Cheap Auto Insurance for High-Risk Drivers in Maryland (10 Most Affordable Companies for 2025)

State Farm, Nationwide, and USAA are the top picks for cheap auto insurance for high-risk drivers in Maryland, offering the most affordable rates starting at just $62 monthly. These cheap Maryland insurance companies provide the best value and coverage options specifically designed for high-risk drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for High-Risk Drivers in Maryland

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage for High-Risk Drivers in Maryland

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for High-Risk Drivers in Maryland

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews

The top picks for cheap auto insurance for high-risk drivers in Maryland are State Farm, Nationwide, and USAA. State Farm is the cheapest at $62/month for minimum coverage.

State Farm and USAA excel in customer service and claim satisfaction, while Nationwide helps high-risk drivers save with bundling discounts. Geico is the cheapest high-risk auto insurance for teenage drivers in Maryland.

Geico is the cheapest high-risk auto insurance for teenage drivers in Maryland.

Our Top 10 Company Picks: Cheap Auto Insurance for High-Risk Drivers in Maryland

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $62 | B | Customer Service | State Farm | |

| #2 | $64 | A+ | Comprehensive Coverage | Nationwide |

| #3 | $75 | A++ | Military Drivers | USAA | |

| #4 | $87 | A+ | Innovative Options | Progressive | |

| #5 | $102 | A | Customer Satisfaction | American Family | |

| #6 | $104 | A | Personalized Service | Farmers | |

| #7 | $107 | A+ | Infrequent Drivers | Allstate | |

| #8 | $114 | A++ | Coverage Options | Travelers | |

| #9 | $147 | A++ | Young Drivers | Geico | |

| #10 | $174 | A | Flexible Policies | Liberty Mutual |

Start saving on Maryland high-risk auto insurance by entering your ZIP code above and comparing quotes from multiple local companies.

- State Farm is the cheapest MD high-risk auto insurance company at $62/month

- Nationwide high-risk insurance costs $64/month

- USAA is the cheapest high-risk insurance for military drivers at $75/month

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: With a starting rate of $62, State Farm offers one of the most competitive prices for high-risk drivers in Maryland. Compare quotes in our State Farm auto insurance review.

- Tailored Options: State Farm offers diverse coverage options specifically suited for high-risk drivers in Maryland.

- Customer Support: State Farm is top three for high-risk auto insurance customer satisfaction in Maryland and other states in the region.

Cons

- Limited Discounts: State Farm auto insurance discounts for high-risk drivers in Maryland are not as extensive compared to other market players.

- Financial Downgrade: State Farm isn’t as financially stable as other Maryland high-risk insurance companies.

#2 – Nationwide: Cheapest Comprehensive Coverage

Pros

- Broad Coverage: Nationwide offers extensive coverage options, particularly beneficial for high-risk drivers in Maryland looking for thorough protection.

- Stable Financial Backing: With an A+ A.M. Best rating, Nationwide provides high-risk drivers in Maryland with reliable and financially secure insurance options. Get full ratings in our Nationwide review.

- Discounted Multi-Policy Options: Bundle home and auto coverage to save 20% on Maryland high-risk insurance costs.

Cons

- Complex Policy Terms: Some high-risk drivers in Maryland may find Nationwide’s policy terms to be more complex compared to others.

- Variable Customer Service: Nationwide customer satisfaction is average but ranks lower than other high-risk auto insurance companies in MD.

#3 – USAA: Cheapest for Military

Pros

- Military-Tailored Services: USAA specializes in serving military members and their families, offering tailored services for high-risk drivers in Maryland with military backgrounds.

- Top-Notch Ratings: With an A++ rating from A.M. Best, USAA ensures high reliability for high-risk drivers in Maryland seeking quality coverage.

- Competitive Discounts: High-risk drivers in Maryland with military connections enjoy competitive discounts and benefits with USAA. Get a list of discounts in our USAA insurance review.

Cons

- Limited Eligibility: USAA’s services are only available to military members, veterans, and their families, restricting access for a broader range of high-risk drivers in Maryland.

