Best Pay-As-You-Go Auto Insurance in Illinois (Top 9 Companies Ranked for 2025)

Allstate, Nationwide, and Progressive have the best pay-as-you-go auto insurance in Illinois. Usage-based insurance benefits infrequent drivers in Illinois seeking affordable coverage. Pay-as-you-go insurance rates start at $31/month but increase the more you drive. Allstate won't raise rates for bad driving.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for PAYG in Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for PAYG in Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for PAYG in Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsFinding the best pay-as-you-go auto insurance in Illinois ensures drivers only pay for the miles they drive, making it a cost-effective choice for low-mileage drivers. Top providers like Allstate, Nationwide, and Progressive offer pay-per-mile and usage-based auto insurance designed to adjust rates based on driving patterns.

Allstate Milewise and Nationwide SmartMiles track mileage without monitoring driving habits. Progressive Snapshot offers additional discounts based on driving behavior. Rates start as low as $31 monthly, but costs vary by provider, location, and driving habits.

Illinois drivers can lower costs by bundling policies, maintaining a clean record, and taking advantage of low-mileage discounts. Usage-based auto insurance is ideal for those who drive infrequently and prefer flexible options and rates.

Our Top 9 Company Picks: Best Pay-As-You-Go Auto Insurance in Illinois

Company Rank Usaged-Based Discounts A.M. Best Best For Jump to Pros/Cons

#1 40% A+ Infrequent Drivers Allstate

#2 40% A+ UBI Discount Nationwide

#3 30% A+ Cheap Rates Progressive

#4 30% A Customizable Policies Liberty Mutual

#5 40% A- Mobile App Metromile

#6 30% B Young Drivers State Farm

#7 30% A++ Data Concerns Travelers

#8 30% NR Roadside Assistance Root

#9 30% A Costco Members American Family

Comparing providers ensures you get the best deal for your needs. Enter your ZIP code to compare quotes from top Illinois pay-as-you-drive auto insurance companies.

- Pay-as-you-go auto insurance adjusts rates based on mileage and habits

- At $52 a month, Allstate has some of the best pay-as-you-go rates

- Pay-per-mile is ideal for IL drivers who prefer flexible, usage-based coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Allstate: Top Overall Pick

Pros

- Low-Mileage Discounts: Read our Allstate Milewise review, which highlights substantial savings for Illinois drivers opting for low-mileage or pay-as-you-drive insurance.

- Affordable Rates: Allstate Milewise focuses solely on mileage in Illinois, offering competitive pay-per-mile pay-as-you-go insurance rates.

- Flexible Coverage: Allstate offers various coverage options in Illinois, including unlimited mileage or daily rates tailored for pay-as-you-go insurance needs.

Cons

- Drains Phone Battery: Milewise pay-as-you-go insurance usage often leads to increased phone battery drain during longer drives in Illinois.

- Customer Service: Reports of inconsistent service experiences detract from Allstate’s appeal for pay-as-you-go insurance in Illinois.

#2 – Nationwide: Best Usage-Based Discount

Pros

- Low-Mileage Savings: Read our Nationwide SmartMiles review to learn how infrequent drivers save 40% on their pay-as-you-go auto insurance in Illinois.

- Affordable Rates: SmartMiles offers competitive pay-as-you-go insurance in Illinois by tracking car mileage only.

- Safe-Driving Bonus: Safe driving in Illinois can earn drivers an additional 10% off their pay-as-you-go auto insurance.

Cons

- Poor Customer Service: Nationwide ranks lowest for customer satisfaction among Illinois pay-as-you-go insurance providers.

- Telematics Enrollment: Mandatory telematics sign-up may be inconvenient for some seeking pay-as-you-go insurance in Illinois. For more details, contact the Nationwide Insurance number.

#3 – Progressive: Best for Cheap Rates

Pros

- Telematics Savings: According to our Progressive Snapshot review, the company offers savings through telematics for safe driving specifically for Illinois pay-as-you-go insurance.

- Competitive Rates: Safe drivers in Illinois can get cheap pay-as-you-go insurance rates starting at $39 per month through Snapshot.

- Flexible Coverage: Illinois pay-as-you-go insurance customers have a wide range of coverage options tailored to their diverse needs.

Cons

- Telematics Dependency: Heavy reliance on telematics might deter some Illinois drivers from choosing Progressive for pay-as-you-go insurance.

- Service Variability: Customer service quality varies across Illinois, with some inconsistency reported in handling pay-as-you-go insurance claims and queries.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Customizable Policies

Pros

- Tailored Policies: See our Liberty Mutual RightTrack review offers extensive auto insurance customization options for pay-as-you-go customers in Illinois.

