Insurance.com Review for 2025 (Accurate Quote Tool?)

Comparing auto insurance quotes is simple with Insurance.com, which works with 85+ companies to deliver accurate and expert-reviewed rates. Insurance.com auto insurance reviews are mostly positive, and our Insurance.com rating is 4.6/5. Check out this Insurance.com review to see how users rate the platform.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Apr 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

This Insurance.com auto insurance review breaks down how the tool works, what sets it apart, and how it compares to Insurify and NerdWallet.

Insurance.com Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 4.6 |

| Customer Support | 4.5 |

| Discount Clarity | 4.4 |

| Ease of Use | 4.7 |

| Educational Resources | 4.6 |

| Provider Network | 4.5 |

| Quote Accuracy | 4.6 |

| Quote Speed | 4.7 |

| Savings Potential | 4.5 |

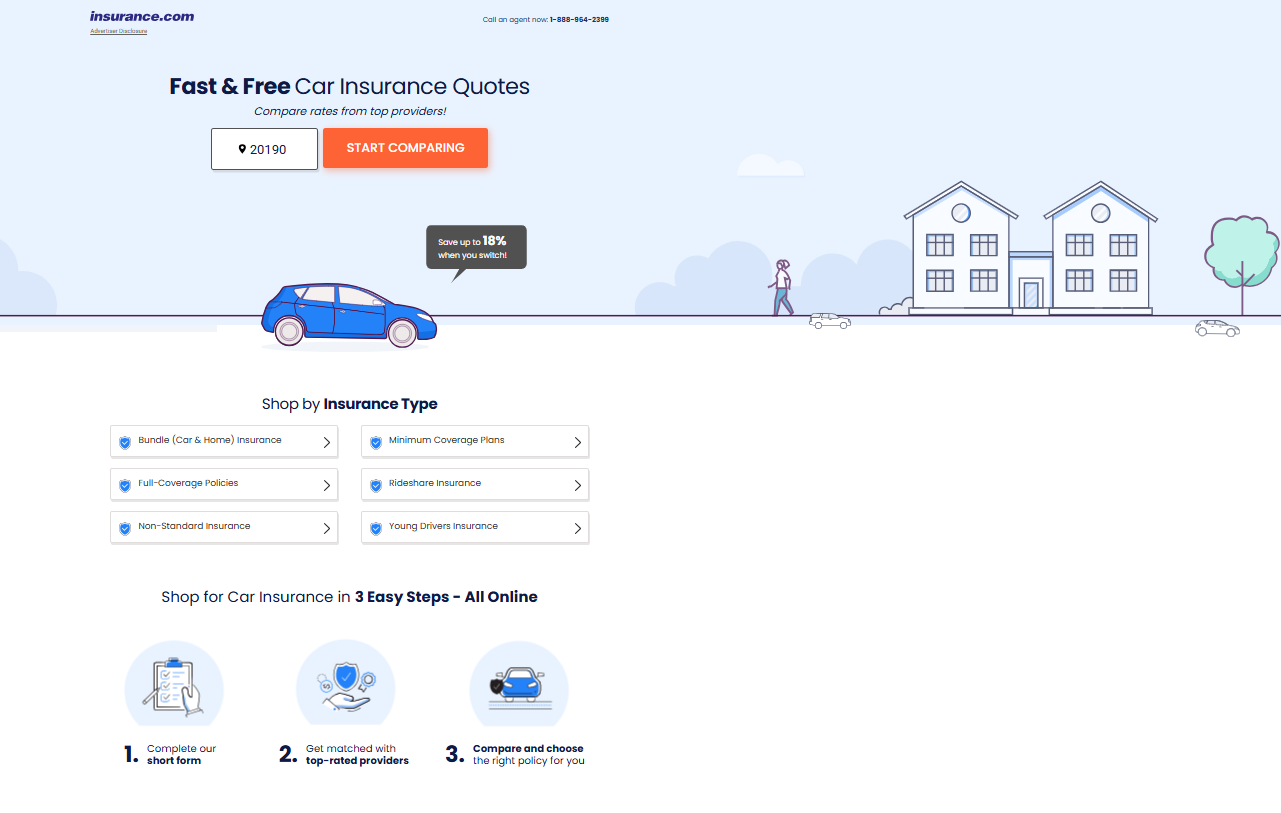

It’s not an insurance company, but it simplifies shopping by giving an instant auto insurance quote comparison online with personalized results based on your ZIP code. This quote comparison tool helps you check rates from 85+ insurers in one place without the hassle of jumping between websites.

