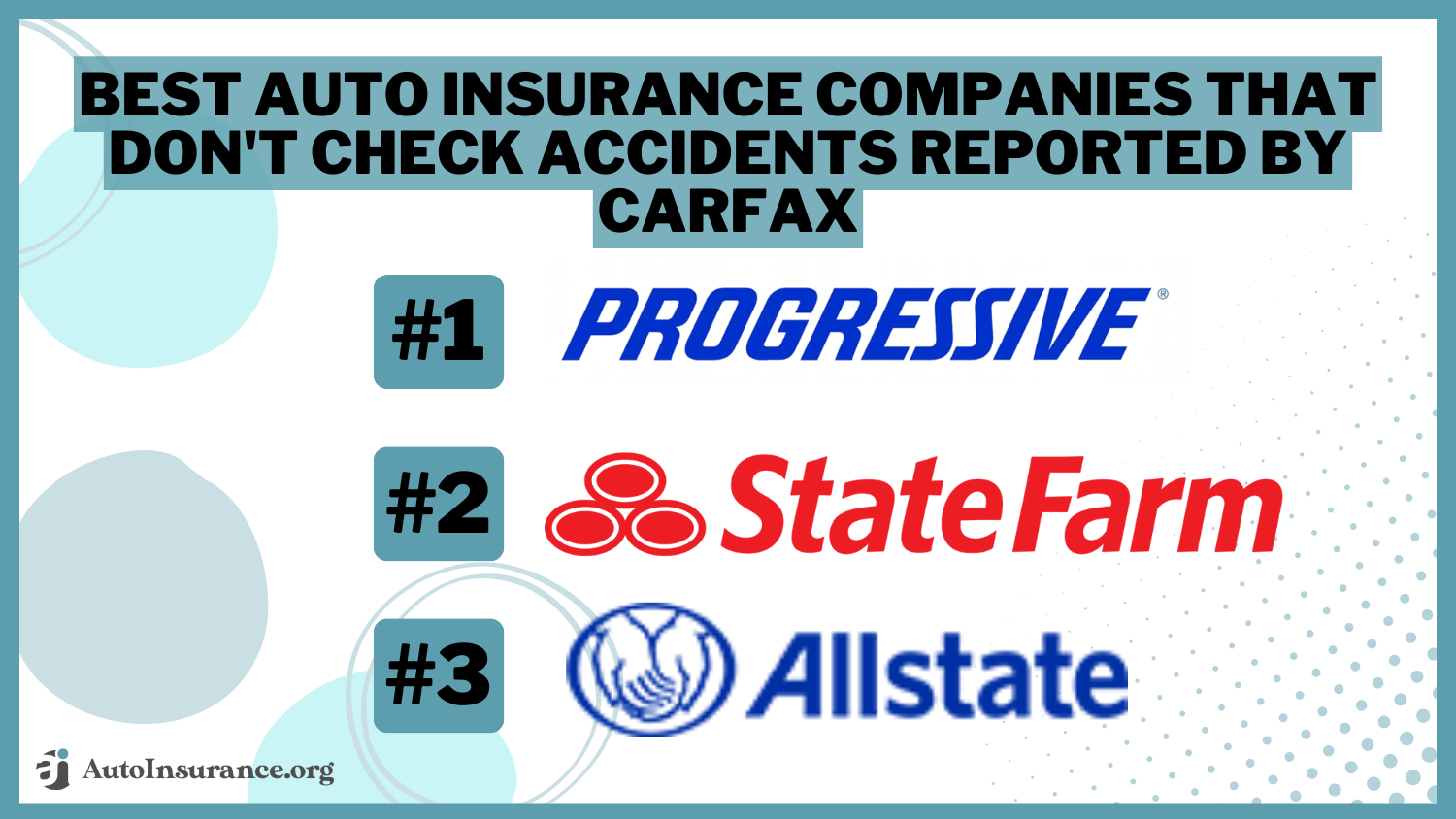

10 Best Auto Insurance Companies That Don’t Check Accidents Reported by CARFAX in 2025

Progressive, State Farm, and Allstate are the best auto insurance companies that don't check accidents reported by CARFAX, with minimum coverage rates starting from $100/mo. If you have been in an accident but still want to keep your insurance rates low, these companies are worth considering.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsThe best auto insurance companies that don’t check accidents reported by CARFAX are Progressive, State Farm, and Allstate. Progressive has the cheapest minimum coverage rates at an average of $100 monthly.

