Cheap Auto Insurance for High-Risk Drivers in Illinois (Save With These 10 Companies in 2025)

State Farm, Progressive, and Travelers are the top picks for cheap auto insurance for high-risk drivers in Illinois. The cheapest minimum rates for high-risk IL drivers start at $27/mo. The cheapest high-risk Illinois companies also offer discounts for further savings.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for High-Risk in IL

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for High-Risk in IL

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for High-Risk in IL

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsState Farm, Progressive, and Travelers are our top choices for cheap auto insurance for high-risk drivers in Illinois.

High-risk auto insurance policies are expensive, but Illinois drivers will find the best deals at the cheap high-risk Illinois insurance companies listed below.

Our Top 10 Company Picks: Cheap Auto Insurance for High-Risk Drivers in Illinois

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $27 | B | Customer Service | State Farm | |

| #2 | $41 | A+ | Bundling Policies | Progressive | |

| #3 | $49 | A++ | Add-On Coverages | Travelers | |

| #4 | $50 | A++ | Military Members | USAA | |

| #5 | $51 | A++ | Online Convenience | Geico | |

| #6 | $55 | NR | Minimum Coverage | Safe Auto |

| #7 | $60 | A+ | SR-22 Insurance | Dairyland | |

| #8 | $62 | A | Signal App | Farmers | |

| #9 | $68 | A+ | Deductible Options | Nationwide |

| #10 | $79 | A | Costco Members | American Family |

Read on for a full breakdown of each company. Or, if you are ready to shop for Illinois high-risk auto insurance now, enter your ZIP in our free quote comparison tool.

- State Farm has the cheapest auto insurance for high-risk drivers in Illinois

- Progressive is also a top choice for cheap high-risk insurance in Illinois

- Illinois minimum coverage will be the cheapest choice for high-risk drivers

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Customer Service: High-risk Illinois drivers can visit local State Farm agents. Learn more about how State Farm’s customer service works in our State Farm review.

- Coverage Options: State Farm has popular add-ons like roadside assistance for high-risk Illinois customers.

- Discount Options: High-risk drivers in Illinois can apply for popular discounts at State Farm to save.

Cons

- Online Management Limitations: State Farm limits the tasks high-risk drivers in Illinois can do, as local agents handle most tasks.

- Financial Stability: State Farm has a low rating compared to other high-risk Illinois companies on our list.

#2 – Progressive: Best for Bundling Policies

Pros

- Bundling Policies: High-risk Illinois auto insurance can be bundled with other policies at Progressive for a discount.

- Snapshot Program: A program that rewards high-risk Illinois drivers with a discount for demonstrating safe driving habits.

- Coverage Variety: High-risk Illinois policies can be customized with add-ons like new car replacement. Learn more in our Progressive review.

Cons

- Snapshot Rate Changes: High-risk Illinois drivers who drive badly in the program could face a rate increase.

- Customer Service Ratings: Progressive’s customer service ratings aren’t the highest among the cheapest auto insurance companies for high-risk Illinois drivers.

#3 – Travelers: Best for Add-On Coverages

Pros

- Add-On Coverages: Travelers has multiple unique coverages for high-risk Illinois drivers, such as modified car coverage. For more coverage details, read our Travelers review.

- IntelliDrive Program: High-risk Illinois drivers can earn a discount by driving safely in the IntelliDrive program.

- Financial Stability: Travelers is one of the most financially stable companies on our list of auto insurance companies for high-risk Illinois drivers.

Cons

- IntelliDrive Rate Increases: IntelliDrive participation can backfire with rate increases if high-risk Illinois drivers do poorly in the program. Compare rates in our IntelliDrive review.

- Customer Service Ratings: Travelers’s customer service ratings aren’t the highest among the high-risk Illinois auto insurance companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Military Members

Pros

- Military Members: USAA is only sold to high-risk Illinois drivers who are military or veterans (and their families), but USAA offers multiple discounts and perks to its customers.

