Best Mitsubishi Mirage G4 Auto Insurance in 2025 (Top 10 Companies Ranked)

State Farm, AAA, and USAA offer the best Mitsubishi Mirage G4 auto insurance, with starting rates for as low as $49/month. These companies provide comprehensive coverage and excel in customer service, extensive discounts, and tailored policies, ensuring optimal protection for your Mitsubishi Mirage G4.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Mitsubishi Mirage G4

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Mitsubishi Mirage G4

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Mitsubishi Mirage G4

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews

Comparing multiple quotes from these best auto insurance companies will help you find the best deal for your Mitsubishi Mirage G4. Secure your coverage today to drive with peace of mind.

Our Top 10 Company Picks: Best Mitsubishi Mirage G4 Auto Insurance

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A++ | Many Discounts | State Farm | |

| #2 | 25% | A | Online App | AAA |

| #3 | 10% | A++ | Military Savings | USAA | |

| #4 | 12% | A+ | Online Convenience | Progressive | |

| #5 | 25% | A | Customizable Polices | Liberty Mutual |

| #6 | 20% | A+ | Usage Discount | Nationwide |

| #7 | 25% | A+ | Add-on Coverages | Allstate | |

| #8 | 20% | A | Local Agents | Farmers | |

| #9 | 8% | A++ | Accident Forgiveness | Travelers | |

| #10 | 25% | A++ | Custom Plan | Geico |

If you own a Mitsubishi Mirage G4, it’s essential to research and select the most suitable Mitsubishi auto insurance to safeguard your investment.

If you’re just looking for coverage to drive legally, enter your ZIP code above to compare cheap auto insurance quotes near you.

