Trumbull Auto Insurance Review in 2025 (Get the Inside Scoop)

This Trumbull auto insurance review details why Trumbull excels by providing top-tier policies solely for AARP members, with rates starting at $50 per month. Trumbull’s strong benefits, like new car replacement and Recover Care services, make it an ideal choice for senior drivers seeking value.

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Feb 8, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 8, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

![]() 0 reviews

0 reviews

Trumbull Insurance Company

Average Monthly Rate For Good Drivers

$50A.M. Best Rating:

A+Complaint Level:

HighPros

- Trumbull car insurance is backed by The Hartford, a reputable provider

- Offers a lifetime guarantee on car repairs if repaired at authorized dealers

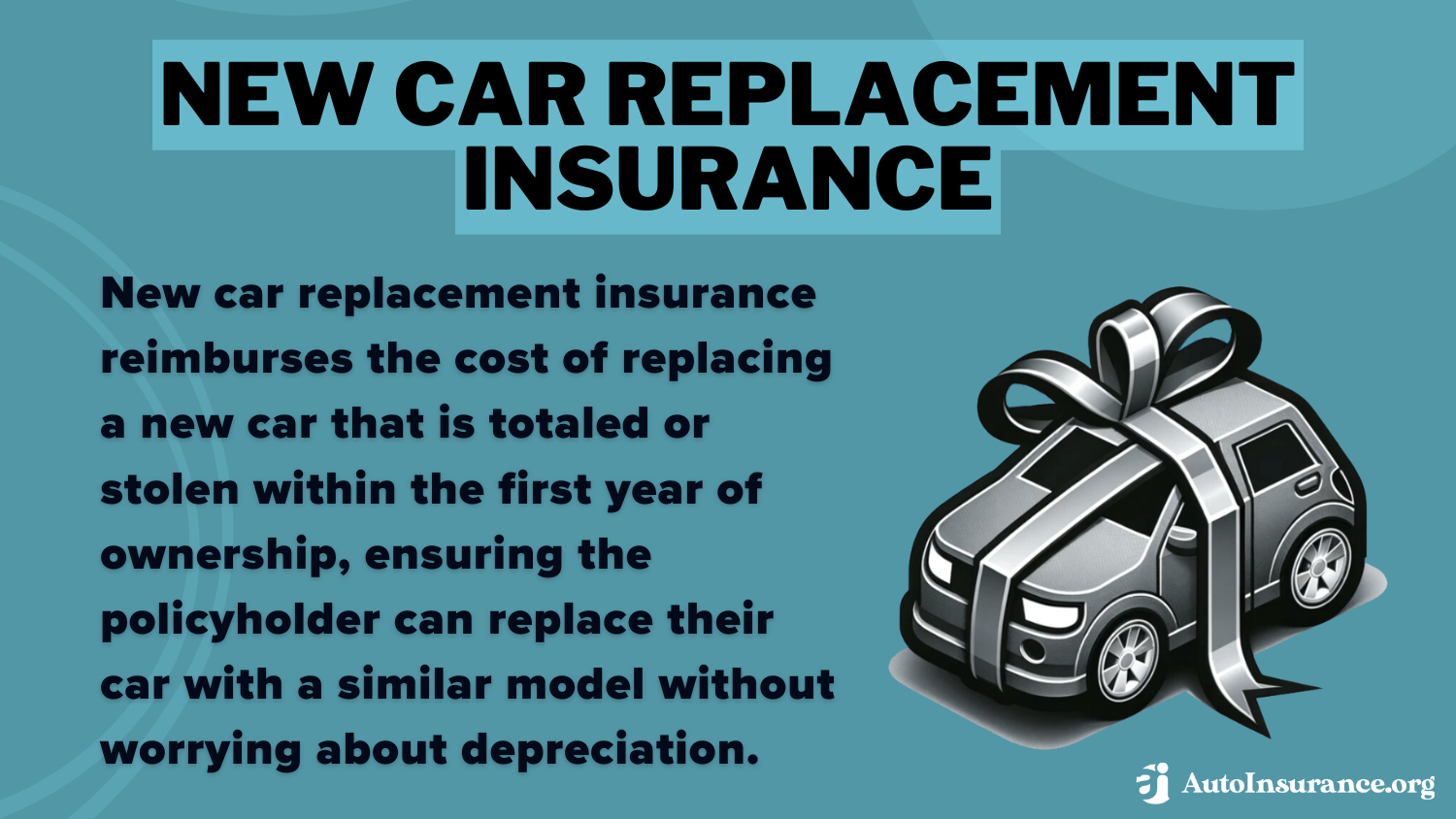

- New car replacement guarantee for cars totaled within 15 months

- Mobile app for policy management and claims filing

Cons

- Trumbull has a high NAIC complaint index score of 3.37

- Its parent company, The Hartford, has poor Better Business Bureau (BBB) customer reviews, but an A+ BBB rating

