Best Teamster Auto Insurance Discounts in 2025 (Save up to 25% With These Deals)

The best Teamster auto insurance discounts are union member, multi-policy, and safe driver discounts, where you can save up to 25%. Several insurance companies offer these discounts for Teamsters members, relatives, and friends of people in the union. Learn how you could save on auto insurance with Teamster.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The best Teamster auto insurance discounts are union member, multi-policy, and safe driver discounts, where you can save up to 25%.

Choosing auto insurance that checks every box can be a complex task for many people. Fortunately, Teamsters auto insurance discounts are available for members, relatives, and friends.

Our Top 10 Picks: Best Teamster Auto Insurance Discounts

Discount Rank Savings Potential Description

Union Member Discount #1 25% Teamster members get a premium discount.

Multi-Policy Discount #2 20% Bundle auto and home insurance for savings.

Safe Driver Discount #3 15% Maintain a clean driving record to lower your premium.

Defensive Driving Course #4 10% Complete a defensive driving course for extra savings.

Multi-Vehicle Discount #5 10% Insure multiple cars on the same policy.

Low Mileage Discount #6 10% Drive fewer miles to reduce your insurance costs.

Loyalty Discount #7 10% Save more the longer you stay with the same insurer.

Automatic Payment Discount #8 5% Set up automatic payments to save on your premium.

Paperless Billing Discount #9 5% Go paperless to simplify billing and reduce costs.

New Vehicle Discount #10 5% Insure a new car to qualify for a discount.

In addition, the Teamsters are one of the largest unions in the country, so many people may be eligible for these discounts. Here’s some additional information about insurance companies that give auto insurance discounts for Teamsters.

Shopping for insurance can feel overwhelming, but you don’t have to do it alone. Enter your ZIP code below into our free comparison tool to get started.

- Teamsters is the largest, most diverse U.S. union

- Teamsters discounts can save you hundreds on auto insurance annually

- Good auto insurance protects property, limits liability, and offers peace of mind

Eligibility Criteria for Teamster Auto Insurance Discount

As a member of the Teamsters Union or an affiliated union, you have access to exclusive discounts that can help lower your auto insurance premiums. Below, we’ll explain the specific requirements you need to meet to qualify for the Teamster auto insurance discount and how you can take advantage of these savings.

From union membership to additional qualifying factors, we’ll break down everything you need to know to ensure you’re eligible for this special discount.

Be a Union Member

Teamster offers cheap auto insurance for union members. To qualify for the Teamster auto insurance discount, one of the key requirements is being a union member. Specifically, the Teamsters Union offers its members exclusive auto insurance discounts through partnerships with certain providers.

Union membership often comes with other perks, such as enhanced customer service and support tailored to the needs of workers. The Teamster auto insurance discount is just one-way union members can enjoy financial benefits beyond their regular union activities.Michael Vereecke Commercial Lines Coverage Specialist

As a union member, you can take advantage of lower premiums and special coverage options designed to support workers in various industries.

The Teamsters Union, with its vast network of members, often negotiates favorable rates and discounts on auto insurance to help reduce the financial burden on its members. To qualify for this discount, you must be an active or retired member of the Teamsters or another affiliated union. This discount recognizes the collective strength of union members, allowing them to benefit from exclusive deals that may not be available to the general public.

Union membership often comes with other perks, such as enhanced customer service and support tailored to the needs of workers. The Teamster auto insurance discount is just one-way union members can enjoy financial benefits beyond their regular union activities. To apply for this discount, you must provide proof of your union membership when signing up for or renewing your auto insurance policy.

Take a Defensive Driving Course

One of the key ways to qualify for the Teamster auto insurance discount is by taking a defensive driving course. Defensive driving courses are designed to improve your driving skills, making you a safer and more responsible driver. Insurance companies, including those that offer discounts to Teamster Union members, reward drivers who complete these courses with lower premiums, as they are statistically less likely to be involved in accidents.

Defensive driving courses typically cover essential skills such as handling road hazards, avoiding collisions, and responding to unexpected situations on the road. The goal is to reduce the likelihood of accidents, reducing the insurance company’s risk of paying out claims. Demonstrating your commitment to safe driving makes you eligible for discounts that save you money on auto insurance.