- Financial Stability: USAA is one of the best financially stable high-risk Illinois companies, with an A++ from A.M. Best.

- Customer Service: USAA is highly rated compared to other high-risk Illinois companies on our list. For more customer service information, read our USAA review.

Cons

- Eligibility Restricted: Illinois high-risk drivers can only buy coverage if they are military or veterans.

- Coverage Options: High-risk drivers in Illinois won’t find as many add-on coverage options available at USAA.

#5 – Geico: Best for Online Convenience

Pros

- Online Convenience: Geico is best for Illinois high-risk drivers who want the freedom to manage their policies and claims online.

- Bundling Discount: Geico high-risk driver auto insurance in IL can be bought with a 25% discount when you bundle it with home or renters insurance. Learn more in our Geico review.

- Adjustable Deductibles: High-risk Illinois drivers can choose a deductible they feel comfortable with on their coverages.

Cons

- No Local Agents: Geico’s services are provided online to high-risk drivers in Illinois.

- Coverage Options: Geico doesn’t have as many add-ons to offer to high-risk Illinois drivers.

#6 – Safe Auto: Best for Minimum Coverage

Pros

- Minimum Coverage: Safe Auto is best for high-risk Illinois drivers who want to carry just minimum coverage.

- SR-22 Filing: Safe Auto is experienced with filing SR-22 forms for high-risk drivers in Illinois. Learn more in our Safe Auto review.

- Multi-Cart Discount: Safe Auto discounts high-risk Illinois auto insurance up to 20% if multiple cars are insured.

Cons

- Limited Coverages: Safe Auto doesn’t have as many add-ons available to high-risk Illinois customers.

- Customer Service: Safe Auto isn’t the highest-rated company for customer service on our list of Illinois high-risk driver companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Dairyland: Best for SR-22 Insurance

Pros

- SR-22 Insurance: Dairyland specializes in SR-22 insurance for high-risk drivers in Illinois. Learn more in our Dairyland review.

- Bundling Discount: High-risk Illinois drivers can also purchase home or renters insurance with their car insurance.

- Non-Owner Insurance: Perfect for high-risk Illinois drivers who borrow cars.

Cons

- Customer Complaints: Other high-risk Illinois companies have better customer satisfaction ratings than Dairyland.

- Coverage Options: Dairyland doesn’t offer as many specialty add-ons as other high-risk Illinois companies.

#8 – Farmers: Best for Signal App

Pros

- Signal App: Farmers’ customers can join Signal to potentially earn a discount on high-risk Illinois auto insurance.

- Bundling Discount: High-risk Illinois drivers can purchase other types of insurance at Farmers. Learn more in our Farmers review.

- Local Agents: Farmers offers local agents in Illinois that can help high-risk drivers with their policies.

Cons

- Customer Satisfaction: Farmers isn’t as highly rated as some of the other high-risk driver Illinois companies on our list.

- Higher Rates: Other high-risk driver Illinois companies on our list are cheaper than Farmers.

#9 – Nationwide: Best for Deductible Options

Pros

- Deductible Options: High-risk drivers in Illinois can choose a deductible from several different options for their coverage.

- Coverage Options: High-risk Illinois policies can have several optional coverages added on. Learn more in our Nationwide review.

- Bundling Discount: High-risk Illinois auto insurance can be bundled with other insurance types.

Cons

- Customer Satisfaction: Nationwide isn’t as highly rated as some of the other high-risk Illinois companies.

- Higher Rates: Other high-risk driver Illinois companies on our list can be cheaper on average than Nationwide.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Costco Members

Pros

- Costco Members: Costco offers discounted rates if high-risk Illinois drivers purchase American Family through Costco.

- Discount Options: Learn what discounts high-risk Illinois drivers can apply for in our American Family review.

- Coverage Options: High-risk drivers in Illinois will have plenty of choices for their policies.

Cons

- Claims Handling: Illinois high-risk driver claims may be handled poorly based on customer reviews.

- Higher Rates: American Family’s high-risk driver rates in Illinois are higher than other companies on our list.

