Best Windshield Replacement Coverage in Texas (Top 10 Companies Ranked for 2025)

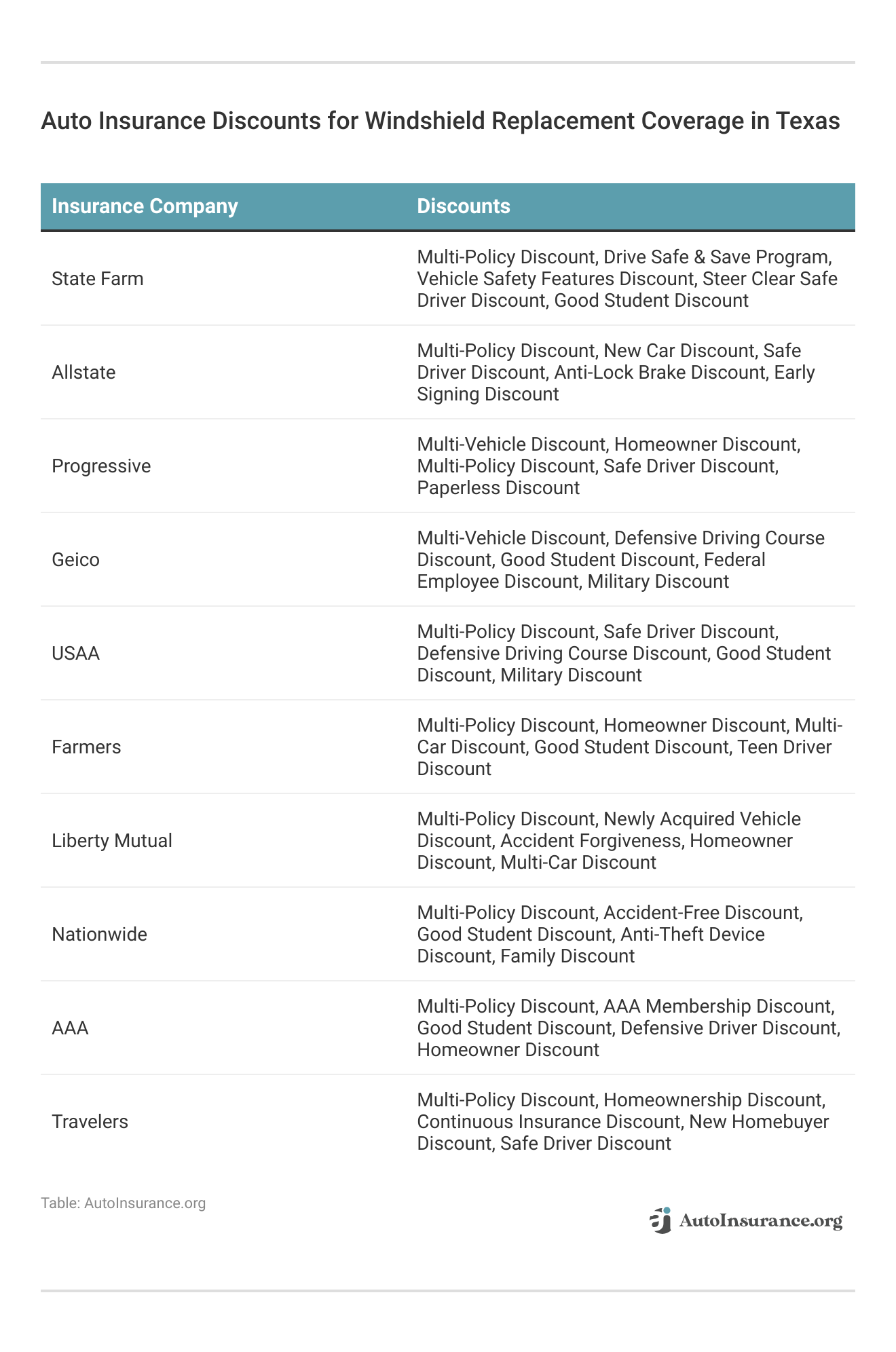

State Farm, Allstate, and Progressive offer the best windshield replacement coverage in Texas, starting as low as $85 per month. Our objective is to facilitate the comparison of quotes from these respected insurers, assisting you in securing ideal coverage and taking advantage of customized discounts.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage Windshield Replacement in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage Windshield Replacement in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage Windshield Replacement in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Extensive Network: State Farm boasts a vast network of agents and service centers, providing personalized assistance and easy access to support. Find out more in our State Farm auto insurance review.

- Strong Financial Stability: With a top-notch financial strength rating, State Farm offers reassurance that claims will be paid promptly and reliably.

