Cincinnati Auto Insurance Review for 2025 (Rates, Discounts, & Options)

Our Cincinnati auto insurance review breaks down the pros and cons of Cincinnati Insurance. Minimum coverage rates start at $46 a month, and it offers discount savings up to 25%. Cincinnati Insurance Company reviews give it high marks for financial strength, broad coverage options, and low complaint levels.

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Apr 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Cincinnati Insurance Company

Average Monthly Rate For Good Drivers

$46A.M. Best Rating:

A++Complaint Level:

LowPros

- Superior A++ financial rating

- Robust mobile app features

- Extensive coverage flexibility

Cons

- Higher premiums for high-risk profiles

- No online quotes

Get a closer look at what this company offers in our Cincinnati auto insurance review, from policy options to digital tools like the MyCincinnati app and RideWell.

Cincinnati Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 4.1 |

| Business Reviews | 4.5 |

| Claims Processing | 3.5 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.0 |

| Customer Satisfaction | 2.0 |

| Digital Experience | 3.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.1 |

| Plan Personalization | 4.5 |

| Policy Options | 3.8 |

| Savings Potential | 4.4 |

Cincinnati Insurance adjusts rates based on your age, credit, and driving record, so compare its discount programs below to see how much you can save with safe driver and multi-vehicle auto insurance discounts. Cincinnati Insurance earns high marks for financial strength and offers solid flexibility through optional add-on coverages.

- Cincinnati Insurance Company reviews give it a strong 4.1/5

- Use the RideWell app for flexible coverage and up to 25% in discounts

- Cincinnati Insurance rates start at $46 per month

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code into our comparison tool today.

Comprehensive Guide to Cincinnati Auto Insurance Rates

This table showcases Cincinnati auto insurance rates by age. It gives a clear breakdown from teens to seniors. Teens pay the most, starting at $170 monthly for minimum coverage up to $340 per month for full coverage. On the other end, 65-year-old males pay $87 and $155, respectively.

Cincinnati Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $170 | $340 |

| 16-Year-Old Male | $190 | $380 |

| 18-Year-Old Female | $150 | $310 |

| 18-Year-Old Male | $172 | $350 |

| 25-Year-Old Female | $95 | $191 |

| 25-Year-Old Male | $110 | $220 |

| 30-Year-Old Female | $85 | $173 |

| 30-Year-Old Male | $96 | $180 |

| 45-Year-Old Female | $80 | $160 |

| 45-Year-Old Male | $78 | $102 |

| 60-Year-Old Female | $75 | $150 |

| 60-Year-Old Male | $86 | $160 |

| 65-Year-Old Female | $81 | $150 |

| 65-Year-Old Male | $87 | $155 |

This provides a direct look at how your age and the coverage you select can impact your Cincinnati Insurance premiums. Below, you will see how driving records impact Cincinnati auto insurance costs.