- Lacking Coverage: Maryland high-risk drivers may not have as many policy options when compared to other insurers in the state.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Cheapest Innovative Options

Pros

- Customizable Plans: Progressive offers highly customizable insurance plans to fit the budget of high-risk drivers in Maryland.

- Extensive Tools: Progressive equips high-risk drivers in Maryland with advanced online tools and mobile apps to manage their policies effectively. Read up on our Progressive auto insurance review for more.

- Competitive Rates: Progressive high-risk insurance costs around $87/month in Maryland, which is cheaper than most competitors.

Cons

- High-Risk Limitations: High-Risk drivers in Maryland may not be able to access all of Progressive’s discounts or innovative savings due to their records.

- Variable Customer Service: While generally robust, the customer service experience can vary for high-risk drivers in Maryland, depending on the region and agent.

#5 – American Family: Best Customer Satisfaction

Pros

- Focused Customer Care: American Family prioritizes customer satisfaction, offering dedicated support and services tailored for high-risk drivers in Maryland.

- Enhanced Discounts: High-risk drivers in Maryland benefit from American Family’s various discounts, including safe driver rewards and loyalty benefits.

- Solid Financial Standing: With an A rating from A.M. Best, high-risk drivers in Maryland can trust American Family’s financial reliability. Get all the ratings in our AmFam auto insurance review.

Cons

- Limited Availability: American Family’s services and coverage options for high-risk drivers in Maryland may not be as widely available compared to larger insurers.

- Premium Costs: High-risk auto insurance in Maryland will be more expensive if drivers don’t qualify for all discounts.

#6 – Farmers: Best Personalized Service

Pros

- Personalized Policies: Farmers excels in offering personalized service and tailored policy options for high-risk drivers in Maryland. Discover more in our Farmers insurance review.

- Diverse Discount Programs: Farmers offers a variety of discount programs that high-risk drivers in Maryland can utilize to reduce their insurance costs.

- Strong Agent Network: Farmers maintains a robust network of agents dedicated to providing detailed guidance to high-risk drivers in Maryland.

Cons

- Higher Premiums for Customization: The cost of highly personalized policies at Farmers can be higher for high-risk drivers in Maryland, reflecting the level of customization.

- Inconsistent Experiences: Depending on the agent, high-risk drivers in Maryland may experience varying levels of service quality from Farmers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Allstate: Cheapest for Infrequent Drivers

Pros

- Infrequent Driver Savings: High-risk drivers in Maryland who drive too much for other low-mileage programs can still get discounts with Allstate Milewise.

- Wide Range of Coverages: Allstate provides a broad spectrum of coverage options, catering to the diverse needs of MD high-risk drivere. Explore options in our review of Allstate.

- Helpful Risk Management Tools: Allstate offers tools and resources that help high-risk drivers in Maryland manage their risks and improve driving habits.

Cons

- Premium Pricing: Despite its comprehensive offerings, Allstate insurance rates for high-risk drivers in Maryland can be on the higher side compared to competitors.

- Varied Customer Satisfaction: Customer satisfaction can vary significantly with Allstate, with some high-risk drivers in Maryland experiencing less than satisfactory service.

#8 – Travelers: Best Variety of Coverage Options

Pros

- Extensive Coverage Options: Travelers offers a plethora of coverage choices, making it a prime choice for MD high-risk drivers who need more coverage.

- Innovative Insurance Solutions: Travelers is known for its innovative approach to insurance, providing unique solutions that cater to the needs of high-risk drivers in Maryland.

- Strong Industry Reputation: With an A++ rating from A.M. Best, Travelers is recognized for its reliability and excellent service in the insurance industry. Learn more in our Travelers review.

Cons

- Higher Cost: Travelers tends to have higher premium rates, which might be a concern for high-risk drivers in Maryland seeking affordable options.

- Complex Policy Offerings: The wide array of options at Travelers can sometimes be overwhelming for high-risk drivers in Maryland, making it challenging to choose the right coverage.

#9 – Geico: Cheapest for Young Drivers

Pros

- Cheap Teen Rates: Maryland auto insurance for teen drivers is considered high-risk, but Geico rates start at $147/month for high-risk drivers under 21.

