Cheapest Teen Driver Auto Insurance in Missouri for 2025 (Top 10 Affordable Companies)

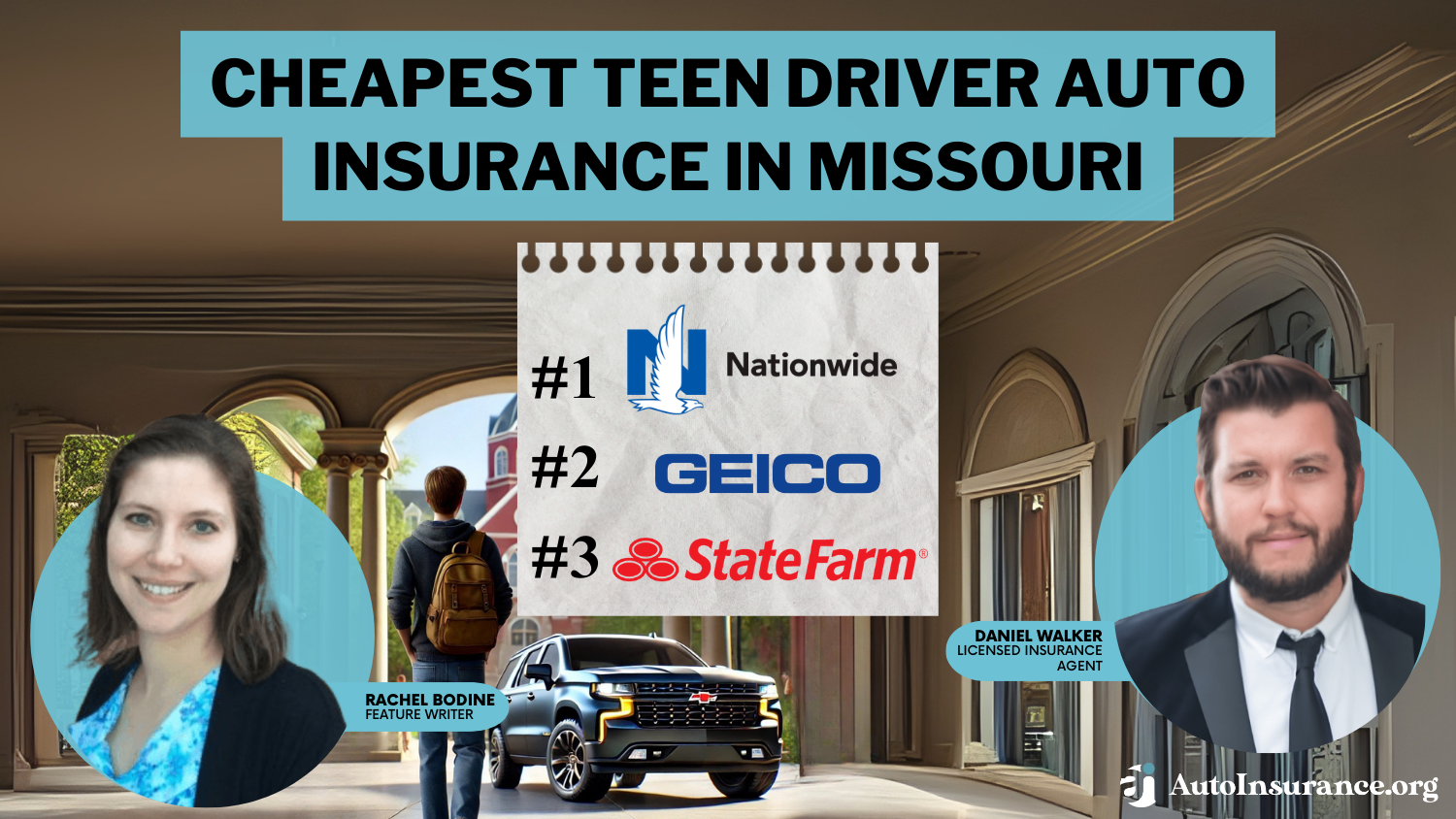

Nationwide, Geico and State Farm have the cheapest teen driver auto insurance in Missouri at as low as $153 a month. Bundling policies can get you 25% discounts from Geico. State Farm boasts the largest agent network in MO, and Progressive has the cheapest car insurance for young drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,071 reviews

3,071 reviewsCompany Facts

MO Teens Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 19,116 reviews

19,116 reviewsCompany Facts

MO Teens Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

MO Teens Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsNationwide, Geico and State Farm have the cheapest teen driver auto insurance in Missouri.

