Best Windshield Replacement Coverage in New Mexico (Top 10 Companies in 2025)

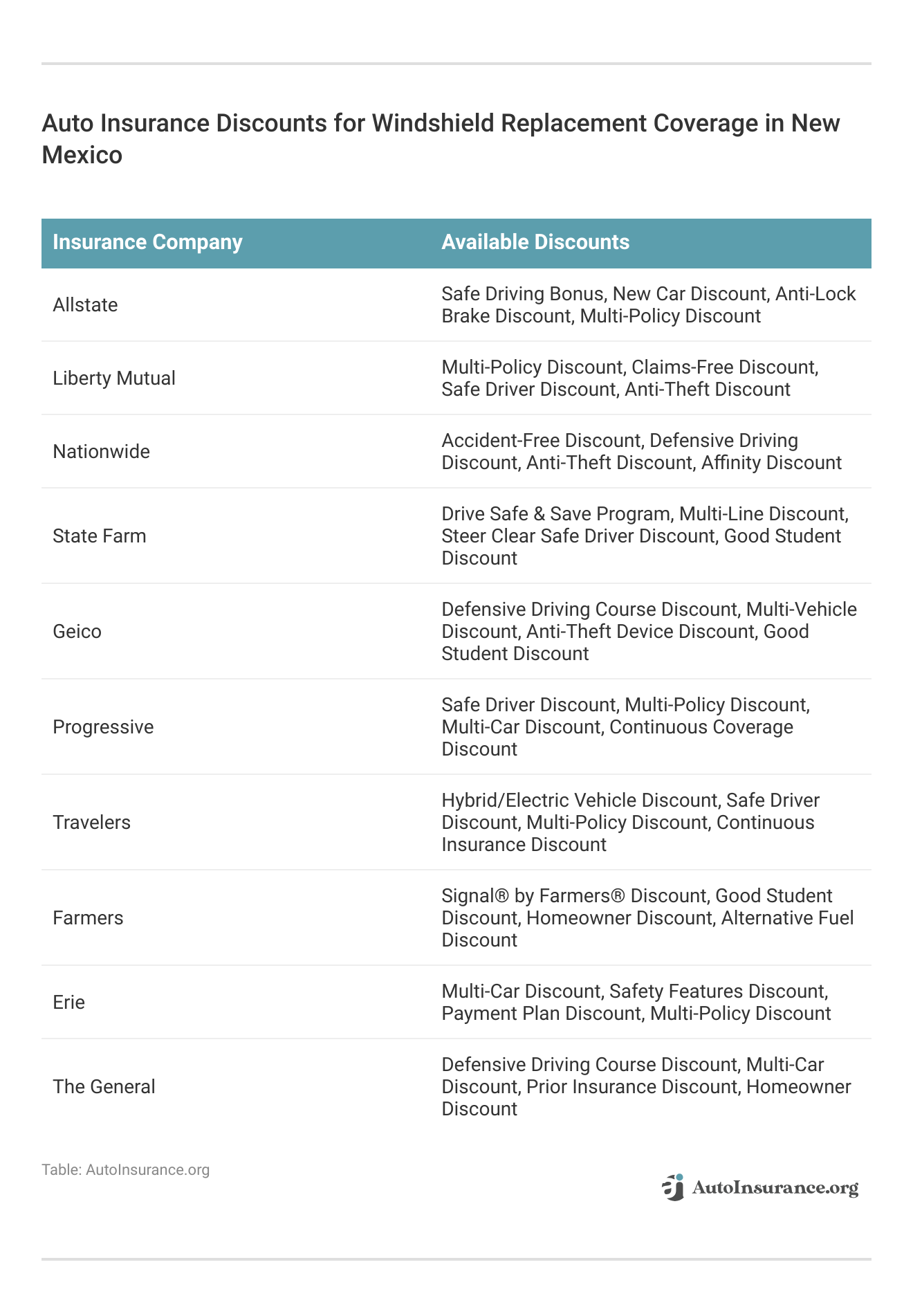

Allstate, Liberty Mutual, and Nationwide offer the best windshield replacement coverage in New Mexico, with rates starting at just $58 per month. We aim to assist in comparing quotes from these trusted insurers, helping you secure the ideal coverage and take advantage of personalized discounts for your vehicle.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage Windshield Replacement in New Mexico

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage Windshield Replacement in New Mexico

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage Windshield Replacement in New Mexico

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews

- Allstate offers attractive rates beginning at $214 per month

- Top insurance companies provide options for windshield replacement

- There are numerous discount available for replacement coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Allstate: Top Overall Pick

Pros

- Extensive Coverage Options: Allstate offers a wide range of coverage options, including comprehensive coverage for windshield replacement.

