Rivian Auto Insurance Review for 2025 (See if They’re a Good Fit)

Use this Rivian auto insurance review to explore special coverage starting from $75/month for people who own a Rivian. Drive+ rewards safe driving with premium discounts, while coverage options extend to home and recreational vehicles, offering Rivian drivers enhanced protection and flexibility.

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviews

Rivian

Average Monthly Rate For Good Drivers

$75A.M. Best Rating:

A+Complaint Level:

LowPros

- Insurance tailored for Rivian electric vehicles

- Discounts are available for using Drive+ automated technology

- Coverage includes options for additional assets like a home, camper, and boat

Cons

- Only available for Rivian vehicle owners

- No direct quote option is available online

Our Rivian auto insurance review highlights how Rivian’s specialized coverage meets the unique needs of electric vehicle owners, combining exclusive benefits with advanced technology integration.

Designed with exclusive benefits, Rivian Insurance partners with established underwriters like Nationwide, one of the best auto insurance companies, to offer policies that align with advanced EV technology.

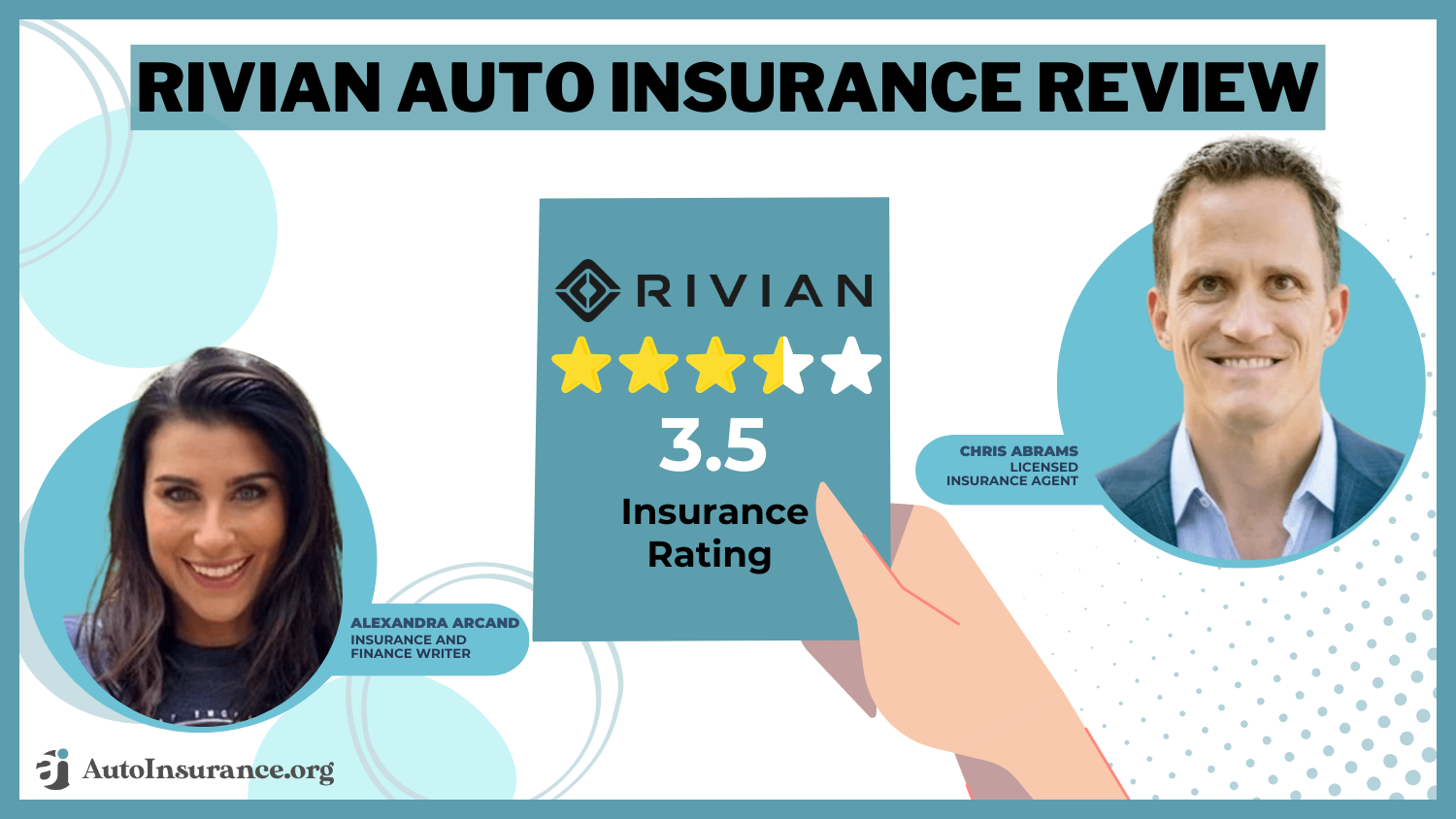

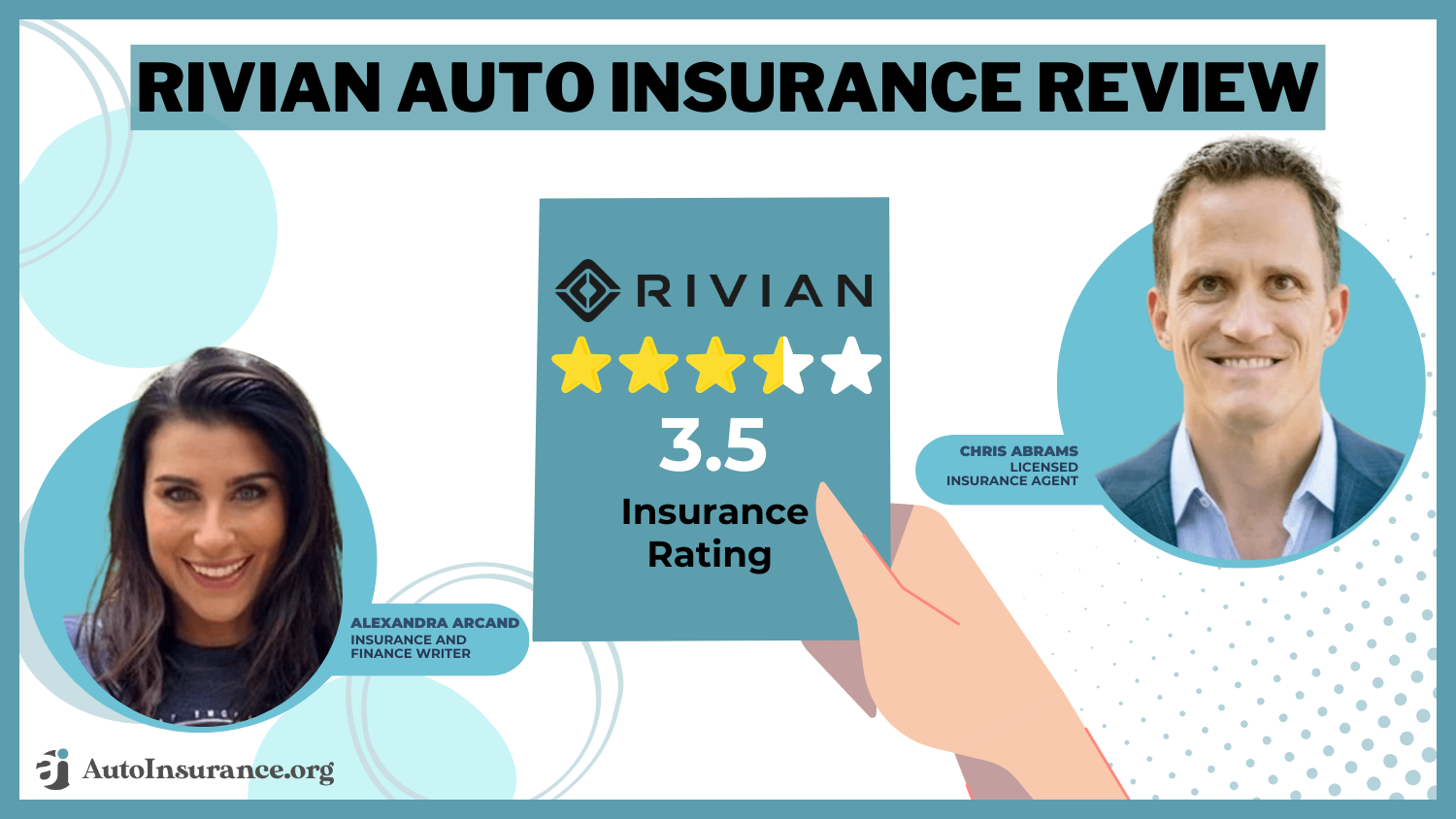

Rivian Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.5 |

| Business Reviews | 3.0 |

| Claim Processing | 3.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 4.7 |

| Coverage Value | 3.0 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 3.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.7 |

| Plan Personalization | 3.5 |

| Policy Options | 2.5 |

| Savings Potential | 4.1 |

With its Drive+ program, Rivian offers special prices for drivers who drive safely and use automatic safety systems to lower risks.

This insurance also covers more than just cars; it includes homes and fun vehicles, so people who own a Rivian get full and flexible protection. Use our free comparison tool to see what auto insurance quotes look like in your area.

- Rivian auto insurance holds an A+ rating for financial strength

- Drive+ rewards safe driving, adding value for Rivian owners

- Coverage includes home and recreational vehicles for added protection

Understanding Rivian Insurance Rate

Here’s a look at Rivian auto insurance rates broken down by age, gender, and coverage level. This table gives you a sense of how premiums can change depending on these factors.

Rivian Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $180 | $320 |

| Age: 16 Male | $190 | $340 |

| Age: 18 Female | $170 | $300 |

| Age: 18 Male | $180 | $320 |

| Age: 25 Female | $120 | $220 |

| Age: 25 Male | $130 | $230 |

| Age: 30 Female | $110 | $210 |

| Age: 30 Male | $120 | $220 |

| Age: 45 Female | $90 | $170 |

| Age: 45 Male | $100 | $180 |

| Age: 60 Female | $80 | $150 |

| Age: 60 Male | $90 | $160 |

| Age: 65 Female | $75 | $140 |

| Age: 65 Male | $85 | $150 |

Young drivers tend to see higher rates, with 16-year-old males paying around $190 for minimum coverage and up to $340 for full coverage auto insurance. As drivers get older, costs generally drop—by age 45, a female driver might pay as low as $90 for minimum coverage.

Gender also makes a difference, with males usually paying a bit more than females across age groups. This breakdown helps Rivian drivers estimate what they might pay based on age and coverage needs.

