Alinsco Auto Insurance Review for 2025 (Check Out Their Score!)

Our Alinsco auto insurance review found it stands out for specialty programs that help drivers with unique needs, like foreign IDs or temporary coverage. Alinsco car insurance rates start at $90 per month, but customers may be able to score lower rates by applying for Alinsco discounts.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Feb 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Alinsco

Monthly Rate:

$90A.M. Best:

B++Complaint Level:

HighPros

- Specialty programs for drivers with foreign IDs and more

- Discount for bundling home and auto insurance

- Add-on coverages like roadside assistance

Cons

- A higher number of customer complaints at NAIC

- Insurance coverage is only available in Texas

Our Alinsco auto insurance review found that the company has affordable rates for drivers with clean records and specialty coverage options, like Alinsco Zoom for temporary coverage or Alinsco Enhanced for drivers with expired or foreign IDs.

While Alinsco offers multiple discounts and add-on types of auto insurance, like roadside assistance, its customer satisfaction is lower than average. There are numerous complaints about denied claims and poor service. Alinsco Insurance’s business ratings are also below average.

Alinsco Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 2.4 |

| Business Reviews | 3.0 |

| Claims Processing | 2.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 1.4 |

| Coverage Value | 2.5 |

| Customer Satisfaction | 1.5 |

| Digital Experience | 3.5 |

| Discounts Available | 1.7 |

| Insurance Cost | 2.8 |

| Plan Personalization | 3.0 |

| Policy Options | 2.2 |

| Savings Potential | 2.4 |

Drivers in Texas seeking coverage for unique situations may benefit most from Alinsco Insurance. If you don’t live in Texas, compare quotes from multiple insurance companies near you to find the best fit for your needs.

- Alinsco auto insurance is only available in Texas

- Texas insurance rates start at $90 a month with Alinsco

- Alinsco has a high number of complaints lodged on the NAIC

Alinsco Auto Insurance Rates

Alinsco Insurance considers multiple factors when calculating your rates. To give you an idea of what customers pay on average at Alinsco, we’ve collected average rates by age and gender below.