- Get the best Mitsubishi Mirage G4 auto insurance with rates at $49/month

- State Farm offers the best Mitsubishi Mirage G4 auto insurance

- Enjoy extensive discounts and tailored policies to meet your insurance needs

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

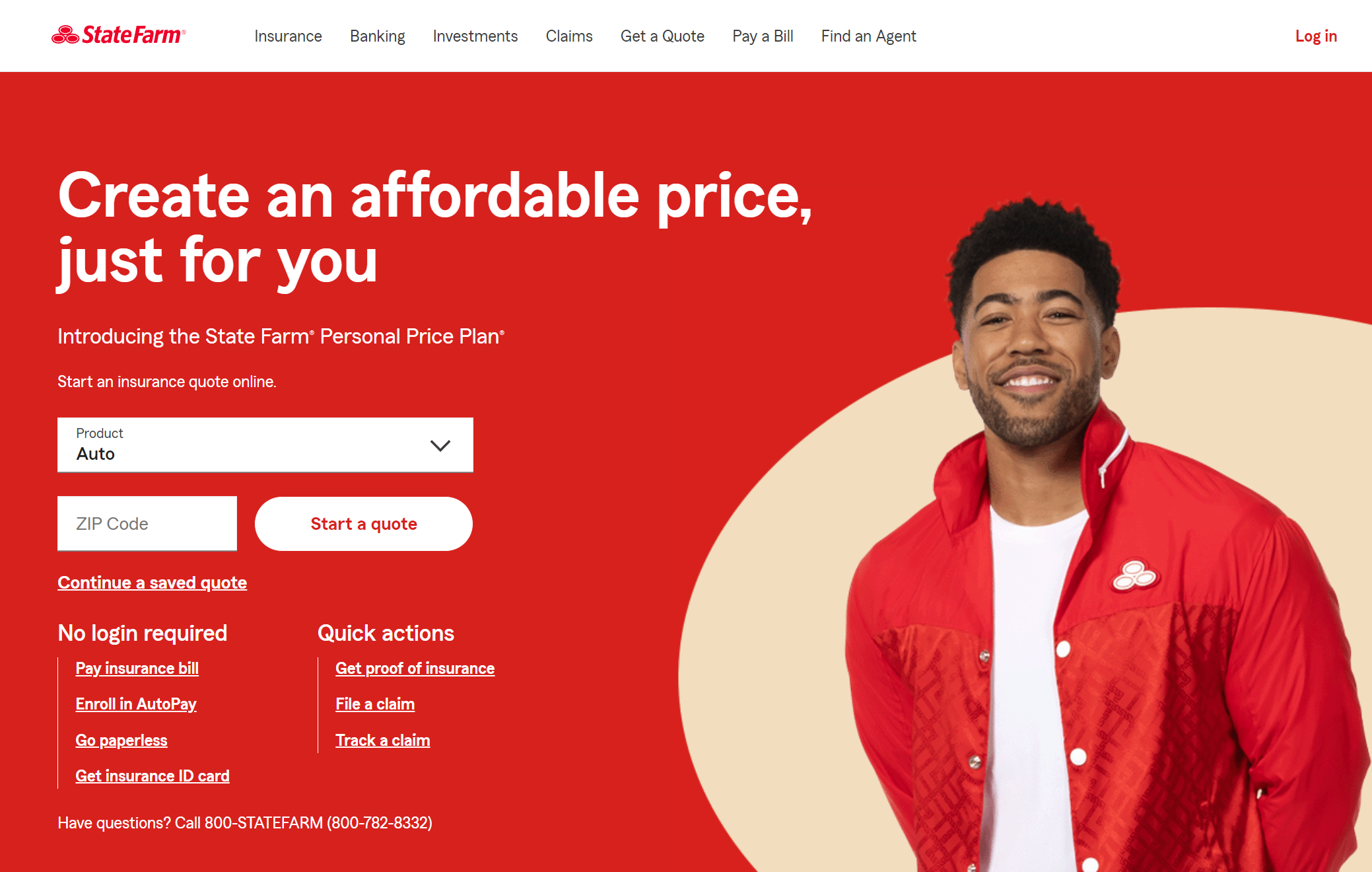

#1 – State Farm: Top Overall Pick

Pros

- Many Discounts: State Farm offers numerous discounts that can help reduce the overall insurance costs for the Mitsubishi Mirage G4.

- Low Monthly Rates: State Farm auto insurance review provides competitive monthly rates at $49 for the Mitsubishi Mirage G4 with minimum coverage.

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies, enhancing savings for Mitsubishi Mirage G4 owners.

Cons

- Limited Multi-Policy Discount: The multi-policy discount from State Farm is not as high compared to some competitors for the Mitsubishi Mirage G4.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels, potentially affecting Mitsubishi Mirage G4 owners.

#2 – AAA: Best for Online App

Pros

- Online App: AAA offers a highly rated online app, making it easy for Mitsubishi Mirage G4 owners to manage their policies and file claims.

- Competitive Rates: AAA auto insurance review provides competitive monthly rates at $56 for the Mitsubishi Mirage G4 with minimum coverage.

- Roadside Assistance: AAA’s insurance plans include comprehensive roadside assistance, benefiting Mitsubishi Mirage G4 drivers.

Cons

- Limited Availability: AAA insurance is not available in all states, which may limit options for Mitsubishi Mirage G4 owners.

- Membership Requirement: AAA requires membership for insurance coverage, adding an extra cost for Mitsubishi Mirage G4 owners.

#3 – USAA: Best for Military Savings

Pros

- Military Savings: USAA offers special discounts for military members and their families, making it affordable for Mitsubishi Mirage G4 owners.

- High Customer Satisfaction: USAA consistently receives high marks for customer service, ensuring Mitsubishi Mirage G4 drivers are well-supported.

- Affordable Rates: USAA auto insurance review provides competitive monthly rates at $71 for the Mitsubishi Mirage G4 with minimum coverage.

Cons

- Eligibility Restrictions: USAA is only available to military members, veterans, and their families, limiting access for other Mitsubishi Mirage G4 owners.

