Best Auto Insurance After a DUI in Illinois (Top 9 Companies Ranked for 2025)

The best auto insurance after a DUI in Illinois is offered by State Farm, AAA, and USAA, with premiums beginning at $27/month. State Farm’s Driver Safety Program delivers targeted discounts and resources for DUI drivers, positioning it as the top Illinois DUI auto insurance company for high-risk drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maria Hanson

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Insurance and Finance Writer

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage After a DUI in Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 3,027 reviews

3,027 reviewsCompany Facts

Full Coverage After a DUI in Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage After a DUI in Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsThe best auto insurance after a DUI in Illinois comes from State Farm, AAA, and USAA due to their exceptional coverage options and strong customer support.

State Farm leads with tailored high-risk auto insurance plans and discounts, specifically designed for drivers with DUIs.

AAA offers comprehensive protection, while USAA provides reliable, affordable policies for high-risk IL drivers in the military.

Our Top 9 Company Picks: Best Auto Insurance After a DUI in Illinois

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | B | Cheap Rates | State Farm | |

| #2 | 15% | A | Roadside Assistance | AAA |

| #3 | 12% | A++ | Military Savings | USAA | |

| #4 | 8% | A+ | 24/7 Support | Erie |

| #5 | 18% | A+ | Insurance Discounts | Allstate | |

| #6 | 9% | A++ | Accident Forgiveness | Travelers | |

| #7 | 11% | A+ | Innovative Programs | Progressive | |

| #8 | 7% | A | Local Agents | Farmers | |

| #9 | 13% | A+ | Multiple Vehicles | Nationwide |

These top providers ensure DUI drivers receive the best possible coverage and service. Avoid expensive auto insurance premiums after a DUI in Illinois by entering your ZIP code above to see the cheapest rates for you.

- State Farm is the top pick for the best auto insurance after a DUI in Illinois

- AAA gives free roadside assistance to Illinois DUI drivers who are members

- USAA has the best DUI auto insurance for drivers in the military

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Cost-Effective Plans: State Farm offers highly competitive premiums for DUI coverage in Illinois. Compare rates in our State Farm auto insurance review.

- DUI-Specific Savings: Tailored discounts and initiatives for DUI drivers in Illinois help make insurance more affordable and accessible.

- Superior Customer Service: State Farm ranks among the top Illinois DUI insurance companies for claims and customer satisfaction.

Cons

- Customization Limits: While prices are competitive, State Farm’s insurance options for DUI drivers in Illinois may lack the flexibility found with other companies.

- Low Financial Ratings: State Farm’s A.M. Best rating is lower than other Illinois DUI insurance companies.

#2 – AAA: Best for Roadside Support

Pros

- Roadside Coverage: AAA stands out for its thorough roadside assistance services, vital for DUI drivers in Illinois seeking additional safety.

- Educational Programs: AAA provides targeted educational resources designed to help DUI drivers in Illinois maintain safe driving habits.

- Membership Benefits: Extra membership perks, including discounted DUI insurance rates in Illinois, add value for motorists. Explore savings in our AAA auto insurance review.

Cons

- Premium Costs: DUI drivers in Illinois might encounter higher full coverage insurance premiums with AAA, despite the benefits of membership.

- Geographical Variations: Pricing and availability for DUI insurance in Illinois can differ considerably based on which city you live in.

#3 – USAA: Best for Military Personnel

Pros

- Military-Centric Services: USAA caters specifically to the needs of military members and their families, including those with a DUI in Illinois.

- Affordable DUI Rates: USAA offers cost-effective rates and comprehensive policies for military personnel with a DUI in Illinois. Compare free quotes in our USAA auto insurance review.

- Exceptional Support: USAA’s top-notch customer service ensures that DUI drivers in Illinois receive dedicated assistance and effective claim resolution.

Cons

- Eligibility Constraints: USAA’s insurance for DUI in Illinois is limited to military members, veterans, and their families, excluding others.

- Higher Costs for Non-Military: Those without a military background may find USAA’s DUI rates in Illinois less advantageous.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Erie: Best Customer Service

Pros

- Budget-Friendly Rates: Erie offers some of the most affordable premiums for DUI insurance in Illinois, making it an attractive choice for drivers with violations.

- Reliable Customer Service: Erie’s focus on customer care ensures DUI drivers in Illinois experience quick and equitable claims processing. Get full rankings in our Erie auto insurance review.

- 24/7 Claims Service: Drivers can file DUI auto insurance claims online at any time in Illinois.

