AAA Auto Insurance Review 2025 (See if They’re a Good Fit)

Our AAA auto insurance review found that AAA is worth considering if you’re a member of the organization. Rates tend to be higher, with minimum coverage averaging $65/mo, but the company offers various member perks. AAA also has a lower number of customer complaints and strong financial stability ratings.

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

AAA

Monthly Rates

$65A.M. Best Rating:

AComplaint Level:

LowPros

- Multiple discounts available for members

- Bundling options

- AAA member perks

- Superior financial strength rating

- Roadside assistance coverage included

- Coverage options for liability, collision, and comprehensive insurance

Cons

- Expensive rates

- Below-average scores for customer service and the handling of claims

- Not available in all states or areas

- AAA membership required for purchasing car insurance

- You have to be a member of AAA to purchase auto insurance with the company

- AAA’s auto insurance rates tend to be higher than the national average

- AAA offers multiple discounts and bundling options to lower rates

If you’re searching for car insurance, you may want to learn more about AAA coverage with our AAA auto insurance review. AAA car insurance policies offer great roadside assistance coverage in many U.S. states, and policyholders may be eligible to earn discounts on coverage.

Unfortunately, AAA insurance plans are not available in every state, and the company’s rates are often higher than average.

AAA Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 4.1 |

| Business Reviews | 4.5 |

| Claim Processing | 3.3 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.1 |

| Customer Satisfaction | 2.1 |

| Digital Experience | 4.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.1 |

| Plan Personalization | 4.0 |

| Policy Options | 4.4 |

| Savings Potential | 4.4 |

Still, anyone considering car insurance coverage — especially those with a AAA membership — should consider getting AAA auto insurance quotes to see how much they would pay for coverage.

Read on to learn more about AAA’s ratings and reviews. Then, enter your ZIP code in our free quote tool to find the best auto insurance quote from companies in your area.

- AAA’s rates are higher than the national average

- AAA’s roadside assistance is one of the best programs available

- AAA has great ratings for financial stability

AAA Auto Insurance Rates Breakdown

Just like at other auto insurance companies, AAA auto insurance costs will vary based on countless driver factors, such as:

- Age, gender, and marital status

- Car make and model

- ZIP code

- Credit score and driving history

- Coverage types

The table below shows what AAA customers pay on average for AAA auto insurance based on their age, gender, and coverage level.