- Limited Local Presence: USAA has fewer local offices, which may be inconvenient for Mitsubishi Mirage G4 drivers who prefer in-person assistance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Online Convenience

Pros

- Online Convenience: Progressive’s online platform makes it easy to get quotes and manage policies for the Mitsubishi Mirage G4.

- Snapshot Program: Progressive offers the Snapshot program, which rewards safe driving habits with discounts for Mitsubishi Mirage G4 owners.

- Affordable Rates: Progressive auto insurance review provides competitive monthly rates at $39 for the Mitsubishi Mirage G4 with minimum coverage.

Cons

- Rate Increases: Some customers report rate increases after the first policy term, affecting Mitsubishi Mirage G4 owners.

- Customer Service: Progressive’s customer service ratings are mixed, which may concern some Mitsubishi Mirage G4 drivers.

#5 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual offers highly customizable policies, allowing Mitsubishi Mirage G4 owners to tailor their coverage.

- Accident Forgiveness: Liberty Mutual’s accident forgiveness program ensures that rates don’t increase after the first accident for Mitsubishi Mirage G4 drivers.

- Competitive Rates: Liberty Mutual auto insurance review provides competitive monthly rates at $69 for the Mitsubishi Mirage G4 with minimum coverage.

Cons

- High Initial Rates: Liberty Mutual’s initial rates can be higher compared to some competitors for the Mitsubishi Mirage G4.

- Discount Availability: Not all discounts are available in every state, which may limit savings for Mitsubishi Mirage G4 owners.

#6 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Nationwide’s SmartRide program offers discounts based on driving habits, benefiting safe Mitsubishi Mirage G4 drivers.

- Vanishing Deductible: Nationwide reduces deductibles for each year of safe driving, which can be advantageous for Mitsubishi Mirage G4 owners.

- Competitive Rates: Nationwide auto insurance review provides competitive monthly rates at $58 for the Mitsubishi Mirage G4 with minimum coverage.

Cons

- Fewer Local Agents: Nationwide has fewer local agents compared to some competitors, which may be inconvenient for Mitsubishi Mirage G4 drivers.

- Claims Process: Some customers report a slower claims process with Nationwide, potentially affecting Mitsubishi Mirage G4 owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Allstate: Best for Add-on Coverages

Pros

- Add-on Coverages: Allstate offers a wide range of add-on coverages, providing extra protection for Mitsubishi Mirage G4 owners.

- Accident Forgiveness: Allstate’s accident forgiveness program prevents rate increases after the first accident for Mitsubishi Mirage G4 drivers.

- Competitive Rates: Allstate auto insurance review provides competitive monthly rates at $61 for the Mitsubishi Mirage G4 with minimum coverage.

Cons

- High Premiums: Allstate’s premiums can be higher than some competitors for the Mitsubishi Mirage G4.

- Mixed Customer Service: Allstate’s customer service ratings vary, which may concern some Mitsubishi Mirage G4 drivers.

#8 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers offers personalized service through a network of local agents, benefiting Mitsubishi Mirage G4 owners.

- Accident Forgiveness: Farmers’ accident forgiveness program ensures rates don’t increase after the first accident for Mitsubishi Mirage G4 drivers.

- Competitive Rates: Farmers auto insurance review provides competitive monthly rates at $93 for the Mitsubishi Mirage G4 with minimum coverage.

Cons

- Limited Discounts: Farmers offers fewer discounts compared to some competitors, which may affect Mitsubishi Mirage G4 owners.

- High Rates: Some customers report higher initial rates with Farmers for the Mitsubishi Mirage G4.

#9 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers’ accident forgiveness program prevents rate increases after the first accident for Mitsubishi Mirage G4 drivers.

- Competitive Rates: Travelers Auto insurance review provides competitive monthly rates at $71 for the Mitsubishi Mirage G4 with minimum coverage.

- Hybrid/Electric Vehicle Discount: Travelers offers discounts for hybrid or electric vehicle owners, which can benefit Mitsubishi Mirage G4 drivers.

