AAA vs. Geico Auto Insurance in 2025 (Side-by-Side Review)

AAA vs. Geico auto insurance proves Geico is cheaper at $43 per month versus AAA’s $65. Geico’s DriveEasy app tracks speed and braking for lower rates, while AAA’s OnBoard gives a 15% sign-up discount and up to 30% savings but adds a mandatory membership fee to access coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Apr 3, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 3, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsAAA vs. Geico auto insurance shows Geico’s DriveEasy rewards safe drivers and averages $43 monthly, while AAA’s OnBoard offers 30% savings but costs $65 monthly and requires up to $120 in annual membership fees.

Geico rates are lower for high-risk drivers—$213 with a DUI versus AAA’s $461. Teen drivers see a $6,000+ yearly savings with Geico.

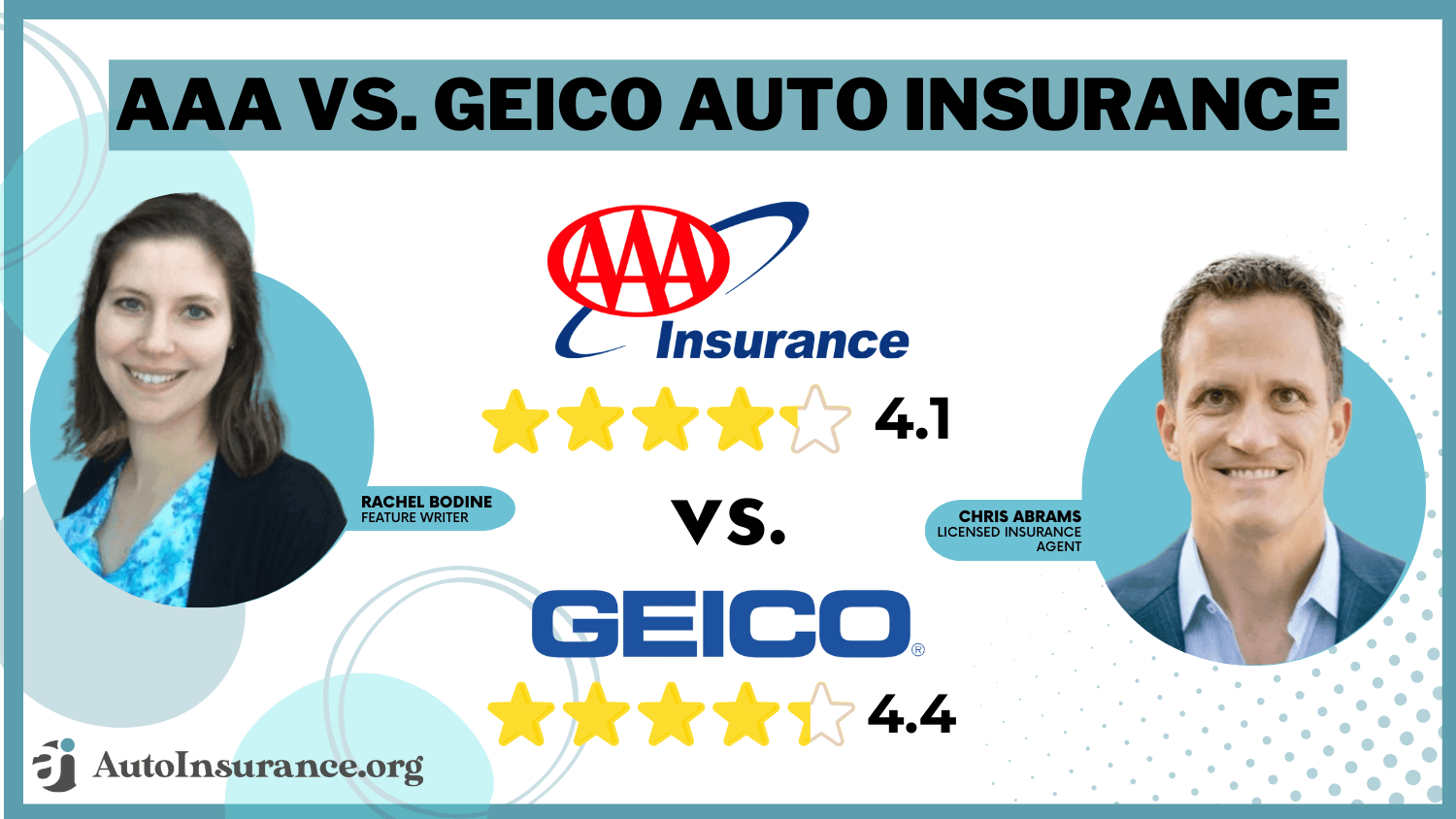

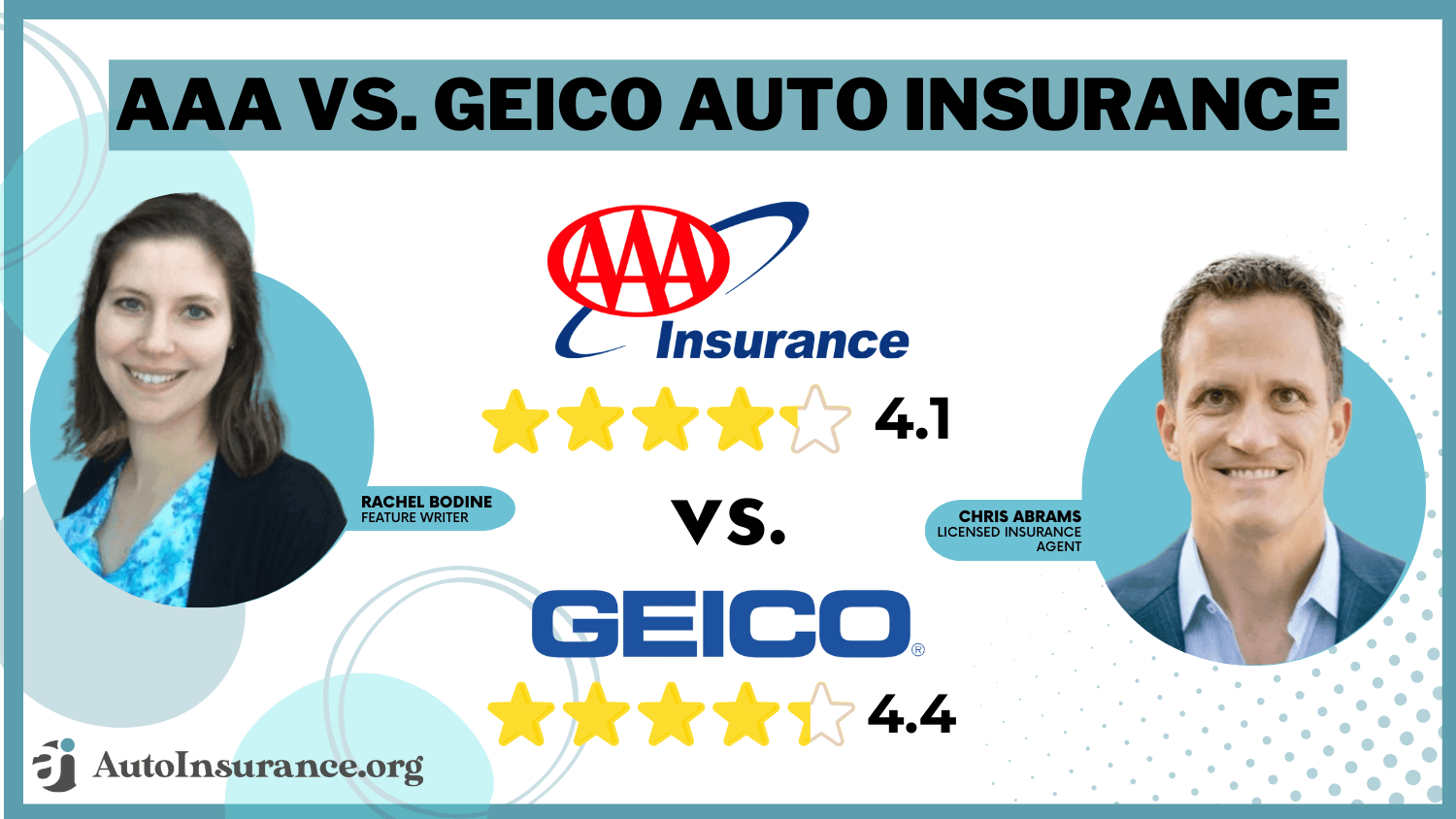

AAA vs. Geico Auto Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.1 | 4.4 |