High-Risk Illinois Driver Auto Insurance Rates by Coverage Type

The table below will give you an idea of the average cost difference between minimum and full coverage at the cheapest high-risk auto insurance companies in Illinois.

Illinois High-Risk Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| American Family | $79 | $207 |

| Dairyland | $60 | $180 |

| Farmers | $62 | $163 |

| Geico | $51 | $134 |

| Nationwide | $68 | $178 |

| Progressive | $41 | $108 |

| Safe Auto | $55 | $170 |

| State Farm | $27 | $70 |

| Travelers | $49 | $128 |

| USAA | $50 | $130 |

Average rates for high-risk drivers in Illinois will be higher than rates for good drivers. There are multiple reasons drivers might be labeled as high-risk in Illinois, from DUIs to multiple tickets.

High-risk Illinois drivers should compare quotes from at least three companies to find the cheapest premium for their vehicles.Dani Best Licensed Insurance Producer

The state of Illinois requires high-risk Illinois drivers to carry minimum coverage to drive in the state. Full coverage is optional for most high-risk Illinois drivers, although lenders require drivers to carry full coverage on a leased car.

The good news is that high-risk drivers can still keep rates affordable by shopping at the cheapest Illinois companies. Read on to learn more saving tips.

How to Save on High-Risk Illinois Driver Auto Insurance Rates

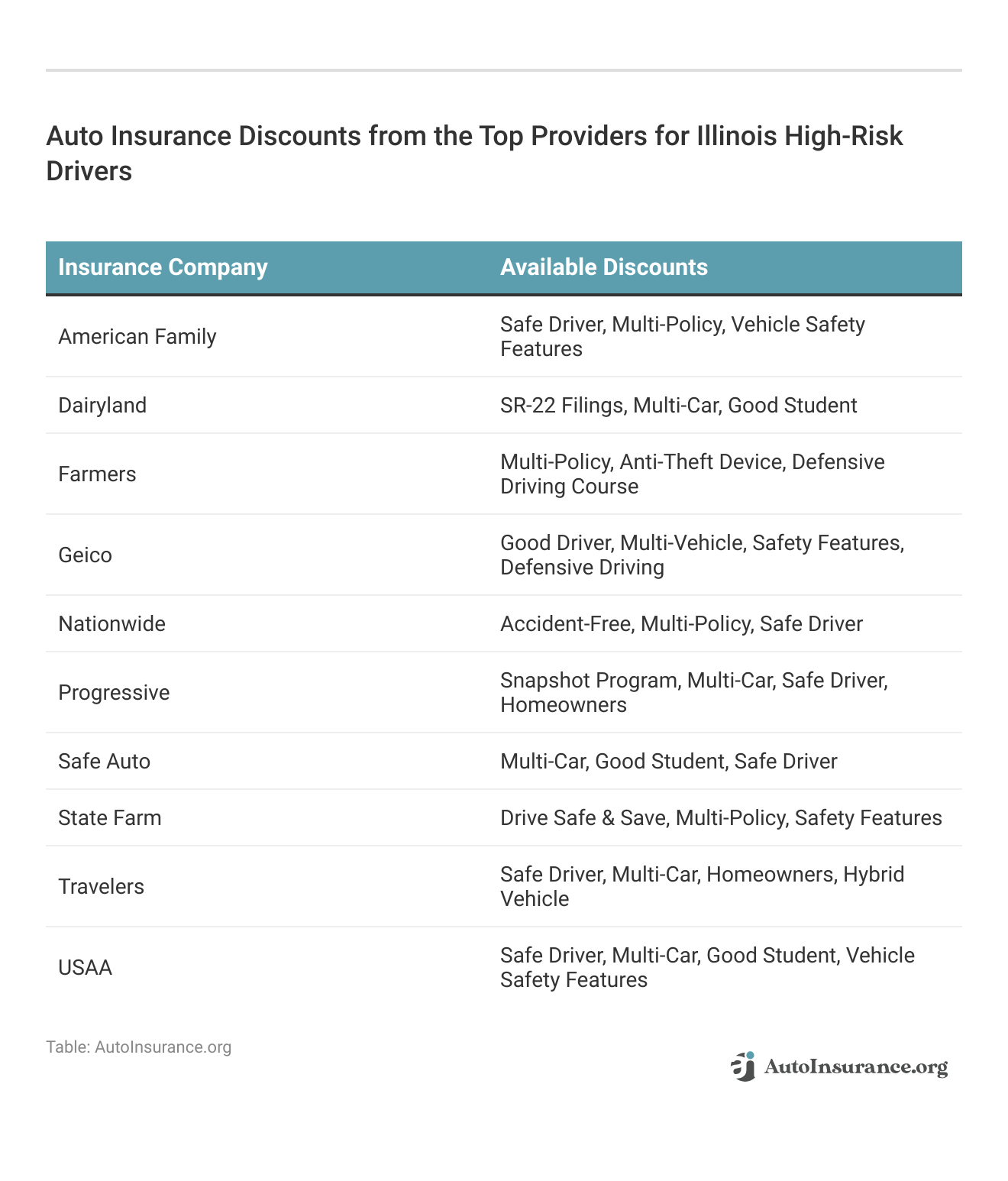

High-risk drivers in Illinois who shop at the cheapest companies will have the opportunity to apply auto insurance discounts to their policies to lower rates. Some popular discounts at the cheapest high-risk companies are listed below.

Multi-car and multi-policy discounts are an easy way for high-risk drivers to save on their Illinois auto insurance policies. Learn how to get a multi-vehicle auto insurance discount.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Finding the Best High-Risk Illinois Driver Auto Insurance Rates for You

State Farm, Progressive, and Travelers are the top companies for cheap auto insurance for high-risk drivers in Illinois. High-risk drivers can also save even more at these companies by applying for auto insurance discounts.

