Best Auto Insurance Discounts for Farm Bureau Members in 2025 (Save 20% With These Deals!)

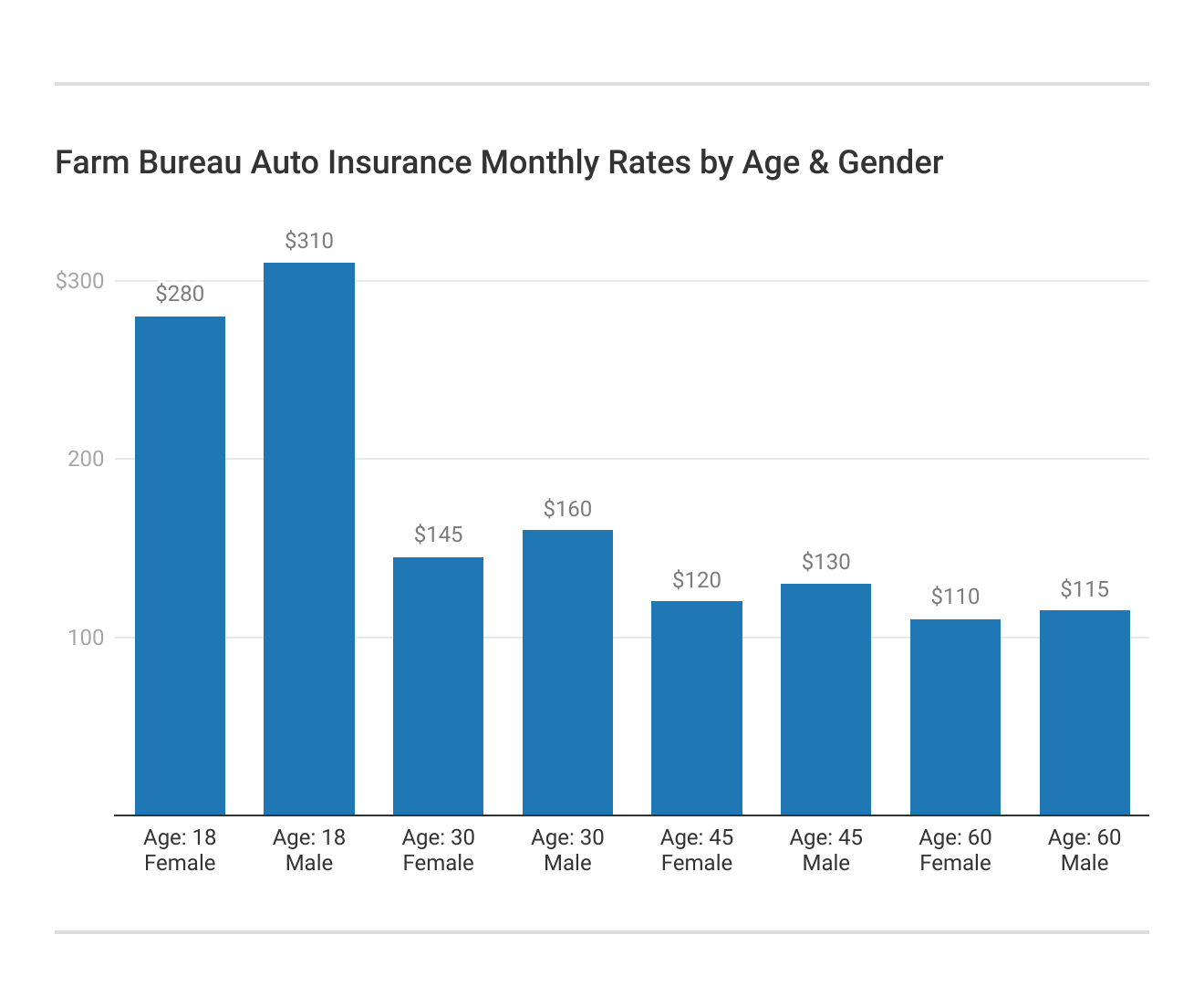

The best auto insurance discounts for Farm Bureau members include significant savings, with potential discounts of up to 20%, members can utilize multi-policy, safe driver, and good student discounts to reduce their premiums. Explore these options to maximize your savings on auto insurance today.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Oct 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The best auto insurance discounts for Farm Bureau members include a multi-policy discount, safe driver discount, and good student discount, allowing members to save up to 20% on their premiums. Check out our ranking of the top providers: Best Auto Insurance Companies

These discounts, policyholders can significantly reduce their costs while ensuring comprehensive coverage. With options for bundling policies, rewarding safe driving habits, and encouraging academic excellence.