- Mixed customer reviews

- Trumbull Automobile Insurance is a subsidiary of The Hartford Insurance Company, which has been around since 1810

- The Hartford and its subsidiaries remain strong after all these years and continue to receive an "A" rating by A.M. Best

- Trumbull provides customer support is on its website where policyholders can view billing information, make payments, report claims/view claim status, update their personal information and locate a repair shop in the area

This Trumbull auto insurance review highlights why it excels, offering AARP members exclusive policies with rates starting at $50 per month and a program for replacing totaled vehicles within 15 months.

Trumbull also offers Recover Care services after accidents, though it carries a higher-than-average complaint index score (3.37) from NAIC, reflecting more dissatisfaction among customers. Older drivers seeking budget-friendly, dependable coverage will gain the most from Trumbull’s plans.

Trumbull Auto Insurance Rating

Rating Criteria Trumbull

Overall Score 3.9

Business Reviews 3.0

Claim Processing 4.6

Company Reputation 4.5

Coverage Availability 5.0

Coverage Value 3.5

Customer Satisfaction 2.5

Digital Experience 4.5

Discounts Available 5.0

Insurance Cost 3.9

Plan Personalization 4.5

Policy Options 2.5

Savings Potential 4.2

However, it’s crucial to compare different quotes to ensure you’re choosing from the best auto insurance companies to find the right option for your personal circumstances.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code above in our free quote comparison tool.

- Trumbull offers AARP-only coverage starting at $50 per month

- Benefits include Recover Care and new car replacement within 15 months

-

Trumbull has a high NAIC complaint score of 3.37

Trumbull’s Pricing by Age and Gender

Trumbull Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

Age & Gender Minimum Coverage Full Coverage

Age: 16 Female $295 $440

Age: 16 Male $325 $470

Age: 18 Female $250 $400

Age: 18 Male $280 $430

Age: 25 Female $135 $210

Age: 25 Male $155 $230

Age: 30 Female $115 $185

Age: 30 Male $125 $195

Age: 45 Female $57 $115

Age: 45 Male $59 $118

Age: 60 Female $52 $110

Age: 60 Male $54 $112

Age: 65 Female $50 $105

Age: 65 Male $52 $108

Younger drivers, especially males, pay higher rates, with 16-year-old males paying $325 for minimum and $470 for full coverage. Rates decrease by age 25, with women paying $135 and men $155. By age 65, premiums drop to $50 for women and $52 for men, showing lower costs for older drivers and smaller gender differences.

