Cheap Auto Insurance for High-Risk Drivers in New York (Save With These 10 Companies for 2025)

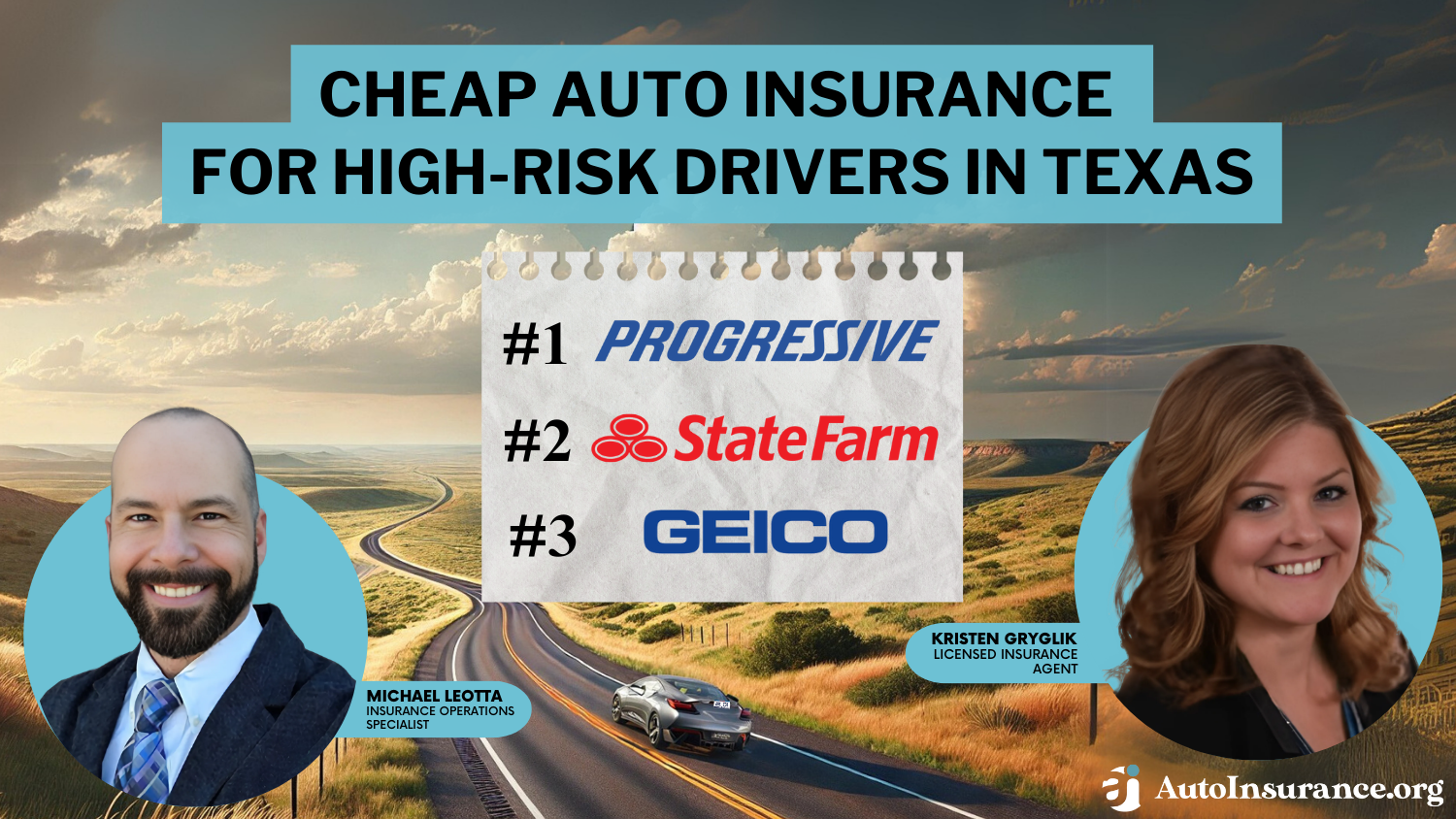

Progressive, State Farm, and Geico provide cheap auto insurance for high-risk drivers in New York, with minimum coverage starting at $60/month. These top providers of auto insurance for high-risk drivers in NY are known for affordable rates, comprehensive coverage, and excellent customer service.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Apr 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

High-Risk Min. Coverage in NY

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,154 reviews

18,154 reviewsCompany Facts

High-Risk Min. Coverage in NY

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

High-Risk Min. Coverage in NY

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsThe top pick overall for cheap auto insurance for high-risk drivers in New York is Progressive, followed closely by State Farm and Geico.