Many drivers look for ways to lower their auto insurance rates, including looking for auto insurance companies that don’t count accidents reported on CARFAX. If a car was previously in an accident, it presents a potential for risks to insurance providers and its drivers.

Our Top 10 Picks: Best Auto Insurance Companies That Don’t Check Accidents Reported by CARFAX

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Online Tools | Progressive | |

| #2 | 17% | B | Personalized Service | State Farm | |

| #3 | 25% | A+ | Discounts Available | Allstate | |

| #4 | 20% | A+ | Customer Satisfaction | Nationwide |

| #5 | 10% | A | Policy Discounts | Farmers | |

| #6 | 12% | A | Loyalty Discounts | Liberty Mutual |

| #7 | 20% | A | Financial Stability | American Family | |

| #8 | 8% | A++ | Coverage Options | Travelers | |

| #9 | 25% | A+ | Online Quotes | MetLife | |

| #10 | 25% | A++ | Digital Experience | Geico |

Keep reading to learn more about how accidents reported on CARFAX affect your rates and why. You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code above in our free quote comparison tool.

- Few auto insurance companies overlook accidents reported on CARFAX

- Auto insurance is pricier for cars with a past accident than those without

- If a CARFAX report lists a false accident, you can get the accident removed

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Pick Overall

Pros

- Online Tools: Progressive offers a variety of online tools to help you manage your policy, file claims, and track your claims status.

- Multi-Policy Discount: If you have multiple insurance policies with Progressive, such as home or renters insurance, you may be eligible for a multi-policy discount. Learn more about coverage options and monthly rates in our Progressive auto insurance company review.

- Three Distinct Accident Forgiveness Schemes: Progressive offers three different types of accident forgiveness programs, including one for those with multiple accidents on their record.

Cons

- Average Rankings for Customer Service: Progressive Insurance gets mixed reviews for customer service, a concern for those valuing support and quick responses.

- Least Likely To Be Renewed Compared to Others: Studies and surveys have shown that Progressive has lower renewal rates compared to other insurers.

#2 – State Farm: Best for Personalized Service

Pros

- Personalized Service: State Farm has a large network of agents who provide personalized service and can assist you with your insurance needs.

- Good Student Discount: If you have a student on your policy who maintains good grades, State Farm offers a discount for their academic achievement. Learn more here: State Farm Auto Insurance Review.

- Wide Agent Network: State Farm has a wide network of professionals to assist with your insurance needs.

Cons

- Higher Rates for Teen Drivers: In some areas, State Farm’s rates for teenage drivers can be higher than other insurers.

- Limited Online Options: While State Farm does have online tools and a mobile app, their digital offerings are more limited compared to other insurers.

#3 – Allstate: Best for Discounts Available

Pros

- Diverse Coverage Options. Allstate Insurance offers various coverage alternatives, including unique options like new car replacement and safe driving bonuses every six months. Find more information about Allstate’s rates in our review of Allstate insurance.

- Simplified Policy Setup. Allstate makes starting a new insurance policy straightforward, streamlining the process through efficient online tools and customer support.

- Rideshare Insurance Coverage. Allstate provides specialized auto insurance for rideshare drivers in several states, catering specifically to those who drive for companies like Uber and Lyft.

Cons

- Higher Costs for High Mileage Drivers. Allstate’s pricing structure can be costly for drivers who log a lot of miles annually.

- Limited Online Services: Allstate’s online presence and options lag behind other insurers, offering less convenience for digitally-inclined customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Customer Satisfaction

Pros

- Affordable Family and Senior Driver Rates. Nationwide offers some of the lowest rates for parents, adding a sixteen-year-old to their policy, and for senior drivers, making it an economical choice for families and older individuals.

- Valuable Loyalty Perks. Nationwide insurance rewards its loyal customers with generous extras like replacement car keys, pet injury coverage, and forgiveness for minor accidents.

- Competitive Post-Incident Rates. Nationwide provides competitive insurance rates for drivers recently involved in an accident or received a speeding ticket. Find out if Nationwide might have the lowest rates for you in our Nationwide auto insurance review.