| Business Reviews | 4.5 | 4.5 |

| Claim Processing | 3.3 | 4.8 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.1 | 4.4 |

| Customer Satisfaction | 2.1 | 2.3 |

| Digital Experience | 4.0 | 5.0 |

| Discounts Available | 5.0 | 4.7 |

| Insurance Cost | 4.1 | 4.5 |

| Plan Personalization | 4.0 | 4.5 |

| Policy Options | 4.4 | 4.1 |

| Savings Potential | 4.4 | 4.5 |

| AAA Review | Geico Review |

Geico also leads in customer satisfaction, digital tools, and claims handling.

AAA’s limited add-on options and low claims satisfaction scores make it less competitive despite offering bundling discounts and travel-related perks.

- Geico charges $213 monthly for DUIs vs. AAA’s $461 for the same driver

- Geico’s DriveEasy app tracks speed and braking to reward safe habits

- AAA’s OnBoard gives 15% off at signup but requires up to $120 yearly

By entering your ZIP code into our free quote comparison tool, you may obtain reasonably priced auto insurance regardless of your driving history.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Gender-Based Price Gaps in AAA vs. Geico Auto Insurance

Age and gender significantly affect how much drivers pay for full coverage. This section details specific monthly rates from AAA and Geico based on these demographics.

AAA vs. Geico Full Coverage Auto Insurance Monthly Rates

| Age & Gender |  | |

|---|---|---|

| 16-Year-Old Female | $635 | $425 |

| 16-Year-Old Male | $664 | $445 |

| 30-Year-Old Female | $141 | $128 |

| 30-Year-Old Male | $147 | $124 |

| 45-Year-Old Female | $125 | $114 |

| 45-Year-Old Male | $122 | $114 |

| 60-Year-Old Female | $111 | $104 |

| 60-Year-Old Male | $108 | $106 |

Geico offers lower full coverage rates than AAA across all groups, with the widest gap seen in 16-year-old males—$445 with Geico compared to $664 with AAA. Female teens also save $210 per month by choosing Geico over AAA.

Among adults, the rate difference narrows, but Geico still leads: 45-year-old males pay $114 with Geico, versus $122 with AAA. Even seniors save more with Geico, as 60-year-old females pay $104 monthly versus $111 with AAA. Geico’s pricing is more favorable overall, especially for younger and male drivers. Learn how age and gender are key factors that affect auto insurance rates.

Driving Record Impacts Geico vs. AAA Auto Insurance Costs

Geico and Triple-A both adjust your rates based on your driving record, and those differences can really add up. Your driving history can dramatically shift what you pay for full coverage. This section compares monthly rates from AAA and Geico based on four types of driving records.

AAA vs. Geico Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record |  | |

|---|---|---|

| Clean Record | $122 | $114 |

| Not-At-Fault Accident | $189 | $189 |

| Speeding Ticket | $154 | $151 |

| DUI/DWI | $211 | $309 |

Drivers with a clean record pay slightly more with AAA at $122 compared to Geico’s $114. For not-at-fault accidents, both insurers charge the same rate of $189, showing no penalty for that incident type. With a speeding ticket, Geico remains slightly more affordable at $151 versus AAA’s $154.

The most important finding is for DUI cases—Geico’s rate spikes to $309 monthly, while AAA’s is just $211, offering a $98 monthly advantage. Drivers with serious violations save more with AAA despite its typically higher rates elsewhere. See how auto insurance companies check driving records for violations and DUIs.

Credit-Based Pricing Differences in AAA Car Insurance vs. Geico

A driver’s credit score is one of the strongest indicators used to determine full coverage rates. This section compares how AAA and Geico adjust monthly prices across three major credit tiers.