Our Top 10 Picks: Best Auto Insurance Discounts for Farm Bureau Members

| Discount | Rank | Savings Potential | Description |

|---|---|---|---|

| Multi-Policy Discount | #1 | 20% | Bundle policies for savings |

| Safe Driver Discount | #2 | 15% | Clean record earns savings |

| Good Student Discount | #3 | 10% | Good grades lower premiums |

| Defensive Driving Discount | #4 | 10% | Complete course, get savings |

| Accident-Free Discount | #5 | 10% | No claims = savings |

| Vehicle Safety Discount | #6 | 10% | Safety features lower cost |

| Low Mileage Discount | #7 | 8% | Drive less, pay less |

| Farm Bureau Member Discount | #8 | 5% | Member-exclusive savings |

| Driver Training Discount | #9 | 5% | Young drivers complete training |

| Paperless Discount | #10 | 5% | Go paperless, save money |

Farm Bureau provides valuable incentives tailored to diverse lifestyles. Explore these opportunities to maximize your savings and enhance your insurance experience today.

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool above.

- Farm Bureau members can save 20% with multi-policy and good student discounts

- Regular policy reviews uncover new discount opportunities for members

- Get unique discounts for students and low-mileage drivers to save more

Auto Insurance Discounts for Farm Bureau

Farm Bureau financial services offer several discounts to help save money on auto insurance. Each member will need to talk to an insurance agent to learn how they may qualify for these discounts. Farm Bureau offers a range of auto insurance discounts to its policyholders. Some of the most common discounts with the company include the following. Take a look at our list of the leading providers: Best Auto Insurance Discounts

Farm Bureau Members Choice Offers Bundled Discounts

You can often save money by bundling insurance policies if you get your car and home insurance from the same company. With Farm Bureau, you pay just one premium and won’t need to manage a range of policies and payments. Plus, you only pay one deductible if you have a major loss event where you may sustain damage to your car and home at the same time.

Farm Bureau Members Choice offers members the opportunity to save significantly through bundled discounts on insurance products. By combining policies such as auto, home, and farm coverage, members can streamline their insurance management while enjoying enhanced protection for their assets.

With personalized service and tailored coverage options, members benefit from a trusted network known for quality service and community involvement. Discover how to maximize your membership benefits with bundled discounts today by visiting your local Farm Bureau office or their website.

Farm Bureau Driveology Program Checks for Save Driver Discounts

Many companies offer discounts linked to monitored driver behavior, and some auto insurance companies offer cash back for safe drivers. For example, Farm Bureau Driveology is the company’s usage-based auto insurance program.

However, the program is currently a work in progress. The company is updating its technology to transition away from the OBD-II devices it once used to record driver behavior. According to the company, its program could save you up to 30% on auto insurance premiums.

So, what does Driveology track? Farm Bureau Driveology tracks certain driving behaviors, such as speeding, acceleration, or hard braking. Then, the Driveology program offers savings based on how well you drive.

Driven to Safety Auto Insurance Discount From Farm Bureau

The driven to safety auto insurance discount offered by Farm Bureau recognizes policyholders for their safe driving behaviors. By following speed limits and keeping a clean driving record, customers can benefit from lower premium rates, showcasing how auto insurance companies check driving records to determine eligibility for discounts.

This initiative encourages safe driving practices, making auto insurance more affordable while promoting safer roads for the community. To qualify, members may need to participate in monitoring programs or provide evaluations of their driving habits. Overall, this discount is a valuable opportunity for Farm Bureau members to save on premiums while fostering road safety.

Claim-Free Farm Bureau Auto Insurance Discount

The claim-free Farm Bureau auto insurance discount is a financial incentive offered by Farm Bureau Insurance to policyholders who have maintained a claim-free driving record over a specified period. This discount is designed to reward responsible drivers who prioritize safety and minimize risk on the road, highlighting the key features of the Claim-Free Discount.

- Eligibility Criteria: Policyholders qualify if they have not filed any auto insurance claims within a specific timeframe, usually between three to five years.

- Discount Percentage: The discount typically ranges from 10% to 25%, significantly reducing overall premium costs for claim-free drivers.