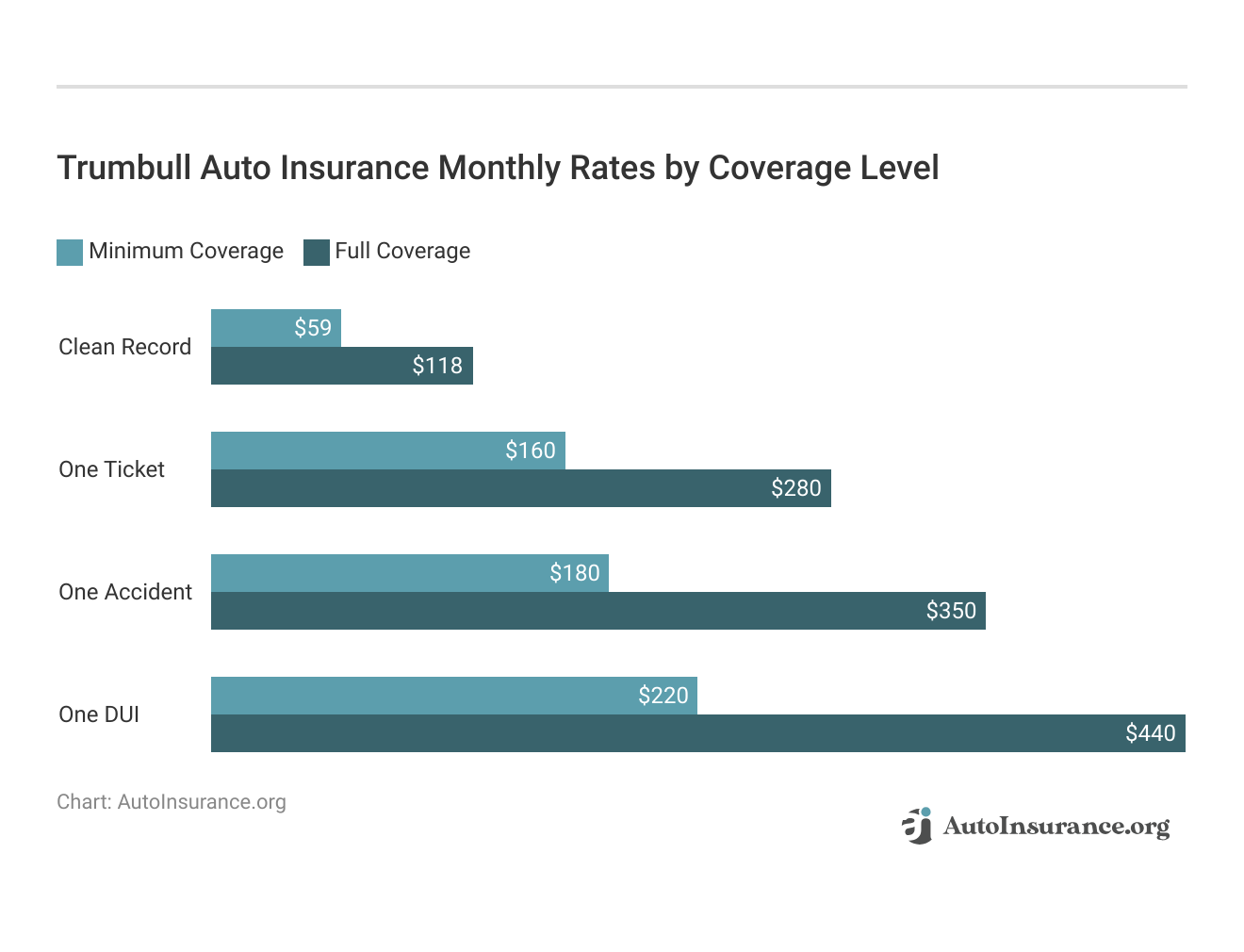

Trumbull auto insurance rates vary significantly based on driving history, with premiums rising for those with accidents, DUIs, or tickets. Drivers with a clean record enjoy the lowest rates, starting at $59 for minimum coverage and $118 for full coverage. Those with a DUI face the highest costs, paying $220 for minimum and $440 for full coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What You Should Know About Trumbull

Trumbull car insurance is a subsidiary of The Hartford insurance Company, which has been around since 1810 when it began selling insurance. The company has grown quite a bit over the last 200 years and currently maintains offices in the United States, Japan, the United Kingdom, Canada, Brazil, and Ireland. Find insights in our guide titled, “Best Auto Insurance for Drivers With a Canadian License.”

The Trumbull Insurance company customer service, through its parent company, is technologically savvy. The company has created an app for your mobile phone. Simply download the app per the directions on the website.

The Hartford and its subsidiaries remain strong after all these years and continue to receive an A+ rating by A.M. Best. Unfortunately, Trumbull Insurance Company reviews are mixed, as it has a high complaint index score of 3.37 from the National Association of Insurance Commissioners (NAIC), more than three times higher than average.

The Trumbull Insurance company also cares about what its policyholders think. As a policyholder, you can submit feedback with any comments you wish to share. Whether you’re a customer of the Trumbull Insurance company in IL, or PA, they want to hear from you on how they can improve.

You can contact Trumbull Ins Co via their phone number at 1-877-896-9320 for any questions or feedback.

Finding the Best Value with Trumbull’s Competitive Insurance Rates

Trumbull Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $150 | $220 | $300 | $180 | |

| $145 | $210 | $280 | $170 | |

| $160 | $230 | $320 | $190 | |

| $155 | $225 | $315 | $185 |

It’s important to assess these rates against your driving profile and compare quotes to ensure you’re getting the most suitable coverage for your needs.