- Strong Financial Stability: Allstate is a financially stable company, providing reassurance that claims will be handled efficiently.

- Personalized Discounts: Allstate offers various discounts, allowing policyholders to save money based on factors like driving history and vehicle safety features.

Cons

- Higher Premiums: Allstate’s premiums may be higher compared to some other insurers, especially for drivers with less-than-perfect driving records.

- Limited Availability: Allstate’s coverage may not be available in all areas, limiting options for some drivers. Use our Allstate auto insurance review as your guide.

#2 – Liberty Mutual: Best for Customized Options

Pros

- Customizable Policies: Liberty Mutual offers customizable policies, allowing drivers to tailor coverage to their specific needs.

- Strong Customer Service: Liberty Mutual is known for its responsive customer service, providing support throughout the claims process. For further insights, refer to our Liberty Mutual auto insurance review.

- Multi-Policy Discounts: Liberty Mutual offers discounts for bundling multiple insurance policies, such as auto and home insurance.

Cons

- Limited Discounts: While Liberty Mutual offers multi-policy discounts, its range of discounts may be more limited compared to some competitors.

- Average Rates: Liberty Mutual’s rates may be average or slightly higher compared to other insurers, potentially making it less competitive for cost-conscious drivers.

#3 – Nationwide: Best for Nationwide Coverage

Pros

- Nationwide Coverage: Nationwide provides coverage across the country, offering convenience for drivers who frequently travel or relocate. Read more through our Nationwide auto insurance review.

- Accident Forgiveness: Nationwide offers accident forgiveness programs, allowing policyholders to avoid rate increases after their first at-fault accident.

- User-Friendly Website: Nationwide’s website and mobile app are user-friendly, making it easy for policyholders to manage their accounts and file claims online.

Cons

- Limited Discounts: Nationwide’s discount offerings may be more limited compared to some competitors, potentially resulting in higher premiums for certain drivers.

- Mixed Customer Reviews: Nationwide has received mixed reviews regarding customer service and claims handling, with some customers reporting dissatisfaction with their experiences.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Trusted Reputation

Pros

- Strong Reputation: State Farm is known for its long-standing reputation and reliability in the insurance industry. Find out more in our State Farm auto insurance review.

- Extensive Agent Network: State Farm has a vast network of local agents, providing personalized assistance and support to policyholders.

- Steady Rates: State Farm’s rates tend to be stable over time, offering predictability for budget-conscious drivers.

Cons

- Limited Online Tools: State Farm’s online tools and mobile app may be less advanced compared to some competitors, potentially impacting the digital experience for tech-savvy customers.

- Fewer Discounts: State Farm may offer fewer discounts compared to some other insurers, limiting opportunities for policyholders to save money on premiums.

#5 – Geico: Best for Excellent Service

Pros

- Competitive Rates: Geico is known for offering some of the most competitive rates in the industry, making it an attractive option for budget-conscious drivers.

- Convenient Online Experience: Geico provides a seamless online experience, allowing customers to manage their policies, file claims, and access resources easily.

- Wide Range of Discounts: Geico offers a wide variety of discounts, including those for safe driving, vehicle safety features, and bundling policies. Read more through our Geico auto insurance review.

Cons

- Limited Agent Support: Geico primarily operates online and over the phone, so customers seeking face-to-face interaction with agents may find their options limited.

- Mixed Customer Service Reviews: While Geico excels in affordability and digital experience, some customers have reported mixed reviews regarding customer service quality and claims handling.

#6 – Progressive: Best for Competitive Rates

Pros

- Name Your Price Tool: Progressive offers a unique “Name Your Price” tool, allowing customers to customize their coverage and premiums to fit their budget.

- Innovative Technology: In our Progressive auto insurance review, Progressive is known for its innovative use of technology, such as Snapshot, which tracks driving habits to potentially lower premiums for safe drivers.

- Variety of Coverage Options: Progressive offers a wide range of coverage options, including comprehensive coverage for windshield replacement, giving customers flexibility in choosing the right policy.

Cons

- Rates May Increase After Claims: Progressive’s rates may increase after filing a claim, particularly for drivers with a history of accidents or violations.

- Limited Availability of Local Agents: While Progressive offers online and phone support, customers seeking in-person assistance may find that local agent availability varies depending on their location.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Financial Stability

Pros

- Financial Stability: Our Travelers auto insurance review reveals that Travelers is a financially stable company, providing reassurance to policyholders that their claims will be handled efficiently.