Cons

- Less Customization: Erie doesn’t offer as many customization options as other DUI insurance companies in Illinois.

- Technology Shortcomings: Erie’s online services for DUI insurance in Illinois might not be as advanced, potentially affecting ease of use.

#5 – Allstate: Best for Broad Discounts

Pros

- Bonus for Safe Driving: Allstate’s bonus program rewards DUI drivers in Illinois for keeping a clean record after their DUI incident.

- Extensive Discounts: Allstate provides numerous discounts for DUI drivers in Illinois, helping to lower overall insurance costs. Explore offerings further in our complete Allstate auto insurance review.

- Local Agent Presence: DUI drivers in Illinois benefit from Allstate’s wide network of local agents, offering personalized guidance and assistance.

Cons

- Rate Hikes: DUI drivers in Illinois may experience significant premium increases, even with available discounts and bonuses.

- Coverage Limitations: Allstate’s DUI coverage options in Illinois may come with conditions that restrict choices for some drivers.

#6 – Travelers: Best for Accident Forgiveness

Pros

- Payment Flexibility: Travelers offers DUI drivers in Illinois flexible payment options, making it easier to handle insurance expenses.

- Forgiveness for Accidents: Travelers’ accident forgiveness program can protect DUI drivers in Illinois from rate hikes after a first at-fault accident.

- Broad Coverage: DUI drivers in Illinois have access to a range of insurance options, providing thorough protection. Find out more in our Travelers auto insurance review.

Cons

- Rate Fluctuations: DUI insurance costs with Travelers in Illinois can vary greatly, making budget planning less predictable.

- Limited Physical Locations: DUI drivers in Illinois might find fewer Travelers offices, impacting access to face-to-face assistance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Progressive: Best Modern Tools

Pros

- Usage-Based Pricing: Progressive’s Snapshot program allows DUI drivers in Illinois to receive rates based on actual driving habits, potentially lowering premiums.

- Intuitive App: Progressive offers DUI drivers in Illinois an easy-to-navigate app for managing their policies and claims.

- Diverse Coverage: Progressive provides a wide array of insurance options to meet the needs of DUI drivers in Illinois. Get further details in our comprehensive Progressive auto insurance review.

Cons

- Higher Initial Rates: DUI drivers in Illinois might face steeper starting premiums with Progressive, despite potential savings from usage-based discounts.

- Inconsistent Service: Progressive’s customer service for DUI drivers in Illinois may be inconsistent, leading to varying levels of satisfaction.

#8 – Farmers: Best for Local Agents

Pros

- Adaptable Coverage: Farmers allows DUI drivers in Illinois to customize their insurance policies, offering flexibility to fit specific needs.

- Savings for Safe Driving: Farmers provides discounts to DUI drivers in Illinois who maintain a good driving record after their DUI.

- Extensive Agent Network: DUI drivers in Illinois can rely on Farmers’ large network of agents for personalized advice and support. Read more in our complete Farmers auto insurance review.

Cons

- Premium Costs: DUI insurance from Farmers in Illinois may be more expensive than some other providers, even with available discounts.

- Less Advanced Online Tools: DUI drivers in Illinois may find Farmers’ digital tools less sophisticated, reducing online management options.

#9 – Nationwide: Best for Multiple Vehicles

Pros

- Competitive Multi-Vehicle Discounts: Get 20% off DUI insurance rates in Illinois if you insure two or more vehicles with Nationwide.

- Big Bundling Discounts: Nationwide offers 20% discounts for DUI drivers in Illinois who bundle auto insurance with other policies. Discover more insurance savings in our Nationwide review.

- Financial Strength: Nationwide’s solid A.M. Best rating ensures DUI drivers in Illinois have dependable and secure coverage.

Cons

- Fewer In-Person Options: DUI drivers in Illinois may find fewer Nationwide offices, limiting opportunities for in-person service.

- Potential Rate Increases: Nationwide’s DUI insurance in Illinois might lead to higher premiums, particularly for high-risk drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How a DUI Affects Illinois Auto Insurance Rates

There are several critical factors that affect auto insurance rates for DUI drivers in Illinois. Opting for full coverage, including comprehensive and collision insurance, generally results in higher DUI insurance costs than minimum coverage.

The table below compares the minimum and full coverage auto insurance costs across various providers, highlighting the options available to drivers.