Trumbull Car Insurance Policyholder Benefits

Trumbull, under The Hartford insurance company, provides many benefits to its customers. For example, the company offers Recover Care, which provides assistance to its policyholders after an accident such as cooking, cleaning, shopping, and providing transportation.

Another benefit the company provides is a lifetime guarantee on car repair if your vehicle is repaired at one of the authorized dealers recognized by Trumbull insurance.

There’s also a new car replacement insurance guarantee if your 15-month-old or younger car is deemed totaled after an accident. What does a new car replacement mean? Your auto insurance company will pay you the full amount you owe on your car if you total it.

Trumbull also promises never to drop its policyholders due to accidents or citations, unless the policyholder is found guilty of driving under the influence of drugs or alcohol.

Is rental car reimbursement necessary? It may be, and it is another benefit of Trumbull. Not only will they pay for the car rental, but the Trumbull Insurance Company at One Hartford Plaza will have the rental car delivered to you at a convenient location.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Trumbull Insurance Company Contact Details

The Trumbull Insurance Company is in Hartford, CT, since its parent company The Hartford is headquartered there.

The Trumbull Insurance Company address is:

One Hartford Plaza

Hartford, CT 06155

However, the Trumbull Insurance Company claims address is:

P.O. Box 14219

Lexington, KY 40512

Contact the Trumbull Insurance Company provider phone number at 1-877-896-9320. The Hartford Insurance phone number is the same at 1-877-896-9320.

Another way Trumbull provides customer support is through its website, where policyholders can view billing information, make payments, file claims, review claim status, change their email address, or locate a repair shop in their area.Travis Thompson Licensed Insurance Agent

You can also contact the AARP Trumbull Insurance Company phone number at 1-888-546-9099. The Hartford AARP insurance phone number is the same at 1-888-546-9099.

For assistance filing a Trumbull insurance claim, call 1-866-574-4833, which is also The Hartford’s auto claims phone number. Get detailed insights in our guide titled, “Can you claim auto insurance if it’s your fault?”

Trumbull Insurance Coverage Options

The Hartford, Trumbull Insurance company provides various coverage choices depending on the state you live in and your insurance needs.

Available coverage from the Trumbull insurance agency includes:

- Bodily Injury Liability

- Comprehensive Insurance

- Collision Auto Insurance

- Uninsured/Underinsured Motorist Coverage

- Medical Payments

You can call a specialist at the Trumbull Insurance company phone number at 1-877-896-9320, or you can use the online auto insurance coverage calculator to determine the coverage you need and find affordable Trumbull auto insurance rates.

Trumbull Car Insurance Coverage Options

| Coverage | Description |

|---|---|

| Liability | Covers bodily injury and property damage to others |

| Collision | Pays for damage to your car from a collision |

| Comprehensive | Protects against theft, vandalism, and weather damage |

| Uninsured/Underinsured Motorist | handles medical bills and wages for you and passengers |

| Personal Injury Protection (PIP) | Manages medical bills and lost wages for passengers |

| Medical Payments | Pays for medical expenses regardless of who is at fault |

| Roadside Assistance | Assists with towing, tire changes, or jump-starts |

| Rental Car Reimbursement | Covers rental car costs while your car is being repaired |

| Gap Insurance | Bridges the gap between your car's value and loan balance |

| Accident Forgiveness | Prevents your rates from going up after your first accident |

Trumbull provides an extensive selection of coverage types, from basic liability and collision protection to more tailored services like gap coverage and accident forgiveness. These offerings allow policyholders to personalize their coverage according to their unique needs. With a variety of options available, Trumbull delivers reassurance in a range of driving situations.

Trumbull Auto Insurance Add-on Coverages and Benefits

Trumbull Insurance company also provides additional coverage for an additional cost. The additional coverage includes:

- Rental Car Reimbursement: Coverage for Trumbull rental car expenses while your vehicle gets repaired after a covered accident.

- First Accident Forgiveness: Trumbull Insurance will forgive your first at-fault accident by not increasing your rates as a result.

- Vanishing Deductible: Your deductible will go down by $150 with a good driving record.