These providers offer affordable rates, comprehensive high-risk auto insurance coverage, and exceptional customer service, making them ideal for high-risk drivers.

Our Top 10 Company Picks: Cheap Auto Insurance for High-Risk Drivers in New York

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $60 | A+ | Snapshot Program | Progressive | |

| #2 | $78 | B | Broad Coverage | State Farm | |

| #3 | $99 | A++ | Online Services | Geico | |

| #4 | $106 | A+ | Accident Forgiveness | Allstate | |

| #5 | $113 | A++ | Intellidrive Program | Travelers | |

| #6 | $118 | A | Personalized Service | American Family | |

| #7 | $119 | A | Extensive Coverage | Farmers | |

| #8 | $205 | A+ | AARP Benefits | The Hartford |

| #9 | $237 | A+ | Reliable Service | Nationwide |

| #10 | $267 | A | Customizable Plans | Liberty Mutual |

Use this guide to find the best high-risk auto insurance companies in New York. We will help you understand the benefits and drawbacks of each company. By comparing quotes and understanding your coverage needs, you can make informed decisions and save money on high-risk driver insurance in NY.

- Progressive stands out, with rates starting at $60 per month

- State Farm is the second-cheapest at $78 per month

- Liberty Mutual is the most expensive at $267 per month

Our free online comparison tool allows you to instantly compare cheap car insurance for high-risk drivers. Just enter your ZIP code to get started.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Affordable Rates: According to our Progressive auto insurance review, starting at $60 per month for high-risk drivers in New York.

- Comprehensive Coverage: Extensive coverage options are tailored specifically for those seeking car insurance for high-risk drivers in NY.

- Excellent Customer Service: Progressive is highly rated and one of the best car insurance for high-risk drivers in New York.

Cons

- Rate Increases: High-risk insurance premiums in NY can rise significantly after accidents.

- Limited Discounts: Progressive only offers a few car insurance discounts for high-risk drivers in New York.

#2 – State Farm: Best for Broad Coverage

Pros

- Competitive Rates: State Farm offers cheap car insurance for bad drivers in New York at $78 per month.

- Wide Coverage Options: Based on our State Farm auto insurance review, the company provides comprehensive NY high-risk auto insurance coverage plans.

- Personalized Service: State Farm’s high-risk insurance service ensures that the specific needs of drivers in New York are met.

Cons

- Higher Premiums After Claims: Auto insurance rates for high-risk drivers can increase after certain claims in New York.

- Limited Online Tools: Offers fewer digital resources for managing high-risk insurance policies for high-risk drivers in New York.

#3 – Geico: Best for Online Service

Pros

- Low Rates: Geico is known for its affordable car insurance for high-risk drivers in New York.

- User-Friendly Platform: Drivers in NY with high-risk car insurance have streamlined policy management from Geico’s simple online platform.

- Discount Opportunities: According to our Geico auto insurance review, multiple discounts are available even for high-risk drivers in New York.

Cons

- Variable Customer Service: Customer service quality can vary significantly for high-risk drivers in New York.

- Coverage Limitations: Geico high-risk insurance options are not as many other insurers in New York.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Accident Forgiveness

Pros

- Broad Coverage: Read our Allstate auto insurance review to learn about its extensive coverage options for high-risk drivers in New York.

- Strong Customer Support: Known for excellent customer service aimed specifically at high-risk drivers in New York.

- Accident Forgiveness: Provides accident forgiveness policies to high-risk drivers in New York to prevent rate spikes after accidents.

Cons

- Higher Premiums: Generally, Allstate policyholders face higher auto insurance rates for high-risk drivers in New York.

- Discount Limitations: Fewer discount options are available than other high-risk insurance companies in New York.

#5 – Travelers: Best for Usage-Based Savings

Pros

- Customizable Policies: Discover our Travelers auto insurance review, which discusses tailored coverage options for high-risk drivers to meet diverse needs in New York.

- Good Customer Service: Positive service reviews, specifically from high-risk drivers in New York.

- Discounts Available: Offers various discounts that can help high-risk policyholders get cheap auto insurance in NY.

Cons

- Higher Rates: Rates tend to be comparatively higher for high-risk drivers in New York.

- Limited Availability: Not all coverage options may be available to high-risk drivers in New York.

#6 – American Family: Best for Personalized Service

Pros

- Personalized Policies: Take a look at our American Family auto insurance review for customizable coverage options tailored for high-risk drivers in New York.

- Discount Programs: Offers multiple discounts for drivers in New York to reduce high-risk insurance costs.

- Strong Customer Service: Noted for delivering good customer service specifically to high-risk drivers in New York.