Cons

- Mediocre Collision Repair Ratings. Nationwide’s collision repair processes have received a mediocre grade of C from industry professionals.

- High DUI-Related Premiums. Nationwide tends to charge higher premiums for drivers with a DUI on their record.

#5 – Farmers: Best for Policy Discounts

Pros

- Generous Discount Offerings. Farmers offer a wide array of discounts that can significantly lower insurance costs, including multi-vehicle discounts and reduced rates for eco-friendly vehicles.

- Extensive Coverage Options. Farmers Insurance provides an excellent range of add-ons and coverage possibilities which you can learn more about in our Farmers auto insurance review .

- High Customer Satisfaction. Farmers Insurance scores above average in customer satisfaction for purchasing policies and filing claims.

Cons

- Slower Roadside Assistance. Some customers have reported dissatisfaction with Farmers Insurance’s roadside assistance, citing slower response times than expected.

- Higher Than Average Premiums. Farmers Insurance tends to have higher rates across all driver categories compared to the national average.

#6 – Liberty Mutual: Best for Loyalty Discounts

Pros

- Competitive Pricing. Liberty Mutual offers better pricing than many competitors across various categories. You can learn more about Liberty Mutual’s pricing in our complete guide: Liberty Mutual Auto Insurance Review.

- Extensive Discounts for Young Drivers. Liberty Mutual stands out for its numerous discounts aimed at young drivers, including savings for good student records and completing driver training courses.

- Available Nationwide. Liberty Mutual provides auto insurance across the entire United States, ensuring that coverage is accessible regardless of where a customer lives.

Cons

- Average Service Ratings. Liberty Mutual has received middling ratings for claims processing and customer service.

- Higher Premiums. Despite offering competitive pricing in some categories, Liberty Mutual’s rates can be high, particularly for specific demographics or coverage options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – American Family: Best for Financial Stability

Pros

- Competitive Rates for High-Risk Drivers: American Family Auto Insurance offers average rates lower than many competitors for drivers with an at-fault accident or a speeding ticket on their records.

- Low Complaint Ratio: American Family has fewer customer complaints than expected for a company of its size, indicating higher customer satisfaction and reliability.

- Diverse Coverage Options: American Family provides various coverage types, allowing customers to tailor their policies to meet specific needs.

Cons

- Limited Digital Features: American Family Auto Insurance’s digital experience may not be as user-friendly as some competitors offer. Find out more about American Family in our American Family review.

- Restricted Availability: American Family offers its auto insurance services in only 19 states.

#8 – Travelers: Best for Coverage Options

Pros

- Multiple Accident Forgiveness Options. Travelers Auto Insurance provides two distinct accident forgiveness plans, which can prevent premium increases after a first or minor accident. Read our full review of Travelers insurance for more information.

- Exceptional Financial Strength. Travelers Insurance has earned an A++ rating from AM Best, indicating superior financial health and a solid ability to meet its insurance obligations.

- New Car Replacement Coverage. Travelers offer new car replacement insurance, which means if your new vehicle is totaled, it will be replaced with a brand-new model of a similar make and specifications.

Cons

- Limited Rideshare Coverage. Travelers Auto Insurance does not offer rideshare insurance in most states, which can be a significant drawback for drivers who use their vehicles for ridesharing services like Uber or Lyft.

- Geographic Discount Variability. The discounts available through Travelers can vary significantly based on location, potentially disadvantaging customers in certain regions.

#9 – MetLife: Best for Online Quotes

Pros

- Single Deductible for Combined Policies. MetLife offers an attractive feature where customers who purchase both home and auto insurance can benefit from a single deductible for claims involving both policies.

- Versatile Coverage Options. MetLife provides a diverse range of coverage options, modern features, and additional add-ons, allowing customers to customize their insurance to meet specific needs. Explore our MetLife auto insurance review to find out which coverage is best for you.

- Convenient Online Quotes: You can easily get a quote and purchase a policy online with MetLife.

Cons

- Subpar Shopping Experience. MetLife Auto Insurance has received below-average ratings for customer satisfaction during the auto insurance shopping process.

- Limited Customer Support Hours. Unlike some competitors, MetLife does not offer 24/7 customer support.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Geico: Best for Digital Experience

Pros

- Quick and Easy Online Quotes. Geico’s online quoting process is straightforward, user-friendly, and typically provides a quote in minutes.