Illinois DUI Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $57 | $148 |

| Allstate | $108 | $282 |

| Erie | $42 | $107 |

| Farmers | $62 | $163 |

| Nationwide | $68 | $178 |

| Progressive | $41 | $108 |

| State Farm | $27 | $70 |

| Travelers | $49 | $128 |

| USAA | $50 | $130 |

Rates can vary significantly, so choosing a provider that aligns with your budget and coverage needs is essential. State Farm stands out with the lowest rates, offering minimum coverage at $27/month and full coverage at $70/month.

Progressive and Erie also provide competitive DUI auto insurance rates, making them strong contenders for budget-conscious drivers in Illinois. On the higher end, Allstate’s monthly DUI insurance rates are $108 for minimum coverage and $282 for full coverage.

For DUI drivers in Illinois, State Farm provides both affordability and peace of mind.Laura Berry Former Licensed Insurance Producer

A history of accidents or traffic violations can significantly increase premiums, especially after a DUI conviction. Where you live in Illinois also affects rates due to local accident statistics, crime rates, and even weather conditions. Compare quotes from multiple companies to find the best car insurance after a DUI in Illinois.

How to Get Cheap DUI Auto Insurance in Illinois

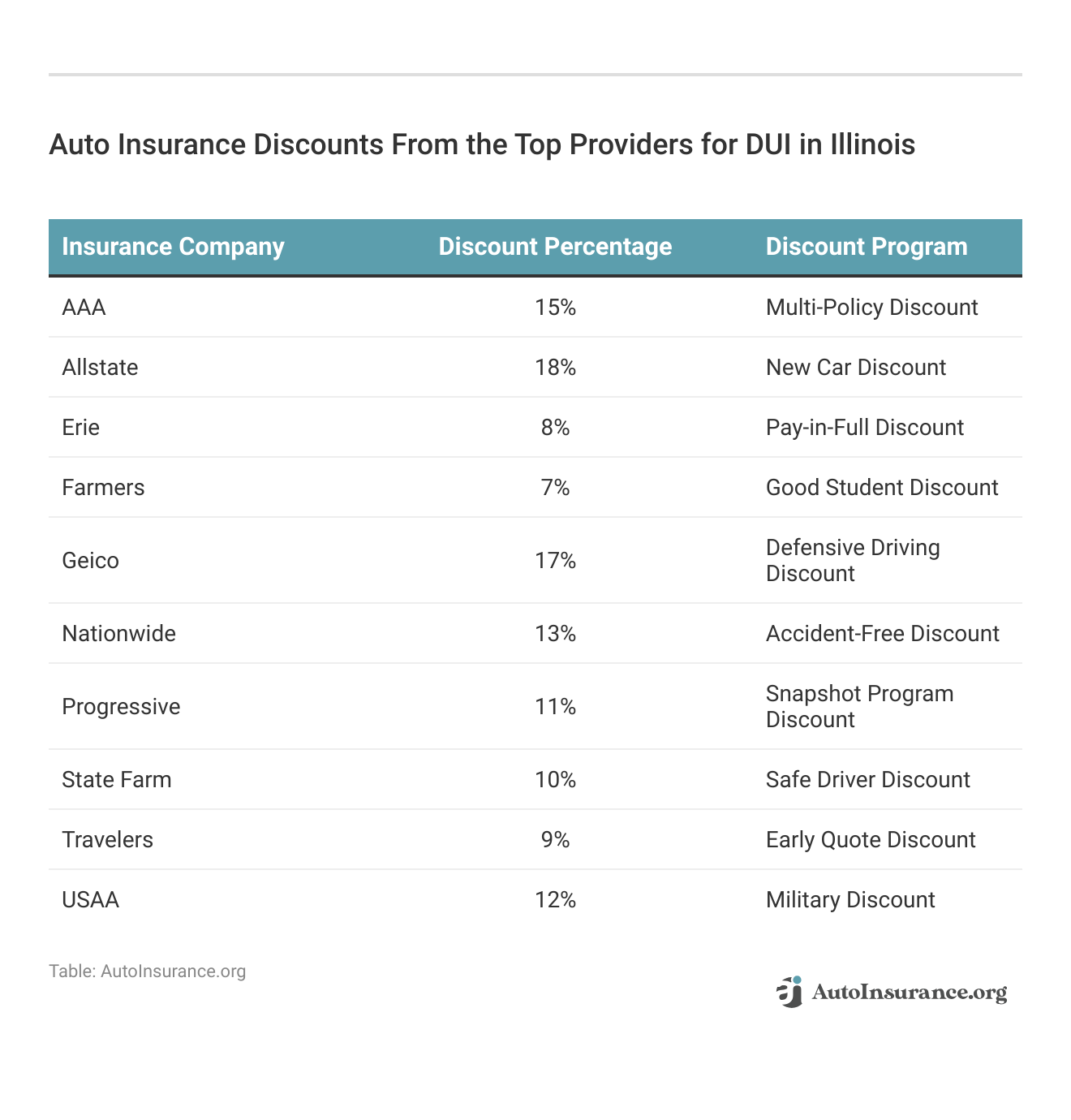

Getting cheap high-risk auto insurance in Illinois after a DUI is possible with discounts.

