Collision Auto Insurance in 2025 (What Every Driver Should Know)

Collision auto insurance pays for car repairs after a collision minus a deductible, averaging $25/mo. Below, we'll explain the collision insurance claims process, how collision coverage works, the difference between comprehensive vs. collision insurance, and help you find cheap collision coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Insurance & Finance Analyst

UPDATED: Feb 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Collision auto insurance is a type of auto insurance that pays to cover your vehicle damages after an accident.

While it’s an optional coverage, we highly recommend drivers carry collision auto insurance coverage in most cases. If you cause an accident, collision insurance saves you from out-of-pocket repair expenses.

However, collision insurance isn’t always the right choice for drivers, even if purchased from one of the best companies for auto insurance. So, it’s important to do your research beforehand.

Read on to learn more about when to drop collision insurance and how collision coverage works.

Then, enter your ZIP code above to compare collision car insurance rates from the top companies.

- Collision auto insurance covers vehicle damage after you hit a car or object

- States don’t require collision, but a lender may if you have a car loan or lease

- Collision coverage averages $25/mo, and usually costs more than comprehensive

Collision Auto Insurance Definition

In a car insurance policy, collision auto insurance pays for the damages to your car if you get in an accident with another vehicle or object. You must carry this coverage if you have a lease or loan on your vehicle. Read more about car leasing with auto insurance to ensure your leased car has the proper coverage.

While in most most cases collision coverage is optional, it’s an excellent investment to make if you’re looking to provide financial protection for yourself if you get into an accident.

Whether collision coverage is right for you depends upon several factors, such as the cost, your vehicle’s worth, and more. Drivers of older cars or drivers who struggle to pay for car insurance may opt out of collision coverage, though most drivers will carry it to protect their assets.Brandon Frady Licensed Insurance Producer

If you’ve got an older vehicle and you’re considering whether collision insurance is right for you, check out our article titled “Auto Insurance for Older Cars” to help inform your decision.

Quick Facts on Collision Auto Insurance

Before we dive into all the specifics of collision coverage, here are a few important facts you should know about what collision auto insurance is:

- Collision coverage pays for repairs if you collide with another vehicle.

- Collision coverage will also pay for repairs if you hit an inanimate object like a mailbox.

- Collision coverage won’t pay for your damages if another driver caused the accident and their insurance is paying for repairs.

- You must carry the state minimum auto insurance requirements to purchase collision coverage.

- You may need to purchase both comprehensive coverage and collision coverage at most insurance companies, as they are often sold as a package deal.

- Pothole damage is usually covered under collision insurance.

While you may be able to purchase collision insurance separately from comprehensive insurance, they are often sold together as a full coverage policy deal.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