- Generous Policy Limits. Geico offers high policy limits, providing customers with extensive coverage options that can protect against significant financial losses in the event of major accidents.

- Competitive Pricing. Geico is known for offering low car insurance rates for most drivers, making it an affordable option across a broad demographic spectrum. Check out our Geico review to learn more.

Cons

- Lack of Gap Insurance Coverage. Geico does not offer gap insurance.

- Less Competitive Rates for High-Risk Drivers. While Geico typically offers low rates, it may not always be the cheapest option for individuals with poor credit or recent accidents.

Auto Insurance Companies That Don’t Count Accidents Reported on CARFAX

Most auto insurance companies count accidents reported on CARFAX because it’s a reliable source. Insurers will check your driving history, personal facts, and car history report. Auto insurance companies are businesses that want to avoid costly risks. If you present any potential risk, including a vehicle with damage history, your rates will reflect those risks.

Though CARFAX has a reputation for reliable vehicle history reports, not every accident appears on its reports.

Usually, an accident won’t appear on CARFAX if the driver doesn’t call the police or if CARFAX can’t access the police department’s record system. In some cases, drivers may not file a report or car insurance claim, as it may be cheaper for them to pay for damages out-of-pocket rather than risk higher insurance rates for years.

Another common situation is a time delay in reporting an accident to CARFAX.

Many people buy a car based on a clean CARFAX report only to find out later that it was involved in a significant accident.

To avoid making that mistake, look at the CARFAX report and car inspection, and perform a test drive before buying a used vehicle. You can look up a car’s history report and CARFAX value using the CARFAX VIN checks online.

Finally, talk with your insurance company to ensure you have the right coverage. Understanding the different types of auto insurance coverage and comparing rates from multiple companies will help your search.

Understanding a CARFAX Report

What counts as an accident on CARFAX?

Understanding the difference between damage reported vs. accidents on CARFAX reports can be a little confusing. Damage doesn’t have to be caused by a collision — it can be cosmetic damage, such as scratches or scrapes caused by regular use, bumper dents from backing into a pole or other object, or anything that resulted in minor damage. Anything listed as an accident on CARFAX typically involved another vehicle and was reported to the police.

Less than stellar driving record😟? You may not be stuck paying exorbitant 💵car insurance rates. https://t.co/27f1xf131D has the help you need. Check it out here👉: https://t.co/SdUkCTmuvX pic.twitter.com/rGDbPVSST0

— AutoInsurance.org (@AutoInsurance) April 18, 2024

While CARFAX reports may show that an accident occurred, the report may not tell you the details, such as the damages incurred and if the accident was severe. To learn the details of a vehicular incident, consider utilizing a Comprehensive Loss Underwriting Exchange (CLUE) report along with your CARFAX report. The CLUE report shows any insurance claim associated with a vehicle, even if the driver didn’t file a police report. You can learn how to check your CLUE report in our guide.

How does an accident reported to CARFAX affect you?

You’ll be affected in several ways if your vehicle has an accident history, regardless of whether or not you were the one behind the wheel when it happened. The best auto insurance companies for drivers with accidents vary by driver.

An accident raises your auto insurance rates. While some insurance companies may overlook your first accident, most raise your rates for the next three years.

This table shows how much one accident affects your car insurance rates.

Full Coverage Auto Insurance Monthly Rates With One Accident by Provider

Insurance Company Clean Record One Accident Rate Increase

Allstate $86 $225 $139

American Family $117 $176 $59

Farmers $139 $198 $59

Geico $80 $132 $52

Liberty Mutual $174 $234 $61

Nationwide $115 $161 $47

Progressive $105 $186 $81

State Farm $86 $102 $16

Travelers $99 $139 $40

USAA $59 $78 $19

You can expect your insurance rates to increase an average of $81 a month after one accident. If you have more than one accident, your rates increase significantly. In many cases, you’ll also lose certain auto insurance savings, such as claims-free and safe driver discounts, resulting in a rate increase.

An accident on your vehicle’s CARFAX record also lowers its resale value. If you’re actively trying to sell your vehicle when the report updates, buyers could lower their offer on your car.

How to Remove an Accident From CARFAX

An accident usually stays on a car’s CARFAX report for up to three years after the incident occurred. Sometimes, CARFAX’s vehicle history reports list accidents that never happened. In this case, you can submit evidence to the CARFAX corrections claim center online.