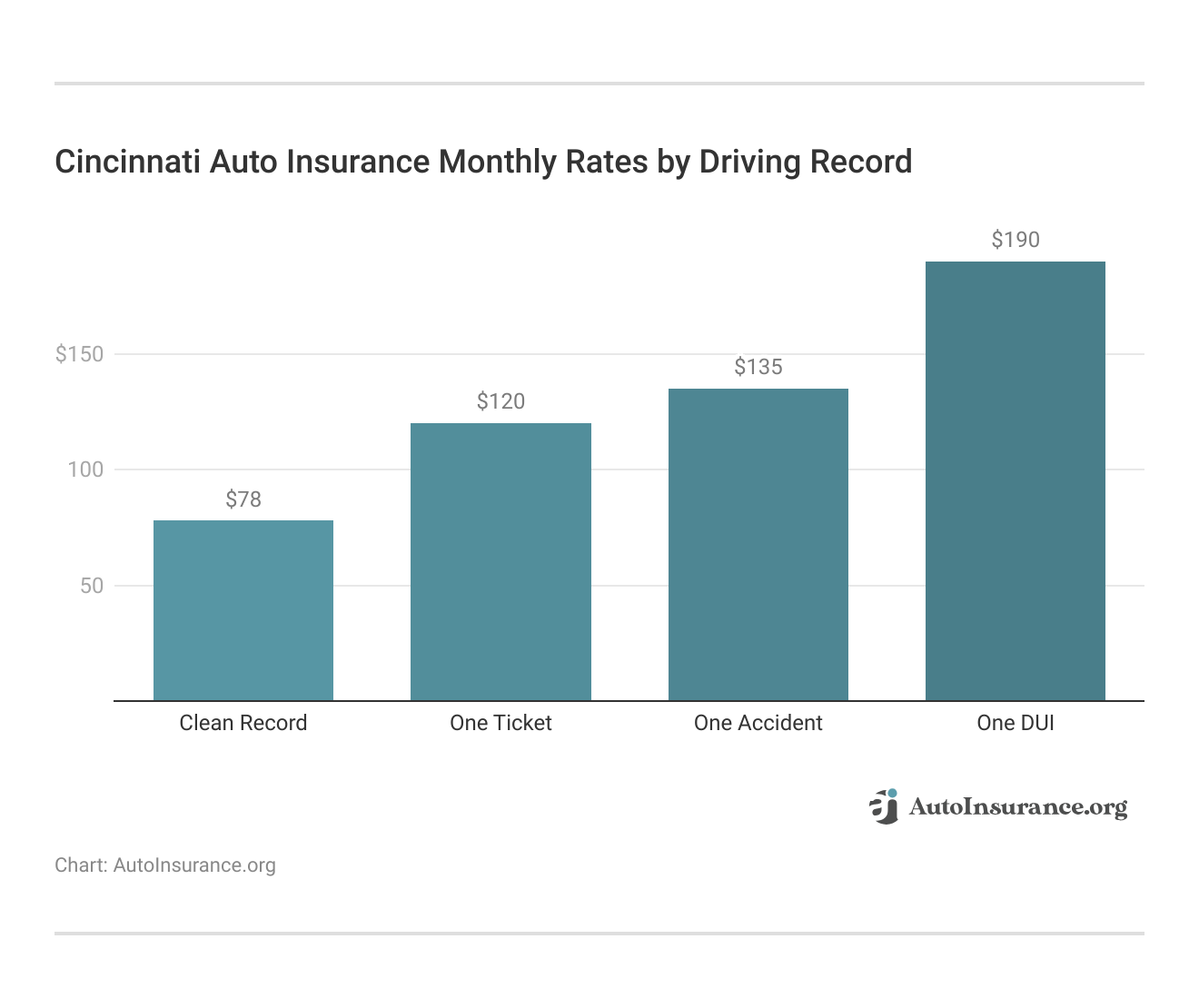

For drivers with a DUI, Cincinnati’s rates increase to $310 for full coverage, which is still less drastic than what you might see with other companies. How does the Cincinnati Indemnity Company compare to the competition? Scroll down to explore more auto insurance quotes.

Affordable Cincinnati Auto Insurance Rates in a Competitive Market

Cincinnati Insurance Company really holds its own when you compare its car insurance rates with other providers. It’s a great choice for those watching their budget. For example, Cincinnati offers minimum coverage starting at just $46 a month, which is a lot more affordable than competitors such as Allstate and Liberty Mutual, where prices kick off at $87 and $96 monthly.

Cincinnati Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $46 | $157 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 |

This makes Cincinnati a better option for those who want to keep their costs as low as possible, without cutting back on coverage quality. Monthly full coverage is more expensive if comparing Cincinnati versus State Farm, but it’s a bargain at $157 per month when compared to the $228 per month at Allstate and the $248 per month Travelers charges.

It manages to undercut several larger insurers, providing substantial coverage at a fraction of the cost, which reflects Cincinnati’s balanced approach to risk pricing. Various Cincinnati Insurance auto insurance reviews recommend it as an excellent choice for drivers of all kinds who are in search of comprehensive yet moderately priced insurance coverage.

Competitive Cincinnati Insurance Auto Rates Across Credit Scores

Cincinnati Insurance Company is one of the companies that stands out from the competition, offering full coverage with monthly rates tailored to varying credit scores. Cincinnati’s rate for good credit is $157 a month. While not the cheapest, Cincinnati’s quality of service and coverage provide good value.

Cincinnati Auto Insurance Full Coverage Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $125 | $145 | $200 | |

| $128 | $148 | $198 | |

| $157 | $179 | $190 |

| $135 | $160 | $220 | |

| $110 | $130 | $180 | |

| $130 | $155 | $210 |

| $118 | $138 | $188 |

| $120 | $140 | $190 | |

| $105 | $125 | $175 | |

| $115 | $135 | $185 |

For poor credit categories, Cincinnati’s rates of $190 per month remain more affordable than many competitors. For example, Farmers charges significantly more at $220 monthly, and Liberty Mutual’s rates are $210 per month for the same credit status.