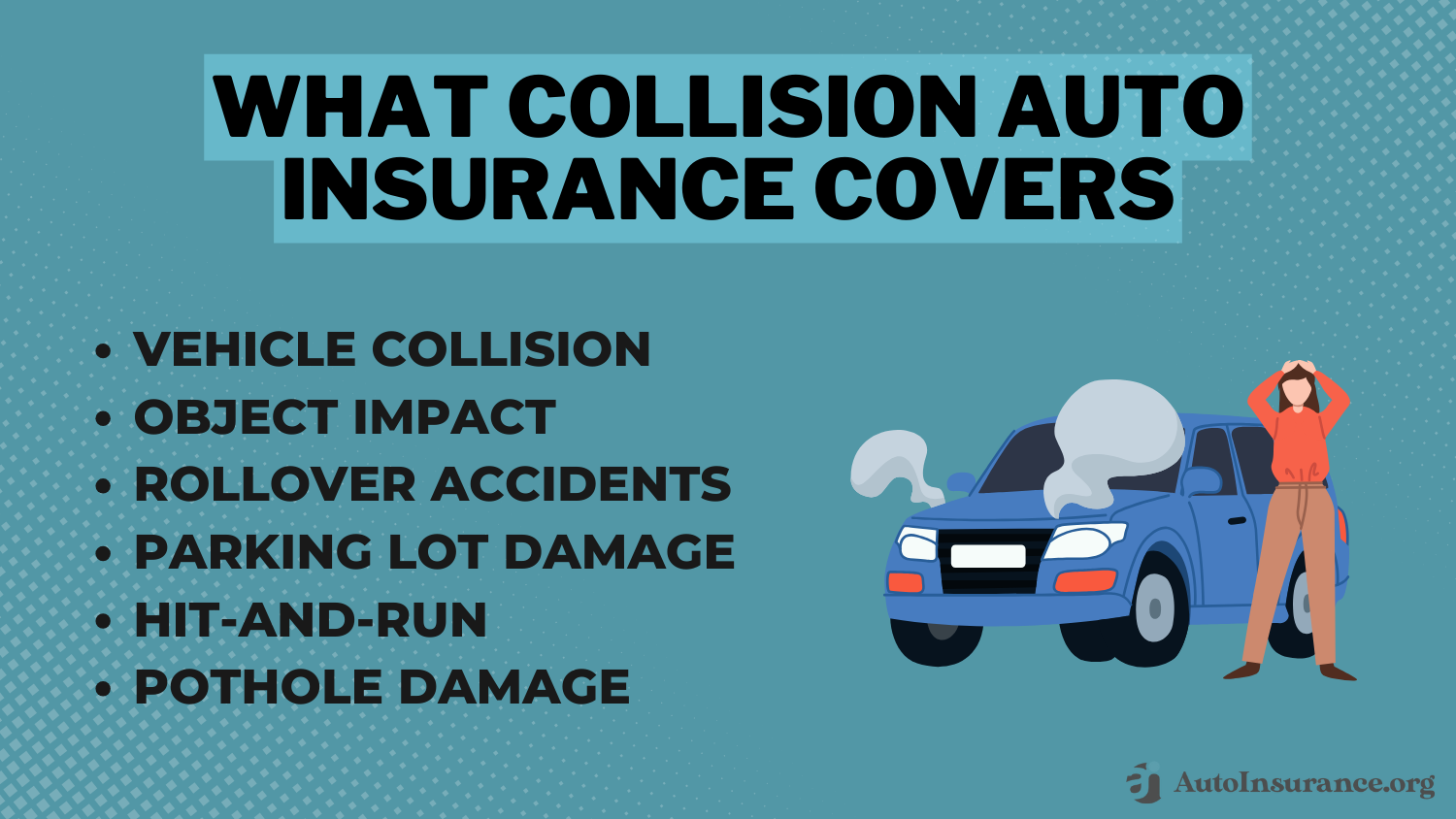

What Collision Auto Insurance Covers

A top question readers ask is, “What does collision insurance cover?” Generally, collision car insurance covers impact with any vehicles, buildings, fences, guard rails, mailboxes, potholes, telephone poles, and trees.

However, what is actually covered depends on your insurer. For example, not all insurance companies cover you if you hit a pothole or flip your vehicle, so if you live in an area with a lot of potholes or winding roads, you may wish to purchase insurance from a different company.

It’s important to know the state of federal highways and bridges to prepare for potential hazards on the road when driving.

What Collision Auto Insurance Doesn’t Cover

While collision coverage covers a wide variety of incidents, it doesn’t cover everything. Some of the accidents and damages excluded from collision coverage include the following:

- Damage to Other Vehicles: If you caused the accident, your liability auto insurance covers other drivers’ damages. Collision coverage only pays for damages to your vehicle.

- Animal Collision Damage: If you hit a deer, collision coverage won’t pay for damages. You’ll need comprehensive auto insurance for animal collisions. You should also learn whether hitting a deer will raise your auto insurance rates with your company by talking to your insurance agent.

- Damage From Weather, Fire, Vandalism, or Theft: Any damages from weather or people aren’t covered by collision coverage. You will need comprehensive insurance if you want protection for these incidents.

- Medical Bills: Your liability insurance and personal health insurance will cover any injuries from an accident.

Carrying a full coverage policy consisting of collision, comprehensive, and liability coverages will ensure you are protected in a wide range of accidents.

Make sure you look into coverages other than collision coverage to fully protect yourself. For instances, comprehensive auto insurance helps out if your car gets damaged by a non-collision event.