Many defensive driving courses are available online or in person and can often be completed in just a few hours. Once you complete the course, you’ll receive a certificate that can be submitted to your insurance provider as proof. This added step enhances road safety for Teamster members and helps meet one of the key requirements for maximizing the auto insurance discount.

In addition to lowering your insurance rates, you should take a defensive driving class to help you become a more confident and safer driver, providing long-term benefits beyond the immediate financial savings.

Bundle Your Policies

Bundling your insurance policies is one of the most effective ways to qualify for the Teamster auto insurance discount. You can take advantage of significant savings by combining multiple insurance policies—such as auto, home, renters, or even life insurance—under a single provider. Insurance companies often offer discounts to customers who consolidate their coverage, as it simplifies their management and strengthens customer loyalty.

For Teamster Union members, bundling policies is a convenient option and a smart financial move. Many insurance companies affiliated with the Teamsters offer exclusive discounts for union members who bundle their auto insurance with other types of coverage. By having all your insurance needs met by one provider, you can enjoy the ease of a single premium, streamlined communication, and reduced costs.

The savings from bundling policies can be substantial, often reducing premiums by 10% to 25%. This discount can apply to both your auto insurance and the other types of coverage you bundle, making it an excellent way to maximize your benefits. In addition, bundling can help ensure comprehensive coverage across multiple areas of your life, from protecting your vehicle to securing your home or personal property.

The savings from bundling policies can be substantial, often reducing premiums by 10% to 25%. This discount can apply to both your auto insurance and the other types of coverage you bundle, making it an excellent way to maximize your benefits.Joel Ohman Certified Financial Planner

To qualify for this discount, inquire with your insurance provider about available bundling options and ensure they are part of the Teamster insurance program. By bundling your policies, you’ll meet one of the key requirements for the Teamster auto insurance discount while simplifying your financial life and reducing your overall insurance expenses.

Read our article on what an auto insurance specialist says about bundling rates to learn more about how much you can save when you bundle your auto insurance.

Be a Loyal Customer

Teamster offers one of the best customer loyalty auto insurance discounts. Being a loyal customer is another way to qualify for the Teamster auto insurance discount. Insurance companies value long-term client relationships and reward customer loyalty with premium discounts. As a Teamster Union member, your loyalty to an insurance provider can result in lower rates, saving you money over time.

Our latest research found that employees who understand their benefits are happier, healthier, and more engaged at work. Help people make confident open enrollment decisions with these recommended actions: https://t.co/N2364kR3mZ #MetLifeBenefitTrends2023 #HR pic.twitter.com/geCMk5kXhs

— MetLife (@MetLife) October 18, 2023

The concept behind the loyalty discount is simple: the longer you stay with the same insurance provider, the more trust you build with them. They often offer discounted rates to retain you as a customer.

Loyalty discounts can vary depending on how long you’ve been with the insurer, with more extended periods typically resulting in greater savings. For example, if you’ve been insured with the same company for five or more years, you could qualify for a substantial loyalty discount.

For Teamster members, sticking with the same insurance provider can also lead to additional perks. Some companies may offer flexible payment options, faster claim processing, or enhanced customer service as part of their loyalty rewards. This creates a win-win scenario where the insurance provider retains a dedicated client, and you benefit from financial savings and added convenience.

Maintaining continuous coverage with your provider is essential to take advantage of this discount. Switching policies too often may disqualify you from loyalty savings. By being a loyal customer, you secure better rates and strengthen your relationship with your insurer, ensuring long-term benefits.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Teamster Auto Insurance Discounts

As a member of the Teamsters Union, you can take advantage of several exclusive auto insurance discounts that are specifically designed to help you save money. Among the best discounts available to union members are the union member discount, multi-policy discount, and safe driver discount.

Each of these offers substantial savings and rewards you for:

- Your union membership

- Responsible driving

- Bundling multiple insurance policies

So try to find out which of these you qualify for. If you don’t qualify for these, check out our list of other discounts offered by Teamsters.