Alinsco Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $241 | $390 |

| 16-Year-Old Male | $265 | $420 |

| 18-Year-Old Female | $210 | $360 |

| 18-Year-Old Male | $240 | $395 |

| 25-Year-Old Female | $130 | $220 |

| 25-Year-Old Male | $145 | $235 |

| 30-Year-Old Female | $115 | $200 |

| 30-Year-Old Male | $125 | $210 |

| 45-Year-Old Female | $105 | $180 |

| 45-Year-Old Male | $148 | $232 |

| 60-Year-Old Female | $100 | $170 |

| 60-Year-Old Male | $110 | $181 |

| 65-Year-Old Female | $107 | $175 |

| 65-Year-Old Male | $115 | $185 |

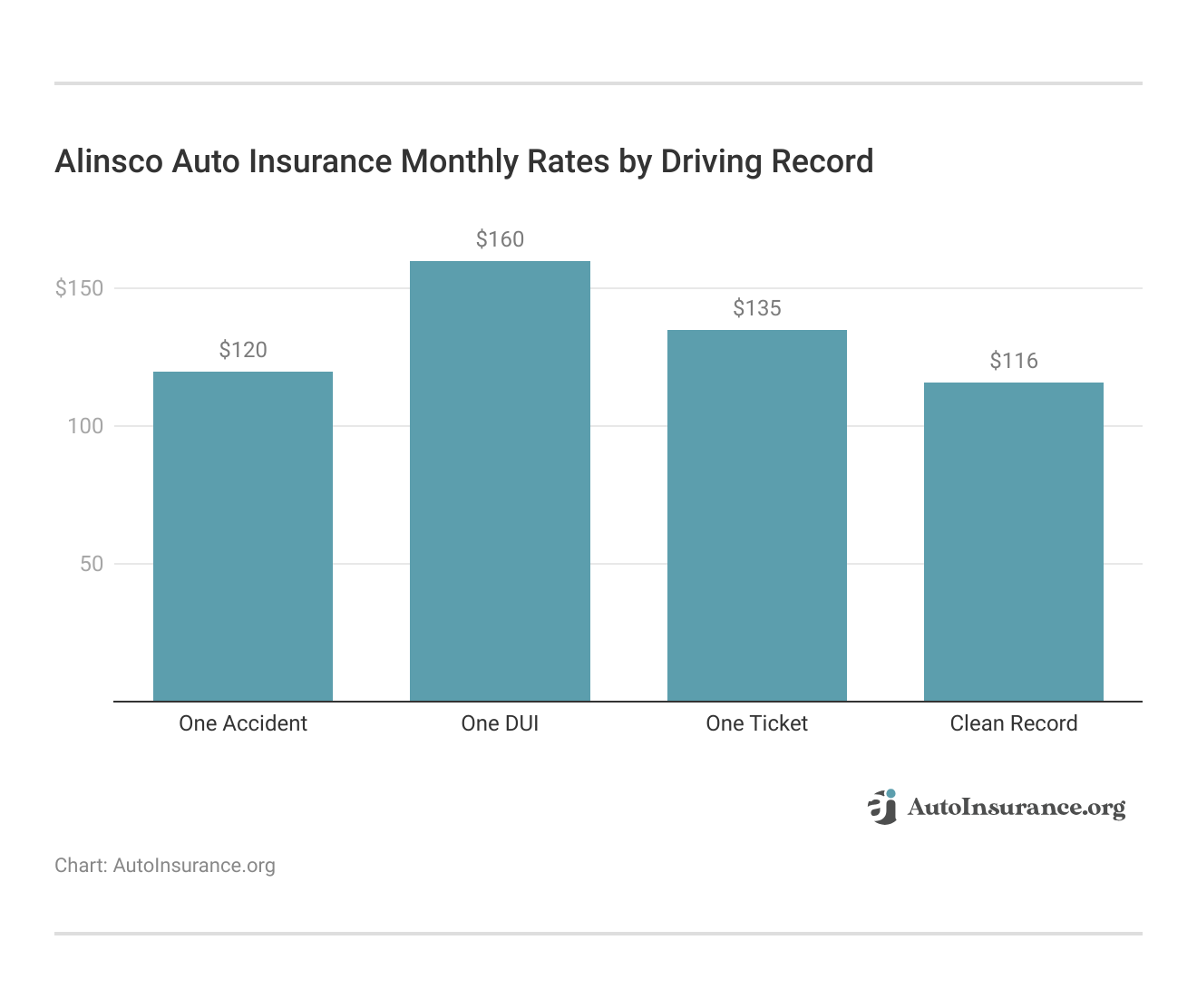

In addition to age, another big factor that Alinsco Insurance will use for rate calculations is your driving record. Your driving record helps Alinsco Insurance assess the level of risk you present. Frequent tickets, for example, show that you are more likely to be in an accident due to unsafe driving behaviors.

Maintaining a clean driving record after accidents or violations will help you get cheap auto insurance for high-risk drivers in Texas from Alinsco Insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Alinsco Auto Insurance Rates vs. the Competition

Alinsco offers reasonable rates to customers, even compared to major competitors. While a few companies offer cheaper rates, like Geico and Progressive, Alinsco Insurance is still an affordable option for drivers (Read More: Geico vs. Progressive Auto Insurance Review).

Alinsco Auto Insurance Monthly Rates vs. Top Competitors by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $90 | $200 | |

| $98 | $230 | |

| $91 | $220 | |

| $92 | $225 | |

| $85 | $220 | |

| $93 | $235 |

| $89 | $205 |

| $88 | $215 | |

| $95 | $210 | |

| $85 | $210 |

Because some companies charge very differently for poor driving records, we want to compare Alinsco’s rates to those of its competitors for different infractions. Take a look at Alinsco’s rates compared to competitors for different driving records below.

