Best Auto Insurance for Panera Bread Delivery Drivers in 2025 (Top 10 Companies Ranked)

Progressive, State Farm, and Liberty Mutual are the best auto insurance options for Panera Bread delivery drivers, offering essential coverage for as low as $95/month. These companies provide essential protection for delivery-specific risks, ensuring Panera Bread delivery drivers stay covered on the road.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Feb 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Panera Bread Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Panera Bread Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Panera Bread Delivery Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews

Progressive, State Farm, and Liberty Mutual are the best auto insurance for Panera Bread delivery drivers, offering specialized coverage options to handle the demands of food delivery.

These companies stand out for their comprehensive policies that cover both personal and commercial use, ensuring drivers are protected during every shift. Choosing one of these top providers guarantees peace of mind and financial security in case of accidents or other incidents.

Our Top 10 Company Picks: Best Auto Insurance for Panera Bread Delivery Drivers

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A+ Custom Coverage Progressive

#2 18% B Local Agents State Farm

#3 13% A Flexible Policies Liberty Mutual

#4 12% A++ Military Families USAA

#5 17% A+ Accident Forgiveness Nationwide

#6 15% A+ Drivewise Discounts Allstate

#7 13% A Roadside Assistance Farmers

#8 7% A+ Tailored Plans The Hartford

#9 12% A++ Hybrid Discounts Travelers

#10 16% A Safe Driving American Family

For Panera Bread delivery drivers, selecting the right insurance is essential to safeguard their vehicles and livelihoods. Find more details in our guide titled “Best Delivery Driver Auto Insurance.”

Make sure you are covered for the best Panera Bread auto insurance rates with our free quote tool above.

- Progressive is the top pick for Panera Bread delivery drivers

- Delivery drivers need insurance covering both personal and business use

- Right insurance ensures protection from work-related incidents

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Customizable Policy Options: Progressive offers flexible coverage plans specifically designed for Panera Bread delivery drivers, including both personal and commercial use options that fit various needs. Read more in our full review on our article titled “Progressive Auto Insurance Review.”

- Snapshot Program for Discounts: Progressive’s usage-based Snapshot program allows Panera Bread delivery drivers to earn discounts by monitoring their driving habits, potentially lowering monthly premiums significantly.

- Extensive Repair Network: With a vast network of affiliated repair centers, Progressive ensures that Panera Bread delivery drivers can access prompt and efficient service if they need vehicle repairs after an accident.

Cons

- Higher Rates for High-Risk Drivers: Panera Bread delivery drivers with poor driving records or past infractions may face higher premiums, as Progressive tends to price higher for drivers considered high-risk.

- Complex Discount Structure: Understanding and maximizing the various discounts available through Progressive can be challenging, potentially complicating the decision-making process for Panera Bread delivery drivers.

#2 – State Farm: Best for Local Agents

Pros

- Local Agent Availability: State Farm’s extensive network of local agents provides Panera Bread delivery drivers with personalized service, offering tailored advice and support that can be crucial when selecting or managing insurance coverage.

- Reliable Roadside Assistance: State Farm includes comprehensive roadside assistance in its policies, ensuring Panera Bread delivery drivers have support for emergencies such as flat tires, dead batteries, or towing needs.

- Drive Safe & Save Rewards: Through the Drive Safe & Save program, Panera Bread delivery drivers can benefit from substantial discounts by maintaining safe driving habits, with savings reflecting their performance. Learn more by reading our article titled “State Farm Auto Insurance Review.”

Cons

- Basic Online Tools: Compared to competitors, State Farm’s digital tools may lack advanced features, making it less convenient for Panera Bread delivery drivers who prefer to manage their insurance online.

- Strict Underwriting Policies: State Farm’s rigorous underwriting process may limit coverage availability for Panera Bread delivery drivers with previous accidents or traffic violations, potentially leading to higher costs or denial of coverage.

#3 – Liberty Mutual: Best for Flexible Policies

Pros

- Flexible Coverage Options: Liberty Mutual provides a variety of customizable policies that cater to the unique needs of Panera Bread delivery drivers, whether they work part-time or full-time, ensuring they have adequate protection.

