Cheap Gap Insurance in Mississippi (See the Top 10 Companies for 2025)

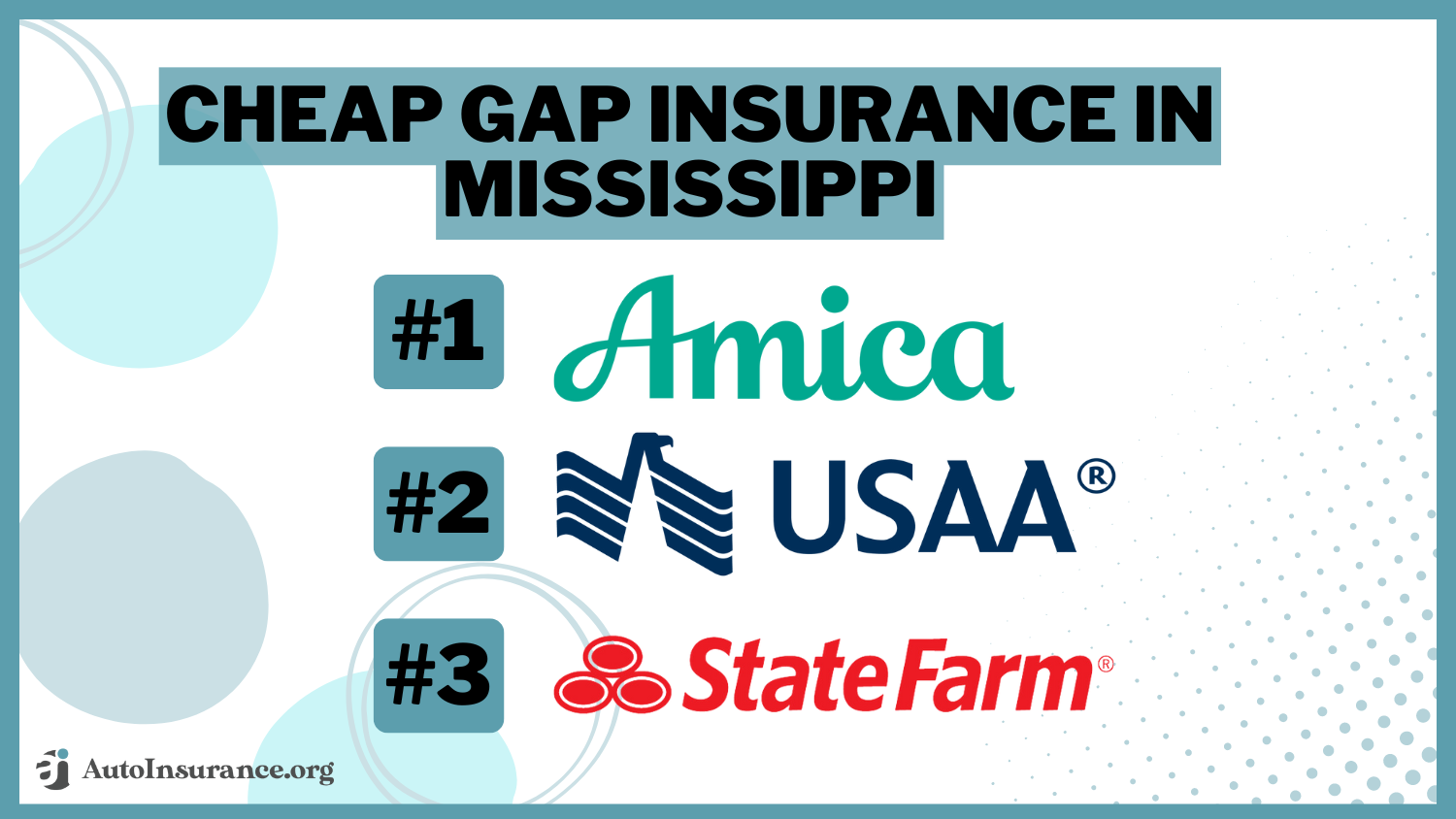

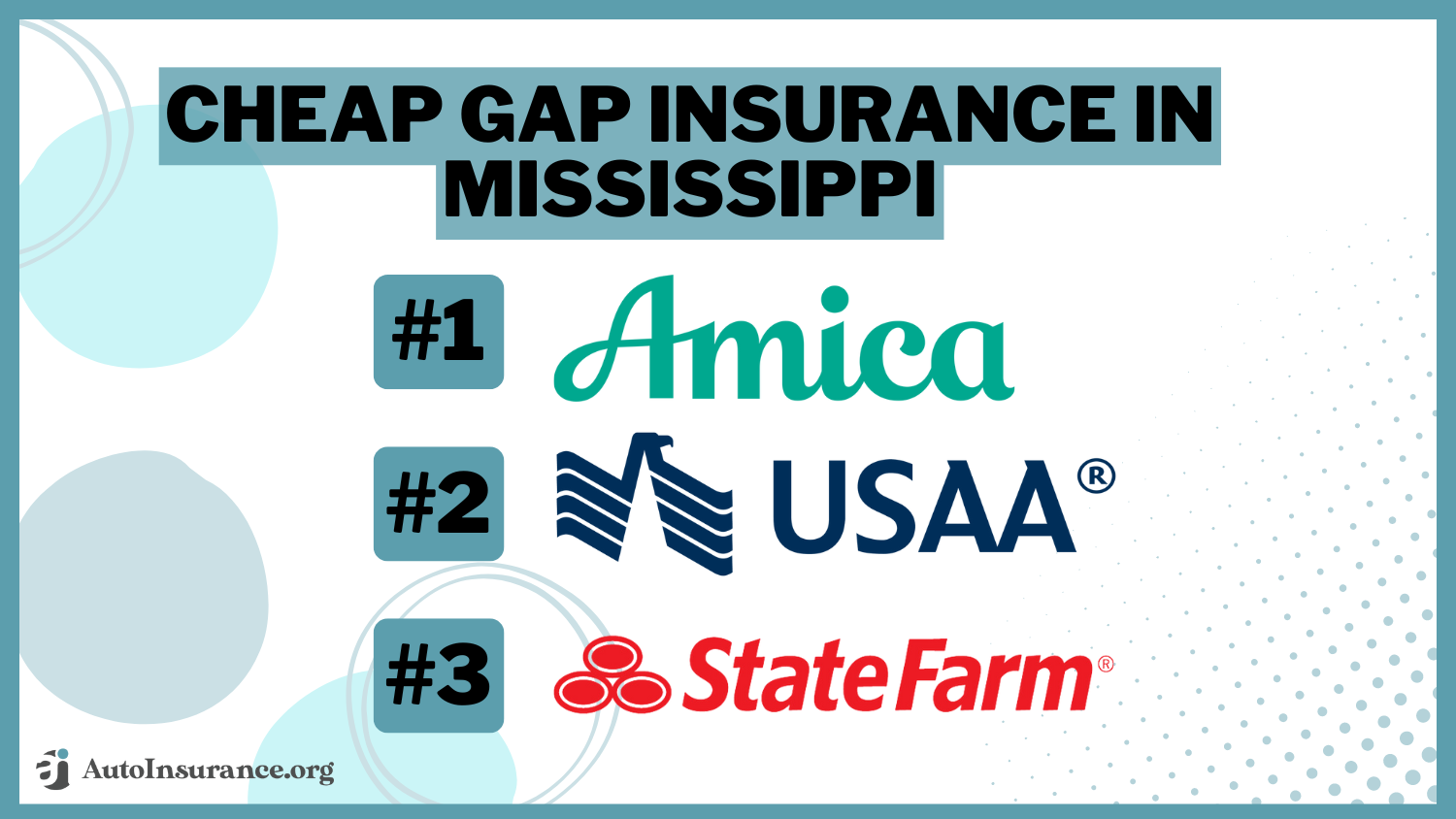

Amica, USAA, and State Farm offer the best cheap gap insurance in Mississippi, with rates starting at $22/month. Amica has the cheapest gap insurance rates with big discounts for safe drivers. USAA is the best Mississippi gap insurance company for military families, while State Farm has the best claims service.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

UPDATED: Oct 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

768 reviews

768 reviewsCompany Facts

Gap Insurance in Mississippi

A.M. Best Rating

Complaint Level

Pros & Cons

768 reviews

768 reviews 6,589 reviews

6,589 reviewsCompany Facts

Gap Insurance in Mississippi

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,154 reviews

18,154 reviewsCompany Facts

Gap Insurance in Mississippi

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews

The top providers of cheap gap insurance in Mississippi, including Amica USAA, and State Farm, offer the best balance of affordability and protection for new or leased vehicles.

With consistently competitive rates, extensive coverage options, and strong customer service, these companies provide excellent auto insurance for different types of drivers.

With consistently competitive rates, extensive coverage options, and strong customer service, these companies provide excellent auto insurance for different types of drivers.

