Distant Student | 35 | Yes |

| Driver's Ed | 10 | No |

| Driving Device/App | 20 | Yes |

| Early Signing | 10 | Yes |

| Electronic Stability Control | 2 | No |

| Emergency Deployment | No | Yes |

| Engaged Couple | No | Yes |

| Family Legacy | No | Yes |

| Family Plan | No | Yes |

| Farm Vehicle | 10 | Yes |

| Federal Employee | No | Yes |

| Full Payment | 10 | No |

| Garaging/Storing | No | Yes |

| Good Credit | No | Yes |

| Good Student | 20 | No |

| Green Vehicle | 10 | 5 |

| Homeowner | No | Yes |

| Life Insurance | No | Yes |

| Loyalty | No | Yes |

| Married | No | Yes |

| Military | No | Yes |

| Multiple Policies | 10 | No |

| Multiple Vehicles | No | Yes |

| New Graduate | No | Yes |

| Newer Vehicle | 30 | Yes |

| On Time Payments | 5 | No |

| Paperless Documents | 10 | Yes |

| Paperless/Auto Billing | 5 | No |

| Passive Restraint | 30 | No |

| Recent Retirees | No | Yes |

| Renter | No | Yes |

| Roadside Assistance | No | Yes |

| Safe Driver | 45 | No |

| Senior Driver | 10 | No |

| Stable Residence | No | Yes |

| Switching Provider | No | Yes |

| Utility Vehicle | 15 | No |

| Vehicle Recovery | 10 | No |

| VIN Etching | No | Yes |

Allstate has 29 auto insurance discounts that could potentially reduce your Allstate auto insurance quotes, and Farmers has 34 discounts.

What discounts does Farmers offer? Our source doesn’t provide the amount of each discount for Farmers, but you can use your Farmers insurance login or Allstate insurance login to get more details about each company’s savings opportunities. With Allstate, you can save between 5% and 45% with discounts.

Allstate offers 29 discounts, but Farmers leads with 34. For example, Farmers includes perks for eco-friendly and low-mileage vehicles.Laura Berry Former Licensed Insurance Producer

Additionally, always ask about bundling discounts. Choosing between these two companies may come down to who has a better discount by bundling your auto insurance policy with a Farmers or Allstate home insurance policy. Before you choose between Allstate vs. Farmers auto insurance, use our free comparison tool to see rates from multiple auto insurance companies in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Are Farmers more expensive than Allstate?

You may find that Farmers is usually cheaper than Allstate, especially for high-risk drivers, with lower monthly rates after tickets or DUIs. See how high-risk auto insurance supports drivers after a DUI.

Is Farmers auto insurance a good insurance?

Yes, Farmers auto insurance is a good option if you want flexible discounts, custom equipment coverage, and more forgiving rates for driving violations.

Is Allstate a good auto insurance?

If you want accident forgiveness, strong digital tools, and reliable claims support, Allstate is the company for you, though monthly rates may run higher. Find savings on Allstate vs Farmers auto insurance using our free quote comparison tool.

Which insurance is better than Allstate?

You might consider companies like Farmers or Geico if you’re looking for cheaper monthly rates or more options for high-risk and budget-conscious drivers.

How does Allstate vs Farmers homeowners insurance compare for coverage and cost?

You’ll find that Allstate vs Farmers home insurance offers strong options, but Farmers may give you more flexible discounts, while Allstate tends to have higher monthly premiums. Explore the best companies for bundling home and auto insurance to lower your bills.

Should you choose Allstate vs Infinity for auto insurance?

You should choose Allstate vs Infinity if you want more coverage choices and claim support, though Infinity may offer lower monthly rates for high-risk drivers.

Is Allstate vs Safeco better for car insurance value and features?

When comparing Allstate vs Safeco, you’ll get more digital tools and accident forgiveness with Allstate, while Safeco may give you cheaper monthly premiums and flexible add-ons.

What can you learn from Allstate vs Farmers Reddit discussions?

You can find real user experiences on Allstate vs Farmers Reddit threads, where drivers often compare customer service, claims speed, and savings opportunities.

How does State Farm compare to Allstate in terms of monthly car insurance rates?

You’ll likely find lower monthly rates with State Farm if you have a clean record, while Allstate may offer more perks like accident forgiveness. Visit the State Farm auto insurance review to compare coverage and value.

How does Geico compare to Allstate vs. Farmers auto insurance?

You may find Geico offers lower rates for safe drivers, but unlike Allstate’s accident forgiveness or Farmers’ custom equipment coverage, Geico’s extras are limited.

Should you trust Farmers Insurance reviews before buying a policy?

Yes, reading Farmers Insurance reviews helps you understand how real customers rate claim handling, customer service, and policy satisfaction. Enter your ZIP code now to uncover better rates for Allstate vs. Farmers auto insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Where does Progressive Insurance stand in the Allstate vs. Farmers auto insurance comparison?