Full Coverage Insurance Monthly Rates by Credit: AAA vs. Geico

| Credit Score |  | |

|---|---|---|

| Good Credit (670–739) | $120 | $110 |

| Fair Credit (580–669) | $145 | $130 |

| Bad Credit (300–579) | $190 | $165 |

Drivers with good credit between 670 and 739 pay $110 per month with Geico, while AAA charges $120. For fair credit scores ranging from 580 to 669, Geico offers a $130 rate, saving drivers $15 each month compared to AAA’s $145.

The largest pricing gap shows up for drivers with bad credit between 300 and 579—Geico charges $165, while AAA’s rate spikes to $190, a $25 difference. Geico keeps things more affordable no matter where your credit stands. On top of that, AAA’s rates come with a membership fee, making it even pricier. Understand how credit scores affect auto insurance rates with Geico and AAA.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

AAA vs. Geico Auto Insurance Discount Comparison

Auto insurance discounts can seriously cut down your monthly bill if you qualify. This breakdown of AAA vs. Geico auto insurance discounts shows precisely where each company gives you the most significant savings.

Auto Insurance Discounts and Savings: AAA vs. Geico

| Discount Type |  | |

|---|---|---|

| Anti-Theft Device | 8% | 25% |

| Bundling | 15% | 25% |

| Defensive Driving Course | 14% | 15% |

| Good Driver | 30% | 26% |

| Good Student | 14% | 15% |

| Low Mileage | 10% | 30% |

| Military/Service Member | 10% | 15% |

| Multi-Car | 25% | 25% |

| Safe Driver | 10% | 15% |

| Safety Features | 10% | 15% |

Geico leads in most areas, offering a 25% discount for anti-theft devices, compared to AAA’s modest 8%. Low-mileage drivers save the most with Geico’s 30% discount, while AAA only offers 10%. Both companies match at 25% for multi-car policies, and you can also save money by bundling insurance policies with either provider.

Good driver discounts can significantly lower your premium, but eligibility often depends on five years of clean driving.Daniel Walker Licensed Auto Insurance Agent

Geico offers stronger savings for military members, safety features, and defensive driving courses—all at 15% versus AAA’s 10% or 14%. AAA, on the other hand, outperforms Geico in one important area: their 30% good driver discount is higher than Geico’s 26%. If you qualify for multiple discounts, Geico’s broader and higher-value alternatives frequently result in cheaper total rates.

Key Coverage Features in AAA vs. Geico Auto Insurance

AAA auto insurance vs. Geico highlights the key coverage differences drivers should consider before choosing a policy. Knowing what each insurer actually covers can make all the difference when choosing a policy. This section breaks down the real differences between AAA vs. Geico auto insurance with clear examples of what each one includes and what they leave out.

Auto Insurance Coverage Options: AAA vs. Geico

| Coverage Type |  | |

|---|---|---|

| Liability Coverage | ✅ | ✅ |

| Collision Coverage | ✅ | ✅ |

| Comprehensive Coverage | ✅ | ✅ |

| Uninsured/Underinsured Motorist | ✅ | ✅ |

| Medical Payments (MedPay) | ✅ | ✅ |

| Personal Injury Protection (PIP) | ✅ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| Rental Car Reimbursement | ✅ | ✅ |

| Gap Insurance | ✅ | ❌ |

| Accident Forgiveness | ✅ | ✅ |

| New Car Replacement | ✅ | ❌ |

| Rideshare Coverage | ✅ | ✅ |

| Custom Equipment Coverage | ✅ | ✅ |

| Mechanical Breakdown Insurance | ❌ | ✅ |

| Usage-Based Insurance | ✅ | ✅ |

Both companies cover the basics, including liability for damage you cause to others, collision for your car in an accident, and comprehensive coverage for events like theft, hail, or flood. You’ll also get medical payments (MedPay) and personal injury protection to help with medical bills regardless of fault, plus uninsured and underinsured motorist coverage in case someone hits you without enough insurance.