Alinsco Full Coverage Insurance Monthly Cost vs. Top Competitors by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $90 | $110 | $130 | $160 | |

| $98 | $120 | $145 | $180 | |

| $91 | $110 | $135 | $167 | |

| $92 | $112 | $138 | $172 | |

| $85 | $105 | $125 | $155 | |

| $93 | $115 | $140 | $175 |

| $89 | $108 | $132 | $162 |

| $88 | $108 | $135 | $165 | |

| $95 | $115 | $140 | $170 | |

| $85 | $105 | $125 | $155 |

Again, Alinsco falls in the middle for affordability. While the best Texas insurance companies have rates slightly cheaper than Alinsco’s, Alinsco is not one of the priciest providers. However, you’ll also want to consider which car insurance company has better reviews in your city, as price is just one factor of a company.

Alinsco Auto Insurance Policy Options

Consider your driving habits and budget when choosing coverages at Alinsco Insurance. Alinsco Insurance offers a range of options, from liability coverage to roadside assistance.

Alinsco Auto Insurance Coverage Options

| Coverage Name | What it Covers |

|---|---|

| Liability | Covers injuries and damage you cause to others |

| Collision | Pays for your car’s damage after a crash |

| Comprehensive | Covers theft, vandalism, and non-crash damage |

| Personal Injury Protection | Covers medical bills and lost wages |

| Uninsured/Underinsured Motorist | Protects you from uninsured or underinsured drivers |

| Medical Payments (MedPay) | Pays medical expenses for you and passengers |

| Rental Reimbursement | Covers rental car costs after an accident |

| Roadside Assistance | Provides towing, jump-starts, and other help |

While you have to carry liability insurance and personal injury protection to meet minimum Texas auto insurance requirements, you can add additional coverage based on your personal preferences.

Alinco also has specialty programs for drivers who are shopping for cheap temporary auto insurance, have foreign or expired licenses, or rent cars. The several coverage programs available at Alinsco Insurance include:

- Alinsco Bravo: Coverage for cars that are rented or borrowed.

- Alinsco Enhanced: Coverage for drivers with an expired or foreign ID.

- Alinsco Select: Coverage for licensed drivers in 6-month, 12-month, or 24-month policy periods.

- Alinsco Zoom: Coverage for foreign IDs in 30-day periods.

The coverage programs include collision and comprehensive coverage and are useful for those looking for quick coverage options. You can manage your coverages from the Alinsco app.

Alinsco Auto Insurance Discounts

Alinsco Insurance has several discounts that can help lower your premium. The best auto insurance discounts include savings for participating in Alinsco’s safe driving program, bundling policies, and having anti-theft features in your car.

Alinsco Auto Insurance Discounts by Savings Potential

| Discount Name | Savings Potential | How to Qualify |

|---|---|---|

| Telematics Program | 50% | Participate in tracking program |

| Safe Driver | 25% | Clean driving record |

| Bundling | 20% | Combine policies |

| Multi-Car | 15% | Insure multiple vehicles |

| Good Student | 15% | Maintain good grades |

| Defensive Driving | 10% | Complete defensive driving course |

| Low Mileage | 10% | Drive less than average miles |

| Anti-Theft Device | 5% | Install anti-theft device |

Applying for multiple discounts can help maximize your savings at Alinsco Insurance. For example, families with young drivers can benefit from the good student discount to lower their coverage costs.

You will have to show Alinsco proof of qualification for some of these discounts, like a good student or defensive driver discount, before you can get the discount applied to your premium.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Alinsco Insurance Reviews From Customers

Alinsco reviews from customers can be incredibly helpful when digging into Alinsco Insurance reviews, as they provide real-life insights into the company. Unfortunately, Alinsco Insurance has multiple negative reviews on sites like Yelp.

Common complaint threads from Alinsco customers are a lack of responsiveness from customer service representatives and either low claim settlements or denied claims. Multiple third parties who were hit by Alinsco customers also posted negative reviews about the lack of responsiveness and denied claims.

Read More: Best Auto Insurance Companies for Paying Claims

Business Ratings of Alinsco Insurance

Another important aspect of Alinsco to examine is its business ratings. Alinsco Insurance Agency has been rated by several businesses, including J.D. Power, BBB, and more.