Union Member Discount

The union member discount is one of the most valuable perks for Teamster members, offering up to 25% off your auto insurance premiums. This discount is available exclusively to active and retired Teamsters Union members, recognizing the union’s strength and its members’ loyalty.

To qualify, you simply need to provide proof of your union membership. Whether you’re working or retired, this discount can help reduce your auto insurance costs.

Learn more: Best Membership Auto Insurance Discount

Multi-Policy Discount

The multi-policy discount is another major way to save on auto insurance. By bundling your auto insurance with other policies, such as home or renters insurance, you can earn up to 20% off your total premium. This not only saves you money but also simplifies your insurance needs by combining your policies under one provider.

For Teamster members with multiple insurance needs, the multi-policy discount is an excellent way to reduce costs while maintaining comprehensive coverage.

If you’re wondering How to save money by bundling insurance policies, this discount is one of the easiest and most effective methods to explore. Bundling can lead to significant savings and convenience in managing your insurance policies.

Safe Driver Discount

The safe driver discount is the best auto insurance discount for good drivers. The Safe Driver discount rewards those who maintain a clean driving record, offering up to 15% off their auto insurance.

Suppose you’ve gone several years without an accident or traffic violation. In that case, you can qualify for this discount, which is a great way to lower your insurance costs while practicing responsible driving habits. For Teamster members who prioritize safety on the road, the safe driver discount is a practical and rewarding option.

Together, these three Teamster auto insurance discounts—union member, multi-policy, and safe driver—offer significant savings opportunities for members, helping them get affordable, reliable coverage while taking advantage of their union benefits.

Top Companies That Offer Auto Insurance Discounts for Teamsters

Several car insurance companies offer auto insurance discounts for Teamsters, including General Motors Acceptance Corporation (GMAC) and MetLife Auto & Home Insurance:

- GMAC Teamster Vehicle Insurance Program: GMAC Provides customizable auto insurance coverage, and claims satisfaction is guaranteed, or your deductible will be waived up to $250. Teamsters and their family members can take advantage of additional commercial or Class B driver’s license discounts to find cheap auto insurance options.

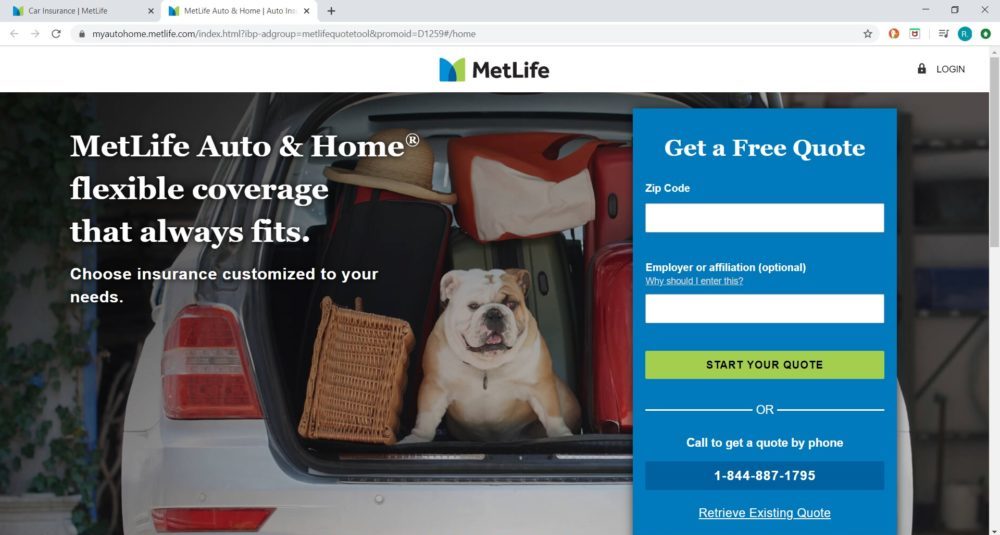

- Teamster Auto Insurance Program from MetLife Auto & Home Insurance: MetLife offers 15% off auto insurance for Teamsters, plus additional discounts for automatic payments, multi-policy, and multi-vehicle. It also provides insurance for recreational vehicles, boats, mobile homes, and excess personal liability or umbrella policies.