- Renewal Benefits: Maintaining a claim-free record can lead to additional discounts or benefits upon policy renewal, enhancing long-term savings.

- Promotion of Safe Driving: This discount encourages responsible driving habits, fostering a culture of safety among policyholders.

- Review for Additional Discounts: Policyholders should regularly review their auto insurance policies to ensure they receive all applicable discounts, including the Claim-Free Discount.

The claim-free discount rewards safe driving, offering savings and promoting responsibility in the community.

By recognizing and rewarding responsible behavior, Farm Bureau Insurance helps its members enjoy peace of mind while potentially lowering their insurance costs.

Farm Bureau Auto Insurance Good Student Discount

Students that maintain a “B” average or higher can qualify for lower insurance payments with the Farm Bureau good student discount. Read more about how to get a good student auto insurance discount. Typically available to high school and college students, this discount is often granted to those who maintain a GPA of 3.0 or higher.

By significantly reducing auto insurance premiums, it helps families save money while encouraging safe driving habits linked to academic performance. To apply, students usually need to provide proof of their grades, such as report cards or transcripts. Additionally, some policies may offer further discounts for completing driver education courses.

Overall, this discount not only provides immediate financial relief but also fosters a sense of responsibility among young drivers, highlighting the connection between academic diligence and real-world benefits.

Safe Young Driver Auto Insurance Discount With Farm Bureau

There are many reasons auto insurance costs more for young drivers, but there are ways to lower these costs. You can complete a young driver safety program if you are 25 or younger and want an auto insurance discount for Farm Bureau members.

- Watch an Approved Driving Safety Video: View a safety video with an agent to understand safe driving practices.

- Log 30 Hours of Supervised Driving: Complete 30 hours of driving under the supervision of a licensed adult to gain practical experience.

- Commit to Driving Safely: Agree to adhere to safe driving habits and follow traffic laws.

- Reveal Your Personal Driving Record: Provide your driving record and any claims history to the insurer for risk assessment.

Young drivers can significantly reduce their insurance costs while promoting safer driving habits.

Completing the young driver safety program not only provides valuable skills and experience but also fosters a commitment to responsible driving. Start your journey towards safer roads and savings today.

Low Mileage Discount With Farm Bureau Auto Insurance

Farm Bureau Auto Insurance Discounts for Multiple Vehicles

Farm Bureau auto insurance offers significant discounts for policyholders insuring multiple vehicles under one policy. Customers must list at least two vehicles, like cars or trucks, to qualify for greater savings. For details on verifying a vehicle’s insurance coverage, see “How to Check if a Vehicle Has Auto Insurance Coverage.”

Farm Bureau auto insurance offers significant discounts for bundling multiple vehicles under one policy, simplifying management while maximizing savings.

This bundling simplifies management by allowing customers to handle payments and claims through one policy, while also providing access to comprehensive coverage options tailored to each vehicle. Interested customers should contact their local Farm Bureau agent for personalized quotes and to evaluate their coverage needs, ensuring maximum savings and protection for all their vehicles.

Continued In-Force Credit Farm Bureau Auto Insurance Discounts

This refers to the ongoing application of credits or discounts for policyholders who maintain their auto insurance with Farm Bureau. These discounts are designed to reward loyal customers and encourage safe driving practices. Explore our list of the best providers: Best Companies for Credit-Based Auto Insurance

Customers may benefit from reduced premiums or other financial incentives that reflect their driving history, claims experience, and overall loyalty to the company. This program not only supports policyholders in managing their insurance costs effectively but also enhances their relationship with Farm Bureau by fostering a sense of community and trust.

Annual Check Looks for Additional Auto Insurance Discounts From Farm Bureau

Each year, it is important to review your auto insurance policy to identify potential discounts that you may qualify for through Farm Bureau. This annual check not only ensures that you are receiving the best rates possible but also allows you to take advantage of new discounts that may have been introduced since your last review.

Farm Bureau members can save up to 20% on auto insurance by leveraging discounts for multi-policy bundling, safe driving, and academic excellence.Daniel Walker Licensed Auto Insurance Agent

Farm Bureau often offers various discounts based on factors such as safe driving records, bundling policies, and participation in specific programs. By conducting this annual assessment, you can potentially lower your premiums, improve your coverage, and gain peace of mind knowing that you are making the most of your insurance investment. Review our top-rated providers: Best Companies for Bundling Home and Auto Insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Other Farm Bureau Auto Insurance Discounts

In addition to the standard auto insurance discounts, you may qualify for several other discounts offered by Farm Bureau Auto Insurance. These discounts are designed to help you save on your premium while ensuring you have the coverage you need.