Both offer extras like roadside assistance, rental car reimbursement, rideshare coverage, and accident forgiveness that protects your rate after your first at-fault accident. AAA stands out with gap insurance to cover the loan balance if your car is totaled and new car replacement that gives you a brand-new vehicle during the early ownership period.

Geico does not include such, but it does provide mechanical breakdown insurance, which is suitable for newer vehicles and covers expensive repairs such as transmission or engine damage. Both provide usage-based insurance packages, which reward careful drivers with lower rates.

AAA and Geico: Behind the Brand Names and Regional Differences

Although coverage and cost are likely your top priorities when you get auto insurance from AAA or Geico, the company name on your policy may not be what you were expecting. That’s because AAA, also known as the American Automobile Association, works through regional clubs, and Geico, short for the Government Employees Insurance Company, uses different companies under its brand depending on your situation.

If you’re in Texas, your AAA policy is actually handled by Auto Club County Mutual Insurance Company, even though it’s still the same AAA service and coverage like liability and collision. In places like Pennsylvania, Ohio, West Virginia, New York, and Kentucky, it’s AAA East Central that manages your membership and insurance.

And if you’re in Michigan, Florida, Georgia, or Illinois, you’ll be working with The Auto Club Group—again, same perks, just run locally.

With Geico, everything feels more centralized, but they also operate through a few different names. If you’re getting basic or high-risk coverage, it might come from Geico General Insurance Company.

Do you require typical full coverage auto insurance that includes comprehensive and collision? Geico Indemnity Company frequently does that. Furthermore, Geico Casualty Company maybe your policy provider if you have experienced any setbacks, such as previous collisions, lapsed coverage, or SR-22 regulations. All of Geico is still there; it’s just customized for you.

So, if you ever notice a different name on your AAA or Geico documents, don’t stress—it’s just how they organize things behind the scenes to meet state rules and different coverage needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Geico and AAA: Telematics Programs

Telematics, or usage-based insurance systems, allow companies to offer lower rates to drivers who practice safe habits behind the wheel. Geico and AAA offer telematics programs, and they are fairly similar.

Geico DriveEasy

Geico’s DriveEasy program tracks habits like your speed, braking, acceleration, driving time of day, and mileage. The company offers cheaper rates for safe drivers, though Geico does not specify how much you will save on its website.

The DriveEasy app has 3.5 out of five stars for both Google Play and the Apple Store.

AAA OnBoard

With OnBoard, you can save up to 30% on your auto insurance. In addition, AAA tracks the same things that Geico does, and the company offers a 15% discount just for signing up for the program. AAA’s Auto Club app has 4.7 out of five stars on the Apple Store and 4.3 out of five stars on Google Play.

AAA vs. Geico: Roadside Assistance

You may think AAA has a better roadside assistance plan because of its popularity, but the roadside assistance coverage with Geico and AAA are fairly similar. With Geico’s roadside assistance, you’ll get:

- Towing services

- Jump starts

- Tire services

- Lockout services (up to $100)

- Fuel delivery

In comparison, AAA offers the following services with its roadside assistance plan:

- Towing

- Jump starts

- Fuel delivery

- Extricating

- Trip interruption

The one thing AAA offers that Geico does not in terms of roadside assistance is its trip interruption coverage.

AAA vs. Geico Auto Insurance Review Scores Compared

Consumer satisfaction and financial strength say a lot about how well an insurance company serves its policyholders. This section compares AAA vs. Geico auto insurance based on scores from trusted industry sources.

Insurance Business Ratings & Consumer Reviews: AAA vs. Geico

| Agency |  | |

|---|---|---|

| Score: 706 / 1,000 Avg. Satisfaction | Score: 692 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Feedback | Score: 74/100 Good Customer Satisfaction |

|

| Score: 0.58 Fewer Complaints Than Avg. | Score: 0.55 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A++ Superior Financial Strength |

Geico scores higher in J.D. Power’s survey with 706 out of 1,000, while AAA comes in at 692, just under the industry average. Both companies get a solid 74 out of 100 from Consumer Reports, showing that customers are generally happy with claims and service. Geico has slightly fewer complaints, too, with a complaint index of 0.55 compared to AAA’s 0.58, both better than average.