Our Top 10 Company Picks: Cheap Gap Insurance in Mississippi

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $22 A++ Cheap Rates Amica

#2 $30 A++ Military Benefits USAA

#3 $33 B Diverse Policies State Farm

#4 $37 A++ Industry Experience Travelers

#5 $39 A+ Loyalty Discounts Progressive

#6 $44 A Costco Members American Family

#7 $45 A+ Multi-Vehicle Savings Nationwide

#8 $53 A Group Discounts Farmers

#9 $61 A+ Usage-Based Discount Allstate

#10 $68 A 24/7 Support Liberty Mutual

By thoroughly comparing gap insurance plans in Mississippi and evaluating all available discounts, you can ensure you secure the most cost-effective and well-rounded coverage for your vehicle.

Stop overpaying for Mississippi auto insurance. Enter your ZIP code above to find out if you can get a better deal.

- Amica offers the best cheap gap insurance in Mississippi at $22 monthly

- USAA gap insurance is the cheapest for Mississippi drivers in the military

- Gap coverage on minimum insurance policies will have the cheapest rates

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Amica: Top Overall Pick

Pros

- Cheap Mississippi Gap Insurance: Amica has the cheapest gap insurance in Mississippi with minimum coverage starting at $22/month and full coverage costing $80/month.

- Safe Driver Discounts: Safe drivers in Mississippi save 25% on gap insurance with Amica. Explore more discounts in our Amica insurance review.

- Dividend Payments: Unlike other Mississippi insurance companies, Amica pays gap insurance policyholders annual dividends if premium payments are higher than the company’s claims payouts.

Cons

- Limited Availability: Amica is not available nationwide, which can make it difficult to find cheap gap insurance if you move out of Mississippi.

- Limited Online Tools: As a smaller, regional company, Amica doesn’t offer as many convenient mobile tools as other Mississippi gap insurance providers.

#2 – USAA: Cheapest With Military Benefits

Pros

- Specialized Military Benefits: USAA offers gap insurance in Mississippi with exclusive advantages tailored for military families.

- Attractive Pricing: Competitive USSA rates for gap insurance in Mississippi make it a cost-effective choice for eligible members. Find out more in our USAA auto insurance review.

- Superior Service: Known for exceptional customer service, USAA provides top-notch support for gap insurance in Mississippi.

Cons

- Eligibility Restrictions: USAA gap insurance in Mississippi is available only to military members and their families, limiting broader access.

- Limited Local Presence: Fewer local agents are available for personalized Mississippi gap insurance service.

#3 – State Farm: Cheapest Diverse Policy Options

Pros

- Diverse Policy Options: State Farm offers a variety of Mississippi auto insurance plans, including gap coverage, to suit different drivers’ needs.

- Personalized Assistance: Local State Farm agents provide tailored support and advice for gap insurance in Mississippi. Read our State Farm review for more.

- Exceptional Claims Service: State Farm consistently ranks among the top five companies for gap insurance claims service in Mississippi.

Cons

- Lower Financial Ratings: State Farm gap insurance in Mississippi may be less reliable than other companies with stronger financial scores.

- Limited Online Resources: Fewer online tools for managing State Farm gap insurance policies in Mississippi may hinder convenience.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Travelers: Best for Industry Experience

Pros

- Extensive Experience: Travelers’ long-standing presence in the industry ensures reliable gap insurance in Mississippi. For a complete list, read our Travelers review.

- Multiple Coverage Choices: Travelers offers various Mississippi gap insurance policy options to accommodate different vehicle needs.

- Robust Support: Known for strong customer service, Travelers handles gap insurance claims effectively in Mississippi.

Cons

- Elevated Rates: Travelers gap insurance in Mississippi might be more expensive with Travelers, impacting overall affordability.

- Fewer Discount Opportunities: The limited availability of discounts on gap insurance in Mississippi may reduce potential savings with Travelers.

#5 – Progressive: Best Loyalty Discounts

Pros

- Competitive Rates: Progressive offers appealing pricing for gap insurance in Mississippi, with opportunities for potential discounts.

- Loyalty Incentives: Progressive rewards loyal customers with gap insurance in Mississippi with continuous discounts and accident forgiveness. Get a complete overview in our Progressive review.

- User-Friendly Platform: The intuitive online platform simplifies the management of gap insurance in Mississippi.

Cons

- Reduced Protection: Progressive gap insurance in Mississippi may not provide the full protection offered by other providers.

- Fewer Local Agents: The limited availability of local agents can affect personalized service for gap insurance in Mississippi.

#6 – American Family: Cheapest With Costco Membership

Pros

- Membership Rewards: Mississippi drivers with Costco memberships have exclusive access to discounts and cheap gap insurance rates.