- Big Discounts: Usage-based and safe driving discounts can save Illinois drivers up to 30% on their pay-as-you-go auto insurance.

- Flexible Coverage: Extensive customization options cater specifically to Illinois drivers using pay-as-you-go insurance.

Cons

- Higher Premiums: Pay-as-you-go auto insurance rates in Illinois are notably higher, starting at $56 per month.

- Poor Claims Service: Noted as the least satisfactory among Illinois companies for handling pay-as-you-go insurance claims.

#5 – Metromile: Best Mobile App

Pros

- Innovative Technology: Read our Metromile auto insurance review and find out how user-friendly Metromile app is praised for enhancing the pay-as-you-go auto insurance experience in Illinois.

- Beyond Telematics: Metromile’s pay-as-you-go insurance tracks comprehensive driving data and offers additional features like diagnostics and GPS tracking for Illinois drivers.

- Cheapest Rates: Provides the lowest average rates for pay-as-you-go auto insurance in Illinois, starting at $31 monthly.

Cons

- Mobile Data Requirement: Heavy reliance on the Metromile mobile app in Illinois for managing pay-as-you-go insurance can increase data usage, a concern for some Illinois policyholders.

- Fewer Options: Limited discounts and fewer policy choices compared to larger pay-as-you-go auto insurance companies in Illinois.

#6 – State Farm: Best for Young Drivers

Pros

- Comprehensive Coverage: According to our State Farm Drive Safe and Save review, the company offers a range of pay-as-you-go insurance options specifically for Illinois drivers.

- Young Driver Discounts: Illinois teen drivers benefit from additional discounts for safe driving and enrolling in programs like Steer Clear, enhancing their pay-as-you-go insurance savings with State Farm.

- Extensive Network: A robust agency network provides personalized service for pay-as-you-go insurance customers across Illinois.

Cons

- Financial Downgrade: A recent downgrade by A.M. Best could affect reliability for pay-as-you-go insurance claims in Illinois.

- Telematics Enrollment: Installation and tracking requirements for getting pay-as-you-go insurance discounts may not appeal to all drivers in Illinois.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Drivers With Data Concerns

Pros

- Telematics Discounts: Explore our Travelers IntelliDrive review and find significant auto insurance discounts for safe driving in Illinois through pay-as-you-go insurance.

- 90-Day Tracking: Only requires 90 days of tracking before applying annual discounts to Illinois pay-as-you-go car insurance.

- Competitive Rates: Offers affordable rates without constant monitoring, appealing for Illinois pay-as-you-go insurance at $44 monthly.

Cons

- Rate Increases: IntelliDrive can increase rates for bad driving in Illinois, affecting pay-as-you-go insurance costs.

- Poor Claims Service: Known for below-average auto insurance claims handling in Illinois.

#8 – Root: Best for Roadside Assistance

Pros

- Free Roadside Assistance: Each pay-as-you-go insurance policy in Illinois includes 24-hour roadside help via the Root app. Explore our Root auto insurance review to learn more.

- Safe Driver Discounts: Substantial savings for Illinois drivers who maintain good driving records under pay-as-you-go policies.

- Low Rates: Offers competitive monthly rates of around $41, making pay-as-you-go insurance in Illinois affordable.

Cons

- App Dependency: Some drivers may find it challenging to use the mobile app extensively to manage pay-as-you-go policies.

- Fewer Options: Limited customization for pay-as-you-go auto insurance policies is available in Illinois.

#9 – American Family: Best for Costco Members

Pros

- Member Discounts: Offers special rates for Costco members on pay-as-you-go auto insurance in Illinois.

- Customizable Coverage: Delve into our American Family Insurance KnowYourDrive review to discover a range of customizable coverage options, tailored for drivers seeking pay-as-you-go insurance in Illinois.

- Affordable Rates: Illinois drivers can enjoy competitive pricing, with low-mileage pay-as-you-go insurance rates averaging $46 monthly.

Cons

- Membership Requirement: Costco membership is necessary to get discounts on pay-as-you-go insurance in Illinois.

- Telematics Enrollment: Mandatory telematics installation and tracking for obtaining discounts on pay-as-you-go insurance in Illinois.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pay-As-You-Go Auto Insurance Rates in Illinois

The table outlines monthly rates for Pay-As-You-Go (PAYG) auto insurance in Illinois, categorized by provider and level of coverage. The type and amount of coverage you select affect your rates, so we compare both minimum and full coverage options for the top nine companies, including Allstate, Progressive, and State Farm.