Missouri auto insurance plans will be the most affordable if you shop at any of the following companies.

Our Top 10 Company Picks: Cheapest Teen Driver Auto Insurance in Missouri

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $153 | A+ | Widespread Availability | Nationwide |

| #2 | $156 | A++ | Affordable Rates | Geico | |

| #3 | $163 | A++ | Personalized Policies | State Farm | |

| #4 | $209 | A | Loyalty Rewards | American Family | |

| #5 | $244 | A+ | Add-on Coverages | Allstate | |

| #6 | $247 | A | Business Vehicles | Liberty Mutual |

| #7 | $275 | A | High-Risk Coverage | The General |

| #8 | $313 | A+ | Safe-Driving Discounts | Progressive | |

| #9 | $432 | A | Family Plans | Farmers | |

| #10 | $517 | A++ | Bundling Policies | Travelers |

Read on to learn more about Missouri auto insurance for teens. You can also compare rates quickly with our free tool to find cheap Missouri insurance quotes.

- Geico is the cheapest Missouri car insurance company for teens

- Progressive and Travelers also have cheap insurance for teens in Missouri

- Teens will need to fulfill Missouri car insurance coverage requirements

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Nationwide: Top Overall Pick

Pros

- Minimum Coverage Advantage: Nationwide offers one of the lowest minimum coverage rates in Missouri at $153 monthly, making it accessible for teen drivers seeking cheap car insurance in Missouri.

- Statewide Network: Teens in Missouri benefit from Nationwide’s extensive service network across rural and urban areas, ensuring coverage no matter where they drive.

- Policy Customization: According to our Nationwide auto insurance review, the same customization options extend to their auto policies, giving Missouri teens flexible coverage choices.

Cons

- Higher Full Coverage Premium: Missouri teenagers looking for full coverage from Nationwide can experience greater premium hikes than their more affordable minimum coverage plans.

- Limited Teen-Specific Discounts: Nationwide has fewer teen-specific discounts available in Missouri than many competitors, possibly leaving savings on the table for teens.

#2 – Geico: Best for Affordable Rates

Pros

- Competitive Pricing: Geico offers Missouri teens the second-lowest minimum coverage rate of $156 per month, which is affordable car insurance in Missouri statewide.

- Mobile Accessibility: Teen drivers in Missouri can easily manage their Geico policies through a highly-rated mobile app, perfect for tech-savvy young drivers.

- Discount Variety: Our Geico auto insurance review confirms they offer numerous discounts for Missouri teens, including good student and defensive driving course reductions.

Cons

- Limited Local Agents: Missouri teens who prefer to get service in person might feel that Geico does not have enough offices in the state.

- Policy Framework: Geico provides low-cost teen driver insurance in Missouri, though with more consistency than some other carriers.

#3 – State Farm: Best for Personalized Policies

Pros

- Accessible Expert Help: State Farm has the most agents in Missouri, offering teen drivers individual assistance in choosing the right coverage.

- Good Student Benefits: Missouri teens with good grades qualify for substantial discounts, potentially lowering their $163 monthly minimum coverage rate significantly.

- Driver Training Programs: According to our State Farm review, their Steer Clear program helps Missouri teens become safer drivers while earning additional policy discounts.

Cons

- Higher Urban Rates: Teen drivers in St. Louis and Kansas City may face higher State Farm premiums than those in smaller Missouri communities.

- Limited Online Features: Missouri teens expecting comprehensive digital policy management may find State Farm’s online tools less robust than tech-focused competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – American Family: Best for Loyalty Rewards

Pros

- Long-Term Savings: American Family rewards Missouri teen drivers who maintain clean records with steadily decreasing premiums as they gain experience.

- Family Plan Benefits: Missouri families adding multiple teen drivers can access bundled discounts not highlighted in the American Family auto insurance review.

- Teen-Safe Driver Program: Missouri teens can earn up to 20% off their $209 monthly minimum coverage by participating in American Family’s safe driving monitoring program.

Cons

- Higher Initial Premiums: First-year Missouri teen drivers typically face higher starting rates with American families compared to some competitors.

- Limited Coverage Area: Teen drivers in certain rural Missouri counties may find American Family coverage options more limited than with larger insurers.

#5 – Allstate: Best for Add-on Coverages

Pros

- Accident Forgiveness: Missouri teen drivers benefit from Allstate’s accident forgiveness program, which prevents rate increases after a first accident.