- Loyalty Programs: American Family offers valuable loyalty rewards for gap insurance in Mississippi, benefiting long-term policyholders.

- Comprehensive Protection: AmFam provides broad gap insurance coverage options in Mississippi for various vehicle types. Explore our American Family review to learn more.

Cons

- Premium Costs: Gap insurance in Mississippi might involve higher premiums with American Family compared to some other options.

- Limited Customization Options: American Family offers fewer customization choices for gap insurance policies in Mississippi, which might not suit everyone’s specific needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Cheapest With Multi-Vehicle Savings

Pros

- Multi-Vehicle Discounts: Mississippi drivers who insurance two or more vehicles with Nationwide can get 20% off their gap insurance rates.

- Multi-Policy Discounts: Bundle savings opportunities for multiple policies, including gap insurance in Mississippi, reduce overall costs.

- Variety of Options: Offers a range of gap insurance policies in Mississippi to suit different needs and preferences, which is covered in our Nationwide review.

Cons

- Higher Monthly Rates: Gap insurance in Mississippi can be more expensive with Nationwide than some competitors.

- Mixed Customer Service Reviews: Nationwide gap insurance claims and customer service is average in Mississippi, but its usage-based insurance receives poor reviews.

#8 – Farmers: Cheapest With Group Discounts

Pros

- Group Discounts: Farmers provides a variety of group discounts on gap insurance in Mississippi, potentially lowering overall costs for eligible groups.

- Comprehensive Coverage Plans: Flexible and thorough gap insurance options are available in Mississippi through Farmers.

- Strong Financial Backing: Farmers’ financial stability supports reliable gap insurance protection in Mississippi. Learn more in our Farmers review.

Cons

- Premium Costs: Gap insurance premiums in Mississippi may be higher compared to some other insurers.

- Limited Online Tools: Fewer online resources for managing gap insurance policies in Mississippi may impact convenience.

#9 – Allstate: Cheapest With Usage-Based Discount

Pros

- Usage-Based Discounts: Allstate Drivewise and Allstate Milewise offer discounts based on safe driving and low mileage to help all types of drivers save money on Mississippi gap insurance.

- Extensive Coverage Options: A wide range of Allstate gap insurance coverage plans are available in Mississippi.

- Trusted Customer Service: Allstate provides reliable support for gap insurance in Mississippi, ensuring effective assistance. Discover details in our Allstate review.

Cons

- Increased Expenses: Choosing Allstate for gap insurance in Mississippi might lead to higher costs than other available options.

- Limited Customization: The gap insurance offerings in Mississippi may lack the flexibility to fully meet diverse personal requirements.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Customer Support: Provides round-the-clock assistance for managing gap insurance in Mississippi, ensuring continuous support. See our Liberty Mutual review for more.

- Comprehensive Coverage: Extensive gap insurance protection is available in Mississippi, catering to various needs.

- Flexible Policy Options: Various Liberty Mutual gap insurance plans in Mississippi accommodate different preferences and requirements.

Cons

- Elevated Premiums: Rates for gap insurance in Mississippi with Liberty Mutual can be higher than some competitors.

- Poor Customer Service: Liberty Mutual gap insurance in Mississippi consistently ranks below-average for customer service and claims processing.

Mississippi Gap Insurance Pricing Insights

Below, you’ll find a breakdown of the monthly costs for minimum and full coverage from the best Mississippi auto insurance companies for gap coverage:

Gap Insurance Rates in Mississippi by Provider

Insurance Company Monthly Rates

$61

$44

$22

$53

$68

$45

$39

$33

$37

$30

Always consider both minimum and full coverage options to find the best balance between affordability and protection. The choice between coverage affects your monthly payment, with more comprehensive plans typically costing more.

Higher-valued vehicles also require more comprehensive coverage and generally result in higher gap insurance premiums.

Since guaranteed auto protection (gap) insurance covers the difference between your car’s actual cash value (ACV) and the remaining balance on your loan or lease if the vehicle is totaled, it’s important to get high enough coverage levels to pay for your debts if the vehicle is totaled or stolen.

When selecting gap insurance in Mississippi, understanding the factors that influence your rates is crucial. These elements can help you choose the most cost-effective and suitable coverage for your needs.

Learn More: What are the recommended auto insurance coverage levels?

Smart Ways to Cut Costs on Mississippi Gap Insurance

Are you trying to save money on car insurance in Mississippi? To effectively manage your gap insurance costs, employ these smart strategies:

- Compare Multiple Quotes: Shop around and obtain quotes from various insurers to find the most competitive rates and coverage options.