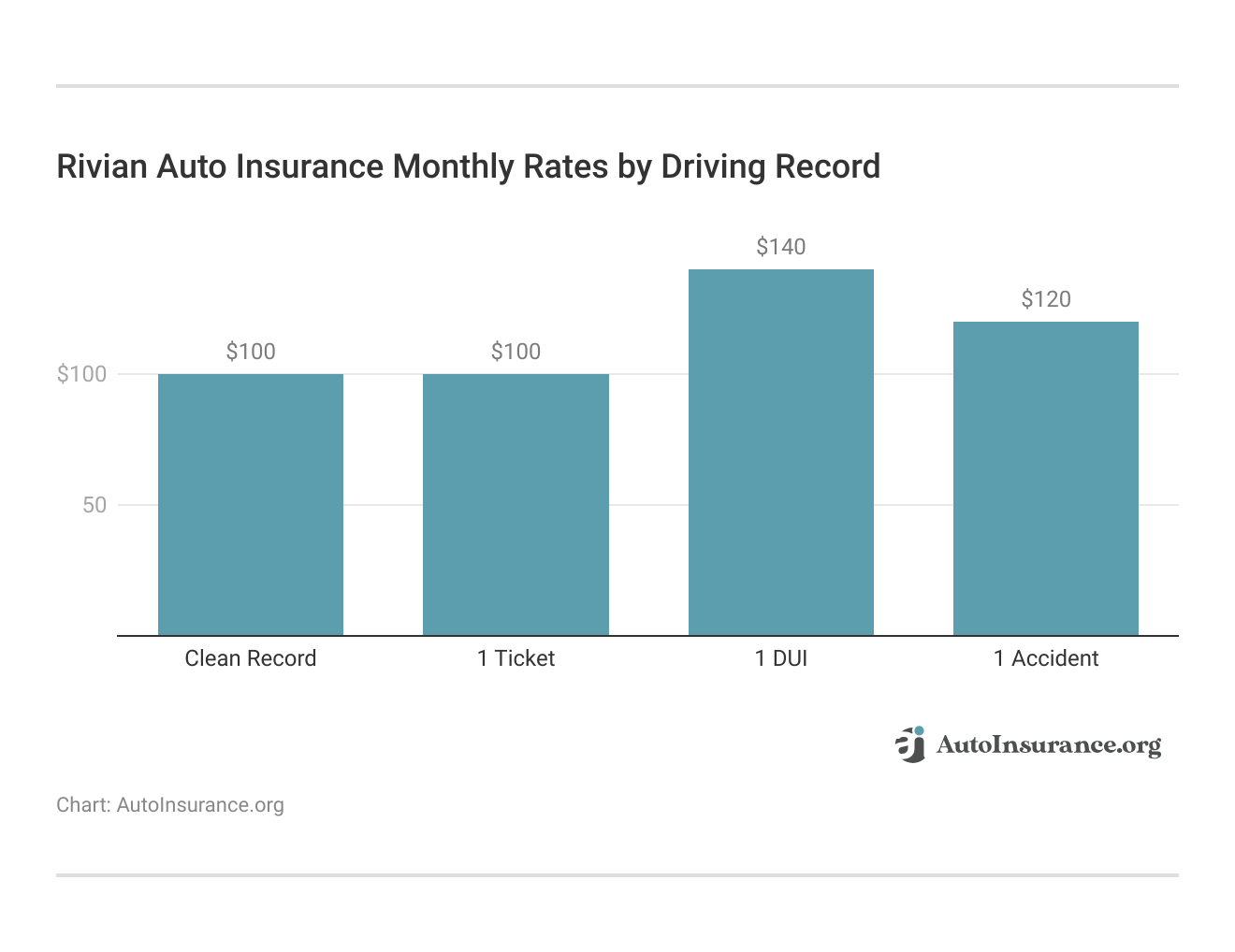

Rivian auto insurance rates change significantly depending on your driving record, with clean drivers getting the best minimum and full coverage deals. However, a single ticket or accident can quickly raise those monthly costs.

Knowing how your driving history impacts Rivian insurance rates can help you save more in the long run. Keep a clean record to score the lowest premiums and get the most out of your coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Rivian Auto Insurance Availability

Rivian Auto Insurance Solutions will be available in 48 states and will quickly add more states. However, you need help getting Rivian auto insurance quotes online, and it appears the company is just in the beginning stages of offering insurance. Even though Rivian is new to the insurance game, its underwriters have been around for a long time and are well-respected.

Although Rivian auto insurance rates aren’t available, we have Nationwide rates that can give you an idea of what to expect. Many factors that affect auto insurance rates, including your driving record.

This table shows average monthly rates based on driving records from Nationwide and other top companies, which you can compare.

Rivian Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $160 | $188 | $225 | $270 | |

| $139 | $173 | $198 | $193 | |

| $80 | $106 | $132 | $216 | |

| $174 | $212 | $234 | $313 |

| $115 | $137 | $161 | $469 |

| $105 | $140 | $186 | $140 | |

| $150 | $190 | $210 | $310 | |

| $297 | $352 | $324 | $324 | |

| $99 | $134 | $139 | $206 | |

| $59 | $67 | $78 | $108 |

Rivian’s electric vehicles with Drive+ aim to improve your driving record by helping you avoid accidents and stop poor driving habits. In addition to standard auto insurance coverage, Rivian will also offer insurance for your home, boat, camper, and other recreational vehicles.