- Education Resources: Allstate provides Missouri teens with extensive educational resources to help them become safer drivers and qualify for additional discounts.

- Vanishing Deductible: Our Allstate auto insurance review includes their exclusive program through which Missouri teens can reduce deductibles by $100 annually for good driving.

Cons

- Pricing Structure: Missouri teens pay relatively expensive $244 monthly minimum coverage premiums compared to other insurers that offer similar levels of coverage.

- Discount Requirements: Missouri teen drivers must meet more conditions in order to receive Allstate’s advertised discounts than other insurance providers.

#6 – Liberty Mutual: Best for Business Vehicles

Pros

- Teen Business Use: Liberty Mutual offers specialized coverage for Missouri teens who occasionally use family vehicles for part-time business or delivery purposes.

- Customizable Protection: Missouri teen drivers can tailor their $247 monthly policies with Liberty Mutual to include only the specific coverages they need.

- Accident Prevention: The Liberty Mutual auto insurance review shows they offer Missouri teens unique technology-based programs to improve driving habits and lower rates.

Cons

- Rate Increases: Teen drivers in Missouri often experience more significant rate increases after claims with Liberty Mutual than with some competitors.

- Limited Rural Coverage: Teens in remote Missouri areas may find Liberty Mutual’s coverage options and claim service networks less comprehensive than those of larger insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – The General: Best for High-Risk Coverage

Pros

- Second-Chance Policies: The General specializes in providing cheap full coverage car insurance in Missouri for teens with accidents or violations on their records.

- Easy Qualification: Missouri teens with limited driving history or credit can still obtain affordable coverage through The General’s simplified approval process (Read More: The General Auto Insurance Review).

- Flexible Payment Options: Missouri teen drivers appreciate The General’s multiple alternative payment plan strategies to accommodate the $275 yearly premium payments.

Cons

- Standard Protection: Teenagers in Missouri looking for premium policy features might find The General’s basic policy features lacking compared to larger insurance companies.

- Customer Service Limitations: Teen drivers in Missouri sometimes report less satisfactory claim experiences compared to higher-priced insurance providers.

#8 – Progressive: Best for Safe-Driving Discounts

Pros

- Snapshot Program: Missouri teen drivers can save substantially on their $313 monthly rates through Progressive’s usage-based Snapshot program monitoring safe driving habits (Read More: Progressive Snapshot Review).

- Name Your Price Tool: Progressive’s unique tool helps Missouri teens find the cheapest insurance for young drivers that fits their specific budget constraints.

- Ticket Forgiveness: The company offers Missouri teens forgiveness for their first minor violation, preventing rate increases.

Cons

- Higher Initial Rates: Missouri teen drivers face relatively high starting rates with Progressive before safe driving discounts are applied to their policies.

- Complex Discount Structure: Teen drivers in Missouri sometimes find Progressive’s numerous discount programs confusing and difficult to fully maximize for savings.

#9 – Farmers: Best for Family Plans

Pros

- Multi-Vehicle Savings: Farmers offers substantial discounts for Missouri families insuring multiple vehicles, offsetting their higher $432 monthly base teen rates.

- Signal App Benefits: The Farmers auto insurance review highlights their Signal app, which helps Missouri teens improve driving habits while earning significant discounts.

- Student Discounts: Missouri teens who maintain good grades or attend school over 100 miles from home qualify for special rate reductions.

Cons

- Premium Base Rates: Teen drivers in Missouri face some of the highest base premium rates with Farmers compared to other major insurers.

- Limited Economy Options: Missouri families seeking low-income car insurance in Missouri for their teens may find Farmers’ minimum options still relatively expensive.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Bundling Policies

Pros

- Multi-Policy Benefits: Missouri families can significantly reduce Travelers’ $517 monthly teen driver rates by bundling with home, renters, or other insurance products.

- Student Coverage Extensions: Our Travelers auto insurance review notes they offer extended coverage for Missouri teens attending college, with special away-from-home discounts.

- Responsible Driver Rewards: Missouri teen drivers with clean records for three years receive substantial rate decreases not offered by many competitors.

Cons

- Highest Base Premiums: Travelers charge Missouri teen drivers the highest starting rates among major insurers at $517 monthly for minimum coverage.

- Limited Stand-Alone Value: Teen drivers in Missouri seeking stand-alone auto policies without bundles find significantly less competitive rates compared to other providers.

How to Save Money on Teen Driver Auto Insurance in Missouri

There are a number of ways to save on teen insurance in Missouri. Finding cheap auto insurance for young drivers begins with shopping at the cheapest companies.