- Rate Lock for Stability: Liberty Mutual offers a 12-month rate guarantee, which ensures Panera Bread delivery drivers have consistent and predictable insurance costs, protecting them from sudden rate hikes. See the reviews and rankings in our full guide titled “Liberty Mutual Auto Insurance Review.”

- Bundling Savings: By offering a 13% discount for bundling auto insurance with other policies, Liberty Mutual helps Panera Bread delivery drivers reduce overall insurance costs while maintaining comprehensive coverage.

Cons

- Higher Premiums for High Mileage: Panera Bread delivery drivers who log extensive miles may face higher insurance premiums with Liberty Mutual, as the company factors mileage into its pricing models.

- Limited Access to In-Person Support: Liberty Mutual’s focus on digital and phone-based customer service means Panera Bread delivery drivers may have fewer opportunities for face-to-face interactions with insurance agents.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Military Families

Pros

- Exclusive Membership Benefits: USAA provides Panera Bread delivery drivers who are military members or their families with specialized rates and benefits tailored to their unique needs. Wondering about their level of customer service? Find out in our article titled “USAA Auto Insurance Review.”

- Superior Customer Service: Known for top-tier customer service, USAA offers Panera Bread delivery drivers reliable and responsive support, ensuring a positive experience when managing policies or filing claims.

- A++ Financial Stability: USAA’s highest rating from A.M. Best guarantees strong financial backing, giving Panera Bread delivery drivers confidence in the company’s ability to cover claims and maintain policy benefits.

Cons

- Restricted Membership: Only military members, veterans, and their families are eligible for USAA insurance, limiting its availability to Panera Bread delivery drivers outside of this group.

- Limited Local Branches: USAA primarily operates online and through phone services, meaning Panera Bread delivery drivers may not have easy access to in-person support or local branches.

#5 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Nationwide offers accident forgiveness, ensuring Panera Bread delivery drivers can avoid rate increases after their first at-fault accident, providing financial relief and stability.

- 17% Bundling Discount: Nationwide offers substantial savings when Panera Bread delivery drivers combine multiple insurance policies, such as auto and home, enhancing affordability. Find more information about Nationwide’s rates in our article titled “Nationwide Auto Insurance Review.”

- On Your Side Review: This program ensures that Panera Bread delivery drivers receive regular insurance checkups, optimizing their coverage and making sure they are getting the best value for their premiums.

Cons

- Average Online Experience: Nationwide’s digital tools may not be as advanced as other insurers, which could affect Panera Bread delivery drivers who prefer managing their insurance online.

- Premiums Vary Widely: Panera Bread delivery drivers may find that Nationwide’s premiums can fluctuate based on location and driving history, making it essential to carefully review policy costs.

#6 – Allstate: Best for Drivewise Discounts

Pros

- Drivewise Program for Savings: Allstate’s Drivewise program allows Panera Bread delivery drivers to earn rewards and discounts based on their driving behavior, helping reduce their insurance costs.

- Comprehensive Coverage Options: Allstate provides a wide range of insurance coverages, making it suitable for Panera Bread delivery drivers looking for extensive protection. Find out more about Allstate in our article titled “Allstate Auto Insurance Review.”

- 15% Bundling Discount: By combining policies like auto and renters insurance, Panera Bread delivery drivers can save up to 15% on their premiums, enhancing affordability.

Cons

- Higher Rates for New Drivers: Panera Bread delivery drivers who are new to the profession may face higher premiums, as Allstate adjusts rates based on experience and driving history.

- Moderate Claims Satisfaction: Some Panera Bread delivery drivers may experience average satisfaction with Allstate’s claims process, which could affect their overall experience.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Roadside Assistance

Pros

- Excellent Roadside Assistance: Farmers offers robust roadside assistance programs, ensuring Panera Bread delivery drivers have help available for emergencies like lockouts, flat tires, or breakdowns.

- Customizable Coverage: Farmers provides a variety of policy options, allowing Panera Bread delivery drivers to tailor their coverage based on specific needs, including both personal and commercial use.

- 13% Discount for Multiple Policies: Panera Bread delivery drivers can save on insurance costs by bundling their auto policy with other insurance products, such as home or renters insurance. Read our guide titled “Farmers Auto Insurance Review” to find out more about the company.