- Fast Mobile Claims: Geico is renowned for its efficient and quick claims process, providing prompt support to high-risk drivers in Maryland during stressful times.

- Extensive Discounts Available: Young high-risk drivers in Maryland can take advantage of the best Geico insurance discounts, including student and occupational discounts.

Cons

- Customer Service Variability: While generally positive, the customer service experience at Geico can vary, potentially affecting high-risk drivers in Maryland.

- Generic Coverage Options: Some high-risk drivers in Maryland may find Geico’s coverage options somewhat generic and not as tailored as those offered by niche insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Cheap Flexible Policies

Pros

- Flexibility in Coverage: Liberty Mutual stands out for its flexibility in policy options for high-risk drivers in Maryland. Learn more in our Liberty Mutual auto insurance review.

- Customizable Discounts: Liberty Mutual offers a variety of customizable discount options that high-risk drivers in Maryland can use to tailor their rates to their specific circumstances.

- Strong Support Network: With a comprehensive support network, Liberty Mutual ensures that high-risk drivers in Maryland receive timely and effective assistance.

Cons

- Higher Premiums for Custom Policies: Customized policies at Liberty Mutual can come at a higher cost, which might not be the most economical option for some high-risk drivers in Maryland.

- Complex Navigation of Choices: The broad array of choices and customization options at Liberty Mutual can be overwhelming for high-risk drivers in Maryland, making policy selection complex.

Maryland High-Risk Driver Insurance Rates Comparison

This table presents a detailed comparison of monthly auto insurance rates for high-risk drivers in Maryland, broken down by coverage level and provider.

Maryland High-Risk Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $107 $201

American Family $102 $193

Farmers $104 $195

Geico $147 $276

Liberty Mutual $174 $327

Nationwide $64 $120

Progressive $87 $165

State Farm $62 $118

Travelers $114 $214

USAA $75 $142

For high-risk drivers in Maryland, the monthly rates vary significantly between providers and coverage levels. For instance, State Farm offers the most competitive rates for both minimum and full coverage at $62 and $118 respectively.

On the other end, Liberty Mutual presents the highest rates, with minimum coverage starting at $174 and full coverage escalating to $327. Notably, Nationwide also stands out with a notably affordable full coverage option at $120, only slightly more than its minimum coverage cost of $64.

Check out our ranking of the top providers: Best Companies for Bundling Home and Auto Insurance

Factors Influencing Maryland High-Risk Auto Insurance Costs

Auto insurance premiums for high-risk drivers in Maryland are influenced by a variety of factors that can significantly affect the cost of policies.

The presence of accidents, speeding tickets, and DUI/DWI charges on a driver’s record categorizes them as high-risk, which typically leads to higher insurance premiums. Understanding these other factors can help drivers make more informed decisions about their auto insurance choices:

- Type of Coverage: Choosing between minimum coverage and full coverage impacts costs, with full coverage being considerably more expensive but offering more protection.

- Age and Experience: Younger, less experienced drivers often face higher rates due to their perceived risk, whereas older, more experienced drivers may benefit from lower premiums.

- Vehicle Type: Vehicle year affects insurance rates, and high-risk drivers with high-performance or luxury vehicles can expect higher insurance rates due to the higher cost of repairs and replacement.

- Location: Living in areas with high traffic congestion, theft rates, or accident prevalence can increase insurance costs for high-risk drivers.

- Credit Score: In Maryland, as in many states, a lower credit score can lead to higher auto insurance rates because it is associated with a higher risk of filing claims.