You’ll see Progressive Insurance competing on price, but unlike Allstate and Farmers, it may lack exclusive perks like forgiveness or modified car coverage. Check the Progressive auto insurance review for pricing and features.

You may find that Farmers is usually cheaper than Allstate, especially for high-risk drivers, with lower monthly rates after tickets or DUIs. See how high-risk auto insurance supports drivers after a DUI.

Yes, Farmers auto insurance is a good option if you want flexible discounts, custom equipment coverage, and more forgiving rates for driving violations.

Is Allstate a good auto insurance?

If you want accident forgiveness, strong digital tools, and reliable claims support, Allstate is the company for you, though monthly rates may run higher. Find savings on Allstate vs Farmers auto insurance using our free quote comparison tool.

Which insurance is better than Allstate?

You might consider companies like Farmers or Geico if you’re looking for cheaper monthly rates or more options for high-risk and budget-conscious drivers.

How does Allstate vs Farmers homeowners insurance compare for coverage and cost?

You’ll find that Allstate vs Farmers home insurance offers strong options, but Farmers may give you more flexible discounts, while Allstate tends to have higher monthly premiums. Explore the best companies for bundling home and auto insurance to lower your bills.

Should you choose Allstate vs Infinity for auto insurance?

You should choose Allstate vs Infinity if you want more coverage choices and claim support, though Infinity may offer lower monthly rates for high-risk drivers.

Is Allstate vs Safeco better for car insurance value and features?

When comparing Allstate vs Safeco, you’ll get more digital tools and accident forgiveness with Allstate, while Safeco may give you cheaper monthly premiums and flexible add-ons.

What can you learn from Allstate vs Farmers Reddit discussions?

You can find real user experiences on Allstate vs Farmers Reddit threads, where drivers often compare customer service, claims speed, and savings opportunities.

How does State Farm compare to Allstate in terms of monthly car insurance rates?

You’ll likely find lower monthly rates with State Farm if you have a clean record, while Allstate may offer more perks like accident forgiveness. Visit the State Farm auto insurance review to compare coverage and value.

How does Geico compare to Allstate vs. Farmers auto insurance?

You may find Geico offers lower rates for safe drivers, but unlike Allstate’s accident forgiveness or Farmers’ custom equipment coverage, Geico’s extras are limited.

Should you trust Farmers Insurance reviews before buying a policy?

Yes, reading Farmers Insurance reviews helps you understand how real customers rate claim handling, customer service, and policy satisfaction. Enter your ZIP code now to uncover better rates for Allstate vs. Farmers auto insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Where does Progressive Insurance stand in the Allstate vs. Farmers auto insurance comparison?

You’ll see Progressive Insurance competing on price, but unlike Allstate and Farmers, it may lack exclusive perks like forgiveness or modified car coverage. Check the Progressive auto insurance review for pricing and features.

If you want accident forgiveness, strong digital tools, and reliable claims support, Allstate is the company for you, though monthly rates may run higher. Find savings on Allstate vs Farmers auto insurance using our free quote comparison tool.

You might consider companies like Farmers or Geico if you’re looking for cheaper monthly rates or more options for high-risk and budget-conscious drivers.

How does Allstate vs Farmers homeowners insurance compare for coverage and cost?

You’ll find that Allstate vs Farmers home insurance offers strong options, but Farmers may give you more flexible discounts, while Allstate tends to have higher monthly premiums. Explore the best companies for bundling home and auto insurance to lower your bills.

Should you choose Allstate vs Infinity for auto insurance?

You should choose Allstate vs Infinity if you want more coverage choices and claim support, though Infinity may offer lower monthly rates for high-risk drivers.

Is Allstate vs Safeco better for car insurance value and features?

When comparing Allstate vs Safeco, you’ll get more digital tools and accident forgiveness with Allstate, while Safeco may give you cheaper monthly premiums and flexible add-ons.

What can you learn from Allstate vs Farmers Reddit discussions?

You can find real user experiences on Allstate vs Farmers Reddit threads, where drivers often compare customer service, claims speed, and savings opportunities.

How does State Farm compare to Allstate in terms of monthly car insurance rates?

You’ll likely find lower monthly rates with State Farm if you have a clean record, while Allstate may offer more perks like accident forgiveness. Visit the State Farm auto insurance review to compare coverage and value.

How does Geico compare to Allstate vs. Farmers auto insurance?

You may find Geico offers lower rates for safe drivers, but unlike Allstate’s accident forgiveness or Farmers’ custom equipment coverage, Geico’s extras are limited.

Should you trust Farmers Insurance reviews before buying a policy?