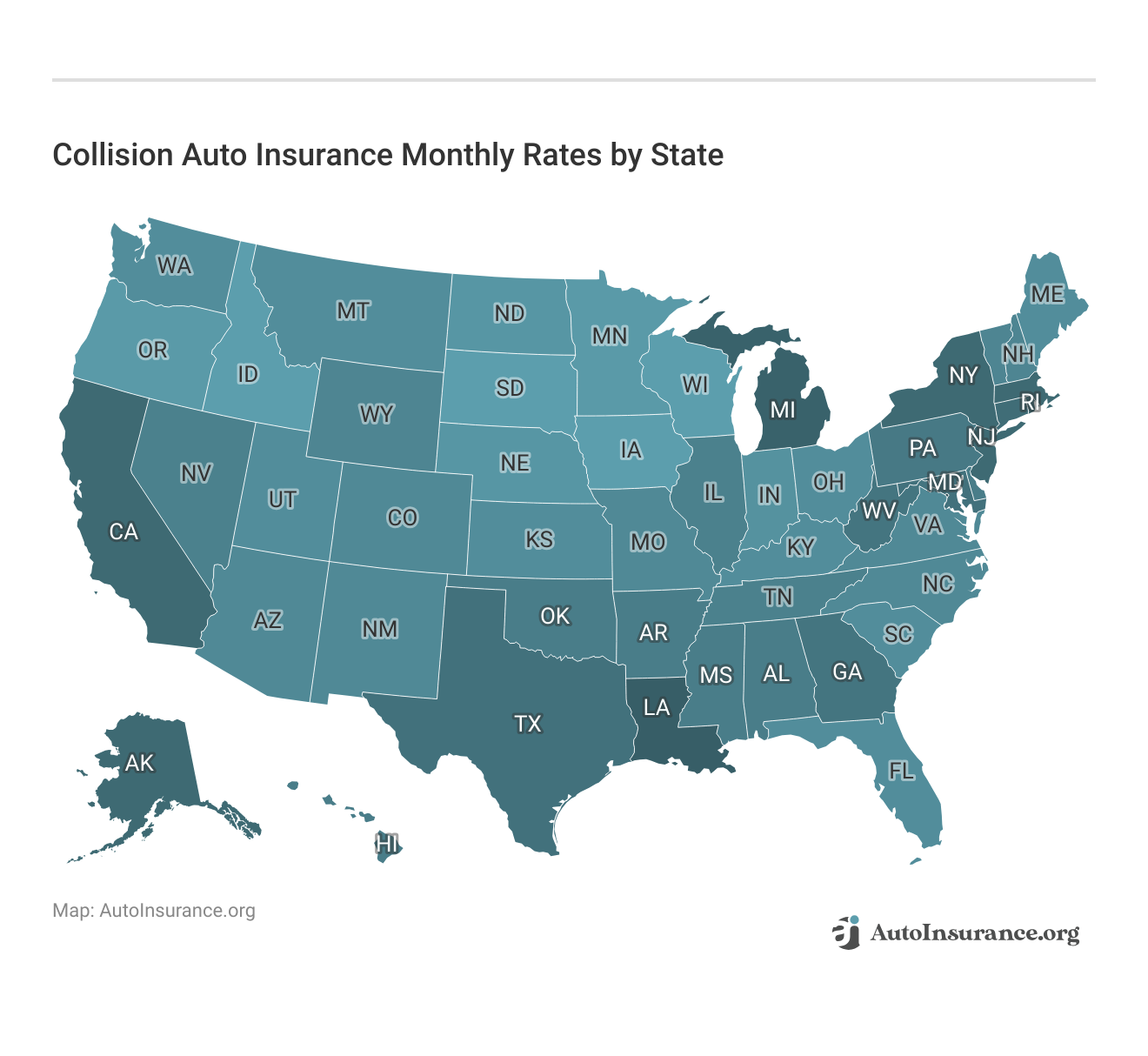

Collision Auto Insurance Rates

The average annual cost of collision coverage can vary greatly, from a few hundred dollars to over a thousand dollars. So, how much can I expect to pay for coverage where I live? The table below will give you an idea of rates based on your state:

Looking to shop around for collision coverage from the top providers in your area? Check out the table below to see how much you might pay from some of the best auto insurance companies:

Collision Auto Insurance Monthly Rates by Provider

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $25 |

| American Family | $23 |

| Erie | $24 |

| Farmers | $26 |

| Geico | $22 |

| Liberty Mutual | $28 |

| National General | $21 |

| Nationwide | $27 |

| Progressive | $24 |

| State Farm | $23 |

| The General | $26 |

| The Hartford | $25 |

| Travelers | $22 |

As you can see, Geico is the most affordable option for collision coverage, with rates averaging $95 monthly. In addition, you can also see how much you could pay for collision coverage based on the deductible you choose:

Collision Auto Insurance Monthly Rates by Deductible Amount

| Deductible | Rates |

|---|---|

| $0 | $40 |

| $100 | $35 |

| $250 | $30 |

| $500 | $25 |

| $1,000 | $20 |

| $2,000 | $15 |

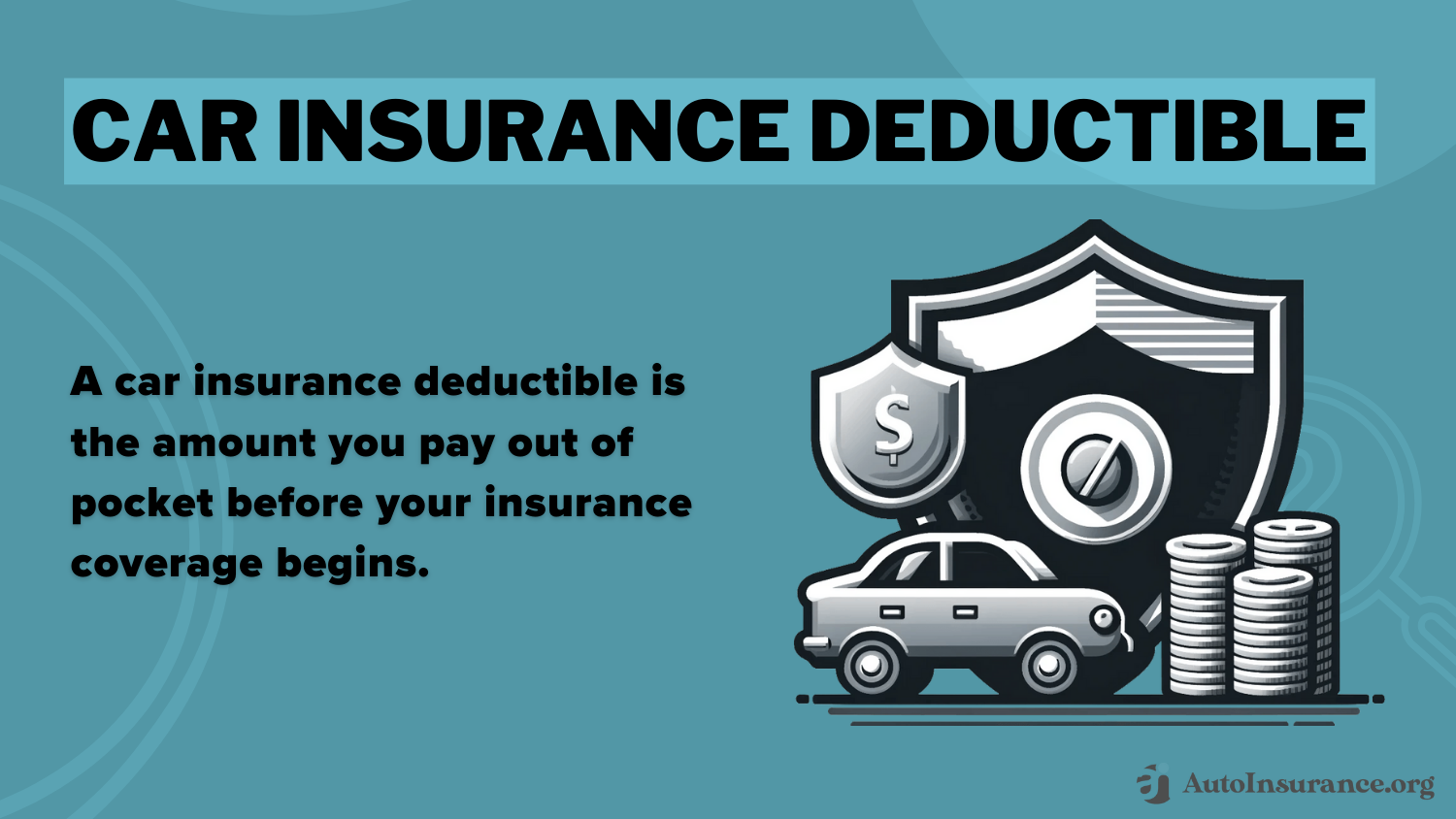

As you can see, the higher your deductible is, the lower your average auto insurance cost per month. However, it’s important to make sure that the higher collision deductible is something you can pay off after an accident.

