Cheapest Teen Driver Auto Insurance in Louisiana for 2025 (8 Most Affordable Companies)

USAA, Geico, and Allstate offer the cheapest teen driver auto insurance in Louisiana, with rates starting at $108 per month. These companies offer low-cost coverage for young drivers, with discounts for good students, safe driving apps, and low-mileage usage to help reduce total teen insurance costs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Apr 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Teens in LA

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Teens in LA

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 11,638 reviews

11,638 reviewsCompany Facts

Min. Coverage for Teens in LA

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsThe top pick overall for the cheapest teen driver auto insurance in Louisiana is USAA, with Geico and Allstate also ranked among the best providers for various types of auto insurance.

These companies are recognized for their specialized coverage options, organizational discounts, and flexible policies tailored to young drivers seeking cheap car insurance for young drivers.

Our Top 8 Company Picks: Cheapest Teen Driver Auto Insurance in Louisiana

| Company | Rank | A.M. Best | Monthly Rates | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | $108 | Small Businesses | USAA | |

| #2 | A++ | $166 | Specialized Coverage | Geico | |

| #3 | A+ | $178 | Organization Discount | Allstate | |

| #4 | A | $190 | Comprehensive Coverage | AAA |

| #5 | A+ | $185 | Coverage Options | Amica | |

| #6 | A+ | $215 | Customer Service | Nationwide |

| #7 | A | $225 | Bundling Policies | The General | |

| #8 | A+ | $399 | Tailored Policies | Progressive |

By comparing these top choices, families can find good insurance for young drivers and make informed decisions to secure the right coverage.

- USAA offers the best teen insurance rates starting at $108 per month

- Geico has affordable teen car insurance for $166 per month

- Student discounts for teens help lower auto insurance rates

The cheapest auto insurance companies for teen drivers is just a click away. Enter your ZIP code into our free quote tool above to find the best teen auto insurance in Louisiana.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros

- Military Discounts: USAA teen driver insurance in Louisiana includes military-specific benefits and discounts, ideal for families looking for cheap teen insurance.

- Discounts for Small Business Families: Provides discounts advantageous to small business owners and their teen driver auto insurance in Louisiana.

- Consistent Service: Discover our USAA review, emphasizing dependable customer service for teen driver auto insurance in Louisiana.

Cons

- Eligibility Restrictions: Teen driver auto insurance in Louisiana is exclusively available to military families.

- Expensive High-Risk Rates: In Louisiana, teen drivers who have accidents will pay higher premiums with USAA than with other auto insurance companies.

#2 – Geico: Best for Specialized Coverage

Pros

- Customizable Teen Coverage: Provides extensive customization options tailored to the unique requirements of teen driver auto insurance in Louisiana.

- Innovative Features: Includes Geico DriveEasy usage-based insurance and educational programs that encourage safe driving behavior among Louisiana teenage drivers.

- Wide Range of Add-Ons: In our Geico auto insurance review, we outline the various additional options that offer increased protection for teen driver auto insurance in Louisiana.

Cons

- No Gap Insurance: Teen drivers in Louisiana with new cars cannot obtain auto loan coverage from Geico.

- Variable Customer Feedback: Some teen drivers in Louisiana report varying experiences with auto insurance claims.

#3 – Allstate: Best for Organization Discount

Pros

- Substantial Organization Discounts: Provides substantial discounts on teen driver auto insurance in Louisiana for members of affiliated organizations.

- Teen Smart Discounts: Explore our Allstate auto insurance review to see how the TeenSmart driver program helps teens drive safely and qualify for discounts in Louisiana.

- Extensive Agent Network: A wide network of agents allows families with teen drivers to receive tailored service, including those seeking auto insurance in Louisiana.

Cons

- Premium Fluctuations: Teen driver auto insurance discounts in Louisiana can change from city to city, creating surprises in your premium amounts.

- Eligibility for Discounts: Certain discounts for teen driver auto insurance in Louisiana may have qualifications that not all teenagers can meet.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – AAA: Best for Comprehensive Coverage

Pros

- Extensive Coverage Options: Provides extensive coverage options and add-ons for complete teen driver auto insurance in Louisiana.

- Roadside Assistance: View our AAA auto insurance review, their policies provide excellent roadside assistance, ideal for new teen drivers in Louisiana.