This pricing strategy leads to many positive Cincinnati Insurance car insurance reviews, as it’s an attractive option for people with subpar credit or those concerned about how credit scores affect auto insurance rates. Cincinnati’s consistent rates for various credit profiles speak to its affordability while maintaining coverage quality.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Get The Best Savings With Cincinnati Auto Insurance Discounts

Cincinnati Insurance Company provides a set of discounts that can drastically reduce the cost of your auto insurance. For instance, you can save up to 20% by bundling your policies. The multi-car discount is on the high side at 25%.

Cincinnati Auto Insurance Discounts by Savings Potential

| Discount |  |

|---|---|

| Advance Purchase | 10% |

| Anti-Theft Device | 15% |

| Bundling | 20% |

| Good Claim History | 10% |

| Good Student | 20% |

| Healthy Living | 5% |

| Homeowner | 10% |

| Multi-Car | 25% |

| RideWell℠ Program | 18% |

| Safe Driver | 20% |

| Safety Equipment | 10% |

They also reward responsible behavior to help lower expensive teen insurance rates. Students with good grades can reduce their premiums by 20% through the good student discount.

Safe drivers can save up to 20% by maintaining a clean driving record. Participating in the RideWell program offers an additional 18% discount for tracking safe driving habits with telematics. Installing anti-theft devices gives a person a 15% discount, and being a homeowner will give you an additional 10% discount.

Cincinnati Insurance Company Reviews & Ratings

Who are the reputable auto insurance companies? Cincinnati Insurance Company has earned solid ratings from numerous agencies, supporting its creditor reliability and strength. For example, J.D. Power scores Cincinnati at 820 out of 1000, reflecting high levels of customer satisfaction.

Cincinnati Insurance Company Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 820/ 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 75/100 Above Avg. Customer Satisfaction |

|

| Score: 0.65 Fewer Complaints Than Avg. |

|

| Score: A++ Superior Financial Strength |

Cincinnati Insurance Company reviews by Consumer Reports score a 75 out of 100, and the Better Business Bureau (BBB) rates it an A+, supporting its reputation for customer satisfaction. The NAIC rating of 0.65 indicates that Cincinnati Insurance has fewer complaints than average, underscoring its reliability.

To file a claim with Cincinnati Insurance, simply call their 24/7 support or use the MyCincinnati app for quick, hassle-free processing.Dani Best Licensed Insurance Producer

Additionally, the company’s reputation is well illustrated through customer feedback, as one Reddit user says here, praising Cincinnati’s replacement cost to actual cash value when it comes to claims.

The Cincinnati Insurance A.M. Best rating is A++, and Cincinnati home insurance reviews frequently highlight the company’s excellent service and claims handling.

Read More: Where can I compare online auto insurance companies?

Comprehensive Coverage Options From Cincinnati Insurance

If you want to protect your assets, the right types of auto insurance coverage will make all the difference. Cincinnati Insurance Company provides a wide array of custom insurance coverage options. Let’s take a closer look at the top-tier coverage options to come out of Cincinnati Financial Corporation:

- Classic Car Insurance: Underwritten exclusively for antique and collector cars, this coverage protects your limited-usage vehicles on terms reflecting their true value.

- Bundled Policies: Bundle all your vehicle policies — including cars, motorcycles, and classic cars — into one policy for simplicity and ease.

- Replacement Cost Plus: This option provides an additional level of protection by paying for a replacement vehicle in the event yours is totaled, avoiding the depreciation issue that usually affects payout amounts.

- Auto Plus Endorsement: Get no-deductible windshield repairs, roadside assistance, and more for enhanced coverage and peace of mind.

- Tailored Personal Insurance: Cincinnati Insurance provides coverage customized to your specific needs for total protection.

With Cincinnati Insurance auto insurance, you’re investing in comprehensive protection for what matters most. Whether it’s your daily commute, a classic show car, or securing your family’s future, Cincinnati’s coverage options provide robust protection.

View this post on Instagram

Need to tailor your plan? Contact a Cincinnati agent today using the Cincinnati Insurance Company phone number provided on its website. Or you can enter your ZIP code to find tailored insurance plans near you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of Cincinnati Insurance Company

Cincinnati Insurance stands out for its strong financial stability and a range of coverage options. Here are a few more details that might make Cincinnati a good option for you:

- Strong Financial Rating: Cincinnati also brings an A++ (Superior) financial strength rating from A. M. Best.

- Extensive Discount Offers: From multi-car to safe driver discounts, Cincinnati offers various ways to save on premiums, making it financially attractive.

- Innovative Mobile Apps: The MyCincinnati and RideWell apps enhance user experience by providing easy access to policy management and lower usage-based rates (Read More: Best Auto Insurance Apps).