Factors Affecting Collision Auto Insurance Rates

Collision insurance rates depend upon the following factors:

- Area: Where you live can have a huge impact on your rates. For example, your rates may be lower if you live in an area with a history of few vehicle collisions. So, it’s always best to compare auto insurance rates by ZIP code.

- Deductible: Raising your collision deductible can lower your car insurance rates significantly.

- Driving Record: Drivers with clean driving records will have much cheaper rates than auto insurance policyholders with a history of collision claims. See how to find cheap auto insurance for a bad driving record here.

- Gender and Age: In some states, insurance companies will use the driver’s gender to determine risk. Male vs. female auto insurance costs can differ by region and carrier. Age is also a factor in calculating rates, with new drivers often being charged more than more experienced drivers.

- Vehicle: If your vehicle is worth a lot or is expensive to repair, you will have higher insurance rates.

While you can’t control a number of these factors, keeping a clean driving record will greatly reduce your collision insurance costs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

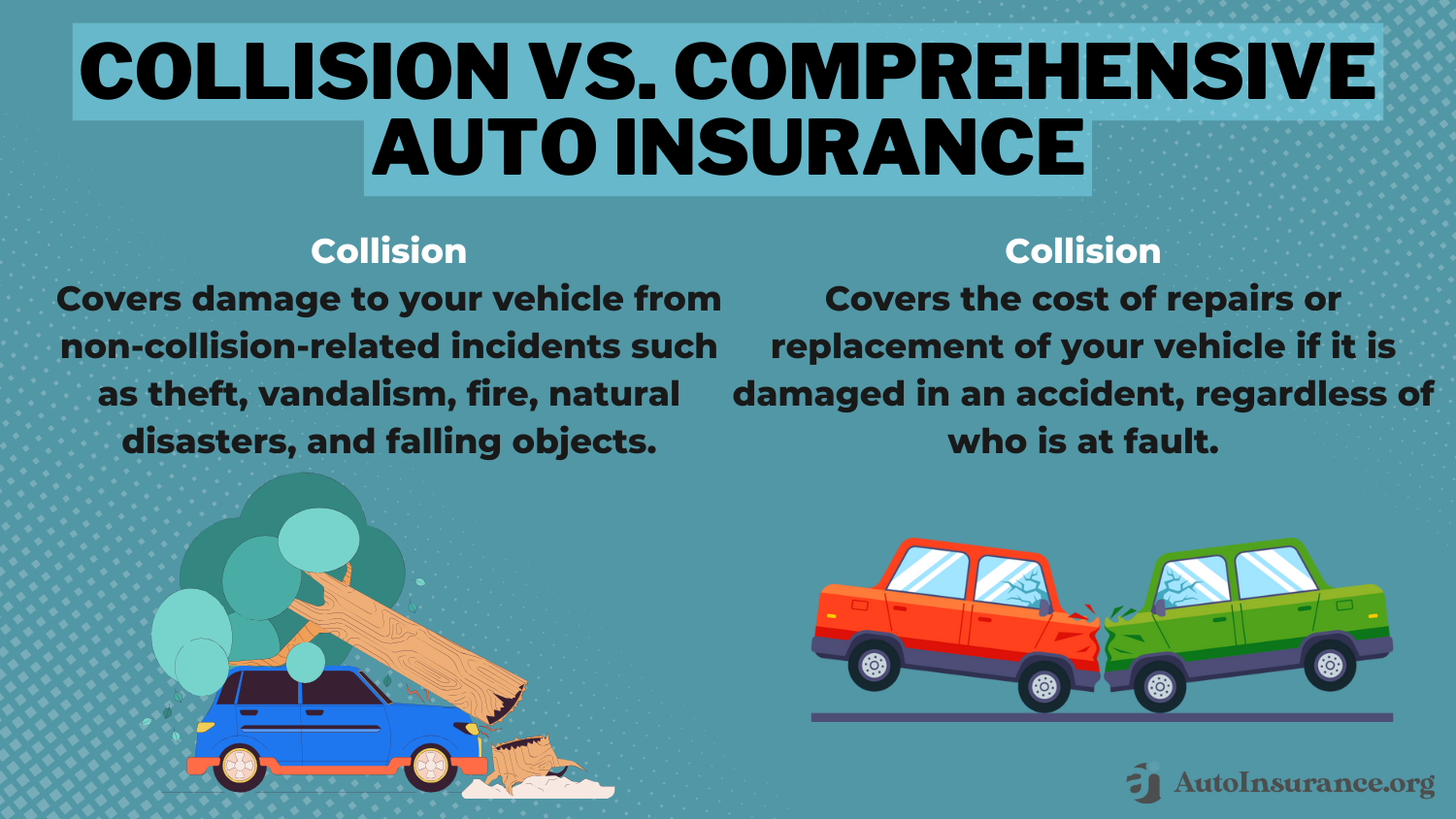

Difference Between Collision vs. Comprehensive Auto Insurance

When looking at what collision insurance covers and doesn’t cover, understanding the difference between collision and comprehensive auto insurance coverage can be difficult. While these coverages are separate, they are often sold together to offer drivers complete coverage for all types of accidents.

According to the Insurance Information Institute, the core difference between the two is that collision coverage protects you if you collide with another vehicle or object. Comprehensive coverage covers you if you collide with something other than another vehicle or object, as well as a number of natural weather disasters and crime-related incidents.

When choosing which one to purchase, comprehensive coverage is usually cheaper. However, carrying both collision and comprehensive coverage will better protect you.

How Collision Auto Insurance Coverage Works

Collision auto insurance coverage functions the same as any other insurance coverage when it comes to filing claims. If you are in an accident that qualifies for collision coverage, you can go ahead and start the collision insurance claims process with your insurance company. If you have a deductible, you will have to pay the deductible amount before your collision insurance pays for the rest of the repair costs.

What is an auto insurance deductible? A collision deductible is how much you agree to pay toward repairs before your insurance covers the rest. So if you have a $500 deductible, you’ll need to pay $500 before the insurance pays for the remaining repair costs.