The biggest gap is in financial strength—Geico holds an A++ from A.M. Best, the highest possible, while AAA carries a still-strong A rating. If you care about fewer complaints, better service scores, and financial backing, Geico has a bit of an edge.

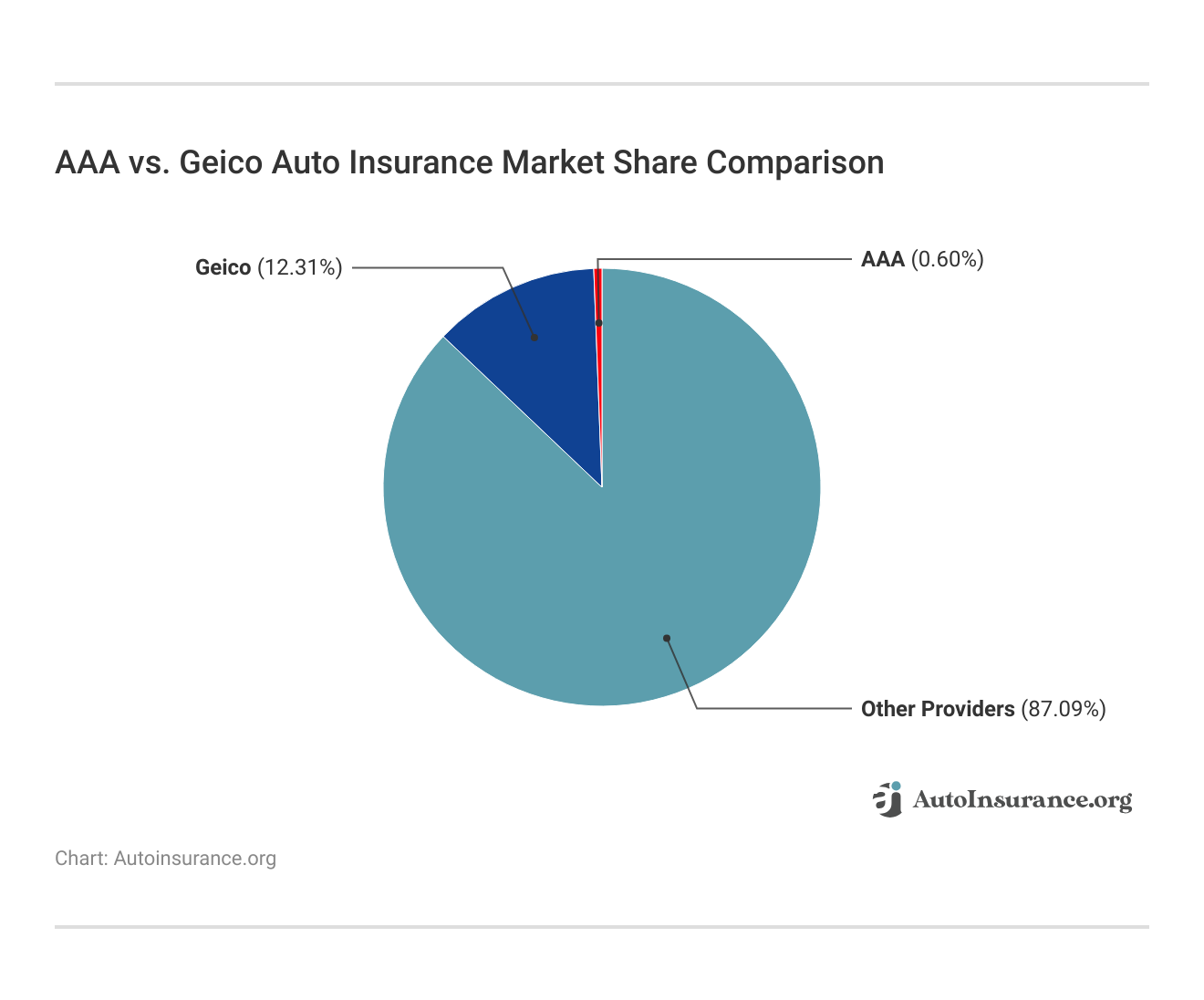

Market share reveals how dominant a company is in the auto insurance industry. This chart shows a sharp contrast in reach between AAA vs. Geico auto insurance providers.