While customer reviews are mixed with a 2.9 Trustpilot score and a C- BBB rating, we gave it a high 4.6/5 for how quickly and accurately it provides coverage information and policy pricing.

- The Insurance.com rating is 4.6/5

- Insurance.com pulls rates from more than 85 insurers

- Insurance.com reviews show a 2.9 Trustpilot score and a C- from the BBB

Don’t let expensive insurance rates hold you back. Enter your ZIP code and shop for affordable premiums from the top companies.

What You Need to Get Started With Insurance.com

Insurance.com isn’t a direct insurance provider. Instead, it serves as a comparison platform that helps you shop smarter by pulling quotes from the best auto insurance companies all in one place. Here’s exactly how Insurance.com’s quote tool works and what you’ll need to complete it.

It all starts with your ZIP code. Since auto insurance premiums vary by state, even down to your ZIP code, entering it makes sure you’re only shown options that actually fit your location.

Once you enter your ZIP code and hit “Start Comparing,” you’ll go through a quick form that asks for the basics to get your quotes ready. Here’s what you’ll need to have on hand:

- Your full name, date of birth, and address

- Basic details about your car (year, make, model)

- How the vehicle is used (personal, business, commute, etc.)

- Your current insurance status

- Driving history, including any past accidents or tickets

The form takes just a few minutes to fill out, and you only need to do it once to access a wide range of options. After you’ve entered your info, Insurance.com pulls real-time quotes from multiple insurers. You’ll see different coverage options, monthly rates, and provider details — all organized side by side, so it’s easy to compare what each one offers.

Insurance.com doesn’t sell policies directly, but it makes it easier to find the right one. Its tools allow you to calculate and compare the rates for your coverage without pressure, and it doesn’t favor one insurer over another.

Insurance.com helps you compare real quotes side by side, so you can quickly see which coverage fits your needs and budget without having to visit multiple sites.Kristen Gryglik Licensed Insurance Agent

When you find a rate and coverage that fit your needs, you can click through to choose an auto insurance policy and finalize your purchase directly with the insurer.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Insurance.com Customer Ratings & Third-Party Reviews

Insurance.com has a C- rating from the Better Business Bureau and a 2.9 out of 5 on Trustpilot, but that’s based on just two reviews. A C- rating the BBB isn’t ideal as it usually points to some customer service issues or unresolved complaints.

Insurance.com Reviews & Third-Party Platform Customer Ratings

| Review Platform |  |

|---|---|

| C- | |

| 2.9 / 5.0 (2 reviews) |

As for the Trustpilot score, 2.9 isn’t the worst, but it’s not exactly a strong vote of confidence either, especially with so few reviews to go on. The low number of ratings does raise a flag since it could mean that users don’t typically interact directly with Insurance.com post-quote, or they just don’t think of reviewing a comparison platform the same way they would an actual insurer.

Still, if you’re the type of consumer who wants a flawless user experience from start to finish—or who relies heavily on reviews—these ratings are worth noting before you dive in, especially if you’re trying to figure out how to check if an auto insurance company is legitimate before sharing your information.