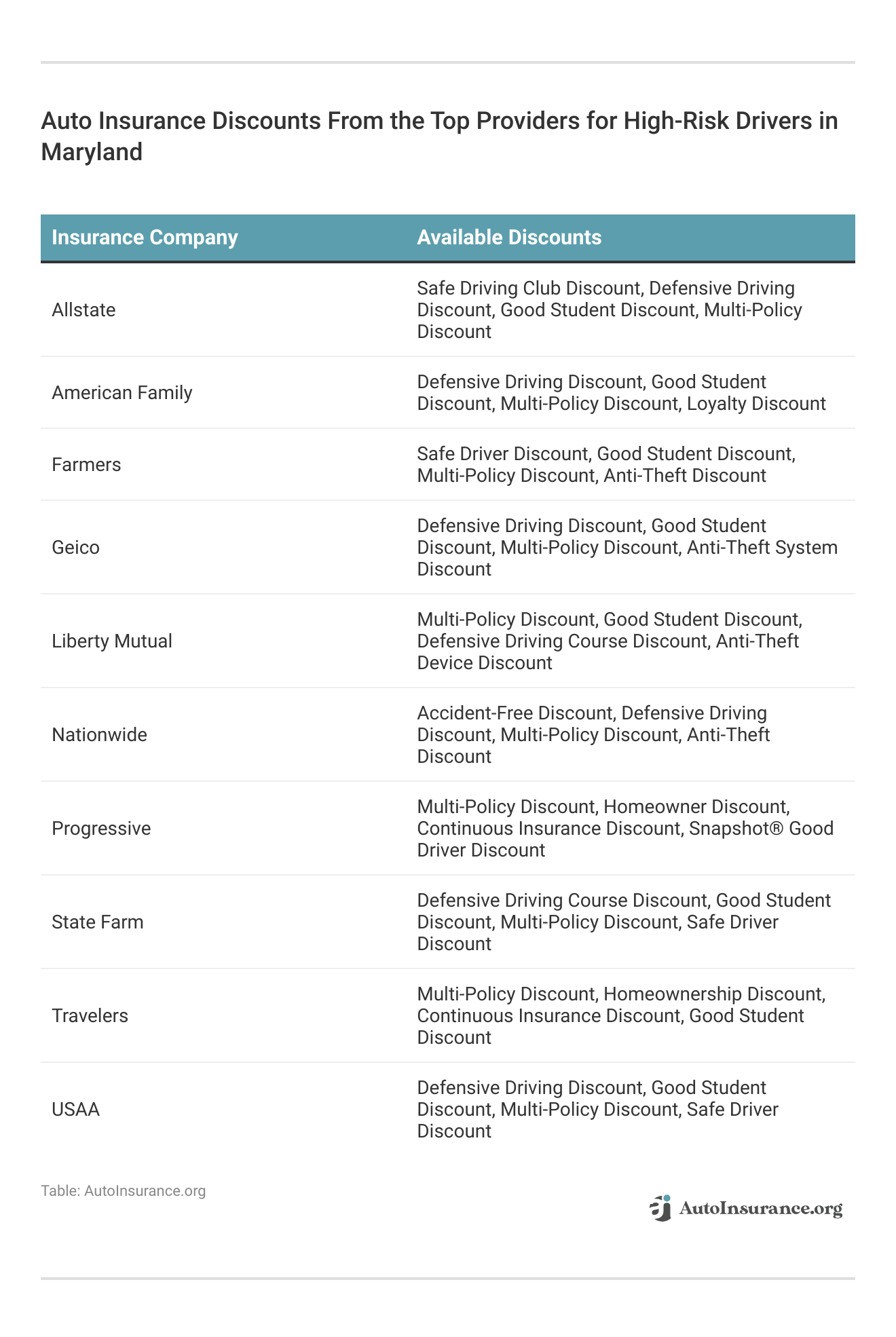

Each of these factors plays a crucial role in determining the insurance rates for high-risk drivers in Maryland. However, several strategies can help you save money on car insurance. For instance, high-risk drivers can lower their auto insurance costs by taking advantage of defensive driving courses, which often lead to discounts from insurers

Maintaining a clean driving record over time will also gradually decrease premiums. Opting for higher deductibles can significantly reduce monthly costs, though it increases out-of-pocket expenses in the event of a claim.

Case Studies: Insurance Solutions for High-Risk Drivers in Maryland

Choosing the right car insurance is crucial, especially for high-risk drivers who require reliable and affordable coverage. The following case studies illustrate how State Farm, Nationwide, and USAA effectively meet the unique needs of Maryland high-risk drivers.