- Travel Discounts: Offers additional travel-related discounts that can help Louisiana families with teen driver auto insurance.

Cons

- Membership Required: Teen driver auto insurance in Louisiana necessitates an AAA membership, which incurs an additional expense.

- Higher Premiums: Including comprehensive coverage options will raise auto insurance rates for teen drivers in Louisiana.

#5 – Amica: Best for Coverage Options

Pros

- Flexible Coverage Choices: Offers families the ability to widely customize their teen driver auto insurance in Louisiana based on their adolescent’s driving preferences.

- High Customer Satisfaction: Consistently praised for outstanding customer service experience and high levels of satisfaction with Louisiana teen driver auto insurance.

- Good Driver Rewards: According to our Amica auto insurance review, the company offers various discounts to teen drivers in Louisiana who maintain clean driving records.

Cons

- Limited Local Agents: Fewer local agents may affect personalized service for teen driver auto insurance in Louisiana.

- Cost Variability: The cost of teen driver auto insurance in Louisiana varies, and knowing the car insurance costs for teenagers helps families plan better.

#6 – Nationwide: Best for Customer Service

Pros

- Dedicated Support for Teens: Renowned for outstanding customer service, particularly in managing teen driver auto insurance in Louisiana.

- Accident Forgiveness: Check out our Nationwide auto insurance review to see how they offer crucial accident forgiveness for teen driver auto insurance in Louisiana.

- Easy Claim Process: Nationwide simplifies claims for teen driver auto insurance in Louisiana, easing the process for teens and their families.

Cons

- Pricing Disparities: Rates for auto insurance for teen drivers in Louisiana can differ wildly from region to region.

- Limited Policy Customization: Less flexibility in customizing policies compared to more affordable options for teen driver auto insurance in Louisiana.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – The General: Best for Bundling Policies

Pros

- Attractive Bundling Discounts: Provides substantial savings when you bundle teen driver auto insurance in Louisiana with other policies.

- Acceptance of High-Risk Drivers: Offers broader accessibility for teen drivers with less-than-perfect driving records, specifically for auto insurance in Louisiana.

- Rapid Policy Approval: Read The General auto insurance review to see how their fast processing benefits new teen drivers in Louisiana needing quick auto insurance coverage.

Cons

- Basic Coverage Options: Although it is cost-effective, it typically offers more basic coverage for Louisiana insurance, which might not fully meet the needs of your teen driver.

- Reputation Variability: Some customers report inconsistency in customer service and claim satisfaction for teen driver auto insurance in Louisiana.

#8 – Progressive: Best for Tailored Policies

Pros

- Custom Policies for Teens: Specializes in developing tailored auto insurance policies for teen drivers in Louisiana, designed to match their unique driving habits.

- Snapshot Program: Read our Progressive Snapshot review to discover how to substantially reduce teen driver auto insurance rates in Louisiana by focusing on real driving habits.

- Wide Coverage Range: Provides a range of teen driver auto insurance in Louisiana, from basic liability to comprehensive plans.

Cons

- Inconsistent Claims Experience: A few customers have mentioned inconsistencies in the way insurance claims for teen driver auto insurance in Louisiana are processed.

- Rate Increases: Teen driver auto insurance in Louisiana can see sudden rate increases at renewal despite initially low rates.

Teen Auto Insurance Rates in Louisiana

Teens are considered high-risk drivers, increasing the cost of Louisiana car insurance. To save, compare rates from cheap auto insurance providers in Louisiana who offer inexpensive minimum and full protection options.

Louisiana Teen Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $190 | $625 |

| $178 | $589 | |

| $185 | $610 | |

| $166 | $550 | |

| $215 | $711 |

| $399 | $1,322 | |

| $225 | $780 | |

| $108 | $359 |

USAA offers the cheapest Louisiana auto insurance rates for teens, with $108 for minimum coverage and $359 for full coverage, making it a top choice for affordable car insurance for young adults. Geico also offers competitive rates at $166 for minimum and $550 for full coverage. At the high end, Progressive prices $399 for minimum and $1,322 for full coverage.

