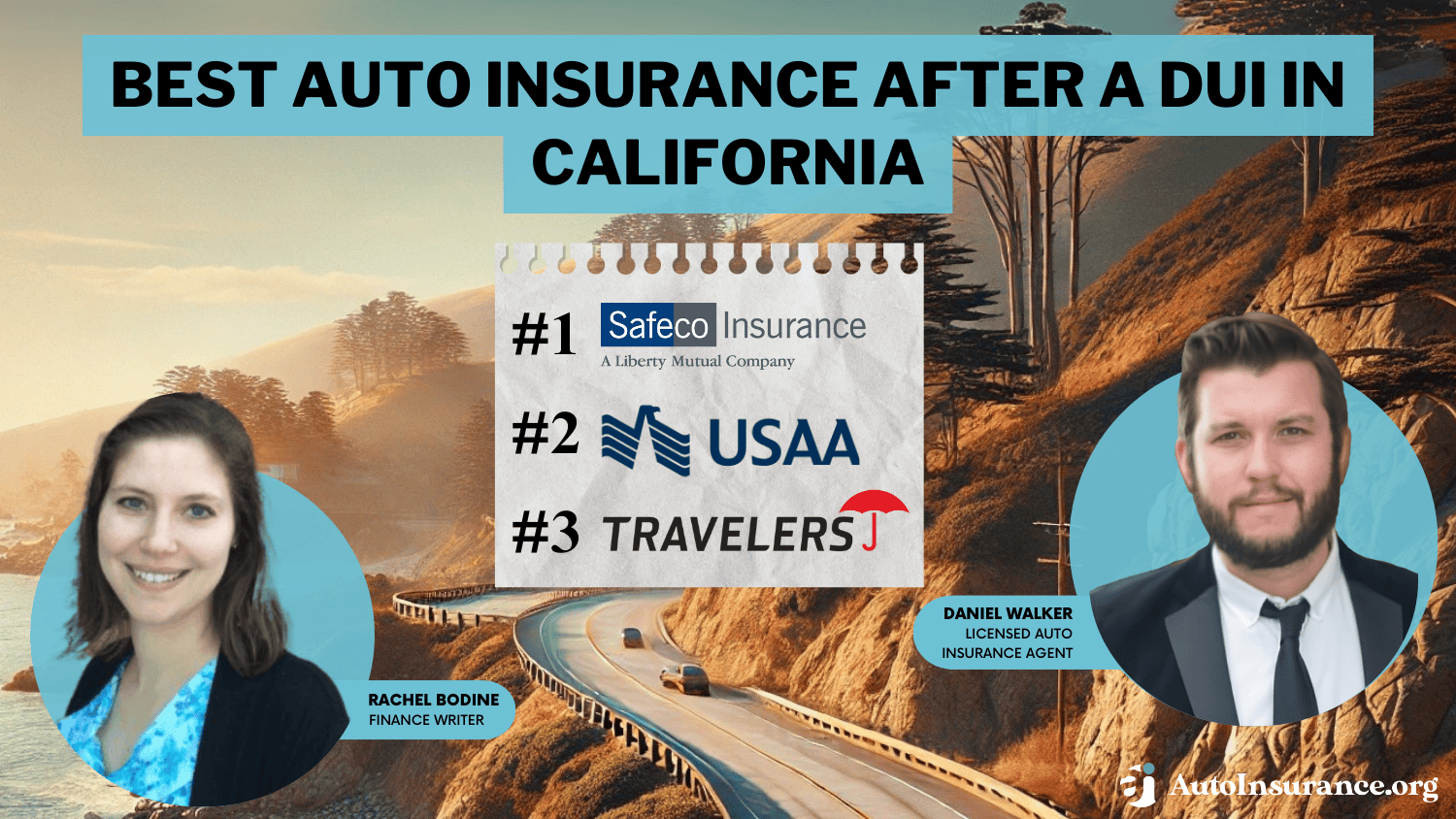

Best Auto Insurance After a DUI in California (Top 10 Companies in 2025)

Safeco, USAA, and Travelers have the best auto insurance after a DUI in California. USAA is best for military car insurance after a DUI in California, with rates starting at $44 per month. Drivers who need DUI insurance in California, but don't qualify for USAA will find affordable coverage at Safeco and Travelers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Feb 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,277 reviews

1,277 reviewsCompany Facts

Full Coverage After a DUI in California

A.M. Best Rating

Complaint Level

Pros & Cons

1,277 reviews

1,277 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage After a DUI in California

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage After a DUI in California

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsThe top companies that stand out for the best auto insurance after a DUI in California are Safeco, USAA, and Travelers.

The best auto insurance companies for DUI drivers in California offer discount savings and complete protection plans to DUI customers.