Cons

- Limited Local Agents: Travelers has fewer local agents compared to some competitors, which may be inconvenient for Mitsubishi Mirage G4 owners.

- Customer Service: Some customers report mixed experiences with Travelers’ customer service, potentially affecting Mitsubishi Mirage G4 drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Geico: Best for Custom Plan

Pros

- Custom Plan: As mention in Geico auto insurance review, Geico offers flexible insurance plans that can be customized to meet the specific needs of Mitsubishi Mirage G4 owners.

- Affordable Rates: Geico provides some of the lowest monthly rates at $56 for the Mitsubishi Mirage G4 with minimum coverage.

- Easy Online Management: Geico’s user-friendly online platform makes managing policies and filing claims easy for Mitsubishi Mirage G4 owners.

Cons

- Customer Service: Geico’s customer service ratings are mixed, which may concern some Mitsubishi Mirage G4 drivers.

- Limited Local Agents: Geico has fewer local agents compared to some competitors, potentially affecting Mitsubishi Mirage G4 owners who prefer in-person assistance.

Factors Affecting Mitsubishi Mirage G4 Insurance Rates

The trim and model of your Mitsubishi Mirage G4 can significantly impact the insurance rates you pay. Higher trim levels with more features often come with higher insurance premiums due to increased repair and replacement costs. based on your needs and budget.

Mitsubishi Mirage G4 Auto Insurance Monthly Rates by Coverage Type

| Coverage | Rates |

|---|---|

| Comprehensive | $28 |

| Collision | $54 |

| Minimum Coverage | $33 |

| Full Coverage | $128 |

Based on the table above, monthly rates for different coverage types also vary: comprehensive coverage averages $28, collision coverage $54, minimum coverage $33, and full coverage $128. These rates highlight the importance of selecting the right coverage level. Unlock details in our guide titled “What are the recommended auto insurance coverage levels?”

Additional factors influencing Mitsubishi Mirage G4 insurance rates include your location, driving history, age, and gender. Insurance companies adjust rates based on these factors, as they correlate with risk levels.

Mitsubishi Mirage G4 Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $56 | $175 |

| $61 | $189 | |

| $93 | $294 | |

| $56 | $167 | |

| $69 | $195 |

| $58 | $172 |

| $39 | $124 | |

| $49 | $142 | |

| $71 | $215 | |

| $71 | $212 |

For instance, monthly rates for full coverage vary widely among providers, with AAA at $175, Geico at $167, Progressive at $124, and State Farm at $142. Comparing these rates helps ensure you get the best deal for your insurance needs.

Expensiveness of Mitsubishi Mirage G4 Insurance

Mitsubishi Mirage G4 Auto Insurance Monthly Rates vs. Similar Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Kia Forte | $27 | $42 | $31 | $113 |

| Chevrolet Sonic | $23 | $45 | $33 | $114 |

| Nissan Altima | $27 | $50 | $31 | $121 |

| Mercury Milan | $17 | $29 | $33 | $90 |

| Cadillac CT6 | $32 | $65 | $33 | $143 |

| Hyundai Sonata | $25 | $44 | $35 | $119 |

| Audi S4 | $31 | $62 | $28 | $132 |

| Volvo S80 | $28 | $56 | $36 | $132 |

Examining these models reveals that while the Mirage G4 is designed with cost-effective insurance in mind, other factors such as comprehensive and collision coverage, as well as minimum and full coverage auto insurance, significantly affect the overall expense.

For a broader perspective, looking at monthly rates for comparable vehicles shows the diversity in insurance costs. For instance, the comprehensive and collision coverage for a Kia Forte ranges from $27 to $42, whereas the Cadillac CT6’s rates soar to $32 and $65 respectively.