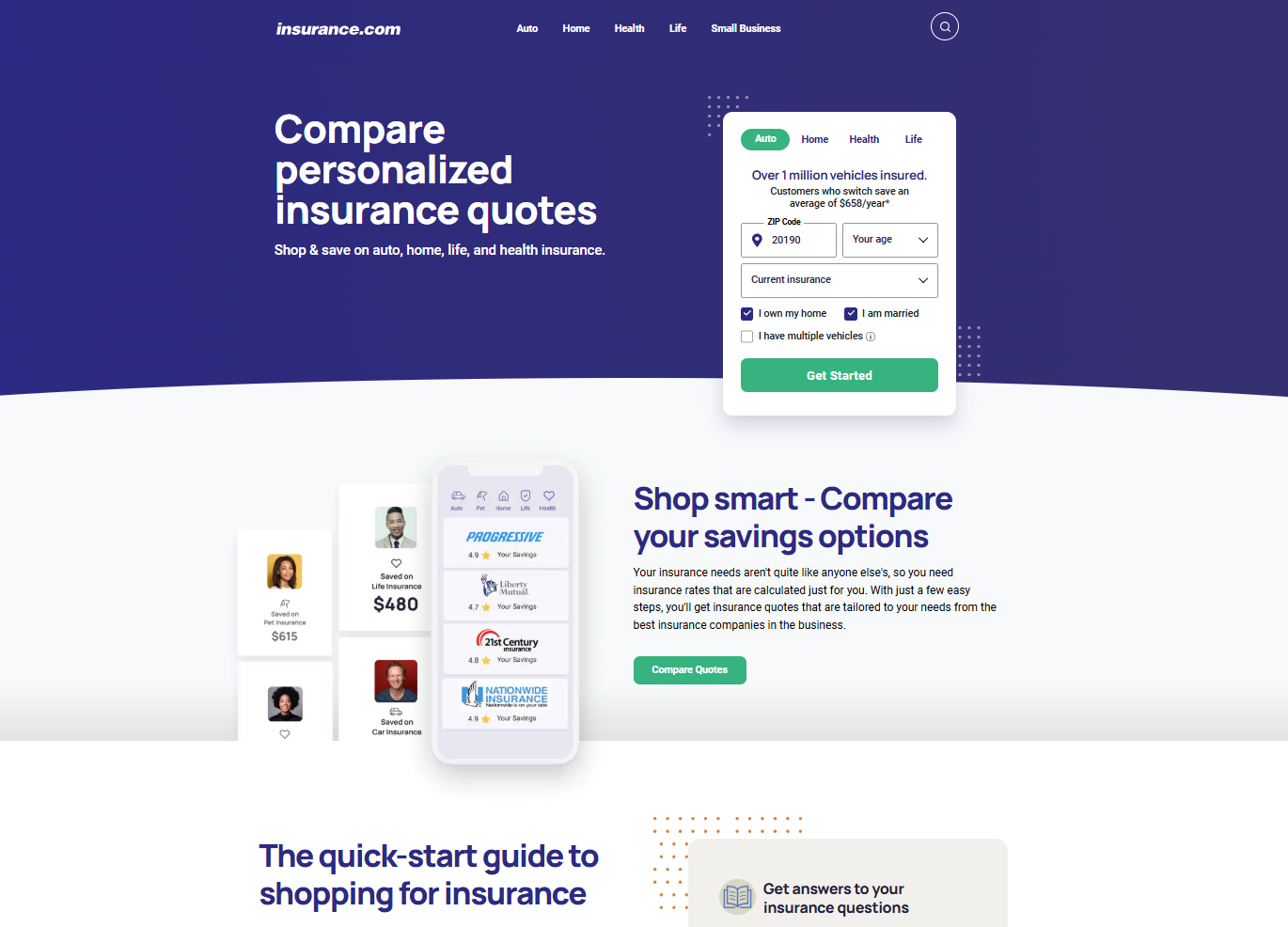

Insurance.com vs. Insurify: Which Quote Tool Offers the Better Experience

When comparing Insurance.com to Insurify, the biggest difference shows up in user experience and customer satisfaction. Insurify reviews clearly come out ahead in terms of mobile access and reviews. It’s available on both the App Store and Google Play with a 3.4/5 rating on each, while Insurance.com doesn’t offer an app at all.

Insurance.com vs. Insurify: Third-Party Customer Ratings

| Reviewer |  | |

|---|---|---|

| X | 3.4 / 5.0 (141 reviews) | |

| C- | A+ | |

| X | 3.8 / 5.0 (130+ reviews) | |

| X | 3.4 / 5.0 (141 reviews) | |

| 2.9 / 5.0 (2 reviews) | 4.7 / 5.0 (2k+ reviews) | |

| X | 4.1 / 5.0 (70+ reviews) |

Insurify also earns strong marks with a 4.7/5 on Trustpilot (from over 2,000 users), 4.1/5 on WalletHub, and an A+ rating from the BBB. In contrast, Insurance.com has a 2.9/5 on Trustpilot from just two users and a C- with the BBB.