- Comprehensive Coverage Options: State Farm offers a wide range of coverage options, including windshield replacement, tailored to meet diverse needs.

Cons

- Potentially Higher Rates: While State Farm provides quality coverage, some customers may find their rates slightly higher compared to other insurers.

- Limited Online Tools: State Farm’s online tools and mobile app might not be as robust as those offered by some competitors, potentially leading to a less streamlined experience for tech-savvy users.

#2 – Allstate: Best for High-Mileage Savings

Pros

- Innovative Features: Allstate’s innovative features, such as the Milewise program, offer personalized savings based on actual driving habits. Read more through our Allstate auto insurance review.

- Highly Accessible: With a user-friendly website and mobile app, Allstate makes it easy for customers to manage policies, file claims, and access support.

- Generous Discounts: Allstate offers an array of discounts, including those for safe driving, bundling policies, and loyalty, helping customers save on premiums.

Cons

- Potentially Complex Pricing: Allstate’s pricing structure may be complex, leading to confusion for some customers when trying to understand their premiums.

- Mixed Customer Service Reviews: While Allstate generally provides good customer service, some customers have reported mixed experiences, particularly in handling claims.

#3 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s Snapshot program rewards safe driving habits with potential discounts, making it an attractive option for cautious drivers.

- Tech-Savvy Solutions: In our Progressive auto insurance review, Progressive offers advanced online tools and a mobile app that make managing policies, filing claims, and accessing support convenient and efficient.

- Competitive Rates: Progressive is known for offering competitive rates, especially for drivers with clean records or those willing to participate in usage-based programs.

Cons

- Limited Coverage Options: While Progressive offers essential coverage, its options may not be as extensive as some competitors, potentially limiting customization for specific needs.

- Less Personalized Service: Despite its technological prowess, some customers may find Progressive’s service less personalized compared to traditional insurers with a larger agent network.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Geico: Best for Online Convenience

Pros

- Affordability: Geico is often praised for its competitive rates, making it an appealing choice for budget-conscious customers. Read more through our Geico auto insurance review.

- Convenient Online Experience: Geico’s user-friendly website and mobile app provide easy access to policy management, claims filing, and customer support.

- Wide Range of Discounts: Geico offers a variety of discounts, including those for safe driving, military service, and vehicle safety features, helping customers save on premiums.

Cons

- Limited Local Agents: Geico primarily operates online and through call centers, which means customers seeking face-to-face interaction with agents may find their options limited.

- Mixed Customer Service Reviews: While Geico generally receives positive reviews for its customer service, some customers report challenges with claims processing and communication.

#5 – USAA: Best for Military Savings

Pros

- Exceptional Customer Service: USAA consistently receives high marks for its exceptional customer service, including quick and efficient claims processing.

- Exclusive Benefits: USAA offers exclusive benefits to military members and their families, such as tailored coverage options and discounted rates. Read more through our USAA auto insurance review.

- Financial Stability: With a strong financial standing and commitment to serving its members, USAA provides peace of mind that claims will be handled promptly and fairly.

Cons

- Membership Requirements: USAA membership is restricted to military personnel, veterans, and their families, limiting its availability to the general public.

- Limited Branch Locations: While USAA provides excellent online and phone support, customers who prefer in-person assistance may find their options limited due to fewer branch locations.

#6 – Farmers: Best for Discount Variety

Pros

- Personalized Coverage: Farmers offers customizable coverage options, allowing customers to tailor policies to their specific needs and preferences.

- Strong Agent Network: With a vast network of agents across the country, Farmers provides personalized assistance and guidance to customers. Read more through our Farmers auto insurance review.

- Innovative Programs: Farmers offers innovative programs like Signal, which rewards safe driving behaviors with potential discounts on premiums.

Cons

- Potentially Higher Rates: While Farmers provides quality coverage and service, some customers may find their rates slightly higher compared to other insurers.

- Limited Online Tools: Farmers’ online tools and mobile app may not be as robust as those offered by some competitors, potentially leading to a less streamlined experience for tech-savvy users.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Add-on Coverages

Pros

- Customizable Coverage Options: Liberty Mutual offers a wide range of coverage options, allowing customers to tailor their policies to meet their specific needs.

- Additional Coverages: Liberty Mutual provides various add-on coverages, such as rental car reimbursement and roadside assistance, to enhance protection and convenience.

- Discount Opportunities: Liberty Mutual offers numerous discounts, including those for safe driving, bundling policies, and vehicle safety features, helping customers save on premiums.

Cons

- Mixed Customer Service Reviews: While Liberty Mutual generally provides satisfactory customer service, some customers report mixed experiences with claims processing and communication.