Teen drivers pay more due to inexperience. Discounts and safety courses help lower rates. For example, a defensive driving class can cut costs.Brandon Frady Licensed Insurance Producer

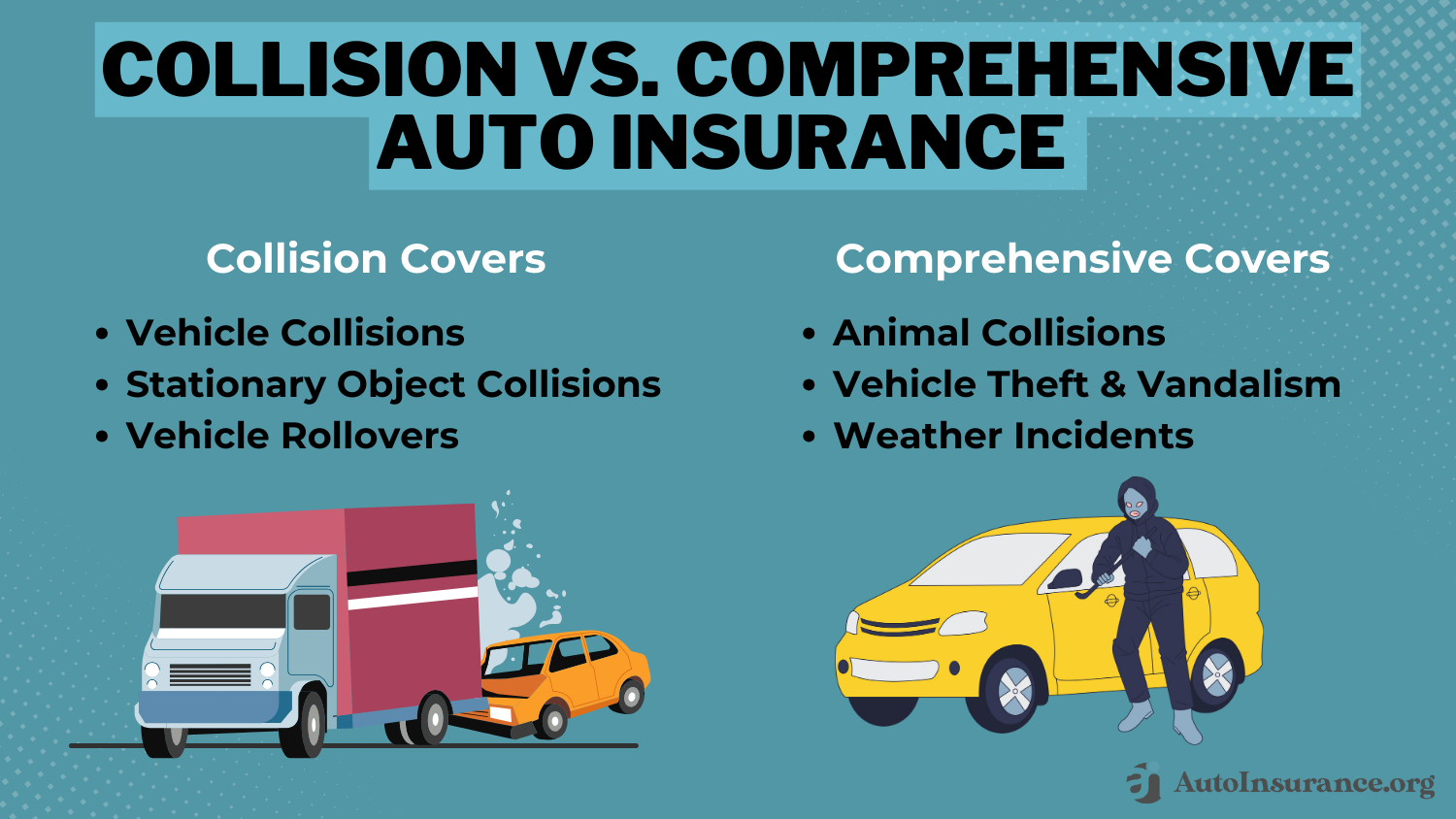

The choice between comprehensive full coverage vs. minimum liability coverage is crucial to protect young drivers. Louisiana minimum auto insurance requirements are very low and do not protect teen drivers or their property. If you want to add full coverage or increase policy limits, it will increase your teen insurance costs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Discounts for Teen Drivers in Louisiana

In Louisiana, you can get cheap car insurance for young drivers by taking advantage of different auto insurance discounts provided by insurers. These discounts are more important to controlling the usually higher premiums associated with insuring younger drivers.