Cons

- Higher Costs: Premiums may be elevated for high-risk drivers in New York.

- Regional Limitations: Availability may vary in different parts, affecting high-risk drivers in New York.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Extensive Coverage Options

Pros

- Extensive Coverage: Provides a wide range of coverage options specifically for high-risk drivers in New York.

- Discounts: Various discounts are available for high-risk drivers in New York. Here is a list of Farmers auto insurance discounts.

- Flexible Payments: Flexible payment options make it easier to manage expensive, high-risk auto insurance premiums in New York.

Cons

- Higher Premiums: Higher rates compared to the cheapest high-risk auto insurance companies in the market.

- Limited Online Tools: Fewer online resources for managing policies compared to other high-risk car insurance companies.

#8 – The Hartford: Best for Senior Drivers

Pros

- Custom Coverage: Check our The Hartford auto insurance review for a full overview of policy options geared towards high-risk drivers in New York.

- Strong Reputation: Known for good service to those seeking car insurance for drivers with accidents throughout the state.

- Discount Options: Multiple discounts are available for AARP members who need affordable, high-risk auto insurance.

Cons

- Higher Rates: High-risk auto insurance is not cheap with The Hartford in New York.

- Limited Availability: Not all coverage options are available in every area for high-risk drivers in New York

#9 – Nationwide: Best for Reliable Service

Pros

- Comprehensive Plans: Read our Nationwide auto insurance review for extensive coverage options for high-risk drivers in New York.

- Discount Programs: Various discounts aimed at reducing insurance costs for high-risk drivers in New York.

- Good Service: Known for good customer service, particularly to high-risk drivers in New York.

Cons

- Higher Costs: High-risk drivers in New York may face higher insurance rates.

- Coverage Limitations: Some insurance options may be limited for high-risk drivers in New York.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Flexible Options

Pros

- Flexible Plans: Offers customizable policies specifically for high-risk drivers in New York.

- Discount Opportunities: Explore our Liberty Mutual auto insurance review for the multiple discounts aimed at high-risk drivers in New York.

- Accident Forgiveness: Features accident forgiveness to prevent rate increases after claims for high-risk drivers in New York.

Cons

- Higher Premiums: Rates are higher for high-risk drivers in New York.

- Poor Customer Service: Often receives poor customer satisfaction reviews for claims and rate hikes for high-risk drivers in New York.

Cheap High-Risk Auto Insurance Rates in New York

Why do auto insurance rates vary so much for high-risk drivers? Insurance companies closely examine driving history, with traffic violations, accidents, or DUI convictions leading to higher premiums.

This list of high-risk auto insurance companies shows monthly insurance rates for high-risk drivers in New York from the cheapest providers:

New York High-Risk Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $106 | $205 | |

| $118 | $228 | |

| $119 | $230 | |

| $99 | $192 | |

| $267 | $516 |

| $237 | $457 |

| $60 | $115 | |

| $78 | $151 | |

| $205 | $335 |

| $113 | $219 |

For minimum coverage, Progressive offers the lowest rate at $60, followed by State Farm at $78 and Geico at $99. For full coverage, Progressive also has the lowest rate at $115, with State Farm at $151 and Geico at $192.

Progressive offers the best overall value for high-risk drivers in New York with comprehensive coverage and excellent customer service.Brandon Frady Licensed Insurance Producer

Liberty Mutual offers the highest rates, $267 for the minimum and $516 for full coverage. Other providers include Allstate, American Family, Farmers, Nationwide, The Hartford, and Travelers, which offer varying rates for both coverage levels.