Both companies provide 24/7 claims service, but only GMAC works with mechanics who use genuine parts made by the manufacturer at no extra cost. Towing is covered nationwide with GMAC as well, and you can use up to $500 for emergency expenses.

However, MetLife auto insurance typically doesn’t have any service fees, down payments, or interest charges. To sign up for MetLife Auto and Home, call 1-877-491-5089 and mention the Teamsters discount code, B6J. Or use our free comparison tool to find local companies near you with auto insurance discounts for Teamsters.

Additionally, When looking for auto insurance discounts for Teamsters, there are several notable options. Farmers insurance offers a UPS discount for teamsters, which provides significant savings for Teamsters working with UPS. Another great option is using a Mercury insurance promotional code for teamster, which can offer additional discounts.

Teamsters should also explore Teamster discounts and Teamster insurance plans, which are tailored to their needs. Additionally, many seek out Teamsters car insurance, which offers both comprehensive coverage and potential savings, reflecting the special benefits available to union members.

Overall, auto insurance for Teamsters can offer significant savings through various top providers. Companies like GMAC and MetLife offer tailored plans, with union car insurance companies often providing special rates. For example, Farmers insurance offers a UPS discount for Teamsters, providing substantial savings for Teamsters employed by UPS(Find out more in our review of Farmers car insurance).

Also, using a Mercury insurance promotional code for Teamster can further enhance discounts.

Teamsters should explore Teamster discounts and Teamster insurance plans that cater specifically to their needs. To find the best options, consider tools to compare rates and look for the cheap union car insurance that offers discounts for members of the Teamsters Union.

Requirements for Auto Insurance Discounts for Teamsters

If you qualify for a Teamsters discount, you might save several hundred dollars annually on auto insurance. You can find the nearest branch of the International Brotherhood of Teamsters on their website.

Even if the union isn’t currently active at your workplace, it can expand into new workplaces often. So you can help yourself and your coworkers get a great deal on auto insurance.

Welcome back to school! Let’s learn insurance-bundling syntax. pic.twitter.com/aR5neZwKCJ

— Farmers Insurance (@WeAreFarmers) September 3, 2024

In addition, when looking for an auto insurance discount for UPS employees, Teamsters can access several valuable programs. For example, many insurers offer rental car discounts for Teamsters, which can help reduce costs for temporary vehicle use.

It’s essential to remember that car insurance is mandatory in the USA, so Teamsters must ensure they are compliant with legal requirements while exploring these discount options. Reviewing different car insurance policies in the USA will help Teamsters find the most suitable rates and coverage.

Teamsters can save significantly on auto insurance by using union-specific discounts and choosing comprehensive coverage tailored to their needs.

Also, Teamsters may want to consider premium auto insurance for enhanced coverage and benefits. These policies often provide extra protection and additional features, offering more comprehensive support. By comparing various car insurance policies in the USA and utilizing available auto insurance discount for UPS employees, Teamsters can effectively manage their insurance expenses while meeting all necessary legal standards.

Furthermore, understanding the purpose of the Teamsters is crucial when exploring auto insurance discounts. The Teamsters Union is dedicated to providing its members with various benefits, including special auto insurance rates.

This commitment is evident when considering the difference between general labor unions and the Teamsters Union, as the Teamsters often secure unique discounts due to their large and influential membership base.

Moreover, knowing the origin of the Teamsters’ name highlights the union’s longstanding history and commitment to its members. The Teamsters Union death benefit is one of the many ways the union supports its members, reflecting its overall dedication to providing comprehensive benefits.

When looking for auto insurance discounts, Teamsters should leverage these union benefits to find the best possible rates and coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Essential Guide to Auto Insurance Discounts for Teamsters

When evaluating auto insurance discounts for Teamsters, it is crucial to grasp the broader context of insurance for drivers to make well-informed decisions. This involves exploring various options, including car insurance in Florida, where rates and coverage can differ significantly depending on the state.

Comment

byu/Juantimeinmexico from discussion

inTruckers

For Teamsters looking to save on their insurance premiums, understanding car insurance costs in the USA is essential for comparing different rates and identifying the best available discounts. By being informed about these variables, Teamsters can effectively navigate their options and secure the most cost-effective insurance.