Illinois Pay-As-You-Go Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$52 $147

$46 $144

$56 $159

$31 $118

$48 $143

$39 $136

$41 $134

$37 $128

$44 $142

Rates for minimum coverage start as low as $31 per month with Metromile and go up to $56 with Liberty Mutual, while monthly full coverage rates range from $118 with Metromile to $159 with Liberty Mutual.

PAYG insurance benefits low-mileage drivers with cheap auto insurance for infrequent drivers, and the telematics systems provide more detailed data on driving behavior for more accurate risk assessment and better rates on Illinois auto insurance.

Factors Influencing PAYG Auto Insurance in Illinois

When considering pay-as-you-go auto insurance in Illinois, several factors that affect auto insurance rates, like credit score, age, and gender, won’t impact your rates nearly as much as other companies.

Pay-as-you-go insurance sets rates based on mileage, rewarding low-mileage drivers with big savings.Laura Berry Former Licensed Insurance Producer

The make and model of your vehicle, your place of residence, and your driving record also impact the costs, with safer cars, rural locations, and clean driving records typically resulting in lower rates.

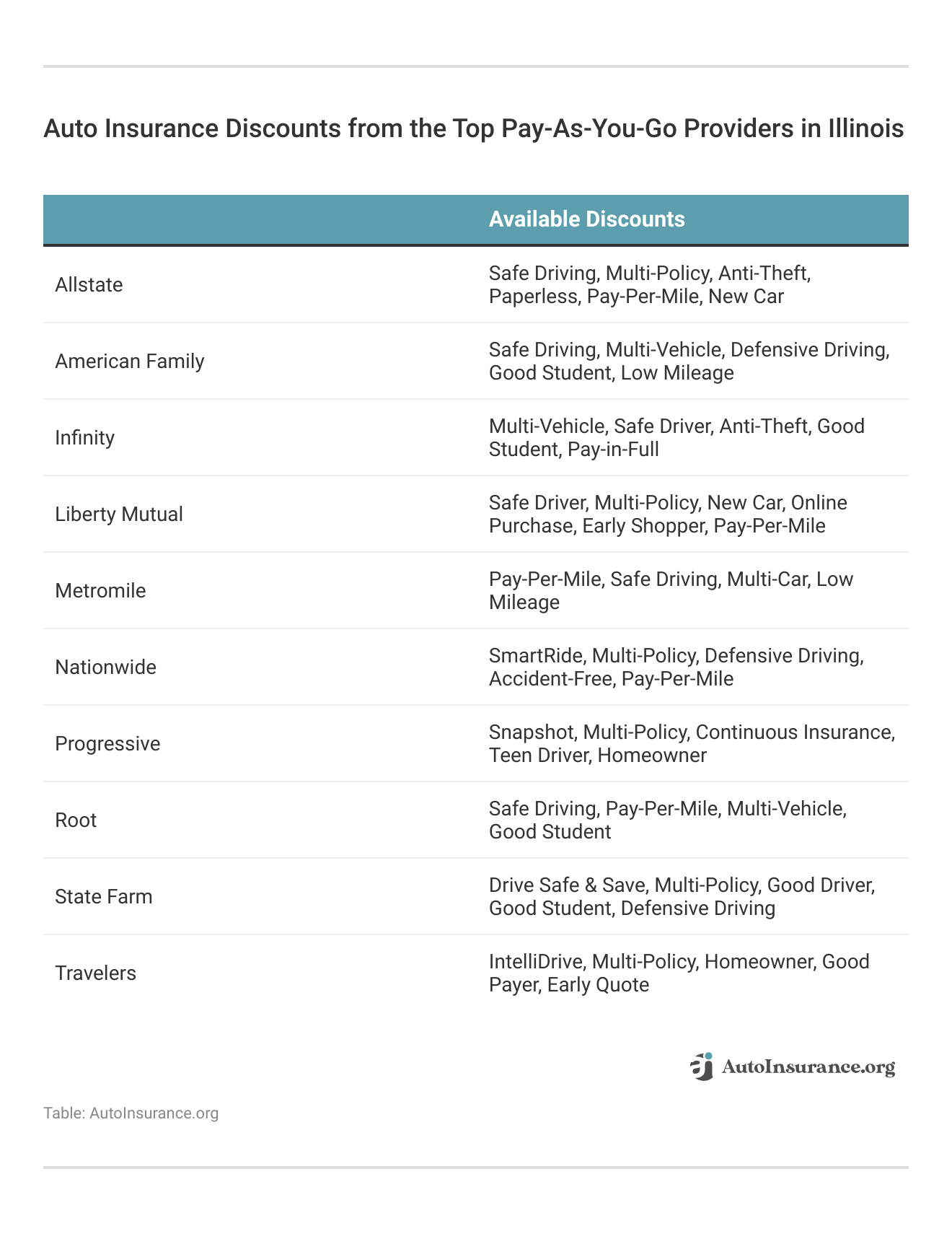

Pay-As-You-Go Auto Insurance Discounts in Illinois

Many providers offer discounts for safe driving, low mileage, and policy bundling, so compare the available discounts from the best pay-as-you-go auto insurance companies in Illinois to maximize your car insurance savings.