- Deductible Waiver: You won’t pay a deductible with Trumbull if you didn’t cause the accident. Contact The Hartford auto claims phone number at 1-866-574-4833 to begin your claim after an accident.

- AARP Benefits: You can get benefits from AARP with Trumbull Insurance Company. AARP members save up to 10% on car insurance through the AARP Auto Insurance Program from The Hartford. Contact the AARP Trumbull Insurance Company phone number at 1-888-546-9099 for more details.

For assistance with non-AARP auto insurance policies, call the Trumbull Insurance Company number at 1-877-896-9320.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Trumbull Insurance Rates Breakdown

Since you’ll get your Trumbull car insurance coverage from The Hartford, check out the table below to compare The Hartford car insurance rates from other cheap providers:

Low-Income Auto Insurance Monthly Rates

| Insurance Provider | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $61 | $161 |

| $32 | $84 |

As you can see, full coverage auto insurance rates from The Hartford average $130 monthly. Always compare your Hartford, Trumbull Insurance company quotes against competitors to find the best rates.

Contact The Hartford Insurance Company phone number at 1-877-896-9320 to learn more about other ways to save, such as discounts or fewer coverage options. If you’re an existing policyholder and need to file a claim, contact The Hartford insurance auto claims phone number at 1-866-574-4833. (Read More: The Hartford auto insurance review)

Comparing Trumbull’s Premium Discounts for Maximum Value

Trumbull auto insurance provides numerous discounts, giving drivers ample opportunities to reduce their premiums. With savings such as a 25% safe driver discount and 15% off for bundling policies, these options help make coverage more cost-effective. Find out more by reading our guide titled, “How to Save Money by Bundling Insurance Policies.”

Trumbull Car Insurance Discounts by Savings Potential

| Discount | Trumbull |

|---|---|

| Safe Driver | 25% |

| Accident-Free | 20% |

| Multi-Vehicle | 20% |

| Bundling | 15% |

| Defensive Driving | 10% |

| Early Signing | 10% |

| Good Student | 10% |

| Paid-in-Full | 10% |

| Anti-Theft Device | 5% |

| Homeowner | 5% |

| Low Mileage | 5% |

Even with these discounts, it’s essential to review Trumbull’s overall business evaluations. Holding an A+ rating from both the Better Business Bureau and A.M. Best, Trumbull shows strong financial stability and customer satisfaction.

Trumbull Insurance Business Ratings & Consumer Reviews

| Agency | Trumbull |

|---|---|

| Score: 825 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 80/100 Good Customer Feedback |

|

| Score: 3.37 Above Avg. Complaints |

|

| Score: A+ Excellent Financial Strength |

However, specific ratings from J.D. Power and Consumer Reports are currently unavailable, making it important to compare its rates and discounts with other insurers to ensure you’re getting the best value for your situation.

Trumbull Insurance Company: Strength and Weaknesses

Trumbull auto insurance offers various perks, especially for drivers looking for solid coverage supported by a well-known provider. Its policies deliver strong value, particularly with specialized benefits designed to enhance customer satisfaction.

- Affordable Premiums: Trumbull’s rates are cheaper than many of its competitors, especially for people with traffic tickets or DUIs.

- Supported by The Hartford: Trumbull’s connection to The Hartford makes it seem more trustworthy.

- Repair Guarantee: Authorized dealer repairs come with a lifetime guarantee, giving you peace of mind.

- Replacement Coverage: Trumbull will give you a new car if your old one breaks down within 15 months, so people with newer cars will get more value.

With its association with The Hartford and unique coverage guarantees, Trumbull is a strong contender for customers buying auto insurance for new cars or those needing flexible, dependable coverage. The company’s ability to serve drivers with unique needs, like accidents or new cars, sets it apart from its rivals.

You may have heard 👂that comparing car🚗 insurance quotes can lead to savings🤑, but are you intimidated by the process? It’s time to figure it out so you can save. We have the step-by-step guide for you right here👉:https://t.co/7c2R2bodbp pic.twitter.com/8vc6ZXcmhX

— AutoInsurance.org (@AutoInsurance) October 1, 2024

Despite Trumbull’s strong offerings, it has a few downsides that may dissuade potential customers. These issues include customer service challenges reflected in various ratings.

- High Complaint Rate: Trumbull’s NAIC complaint index of 3.37 indicates that the company receives a greater number of consumer grievances than the national average.