AAA Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $246 | $635 |

| 16-Year-Old Male | $269 | $664 |

| 18-Year-Old Female | $200 | $540 |

| 18-Year-Old Male | $231 | $468 |

| 25-Year-Old Female | $57 | $152 |

| 25-Year-Old Male | $59 | $158 |

| 30-Year-Old Female | $53 | $141 |

| 30-Year-Old Male | $55 | $147 |

| 45-Year-Old Female | $47 | $125 |

| 45-Year-Old Male | $65 | $122 |

| 60-Year-Old Female | $42 | $108 |

| 60-Year-Old Male | $43 | $111 |

| 65-Year-Old Female | $46 | $122 |

| 65-Year-Old Male | $45 | $119 |

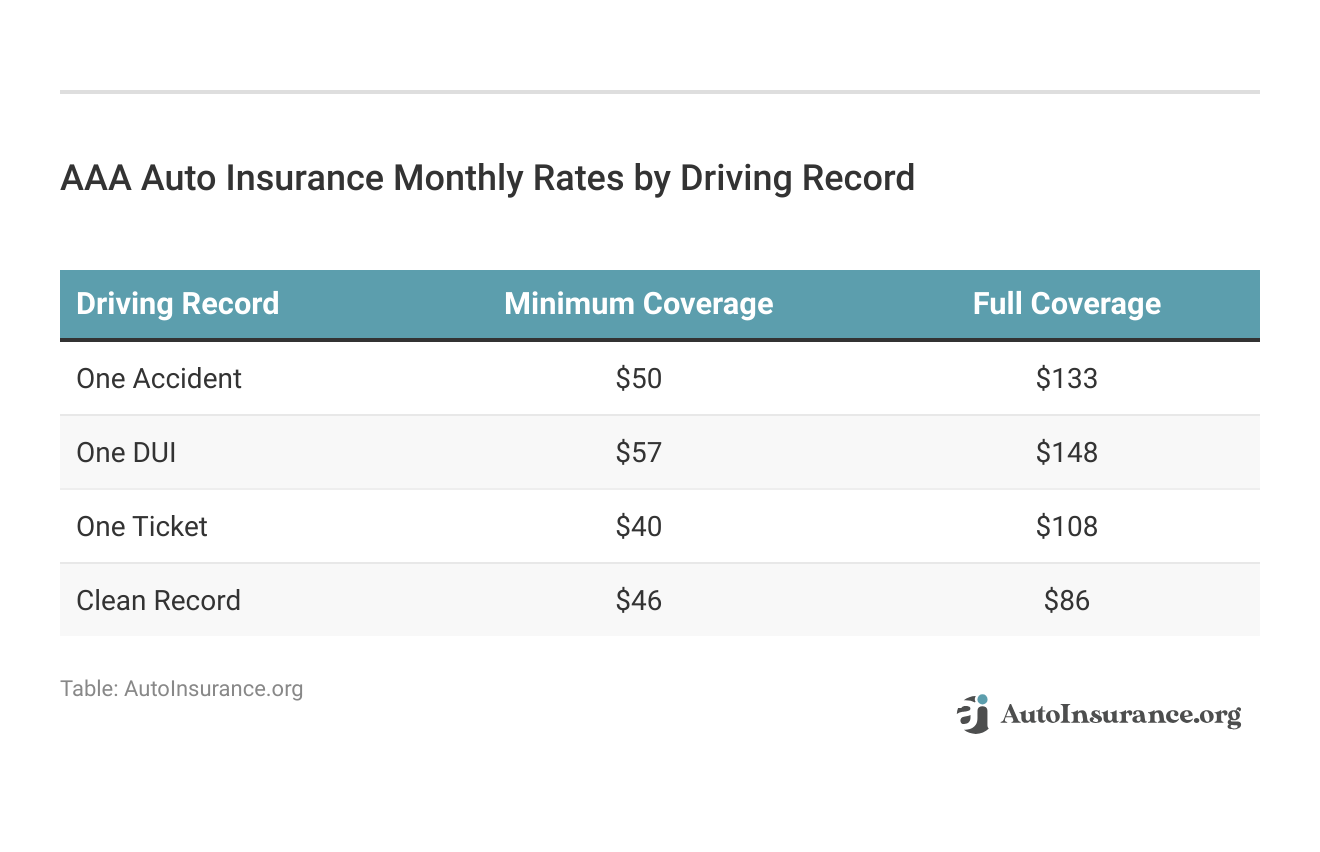

Young drivers will have the most expensive auto insurance rates from AAA due to driving inexperience, with young male drivers paying slightly more than young female drivers. A driver’s record will also impact their AAA auto insurance rates, in addition to gender, age, and coverage level. Take a look at the table below to see how AAA charges for DUIs, accidents, and more.

AAA’s average rates for drivers with a clean record are affordable, but the company may not be the best choice for DUI drivers and other high-risk drivers (Read More: Best Auto Insurance Companies for High-Risk Drivers).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

AAA Membership Cost

Roadside assistance is a popular option when shopping for extra car insurance coverage. AAA roadside assistance has various benefits, from jumpstart assistance to discounts on attractions. However, the price tag for AAA membership is higher than some of the best roadside assistance, so unless drivers take advantage of all the perks, they’re better off choosing a cheaper program.

AAA has three different membership levels, each offering different benefits. Most drivers will benefit from the basic plan, which includes towing, jumpstart, and more.Dani Best Licensed Insurance Producer

The prices we listed below are the normal prices, though you may get a lower price during one of the AAA’s sign-up deals. For example, in the past, AAA has offered a 50% discount on their membership prices and waived the $20 sign-up fee for new members who enrolled in autopay. Take a look at the standard prices below.

AAA Membership Annual Costs

Membership Level Classic AAA Plus AAA Premier

1st Member (Primary) $54 $90 $127

2 Members $85 $132 $169

3 Members $116 $174 $211

4 Members $147 $216 $253

These are the basic costs listed on AAA’s membership website. However, as stated earlier, how much it costs also depends on any promotions and deals AAA might be running. If the cost seems too high, it might be best to wait for a promotion to get a cheaper annual fee.

Now that we’ve covered the cost of AAA membership, it’s time to consider the benefits to determine if the higher price tag is worth it for drivers. If you’re a senior, you may want to compare AAA vs. AARP Auto Insurance.

AAA Membership Benefits

AAA offers all the basic benefits of a roadside assistance program. The benefits vary slightly by membership level. The table below covers the basic roadside assistance benefits, such as AAA towing levels.