However, there are two different situations when filing a claim with collision insurance. If you weren’t at fault for the accident, you might choose not to file an auto insurance claim with your company and instead let the other driver’s insurance take over.

On the other hand, let’s say the other driver’s insurance isn’t covering the total cost of damages, or you want to get back on the road as soon as possible. You can then choose to file a claim with your insurance company to help cover the repair costs and make the process quicker.

If you had an at-fault accident, you’ll want to file with your insurance company as soon as possible and pay off your deductible to get repairs done quickly.

Deciding Whether You Need a Collision Car Insurance Policy

It’s important to know when to drop collision insurance since not every driver needs it. If your vehicle isn’t worth much and you would pay 10% or more of your car’s worth in collision coverage payments after a year, you can choose to skip out on collision insurance.

Collision insurance is for, well, collisions. Comprehensive is an optional coverage for the other stuff, like fire, theft, or flood. pic.twitter.com/SaQI9Sfohg

— Liberty Mutual (@LibertyMutual) January 14, 2019

However, you should carry collision coverage if any of the following are true:

- You Have a Car Loan: In the majority of cases, your lease or loan holder will require you to carry collision coverage. Even if they don’t, you should still carry it to protect yourself if you crash.

- You Can’t Afford Repairs: If you can’t pay for repairs or a new vehicle if you crash, it is better to pay for collision coverage than be stuck without a vehicle after a crash.

- Your Car Is Expensive: If you have a vehicle that would be expensive to repair, you should carry collision coverage to protect your assets.

If you feel that collision insurance is too expensive, even if you need to carry it, consider raising your deductible, utilizing insurance discounts, or shopping around and comparing quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Deciding if Collision Auto Insurance Is Worth it for You

Since collision coverage is optional and can raise your insurance costs, you probably want to know if it’s worth it. It really depends on your budget and needs.

It is worth it if you have a car with a lease or loan. Even if your lender doesn’t require it, carrying collision insurance will protect you if you cause serious damage by hitting a pothole in your new car, for example.

#Spring is here…and so are potholes. https://t.co/51atpynz3i pic.twitter.com/57DVejYVXR

— Allstate (@Allstate) March 23, 2017

Without collision insurance, you could be responsible for paying for repairs on top of paying off your lease or loan. Collision coverage is also worth it if you’re buying auto insurance for a new car.