Mitsubishi Mirage G4 Similar Vehicles Auto Insurance Monthly Rates

| Vehicle | Rates |

|---|---|

| Volvo S80 | $132 |

| Mercedes-Benz C300 | $138 |

| Toyota Camry | $119 |

| Audi S8 | $215 |

| Mercury Grand Marquis | $95 |

| Honda Accord Hybrid | $128 |

| Hyundai Elantra | $114 |

| Acura TL | $114 |

Full coverage rates can vary greatly, with the Chevrolet Sonic at $114 and the Audi S8 at $215. This comparison highlights that while the Mitsubishi Mirage G4 may have moderate insurance costs, individual rates are highly dependent on specific vehicle characteristics and coverage levels.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Understanding the Cost of the Mitsubishi Mirage G4

The cost will vary depending on the trim level of the Mitsubishi Mirage G4 you choose and any dealer incentives that might be available to you. Delve into our evaluation of “Factors That Affect Auto Insurance Rates.”

Mitsubishi Mirage G4 Safety Ratings

Your Mitsubishi Mirage G4 car insurance rates are closely linked to the vehicle’s safety ratings. The Mirage G4 boasts impressive safety ratings, with “Good” ratings in key areas such as small overlap front (both driver and passenger sides), moderate overlap front, roof strength, and head restraints & seats.

Mitsubishi Mirage G4 Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Acceptable |

| Roof | Good |

| Head restraints & seats | Good |

The side crash rating is “Acceptable.” These strong safety ratings can contribute to lower insurance premiums, as they indicate a lower risk of injury and damage in the event of an accident. In particular, a lower risk of bodily injury means that the potential costs for medical treatments and liability claims are reduced.

Additionally, with a reduced likelihood of severe bodily injuries, there is less chance of long-term disability claims. As a result, insurance companies may offer more favorable rates for vehicles with strong safety ratings, recognizing the diminished likelihood of expensive payouts related to bodily injuries and property damage.

Mitsubishi Mirage G4 Crash Test Ratings

Crash test ratings play a crucial role in determining the cost of your Mitsubishi Mirage G4 car insurance. The Mitsubishi Mirage G4 consistently receives high marks, with overall ratings of 5 stars, 4 stars for frontal impacts, 5 stars for side impacts, and 3 stars for rollover resistance from 2017 to 2024.

Mitsubishi Mirage G4 Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Mitsubishi Mirage G4 DR FWD | 5 stars | 4 stars | 5 stars | 3 stars |

| 2023 Mitsubishi Mirage G4 DR FWD | 5 stars | 4 stars | 5 stars | 3 stars |

| 2022 Mitsubishi Mirage G4 DR FWD | 5 stars | 4 stars | 5 stars | 3 stars |

| 2021 Mitsubishi Mirage G4 DR FWD | 5 stars | 4 stars | 5 stars | 3 stars |

| 2020 Mitsubishi Mirage G4 DR FWD | 5 stars | 4 stars | 5 stars | 3 stars |

| 2019 Mitsubishi Mirage G4 DR FWD | 5 stars | 4 stars | 5 stars | 3 stars |

| 2018 Mitsubishi Mirage G4 DR FWD | 5 stars | 4 stars | 5 stars | 3 stars |

| 2017 Mitsubishi Mirage G4 DR FWD | 5 stars | 4 stars | 5 stars | 3 stars |

These strong safety ratings can help lower insurance premiums, as insurers view vehicles with better crash test results as less risky to insure. Read our article to find the best accident forgiveness auto insurance companies.

Ways to Save on Mitsubishi Mirage G4 Insurance

To reduce the cost of your Mitsubishi Mirage G4 insurance rates, consider purchasing a roadside assistance program, which can sometimes lead to discounts on your insurance premium.

Additionally, inquire about welcome discounts that insurers offer to new customers, which can provide immediate savings. It’s also essential to check reviews and state complaints before selecting an insurer to ensure you choose a reliable company with good customer service and claims handling.

Adding a more experienced driver to your policy can further reduce rates, as insurers often offer lower premiums for policies that include drivers with a history of safe driving.

