Costco Auto Insurance Review for 2025 (Rates, Discounts, & Options)

Costco auto insurance review shows that rates start at $31 per month for minimum coverage through CONNECT, a subsidiary of American Family Insurance. Rates vary based on age, driving record, and coverage level. Members get exclusive discounts, but availability depends on location and underwriting approval.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Costco

Average Monthly Rate For Good Drivers

$31A.M. Best Rating:

AComplaint Level:

LowPros

- Exclusive member discounts

- Roadside assistance included

- Lifetime renewability perk

- Multiple policy options

Cons

- Higher-than-average rates

- Limited state availability

- Mixed customer reviews

Costco auto insurance review breaks down how coverage through CONNECT by American Family Insurance works for Costco members.

Costco Auto Insurance Rating

| Rating Criteria | Score |

|---|---|

| Overall Score | 4.6 |

| Business Reviews | 5 |

| Claim Processing | 4.7 |

| Company Reputation | 4 |

| Coverage Availability | 4.9 |

| Coverage Value | 4.8 |

| Customer Satisfaction | 3.7 |

| Digital Experience | 4 |

| Discounts Available | 5 |

| Insurance Cost | 4.5 |

| Plan Personalization | 4 |

| Policy Options | 5 |

| Savings Potential | 4.7 |

It covers what types of policies are available, how member perks apply, and which drivers may benefit most. The article also compares pricing across providers and explains how discounts affect your rate.

If you’re thinking about using your membership for auto insurance, this guide helps you weigh the pros and cons.

- Costco auto insurance starts at $31 per month through CONNECT by AmFam

- Members get extra perks like roadside assistance and accident forgiveness

- Rates vary by age, driving history, and location, often above national averages

Start comparing total coverage auto insurance rates by entering your ZIP code here.

Costco Auto Insurance Rates by Age and Coverage

Costco auto insurance premiums vary widely depending on the policyholder’s age and level of coverage. Young drivers are the highest by age group: 16-year-old men pay $201 a month for minimum coverage and $472 a month for full coverage. A 60-year-old female pays only $31 for minimum coverage and $77 for full coverage.

Costco Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $183 | $451 |

| 16-Year-Old Male | $201 | $472 |

| 18-Year-Old Female | $149 | $332 |

| 18-Year-Old Male | $172 | $383 |

| 25-Year-Old Female | $43 | $108 |

| 25-Year-Old Male | $44 | $112 |

| 30-Year-Old Female | $40 | $100 |

| 30-Year-Old Male | $41 | $104 |

| 45-Year-Old Female | $35 | $89 |

| 45-Year-Old Male | $34 | $87 |

| 60-Year-Old Female | $31 | $77 |

| 60-Year-Old Male | $32 | $79 |

| 65-Year-Old Female | $35 | $87 |

| 65-Year-Old Male | $34 | $85 |

While Costco offers competitive pricing for older drivers, younger drivers may find lower costs elsewhere. Auto insurance rates by age show that Costco’s full coverage rates tend to be higher than national averages, particularly for high-risk drivers. Getting a Costco auto insurance quote and comparing it with multiple providers can help determine if Costco’s CONNECT insurance offers the best value.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Costco Car Insurance Rates Compare to Other Providers

Costco auto insurance through CONNECT by American Family Insurance offers you competitive rates, but it is not always the cheapest. Minimum coverage costs $49 per month, lower than Allstate at $87, Farmers at $76, and Liberty Mutual at $96. It is slightly higher than Geico at $43 and State Farm at $47.

Costco Auto Insurance Monthly Rates vs. Top Providers

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $49 | $124 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 |