Cons

- Higher Premiums for Comprehensive Coverage: Panera Bread delivery drivers may find that comprehensive coverage options with Farmers come at a higher cost compared to basic plans.

- Rates Can Increase Over Time: Panera Bread delivery drivers might experience rate increases with Farmers, especially if they have multiple claims or changes in driving habits.

#8 – The Hartford: Best for Tailored Plans

Pros

- Customized Policy Options: The Hartford offers tailored insurance plans designed to meet the specific needs of Panera Bread delivery drivers, ensuring appropriate coverage for both personal and commercial use.

- AARP Partnership: The Hartford’s partnership with AARP provides Panera Bread delivery drivers who are AARP members access to additional discounts and benefits, enhancing affordability.

- Comprehensive Claims Support: The Hartford is known for excellent customer service, offering Panera Bread delivery drivers reliable and responsive claims support. Read more about The Hartford’s ratings in our article titled “The Hartford Auto Insurance Review.”

Cons

- Higher Premiums for New Policies: Panera Bread delivery drivers might find initial premiums with The Hartford higher compared to other insurers, especially if they lack a previous insurance history.

- Limited Online Tools: The Hartford may not offer as many digital tools and resources as some competitors, which could affect Panera Bread delivery drivers who prefer to manage their insurance online.

#9 – Travelers: Best for Hybrid Discounts

Pros

- Hybrid Vehicle Discounts: Travelers provides discounts specifically for Panera Bread delivery drivers who use hybrid or electric vehicles, promoting environmentally friendly options.

- Flexible Coverage Options: Travelers offers a variety of customizable coverage plans, making it a suitable choice for Panera Bread delivery drivers looking for specific protections tailored to their delivery work.

- Superior Claims Handling: Known for efficient and fair claims processing, Travelers ensures Panera Bread delivery drivers receive prompt support and settlements when needed. Check out our article titled “Travelers Auto Insurance Review” for more information.

Cons

- Higher Rates for High-Risk Drivers: Panera Bread delivery drivers with a history of accidents or violations may face higher premiums, as Travelers adjusts rates based on risk factors.

- Moderate Digital Experience: While Travelers offers some online tools, Panera Bread delivery drivers might find their digital experience less comprehensive compared to other insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Safe Driving

Pros

- Safe Driving Discounts: American Family rewards Panera Bread delivery drivers with significant discounts for maintaining safe driving records, encouraging cautious and responsible driving.

- Teen Safe Driver Program: For Panera Bread delivery drivers with young drivers in the family, American Family’s Teen Safe Driver Program provides monitoring and feedback to encourage safe driving habits.

- 16% Discount for Bundling: By combining policies like auto and home insurance, Panera Bread delivery drivers can take advantage of American Family’s 16% bundling discount, reducing overall costs. To see monthly premiums and honest rankings, read our article titled “American Family Auto Insurance Review.”

Cons

- Limited Nationwide Availability: American Family’s services may not be available in all states, potentially limiting options for Panera Bread delivery drivers who live outside the company’s coverage areas.

- Higher Premiums for High Mileage: Panera Bread delivery drivers who drive long distances might face higher insurance costs with American Family, as premiums are often calculated based on mileage.

Comparing Auto Insurance Costs for Panera Bread Delivery Drivers

Knowing the monthly costs for auto insurance is essential for Panera Bread delivery drivers, as it assists in finding the most affordable and suitable coverage choices. Various insurers provide different prices based on the coverage level selected, which can greatly affect a driver’s financial planning and budgeting.

Panera Bread Delivery Driver Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $125 $195

American Family $112 $180

Farmers $120 $180

Liberty Mutual $130 $200

Nationwide $115 $185

Progressive $120 $190

State Farm $110 $175

The Hartford $135 $210

Travelers $118 $185

USAA $95 $160

For Panera Bread delivery drivers, insurance premiums can fluctuate significantly depending on the insurer and the level of coverage needed. Basic coverage premiums begin as low as $95 with USAA, offering the most budget-friendly option, while The Hartford has the highest rate for basic coverage at $135.

Comprehensive coverage costs also vary, with USAA providing the lowest rate at $160, delivering broad protection at an economical price, while The Hartford’s comprehensive coverage goes up to $210, appealing to those requiring extensive protection. Discover insights in our article titled “Comprehensive Auto Insurance Defined.”

