How to Evaluate Auto Insurance Quotes in 2025 (4 Simple Steps)

The way you evaluate auto insurance quotes involves reviewing top companies that offer competitive rates and trustworthy coverage. To settle on the best car insurance quote, focus on insurers with a proven history of efficient claims handling and customer satisfaction rates typically exceeding 85%.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Mar 21, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 21, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

To evaluate auto insurance quotes effectively, start by understanding that more than 85% of drivers benefit from comparing different options. Learn how to evaluate auto insurance quotes by focusing on coverage types, premium rates, and insurer reliability.

Reviewing multiple factors, including specific rates and company performance, helps ensure you choose the best policy for your needs. Make informed decisions to secure optimal coverage and savings.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool above to instantly compare quotes near you.

- Step #1: Understand Coverage – Learn about different insurance types

- Step #2: Compare Premiums – Collect and compare quotes

- Step #3: Check Insurer Ratings – Review ratings and stability

- Step #4: Review Policy Details – Look for extra benefits and fees

- Evaluating Auto Insurance Quotes

- How to Get a Quote From an Auto Insurance Company in 2025 (Follow These 4 Steps)

- How to Get Multiple Auto Insurance Quotes in 2025 (8 Simple Steps)

- How to Get an Auto Insurance Quote Without Giving Personal Information in 2025 (Follow These 5 Steps)

- Do auto insurance quotes change daily? (What You Should Know in 2025)

- How to Get an Auto Insurance Quote Without a Car in 2025 (5 Easy Steps)

- Why to Get Multiple Auto Insurance Quotes (2025)

- Auto Insurance Rates by ZIP Code (2025)

- How to Get Free Online Auto Insurance Quotes in 2025 (8 Easy Steps to Follow)

4 Steps to Evaluate Auto Insurance Quotes

Evaluating auto insurance quotes can be a simple process when you know what steps to follow. First, it’s important to understand the different types of coverage available. Once you understand your coverage needs, compare premiums from multiple insurance companies.

Financial ratings from agencies like A.M. Best or Standard & Poor’s can give you an idea of whether the insurer is stable enough to pay claims. Additionally, customer satisfaction ratings from sources like J.D. Power will give you insight into the company’s claims handling and service quality.

Lastly, don’t forget to review the policy details, including coverage limits, exclusions, and any extra benefits like roadside assistance or rental car coverage.

