Allstate Milewise Review (2025)

Our Allstate Milewise review explains how drivers can save up to 15% with low-mileage auto insurance. Allstate Milewise only tracks mileage, not driving habits, making it an affordable option for high-risk drivers. Compare Allstate Milewise costs below starting at $60/mo to get cheap insurance by the mile.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Insurance & Finance Analyst

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

What is Allstate Milewise? Allstate’s pay-per-mile auto insurance program that determines how much you’ll pay each month based on how many miles you drive. If you’re looking for auto insurance for infrequent drivers, Milewise might be the best choice.

Explore this Allstate Milewise insurance review to see if it offers the best pay-per-mile car insurance for your needs. You can also locate an Allstate Milewise review on Reddit to see what customers there say.

Then, enter your ZIP code into our free quote tool above to compare your options with other companies and find the cheapest pay-per-mile car insurance near you.

- Milewise is Allstate’s pay-per-mile insurance program

- Allstate tracks your mileage to determine how much you pay for coverage

- Milewise is available in 21 states

Allstate Milewise Explained

What is Milewise Allstate? Milewise is the Allstate pay-as-you-go insurance program that helps low-mileage drivers keep their rates down.

The average American drives 13,500 miles per year, or a little over 1,000 per month. If your annual mileage is close to or over the average, you should consider a different usage-based insurance program like Drivewise to lower your car insurance costs.Scott W. Johnson Licensed Insurance Agent