AAA Membership Basic Car Assistance Benefits

Benefit Classic Membership AAA Plus Membership AAA Premier Membership

Towing 3 miles or unlimited back to service provider Up to 100 miles Up to 100 miles plus one tow up to 200 miles

Emergency Fuel Delivery Free delivery but member pays for fuel Free fuel and free delivery Free fuel and free delivery

Vehicle Lockout $60 towards a locksmith $100 towards a locksmith $150 towards a locksmith

Battery Service and Jumpstart Included Included Included

Flat Tire Included Included Included

Rental Car Discounted rates provided Discounted rates provided plus one upgrade of car class Reimbursement for midsize rental for one day

Extrication/Winching 1 vehicle and 1 driver Up to 2 drivers and 2 vehicles Up to 2 drivers and 2 vehicles

Minor Mechanical First Aid Included Included Included

In addition to roadside benefits, drivers can take advantage of several additional discounts and benefits. Some of the other benefits include:

- AAA Rewards and Discounts: Taking advantage of some of the best perks is one of the easiest ways to make your membership worth it. You can get discounts for dining, movies, attractions, and more.

- Identity Theft Protection: AAA offers identity theft protection with all membership levels, such as lost wallet assistance and credit monitoring.

- Discounted Passport Photos: AAA offers free passport photos with the highest membership level or $10 and below for the other levels.

- Vehicle Pricing Reports: You can get free vehicle pricing reports through AAA.

- Vacation Packages: AAA offers travel guides, discounts on travel tickets, and more.

These are just a few of the perks of a AAA membership. If you sign up, take advantage of as many perks and discounts as possible.

AAA Auto Insurance Rates vs. the Competition

In comparing auto insurance options, AAA stands out when pitted against major competitors like AARP, Geico, and State Farm. This analysis sheds light on how AAA surpasses its counterparts in various aspects, providing a comprehensive overview for informed decision-making.

| AAA Auto Insurance vs. Top Competitors |

|---|

| AAA vs. AARP |

| AAA vs. Geico |

| AAA vs. State Farm |

AAA auto insurance quotes typically indicate that AAA’s pricing of policies is often more expensive than a policy with other competitors. The table below shows the average full coverage rates of the top insurance companies as well as the national average.

AAA Full Coverage Auto Insurance Rates vs. Top Competitors

| Insurance Company | Monthly Rates |

|---|---|

| $122 |

| $228 | |

| $166 | |

| $198 | |

| $114 | |

| $248 |

| $164 |

| $150 | |

| $123 | |

| $141 | |

| $84 | |

| U.S. Average | $165 |

You can expect AAA car insurance full coverage costs to be nearly 58% higher than the national average when getting an AAA insurance quote. This trend is common in most AAA full coverage insurance rates.

The following table shows liability coverage rates, and AAA is often 56% higher than the national average.

AAA Liability Auto Insurance Rates vs. Top Competitors

| Insurance Company | Monthly Rates |

|---|---|

| $32 |

| $61 | |

| $44 | |

| $53 | |

| $30 | |

| $67 |

| $44 |

| $39 | |

| $33 | |

| $38 | |

| $22 | |

| U.S. Average | $45 |

Similarly, people with poor credit scores are likely to pay rates around 76% higher than the national average. Individuals charged with a DUI could pay rates approximately 97% higher than the national average, as they will have to purchase high-risk auto insurance coverage.

Unfortunately, nearly every category shows that AAA requires policyholders to pay rates that are significantly higher than other insurance providers:

- Rates for teen drivers are around 20% higher than the national average.

- Rates for young adult drivers are 55% higher than the national average.

- Rates for adult drivers are 53% higher than the national average.

- Rates for senior drivers are 58% higher than the national average.

- Rates following a speeding ticket are 68% higher than the national average.

If you’re considering purchasing an auto insurance policy with AAA, you should compare AAA car insurance quotes online to quotes from other companies (Read More: How to Evaluate Auto Insurance Quotes). It’s unlikely you’ll find cheap car insurance with AAA, and comparing AAA online quotes will help you determine which company would work best for you and your family.

AAA Car Insurance Coverage Options

AAA offers several options for car insurance coverage. Exact options for coverages, benefits, and discounts vary based on where you live, but some of the most common options for AAA auto coverage include:

| AAA Auto Insurance Coverages |

|---|

| Collision |

| Comprehensive |

| Bodily Injury Liability |

| Gap |

| MedPay |

| Non-Owners |

| PIP |

| Property Damage Liability |

| Rental Car Reimbursement |

| Underinsured Motorist |

| Uninsured Motorist |

Individuals can purchase coverage that adds up to a full coverage auto insurance policy — including liability, collision, and comprehensive insurance — through most AAA clubs. Still, you’ll need to speak with a representative of an AAA club in your area to ensure you know what options are available to you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

AAA Car Insurance Discounts

When you get AAA price of insurance, you may want to learn how to lower your insurance costs. Luckily, there are many AAA auto insurance discount options available to its members and policyholders. Some of AAA auto insurance discounts include:

AAA Auto Insurance Discounts

| Discount Type | Savings Potential |

|---|---|

| Anti-Theft Device Discount | 10% |

| Defensive Driving Course Discount | 10% |

| Good Student Discount | 15% |

| Low Mileage Discount | 10% |

| Loyalty Discount | 15% |

| Multi-Policy Discount | 25% |

| Multi-Vehicle Discount | 27% |

| Paid-in-Full Discount | 5% |

| Safe Driver Discount | 20% |

Much like AAA’s coverage options, the company’s discounts vary from one state and location to the next. Again, you’ll need to speak with an AAA representative in your area to learn more about discounts you may be eligible for.