- BBB Feedback: The Hartford maintains an A+ rating with the Better Business Bureau; however, its customer evaluations are predominantly unfavorable.

- Mixed Customer Opinions: The reviews are inconsistent as a result of the broad range of feedback from clients.

Even with its affordable pricing and solid policy options, Trumbull’s high complaint index and mixed customer reviews may raise concerns for potential buyers. It’s important for drivers to weigh these factors when comparing insurance choices.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Trumbull Discounts Available

Trumbull Insurance agency offers discounts to its policyholders that qualify. For example, if you also have homeowners insurance through the Hartford, you can receive a discount on your automobile insurance.

You may also qualify for a usage-based car insurance discount with The Hartford, Trumbull Insurance company. Check out the table below to see how much you could save with UBI:

Usage-Based Auto Insurance Discounts by Provider & Savings Amount

| Insurance Company | Program Name | Device Type | Sign-up Discount | Savings Potential |

|---|---|---|---|---|

| AAADrive | Mobile App | 15% | 30% |

| Drivewise | Mobile App | 10% | 40% | |

| KnowYourDrive | Mobile App or Plug-in | 10% | 20% | |

| DriveEasy | Mobile App | 20% | 25% | |

| RightTrack | Mobile App or Plug-in | 5% | 30% |

| Mile Auto | Neither | 20% | 40% | |

| SmartRide | Mobile App or Plug-in | 10% | 40% |

| Snapshot | Mobile App or Plug-in | $25 | 20% | |

| Drive Safe & Save | Mobile App or Plug-in | 5% | 50% | |

| TrueLane | Plug-in | 5% | 25% |

| IntelliDrive | Mobile App | 10% | 30% | |

| SafePilot | Mobile App | 5% | 20% |

You could save up to 25% with The Hartford’s TrueLane program. Contact a The Hartford auto insurance customer service agent to get exact program details for your area — The Hartford auto insurance phone number is 1-877-896-9320.

Other discounts include good student discounts, air bag discounts, and anti-theft insurance discounts.

Trumbull Insurance Company Coverage Highlights

Trumbull auto insurance offers a variety of attractive coverage options, supported by The Hartford, making it a reliable option for AARP members looking for cost-effective premiums and special features like new car replacement and lifetime repair warranties. Unlock details in our article called, “AAA vs. AARP Auto Insurance.”

However, the elevated complaint rate and varied customer feedback highlight areas where improvements could be made, especially in terms of service quality and app performance. Comparing Trumbull to other leading insurers can help drivers decide if the advantages outweigh the potential downsides, particularly for those with a history of accidents or violations.

Backed by The Hartford, Trumbull combines reliability with unique benefits like lifetime repair warranties.Kristen Gryglik Licensed Insurance Agent

Shopping around for quotes remains essential for finding the best protection at the most competitive prices. Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What is Trumbull auto insurance?

Trumbull auto insurance is an insurance company that provides coverage for automobiles. They offer various types of policies to protect your vehicle against damage, accidents, and other risks.

Contact the Trumbull Insurance Company number at 1-877-896-9320 for questions about coverages and exclusions.

What types of auto insurance coverage does Trumbull offer?

Trumbull auto insurance offers a range of coverage options, including liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), uninsured/underinsured motorist coverage, and more. These options allow you to tailor your policy to suit your needs.

For more details about these options, contact the Trumbull Insurance Company customer service phone number at 1-877-896-9320.

Can I manage my Trumbull auto insurance policy online?

Yes, Trumbull auto insurance provides an online portal that allows policyholders to manage their policies conveniently. Through the portal, you can make payments, view policy details, update information, file claims, and access other policy-related services.

To file a claim, you can also contact Trumbull Ins Co’s claims phone number at 1-866-574-4833.

Visit the Trumbull Insurance Company website at www.thehartford.com, since the company is a subsidiary of The Hartford.

What factors affect the cost of Trumbull auto insurance?

Several factors can influence the cost of your Trumbull auto insurance policy, including your driving record, age, type of vehicle, location, coverage options, and deductible amount. Generally, drivers with a clean driving history and low-risk factors may qualify for lower premiums.

What should I do if I need to file an auto insurance claim with Trumbull?

If you need to file an auto insurance claim with Trumbull, you should contact their claims department as soon as possible. They will guide you through the process, provide the necessary forms, and assist you in documenting the incident to initiate the claim.