For instance, bundling auto insurance with other policies, such as homeowners or renters insurance, can lead to substantial multi-policy discounts with the top companies. Explore more discount opportunities below:

Additionally, maintaining a clean driving record post-DUI is crucial, as it can gradually improve insurance rates over time. Shopping around and comparing quotes from various providers allows drivers to find the best deals tailored to their unique needs.

Take a look at these case studies to see how different Illinois drivers found affordable DUI car insurance after shopping around online:

- Case Study #1 – State Farm Success: After receiving a DUI, John chose State Farm for its competitive rates and DUI-specific discounts. This decision provided him with reliable coverage and substantial savings, helping him maintain his insurance budget.

- Case Study #2 – AAA Assurance: Maria faced a DUI and needed comprehensive support. She opted for AAA’s services with her membership. The robust roadside assistance and educational programs offered her peace of mind and tools to stay safe on the road.

- Case Study #3 – USAA Advantage: As a veteran with a DUI, Mike turned to USAA for their military-focused services. The affordable rates and exceptional customer support helped him secure reliable coverage tailored to his unique situation.

These case studies highlight how choosing the right Illinois insurance provider after a DUI can make a significant difference in both coverage and overall driving experience, demonstrating the strengths of each top company.

Read More: Best Illinois Auto Insurance Companies

Comparing the Top Auto Insurance Companies for DUI Drivers in Illinois

State Farm, AAA, and USAA have the best auto insurance after a DUI in Illinois. State Farm provides some of the most affordable rates with tailored programs for DUI drivers.

Thank you to our friends at @Trupanion for providing our canine companions with pet insurance! #NationalDogDay pic.twitter.com/uQYwg3E3qV

— State Farm (@StateFarm) August 26, 2024

AAA excels with its extensive roadside assistance and membership perks, which add value and security for drivers. USAA, specifically serving military families, delivers exceptional customer service and specialized insurance options, making it a top choice for those within its eligibility criteria.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers after a DUI in Illinois that fit your needs and budget.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What’s the best auto insurance for a DUI in Illinois?

The best auto insurance companies after a DUI in Illinois are State Farm, AAA, and USAA, which offer specialized coverage and competitive rates for DUI drivers.

How long does a DUI in Illinois affect your insurance?

A DUI in Illinois can impact your insurance rates for up to five years, with higher premiums being common during this period. Explore your auto insurance after a DUI in Illinois by entering your ZIP code into our free comparison tool below today.

How long does a DUI stay on your record in Illinois?

A DUI in Illinois remains on your driving record permanently, but it may affect your insurance rates for several years. Learn how to get cheap auto insurance for a bad driving record.

What happens to first-time DUI offenders in Illinois?

First-time DUI offenders in Illinois may face penalties such as fines, a license suspension, mandatory alcohol education programs, and increased insurance rates.

What happens after you get a DUI in Illinois?

After receiving a DUI in Illinois, you may face license suspension, fines, mandatory classes, and higher insurance costs. Find out how a suspended license affects auto insurance rates.

How much is SR-22 insurance per month for a DUI in Illinois?

SR-22 insurance for a DUI in Illinois typically costs between $30 and $60 per month, depending on the insurer and the driver’s history.

What company has the cheapest SR-22 insurance for an Illinois DUI?

For DUI drivers in Illinois, companies like State Farm and Progressive often offer the most affordable SR-22 insurance rates.

Do you lose your license for DUI in Illinois?

Yes, a DUI conviction in Illinois typically results in a license suspension, with the length depending on the circumstances of the offense.

How to get out of a DUI in Illinois?

To challenge a DUI in Illinois, consult with an experienced attorney who can explore options such as challenging the evidence or negotiating reduced charges.

How do I expunge a DUI in Illinois?

Expunging a DUI in Illinois is not possible, as DUI convictions are permanent and cannot be removed from your record.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Maria Hanson

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Insurance and Finance Writer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.