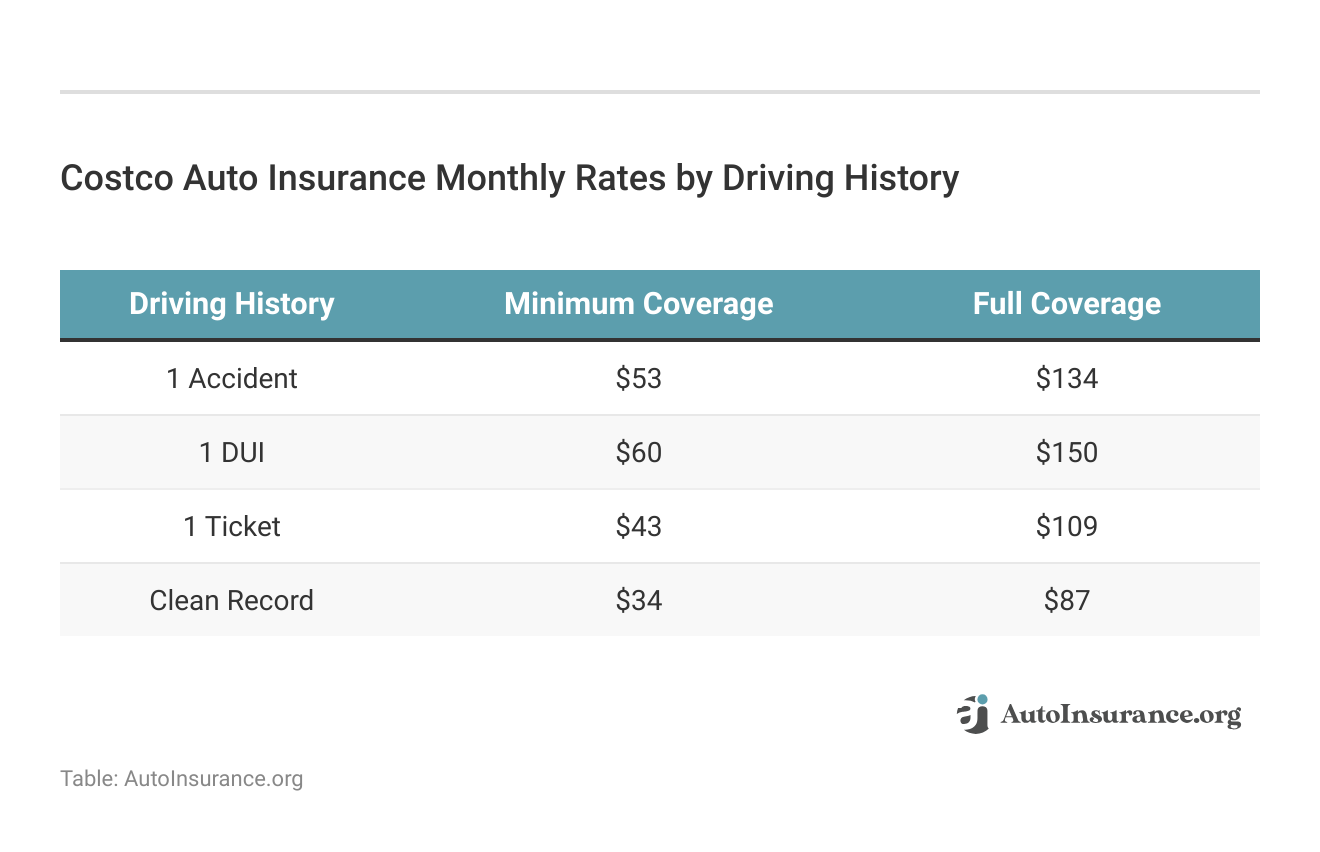

Full coverage costs $124 per month, less than Allstate at $228, Farmers at $198, Liberty Mutual at $248, but higher than Geico at $114 and State Farm at $123. Costco’s rates are reasonable for drivers with clean records. A ticket raises the minimum coverage rate from $49 to $62, an accident increases it to $76, and a DUI brings it to $86.

Full coverage starts at $124 and increases to $156 after a ticket, $192 after an accident, and $214 after a DUI. While rate increases are common, competitors like Geico and State Farm often offer lower pricing after violations.

If you're a Costco member, compare CONNECT’s rates and discounts with other insurers to make sure you're getting the right coverage at the best price.Michelle Robbins Licensed Insurance Agent

Costco auto insurance is a good option for members with clean records, but may not be the best choice for drivers with violations. Some competitors provide lower rates, so getting a Costco car insurance quote and comparing options before choosing your policy is important.

Costco Car Insurance Pricing for Different Credit Scores

Costco Insurance offers you a competitive auto rate, but its affordability depends on your credit score. For good credit, Costco’s $114 monthly rate is lower than Allstate, Farmers, and Liberty Mutual but higher than Geico and Travelers. For fair credit, Costco’s $130 rate is more affordable than Allstate and Farmers but still above Geico, Nationwide, and Progressive.