- Case Study #1 – State Farm’s Affordable Solution: John, a high-risk driver due to past speeding tickets, found State Farm’s rates exceptionally affordable. When he faced another minor traffic incident, State Farm ensured quick claim processing and minimal Maryland auto insurance rate increases.

- Case Study #2 – Nationwide’s Comprehensive Coverage: Sarah, classified as a high-risk driver after a few accidents, chose Nationwide for its extensive coverage options. Nationwide’s policy covered all her liabilities and repairs without a hassle, providing peace of mind despite her driving history.

- Case Study #3 – USAA’s Military Precision: As a military member with a high-risk driving profile, Mark benefited from USAA’s tailored services. USAA offered him specialized rates and coverages that considered both his military service and driving record.

These scenarios are based on real-world possibilities, highlighting the importance of choosing an insurance provider that caters specifically to high-risk drivers in Maryland.

State Farm excels in customer service and competitive pricing, making it a top choice for value and reliability. Nationwide offers robust coverage for high-risk drivers, supported by strong financial stability. USAA, serving military members and families, delivers tailored solutions with benefits addressing high-risk driving challenges.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Auto Insurance for High-Risk Drivers in Maryland

The best cheap auto insurance for high-risk drivers in Maryland includes State Farm, Nationwide, and USAA, each known for competitive rates for drivers with accidents and speeding tickets.

Choosing State Farm means opting for reliability and financial stability, crucial for high-risk drivers in Maryland.Michelle Robbins Licensed Insurance Agent

Regularly comparing auto insurance quotes from these providers and more ensures that Maryland high-risk drivers always get the best possible rates. Leveraging any available discounts for things like low annual mileage, having multiple policies, or installing anti-theft devices, can further reduce insurance costs.

Score a powerful bundle with the State Farm Personal Price Plan®. 💪 pic.twitter.com/Pwk4vxBTbp

— State Farm (@StateFarm) August 24, 2024

Together, these companies represent the best blend of affordability, coverage options, and customer service for high-risk drivers in the state, ensuring they receive the protection they need without compromising on quality or cost. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

Who has the lowest auto insurance rates for high-risk drivers in Maryland?

State Farm is one of the cheapest auto insurance companies for high-risk drivers in Maryland at $62/month.

What does high risk mean in Maryland insurance?

Maryland car insurance companies will consider you high-risk if you have accidents on your record, multiple speeding tickets, or DUIs. Teens and young drivers under 25 may also be considered high-risk with certain companies.

What is the recommended auto insurance coverage for high-risk drivers in Maryland?

It is recommended that high-risk drivers in Maryland opt for full-coverage auto insurance to ensure adequate protection against various road incidents.

What Maryland auto insurance company is the cheapest for full coverage for high-risk drivers?

State Farm typically offers the most affordable full-coverage auto insurance for high-risk drivers in Maryland.

What is the most popular type of insurance for high-risk drivers in Maryland?

Full coverage auto insurance is the most popular type of insurance among high-risk drivers in Maryland due to its extensive protection.

What percentage of Maryland drivers are uninsured?

Approximately 12% of drivers in Maryland are uninsured, which poses additional risks for high-risk drivers in collisions.

Does Maryland require uninsured motorist coverage for high-risk drivers?

Yes, Maryland requires uninsured motorist coverage to protect high-risk drivers against losses from accidents with uninsured or underinsured drivers.

What is the minimum amount of car insurance required to drive in Maryland for high-risk drivers?

High-risk drivers in Maryland must have at least liability coverage, which includes $30,000 for bodily injury per person, $60,000 per accident, and $15,000 for property damage.

What happens if you drive without insurance in Maryland as a high-risk driver?

Driving without insurance in Maryland can result in severe penalties, including fines, license suspension, and vehicle registration suspension, especially critical for high-risk drivers. Learn how to report a driver without insurance.

Is Maryland a fault state for auto insurance?

Yes, Maryland is an at-fault insurance state, and drivers can sue one another and their insurance companies after an accident or collision.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.