Step #1: Understand Coverage

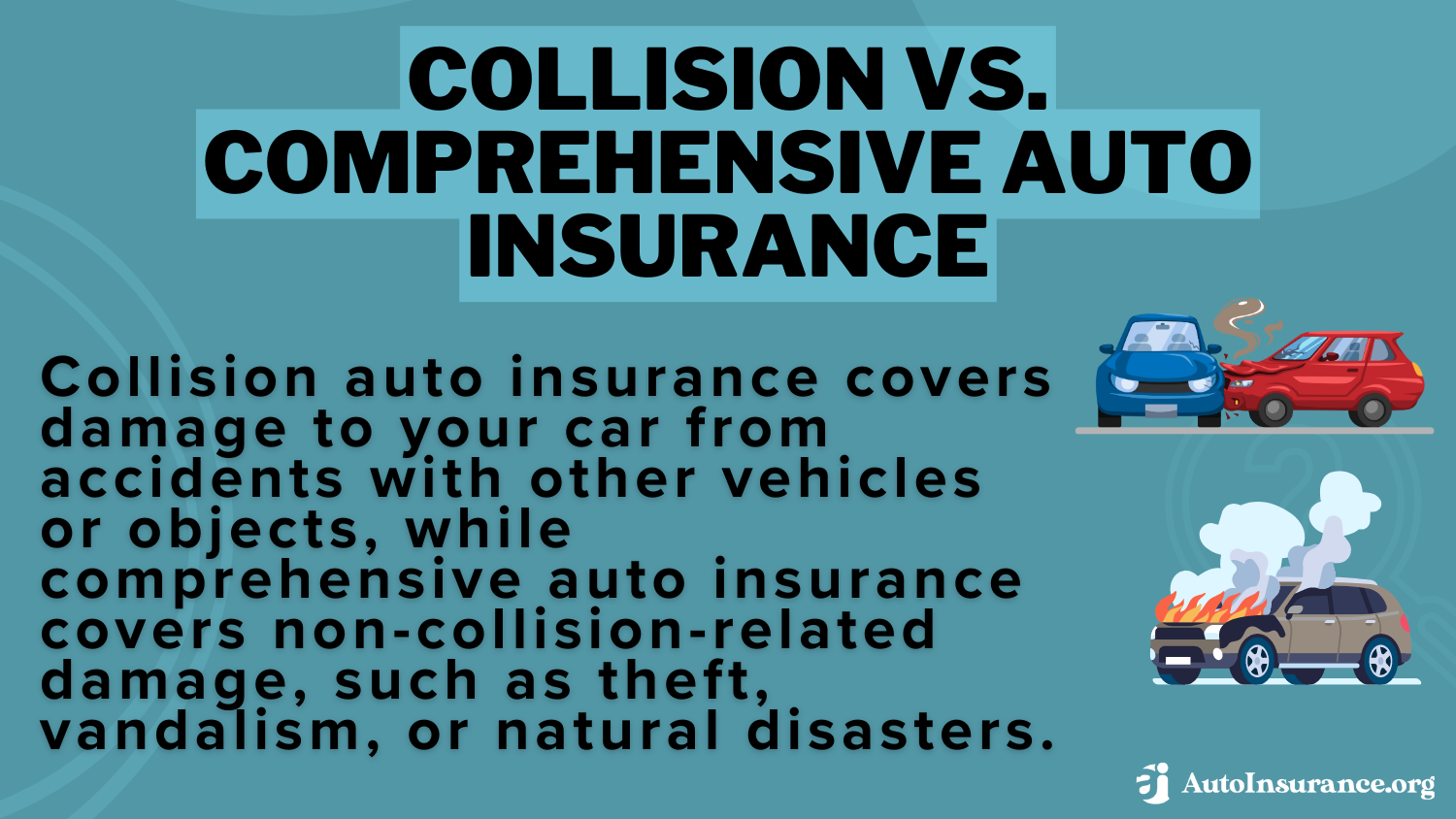

Understanding auto insurance types is key to making informed decisions. Liability insurance covers damages and injuries you cause to others. Collision insurance pays for repairs to your vehicle after an accident, while comprehensive auto insurance protects against non-collision issues like theft and natural disasters.

Personal Injury Protection (PIP) covers medical expenses for you and your passengers, regardless of fault. Underinsured/uninsured motorist coverage helps if the at-fault driver has insufficient insurance. Lastly, Gap insurance covers the difference between your vehicle’s loan balance and its actual cash value if it’s totaled. Knowing these options helps you choose the right coverage.

Step #2: Compare Premiums

Gather and compare auto insurance quotes from multiple providers to find the best rates for your coverage needs. For example, Geico offers minimum coverage at $30 and full coverage at $80, while Liberty Mutual’s rates are $68 for minimum coverage and $174 for full coverage.

Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $76 | $198 | |

| $43 | $114 | |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

Use consistent information when requesting quotes to ensure fair comparisons, and consider additional benefits to get the best value for your policy. Learn how to compare auto insurance quotes.

Step #3: Check Insurer Ratings

Evaluating insurer ratings is crucial when selecting an auto insurance provider. Start by researching ratings from reputable agencies like A.M. Best, Moody’s, and Standard & Poor’s, which assess the financial stability and reliability of insurance companies. A strong rating indicates that an insurer is capable of paying claims and managing risks effectively.

Additionally, consider customer satisfaction ratings from sources like J.D. Power and Consumer Reports. These ratings reflect policyholder experiences regarding claims processing, customer service, and overall satisfaction.

By checking insurer ratings, you can make informed decisions, ensuring you choose a provider that not only offers competitive auto insurance premiums but also has a solid reputation for reliability and service.

Step #4: Review Policy Details

Taking the time to review policy details is essential when choosing auto insurance. Look beyond the premium rates and examine the coverage limits, exclusions, and any additional benefits included in the policy. Understanding what each policy covers helps ensure you’re adequately protected in various situations.

Pay attention to aspects like roadside assistance, rental car coverage, and any discounts you might qualify for. Additionally, check for any hidden fees or conditions that could impact your overall cost. If you’re looking for more insights, check out our comprehensive guide on the best roadside assistance plans.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Mastering the Process of Evaluating Auto Insurance Quotes

When evaluating auto insurance quotes, the process goes far beyond simply comparing prices. Start by understanding the types of coverage offered, as each policy varies in what it protects. Next, gather and compare quotes from several providers to ensure you’re getting the most competitive rates.