The decision between basic and comprehensive coverage depends on the driver’s requirements for liability coverage and vehicle protection, making it crucial to compare these costs to determine the best option.

Panera Bread Delivery Drivers Must Have Their Own Auto Insurance

The one thing you might not consider when you apply for a job with Panera working as a delivery driver is your insurance. You must carry a valid insurance policy as required by the state in which you live, but does that policy cover you if you’re involved in an accident while working for Panera?

While it might seem like a simple yes or no answer, it’s not that simple. Before you start shopping around for an auto insurance policy for your newfound delivery vehicle, there are a few things you must know.

Panera is not responsible for providing auto insurance to its drivers. You need to get your own food delivery car insurance.

Each Panera Bread location with delivery service has different requirements, opportunities, and specifics, but each one requires their drivers to have a valid driver’s license, a clean driving record, and you must prove you have auto insurance that meets at least the state minimum in the state where you reside.

There are many good commercial auto insurance companies out there to choose from. If you do not have these things to prove when you apply for a delivery position within the company, you are not hired for the position.

Panera only allows responsible drivers 18 and up to deliver for them, and you must have your own insurance policy.

If you don’t have insurance, you can shop for food delivery auto insurance and compare rates so you are eligible to apply for the job with Panera.

Some Panera Bread locations offer their employees discounts on different insurance policies. It depends on where you live and which Panera you work for.

Progressive offers customized policies for Panera Bread delivery drivers, starting at just $120 per month for minimum coverage.Jeff Root Licensed Insurance Agent

For example, if you work for the St. Louis, Missouri Panera, you are eligible to receive discounts through several different insurance companies. It’s offered as a perk of the job, but it still means you must carry your own insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Understanding Accident Coverage for Panera Bread Drivers

If you are delivering food for Panera and you are in an accident, you might face serious problems. Once you tell the police officer you are on the road delivering a meal for your company, it’s noted on your accident report.

Your insurance agency might decide to deny your claim for repairs and medical coverage once it’s submitted as they simply might not cover delivery situations.

If you’re on the road for your job delivering food regularly, it makes you a riskier driver. For this reason, companies will at times exclude delivery situations from personal auto coverage.

Insurance companies typically require their policyholders to pay much higher premiums if they are on the road more than the average person, and it could be all they need to deny your claim. This doesn’t mean your insurance company will deny your claim, but it’s very possible. Unlock details in our comprehensive analysis titled “Will my auto insurance claim check be made out to me?”

Panera’s Liability in Delivery Driver Accidents

Typically, no. However, that might not stop other drivers from suing Panera if you are involved in an accident.

For example, if you cause an accident while driving for Panera and your insurance company denies the claim, the other driver might go after your employer for the cost of the accident.

It’s usually more profitable in a lawsuit to sue an employer than it is an employee, and whether it might happen depends on the situation, where you live, and what kind of policies you and the company both carry.

Why don’t delivery services cover accidents under your personal policy? There are a lot of factors that go into this, but one is that it is a risky job. The U.S. Bureau of Labor Statistics reports that delivery drivers are actually the 4th most dangerous job in America. For insurers, and that means there’s a higher likelihood that they’ll have to pay out a claim.

Panera Delivery Driver Insurance: Commercial Auto Insurance

The best thing you can do to avoid denied claims in case of an accident is to purchase commercial coverage when you begin driving as a delivery driver. This is a different kind of coverage offered by insurance agents. Delve into our evaluation of article titled “Does a denied claim affect auto insurance rates?”

This video from Travelers talks a bit more about commercial auto coverage.

The Insurance Information Institute (III) notes that your personal umbrella liability insurance won’t usually cover expenses incurred that are business-related, such as delivering food.

To find the best rates and most commercial coverage, you can compare rates and quotes with various auto insurance companies to see who has the best policy.

It’s a good idea to do this not only to cover you in case of an accident but also to make your premiums more affordable.