Discounts for teen drivers can reduce costs, with the best Louisiana insurance companies offering savings for good grades, defensive driving courses, or using telematics devices that monitor driving behavior. Scroll through this list of teen auto insurance discounts available from Louisiana insurers:

Auto Insurance Discounts From the Top Providers for Teen Drivers in Louisiana

| Insurance Company | Bundling | Safe Driver | Good Student | Anti-Theft Device | Loyalty |

|---|---|---|---|---|---|

| 15% | 10% | 14% | 8% | 12% |

| 25% | 18% | 22% | 10% | 15% | |

| 25% | 20% | 25% | 25% | 18% | |

| 30% | 15% | 20% | 18% | 13% | |

| 25% | 15% | 15% | 25% | 10% | |

| 20% | 12% | 18% | 5% | 8% |

| 10% | 10% | 10% | 25% | 13% | |

| 18% | 12% | 20% | 15% | 9% | |

| 5% | 8% | 12% | 10% | 7% |

| 10% | 10% | 10% | 15% | 11% |

USAA offers military and mileage discounts on auto insurance for teen drivers, while Geico provides savings for good drivers. Progressive includes Snapshot discounts, and Allstate offers early signing and new car discounts.

These head-to-head comparisons from @usnews are helpful, but we feel like they buried the lead: USAA is No. 1 in car insurance. https://t.co/wEv0rBGSGD pic.twitter.com/u3QSfpPh39

— USAA (@USAA) March 6, 2019

Understanding high-risk auto insurance is also critical to securing cheap teen auto insurance in Louisiana. Consider these strategic points to enhance safety and manage costs:

- Choose the Right Vehicle: Compare auto insurance by vehicle. Vehicles with high safety ratings and those that are less expensive to repair typically carry lower teen insurance premiums.

- Increase Deductibles: Raising your deductible can reduce the average teenage car insurance cost per month but ensure it’s still affordable if an accident happens.

- Pick the Right Coverage: Liability is required in Louisiana, but the best car insurance for drivers under 25 adds collision and comprehensive for better protection.

- Practice Safe Driving: Encourage teens to drive safely as it helps avoid accidents and supports cheap car insurance for new drivers under 21.

- Add a Teen Driver: Adding a teenager to your auto insurance policy will cut premiums in half.

Location within Louisiana also influences teen auto insurance due to varying traffic density, road conditions, and accident rates in different cities.

Rates can vary significantly between companies, so regularly comparing insurance quotes is key to finding cheap first-time insurance from the most affordable providers.

3 Case Studies: Auto Insurance Solutions for Louisiana Teen Drivers

These cases are examples of the approach taken with real families so you can see how auto insurance options might look for your family working with a top three auto insurance provider in Louisiana.

- Case Study #1 – Comprehensive Coverage: Jake, a 17-year-old high school student in Baton Rouge with a mother who is a veteran, just got his driver’s license and was searching for cheap auto insurance for new drivers. They selected USAA’s full auto insurance, applying discounts for Jake’s good grades and for completing a safe-driving course.

- Case Study 2 – Specialized Coverage: Emily is a 16-year-old college freshman who drives from Shreveport every afternoon to get to school. Her parents researched car insurance for 16-year-olds, selecting Geico for its teen discounts and affordable coverage, such as roadside assistance and rental reimbursement.

- Case Study #3 – Organization Discounts: A 19-year-old from New Orleans named Dylan signed up with Allstate because it offered flexible coverage and business discounts. Seeking the cheapest auto insurance for young men, he saved by taking advantage of organizational perks and a clean driving record.

These case studies illustrate Louisiana’s cheap car insurance for teen drivers, showing how tailored coverage and strategic discounts meet the specific needs of young drivers.

Compare auto insurance rates by age to learn more and find cheap car insurance for 16-year-olds, who often face the highest premiums due to limited driving experience.

How to Get Teen Driver Auto Insurance in Louisiana

USAA, Geico, and Allstate offer the cheapest teen driver auto insurance in Louisiana, with USAA providing military family savings, Geico offering DriveEasy usage-based discounts, and Allstate featuring organization-based discounts.