Alinsco Auto Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 798 / 1,000 Below-Average Satisfaction |

|

| Score: B Fair Business Practices |

|

| Score: 68 / 100 Below-Average Customer Feedback |

|

| Score: 1.23 More Complaints Than Avg. |

|

| Score: B++ Good Financial Strength |

All of Alinsco’s business scores are average or below average. It has average financial strength and business practices, according to A.M. Best and BBB. However, NAIC customer complaints are high.

The NAIC (National Association of Insurance Commissioners) rates companies based on the number and severity of complaints they receive. A low score could indicate a pattern of unresolved customer issues.Brandon Frady Licensed Insurance Producer

J.D. Power and Consumer Reports also gave Alinsco a lower-than-average rating for customer claims satisfaction, so Alinsco’s customer service could use improvement

Read More: Best Auto Insurance Companies According to Consumer Reports

Alinsco Auto Insurance Pros and Cons

There are some positives to recommend Alinsco to potential customers, from great discounts to comprehensive coverage:

- Add-On Options: Alinsco Insurance has extras like roadside assistance for breakdowns, tows, and more (Learn More: Best Roadside Assistance Plans).

- Discount Options: Alinsco customers can apply for several discounts, such as a good student discount.

- Coverage Programs: Alinsco has several specialty coverage programs for foreign drivers and temporary coverage needs, such as Alinsco Zoom.

Alinsco’s main strengths are its add-on options and coverage programs. However, Alinsco Insurance has some significant downsides as well, including limited availability:

- Not in Every State: Alinsco car insurance is only available in Texas.

- Low Insurance Ratings: Alinsco has more complaints than average, and its business ratings are average or below-average compared to other Texas insurers.

Because of the mixed ratings from businesses and customers, Alinsco’s cons may make some drivers think twice before signing up.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Choosing Alinsco as Your Auto Insurance Company

Our Alinsco auto insurance review found that Alinsco’s affordable rates and unique coverage programs, such as Alinsco Zoom for temporary foreign ID coverage, make it an excellent choice for foreign drivers or those who need cheap auto insurance when traveling to Mexico. Alinsco’s rates are also competitive throughout Texas.

However, coverage is only available in Texas. And Alinsco Insurance’s poor customer satisfaction and below-average business ratings may raise concerns among customers.

To ensure you get the best deal on auto insurance, it’s crucial to compare multiple car insurance quotes online and evaluate all your options.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is Alinsco insurance real?

Yes, Alinsco Insurance Company is a real company based out of Texas. It only sells auto insurance in Texas.

What is the phone number for Alinsco claims?

The Alinsco insurance claims number is 1-877-437-5007.

Is Alinsco insurance good?

Alinsco insurance reviews are mixed. Alinsco Managing General Agency, Inc. has a B+++ financial rating from A.M. Best and a lower-than-average score from J.D. Power of 798/1,000 for customer satisfaction (Read More: Auto Insurance Companies With the Best Customer Service).

What is the Alinsco insurance email?

You can email Alinsco from their website or use the email address [email protected].

Is there an Alinsco insurance app?

Yes, there is an Alinsco insurance app. You can use your Alinsco insurance login on the app and go to Alinsco Insurance Manage My Policy to file Alinsco auto insurance claims, pay bills, and more.

Which company has the best auto insurance rates?

USAA has the cheapest rates, starting at $85 per month, but only sells to military and veterans. Learn more about the company in our USAA auto insurance review.

How much is Alinsco auto insurance?

Alinsco car insurance rates start at $90 per month. Shop for the most affordable auto insurance in your area by entering your ZIP in our free quote finder.

What is the most trusted car insurance company?

Wondering what is the best auto insurance company? Some of the best-rated companies with over an A financial rating from A.M. Best include USAA, Geico, and Progressive (Read More: Who are the reputable auto insurance companies?).

Which company is best for a car insurance claim?

One of the companies with the highest satisfaction ratings from J.D. Power is USAA, with a score of 882/1,000.

Are there Alinsco insurance company careers?

Yes, you can find available job listings on sites like Indeed (Learn More: How to Become an Auto Insurance Agent).

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.