- Married Driver Discount: Available to married couples, this discount reflects safer driving habits often associated with married drivers.

- Military Service Discount: Active duty military members and veterans may qualify for this discount as recognition of their service.

- Paid in Full Discount: If you pay your premium in full instead of monthly, you can benefit from this discount, which helps reduce your overall cost.

- Online Service Discount: Opting for digital communications and online policy management instead of paper can lead to savings on your premium.

- Senior Discount: Available for drivers aged 55 and older, this discount rewards experienced drivers who typically maintain safer driving records.

It’s important to note that the availability and amount of these discounts can vary by insurance company.

Maximizing Savings: Auto Insurance Discounts for Farm Bureau Members

Farm Bureau members can take advantage of various auto insurance discounts, including savings for good students, low-mileage drivers, and safe driving behaviors tracked through the Driveology program. Additional discounts are available for bundling policies, maintaining a claim-free record, and completing young driver safety programs.

Regularly reviewing your policy can help identify new savings opportunities, making it easier to manage costs while ensuring adequate coverage. You may also be eligible for multiple vehicle discounts and savings if you bundle your home and car insurance. Learn more about how to save money by bundling insurance policies.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Frequently Asked Questions

What is the Farm Bureau low mileage discount?

The Farm Bureau low mileage discount rewards policyholders who drive less than a specified number of miles annually, typically under 7,500 miles. This discount can range from 5% to 15%, reflecting the reduced risk of accidents associated with lower mileage.

What is Driveology Farm Bureau, and how does it work?

Driveology is a usage-based insurance program offered by Farm Bureau that tracks driving behavior through a mobile app or telematics device. It monitors factors like speed, acceleration, and braking to reward safe driving habits with potential discounts on premiums.

Finding cheaper insurance rates is as easy as entering your ZIP code into our free quote comparison tool below.

Can Driveology help reduce my insurance rates if I frequently speed?

While safe driving is crucial for receiving discounts, frequent speeding may lead to higher premiums rather than reductions. Driveology tracks speeding behaviors, and consistent speeding can negatively impact your eligibility for discounts like the safe driver discount. For more insights, check out our guide on “Best Auto Insurance Discounts for Good Drivers.”

What do Driveology reviews say about its effectiveness?

Many users appreciate the potential savings offered through the Driveology program, often reporting discounts of up to 30% based on their safe driving. However, experiences can vary, and some drivers may find the monitoring intrusive. Checking recent reviews can provide insight into current user satisfaction.

Is the Farm Bureau Driveology review favorable?

Generally, the Driveology program receives positive feedback for incentivizing safe driving and providing cost savings. However, some users express concerns about privacy and the accuracy of the data collected. Reviewing both positive and negative experiences can help determine if it fits your needs.

What types of auto discounts does Farm Bureau offer?

Farm Bureau provides various auto insurance discounts, including multi-vehicle discounts, low mileage discounts, safe driver discounts, good student discounts, and discounts for bundling home and auto insurance. Checking with your agent can help identify specific savings applicable to your policy.

How can I qualify for the Farm Bureau safe driver discount?

To qualify for the safe driver discount, you must maintain a clean driving record, demonstrating responsible driving habits. Participation in programs like Driveology can also enhance your eligibility for this discount by providing evidence of safe driving behavior.

Does Farm Bureau offer gap insurance?

Yes, Farm Bureau provides gap insurance options for those who finance or lease their vehicles. Gap insurance covers the difference between what you owe on your vehicle and its actual cash value in the event of a total loss.

Is the Farm Bureau good student discount form easy to complete?

Yes, the good student discount form is typically straightforward. Students must provide proof of maintaining a “B” average or higher (usually a GPA of 3.0 or above) by submitting report cards or transcripts. This discount encourages academic excellence while reducing insurance costs.

What features does the Driveology app provide?

The Driveology app allows users to track their driving habits, view feedback on their performance, and monitor their progress towards potential discounts. It can also provide insights into areas for improvement in driving safety.

Searching for more affordable premiums? Insert your ZIP code below to get started on finding the right provider for you and your budget.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.