- Bundle Policies: Combine your gap insurance with other types of coverage, like home or renters insurance, to qualify for discounts and lower overall premiums.

- Leverage Discounts: Take advantage of auto insurance discounts for maintaining a clean driving record or affiliations with certain organizations to get cheap gap coverage.

Securing discounts on gap insurance in Mississippi can significantly reduce your premium. Exploring these discount opportunities can help you lower your overall gap insurance costs while maintaining comprehensive coverage.

Auto Insurance Discounts From the Top Providers for Gap in Mississippi

| Insurance Company | Available Discounts |

|---|---|

| Automatic Payments Discount, Multi-Policy Discount, Safe Driver Discount, Vehicle Safety Discount | |

| Bundled Insurance Discount, Paperless Billing Discount, Defensive Driving Discount, Telematics Discount | |

| Vehicle Safety Equipment Discount, Safe Driving Program Discount, Multi-Vehicle Discount, Anti-Theft Discount | |

| Multi-Car Discount, Accident-Free Discount, Anti-Theft Device Discount, Bundled Insurance Discount | |

| Automatic Payments Discount, Safety Features Discount, Multi-Policy Discount, Accident Forgiveness Discount |

| Defensive Driving Discount, Vehicle Safety Features Discount, Automatic Payments Discount, Bundled Insurance Discount |

| Multi-Car Discount, Telematics Discount, Paperless Billing Discount, Safe Driver Discount | |

| Drive Safe & Save Discount, Defensive Driving Discount, Multi-Policy Discount, Vehicle Safety Features Discount | |

| Telematics Discount, Safe Driving Course Discount, Multi-Vehicle Discount, Bundled Insurance Discount | |

| Safety Features Discount, Defensive Driving Discount, Automatic Payments Discount, Bundled Insurance Discount |

Many providers offer loyalty discounts for long-term customers and reductions for maintaining a clean driving record. For instance, a clean driving record can lower your Mississippi gap insurance rates by 25% with Amica, while accidents or violations may increase them.

Find out how to get a good driver auto insurance discount and compare providers to find the most competitive rates and best coverage options. By taking advantage of discounts and comparing quotes, you can find a balance between affordability and coverage, ultimately providing peace of mind and financial security.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Get Cheap Mississippi Gap Insurance

Choosing the right gap insurance in Mississippi involves understanding key factors like vehicle value, driving history, and coverage levels. Find out how insurance companies check driving records to get the cheapest gap coverage.

Amica stands out as the best option for gap insurance in Mississippi, offering excellent coverage with monthly rates starting at just $22.Brandon Frady Licensed Insurance Producer

Amica, USAA, and State Farm all have cheap gap insurance in Mississippi, but you should still compare quotes from multiple providers and explore auto discount opportunities to find a policy that offers both protection and affordability.

Taking these steps ensures you’re well-prepared for any financial gaps that may arise if your vehicle is totaled. Get fast and cheap Mississippi auto insurance coverage today with our free quote comparison tool below.

Frequently Asked Questions

Who has the cheapest gap insurance in Mississippi?

You can get cheap Mississippi gap insurance from Amica, USAA, and State Farm. Rates may vary based on coverage options and personal driving history.

Will gap insurance cover a blown engine in Mississippi?

Gap insurance generally does not cover mechanical issues like a blown engine. It primarily covers the difference between your car’s value and the amount owed on your loan or lease if the car is totaled or stolen.

What is the most gap insurance will pay in Mississippi?

The most gap insurance will pay is the difference between your car’s value and the amount owed on your loan or lease.

How much is Mississippi auto insurance per month?

Car insurance in Mississippi typically costs around $120 per month, varying by coverage and provider. Enter your ZIP code below to see how much Mississippi auto insurance costs in your city.

Which companies have the lowest insurance rates in Mississippi?

State Farm and Geico are usually the cheapest Mississippi auto insurance companies for most drivers.

What type of auto insurance is required in Mississippi?

Mississippi auto insurance law requires drivers to have minimum liability coverage of $25,000 per person and $50,000 per accident.

What is full coverage auto insurance in Mississippi?

Cheap full coverage car insurance in Mississippi includes liability, comprehensive, and collision insurance.

What is the cheapest full-coverage car insurance?

Amica has the cheapest full coverage in Mississippi with gap insurance starting at $80/month.

Why is auto insurance high in Mississippi?

Insurance rates in Mississippi are relatively high compared to some other states due to factors like weather-related risk and higher coverage requirements.

Which type of Mississippi auto insurance is the cheapest?

You’ll get the cheapest gap insurance in Mississippi if you add it to a minimum coverage policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.