Safe driving discounts are also common, where insurers that use telematics to monitor driving behavior, such as speed, braking, and time of day, offer lower rates to those who demonstrate safe driving habits. Learn how to get a low-mileage auto insurance discount.

Not all of the Illinois auto insurance companies on our list track driving habits, so take advantage of automatic payment plans or pay your premium in full to get discounts. Many PAYG insurers also provide discounts for policy bundling, allowing you to save by combining auto insurance with other types of insurance.

To make the most of PAYG auto insurance in Illinois, implement the following smart strategies to save even more money:

- Bundle Policies: Consider bundling your PAYG auto insurance with other policies, like home or renters insurance, to take advantage of multi-policy discounts.

- Avoid Infractions: Auto insurance companies check driving records, so maintain a clean record and avoid claims to get discounts and lower PAYG rates.

- Compare Quotes: Regularly compare quotes from different providers to find the best deal on Illinois insurance.

Stay informed about new discounts or policy changes by communicating with your provider and comparing pay-as-you-go insurance quotes online.

Case Studies: Pay-As-You-Go Auto Insurance in Illinois

These case studies, based on real-world scenarios, illustrate the benefits and different coverage options from the top pay-as-you-go car insurance companies in Illinois:

- Case Study #1 – Flexible Coverage: Sarah, 30, drives infrequently and opted for Allstate Milewise. She leveraged telematics to monitor her mileage and tailored her premiums to her actual usage. Sarah also qualified for multiple discounts, including safe driving and early signing, reducing her monthly premium to $35.

- Case Study #2 – Reliable Service: Tom, 45, commutes occasionally and chose Nationwide SmartMiles to track his mileage accurately. Tom qualified for low-mileage discounts and saved money by bundling his auto insurance with home insurance, reducing his monthly premium to $40.

- Case Study #3 – Affordable Rates: Linda, 27, works from home and rarely drives. She selected Progressive Snapshot for its affordable rates. By maintaining a clean driving record, Linda lowered her premium to $32 per month and received additional savings from automatic payment discounts.

Coverage offerings are diverse, allowing customers to potentially lower their Illinois car insurance rates by qualifying for multiple discounts along with pay-as-you-go savings.

Allstate has an exceptional 95% customer satisfaction rate, making it the best pay-as-you-go auto insurance company in Illinois.Daniel Walker Licensed Auto Insurance Agent

It’s possible to use usage-based technology to maximize savings in Illinois in many different ways, but it’s essential to compare options to find the best coverage for your needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Essential Guide to The Best Pay-As-You-Go Car Insurance in Illinois

Understanding how annual mileage affects your auto insurance rates is crucial. PAYG insurance tailors premiums to actual usage, potentially saving money.

Telematics devices or apps record driving data, including mileage, speed, and driving behavior, which insurers use to calculate premiums. Several auto insurance discounts can further reduce PAYG insurance costs, such as low-mileage discounts, safe driving discounts for good driving behavior, policy bundling discounts, and incentives for maintaining a clean driving record.

The Milewise device tracks mileage, offers driving feedback, and earns Allstate Rewards. It plugs into your car’s diagnostics port, usually under the steering column. ^SE https://t.co/vYIVrwsUyL

— Allstate (@Allstate) December 4, 2020

Some insurers offer early signing discounts, automatic payment discounts, and full payment discounts. When selecting a PAYG insurance plan, it’s crucial to compare pay-as-you-go auto insurance quotes from different providers to find the best rates and inquire about all available discounts.

Get the right car insurance at the best price — enter your ZIP code to shop for coverage from the best Illinois auto insurance companies.

Frequently Asked Questions

What is the best car insurance in Illinois for pay-as-you-go auto insurance?

The best car insurance in Illinois for pay-as-you-go plans includes top providers like Allstate, Nationwide, and Progressive, known for their flexible and affordable coverage options.

What is the average cost of auto insurance in Illinois for pay-as-you-go auto insurance?

How much is auto insurance a month in Illinois? The average cost of pay-as-you-go auto insurance in Illinois typically ranges from $30 to $70 per month, depending on driving habits and mileage.