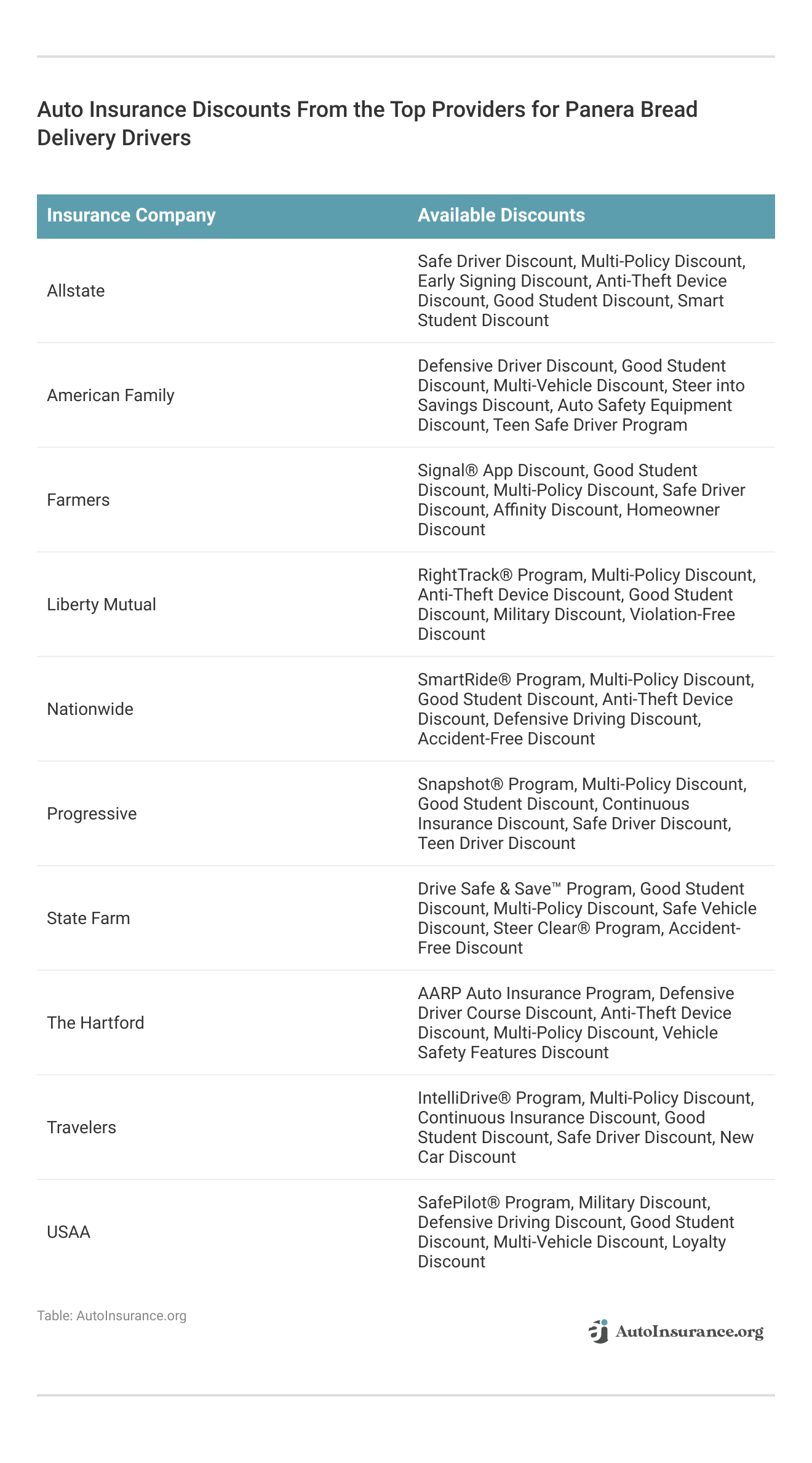

Tips for Finding Affordable Panera Driver Auto Insurance

If you’re in the market for better insurance now that you’re considering a delivery job with Panera, you want to check with multiple companies to find the best rate.

Your driving record plays a big role in the amount you pay for premiums every year. A good driving record means you get better rates.

It’s also important to ask for discounts for your vehicle. These car insurance discounts make a big difference.

If you drive a vehicle that’s got a lot of safety options, you might get a discount. If you have more than one car on your policy, you also get a discount. If you bundle your home and life insurance with your auto insurance, you might also get a discount.