Insurance.com still offers value with in-depth content, rate calculators, and side-by-side comparisons that can be useful if you want to dive into the details of a policy, not just find the lowest price.

Insurance.com vs. NerdWallet: Which Tool Do Users Trust More

When you stack Insurance.com against NerdWallet insurance reviews, the difference in user experience is pretty clear. NerdWallet has built a strong reputation for user satisfaction, including a 4.8 out of 5 on the App Store and 4.5 on Google Play, not to mention an A+ BBB rating and strong showings on PCMag and Trustpilot.

Insurance.com vs. NerdWallet: Third-Party Customer Ratings

| Reviewer |  | |

|---|---|---|

| X | 4.8 / 5.0 (115k+ reviews) | |

| C- | A+ | |

| X | 4.5 / 5.0 (29.9k reviews) | |

| X | 4.0 / 5.0 | |

| 2.9 / 5.0 (2 reviews) | 3.7 / 5.0 (2k+ reviews) | |

| X | 1.5 / 5.0 (10+ reviews) |

Insurance.com, on the other hand, doesn’t have much of a presence on app stores and holds a C- with the BBB, along with a lower Trustpilot rating. If you’re looking for a more polished, highly-rated tool that users consistently trust for both ease and reliability, NerdWallet clearly leads the way.

What Sets Insurance.com Apart

Since being acquired by QuinStreet, Inc., in 2010 for $35.6 million, Insurance.com has operated as a subsidiary focused on providing consumers with transparent insurance rate information and tools.

Insurance.com Company Overview

| Details |  |

|---|---|

| Category | Details |

| Founders | Louis Geremia |

| Founded | 2000 |

| Headquarters | 950 Tower Lane, Suite 1200, Foster City, CA 94404, United States |

| What They Offer | Comparison tools and resources for various insurance products, including auto, life, home, and health insurance. |

| Employees | 150+ |

| Revenue | $14.9M |

| Phone | 727-367-6900 |

| [email protected] |

With over two decades in the space, it has built a reputation around data-backed guidance and practical resources. If you’re looking to compare personalized insurance quotes.

Insurance.com’s platform is built to make comparison shopping easy, especially for people who don’t want to deal with multiple calls or websites. It leverages advanced technology and partnerships to give users up-to-date pricing from trusted carriers.

It’s essential to keep in mind that Insurance.com is less an operator than a tool. It’s not processing claims or writing policies. It simply pulls quotes and steers you to the insurer that best meets your needs.

Pros and Cons of Using Insurance.com

If you’re thinking about where to compare auto insurance rates, before using Insurance.com, it helps to know what you’re getting into before clicking around. Some of its benefits include:

- Side-by-Side Quotes: The best things about Insurance.com are how easily it lays out rates from different companies in one spot. Enter your ZIP code, answer a few questions, and get a clean snapshot.

- Helpful Tools and Guides: Their coverage calculators, rate breakdowns, and educational content actually help you make informed decisions. It’s built for regular drivers, not insurance experts.

- Expert-Reviewed Content: Unlike some quote sites that just push sales, Insurance.com backs its info with licensed professionals. That means what you read is usually accurate and based on current data.

The platform has been around for over two decades, and while it offers some real conveniences, it’s not perfect. Here’s a quick, honest rundown of the not-so-good features:

- Can’t Finalize Your Policy: Although the site compares rates, you’ll have to navigate over to your insurance site to buy an actual policy. It’s an additional step that can seem a bit cumbersome.

- Mixed User Experiences: Some users report smooth comparisons, others say they didn’t get as many quotes as expected, or found the interface a bit dated; your results may vary.

Just know it’s a comparison tool, not a one-stop shop, and your experience may depend on how much info you’re willing to share. It won’t work for everyone, and you may have better luck with our free quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Insurance.com Helps You Compare Auto Insurance Quickly

If you’re not sure how to evaluate auto insurance quotes, our Insurance.com auto insurance review found it’s a no-frills way to compare real-time auto insurance quotes from multiple providers in one place.