AAA Usage-Based Insurance Discount

AAA uses the AAA Driver Program to monitor drivers’ specific habits on the road. The program is especially useful for young teen drivers who will pay more for auto insurance.

Policyholders who enroll in the program may save up to 20% on their auto insurance policies by allowing the company to monitor their average speed, distracted driving habits, fatigue behind the wheel, braking habits, and other factors.

AAA Customer Reviews and Ratings

One of the aspects of AAA that makes it stand out is its roadside assistance. Most customers will recommend AAA auto insurance to others, even if they don’t recommend an AAA auto policy plan.

In AAA insurance reviews, AAA policyholders tend to agree that AAA customer service could use some improvement. Similarly, many customers state that the AAA claims handling process is a bit more complicated than it needs to be, and some claims take too long to be resolved, which is why AAA isn’t one of our best auto insurance companies for paying claims.

Not all AAA clients will recommend the company to their friends and family. According to AAA car insurance reviews, around 54% of customers are not likely to renew their auto insurance policies with AAA. Therefore, you should consider AAA insurance customer reviews and comments concerning AAA auto insurance before you purchase a policy.

AAA Business Ratings

AAA automobile insurance has been rated by a number of trustworthy sources that evaluate business practices and finances, which all customers should take a look at before buying a policy (Read More: How to Research Auto Insurance Companies Before Buying). Take a look at AAA’s ratings below.

| Agency |  |

|---|---|

| Score: 823 / 1,000 Avg. Satisfaction |

|

| Score: A Excellent Financial Stability |

|

| Score: 74/100 Good Customer Feedback |

|

| Score: 0.58 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

AAA’s insurance rating with A.M. Best is an A+ (Superior), suggesting a stable future outlook. The BBB also rated the company with an A+ rating. There are a few customer complaints on the BBB website, but most AAA insurance complaints have been resolved. AAA also had a lower number of complaints than the national average, which is good.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

AAA Auto Insurance Pros and Cons

There are multiple pros to choosing AAA as an auto insurance provider. Some of the best perks of joining AAA are:

- Roadside Assistance: Most people join AAA because of the company’s AAA roadside assistance plans, which include jump starts, towing, emergency fuel delivery, and certain roadside repairs. Additionally, AAA members receive compensation if they’re in an accident more than 100 miles from home.

- Membership Perks: AAA members enjoy certain perks with their AAA membership plans, like discounts on hotel stays, cheaper rental cars, and deals on airfare. Anyone who purchases trips through AAA will receive coverage via AAA’s travel accident insurance.

- Coverage Options: AAA sells more than the basic state-required insurance coverages, as it has extras like guaranteed auto protection (gap) insurance or AAA rental car insurance available for purchase.

Of course, there are some cons to buying auto insurance from AAA as well. We found that the main deterrents for customers are:

- Membership Fee: Purchasing car insurance with AAA often requires that you become an AAA member. The price of different AAA membership levels vary from one location to the next, usually ranging from $60 to $120 annually.

- Availability: AAA auto insurance coverages aren’t widely available in every state or area, so AAA customers who move may need to find another provider.

Every driver has different needs, so make sure to fully consider the pros and cons to decide if AAA is right for you.

Deciding if AAA is Right For You

Is AAA worth it? AAA may be a good choice for auto insurance coverage, especially if you appreciate the roadside assistance with the membership, as AAA is one of the best auto insurance companies with roadside assistance. However, auto insurance rates with AAA insurance company are often significantly higher than rates with other providers.

AAA plans and prices are more expensive than other competitors, but the AAA insurance benefits and perks offset the cost.

You can also take advantage of sign-up deals to lower the initial sign-up cost. However, if you don’t use the perks of AAA, you’re better off with another company with one of the best roadside assistance plans.

Before you make a final decision on coverage, you should compare auto insurance quotes from multiple providers with our free quote tool to see who will offer you the coverage you want at the lowest price.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is AAA membership worth the cost for roadside assistance?