In addition to cost considerations, Teamsters should focus on what represents the best type of car insurance for their unique needs. This involves evaluating whether they require comprehensive coverage that offers extensive protection or more affordable options that might be sufficient for their circumstances.

Striking the right balance between coverage and cost is key to meeting the Teamsters’ demands for insurance that provides both excellent protection and value. Tailoring insurance plans to fit specific needs ensures that Teamsters get the most appropriate coverage for their situations.

Teamsters can save the most on auto insurance by using union discounts and benefits such as the Teamster Privilege credit card.

Furthermore, understanding the broader scope of the Teamsters’ role can provide valuable context. Knowing about countries with Teamsters and the Teamsters’ biggest employer can give insight into the union’s global presence and influence. Familiarity with the full name of the Teamsters and the union’s historical background can offer additional context on how the union negotiates benefits and discounts.

This comprehensive understanding aids Teamsters in making more informed decisions about their auto insurance, ensuring they select the best possible options for their circumstances.

Also, when exploring the essential guide to auto insurance discounts for teamsters, it’s beneficial to consider other financial advantages available to Teamsters. One such benefit is the benefits of the Teamster Privilege credit card, which provides exclusive perks and discounts specifically for Teamsters.

Moreover, taking advantage of Teamster union discounts can further enhance savings by offering reduced rates on various services, including auto insurance. By combining the Teamster Privilege credit card with Teamster union discounts, Teamsters can maximize their financial benefits and effectively manage their insurance costs.

Insights on Auto Insurance Discounts for Teamsters

In final thoughts on auto insurance discounts for Teamsters, it’s important to highlight how various benefits contribute to their insurance options. The Teamsters’ strike benefit and Teamster car insurance coverage in the USA are examples of the comprehensive support available to Teamsters.

When choosing the best insurance type for Teamsters, consider options that match their specific needs and benefits. Also, exploring Teamsters health insurance benefits and Teamsters Union benefits for Toyota employees can help Teamsters find insurance plans that offer both cost savings and extensive coverage.

When choosing the best insurance type for Teamsters, consider options that match their specific needs and benefits. Also, exploring Teamsters health insurance benefits and Teamsters Union benefits for Toyota employees can help Teamsters find insurance plans that offer both cost savings and extensive coverage.Kristen Gryglik Licensed Insurance Agent

Additionally, when considering auto insurance discounts for Teamsters, it’s important to understand the need for insurance. To save on costs, finding the cheapest car insurance in Florida can be helpful, but it’s crucial to balance affordability with coverage (Learn more in our best Florida auto insurance guide).

On the other hand, expensive car insurance in Florida may offer more extensive coverage at a higher cost. Teamsters, including those from Teamsters Local 700, should also think about whether they require extra car insurance in the USA to ensure they have adequate protection. Evaluating these aspects will help Teamsters choose the best auto insurance for their needs.

Auto insurance discounts for union members are available from many companies, even if you’re not a member of the Teamsters. The Teamsters also offer discounts on prescription discount cards, home insurance, mortgage discount programs, and more. Enter your ZIP code above to find local auto insurance companies with discounts for Teamsters.

Frequently Asked Questions

What auto insurance companies belong to the Teamsters?

Teamsters insurance companies include GMAC (Read more about GMAC in our GMAC auto insurance review), MetLife, and Farmers Insurance. These are the three companies that offer specific auto insurance discounts for Teamsters.

Who belongs to the Teamsters?

Many Teamsters are warehouse workers and freight drivers. This union also offers auto insurance for firefighters and other first responders, public defenders, brewers, sanitation workers, zoo keepers, health care workers, and more. It has more than 1.2 million members.

Why are they called Teamsters?

A “teamster” is someone who leads labor animals, such as oxen and mules. Since many union members are laborers and front-line workers, it refers to the union’s ability to organize and lead these workers toward fairer and more respectable working conditions.

Who is the largest employer of Teamsters?