Finding the best auto insurance quotes means prioritizing affordability and reliable coverage for peace of mind on the road.Dani Best Licensed Insurance Producer

Don’t forget to check insurer ratings for trustworthiness and financial stability—these will give you confidence that the company can handle claims efficiently. To gain a thorough understanding on how to file an auto insurance claim, click here.

Finally, carefully review the fine print in your policy to spot any extra benefits or hidden fees. By taking these steps, you’ll be well-prepared to select the insurance plan that best fits your needs and budget.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Frequently Asked Questions

How can I use AutoInsurance.org to evaluate auto insurance quotes?

AutoInsurance.org offers a user-friendly car insurance quote comparison tool, allowing you to evaluate multiple quotes and find the best coverage options for your needs.

How do I evaluate quotes effectively when comparing multiple auto insurance options?

Compare coverage types, deductibles, and premiums. Evaluate quotes by ensuring you look at similar coverage levels and check for any discounts or added benefits.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

What factors should I consider when learning how to get multiple auto insurance quotes?

Gather personal and vehicle details. Use online tools to get multiple auto insurance quotes, then evaluate them based on coverage options, service quality, and premium costs. Learn how to get multiple auto insurance quotes.

What’s the best approach to evaluate car insurance quotes in Mentor?

To evaluate car insurance quotes in Mentor, use comparison tools like AutoInsurance.org or car insurance quotes mentor-based services to analyze different coverage plans and rates.

How do I get a reliable car insurance estimate and evaluate it for better coverage?

You can obtain a car insurance estimate from platforms like AutoInsurance.org or Amica and evaluate the coverage options, premium costs, and additional features to ensure you’re making an informed decision.

What are the 5 parts of an auto insurance policy, and how can I evaluate each one?

The 5 parts are liability, collision, comprehensive, PIP, and uninsured motorist coverage. Evaluate each based on your needs and the risks you’re likely to face.

Find out What are the recommended auto insurance coverage levels.

How can I evaluate third-party car insurance quotes in Reading?

Use AutoInsurance.org or a car insurance quotes reading tool to evaluate third-party car insurance quotes. Comparing the options side by side will help you determine the best deal.

How are insurance companies evaluated, and what role does the quote rate insurance valuation method play?

Insurance companies are evaluated by financial strength, service, claims handling, and pricing. The quote rate helps assess premium competitiveness, while insurance valuation methods determine policy values for assets.

How does a Lemonade auto insurance quote compare when evaluating it against other providers?

When evaluating a Lemonade auto insurance quote, use a comparison tool like AutoInsurance.org to see how it stacks up against other providers in terms of price and coverage.

For a complete breakdown, consult our detailed Lemonade auto insurance review.

What are the 5 C’s of insurance, and how do I calculate how much insurance I need?

The 5 C’s are Coverage, Cost, Claims, Customer Service, and Company Reputation. To calculate how much insurance you need, consider your assets, liabilities, and potential risks to find the right coverage level. For the best quote for third-party car insurance, compare quotes from different insurers to find a policy that balances coverage and affordability.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

How to evaluate an insurance policy?

To evaluate an insurance policy, review coverage types, limits, and exclusions. Compare premiums, deductibles, and the insurer’s customer service reputation to ensure it meets your needs and budget.

What is the quote rate in insurance, and how are insurance companies evaluated?

The quote rate in insurance is the price an insurer offers for a specific policy based on risk factors. Insurance companies are evaluated on financial strength, customer service, claims handling, and pricing. The quote rate helps determine if their premiums are competitive in the market.

To expand your knowledge, read through our thorough guide named How to Check Your Auto Insurance Claims History

What is the insurance valuation method, and how do you evaluate the value of an insurance agency?

The insurance valuation method involves assessing the financial worth of an insurance policy or agency based on various factors such as assets, liabilities, revenue, and market conditions. To evaluate the value of an insurance agency, consider its customer base, operational efficiency, claims history, and profitability, along with industry benchmarks and trends.

How many quotes do you need for insurance, and what to consider when evaluating a policy?

It’s advisable to obtain at least three quotes for insurance to ensure competitive pricing. When evaluating a policy, consider coverage types, deductibles, exclusions, and customer service. This comparison helps you make an informed decision.

What are 5 factors that are used to determine the cost of insurance premiums?

Insurance premiums are affected by driving history, vehicle type, and location. A clean record and safer vehicles lower costs, while high-crime areas increase them. Coverage amount and credit score also significantly impact premiums.

For a detailed exploration, delve into our guide entitled How Credit Scores Affect Auto Insurance Rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.