Teen Driver Auto Insurance in Missouri: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $244 | $613 | |

| $209 | $525 | |

| $432 | $1,083 | |

| $156 | $389 | |

| $247 | $619 |

| $153 | $381 |

| $313 | $783 | |

| $163 | $408 | |

| $275 | $450 | |

| $517 | $1,297 |

When shopping at the companies with the cheapest teen auto insurance, take a look at what discounts they offer.

Auto Insurance Discounts From the Top Providers for Missouri Teens

| Insurance Company | Good Student | Safety Features | Safe Driver | Bundling | Student Away at School |

|---|---|---|---|---|---|

| 22% | 20% | 18% | 25% | 20% | |

| 20% | 18% | 18% | 25% | 25% | |

| 15% | 15% | 20% | 20% | 20% | |

| 15% | 15% | 15% | 25% | 25% | |

| 12% | 12% | 20% | 25% | 25% |

| 18% | 18% | 12% | 20% | 20% |

| 10% | 10% | 10% | 10% | 10% | |

| 35% | 20% | 20% | 17% | 20% | |

| 20% | 18% | 12% | 18% | 18% | |

| 8% | 13% | 17% | 13% | 10% |

Most insurance companies offer discounts tailored exclusively to teens, such as a good student or student-away discount.

Compare Teen Driver Auto Insurance Quotes in Missouri

In addition to coverage type, the average car insurance cost in Missouri for teenagers will also vary by age, gender, and driving record.

Missouri Auto Insurance Monthly Rates by Age, Gender & Driving Record

| Age & Gender | One Ticket | One Accident | One DUI |

|---|---|---|---|

| 16-Year-Old Female | $350 | $400 | $500 |

| 16-Year-Old Male | $400 | $450 | $550 |

| 25-Year-Old Female | $180 | $220 | $300 |

| 25-Year-Old Male | $200 | $250 | $350 |

| 35-Year-Old Female | $150 | $200 | $250 |

| 35-Year-Old Male | $170 | $220 | $270 |

| 60-Year-Old Female | $130 | $180 | $230 |

| 60-Year-Old Male | $140 | $190 | $240 |

Teens with good driving records will have a much easier time getting affordable Missouri teen insurance rates, as it is much harder to find cheap insurance for young drivers after an accident, DUI, or ticket.

Missouri Auto Insurance Monthly Rates by Age, Gender & City

| Age & Gender | Columbia | Independence | Kansas City | Springfield | St. Louis |

|---|---|---|---|---|---|

| 16-Year-Old Female | $320 | $350 | $400 | $370 | $420 |

| 16-Year-Old Male | $370 | $400 | $450 | $420 | $470 |

| 25-Year-Old Female | $150 | $170 | $200 | $180 | $220 |

| 25-Year-Old Male | $160 | $180 | $210 | $190 | $230 |

| 35-Year-Old Female | $100 | $120 | $150 | $130 | $160 |

| 35-Year-Old Male | $110 | $130 | $160 | $140 | $170 |

| 60-Year-Old Female | $90 | $100 | $120 | $110 | $130 |

| 60-Year-Old Male | $95 | $105 | $125 | $115 | $135 |

Insurance in St. Louis and Kansas City costs slightly more. Where a teen lives could also affect rates in Missouri, though not as much as a bad driving record.

Missouri Auto Insurance Laws & Requirements

Missouri auto insurance requirements only require drivers to have minimum coverage. It is illegal to drive without insurance, although there is a small Missouri auto insurance grace period for teens who have permits.

Missouri auto insurance coverage requirements require all drivers to carry 25/50/10 of bodily injury and property damage liability coverage.Dani Best Licensed Insurance Producer

Take a look at the average rates below to see the difference in cost between full and minimum coverage.

Missouri Auto Insurance Monthly Rates by Age, Gender & Coverage Levell

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $173 | $510 |

| 16-Year-Old Male | $194 | $546 |

| 17-Year-Old Female | $163 | $480 |

| 17-Year-Old Male | $183 | $516 |

| 18-Year-Old Female | $142 | $352 |

| 18-Year-Old Male | $166 | $416 |

| 19-Year-Old Female | $135 | $330 |

| 19-Year-Old Male | $158 | $390 |

| 20-Year-Old Female | $128 | $310 |

| 20-Year-Old Male | $150 | $368 |

| 21-Year-Old Female | $122 | $295 |

| 21-Year-Old Male | $144 | $350 |

While full coverage is much more than minimum coverage, it often pays itself off after an accident. Without full coverage auto insurance, teens will have to pay their own repair bills in most accident situations.