- Flexible Coverage Options: Travelers offers a variety of coverage options, allowing customers to tailor their policies to their specific needs.

- Strong Discounts: Travelers provides a range of discounts, including those for safe driving, bundling policies, and vehicle safety features, helping customers save on premiums.

Cons

- Higher Premiums for Some Drivers: Travelers’ premiums may be higher for certain drivers, especially those with less-than-perfect driving records or specific coverage needs.

- Limited Local Agent Network: Travelers’ local agent network may be more limited compared to some competitors, potentially affecting accessibility for customers seeking in-person assistance.

#8 – Farmers: Best for Strong Benefits

Pros

- Customizable Policies: Farmers offers customizable policies, allowing customers to tailor their coverage to their individual needs and budget.

- Extensive Coverage Options: Farmers provides a wide range of coverage options, including comprehensive coverage for windshield replacement, giving customers peace of mind on the road.

- Strong Claims Handling: Farmers is known for its efficient claims handling process, providing support to customers when they need it most.

Cons

- Higher Premiums: Farmers’ premiums may be higher compared to some other insurers, particularly for drivers with less-than-perfect driving records.

- Limited Availability in Some Areas: Farmers’ coverage may not be available in all areas, limiting options for drivers in certain regions. Find out more through our Farmers auto insurance review.

#9 – Erie: Best for Exceptional Coverage

Pros

- Excellent Customer Service: Erie is renowned for its exceptional customer service, with high satisfaction ratings among policyholders.

- Competitive Rates: Erie offers competitive rates, making it an attractive option for budget-conscious drivers. Use our Erie auto insurance review as your guide.

- Multi-Policy Discounts: Erie provides discounts for bundling multiple insurance policies, such as auto and home insurance, helping customers save on premiums.

Cons

- Limited Availability: Erie’s coverage may be limited to certain regions, potentially restricting options for drivers in areas where Erie does not operate.

- Fewer Online Tools: Erie’s online tools and digital experience may be less robust compared to some competitors, potentially impacting the convenience for tech-savvy customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – The General: Best for High-Risk Coverage

Pros

- High-Risk Coverage: The General specializes in providing coverage for high-risk drivers, offering options for those who may have difficulty obtaining insurance elsewhere.

- Quick Quotes: The General offers quick and easy online quotes, making it convenient for customers to get started with their coverage. Read more through our The General auto insurance review.

- Flexible Payment Options: The General provides flexible payment options, allowing customers to choose payment plans that suit their budget and needs.

Cons

- Limited Coverage Options: The General may offer fewer coverage options compared to some other insurers, potentially leaving customers with fewer choices for tailoring their policies.

- Higher Premiums: The General’s premiums may be higher compared to traditional insurers, reflecting the higher risk associated with insuring certain drivers.

Replacement Parts Law in New Mexico

Zero-Deductible Full Glass Coverage Law in New Mexico

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Finding the Best Comprehensive Coverage in New Mexico

Repair Vendor Laws in New Mexico

Right Car Insurance in New Mexico: The Bottom Line

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What should I do if my windshield is damaged in New Mexico?

Contact your insurance provider to report the damage and discuss coverage and repair options.

How can I ensure I have the right car insurance in New Mexico?

Review your policy, understand coverage, consider comprehensive coverage, and compare quotes. Enter your ZIP code now to start.

Are insurance companies required to fix windshields for free with zero-deductible in New Mexico?

No, New Mexico doesn’t have such a requirement for liability auto insurance.

Are there specific laws governing windshield repair in New Mexico?

No, repair methods are generally agreed upon by the driver, insurer, and chosen shop.

Is it illegal to drive with broken glass in New Mexico?

Yes, it’s illegal as per New Mexico laws. Enter your ZIP code now to begin.

Can New Mexico car insurance companies recommend specific repair shops?

Which insurance providers offer the best windshield replacement coverage in New Mexico?

According to the article, Allstate, Liberty Mutual, and Nationwide offer the best windshield replacement coverage in New Mexico.

What are some factors contributing to high accident risks in New Mexico?

The article mentions factors contributing to high accident risks in New Mexico, such as negligence on highways like I-25, I-40, and I-10, which see thousands of deaths annually due to negligence. It also highlights common incidents like windshield damage from rocks. Enter your ZIP code now to start.

Are insurance companies required to fix windshields for free with zero deductible in New Mexico?

How does the article suggest finding the best comprehensive coverage in New Mexico?

The article suggests finding the best comprehensive coverage in New Mexico by visiting websites that analyze insurance companies for comparisons on a single page and by using free quote tools.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.