Liability vs. Full Coverage Auto Insurance in 2025 (Differences Explained)

When you’re comparing liability vs. full coverage auto insurance, the most important things to look at are price and coverage. State minimum liability insurance starts at $43 a month, but it doesn’t cover your vehicle. At $104 per month, full coverage auto insurance costs more but offers better protection.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Apr 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

When you’re comparing liability vs. full coverage auto insurance, the main differences are price and coverage limits. Liability-only auto insurance is cheaper, but full coverage offers better protection for new or leased cars.

Full coverage auto insurance pays for your vehicle repairs and medical expenses after an accident. However, it’s not right for everyone — liability insurance is a better choice for people with older, less valuable vehicles.

- Liability insurance pays for damages and injuries you cause in an accident

- Full coverage covers your vehicle, you, and your passengers

- Liability rates start at $43 a month, while full coverage starts at $104 monthly

Read on to explore full coverage vs. liability car insurance. Then, enter your ZIP code into our free comparison tool to see liability and full coverage rates.

Choosing between liability and full coverage car insurance might seem confusing, but it doesn’t have to be. The following tips will help you pick the perfect coverage.

Liability And Full Coverage Auto Insurance Explained

When purchasing car insurance, one of the biggest decisions you’ll face is whether to choose liability-only coverage or full coverage. Liability auto insurance covers your financial responsibility after an at-fault accident, while full coverage bundles a variety of insurance types into one policy.

The main difference between liability and full coverage is that liability-only auto insurance doesn't cover your vehicle.Scott W. Johnson Licensed Insurance Agent

Liability insurance is the minimum coverage required by law in most states and pays for damages you cause to others in an accident. While there are many factors to consider, liability insurance is always cheaper than full coverage.

Full coverage, on the other hand, includes liability coverage plus additional protection for your own vehicle. Check out the rates below to see the difference in price between liability and full coverage.

Liability vs. Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | Liability Coverage | Full Coverage |

|---|---|---|

| Age: 17 Female | $428 | $595 |

| Age: 17 Male | $462 | $653 |

| Age: 25 Female | $150 | $268 |

| Age: 25 Male | $158 | $282 |

| Age: 35 Female | $142 | $229 |

| Age: 35 Male | $145 | $231 |

| Age: 60 Female | $135 | $200 |

| Age: 60 Male | $138 | $202 |

The right choice depends on your car’s value, budget, and your own risk tolerance. While liability-only insurance is more affordable, full coverage offers greater financial security, particularly for newer or financed vehicles. Additionally, you’ll probably need full coverage if you have a loan or lease on your vehicle.

Read More: Auto Insurance Rates by Age

What Liability Auto Insurance Covers

Liability insurance covers damages and injuries you cause to other people and their property in an at-fault accident. It typically includes:

- Bodily Injury Liability (BIL): Bodily injury liability insurance covers medical expenses, lost wages, and legal fees for other parties involved in an accident you cause. Most states require more BIL coverage than property damage.

- Property Damage Liability (PDL): Property damage liability insurance pays for damage to other vehicles, buildings, or objects. The best companies for property damage liability insurance usually offer this coverage at an affordable price.

Liability insurance does not cover your own vehicle repairs or medical expenses. Because of this, it’s often best suited for older, lower-value cars where the cost of full coverage may outweigh the benefits.

What Full Coverage Auto Insurance Covers

Many lenders require full coverage for financed or leased vehicles. Full coverage includes liability insurance plus additional protections for your own vehicle.

- Collision Coverage: Pays for damage to your car from a crash, regardless of fault.

- Comprehensive Coverage: Covers non-collision damages, such as theft, vandalism, fire, and natural disasters.

While it costs more than liability insurance, it provides peace of mind by protecting your own vehicle from a broader range of risks.

Wondering when it is best to drop full coverage auto insurance? If you own your car and you can afford to replace it, it may be the right time to drop full coverage insurance. However, full coverage doesn’t cover everything.

Is full coverage really full?🚗Looks can be deceiving – it doesn’t cover everything.🚫 Have you wondered what additional coverage you may need? 👉 https://t.co/ZzJApDfK36 Use our FREE💸search to price compare insurance rates near you: https://t.co/27f1xf131D pic.twitter.com/9QnH5Wjsv8

— AutoInsurance.org (@AutoInsurance) February 22, 2023

If you’re interested in more insurance than what full coverage offers, most major insurance companies sell add-ons to increase your coverage.

Other Types of Auto Insurance

While comparing minimum vs. full coverage auto insurance is enough for many drivers, there are plenty of other types of auto insurance you can add to your policy for more coverage.