Lastly, always compare Mitsubishi Mirage G4 quotes for free online. This practice allows you to see a range of rates and coverage options, helping you find cheap auto insurance companies and most affordable insurance for your needs.

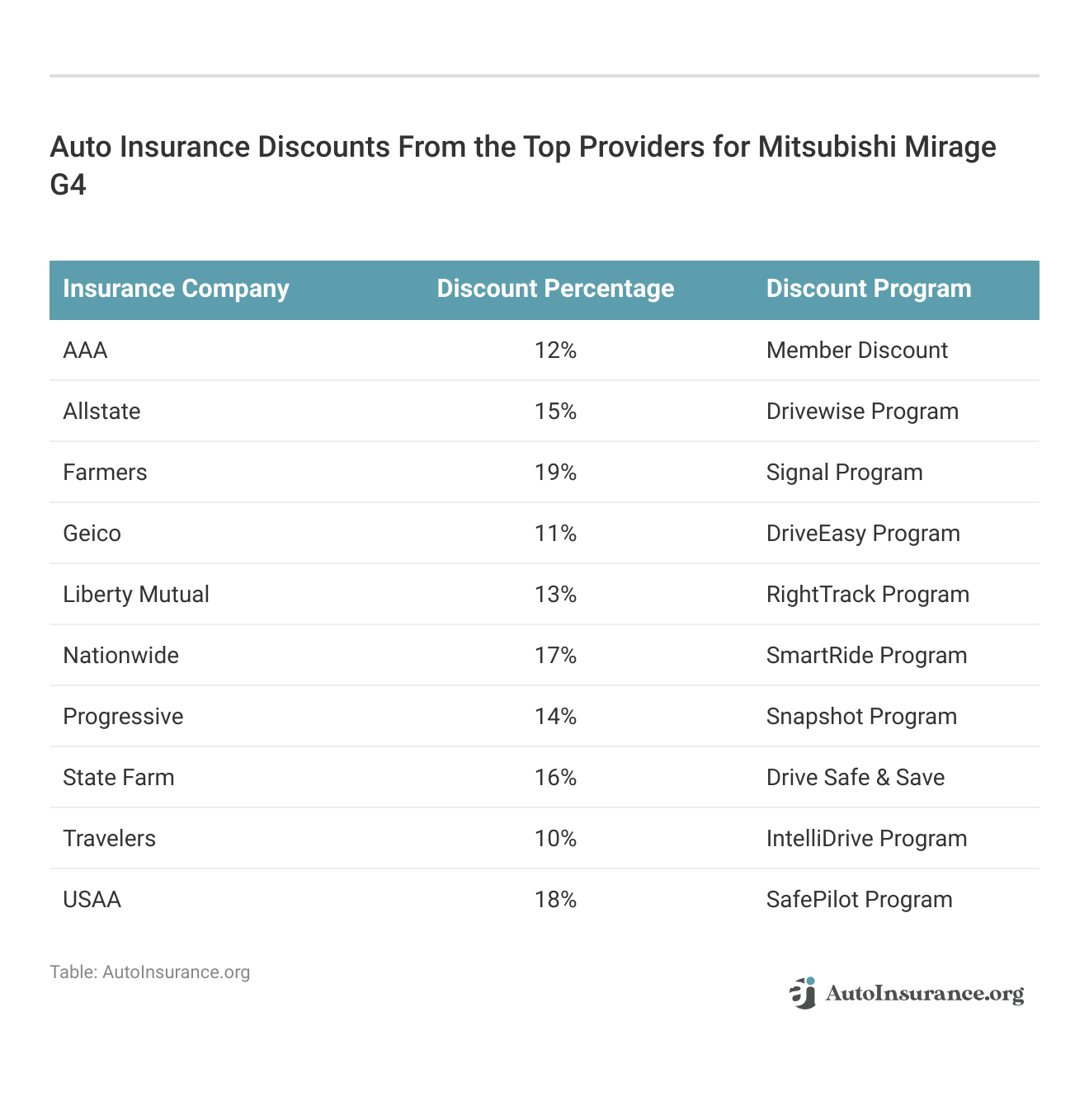

Top Mitsubishi Mirage G4 Insurance Companies

Several insurance companies offer competitive rates for the Mitsubishi Mirage G4, factoring in auto insurance discounts, for safety features and other benefits. Popular providers among Mirage G4 drivers include State Farm, Geico, and Progressive, each commanding significant market share due to their attractive premiums and comprehensive coverage options.