While there are several compelling reasons to consider Cincinnati Insurance, there are also areas where they might not meet everyone’s needs. Keep in mind that it may fall a little bit short:

- No Online Quotes: If you want to buy Cincinnati Insurance car insurance, you have to use an agent to get quotes and pick a policy.

- Coverage Costs: Premiums can be higher than average, particularly for individuals with less-than-perfect driving records, making the coverage less competitive for some potential customers.

Cincinnati Indemnity Company presents a strong insurance option with many attractive features that can easily outweigh the downsides in accordance with your needs and priorities.

Why Cincinnati Insurance Company Stands Out

This Cincinnati auto insurance review finds that the company stands out as a top auto insurer for its strong financial stability, low complaint levels, and comprehensive auto insurance coverage. Features such as the RideWell and MyCincinnati mobile apps emphasize its goal to tailor rates and customer service experiences.

Cincinnati Insurance Company earns its place as one of the better auto insurers for drivers with poor credit. It also offers bigger discounts than its competitors, especially for insuring more than one car and bundling multiple policies.

Bundling your policies with Cincinnati Insurance can slash your premiums by up to 25%, providing substantial savings with comprehensive coverage.Aremu Adams Adebisi Feature Writer

Cincinnati Insurance presents a well-rounded mix of value, protection, and tailored service. If you’re evaluating your insurance needs, protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What is Cincinnati Insurance known for?

Cincinnati Insurance excels in providing customized policies, exceptional claims service, and user-friendly digital tools like the MyCincinnati and RideWell apps.

Does Cincinnati Insurance pay claims?

Yes, Cincinnati Insurance is recognized for its efficient claims process, consistently receiving low complaint ratios in this area from the National Association of Insurance Commissioners (NAIC).

Is Cincinnati Insurance cheap?

Cincinnati Insurance auto insurance is one of the most affordable car insurance companies, offering competitive pricing, especially beneficial to those with bad credit and who qualify for multiple discounts, such as bundling, safe driver discounts, and loyalty incentives, which can significantly lower premiums.

Is Cincinnati Insurance a good carrier?

Cincinnati Insurance is not only good but excellent, maintaining an A++ rating from A.M. Best, which is the highest possible rating, indicating exceptional financial health and claims-paying ability.

How long has Cincinnati Insurance been in business?

Cincinnati Insurance was founded in 1950 and has over 70 years of experience providing customized insurance offerings, along with a history of strong customer satisfaction.

Is Cincinnati Insurance an admitted carrier?

Yes, Cincinnati Insurance operates as an admitted carrier in 46 states, adhering to state regulatory standards. This compliance impacts auto insurance rates by state, so Cincinnati insurance costs will vary based on where you live.

What states does Cincinnati Insurance cover?

Cincinnati Insurance provides coverage in 46 states, with the only exceptions being Alaska, Hawaii, Louisiana, and Massachusetts.

Is Cincinnati Financial a good place to work?

Cincinnati Financial is recognized for its strong corporate culture, which emphasizes employee development, competitive benefits, and a supportive work environment, consistently receiving high ratings on employer review sites such as Glassdoor.

Does Cincinnati Insurance cover rental cars?

Cincinnati Insurance auto insurance policies generally include rental car reimbursement coverage, helping you cover the cost of a rental while your vehicle is repaired under a covered claim.

What is the BBB rating for Cincinnati Insurance?

Cincinnati Insurance holds an exemplary A+ rating from the Better Business Bureau (BBB), reflecting its commitment to resolving consumer issues and maintaining trust in its business practices.

How do you file a claim with Cincinnati Insurance?

Cincinnati Insurance offers customers various claims-filing methods, such as online through their website, through the MyCincinnati mobile app, and by phone. The company prides itself on an easy claims process and round-the-clock support.

How does Cincinnati Insurance vs. State Farm compare in terms of product offerings and customer satisfaction?

Cincinnati Insurance often equals State Farm in customer satisfaction, particularly in claims handling and personalized service, although State Farm often has cheaper rates. Compare quotes in our State Farm auto insurance review.

Is Cincinnati auto insurance expensive?

While individual premiums vary based on several factors, Cincinnati Insurance car insurance rates are typically lower than other national providers like Allstate and Liberty Mutual. Enter your ZIP code into our free quote tool to find the best auto insurance rates in your city.

How many people work at Cincinnati Insurance?

Cincinnati Insurance employs approximately 4,500 individuals across its various divisions and headquarters.

Cincinnati Insurance vs Chubb: Which provides more value in their policies?

Cincinnati Insurance is often better for more professional and value-rich policy problems, while Chubb auto insurance is generally a better fit for high-value properties and global coverage capabilities. Read our Chubb Insurance review to learn more about the company.

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.