Costco Auto Insurance Monthly Rates vs. Top Competitors by Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $120 | $180 | $240 | |

| $120 | $170 | $220 | |

| $114 | $130 | $150 | |

| $130 | $190 | $250 | |

| $90 | $160 | $220 | |

| $140 | $200 | $260 |

| $105 | $125 | $145 |

| $115 | $135 | $155 | |

| $98 | $179 | $179 | |

| $84 | $176 | $176 |

Drivers with poor credit will see rates rise to $150, making Costco cheaper than Farmers and Liberty Mutual but more expensive than Nationwide, Progressive, State Farm, and Travelers. While Costco provides solid pricing, Geico, Travelers, and State Farm often offer lower rates, making them better choices for budget-conscious drivers. Getting a Costco insurance quote can help you determine if it offers the best value for your situation.

Costco Auto Insurance Comprehensive Discounts

Costco auto insurance offers various discounts that can lower your premiums, but how much you save depends on your eligibility. Bundling policies provide the highest discount at 18%, making it a strong option for members who also insure their homes or other vehicles through Costco.

Costco Auto Insurance Discounts by Savings Potential

| Discount | |

|---|---|

| Anti-Theft | 8% |

| Bundling | 18% |

| Good Student | 12% |

| Homeowner | 10% |

| Low Mileage | 9% |

| Loyalty | 14% |

| Military | 16% |

| Multi-Vehicle | 15% |

| New Car | 11% |

| Safe Driver | 10% |

Military members can save up to 16%, while multi-vehicle discounts reach 15%. Long-term customers benefit from a 14% loyalty discount, and students with good grades receive up to 12% off. New car owners can save 11%, while homeowners and safe drivers each get 10%.

Low-mileage drivers receive a 9% discount, and anti-theft features qualify for 8%. Compared to competitors, these discounts are on par with major insurers like Geico and State Farm, but the actual savings will depend on Costco’s higher base rates.

While these discounts can make Costco’s policies more affordable, drivers should compare final quotes to see if they offer real savings over other providers. Before you purchase a policy, reviewing Costco auto insurance requirements can help ensure you qualify for the best available discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Costco Auto Insurance Ratings & Customer Overview

Costco auto insurance receives strong ratings across multiple agencies, indicating reliable service and financial stability. AM Best gives Costco an “A” for excellent financial strength, while the Better Business Bureau (BBB) rates it A+ for strong business practices. Consumer Reports scores Costco 78 out of 100, showing positive customer feedback, and J.D. Power ranks it at 850 out of 1,000, reflecting above-average satisfaction.

Costco Insurance Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: A Excellent Financial Strength |

| Score: A+ Excellent Business Practices |

|

| Score: 78/100 Positive Feedback |

|

| Score: 850 / 1,000 Above Avg. Satisfaction |

|

| Score: 0.83 Fewer Complaints Than Avg. |

The National Association of Insurance Commissioners (NAIC) reports a 0.83 complaint index, meaning Costco receives fewer complaints than the industry average. While these ratings suggest solid performance, customer experiences can vary. A Yelp review from Car S. in San Diego, CA, highlights a smooth and efficient process with the Costco Auto Program.

The reviewer found significant savings when purchasing a vehicle, with dealership support and clear program benefits making the transaction seamless. Costco Insurance reviews support Costco’s reputation for providing valuable discounts and a straightforward experience.