Some of the most popular add-ons drivers choose to add to their policies are gap insurance, roadside assistance, and rental car reimbursement. While it’s never a bad idea to add more coverage to your policy, make sure to only purchase what you need. Add-ons are usually affordable, but they can add up quickly.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Liability vs. Full Coverage Auto Insurance Rates

The average monthly cost of auto insurance depends on several factors, including your age, location, and vehicle value. While there are many factors that affect car insurance rates, liability insurance is always cheaper than full coverage.

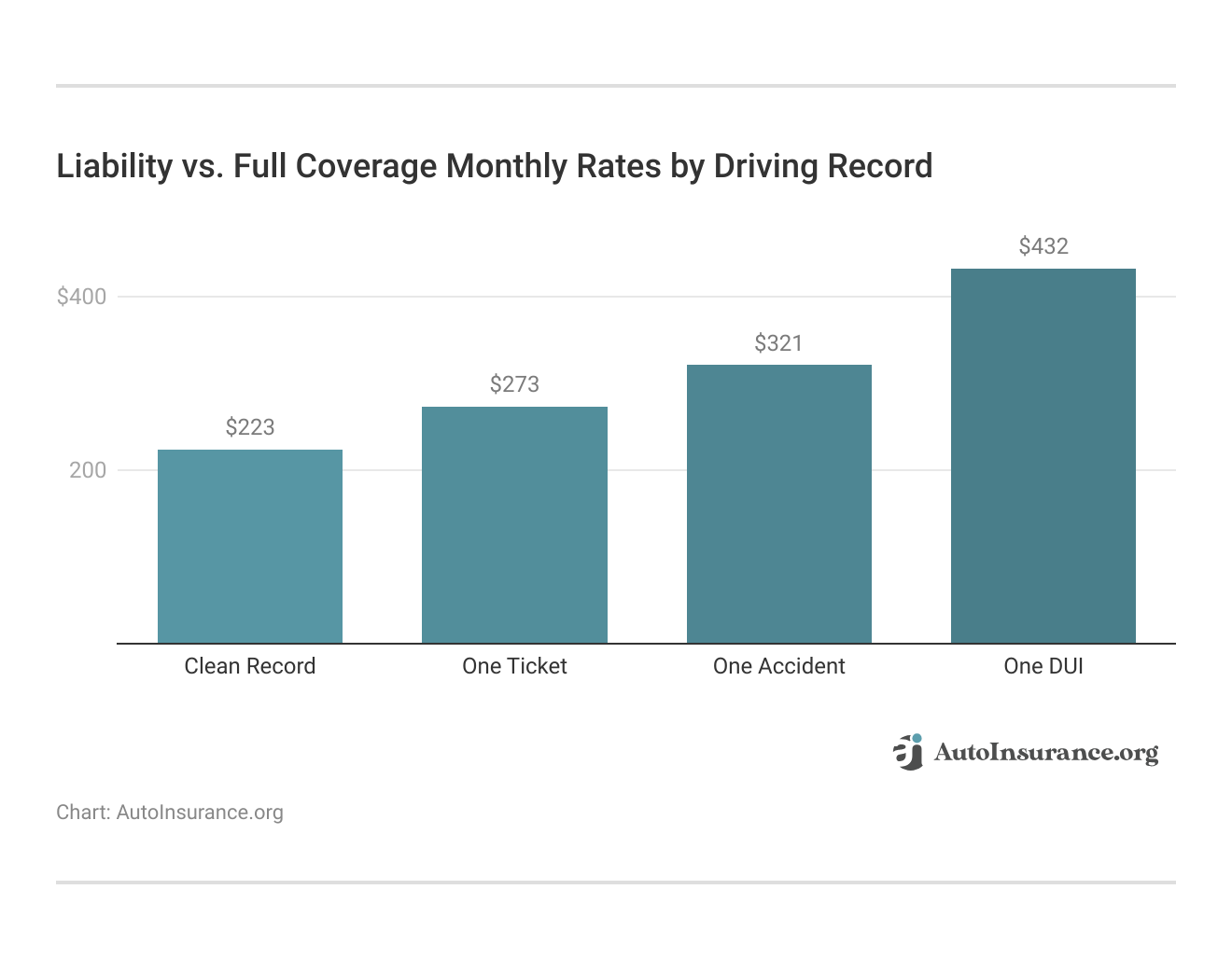

However, one of the most impactful factors on your insurance rates is your driving record. Take a look below to compare liability vs. full coverage auto insurance rates based on what is in your driving record.

People with traffic violations like speeding tickets, at-fault accidents, and DUIs will pay more for their car insurance. Shopping around and applying discounts, such as bundling or good driver discounts, can help lower costs.

One of the most important steps to take when you’re deciding to purchase Liability vs. full coverage car insurance is to compare multiple providers. Compare the price difference between liability and full coverage auto insurance from the top companies below.