It doesn’t sell policies directly, and it isn’t as polished or highly rated as competitors like Insurify or NerdWallet, but it does the job when it comes to basic comparison shopping. If you prefer to do your own research and don’t mind a bare-bones interface without all the bells and whistles, it can help you narrow your choices.

Just know it’s a quote tool, not a hands-on service. Your experience will depend on the insurers you connect with through the platform. If you want access to local companies and more personalized quotes, use our free quote tool instead. Just enter your ZIP code to get started.

Frequently Asked Questions

Is Insurance.com legit for comparing quotes?

Yes, Insurance.com is a legitimate source for comparing insurance quotes. It partners with reputable national and regional insurers and uses secure tools to deliver side-by-side rate comparisons.

How do you explain an insurance company like Insurance.com?

Insurance.com is not an insurance carrier. It is a licensed insurance marketplace that allows users to compare online auto insurance companies with multiple quotes through affiliated providers.

What is an insurance company example that’s like Insurance.com?

A comparable example to Insurance.com is Insure.com, which also provides insurance comparison tools. Is Insure.com legit? Both are part of QuinStreet’s portfolio, and they don’t sell insurance directly but connect users to licensed insurers for auto, home, and other coverage types.

What is the benefit of using Insurance.com?

The biggest benefit is convenience and cost savings. Insurance.com lets you compare quotes from multiple insurers in one place, often in under five minutes. If you want to compare insurance rates right now, enter your ZIP code.

Which is the best company for insurance quotes on Insurance.com?

According to Insurance.com’s data, Erie Insurance is ranked as the top pick for auto insurance quotes, with a 4.7 out of 5 score in customer satisfaction, claims handling, and affordability. Learn more in our Erie auto insurance review.

Who owns the Insurance.com company?

Insurance.com is owned by QuinStreet, Inc., a publicly traded digital marketing company based in Foster City, California. QuinStreet also owns other consumer-focused insurance websites, including Insure.com and CarInsurance.com, and partners with dozens of top-tier insurance providers.

What is the main function of Insurance.com in insurance shopping?

Insurance.com’s main function is to simplify the insurance shopping process. It offers users customized rate comparisons, insurer reviews, discount information, and educational tools. It doesn’t issue policies, but it connects users to licensed agents or the insurer’s quoting system to purchase coverage.

What insurance company makes the most money on Insurance.com?

While Insurance.com doesn’t publish revenue by carrier, large insurers like State Farm, Progressive, and Allstate auto insurance tend to dominate listings due to their advertising budgets and national reach. However, smaller companies like Erie and Auto-Owners often offer cheaper rates and higher satisfaction scores.

How important is the Insurance.com company when comparing quotes?

If you’re looking for a trustworthy tool to compare quotes, check out Insurance.com. It works with more than 70 carriers and evaluates rates at 34,000+ ZIP codes. It offers price comparisons as well as complaint ratios, A.M. Best ratings, and customer satisfaction scores to help consumers make informed decisions.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

How does Insurance.com work for auto insurance quotes?

You enter your ZIP code and basic driving details on Insurance.com, and the site uses that data to pull quotes from its partner insurers. You can compare rates, adjust coverage levels, and in some cases, complete the purchase online. The quotes are tailored using factors like driving record, credit score, and vehicle details.

How do insurance companies help drivers through platforms like Insurance.com?

Insurers use platforms like Insurance.com to reach qualified leads and offer competitive rates. Consumers win by receiving personalized quotes, the capacity to access real customer reviews, and parts of discounts on car insurance that they might not otherwise have found. In return, insurers acquire new customers at a lower acquisition cost.

What are Good2GoInsurance.com reviews and ratings like?

Good2Go auto insurance reviews are mixed. Many customers cite it as a budget-friendly option for minimum coverage, especially for high-risk drivers. However, it holds a lower-than-average customer satisfaction score in third-party surveys. It’s best for drivers looking for immediate SR-22 filings or basic coverage, but not ideal for full-service needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.