Geico holds 12.31% of the U.S. auto insurance market, making it one of the biggest players out there. AAA only holds 0.60%, which is a tiny slice by comparison. The other 87.09% is split among other providers, showing just how competitive this space really is.

Geico’s big market share comes from its easy online tools, national availability, and strong advertising. AAA’s smaller share is because it operates through local clubs and requires a membership to get coverage.

On Reddit, a Reddit user shared that they had AAA for years and thought the experience was solid. They’d been in a few accidents that weren’t their fault and said AAA handled everything without a fight, even covering rental cars without hassle.

Comment

byu/MShorter02 from discussion

inInsurance

They admitted AAA was a little pricier than other companies but felt it was worth it—especially because of the towing service. They don’t have AAA now but mentioned they’d probably sign up again for car and renters insurance. It’s a good reminder from Reddit that sometimes paying a bit more can mean less stress when things go wrong.

Learn more: Where can I compare online auto insurance companies?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of AAA

Pros

- New Car Replacement: AAA provides in the first year full replacement of a totaled car with a brand-new one, which Geico does not provide at all.

- Gap Insurance Included: Included in the gap insurance is AAA’s gap insurance might pay the difference—something Geico does not offer—if you owe more on your vehicle than it is worth.

- Top-Tier Good Driver Discount: Safe drivers can score up to 30% off with AAA, which is higher than Geico’s 26%. Get more quotes in our AAA auto insurance review.

Cons

- Tiny Market Share: AAA only holds 0.60% of the auto insurance market, way behind Geico’s 12.31%, which limits its availability and reach.

- Mandatory Membership Fee: AAA requires a paid membership ($60–$120 annually) just to be eligible for auto insurance, adding to the upfront cost.

Pros and Cons of Geico Auto Insurance

Pros

- Lower Rates: Consistently offers cheaper premiums than AAA, especially for drivers with good credit and clean records.

- Best for Teen and Young Drivers: Geico saves teen drivers over $6,000 per year compared to AAA, making it a smarter choice for families.

- Huge Low-Mileage Discount: If you don’t drive much, Geico offers up to 30% off, compared to just 10% with AAA. Discover insights in our Geico auto insurance review.

Cons

- No Gap Coverage: Geico doesn’t offer gap insurance, which could leave you stuck paying off a loan if your car gets totaled.

- No New Car Replacement: Unlike AAA, Geico won’t replace your totaled car with a brand-new one if it’s still pretty new.

Comparing AAA and Geico Helps Drivers Find the Best Policy Fit

AAA vs. Geico auto insurance shows how different your experience can be depending on what you’re looking for. AAA works well for drivers who want perks like rental car reimbursement and new car replacement insurance, while Geico is better for those who like using tech tools like DriveEasy to earn discounts.

AAA offers a 30% good driver discount, which is higher than what Geico gives, but its coverage can vary depending on your local club. Geico stands out by offering mechanical breakdown insurance, something AAA doesn’t include, which is great if you’ve got a newer car.

To find the best fit for your needs and budget, use our free comparison tool to check quotes from multiple auto insurance companies in one place.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Are there any extra benefits in Geico roadside assistance vs. AAA?

AAA includes extras like trip interruption coverage, discounts on hotels and car rentals, and DMV services at select locations. Geico does not offer these extras, focusing solely on emergency roadside help through the policy add-on.

How does AAA vs. Nationwide compare in terms of rates and benefits for auto insurance?

AAA typically costs more, with full coverage averaging around $147 monthly, but includes extras like trip interruption, rental car reimbursement, and 30% safe driver discounts. Nationwide offers lower base rates in some states and unique perks like vanishing deductibles and SmartRide telematics but lacks AAA’s travel-related benefits.

Which insurer is more cost-effective and comprehensive, AAA vs. American Family?

AAA includes new car replacement, trip interruption, and roadside assistance, but requires a membership fee of $60–$120. American Family offers wider policy customization, strong teen driver discounts, and a KnowYourDrive usage-based insurance program, which can reduce rates for low-mileage drivers.