With an A+ rating, Progressive ensures reliable protection for Panera Bread delivery drivers, even in high-risk situations.Brandon Frady Licensed Insurance Producer

Commercial auto insurance is more expensive than the traditional personal auto insurance, so be sure to check for discounts and better rates with other companies before settling on a plan.

Don’t miss out on our free insurance comparison tool below. Just enter your ZIP code and start comparing rates now for Panera car insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is Panera Bread auto insurance?

Panera Bread auto insurance refers to the insurance coverage specifically designed for vehicles used by Panera Bread employees or the company itself. It provides financial protection in case of accidents, damage to the vehicle, or injuries to individuals involved in a car accident while using a Panera Bread vehicle for business purposes.

Do Panera Bread employees need auto insurance?

Yes, Panera Bread employees who operate company vehicles or use their personal vehicles for work-related purposes are typically required to have auto insurance. The specific insurance requirements may vary based on the employment agreement and the policies of the Panera Bread franchise or corporate entity.

What type of auto insurance do Panera Bread employees need?

Panera Bread employees may need commercial auto insurance if they operate company-owned vehicles for business purposes. If they use their personal vehicles for work-related tasks, they may need a commercial auto policy or an endorsement on their personal auto insurance to cover business use. It’s important for employees to check with their employer or insurance provider to determine the appropriate coverage.

Discover more about offerings in our article titled, “Best Auto Insurance Companies for State Employees.”

Does Panera Bread provide auto insurance for its employees?

Panera Bread may provide auto insurance coverage for its employees who operate company-owned vehicles. The specific insurance arrangements can vary depending on the franchise or corporate policies. Employees should consult their employer or human resources department to understand the insurance coverage provided by Panera Bread.

What should I do in case of an accident while using a Panera Bread vehicle?

If you have an accident in a Panera Bread vehicle, ensure safety, call the police, and exchange insurance information. Take photos of the scene, notify your supervisor, and cooperate with the insurance provider.

Does State Farm cover Panera Bread delivery drivers?

Yes, State Farm can provide coverage for Panera Bread delivery drivers, but a commercial policy or business use endorsement may be needed to ensure proper protection.

Check out two of the top five auto insurance companies in our Nationwide vs. State Farm Auto Insurance review.

What does Panera car insurance cover?

Panera car insurance should cover both personal use and commercial delivery activities, protecting against accidents, liability, and vehicle damage while on delivery routes.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

How can I find cheap insurance for Panera Bread delivery drivers?

To find cheap insurance for Panera Bread delivery drivers, compare rates from multiple providers, explore discounts for safe driving, and consider bundling policies to save on costs.

Does Allstate cover Panera Bread delivery drivers?

Yes, Allstate covers Panera Bread delivery drivers, but they may require a commercial auto policy or an endorsement for business use.

Check out insurance savings in our complete guide titled, “Allstate vs. Progressive Auto Insurance.”

Does Liberty Mutual cover Panera Bread delivery drivers?

Yes, Liberty Mutual provides coverage for Panera Bread delivery drivers, but it typically requires a commercial auto insurance policy or a business use endorsement.

What is food delivery car insurance?

Food delivery car insurance is coverage specifically designed for vehicles used to deliver food, covering both personal and business use to protect against accidents and liabilities.

What is delivery driver insurance?

Delivery driver insurance is a type of auto insurance tailored for those who use their vehicles to deliver goods, ensuring coverage for both personal and commercial activities.

See more details on our article titled, “Types of Auto Insurance.”

What is commercial auto insurance for delivery drivers?

Commercial auto insurance for delivery drivers provides specific coverage for vehicles used in the delivery of goods, ensuring protection beyond personal auto insurance policies.

What insurance companies cover Panera Bread delivery drivers?

Insurance companies like State Farm, Progressive, and Geico offer coverage options for delivery drivers, often requiring a commercial policy or a business use endorsement.

Check out our Geico vs. State Farm auto insurance comparison to break down rates, coverage options, and discounts.

What does delivery driver insurance coverage include?

Delivery driver insurance coverage typically includes liability, collision, comprehensive, and uninsured motorist coverage to protect drivers while making deliveries.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool below to compare your rates against the top insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.