What are the cheapest full coverage auto insurance options for pay-as-you-go auto insurance in Illinois?

The cheapest pay-per-mile insurance options in Illinois are typically offered by Metromile and Progressive, but Progressive provides more comprehensive auto insurance options.

What is the minimum auto insurance in Illinois for pay-as-you-go auto insurance?

What is the minimum car insurance in Illinois? The minimum auto insurance in Illinois for pay-as-you-go policies includes liability coverage of $25,000 per person, $50,000 per accident for bodily injury, and $20,000 for property damage.

What is the best insurance company for first-time car buyers looking for pay-as-you-go auto insurance in Illinois?

Allstate is the best insurance company for first-time car buyers seeking pay-as-you-go auto insurance in Illinois. With Allstate pay-as-you-go, new drivers can access comprehensive coverage and take advantage of multiple discounts.

What is the cheapest full coverage auto insurance provider for pay-as-you-go auto insurance in Illinois?

What is the cheapest full coverage insurance in Illinois? Progressive is often the cheapest full coverage auto insurance provider for pay-as-you-go plans in Illinois, offering competitive rates and significant savings through telematics.

What is the lowest level of car insurance required for pay-as-you-go auto insurance in Illinois?

The lowest level of car insurance required for pay-as-you-go plans in Illinois is liability coverage, meeting the state’s minimum requirements of $25,000/$50,000/$20,000.

What are the best five car insurance companies in Illinois offering pay-as-you-go auto insurance?

Illinois’s best five car insurance companies offering pay-as-you-go plans are Allstate, Nationwide, Progressive, Liberty Mutual, and Metromile, known for their flexible and affordable options.

What insurance is required of all vehicles in Illinois under pay-as-you-go auto insurance?

What auto insurance is required in Illinois? All vehicles in Illinois under pay-as-you-go insurance plans are required to have liability insurance that meets the state’s minimum auto insurance requirements of $25,000/$50,000/$20,000.

Which brand of car has the cheapest insurance with pay-as-you-go auto insurance in Illinois?

Brands like Honda, Toyota, and Subaru often have the cheapest insurance with pay-as-you-go car insurance in Illinois due to their safety features and lower repair costs.

Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

What is the best auto insurance in Illinois?

Who has the best auto insurance in Illinois? The best auto insurance in Illinois depends on your driving habits and budget. For pay-as-you-go insurance, Allstate Pay-As-You-Go, Nationwide SmartMiles, and Mile Auto are top choices.

What is the best but cheapest car insurance?

The cheapest car insurance varies by driver profile. For affordable pay-as-you-go coverage, Nationwide SmartMiles and Mile Auto offer competitive rates.

Read More: Mile Auto Insurance Review

What is the best pay-per-mile car insurance?

The best pay-per-mile car insurance includes Allstate Pay-As-You-Go, Nationwide SmartMiles, and Mile Auto, which charge a base rate plus a pay-per-mile car insurance fee.

Why is auto insurance so high in Illinois?

Illinois has higher insurance costs due to factors like traffic congestion, accident rates, and insurance fraud. Pay-as-you-go plans can help reduce premiums for low-mileage drivers. Find the best low-mileage auto insurance discounts for more savings opportunities.

Who is cheaper, Geico or Progressive?

Who is cheaper between Geico or Progressive? Geico is generally cheaper for low-risk drivers, while Progressive may offer better rates for high-risk drivers. Getting quotes from both is the best way to compare.

Which type of car insurance is best?

What is the most important type of car insurance you should buy in Illinois? The best type depends on your needs. Pay-as-you-go insurance is great for infrequent drivers, while full coverage is best for those with newer or financed cars.

What is the cheapest reliable car to insure?

Which brand of car has the cheapest insurance? Vehicles like the Honda CR-V, Subaru Outback, and Toyota Corolla are among the cheapest to insure due to their safety ratings and repair costs.

Read More: Which cars have the lowest auto insurance premiums?

What is pay-as-you-go mileage?

Pay-as-you-go mileage insurance charges a low base rate plus a per-mile fee, making it ideal for drivers who don’t drive frequently.

Is Allstate a good insurance company?

Is Allstate a good insurance provider? Yes, Allstate is a reputable insurer offering Allstate Pay-As-You-Go, which provides flexible coverage for low-mileage drivers.

Who pays the most for car insurance?

Pay-as-you-go insurance for young drivers, high-risk drivers, and those with poor credit typically face the highest insurance costs. Living in high-crime or high-traffic areas can also raise rates. For high-risk auto insurance, explore specialized coverage options designed to help drivers secure affordable policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.