In the event you can’t provide evidence enough to clear the incident from your record, you may be able to wait until the report clears.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Save on Auto Insurance With Companies That Count Accidents Reported on CARFAX

A significant number of auto insurance providers reference CARFAX when assembling a policy quote. CARFAX is favored for its reputation and detailed background profiles on cars, so there aren’t many auto insurance companies that don’t count accidents reported on Carfax.

Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $120 | $230 |

| American Family | $110 | $215 |

| Farmers | $115 | $225 |

| Geico | $95 | $190 |

| Liberty Mutual | $125 | $240 |

| MetLife | $130 | $250 |

| Nationwide | $105 | $210 |

| Progressive | $100 | $200 |

| State Farm | $110 | $220 |

| Travelers | $115 | $220 |

If your vehicle was previously in an accident, insurers may view it as a greater liability to them since there’s a chance the car could have an unreported problem, need extra maintenance, or otherwise cause you to file a claim later. There are ways to save money if your car is high risk and you’re with a company that counts accidents reported on CARFAX.

The best way to lower your auto insurance rates is to shop around.

Comparing at least three quotes from different auto insurance companies helps you know what to expect and narrows down your options.Scott W. Johnson Licensed Insurance Agent

Another option is to look into what auto insurance discounts are available to you. Most of the time, companies offer discounts that many drivers are unaware exist.

Discounts can save you a ton of money, especially if your car was previously in an accident and your auto insurance company counts accidents reported on CARFAX.

The table below details common auto insurance discounts for eligible drivers.

You can also look into getting an accident removed from CARFAX. If a CARFAX report lists a false accident, you can get the accident removed to save you money.

Auto Insurance Companies That Don’t Count CARFAX Reports

Finding auto insurance companies that don’t count accidents reported on CARFAX is challenging but not impossible. Auto insurance companies seek to pay as little as possible on claims. Most providers will account for accidents on a CARFAX vehicle history report and raise your rates.

If your car has an accident on its history report, you can save money by looking into discounts and shopping around.

As you shop around, compare auto insurance quotes from auto insurance companies that don’t count accidents reported on CARFAX against ones that do. You might find a reputable provider that can offer you affordable rates regardless of a CARFAX report. Explore your auto insurance options by entering your ZIP code into our free comparison tool below today

Frequently Asked Questions

Are there auto insurance companies that don’t check accidents reported by CARFAX?

Yes, some auto insurance companies do not rely solely on CARFAX reports to assess a vehicle’s accident history when determining insurance rates or coverage. These companies may use alternative methods or databases to evaluate a vehicle’s past accidents and claims history. However, it’s important to note that insurance companies have their own processes for evaluating risk, and they may consider various factors beyond CARFAX reports. Read more about the non-driving factors that may affect auto insurance rates.

Why do some insurance companies not rely on CARFAX reports for accident history?

Insurance companies may use their own databases, industry sources, or other means to assess a vehicle’s accident history. While CARFAX reports can provide valuable information, they are not the only source available. Insurance companies have their own underwriting guidelines and risk assessment models, and they may consider additional factors, such as driver history, claims history, and other industry databases, to determine rates and coverage.

Can you report accidents on other people’s vehicles to Carfax report?

No, individuals cannot report accidents on other people’s vehicles to CARFAX. CARFAX compiles vehicle history reports using information from auto insurance claims, repair facilities, and law enforcement records. CARFAX does not accept personal accident reports for claims.

What other factors do insurance companies consider besides CARFAX reports when assessing accident history?

Insurance companies consider multiple factors when assessing accident history, which may include:

- Claims History: Insurers review the insured’s claims history to determine if there have been previous accidents or claims filed.

- Driver’s History: Insurance companies assess the driver’s personal accident history, including any at-fault accidents or traffic violations.

- Vehicle Inspection: Some insurance companies may request a physical inspection of the vehicle to assess its condition and look for signs of previous

Read more: Best Auto Insurance Companies That Don’t Require Vehicle Inspection.

This information helps insurance companies determine the level of risk a driver and their vehicle may pose, which ultimately impacts rates.

Are there any downsides to insurance companies not checking CARFAX reports for accidents?