For Rivian owners, this insurance extends beyond car coverage, protecting homes and recreational vehicles.Kristen Gryglik Licensed Insurance Agent

Rivian’s electric vehicles with Drive+ aim to improve your driving record by helping you avoid accidents and stop poor driving habits. In addition to standard auto insurance coverage, Rivian will also offer insurance for your home, boat, camper, and other recreational vehicles.

Exploring Rivian’s Insurance Coverage Options

Rivian Insurance Services has plenty of coverage options to suit different needs. Here’s a quick look at what’s available, from basic coverage to extras for peace of mind.

Rivian Auto Insurance Coverage Options

| Coverage | Description |

|---|---|

| Collision | Covers collision damage |

| Comprehensive | Non-collision incident coverage |

| Custom Parts | Covers vehicle modifications |

| Gap Insurance | Covers loan/lease balance |

| Liability | Injury, property damage coverage |

| Personal Injury Protection | Medical expenses coverage |

| Rental Reimbursement | Covers rental car costs |

| Roadside Assistance | Emergency vehicle assistance |

| Uninsured Motorist | Covers uninsured accidents |

Collision insurance covers damage from accidents, while comprehensive steps in for things like theft or weather-related damage. If you’ve added custom parts, that coverage protects your modifications. Gap insurance is great for anyone financing, covering the gap between your car’s value and loan balance if it’s totaled.

Standard options like liability and personal injury protection auto insurance help with medical costs and property damage. Extras like rental reimbursement, roadside assistance, and uninsured motorist coverage keep you covered when surprises pop up.

Rivian Insurance Costs

Our analysis of auto insurance indicates that Rivian is an electric vehicle manufacturer expanding its product line to include auto insurance. There is no Rivian vehicle insurance company. Nationwide Insurance underwrites Rivian’s products.

Rivian Auto Insurance will use integrated telematics to help calculate and compare auto insurance rates. Drive+ can automatically change lanes, brake, and steer for drivers.

Rivian Auto Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 45 Female | Age: 45 Male |

|---|---|---|

| $162 | $160 | |

| $139 | $139 | |

| $80 | $80 | |

| $171 | $174 |

| $113 | $115 |

| $112 | $105 | |

| $190 | $190 | |

| $86 | $86 | |

| $98 | $99 | |

| $59 | $59 |

According to Rivian Insurance, Drive+ will significantly increase driver safety, and users who frequently utilize the technology might receive reduced premiums. According to the National Highway Traffic Safety Administration, various degrees of automated driving have unique advantages and disadvantages.

The cost of Rivian Insurance will change based on many things. Different states have rules about what kinds of automated driving are allowed and who is at fault if there is an accident. This is where auto insurance can get tricky.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Cancel Rivian Insurance

Since Rivian auto insurance is provided through Nationwide and other underwriters, you’ll need to follow the cancellation policy specific to your underwriter when you decide to cancel auto insurance.

However, there are certain steps that you will need to follow no matter which company you are insured with. Common steps to canceling your auto insurance policy are:

- Learn when your current policy expires. You may be charged a cancelation fee depending on which insurance company underwriters your policy. Waiting until your policy expires will help you avoid those fees.

- Shop around for new coverage. Every company will weigh your personal factors differently and offer different rates.

- Get your new coverage started. Pick your new company and new coverage. Decide when you want your policy to go into effect.

- Cancel your Rivian auto insurance. Set your cancelation date for a couple of days after your new policy goes into effect to avoid a lapse in coverage.

- Follow up with your old auto insurance company to make sure your policy has been canceled and to see if you are due a refund.

Every auto insurance company will have its own cancellation process in place, so be sure to get all of the details before you begin shopping for new coverage.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How to File a Rivian Insurance Claim

Like canceling your coverage, each underwriter has its process when you need to file an auto insurance claim. You can begin the claims process online or through an app.