Still unsure about purchasing collision insurance? Some pros of collision auto insurance include the fact that you can use it whether you’re at fault or not for an accident, and it protects your assets by helping you avoid out-of-pocket costs. (Learn More: At-Fault Accident Defined)

The cons of collision insurance are that it increases your premiums, and it doesn’t cover medical expenses or other vehicle damages. However, if you have a full coverage auto insurance policy and shop around for cheaper rates, these things shouldn’t be a problem.

Understanding More About Collision Auto Insurance Coverage

While collision insurance is optional, it’s great to protect your assets if you own a newer or more expensive vehicle — read more about how to get auto insurance on a new car. Collision coverage pay for repairs if you crash into another car or object, regardless of whether you caused the accident.

Switching car 🚘insurance companies might be in your best interest, but how do you actually do it🤔? That's where https://t.co/27f1xf1ARb comes in with the details. For step-by-step🔢 help, check out👉: https://t.co/QC0Z11qaSz pic.twitter.com/w8VBDBcye0

— AutoInsurance.org (@AutoInsurance) August 9, 2023

To find savings on collision coverage, learn more about how to find free auto insurance quotes and compare auto insurance discounts from various companies.

Frequently Asked Questions

How much does collision insurance cost?

On average, collision coverage only costs around $25 monthly.

Does collision mean full coverage?

Collision auto insurance is a part of full coverage auto insurance, but there are other components, such as comprehensive and liability insurance.

What is a good deductible for collision?

Generally, you should choose a $500 collision insurance deductible if you can afford to pay it out of pocket.

What is the difference between comprehensive and collision insurance?

Collision insurance covers your damages if you hit a car or object. On the other hand, comprehensive coverage pays for your car repairs if it gets stolen, vandalized, or damaged by animals or weather.

What is a collision deductible waiver?

Collision deductible waivers are an optional add-on to your collision policy. If you get hit by another driver who’s uninsured or underinsured, the insurance company will waive your deductible (Learn More: Best Uninsured and Underinsured Motorist (UM/UIM) Coverage).

Rules and costs vary by state and insurance company, and some companies don’t offer collision deductible waivers, but generally, you won’t be covered if you were partly at fault. In some cases, the other driver must be uninsured for the collision deductible waiver to kick in.

Is collision auto insurance required?

Legally, states don’t require drivers to carry collision auto insurance. However, you may be legally required to carry it by your lender.

When is it best to drop collision insurance?

You can drop your auto collision insurance coverage once your policy’s cost exceeds your vehicle’s market value.

What does collision insurance cover?

Collision coverage helps pay for damages resulting from a collision with another car or object.

Why is my collision premium so high?

Your collision car insurance rates may be high due to your location, driving record, or claims history. So, it’s important to compare collision auto insurance rates by ZIP code.

What is a good amount of collision coverage?

It’s best to have full protection in case of an accident. All collision coverages have a set limit of the estimated value of your car, but how much is covered depends upon the deductible you choose.

For example, if you chose a $1,000 deductible, collision coverage will pay you less than if you chose a $500 deductible. Therefore, what is a good amount of collision coverage depends on how much you are willing to pay out-of-pocket.

Know how much collision coverage you want? Enter your ZIP code into our free quote tool below to instantly compare rates from the top providers near you.

Is it better to have collision or comprehensive coverage?

If you have to choose between the two, most drivers tend to pick comprehensive coverage because comprehensive coverage is slightly cheaper than collision coverage and covers events out of drivers’ control. It’s usually better to pick comprehensive over collision if you live in a rural area with poor weather conditions and plenty of wildlife.

However, you should pick collision over comprehensive if you live in an area with multiple car crashes and have hit other cars before.

What is collision insurance in auto insurance?

Collision auto insurance offers financial protection by repairing or replacing your vehicle if it gets damaged or totaled, up to the collision auto insurance deductible.

Do I need collision coverage on an old car?

You might be wondering when to drop collision insurance on your older vehicle. In most cases, you don’t need collision coverage on old cars with low market value.

What is included in Geico collision coverage?

With Geico, collision coverage helps pay for your vehicle expenses if you hit another vehicle or object, like all other insurers.

Learn More: Geico Auto Insurance Review

What is the Progressive collision coverage limit?

Progressive’s collision coverage will pay up to the actual cash value of your car. Learn more about how insurers calculate payouts in our article titled “Replacement Cost vs. Actual Cash Value: Car Insurance.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Insurance & Finance Analyst

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.