Mitsubishi Mirage G4 Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | $65.6 milllion | 9% | |

| #2 | $46.1 milllion | 7% | |

| #3 | $39.2 milllion | 6% | |

| #4 |  | $35.6 milllion | 6% |

| #5 | $35 milllion | 5% | |

| #6 | $28 milllion | 4% | |

| #7 | $23.4 milllion | 3% | |

| #8 | $23.3 milllion | 3% | |

| #9 | $20.6 milllion | 3% | |

| #10 |  | $18.4 milllion | 3% |

State Farm leads with $65.6 million in premiums written, followed by Geico at $46.1 million, and Progressive at $39.2 million. These companies, along with Liberty Mutual, Allstate, and others, provide a range of insurance solutions tailored to meet the diverse needs of Mitsubishi Mirage G4 owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Comparing Free Mitsubishi Mirage G4 Insurance Quotes Online

To save money on your Mitsubishi Mirage G4 insurance, it’s crucial to compare rates from multiple providers by obtaining free quotes online. This process allows you to see a range of options tailored to your specific needs and driving profile, helping you find the most affordable and comprehensive coverage.

Frequently Asked Questions

How can I save on Mitsubishi Mirage G4 insurance?

To reduce the cost of Mitsubishi Mirage G4 insurance, you can follow tips such as maintaining a clean driving record, considering higher auto insurance deductible, and exploring discounts offered by insurance companies.

Are vehicles like the Mitsubishi Mirage G4 expensive to insure?

Insurance rates for vehicles like the Mitsubishi Mirage G4 can vary. It’s best to compare quotes from multiple insurance companies to find the best deal.

What impacts the cost of Mitsubishi Mirage G4 insurance?

The cost of Mitsubishi Mirage G4 insurance can be influenced by factors such as the trim and model you choose, your location, driving history, age, and gender. You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Which companies offer the best Mitsubishi Mirage G4 auto insurance?

State Farm, AAA, and USAA are among the top providers, offering comprehensive coverage and competitive rates. Explore relevant guide titled “How to Cancel USAA Auto Insurance.”

How much does the Mitsubishi Mirage G4 cost?

The MSRP for a Mitsubishi Mirage G4 actual cost may vary depending on the trim level and available incentives.

What are the safety ratings of the Mitsubishi Mirage G4?

Safety ratings play a role in determining Mitsubishi Mirage G4 car insurance rates. You can find detailed safety ratings for the Mirage G4 through official crash test results.

What discounts are available for Mitsubishi Mirage G4 insurance?

Common discounts include multi-policy insurance discount, good driver, and safety feature discounts. Check with your insurer for specific offers.

How does the trim level of the Mitsubishi Mirage G4 affect insurance rates?

Higher trim levels with more features can increase insurance rates due to the higher cost of repairs and replacement parts.

Can I get usage-based insurance for my Mitsubishi Mirage G4?

Yes, many insurers offer usage-based insurance programs that can lower rates based on your driving habits. (Read more: Why You Should Take a Defensive Driving Class).

Is State Farm a good choice for Mitsubishi Mirage G4 insurance?

Yes, State Farm is highly recommended for its comprehensive coverage options, competitive rates, and excellent customer service. Delve into our guide titled ” State Farm auto insurance discounts.”

How does my driving history affect my Mitsubishi Mirage G4 insurance rates?

A clean driving history can significantly lower your insurance rates, while a history of accidents or violations can increase premiums. Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.