However, ensure you have all the information you need to file your claim, such as a police report and pictures of the damage. Rivian Auto Insurance Solutions offers in-house repairs to ensure your vehicle is repaired correctly and quickly.

Rivian Auto Insurance Discounts

Since Rivian Insurance partners with Nationwide and other companies as underwriters, drivers may qualify for some of the best auto insurance discounts available through these providers.

This table shows you available Nationwide discounts that Rivian customers should be eligible for as well as discounts from other top companies. The amount of the discount is listed if it is known.

Rivian Auto Insurance Discounts by Savings Potential

| Discount | |

|---|---|

| Multi-Vehicle | 25% |

| Safe Driver | 20% |

| Anti-Theft Device | 15% |

| Good Student | 15% |

| Military | 15% |

| Defensive Driving Course | 10% |

| Electric Vehicle | 10% |

| Low Mileage | 10% |

| Pay-in-Full | 10% |

| Autopay | 5% |

Even if auto insurance rates are higher with another company, discounts may lower the rates significantly. Rivian also offers drivers a discount for using the Driver+ function. The more a driver uses the automation feature, the higher the discount.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Rivian Auto Insurance Ratings

Rivian insurance reviews suggest that because the company is so new, it does not have A.M. Best or Better Business Bureau (BBB) ratings. However, you can check out our Nationwide auto insurance review to assess the quality of Rivian’s underwriter.

A.M. Best ranks companies based on financial stability. Nationwide received an A+ showing a superior ability to meet financial obligations.

Rivian Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 745 / 1,000 Slightly Above Avg. Satisfaction |

|

| Score: A+ Strong Customer Service |

|

| Score: 76/100 Good Overall Performance |

|

| Score: 0.95 Below Avg. Complaints |

|

| Score: A+ Strong Financial Stability |

The BBB ranks companies based on customer interaction. Nationwide received an A+ rating and is accredited. While these rankings don’t reflect how Rivian will perform, they can offer drivers peace of mind that their auto insurance needs will be met.

Rivian Auto Insurance: Pros and Cons Breakdown

Rivian Insurance brings unique perks, especially for EV drivers who want coverage tailored to their vehicle and driving habits.

- Great Rates for EV Drivers: Rivian offers competitive rates for electric vehicle owners, with Drive+ discounts for safe driving.

- Built-in Safety Benefits: The Drive+ program rewards drivers who use Rivian’s automated safety features, helping to lower auto insurance premiums.

- Expanded Coverage Choices: Rivian insurance covers more than just cars—it also covers homes, recreational vehicles, and custom parts.

These perks make Rivian insurance a solid option for owners looking for coverage built around their vehicle and lifestyle.

Drivers under 25 years old often pay a fortune 💰for car insurance. If you fall into that age group, you don’t have to be stuck paying $500 a month. Check out 👀our guide and discover ways to save👉: https://t.co/KOghB0qyLF pic.twitter.com/4ORUZKj4Dv

— AutoInsurance.org (@AutoInsurance) October 30, 2024

Of course, a few downsides might only work for some, especially if you’re not already a Rivian driver.

- Only for Rivian Drivers: Rivian insurance is special for people who drive a Rivian, so others can’t get it.

- No Online Quotes: Quick quotes are not available online, so for information, you need to call or visit in person. This can be inconvenient and time-consuming.

These limitations mean Rivian Auto Insurance Solutions may not be the best fit for everyone, especially if you want broader access or online convenience.

This Reddit user, Proud-Project-4069, was pleasantly surprised to find that Rivian’s insurance through Nationwide wasn’t just cheaper than their State Farm policy—it also offered better coverage.

Comment

byu/PortlyPorcupine from discussion

inRivian

They ended up moving all their policies (auto, home, and umbrella) over to Nationwide and even added an extra $1 million to their umbrella coverage, all while saving money. They called the switch a “super pleasant surprise.”

Comprehensive Coverage for Rivian Owners

Rivian Insurance Services offers a unique, tailored approach for Rivian drivers, combining solid rates with perks like Drive+ that reward safe driving. While it’s only available to Rivian owners and doesn’t provide online quotes, it includes coverage beyond just car insurance—protecting the home, recreational vehicles, and custom parts.