The cheapest options from prominent insurers offer a starting point. However, consider more than price. Specialized coverage, organization discounts, and adaptable policies for young drivers are important to lock in cheap auto insurance for teens in Louisiana.

Compare quotes often and use discounts like good student and safe driving programs to lower teen insurance costs in Louisiana.Tonya Sisler Insurance Content Team Lead

By leveraging good student discounts and multi-policy discounts, families with teens can save money on auto insurance. Start comparing companies with the cheapest teen auto insurance to get the lowest rates.

Finding cheap car insurance in Louisiana is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is the cheapest way to insure my 17-year-old son?

The cheapest way is to add him to your existing policy, take advantage of good student and safe driver discounts, and choose a car with low insurance costs.

How much does auto insurance cost for high school drivers in Louisiana?

Auto insurance for high school drivers in Louisiana typically ranges from $108 to $400 per month, depending on the insurer, coverage type, and driving history.

Take the first step toward cheaper car insurance rates. Enter your ZIP code to see how much you could save.

What is the minimum auto insurance in Louisiana for liability coverage?

The minimum required includes bodily injury liability auto insurance of $15,000 per person and $30,000 per accident, plus $25,000 for property damage.

What is the cheapest type of car to insure for a 19-year-old?

Compact sedans like the Honda Civic or Toyota Corolla are often the cheapest to insure due to low repair costs and strong safety ratings.

At what age is car insurance typically the cheapest?

Car insurance is usually cheapest for drivers aged 25 and older, as they’re seen as lower risk due to more experience and a history of responsible driving.

How much is full coverage in Louisiana with a clean driving record?

Drivers with a clean record may pay lower rates for full coverage auto insurance, averaging $150 to $250 per month depending on the insurer.

Which car models are the cheapest to insure for a 17-year-old driver?

Cars like the Honda Civic, Toyota Corolla, and Ford Focus are among the cheapest to insure due to their safety ratings and lower repair costs.

Why does Louisiana have such high car insurance compared to other states?

Louisiana’s high rates are due to frequent severe weather, high accident rates, and a large number of uninsured drivers.

What is the youngest age to get car insurance with a parent?

Teens as young as 16 can be added to a parent’s policy, which is a smart way to access cheap auto insurance for 16-year-olds.

What age does car insurance go down to Louisiana after a high-risk period?

In Louisiana, insurance costs usually decline after age 25, when drivers are statistically less likely to be involved in accidents.

How much is insurance for a 17-year-old monthly with discounts?

With good student, low-mileage, or safe driving discounts, monthly insurance costs for a 17-year-old can drop to around $100–$200.

Is Louisiana a no-fault insurance state for car accidents?

No, Louisiana is an at-fault state, so the driver responsible for an at-fault accident must pay for the damages.

Is Geico teenage driver insurance cost cheaper when added to a parent’s policy?

Yes, adding a teen to a parent’s existing Geico policy is usually more affordable than purchasing a separate teen policy.

What factors affect the USAA new driver insurance cost?

USAA considers age, driving history, location, and vehicle type when determining new driver insurance costs.

What is the uninsured rate in Louisiana, and how does it affect insurance premiums?

A high uninsured rate in Louisiana leads to increased auto insurance premiums for all drivers due to a greater risk of uninsured accident claims.

Can teen drivers benefit from Compliant Drivers program insurance?

Absolutely. It’s a good tool for lowering high teen insurance rates since teen drivers can earn discounts with responsible driving.

How can I find cheap car insurance in New Orleans, LA, if I’m a high-risk driver?

Look for insurers that specialize in high-risk coverage and compare quotes. Taking a defensive driving course may also help lower your premium.

Why is the Geico new driver insurance cost per month higher than that of experienced drivers?

New drivers are considered high risk due to limited experience, which raises monthly premiums even with the best auto insurance for new drivers.

Does Geico Insurance in High Point, NC, offer local agent support?

Yes, Geico has local agents in High Point, NC, who provide in-person support, policy help, and claims assistance tailored to North Carolina regulations.

How much is Geico insurance for new drivers with a clean record?

New drivers with a clean driving record may pay around $150–$200 per month with Geico, though rates vary by state.

See Louisiana’s cheapest car insurance for teens by entering your ZIP code into our free comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.