While insurance companies may not heavily rely on CARFAX reports, there can be potential downsides to not considering this information. CARFAX reports provide a comprehensive record of a vehicle’s reported accidents, damage, and other historical details. Without checking CARFAX reports, insurance companies may have limited visibility into the vehicle’s full accident history, which can affect their ability to accurately assess risk and determine appropriate rates.

Can I provide other documentation to prove a vehicle’s accident history if an insurance company doesn’t check CARFAX reports?

Yes, you may be able to provide alternative documentation to prove a vehicle’s accident history if an insurance company doesn’t rely on CARFAX reports. Some examples of alternative documentation include repair records, police reports, or receipts for previous repairs or bodywork. It’s important to consult with the insurance company directly to understand their specific requirements and what documentation they accept as proof of a vehicle’s accident history.

How accurate is Carfax?

Carfax reports may not always provide detailed or contextual information, which can lead to potentially misleading interpretations. For instance, both major accidents and minor incidents are recorded similarly, without clear distinctions regarding the severity of the damage. This lack of detail can affect the accuracy of how accidents are reported to Carfax.

Do insurance companies report to Carfax?

Do insurance companies report accidents to Carfax? Insurance companies do not directly report accidents to Carfax. However, Carfax may obtain accident information from police reports and other public records. Therefore, details of an accident could still appear on a Carfax report even if not directly reported by the insurance company. Read more: Do auto insurance companies check police records?

Does progressive report to Carfax?

No, Progressive does not directly report accident information to Carfax. Carfax typically gathers data from police reports, repair shops, and other sources to compile its vehicle histories. Thus, an accident may appear on a Carfax report based on other collected data, not directly from Progressive auto insurance.

Does a fender bender count as an accident on Carfax?

A fender bender will only appear on a Carfax vehicle history report if there is official documentation of the incident. However, if the minor accident resulted in substantial damage, this more serious issue could be reflected in the report.

Do all accidents get reported to Carfax?

Not all accidents are reported to Carfax. While Carfax gathers accident information from thousands of sources, there are instances where accidents or damage events are not reported, or the details are not provided to Carfax. Thus, an accident report may not always appear on a Carfax vehicle history report.

Do comprehensive claims show up on Carfax?

Yes, comprehensive claims can show up on a Carfax report. Carfax collects data on various types of insurance claims, including those related to comprehensive coverage. However, including such claims in a Carfax report depends on the information being reported to Carfax by insurance companies. Read auto insurance comprehensive claim defined to learn more.

Who reports accidents to Carfax?

So, who reports damage to Carfax? Carfax receives accident information from insurance companies when a damage claim is made. If an accident is not reported to an insurance company or law enforcement, it will not appear on a Carfax report. Therefore, reporting damage to Carfax is contingent on formal notifications by these entities.

Does State Farm report to Carfax?

No, State Farm generally does not report insurance losses directly to Carfax. Insurance companies typically do not have a direct reporting relationship with Carfax.

Does Geico offer free Carfax?

No, Geico auto insurance does not offer free Carfax reports. Customers looking to obtain a Carfax report need to purchase one directly from Carfax or get it through another source. Geico provides insurance services but does not include free Carfax reports as part of its offerings.

Can you report accidents on other people’s vehicles to CARFAX report?

No, you cannot report accidents on other people’s vehicles to CARFAX. While the exact mechanism for reporting accidents to CARFAX is managed primarily through their network of sources.

How do I find auto insurance companies that don’t check CARFAX reports for accidents?

To find auto insurance companies that don’t heavily rely on CARFAX reports for accidents, you can:

- Research and inquire. Research insurance companies and their underwriting policies regarding accident history. Contact insurance companies directly and ask about their methods for evaluating a vehicle’s accident history during the underwriting process.

- Seek recommendations. Reach out to insurance agents or brokers who work with multiple insurance companies. They can provide insights into companies that have more lenient accident history requirements.

- Consider non-standard insurers. Non-standard auto insurance companies offer high-risk coverage and may be more flexible regarding CARFAX reports.

Research and seeking expert recommendations can help you find the best auto insurance company that doesn’t rely heavily on CARFAX reports for accidents.

How long does it take for CARFAX to update?

Data from state title agencies, police reports, and repair shops typically can take a few days up to several weeks to be reflected in a Carfax report. Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.