Costco Auto Insurance Coverage Options

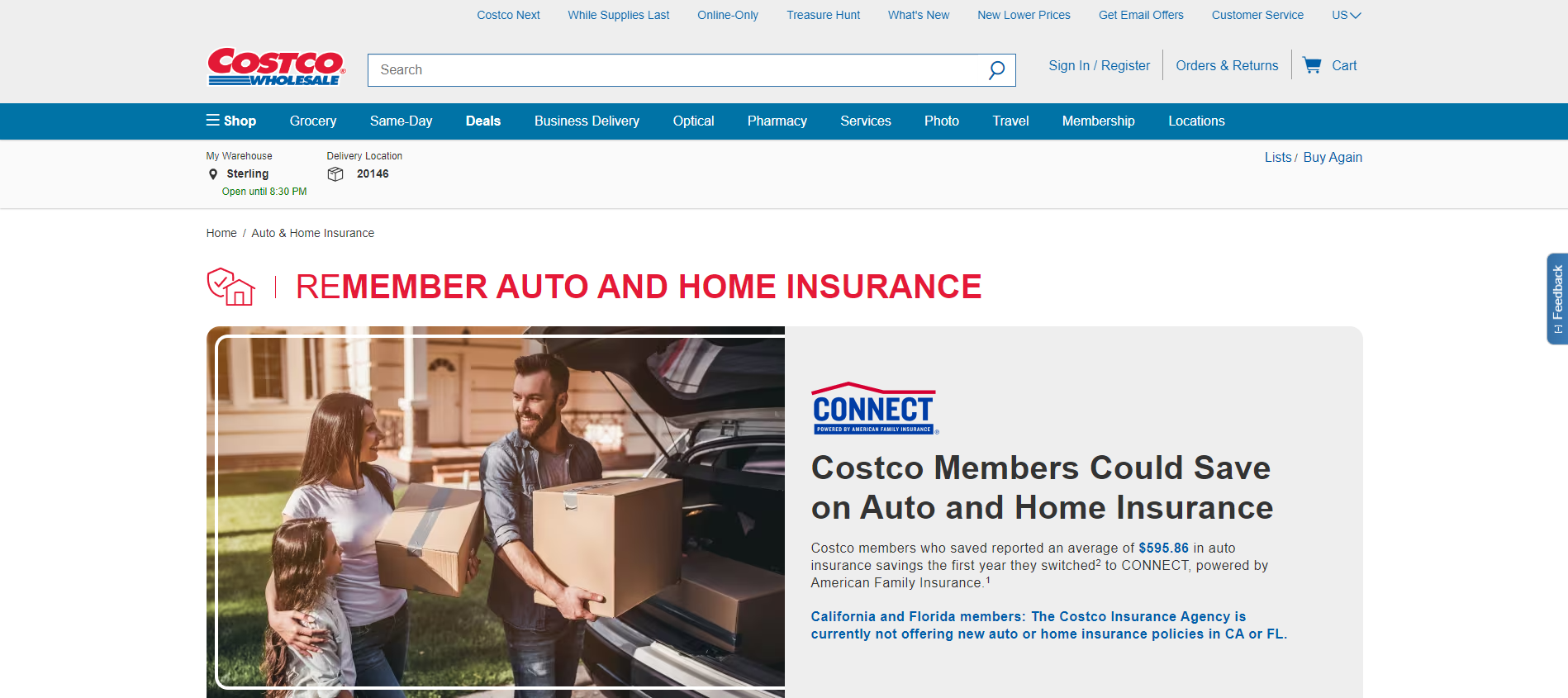

Costco auto insurance, offered through CONNECT by American Family Insurance, provides a range of standard and optional coverages for members. While Costco does not sell its own insurance, its partnership with CONNECT gives members access to policies with added perks and discounts.

Standard Coverage Options

CONNECT policies include essential coverage types that most drivers need:

- Liability Coverage: Pays for bodily injury liability and property damage to others if you’re at fault in an accident.

- Collision Coverage: This helps cover the cost of repairing or replacing your vehicle after an accident.

- Comprehensive Coverage: Protects against non-collision damages, including theft, vandalism, and weather-related incidents.

- Uninsured/Underinsured Motorist Coverage: Ensures you’re covered if another driver lacks adequate insurance.

- Medical Payments Coverage: Helps you and your passengers pay medical bills after an accident.

Optional Add-Ons for Extra Protection

Costco members can customize their policies with optional add-ons:

- Roadside Assistance: Provides help with flat tires, dead batteries, and towing.

- Rental Car Reimbursement: This covers the cost of a rental vehicle while your car is being repaired.

- Accident Travel Expense Coverage: Pays for lodging and meals if an accident leaves you stranded far from home.

Exclusive Benefits for Costco Executive Members

Costco Executive members receive additional perks, such as:

- Lifetime Renewability: Guarantees policy renewal as long as membership and policy conditions are met.

- Enhanced Roadside Assistance: Offers higher coverage limits and expanded services.

While Costco’s auto insurance program provides solid coverage options, its rates may be higher than national averages, particularly for younger drivers and those with poor credit.

Checking rates from different insurers can help you decide if CONNECT is the right choice for your next insurance policy.

Pros and Cons of Costco Auto Insurance

Costco auto insurance, offered through CONNECT by American Family Insurance, provides members with exclusive benefits and competitive pricing. While it can be a solid option for certain drivers, there are some downsides to consider.

Pros

- Exclusive Member Discounts: Auto insurance discounts for Costco members, especially Executive members, reach 18% when you bundle.

- Strong Financial Ratings: CONNECT receives an “A” rating from AM Best, and BBB rates it as A+, which means sound financial strength and strong business practices.

- Lower Rates for Some Drivers: Costco offers competitive rates for drivers with good credit and clean records, making it an affordable option for low-risk policyholders.