If the price is daunting, make sure you are shopping for quotes to help you find the cheapest full coverage auto insurance in Missouri. Enter your ZIP code above to see rates from local companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Add Missouri Teens to a Parent’s Policy

Adding a driver to car insurance is easy. Most insurance companies let customers add a driver online, or customers can call the company to add the driver.

If teens have permits, then insurance companies may not even need the teen added.Zach Fagiano Licensed Insurance Broker

Just make sure to check your company’s rules on permitted driver auto insurance in Missouri and ask about the Missouri car insurance grace period once a teen gets a license.

While some parents may be considering having teens purchase their own policy, the rates below show how much more economical it is for teens to join a parents’ policy making it easy to compare cheapest insurance in Missouri.

Missouri Auto Insurance Monthly Rates by Age, Gender & Policy Type

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $264 | $833 |

| 16-Year-Old Male | $296 | 545.86 |

| 25-Year-Old Female | $61 | $175 |

| 25-Year-Old Male | $67 | $189 |

| 35-Year-Old Female | $57 | $162 |

| 35-Year-Old Male | $62 | $102 |

| 60-Year-Old Female | $24 | $67 |

| 60-Year-Old Male | $24 | $68 |

Teens can stay on a parents’ policy even when they go away to college. Some insurance companies even offer a student-away discount on family policies.

Progressive is our top pick for teen auto insurance discounts for its huge savings and rewards for safe drivers. See how much your teen driver can save in our Progressive Snapshot review.

The Cheapest Missouri Auto Insurance Companies for Teens

For affordable teen driver auto insurance in Missouri, Nationwide leads with the lowest rates at $153 a month, offering flexible coverage statewide. Geico follows with strong digital tools and bundling discounts of up to 25%, while State Farm ranks third with Missouri’s largest agent network and solid good student discounts.

While teen insurance is expensive due to how auto insurance rates by age are calculated, this doesn’t mean teen auto insurance has to break the bank. Teens can qualify for discounts and get quotes at the cheapest Missouri companies to reduce auto insurance costs. Joining a parent’s policy will also help keep rates reasonable.

Ready to start saving on teen insurance in Missouri? Enter your ZIP code into our free tool for free Missouri auto insurance quotes today.

Frequently Asked Questions

How much is auto insurance for a 16-year-old per month in Missouri?

Minimum coverage in Missouri averages $184 per month for 16-year-old drivers. This is expensive, but it doesn’t mean you can’t get cheap auto insurance for 16-year-olds. Comparing rates from companies in your area will help you quickly find cheap car insurance for young drivers in Missouri.

At what age is Missouri auto insurance most expensive?

16-year-old drivers have the most expensive rates, followed by 17-year-old and 18-year-old drivers. Having teenagers join a parent’s policy will get you the best auto insurance for drivers under 25.

What is the cheapest Missouri auto insurance company for a 17-year-old?

Geico is the cheapest Missouri auto insurance company for 17-year-old drivers.

How much is car insurance for a 17-year-old in Missouri?

Minimum coverage in Missouri averages $173 per month for 17-year-old drivers. This is expensive, so make sure to read up on how to find cheap auto insurance for 17-year-olds.

How much is auto insurance for an 18-year-old per month in Missouri?

The average minimum coverage rate for 18-year-old drivers in Missouri is $153 per month. However, the cheapest insurance for an 18-year-old in Missouri is available at Nationwide, Geico, and State Farm.

What are Missouri’s minimum requirements for auto insurance?

The Missouri Department of Insurance requires drivers to carry 25/50/25 of liability insurance.

How much are car tags in Missouri?

The cost of car tags depends on what type of vehicle you drive. Most tags for cars are under $30.

How much does the average car cost in Missouri?

The average car costs around $33,000 in Missouri.

Do all Missouri insurance companies charge the same rates?

No, the rates for Missouri car insurance plans will be different among companies, especially for younger drivers. Learn more about why young drivers are charged more in our article: Six Reasons Auto Insurance Costs More for Young Drivers

Which is better, AAA or Nationwide auto insurance in Missouri?

Nationwide has the best auto insurance rates in Missouri. See who has the best Missouri insurance rates in your city with our free comparison tool.

Is Allstate auto insurance cheaper than Geico in Missouri?

Geico has cheaper Missouri car insurance quotes on average.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.