Our Top 10 Company Picks: Best Auto Insurance in California After a DUI

| Company | Rank | Pay-in-Full Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A | Online Tools | Safeco | |

| #2 | 15% | A++ | Military Savings | USAA | |

| #3 | 12% | A++ | Filing Claims | Travelers | |

| #4 | 18% | B | Local Agents | State Farm | |

| #5 | 10% | A+ | Competitive Rates | Progressive | |

| #6 | 14% | A+ | Accident Forgiveness | Nationwide |

| #7 | 17% | A+ | Customer Service | Amica Mutual | |

| #8 | 13% | A | First-Responder Discount | Farmers | |

| #9 | 16% | A+ | Add-On Coverages | Allstate | |

| #10 | 19% | A | High-Risk Coverage | The General |

If you’re wondering “How much will a DUI increase my insurance?” Our guide goes over finding cheap DUI insurance rates in California, as well as all the pros and cons of these companies so you can choose a California DUI car insurance that’s perfect for your individual needs.

You can also enter your ZIP in our free quote comparison tool to find the cheapest California car insurance after a DUI.

- California drivers will find the best DUI coverage at Safeco

- USAA has the best car insurance in California after a DUI for military drivers

- California DUI drivers pay more than the average driver, even at the top companies

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Safeco: Top Overall Pick

Pros

- Online Tools: Drivers seeking cheap insurance for a DUI in California can use Safeco’s online app and company website for easy management.

- Claims-Free Cash Back: California DUI auto insurance customers get cash back for not filing claims and driving safely.

- Customizable Coverages: California DUI policies can be adjusted with different coverages and deductibles.

Cons

- Customer Satisfaction in California: Safeco may not be the best for DUI customers as it has low overall ratings, which you can learn about in our Safeco auto insurance review.

- California Agent Quotes: You can’t complete a DUI insurance quote online, as you will be directed to an agent to finish an online quote.

#2 – USAA: Best for Military Savings

Pros

- Military Savings: For California auto insurance with DUI coverage, military and veterans will find some of the best deals at USAA. Find out more in our USAA auto insurance review.

- Customer Satisfaction: USAA has one of the highest ratings for overall satisfaction in California with services and claims for DUI drivers.

- California Discount Opportunities: DUI drivers can work to lower their rates by participating in good driver programs, bundling their policies, and more.

Cons

- Membership Restrictions: USAA only sells to California DUI residents who are military or veterans.

- California Coverage Options: USAA doesn’t offer as many add-ons as other major California DUI insurance companies, although it has a good list of basics.

#3 – Travelers: Best for Filing Claims

Pros

- Filing Claims: For those requiring California car insurance after a DUI, Travelers has a straightforward claims filing process.

- Financial Stability: An A++ rating from A.M. Best helps Travelers stand out from other Californian DUI companies.

- California DUI Coverage Options: Travelers offers many coverage options for DUI drivers. For a complete list, read our Travelers auto insurance review.

Cons

- IntelliDrive Discount Not in California: DUI drivers in California can’t join the discount program.

- Customer Service: The service from California representatives for DUI customers is considered average or below average in most customer reviews.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Local Agents

Pros

- Local Agents: State Farm’s agents help with California auto insurance for anyone with a DUI. Read more in our review of State Farm auto insurance.

- California Coverage Options: Our research shows customers in California with DUI auto insurance can add extra coverages like roadside assistance.

- Discount Opportunities: DUI customers in California can work to lower rates with some of State Farm’s discount opportunities.

Cons

- Fewer Online Tools: State Farm has fewer online customer management insurance tools for California DUI drivers.

- Financial Rating: State Farm isn’t as financially strong as other California DUI auto insurance companies.

#5 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive leads in offering the cheapest car insurance for a DUI in California with its competitive pricing structure.

- Online Tools: Progressive has useful budgeting and online management tools for California DUI customers.

- California DUI Coverage Options: Progressive sells many coverage options, including rental car reimbursement. Read our Progressive auto insurance review for a full list.

Cons

- Snapshot Not Available in California: DUI drivers can’t try to get a discount with Snapshot in California.

- California DUI Customer Ratings: Ratings for Progressive’s DUI insurance aren’t as good as those of other companies like Safeco.

#6 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Nationwide forgives some California DUI drivers for their first accident.

- Flexible Insurance Options: Nationwide provides auto insurance specifically for DUI in California through various programs, including SmartMiles for low-mileage drivers.

- California Bundling Discount: DUI drivers can bring rates down by purchasing home or renters insurance with their auto insurance.

Cons

- Local Agent Availability: Some California DUI customers may have trouble finding a local agent.

- California DUI Customer Satisfaction: Ratings are average or worse than most customers, which you can learn about in our Nationwide auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Amica: Best for Customer Service

Pros

- Customer Service: Amica ranks highest in California car insurance DUI satisfaction ratings, which you can check out in our Amica auto insurance review.

- Add-On Coverages: Amica sells extras like full glass coverage to California DUI drivers.

- California Discount Opportunities: DUI drivers can earn small discounts for doing simple things like going paperless.

Cons

- Young Driver Rates: Amica is less affordable for young California drivers with a DUI.

- No Rideshare Insurance: DUI drivers won’t be able to buy rideshare insurance in California.

#8 – Farmers: Best for First-Responders

Pros

- First-Responder Discount: Farmers is the best auto insurance with a DUI for first responders and gives them cheap rates too.

- Local Agents: Car insurance for DUI offenders in California includes personalized support through local representatives. Learn more in our Farmers auto insurance review.