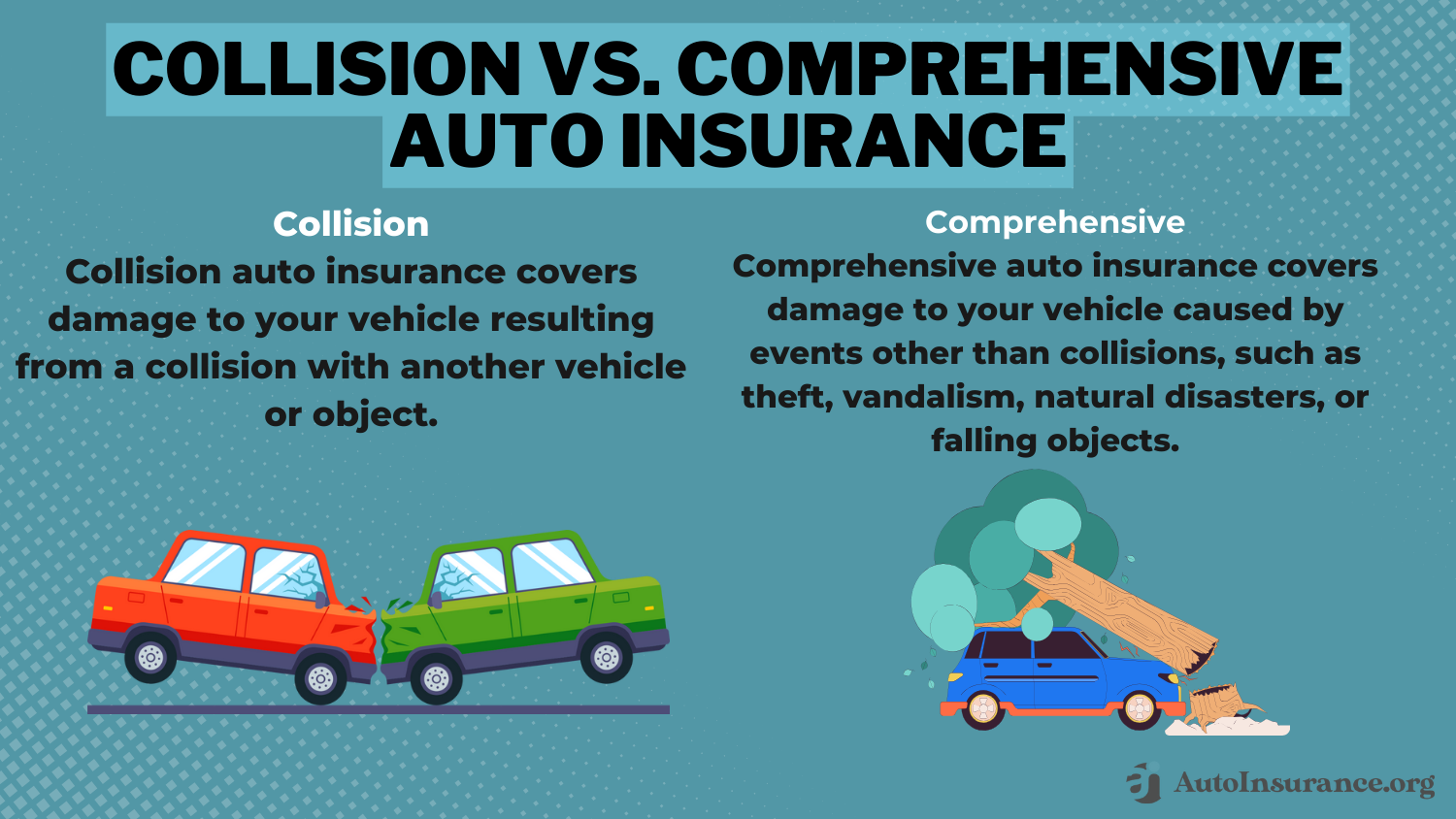

This diversity in rates and coverage options highlights the importance of comparing different insurance providers to find the best collision and comprehensive auto insurance tailored for high-risk drivers.

Factors Influencing High-Risk Auto Insurance in New York

When it comes to securing auto insurance for high-risk drivers in New York, several factors can significantly impact your rates:

- Age and Experience: Younger and less experienced drivers, as well as older drivers with a history of incidents, are often categorized as high-risk.

- Vehicle: The make, model, and year of the vehicle can affect rates, especially for expensive or high-performance cars.

- Location: New York City auto insurance is more expensive than other areas in the state.

The type of coverage selected, whether it’s basic liability or comprehensive, also plays a significant role in determining car insurance premiums. Opting for a higher deductible can often result in lower monthly premiums, too.

Credit scores are another important factor, with lower scores often leading to increased premiums for drivers. Lapses in insurance history, marital status, occupation, and even gender can all influence high-risk insurance rates, so compare quotes online to get the best price on your policy.

If you can’t find coverage with a standard insurer on this list, high-risk drivers can use the New York Automobile Insurance Plan.

Unlocking Auto Insurance Discounts for High-Risk Drivers

As a high-risk driver, you can still find ways to lower premiums by taking advantage of various auto insurance discounts. Discounts may be available for bundling multiple policies, completing defensive driving courses, and installing safety or anti-theft devices in your vehicle.