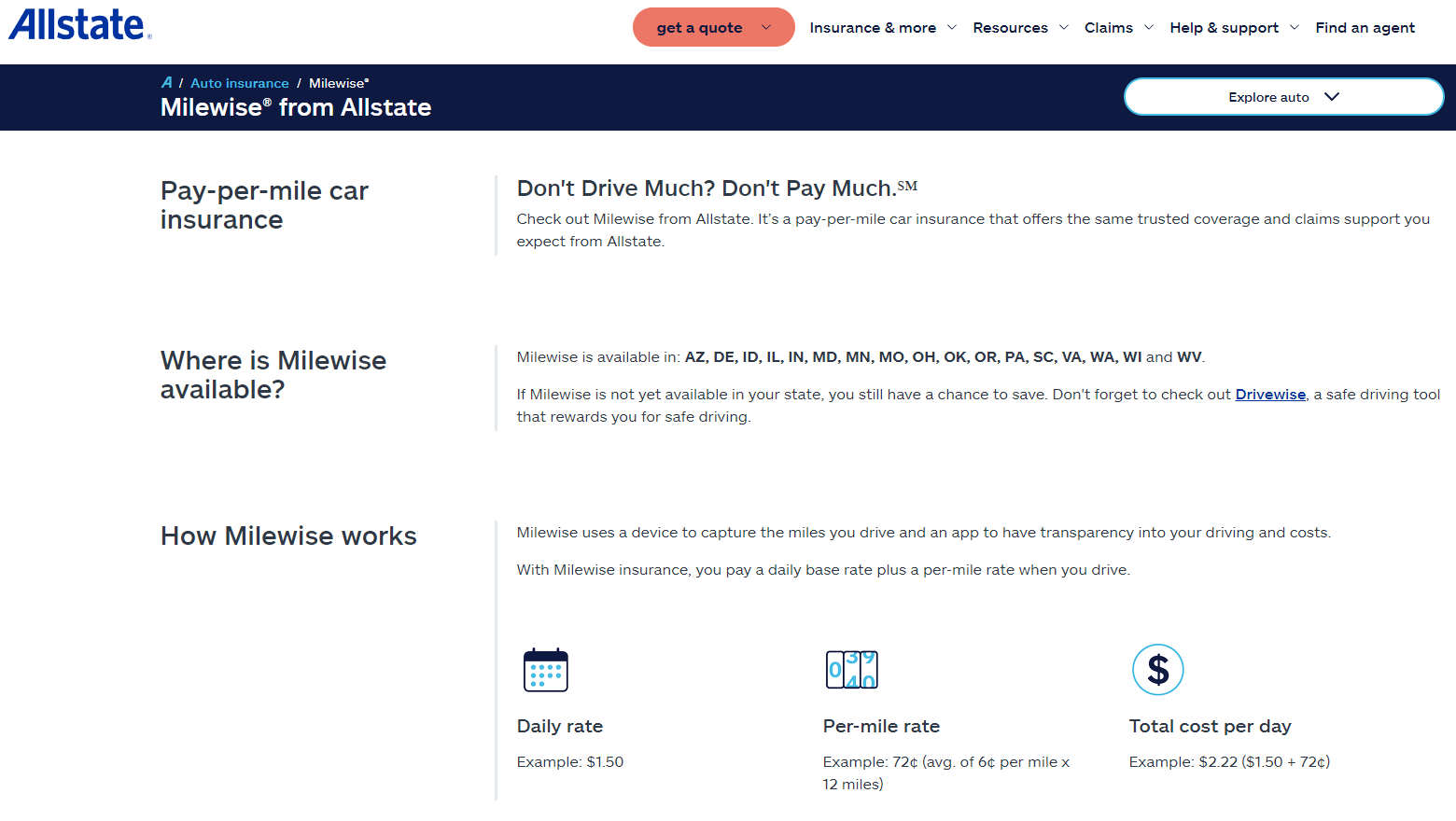

So, how does Allstate Milewise work? The Allstate Milewise program uses a mobile app or plug-in device to track mileage and charges a base rate plus a per-mile rate.

Pay-per-mile insurance isn’t right for everyone, but it can help the right type of driver save significantly on their coverage. For example, stay-at-home parents, remote workers, and drivers with short commutes could benefit from the Allstate pay-by-mile program.

View this post on Instagram

When you’re looking for cheap usage-based auto insurance, Milewise might be the best choice, especially if you’re already an Allstate customer. Before signing up, you should be aware that Milewise doesn’t only track your miles — it also looks at things like when you drive, speeding, and hard braking.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Allstate Milewise Pros and Cons

Like other auto insurance for limited-use vehicles and drivers, Milewise has its benefits and disadvantages. When you sign up for Milewise, you can expect the following pros:

- Lower monthly rates

- Personalized driving recommendations

- Earn Allstate rewards points for safe driving

While it makes it easy to save, there are a few drawbacks you should be aware of with Milewise. These include:

- Only available in 21 states

- Device tracks your car all the time, even when you’re a passenger

- Your data is always tracked, which some drivers are uncomfortable with

Milewise might be the best choice for you, but you’ll need to be an Allstate customer to purchase it. Learn more about Allstate in our comprehensive Allstate auto insurance review.

Allstate Milewise Customer Reviews and Complaints

When looking for the best pay-as-you-go auto insurance companies, looking at customer reviews is one of the first steps you should take.

Generally, Milewise Allstate reviews are positive. Many customers report that Milewise significantly reduces the amount they pay for coverage, especially drivers looking for auto insurance for telecommuters.

However, some customers reported that they didn’t understand what Milewise tracked and felt like their rates were unfairly high. You can avoid this by reading this guide or speaking with a representative before signing up.

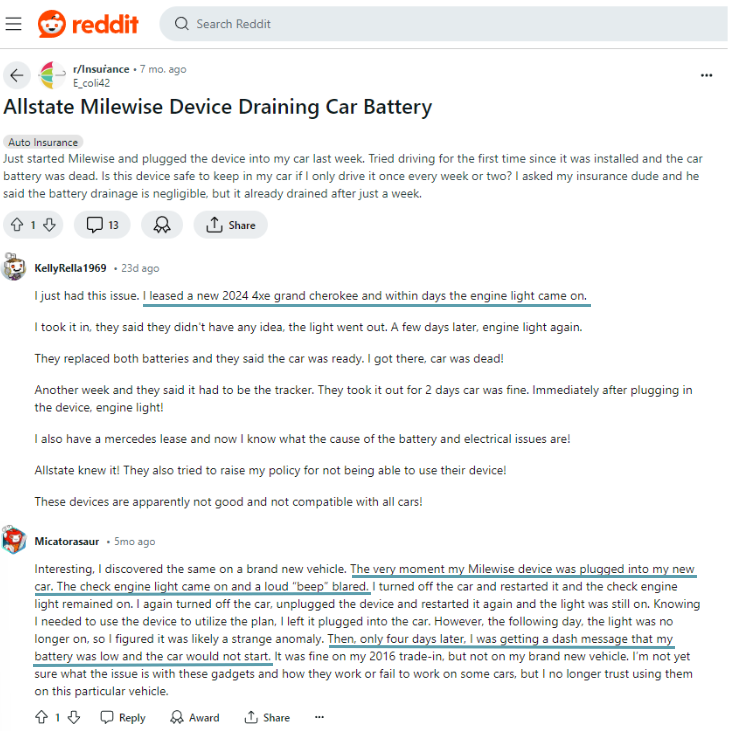

In addition, Allstate Milewise complaints on Reddit from customers say the plug-in device drained their car battery. While one Reddit user said the Milewise device caused their check engine light to immediately come on, another said it came on within a few days.