AAA offers roadside assistance with additional perks and benefits. However, the higher cost compared to other roadside assistance programs may not be worth it if you don’t utilize the services frequently.

Members can request Emergency Roadside Assistance by calling AAA’s roadside assistance number: 800-AAA-HELP (800-222-4357).

How can I cancel a AAA policy?

The cancellation of an AAA auto insurance policy can be done by calling the AAA customer service number: 1-877-387-8378. You will need to provide your policy number and request that payments be canceled immediately. AAA representatives may have additional questions you must answer before successfully canceling your policy.

What other types of insurance does AAA offer?

In addition to auto insurance, AAA offers:

- Home, condo, and renters insurance

- Boat, RV, and motorcycle insurance

- Flood and umbrella insurance

- Life insurance

- Educator’s insurance

AAA offers bundling discounts to policyholders who purchase multiple types of insurance (Read More: How to Save Money by Bundling Insurance Policies).

Do I have to be an AAA member to get car insurance?

Yes, purchasing car insurance with AAA typically requires becoming an AAA member. The AAA cost of membership varies by location and offers additional benefits such as roadside assistance and travel perks.

What discounts are available with AAA auto insurance?

AAA offers various discounts to its members and policyholders, including safe driver discounts, multi-policy discounts, and usage-based insurance discounts through the AAA Driver Program.

How do I file a claim with AAA?

You will need to find the number for your local AAA club to file an official auto insurance claim (Read More: How to File an Auto Insurance Claim).

How do AAA auto insurance rates compare to other companies?

AAA’s rates are often higher than the national average and other insurance providers. Their full coverage rates can be 58% higher and liability rates 56% higher than the national average.

Is AAA a good choice for car insurance?

AAA has a superior financial strength rating and positive reviews from customers. However, some customers have complaints about customer service and claims handling.

Is AAA worth it?

AAA is best known for its roadside assistance, including services like towing, battery jump starts, flat tire changes, and lockout service. If you drive frequently and have a high annual mileage, especially in areas where you might not have easy access to help or for long distances, this can be a significant benefit (Learn More: How Annual Mileage Affects Your Auto Insurance Rates).

Is AAA premier membership worth it?

AAA Premier membership is the highest of of all AAA membership levels and includes the most comprehensive set of benefits. AAA Premier could be worth it if you travel frequently and far from home, where extended towing and trip interruption benefits can come into play.

Are AAA insurance rates competitive?

AAA insurance rates can be competitive, especially for members. AAA members often receive discounts on insurance policies, which can make their rates more attractive compared to non-member pricing. To find the best deal on auto insurance, enter your ZIP in our free quote comparison tool.

How do I find an AAA agent near me?

To find an AAA insurance agent just visit the company’s website and enter your ZIP code. It will direct you to your local AAA club’s page. Learn more about finding agents in our guide on how to find auto insurance agents in your area.

What type of features does the AAA auto insurance app offer?

The AAA app offers several convenient features for policyholders, including:

- Digital ID Cards

- Policy Management

- Claim Filing and Tracking

- Roadside Assistance

- Bill Pay

The AAA app can be easily downloaded onto a customer’s phone.

What’s AAA customer service number?

A commonly used AAA insurance phone number in the US is 1-800-AAA-HELP (1-800-222-4357).

Does AAA offer rental car coverage?

AAA rental car reimbursement coverage is part of your AAA auto insurance policy. It can help pay for a rental car if your vehicle is in the shop due to a covered loss.

Does AAA offer renters insurance?

AAA renters insurance can provide coverage for your personal belongings, liability protection, and sometimes additional living expenses if your rental unit becomes uninhabitable due to covered perils like fire or severe weather.

What AAA membership plans are available?

AAA offers several membership plans, including:

- AAA Basic Membership

- AAA Plus Membership:

- AAA Premier Membership

The basic membership will be the cheapest option for customers.

How to pay my AAA insurance premiums?

AAA insurance payments can be made online through the AAA website, mobile app, or over the phone (Learn More: How do auto insurance payments work?).

What are AAA’s auto insurance ratings?

AAA’s insurance rating from A.M. Best is A+ (Superior).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Sally Ayres

AAA review

sally_a

Crooks

Teezee

Don’t buy triple AAA

Tia_15

DON'T CALL AAA IF THE CRASH ISN'T YOUR FAULT!!!!!!!

cordarei

inefficient claims

tom_pop

Breach of Trust -- Raises Premium Without Notifying Consumer

CCADE

Excellent, Fast Professional & Friendly Service

vintagemx465

Home Owners Insurance

Always_Cold

Good customer service

kathleenl1963

Best Insurance Ever