- Coverage Options: DUI customers can add on extras like California roadside assistance.

Cons

- Accident Forgiveness: California DUI customers will have to pay extra to add accident forgiveness to their policy.

- Signal Discount Not in California: DUI drivers can’t participate in the Signal program, as it’s unavailable in California.

#9 – Allstate: Best for Add-On Coverages

Pros

- Add-On Coverages: Allstate offers the best insurance packages after a DUI, including gap insurance and roadside assistance. Read our Allstate auto insurance review to learn what else is offered.

- Online Tools: Allstate’s app lets California DUI drivers file insurance claims, pay bills, and more.

- California Discount Options: DUI drivers can save small amounts by joining auto-pay or going paperless.

Cons

- Milewise Not in California: Allstate’s mileage-based insurance isn’t sold in California, which will reduce saving opportunities for DUI drivers.

- Drivewise Not in California: Allstate’s discount program is also not available in California, reducing saving opportunities for DUI drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – The General: Best for High-Risk Coverage

Pros

- High-Risk Coverage: The General specializes in high-risk coverage for California DUI drivers, which you can read more about in our review of The General auto insurance.

- California SR-22 Filing: The General will file SR-22 insurance forms for its high-risk DUI customers.

- Mobile App: The General’s app is intended to make policy management for California DUI customers easier.

Cons

- California Coverage Options: The General doesn’t sell as many add-on coverages as other DUI California companies.

- Higher California Rates: The General is not an affordable car insurance for high-risk drivers for DUI customers in California.

Compare DUI Insurance Rates From the Best California Companies

Drivers with one DUI will have more affordable rates than multiple DUI offenders, making it easier to get cheap insurance from the best California companies. For those seeking California car insurance with a DUI, the table below shows average rates for a DUI offender at the top companies.

California DUI Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $110 | $336 | |

| $86 | $283 | |

| $76 | $232 | |

| $96 | $294 |

| $57 | $176 | |

| $47 | $122 | |

| $46 | $140 | |

| $166 | $426 | |

| $83 | $255 | |

| $44 | $136 |

While drivers can still get cheap auto insurance after a DUI in California, rates won’t be as cheap as if drivers had a clean driving record. DUI car insurance rates will be even more expensive if drivers are required to buy high-risk insurance.

Minimum coverage will be the cheapest insurance option for a DUI in California, although it doesn’t offer much financial protection in an accident.

How to Save on California DUI Insurance

Drivers looking to lower their rates at the best car insurance companies for a DUI in California can start by applying for discounts, these discounts serves as the oldest DUI insurance trick to lower rates. The best insurance companies for a DUI on our list offer plenty of discounts to help customers save.

Multi-policy discounts are one of the best ways for drivers to lower DUI insurance costs in California, and they offer the convenience of keeping insurance policies at one provider.

California residents can also adjust their auto insurance deductibles or shop around for auto insurance quotes to get cheap auto insurance for DUI drivers.

If DUI offenders maintain a clean driving record after their DUI, their auto insurance rates will drop after a few years.Brandon Frady Licensed Insurance Producer

Because companies consider DUI drivers high-risk, DUI drivers in California will pay more for car insurance than drivers without a DUI. Knowing discounts and where to get them can help get you the cheapest DUI insurance in California.

Finding The Best Auto Insurance After a DUI in California

Safeco, USAA, and Travelers are the best California auto insurance companies after a DUI, with full coverage options and auto insurance discounts.

High-risk drivers also have plenty of other great options on our list, and we recommend shopping around to find the company that is the best fit for your budget and insurance needs.

Ready to lower your California DUI insurance costs? Use our free tool to find the best insurance in California after a DUI today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How much does your insurance go up after a DUI in California?

It depends on the offense, but California DUI insurance rates can double once it’s on your record.

How long does DUI stay on insurance in California?

DUIs stay on record for ten years, but rates can go down on insurance after a few years if drivers don’t get another DUI.

What is the cheapest car insurance after a DUI in California?

Minimum coverage will be the cheapest car insurance option for DUI drivers in California, although carrying just minimum coverage is not recommended for all drivers (Learn More: When to Buy More Than Minimum Auto Insurance).

How long can you not drive after a DUI in California?

CA DUI insurance law typically suspends driving privileges for at least six months.

Will Progressive drop me after a DUI?

Progressive usually won’t drop customers after a DUI, but the company will raise rates.

How long after a DUI does your insurance go down in California?

It depends, but it takes at least a few years for California rates to go down again after a DUI (Read More: Factors That Affect Auto Insurance Rates).

What is the best insurance in California with a DUI?

The best coverage for a DUI incident will be full coverage insurance. To get a good deal on full coverage insurance in California, make sure to compare rates with our free quote tool.

Does Geico insure DUI?

Yes, Geico will insure DUI drivers, but it is not one of the best auto insurance companies for DUI drivers in California.

Who has the best auto insurance in California for DUI drivers?

Safeco, USAA, and Travelers are the best high-risk auto insurance companies in California for DUI drivers.

How many points is a DUI in California?

A DUI will result in two points on a driver’s record.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.