Auto Insurance Discounts From the Top Providers for High-Risk Drivers in New York

| Insurance Company | Safe Driver | Bundling | Anti Theft | Good Student | Accident-Free |

|---|---|---|---|---|---|

| 18% | 25% | 10% | 20% | 20% | |

| 18% | 25% | 25% | 20% | 20% | |

| 20% | 20% | 10% | 15% | 15% | |

| 15% | 25% | 25% | 15% | 15% | |

| 20% | 25% | 35% | 15% | 15% |

| 10% | 20% | 5% | 15% | 15% |

| 10% | 10% | 25% | 10% | 10% | |

| 8% | 17% | 15% | 25% | 25% | |

| 10% | 5% | 5% | 12% | 12% |

| 17% | 13% | 15% | 8% | 8% |

It’s important to ask different insurance providers about the specific discounts they offer for high-risk drivers. For instance, Progressive and most cheap auto insurance companies for high-risk drivers in New York offer bundling discounts when you buy multiple types of insurance with them.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

3 Case Studies: High-Risk Auto Insurance in New York

These case studies use real-world scenarios to illustrate the benefits and coverage options offered by insurance companies that take high-risk drivers in New York.

- Case Study #1–Affordable and Comprehensive Coverage: John, 35, with traffic violations, chose State Farm for its cheap insurance for high-risk drivers. Using safe driver discounts and bundling with renter’s insurance, he reduced his premium to $115 for full coverage auto insurance.

- Case Study #2—Financial Stability and Personalized Service: Emily, 29, who has had minor accidents, chose Progressive’s high-risk insurance plan. She earned discounts by bundling auto and home insurance and reduced her monthly premium to $151 for full coverage.

- Case Study #3—Affordable Rates and Reliable Coverage: Michael, 45, who had a DUI, chose Geico. Installing an anti-theft device and maintaining continuous coverage lowered his premium to $192 for full coverage. Efficient online services made managing his policy easy.

These scenarios highlight how different insurance providers can offer tailored benefits and discounts, making it important to compare options to find inexpensive car insurance in New York.

Finding the Best Auto Insurance for High-Risk Drivers in New York

Progressive, State Farm, and Geico have cheap auto insurance for high-risk drivers in New York for $60 per month. These providers cater specifically to the needs of high-risk auto insurance, offering affordable premiums, exceptional service, and tailored coverage solutions.

Standing on the sidelines ❌

Saving with Progressive ✅ pic.twitter.com/7tbCtdJsmf— Progressive (@progressive) February 15, 2025

High-risk drivers in New York have access to excellent auto insurance options with competitive rates, comprehensive coverage, and high customer satisfaction.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code into our free comparison tool.

Frequently Asked Questions

What is the cheapest car insurance for high-risk drivers in New York?

Progressive, Geico, and State Farm provide the cheapest auto insurance for high-risk drivers in New York. These companies offer competitive high-risk auto insurance cost tailored for drivers in New York.

Does USAA cover high-risk drivers?

Yes, USAA sells high-risk car insurance, but only to military members living in New York.

What is the best auto insurance for DUI in NY?

The best auto insurance for DUI in NY includes companies like Progressive and State Farm, which provide comprehensive coverage and reasonable rates for drivers with a DUI. These insurers are known for accommodating high-risk drivers in New York.

What is the cheapest category for car insurance?

The cheapest category for car insurance often includes liability-only policies. However, for high-risk drivers in New York, finding affordable rates might require comparing multiple providers and considering state-specific high-risk insurance options.

Which type of insurance is best for new drivers?

For new drivers, the best type of insurance typically includes comprehensive coverage with optional add-ons like accident forgiveness. High-risk drivers in New York, including auto insurance for new drivers, should seek policies that offer robust coverage at competitive rates.

How much is car insurance in NY for new drivers?

Car insurance in NY for new drivers can be quite expensive, often ranging from $200 to $400 per month. High-risk drivers in New York, including new drivers, may face higher premiums due to their lack of driving experience.

Who do auto insurance companies see as the highest risk?

Auto insurance companies see high-risk drivers in New York as those with multiple traffic violations, accidents, DUIs, or lapses in coverage. These drivers are considered the highest risk due to their history of claims and driving behavior.

What type of risk is not insurable?

Risks that are not insurable typically include those that are highly unpredictable and catastrophic, such as acts of war or certain natural disasters. High-risk drivers in New York, however, can still find insurance options tailored to their needs despite being considered high-risk.

What is the minimum auto insurance coverage in New York?

The minimum auto insurance coverage in New York includes $25,000 for bodily injury liability insurance per person, $50,000 per accident, and $10,000 for property damage. High-risk drivers in New York must ensure they meet these minimum requirements.

What does it mean to be high-risk insurance?

High-risk insurance refers to policies specifically designed for drivers who are considered high-risk by insurers. High-risk drivers in New York, often with poor driving records or a history of claims, are offered these policies to ensure they have the necessary coverage.

Ready to find an affordable high-risk auto insurance quote? Get started today by entering your ZIP code below into our free comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.