This insurance delivers flexibility and value for Rivian drivers who want specialized coverage with extra benefits. Younger drivers may see slightly higher rates, and broader access would help those outside the Rivian community.

Drivers using Drive+ automation can save up to 15% on premiums, making Nationwide the ideal partner for Rivian owners.Michelle Robbins Licensed Insurance Agent

For those looking to compare Rivian’s coverage with the cheapest auto insurance companies, it’s worth exploring all options to find the best fit. Use our free quote comparison tool to find affordable auto insurance in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is Rivian car insurance?

Rivian car insurance provides tailored coverage for Rivian EV owners. Options include custom parts, home, and recreational vehicles.

How can I get a Rivian insurance quote?

To obtain a Rivian insurance quote, contact Rivian Insurance Services or its underwriters directly, as online quoting is unavailable.

How much is the Rivian car insurance cost?

Rivian insurance typically starts around $75 per month, though exact rates depend on factors like recommended auto insurance coverage levels, driver history, and location.

Is Rivian insurance worth it?

Yes, Rivian insurance is worth it for EV owners seeking specialized coverage, Drive+ discounts, custom parts, and protection for outdoor gear.

What is the Rivian R1T insurance cost?

Rivian R1T insurance typically costs $75/month, with rates varying based on location, coverage, and driving history.

Which is better, Rivian insurance or Tesla insurance?

Rivian insurance offers Drive+ discounts and custom part coverage, while Tesla auto insurance focuses on usage-based pricing; both cater to EV owners.

What is the Rivian R1S insurance cost?

Rivian R1S insurance averages $75–$90/month, influenced by driver age, record, and selected coverage.

Does Rivian offer health insurance?

Rivian does not offer health insurance to customers but provides competitive health benefits to employees as part of their perks package.

Use our free quote comparison tool to protect your vehicle at the best prices.

Is Rivian insurance good?

Yes, Rivian auto insurance is considered good. It offers EV-specific coverage, Drive+ discounts, and backing from reputable underwriters like Nationwide.

What makes Rivian unique?

Rivian’s uniqueness lies in its commitment to adventure-oriented electric vehicles, integration of sustainability into its mission, and development of proprietary technologies tailored for outdoor enthusiasts.

Are Rivian’s expensive to insure?

Rivian insurance is competitively priced, especially for EV drivers, and offers options like auto insurance for new drivers, though younger drivers may see slightly higher rates.

What is the best insurance for Rivian?

Nationwide is considered the best insurance for Rivian, offering Drive+ discounts, custom part coverage, and affordable rates.

What are the Rivian employee benefits?

Rivian employee benefits include health insurance, retirement plans, stock options, and vehicle discounts for eligible employees.

What is Rivian roadside assistance?

Rivian roadside assistance plans provide emergency support for Rivian vehicle owners, including towing, battery jump-starts, and tire changes.

What does Rivian Automotive do?

Rivian Automotive designs, develops, and manufactures electric vehicles (EVs), including the R1T pickup truck and R1S SUV, emphasizing adventure and sustainability.

Who owns Rivian now?

Rivian is a publicly traded company with various institutional and individual shareholders. Primary stakeholders include Amazon and T. Rowe Price.

Is Rivian a good company?

Rivian is recognized for its innovative EVs, commitment to sustainability, and inclusion of auto insurance discounts for electric vehicles through its partnerships. However, like many startups, it faces financial challenges and market competition.

Are Rivian cars better than Tesla?

Rivian and Tesla offer distinct EVs catering to different preferences. Rivian focuses on adventure-oriented vehicles like the R1T and R1S, while Tesla provides a broader range of models emphasizing performance and technology.

What is the Rivian phone number?

The Rivian phone number can be found on their official website for inquiries about vehicles, insurance, or services.

Using our free comparison tool, you can find the best auto insurance rates.

Why is Rivian struggling?

Rivian faces hurdles such as production delays, supply chain disruptions, intense competition in the EV market, and the need for substantial capital investment.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.