- Potentially Complex Claims Process: Liberty Mutual’s claims process may be perceived as complex by some customers, leading to frustration or confusion when filing claims. Read more through our Liberty Mutual auto insurance review.

#8 – Nationwide: Best for Usage-Based Coverage

Pros

- Wide Availability: Nationwide operates in all 50 states, making it accessible to customers across the country. Read more through our Nationwide auto insurance review.

- Multiple Policy Discounts: Nationwide offers discounts for bundling multiple policies, such as auto and home insurance, providing opportunities for significant savings.

- Strong Financial Stability: With a solid financial standing and high credit ratings, Nationwide offers assurance that claims will be paid promptly and reliably.

Cons

- Potentially Higher Premiums: Some customers may find Nationwide’s premiums slightly higher compared to other insurers, particularly for certain coverage options or demographic groups.

- Limited Online Tools: Nationwide’s online tools and mobile app may not offer as many features or functionalities as those provided by some competitors, potentially limiting the convenience of policy management for tech-savvy users.

#9 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA is renowned for its roadside assistance services, providing peace of mind to customers in case of emergencies on the road. Read more through our AAA auto insurance review.

- Member Benefits: AAA offers various membership benefits, including discounts on travel, dining, and entertainment, enhancing the overall value for members.

- Local Presence: AAA has a strong local presence with numerous branch locations, providing convenient access to in-person assistance and support.

Cons

- Membership Fees: AAA membership requires annual fees, which may deter some potential customers, especially those who don’t frequently utilize the organization’s services.

- Coverage Limitations: AAA’s insurance coverage options may be limited compared to other insurers, potentially resulting in less comprehensive protection for certain needs or situations.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Unique Coverage

Pros

- Unique Coverage Options: Our Travelers auto insurance review reveals that Travelers offers unique coverage options that may not be available with other insurers, allowing customers to tailor their policies to specific needs.

- Financial Stability: With strong financial stability and a long-standing reputation in the insurance industry, Travelers provides assurance that claims will be handled efficiently and reliably.

- Discount Programs: Travelers offers various discount programs, including those for safe driving, home ownership, and multi-policy bundling, helping customers save on premiums.

Cons

- Potentially Higher Rates: Some customers may find Travelers’ rates slightly higher compared to other insurers, particularly for certain coverage options or demographic groups.

- Limited Online Tools: Travelers’ online tools and mobile app may lack some advanced features offered by competitors, potentially impacting the convenience of policy management for tech-savvy users.

Full-Glass Insurance Laws in Texas

Windshield Replacement

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Filing a Claim for Texas Windshield Replacement

Free Full-Glass Insurance Laws in Texas

Texas Windshield Coverage: The Bottom Line

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Does auto insurance in Texas cover windshield replacement?

Yes, most comprehensive auto insurance policies in Texas cover windshield replacement. However, it is important to check your specific policy details to determine the extent of coverage and any applicable deductibles.

What factors affect the coverage for windshield replacement in Texas?

The coverage for windshield replacement in Texas can vary depending on several factors, including the type of insurance policy you have (comprehensive coverage), the terms and conditions of your policy, and the deductible you have chosen. Enter your ZIP code now to begin.

Do I have to pay a deductible for windshield replacement in Texas?

Are there any restrictions on where I can get my windshield replaced in Texas?

Some insurance policies in Texas may have preferred repair shops or specific networks that they work with for windshield replacements. It is advisable to check with your insurance provider to see if there are any restrictions or recommendations regarding repair facilities.

Will filing a claim for windshield replacement affect my insurance premium in Texas?

In general, filing a claim for windshield replacement should not directly impact your insurance premium in Texas. Windshield claims are often classified as comprehensive claims, which typically have a lower impact on premiums compared to at-fault accidents. However, it’s always a good idea to review your policy or consult with your insurance provider to understand how a claim might affect your specific circumstances. Enter your ZIP code now to start.

What are the top three insurance providers for windshield replacement coverage in Texas?

How does State Farm stand out among the top insurers mentioned in the article?

State Farm stands out as the leading choice for windshield replacement coverage in Texas, providing competitive rates starting at just $100 per month for comprehensive protection.

What types of coverage options are emphasized for windshield replacement in Texas?

The article emphasizes the importance of having comprehensive auto insurance or zero-deductible full coverage policies for windshield replacement in Texas. Enter your ZIP code now to start.

What potential impact might windshield damage have on vehicle inspections in Texas?

How does the process of filing a claim for windshield replacement differ depending on the type of auto insurance coverage?

Filing a claim for windshield replacement in Texas depends on the type of auto insurance coverage. With comprehensive coverage, the insurance company may cover the replacement cost, whereas with liability insurance, the cost would typically be out of pocket.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.