To report Trumbull insurance claims or follow up on a claim by phone, call the Trumbull Insurance company claims phone number at 1-866-574-4833.

Does Trumbull auto insurance offer any discounts?

Yes, Trumbull auto insurance offers various discounts that can help reduce your premium costs. These discounts may include safe driving discounts, multi-policy discounts, good student discounts, and more. It’s best to inquire with Trumbull about the specific discounts they offer.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code below into our comparison tool today.

Can I add additional drivers to my Trumbull auto insurance policy?

Yes, Trumbull auto insurance allows you to add additional drivers to your policy. However, the availability and terms of adding drivers may vary depending on the specific policy and state regulations. Contact Trumbull for more information.

What should I do if I need to make changes to my Trumbull auto insurance policy?

If you need to make changes to your Trumbull auto insurance policy, such as updating your address or adding coverage options, you should contact their customer service department. They will guide you through the process and assist you in making the necessary changes. Learn more about offerings in our complete guide called, “Do you have to add your child to your insurance policy?”

What are Trumbull insurance careers?

Find Trumbull careers on The Hartford’s website. The site breaks up its opportunities into three sections.

The first is for recent college graduates, the second is for experienced professionals, and the third is for military veterans.

The site also provides helpful information for potential employees like the interview process, career development, and frequently asked questions regarding employment.

How do I contact a Trumbull car insurance agent?

Trumbull auto insurance agents can be located on The Hartford’s website by inputting your ZIP code into the toolbox. They can also be reached at the Trumbull Insurance phone number.

The website will list auto insurance agents with details such as name, address, phone number, and directions to their office. A map also appears with all of the agent’s locations.

You can also contact the agent directly by clicking on “Contact Agency” and then provide information about yourself so the agent can contact you.

Is Trumbull Insurance part of Hartford?

So, who owns Trumbull Insurance? Trumbull is a subsidiary of The Hartford.

For additional details, explore our comprehensive resource titled, “Best Hartford Auto Insurance Discounts.”

What is The Hartford auto insurance claims phone number?

The Hartford insurance claims phone number is 1-866-574-4833.

However, the general customer service number is different than The Hartford claims phone number. Call the Hartford Insurance Company customer service at 1-877-896-9320.

How is The Hartford insurance customer service?

The Hartford auto insurance customer service is good. According to the NAIC, the company has a complaint index score of 0.41, indicating it receives fewer complaints than average.

Where is the Trumbull company headquarters?

You can find the Trumbull Insurance Company in Hartford, Connecticut, since the company is owned by The Harford auto insurance company. In addition, The Hartford is a popular choice for driver seeking auto insurance in Hartford, CT.

Contact the Trumbull Insurance Company Hartford, CT, phone number at 1-877-896-9320 for more details.

Read More: Connecticut Auto Insurance

Can you get Trumbull Insurance Company workers’ compensation insurance?

Yes, The Hartford offers workers’ compensation insurance for as low as $13 monthly.

Contact The Hartford auto insurance customer service at 1-877-896-9320 to learn more about its workers comp offerings.

What is the Trumbull Insurance Company claim phone number?

The Hartford Insurance auto claims number is the same as Trumbull’s. The Trumbull auto insurance claims phone number is 1-866-574-4833.

Is Trumbull Insurance Company in Michigan?

You can find the Trumbull Ins Co headquarters at One Hartford Plaza, Hartford, CT 06155. In addition, Trumbull insurance, through The Hartford, is available in all 50 states, making it available to Michigan drivers.

Read More: Michigan Auto Insurance

What is The Hartford’s auto insurance address?

The Hartford Insurance Company address is:

One Hartford Plaza

Hartford, CT 06155

The company’s mailing address is:

P.O. Box 14219

Lexington, KY 40512

What is Trumbull Insurance Company AARP?

Trumbull Insurance Company partners with AARP to provide exclusive auto insurance policies and benefits for AARP members.

To find out more, explore our guide titled, “AARP Auto Insurance Program from The Hartford Review.”

What is Trumbull Insurance Company’s NAIC complaint index?

Trumbull Insurance Company has a complaint index score of 3.37 from the NAIC, indicating a higher-than-average number of customer complaints.

Get the best auto insurance rates possible by entering your ZIP code below into our free comparison tool today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.