UPS employs the highest number of Teamsters, with over 300,000 employees as union members. As the largest employer of Teamsters, UPS has built a strong relationship with the union, ensuring that its workforce receives competitive wages and benefits. Many employees may also take advantage of perks like the UPS auto insurance discount, which offers savings on car insurance.

What is the new law for auto insurance in Florida for Teamsters?

The new law for auto insurance in Florida, effective July 1, 2024, requires drivers to carry Personal Injury Protection (PIP) insurance, but it also introduces changes to coverage limits and requirements. Teamsters in Florida should check with their insurance providers for specific updates.

What are the benefits of being in the Teamsters?

Along with the union car insurance discounts, Teamsters members can get health, accident, and life insurance discounts. A Teamsters credit card gives 1.5% cash back on every purchase, a college tuition discount, dental insurance, and vision insurance.

How many years do you need for a Teamsters pension?

You must be vested in Teamsters for at least five years to qualify for the union’s pension benefits.

What insurance does the Teamsters Union offer?

The Teamsters Union offers a variety of insurance benefits to its members, including health insurance, life insurance, and auto insurance discounts. These benefits are tailored to support the needs of Teamster members and their families. Most people wonder if they still need medical payment coverage on auto insurance and if health insurance. The answer is yes because it will help you with your co-pay.

What is the full name of the Teamsters?

The full name of the Teamsters is the International Brotherhood of Teamsters (IBT).

Who is Teamsters’ biggest employer?

The Teamsters represent employees from various industries, but some of their largest employers include UPS (United Parcel Service) and various freight and transportation companies.

Is UPS still Teamsters?

Yes, UPS remains part of the Teamsters. The union’s Package Division is its largest sector, representing hundreds of thousands of members across North America, with UPS being the largest employer within the Teamsters.

Which is the most expensive form of car insurance for Teamsters?

The most expensive form of car insurance for Teamsters is typically comprehensive coverage, which provides extensive protection, including damage from non-collision incidents like theft or natural disasters. This coverage usually comes at a higher premium.

Why are they called Teamsters?

If you’re wondering what is Teamsters and why is it called Teamsters, here’s your answer. The term “Teamsters” originates from the union’s early days when members worked in teams to handle horse-drawn wagons. The name reflects the union’s historical roots in transportation and teamwork.

How do the Teamsters work?

Teamsters work in various industries, including transportation, warehousing, and logistics. They are involved in negotiating labor contracts, advocating for workers’ rights, and providing benefits and support to union members.

How much is car insurance per month for a Teamster employee in the US?

The cost of car insurance per month for a Teamster employee in the US can vary widely based on factors like location, driving history, and insurance provider. On average, it may range from $100 to $300 per month. To find more affordable rates, Teamsters should explore options for cheap car insurance for union members, as many insurers offer special discounts to union-affiliated workers. Taking advantage of these discounts can help significantly reduce monthly auto insurance premiums while still providing adequate coverage.

Can a foreigner who is a Teamster get car insurance in the USA?

Yes, a foreigner who is a Teamster can obtain car insurance in the USA, provided they meet the insurance company’s requirements and have a valid driver’s license and necessary documentation.

Why is car insurance mandatory in the USA for Teamsters?

Car insurance is mandatory for Teamsters in the USA as it is a legal requirement in most states. It ensures that drivers have financial protection in case of accidents and helps cover damages and liabilities.

What is the best and cheapest car insurance for Teamsters?

The best and cheapest car insurance for Teamsters can vary based on individual circumstances. Generally, Teamsters should compare quotes from multiple insurers and look for discounts specific to their profession or union membership to find the most cost-effective options.

When comparing providers, it’s helpful to consider Allstate vs MetLife, as both offer competitive rates and discounts that may benefit union members. Another valuable comparison is MetLife vs Geico, as these companies often provide affordable plans with coverage options tailored to drivers’ needs. Shopping around can help Teamsters find the best deal.

Read more:

Which car insurance company has the most complaints from the Teamsters?

Car insurance companies with the most complaints from Teamsters can vary, but common issues often involve customer service or claims processing. It’s recommended to check consumer review sites and ratings to find current information on insurance companies with frequent complaints

Don’t let expensive insurance rates hold you back. Enter your ZIP code above and shop for affordable premiums from the top companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.