While high-risk drivers will have increased rates for a few years, driving safely and keeping their record clean will lower rates over time. If you are ready to shop for affordable auto insurance for high-risk drivers in Illinois today, enter your ZIP code in our free quote tool.

Frequently Asked Questions

Who has the cheapest auto insurance in Illinois for high-risk drivers?

State Farm has the cheapest car insurance for high-risk drivers in Illinois.

Do high-risk drivers pay lower insurance premiums in Illinois?

No, high-risk drivers in Illinois will pay higher insurance premiums than lower-risk drivers.

What is SR-22 insurance in Illinois?

SR-22 auto insurance is required insurance for certain high-risk drivers. It requires an SR-22 form to be filed by the insurance company that proves to the state that the high-risk driver is carrying auto insurance.

Do I need an SR-22 to reinstate my license in Illinois?

Yes, drivers who had their license revoked will usually need SR-22 insurance to get their license reinstated.

Do you need SR-22 for DUI in Illinois?

DUI drivers in Illinois will usually be required to carry SR-22 insurance, especially if it’s not their first DUI.

Who do auto insurance companies see as the highest risk?

Drivers with DUIs, multiple at-fault accidents, and multiple traffic violations will be labeled as the highest-risk drivers to insure. Teenage drivers are also considered high-risk to insure because of driving inexperience (Read More: Reasons Auto Insurance Costs More for Young Drivers).

Is USAA good for high-risk drivers?

Yes, USAA is great for high-risk drivers in Illinois due to its affordable rates and great customer service. However, USAA only sells insurance to military, veterans, and their families.

What is the cheapest auto insurance in Illinois?

Minimum coverage will be the cheapest car insurance in Illinois for high-risk drivers. To shop for cheap Illinois insurance today, compare rates with our free quote tool.

How many accidents are considered high-risk?

Generally, more than one at-fault accident in Illinois will put drivers in the high-risk category.

What types of things can reduce a driver’s insurance premium in Illinois?

Drivers can reduce their Illinois auto insurance rates by applying for discounts and shopping for quotes annually.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Former State Farm Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.