Check out online Allstate Milewise program reviews to see if the company is right for you.

Comparing Allstate Milewise Insurance Rates

Comparing your pay-per-mile insurance options is an important step in finding the best coverage for your needs. Check out the table below to see how Milewise stacks up against its biggest competitors.

Compare Pay-Per-Mile Auto Insurance by Provider

| Provider | Program | Tracking Method | Monitoring | Availability | Potential Savings | Monthly Rate |

|---|---|---|---|---|---|---|

| Milewise | Plug-in device | Mileage | 21 states | 15% | $124 | |

| DriveMyWay | Mobile app | Driving behavior | Utah only | 20% | $100 | |

| DriveEasy | Mobile app | Driving behavior | 33 states | 25% | $110 | |

| RightTrack | Plug-in device | Driving behavior | 41 states | 30% | $120 |

| SmartMiles | Plug-in device | Mileage | 45 states | 20% | $110 |

| Snapshot | Mobile app | Driving behavior | 12 states | 30% | $135 | |

| Drive Safe & Save | Plug-in & mobile | Mileage & driving | 49 states | 30% | $130 | |

| IntelliDrive | Plug-in device | Driving behavior | 38 states | 20% | $120 | |

| SafePilot | Mobile app | Driving behavior | 30 states | 20% | $125 |

As you can see, Milewise is a solid option compared to its competitors. To learn more, you can check out our State Farm vs. Allstate auto insurance comparison.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

More About How Allstate Milewise Works

How does Milewise from Allstate work? Unlike traditional insurance policies that set a flat fee you’re charged every month, Allstate Mile Wise only charges you for the miles you drive. The amount you’re charged is made up of two parts, which you can explore below.

The best Allstate Milewise mileage is 7,000 miles per year or less. You’ll likely still see savings if you drive a bit more, but the best savings are for people who put a limited number of miles on their car.

Now that you know the answer to, “How does Milewise work?” we’ll explain how to get started with the program.

How to Install Allstate Milewise

Allstate Milewise is an easy way to save on your coverage when you’re trying to figure out how to get a low-mileage auto insurance discount. Signing up for Milewise is as simple as following these steps:

- Sign up for Milewise by speaking with an Allstate representative

- Plug in the device in your car’s diagnostic port once you receive it

- Download the Allstate Milewise app

Milewise will begin tracking your miles as soon as you plug in the device and start driving.

Milewise vs. Drivewise

What is the difference between Milewise and Drivewise? When it comes to UBI programs, many drivers confuse Allstate Milewise vs. Drivewise because they’re similar programs. However, there are some key differences between each listed in the table below.

Allstate Milewise vs. Drivewise: Compare the Differences

| Feature | Milewise | Drivewise |

|---|---|---|

| Policy Add-On | No | Yes |

| Tracking | Mileage | Driving Behavior |

| Availability | 23 States | All States Except NY |

| Discount | 20% | 30% |

| Monthly Rates | $116 | $79 |

While they’re not the same, Drivewise can be a good alternative if you’re concerned about annual mileage affecting insurance rates and if Milewise isn’t offered in your state. You can learn more in our Does annual mileage affect auto insurance rates? review.

How You Can Save With Allstate Per-Mile Insurance

What is Allstate pay-per-mile insurance? Milewise by Allstate is an excellent pay-per-mile insurance program, especially for drivers who are already Allstate customers. However, the program is only available in 21 states, meaning you might have to find an alternative for low-mileage insurance.

As with standard policies, you should compare your options before signing up for Milewise. Many companies offer low-mileage insurance, and you might find a program that suits your needs better than Milewise. Also, check out what customers say about Allstate Milewise on Reddit and Consumer Reports to see if it’s a good fit for you.

Ready to get a quote for Allstate insurance by the mile? Enter your ZIP code into our free quote comparison tool below to evaluate rates from the top pay-per-mile providers near you.

Frequently Asked Questions

Is pay-per-mile auto insurance a good idea?