Cons

- Higher Premiums for High-Risk Drivers: If you have bad credit or you’re a young driver, or you have a few accidents or violations on your record, you’ll pay even higher than the national average, so other insurers like Geico or State Farm auto insurance will be cheaper.

- Limited Availability: Costco auto insurance isn’t available in all states, and some discounts and benefits require a Costco Executive membership, which costs $120 annually.

Before choosing Costco auto insurance, compare quotes from other insurers to determine if its benefits and pricing fit your needs.

Make sure to consider your driving history and coverage needs, as rates can vary significantly based on individual factors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Costco Auto Insurance: A Smart Choice for You

Costco auto insurance, offered through CONNECT by American Family Insurance, provides exclusive discounts and benefits for members, especially Executive members. Perks like roadside assistance, lifetime renewability, and glass repair reimbursement add value, but rates tend to be higher than the national average.

Switching to Costco's CONNECT saved me $500 in the first year—but comparing quotes first confirmed it was the best deal for my situation.Tonya Sisler Insurance Content Team Lead

Costco’s Insurance may work well for members with clean records and bundled policies, but young drivers and those with poor credit might find better deals elsewhere. When looking at auto insurance for different types of drivers, it’s crucial to compare rates from multiple insurers to see if CONNECT offers the best coverage for your situation.

Use our free comparison tool to see what auto insurance quotes look like in your area.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Which insurance company does Costco use?

Costco partners with CONNECT, powered by American Family Insurance, to provide home and auto insurance to its members. While Costco doesn’t underwrite its policies, members can access CONNECT’s insurance products and exclusive discounts through Costco Insurance Agency.

Does Costco Canada have auto insurance?

Costco auto insurance is not available in Canada through CONNECT. CONNECT only serves U.S. residents. While Costco Canada offers various member services, Canadian members must look to local providers for car insurance options.

Does Costco have auto-renewal?

Yes, CONNECT offers lifetime policy renewability for Costco Executive Members, assuming eligibility is maintained. This means your policy can renew automatically every term unless there’s a major violation, unpaid premium, or other disqualifying event.

Does Costco provide car insurance in California?

Yes, Costco offers auto insurance in California through CONNECT. California drivers may also qualify for a good driver auto insurance discount, available only in that state. However, some Executive Member benefits may vary, and certain discounts depend on state regulations and underwriting approval.

Is Costco auto insurance good for coverage and customer service?

Costco auto insurance scores well for both. It holds an AM Best financial strength rating of “A” and a J.D. Power score of 850 out of 1,000. Most members report good experiences with customer service, claims handling, and policy flexibility.

What types of coverage do Costco Insurance car policies offer?

CONNECT provides typical coverages like liability, collision, and comprehensive, along with add-ons like rental reimbursement, roadside assistance, and accident forgiveness. Coverage can be customized to fit your needs, especially if you’re an Executive Member.

What are the benefits of being a Costco member?

Costco members receive exclusive insurance discounts, and Executive Members enjoy added perks like roadside assistance, lifetime renewability, and glass repair reimbursement. Plus, bundling policies through CONNECT can save members up to 18% on premiums.

What do Costco home insurance reviews say?

Costco home insurance reviews are mostly positive, with customers praising strong discounts, reliable claims support, and complimentary benefits such as identity fraud protection and home lockout assistance. But availability and discounts differ by state.

What is the Costco Insurance phone number?

To speak directly with a CONNECT representative, Costco members can call 1-855-531-9253. This number connects you with licensed agents who can help you with quotes, policy questions, or claims support.

Does Costco offer car insurance?

Costco itself doesn’t sell insurance but offers members access to CONNECT auto insurance. Members can get policies with liability, collision, comprehensive, and additional add-ons, plus exclusive pricing not available to non-members.

What is the Costco Auto Program, and is it related to insurance?

The Costco Auto Program is separate from its insurance offerings. It helps members save on new or pre-owned vehicle purchases through pre-arranged pricing with participating dealers. However, many members use the program alongside CONNECT auto insurance for added convenience and savings.

Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.

What are users saying in the Costco auto insurance review Reddit threads?

Reddit users tend to post about mixed experiences. Some rave about CONNECT’s group rates and member-only benefits, whereas others find higher premiums than with competitors such as Geico or State Farm. Most agree that it’s great for older or low-risk drivers, but not as competitive for younger or high-risk applicants.

How do I access my Costco auto insurance login?

Policyholders can access their CONNECT accounts at www.connectbyamfam.com. From there, you can manage your policy, make payments, download documents, and update personal information using your Costco-linked credentials.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.