Liability vs. Full Coverage Auto Insurance Monthly Rates by Top Providers

| Company | Liability Coverage | Full Coverage |

|---|---|---|

| $95 | $178 | |

| $75 | $115 | |

| $43 | $128 |

| $105 | $173 | |

| $65 | $104 | |

| $110 | $190 |

| $85 | $123 |

| $80 | $128 | |

| $70 | $107 | |

| $78 | $113 |

As you can see, there can be significant variations between companies. The prices listed above are only averages, too – you’ll need a personalized quote to compare rates specific to you.

Getting individual quotes is the best way to compare minimum vs. full coverage auto insurance rates, but it can be time-consuming. If you want to skip the hassle of filling out multiple applications, enter your ZIP code into our free comparison tool to see rates specific to you.

How to Choose the Right Amount of Full Coverage vs. Liability Auto Insurance

Deciding between full coverage vs. liability auto insurance can be confusing, especially if you’ve never purchased a policy before. When you’re weighing the pros and cons of liability vs. full coverage, here’s what you should consider:

- Your Vehicle’s Value: If your car is worth less than a few thousand dollars, full coverage may not be cost-effective.

- Your Financial Situation: Can you afford to repair or replace your car out of pocket? If not, full coverage may be a better choice.

- State Requirements: While no state requires full coverage, some have higher requirements than others. Make sure to check state car insurance requirements where you live to make sure you have enough coverage.

- Lender Requirements: Full coverage is usually required if your car is leased or financed.

If your car is newer or you live in an area with high accident or theft rates, full coverage may be worth the extra cost. However, you’re not stuck with full coverage insurance forever. Determining when to drop full coverage auto insurance is an essential part of evaluating your insurance needs from time to time.

The best time to drop full coverage is when you pay off a loan, or when your car loses enough value that paying higher premiums is no longer worth it.Heidi Mertlich Licensed Insurance Agent

Now that you know the difference between liability auto insurance vs. full coverage, your next step is to pick the right policy for you. Although full coverage offers better protection, some drivers are better served by a liability-only policy. Figuring out how much coverage you need is an integral part of learning how to evaluate auto insurance quotes to ensure you don’t pay for too much coverage.

After you know what insurance you want, your next step is to compare quotes from as many companies as possible. Start comparing liability vs. full coverage car insurance by entering your ZIP code into our free comparison tool today.

Frequently Asked Questions

What does liability auto insurance cover?

Liability insurance covers damage and injuries you cause in an at-fault accident. When you compare liability insurance vs. comprehensive coverage, collision insurance, or other types of insurance, liability is one of the only coverage types that does not cover your vehicle.

What does full coverage auto insurance cover?

Full coverage auto insurance is a combination of insurance types, including liability, comprehensive, and collision insurance. While they’re not typically included in a full coverage policy, many drivers elect to add uninsured motorist or personal injury protection coverage to their policies.

Does full coverage include liability insurance?

Yes, liability insurance is one type of coverage included in a full coverage policy.

Who has the cheapest liability auto insurance?

While a variety of factors affect your insurance rates, the companies with the cheapest liability-only auto insurance are typically Erie Insurance, Geico, and State Farm. Depending on your situation, you can find rates as low as $43 per month.

Who has the cheapest full coverage auto insurance?

Geico, State Farm, and Travelers are usually the cheapest full coverage auto insurance companies, with rates starting as low as $104 per month.

Is liability auto insurance the same as minimum insurance coverage?

Although liability auto insurance is usually included in state requirements, it may not be the minimum amount of coverage that you need. Some states require uninsured motorist insurance or personal injury protection coverage before you can drive. You can enter your ZIP code into our free quote generator, and it will automatically tell you the minimum amount of insurance you need.

Is it better to have liability or full coverage auto insurance?

There are several things to keep in mind when you’re comparing full coverage vs. liability car insurance. Full coverage is better for people with expensive cars, loans, or leases on their vehicles, or who want more protection. Liability insurance is a better choice for people who own their car outright and can afford to replace it.

Is full coverage the same as comprehensive auto insurance?

When you compare full coverage vs. comprehensive car insurance, you’ll see that comprehensive only covers damage from unexpected events, like fires, floods, and vandalism. Full coverage, on the other hand, is a combination of several types of insurance. Comprehensive coverage is included, but full coverage also includes liability and collision.

When should you switch from full coverage to liability insurance?

When you’re trying to decide if you should keep full coverage or switch to liability-only, an easy way to decide is to look at the value of your car. If your car’s value is less than your deductible plus your premium, then you may be ready to switch. Additionally, you don’t need full coverage insurance if you own your car outright and you can afford to replace it.

Learn More: What are the recommended auto insurance coverage levels?

Is full coverage auto insurance required?

While state minimum liability insurance requirements vary, no state requires drivers to carry full coverage. However, lenders typically require full coverage insurance if you have a loan or lease on your vehicle.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.