Is insurance per mile worth it? Pay-per-mile auto insurance, also known as pay-as-you-go car insurance, is a good idea if you’re an infrequent driver. The best annual mileage for cheap insurance is 7,000 miles per year — if you drive more than that, pay-per-mile insurance might not save you money.

Are Allstate Milewise reviews good?

You might be thinking, “How are Allstate pay-per-mile reviews?” Allstate Milewise complaints are generally low, but the program isn’t considered as good because it’s only available in a few states.

Does Allstate Milewise track my speed?

A top question readers ask is, “Does Allstate Milewise track your speed?” One of the things Milewise tracks is your speed. To keep your rates as low as possible, Allstate suggests avoiding driving over 80 mph.

Does Allstate Milewise use GPS?

Yes, Milewise uses GPS tracking to determine how many miles you drive each day. Reviews state that there aren’t many Allstate Milewise device problems when it comes to GPS tracking.

How is Allstate Milewise tracked?

Milewise uses a device that plugs into your car to track your daily miles. The device pairs with the Milewise app so you can see exactly how many miles you drive.

Does Allstate use telematics?

While Allstate offers programs that use telematics (like Milewise and Drivewise), a standard Allstate policy does not track your driving.

For questions about the program, the Allstate Milewise customer service number is 1-877-389-0047.

What is the difference between Allstate Milewise and Drivewise?

Both Milewise and Drivewise track your driving habits, including the miles you drive, when you drive, and speeding. The big difference between these programs is that Drivewise offers safe drivers a discount on their regular policies, while Milewise determines your monthly rates by how much you drive.

When did Allstate start Milewise?

Allstate started its insurance for low-mileage drivers in 2016 when it launched Milewise.

What is the Allstate Milewise daily cap?

You might be wondering, “What is the maximum miles per day for Milewise?” Allstate stops charging you once you reach 250 miles in a single day. In some states, the cap is 150 miles.

Will my Allstate auto insurance rates go up if I drive more miles?

If you have a regular Allstate policy, your mileage won’t increase your rates. If you sign up for Milewise, your rates will increase with every mile you drive.

What is the best mileage for cheap Allstate Milewise insurance?

The best mileage to keep Allstate Milewise costs low is under 20 miles per day. While you can still save if you drive more miles, you won’t see as good of rates.

What’s the best pay-per-mile auto insurance program?

While the best low-mileage auto insurance program depends on your situation, many drivers agree that Allstate’s Milewise is one of the best programs. Other excellent options include companies like Metromile and Mile Auto.

Is Allstate Milewise worth it?

You may wonder, “Is Milewise worth it?” Pay-per-mile insurance is worth it if you’re a low-mileage driver. There are plenty of companies that offer insurance by the mile, but many drivers suggest using Milewise.

Is Milewise from Allstate worth it if I drive a lot? Generally, Milewise is designed for low-mileage drivers, meaning you may not benefit from the program if your annual mileage is high.

Have questions about the Milewise program? The Allstate Milewise phone number is 1-877-389-0047.

Does Milewise save you money?

Policyholders who driver fewer miles than the average driver could see an Allstate mileage discount with Milewise auto insurance.

What is considered a lot of miles driven per year?

While “a lot” of miles is subjective, driving over 15,000 miles per year is generally considered high mileage.

Where does the Allstate Milewise device go?

If you opt for the plug-in device, it will go into your car’s OBD-II port, usually found under the dashboard. However, you can also use the mobile app with your Allstate Milewise login to track mileage without the physical device.

How much is Allstate pay-per-mile insurance?

You may be wondering, “How much is Allstate Milewise?” The amount Milewise costs depends on factors such as mileage, driving habits, and location. With Allstate Milewise, drivers pay a base rate plus a per-mile rate, meaning drivers who don’t travel a lot get an Allstate low-mileage discount.

Does Progressive have pay-per-mile insurance?

No, Progressive doesn’t have a pay-per-mile insurance program.

How much is pay-per-mile insurance with Nationwide?

The amount you’ll pay for coverage with Nationwide SmartMiles, the insurer’s per-mile program, depends on your mileage and driving habits.

Who has the best pay-per-mile car insurance in Illinois?

Allstate Milewise, Root, and Metromile are some of the best pay-per-mile programs for Illinois auto insurance.

Read More:

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Insurance & Finance Analyst

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.