Yes, reading Farmers Insurance reviews helps you understand how real customers rate claim handling, customer service, and policy satisfaction. Enter your ZIP code now to uncover better rates for Allstate vs. Farmers auto insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Where does Progressive Insurance stand in the Allstate vs. Farmers auto insurance comparison?

You’ll see Progressive Insurance competing on price, but unlike Allstate and Farmers, it may lack exclusive perks like forgiveness or modified car coverage. Check the Progressive auto insurance review for pricing and features.

You’ll find that Allstate vs Farmers home insurance offers strong options, but Farmers may give you more flexible discounts, while Allstate tends to have higher monthly premiums. Explore the best companies for bundling home and auto insurance to lower your bills.

You should choose Allstate vs Infinity if you want more coverage choices and claim support, though Infinity may offer lower monthly rates for high-risk drivers.

Is Allstate vs Safeco better for car insurance value and features?

When comparing Allstate vs Safeco, you’ll get more digital tools and accident forgiveness with Allstate, while Safeco may give you cheaper monthly premiums and flexible add-ons.

What can you learn from Allstate vs Farmers Reddit discussions?

You can find real user experiences on Allstate vs Farmers Reddit threads, where drivers often compare customer service, claims speed, and savings opportunities.

How does State Farm compare to Allstate in terms of monthly car insurance rates?

You’ll likely find lower monthly rates with State Farm if you have a clean record, while Allstate may offer more perks like accident forgiveness. Visit the State Farm auto insurance review to compare coverage and value.

How does Geico compare to Allstate vs. Farmers auto insurance?

You may find Geico offers lower rates for safe drivers, but unlike Allstate’s accident forgiveness or Farmers’ custom equipment coverage, Geico’s extras are limited.

Should you trust Farmers Insurance reviews before buying a policy?

Yes, reading Farmers Insurance reviews helps you understand how real customers rate claim handling, customer service, and policy satisfaction. Enter your ZIP code now to uncover better rates for Allstate vs. Farmers auto insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Where does Progressive Insurance stand in the Allstate vs. Farmers auto insurance comparison?

You’ll see Progressive Insurance competing on price, but unlike Allstate and Farmers, it may lack exclusive perks like forgiveness or modified car coverage. Check the Progressive auto insurance review for pricing and features.

When comparing Allstate vs Safeco, you’ll get more digital tools and accident forgiveness with Allstate, while Safeco may give you cheaper monthly premiums and flexible add-ons.

You can find real user experiences on Allstate vs Farmers Reddit threads, where drivers often compare customer service, claims speed, and savings opportunities.

How does State Farm compare to Allstate in terms of monthly car insurance rates?

You’ll likely find lower monthly rates with State Farm if you have a clean record, while Allstate may offer more perks like accident forgiveness. Visit the State Farm auto insurance review to compare coverage and value.

How does Geico compare to Allstate vs. Farmers auto insurance?

You may find Geico offers lower rates for safe drivers, but unlike Allstate’s accident forgiveness or Farmers’ custom equipment coverage, Geico’s extras are limited.

Should you trust Farmers Insurance reviews before buying a policy?

Yes, reading Farmers Insurance reviews helps you understand how real customers rate claim handling, customer service, and policy satisfaction. Enter your ZIP code now to uncover better rates for Allstate vs. Farmers auto insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Where does Progressive Insurance stand in the Allstate vs. Farmers auto insurance comparison?

You’ll see Progressive Insurance competing on price, but unlike Allstate and Farmers, it may lack exclusive perks like forgiveness or modified car coverage. Check the Progressive auto insurance review for pricing and features.

You’ll likely find lower monthly rates with State Farm if you have a clean record, while Allstate may offer more perks like accident forgiveness. Visit the State Farm auto insurance review to compare coverage and value.

You may find Geico offers lower rates for safe drivers, but unlike Allstate’s accident forgiveness or Farmers’ custom equipment coverage, Geico’s extras are limited.

Should you trust Farmers Insurance reviews before buying a policy?

Yes, reading Farmers Insurance reviews helps you understand how real customers rate claim handling, customer service, and policy satisfaction. Enter your ZIP code now to uncover better rates for Allstate vs. Farmers auto insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Where does Progressive Insurance stand in the Allstate vs. Farmers auto insurance comparison?

You’ll see Progressive Insurance competing on price, but unlike Allstate and Farmers, it may lack exclusive perks like forgiveness or modified car coverage. Check the Progressive auto insurance review for pricing and features.

Yes, reading Farmers Insurance reviews helps you understand how real customers rate claim handling, customer service, and policy satisfaction. Enter your ZIP code now to uncover better rates for Allstate vs. Farmers auto insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

You’ll see Progressive Insurance competing on price, but unlike Allstate and Farmers, it may lack exclusive perks like forgiveness or modified car coverage. Check the Progressive auto insurance review for pricing and features.

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.