What should drivers know from an AAA mechanical breakdown insurance review?

AAA mechanical breakdown insurance is available in select states and covers repairs for major systems like the engine, transmission, and air conditioning—usually for vehicles under 10 years old and with less than 100,000 miles. It doesn’t require a dealership repair contract and can be more affordable than extended warranties.

What are the major coverage differences between AAA and Geico home insurance?

AAA home insurance includes extended replacement costs, identity theft protection, and emergency repairs as part of membership perks. Geico partners with third-party insurers for home coverage, meaning available features and claim experiences vary and often exclude AAA-style membership benefits.

What do drivers gain from AAA vs. State Farm auto insurance?

AAA is better for drivers seeking travel-related perks like discounts on hotels and free towing services, plus its accident forgiveness and new car replacement add value. State Farm Drive Safe and Save uses real-time driving data to reward safe habits and is part of a broader offering that includes national coverage and a 19,000-agent network.

State Farm offers broader national coverage, a 19,000-agent network, and a strong Drive Safe & Save telematics program that can cut premiums up to 30%.

In the Nationwide vs. AAA comparison, who supports safer driving more effectively?

Nationwide’s SmartRide program offers up to 40% off for safe driving, the highest usage-based discount among large insurers. AAA provides a 30% discount through its OnBoard program, though participation and availability vary by region.

What should policyholders expect from AAA vs. Esurance for claims service?

AAA’s claims experience depends heavily on your local club—some offer in-person help and local adjusters, while others may be slower. Esurance offers 100% digital claims with a mobile app, tracking updates, and a streamlined repair shop network, often speeding up the resolution process.

What are the main distinctions between AAA and Progressive auto insurance policies?

AAA offers gap insurance and rental reimbursement as standard with many policies and delivers strong regional roadside service. Progressive is more competitive for high-risk drivers and offers a Name Your Price tool and Snapshot telematics program with discounts of up to 30%.

Is Geico good car insurance?

Yes, Geico is good car insurance for drivers who value affordability and convenience. It offers rates as low as $43 per month for full coverage, access to the DriveEasy telematics program that rewards safe driving, and mechanical breakdown insurance for newer vehicles. Geico also maintains an A++ financial strength rating from A.M. Best and handles fewer complaints than average, with a 0.55 NAIC complaint index.

What are the disadvantages of AAA?

The disadvantages of AAA include a required annual membership fee between $60–$120 just to access insurance, higher monthly rates for high-risk drivers (e.g., $461 per month for a DUI), and regional service inconsistencies due to its club-based structure. AAA also lacks mechanical breakdown insurance and tends to receive lower customer satisfaction scores compared to national carriers like Geico.

Which insurer provides better extras and digital features in AAA vs. Liberty Mutual?

Liberty Mutual offers accident forgiveness, new car replacement for vehicles under one year old, and robust online policy management tools. AAA stands out for members needing travel planning, DMV services, and roadside assistance built into the insurance package, though online tools may vary by region.

How to lower car insurance in Geico?

Consider signing up for DriveEasy, which tracks your driving patterns and incentivizes safe driving, to reduce your Geico auto insurance. In addition, you can install safety features like airbags and anti-theft devices, keep a spotless driving record, and combine your auto policy with homeowners or renters insurance. Additionally, Geico provides drivers who reduce their mileage with discounts of up to 30%.

Which insurance is better than Geico?

Insurance that is better than Geico depends on the coverage you’re looking for. While Geico excels in affordability, AAA may be better for those who want gap insurance or new car replacement, which Geico doesn’t offer. AAA also includes trip interruption coverage with its roadside plan, which is ideal for long-distance travelers, something not available with Geico.

What is the number one risk factor for AAA?

The number one risk factor for AAA is being classified as a high-risk driver, such as having a DUI or poor credit. AAA charges $190 a month for bad credit and $461 a month for DUI—rates significantly higher than Geico. These high rates make AAA less ideal for drivers with violations or financial instability, especially those seeking high-risk auto insurance with more affordable options.

Find better coverage rates in minutes using our free quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.