Best Alton, Illinois Auto Insurance in 2025 (Find the Top 10 Companies Here)

Allstate, Farmers, and American Family offer the best Alton, Illinois auto insurance with rates starting at $80 per month. These insurers stand tall in offering customizable plans and pioneering discounts, making them top choices for drivers looking for cheap car insurance in the area.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Alton Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Alton Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 2,235 reviews

2,235 reviewsCompany Facts

Full Coverage in Alton Illinois

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews

The best Alton, Illinois auto insurance providers are Allstate, Farmers, and American Family, with rates starting at $80 per month.

In Alton, Illinois, the regulations governing auto insurance require that all drivers maintain a minimum level of coverage. Designed to ensure that all motorists have sufficient financial protection in the event of an accident or other incidents involving their vehicles.

Our Top 10 Company Picks: Best Alton, Illinois Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A+ Comprehensive Coverage Allstate

#2 15% A Customizable Plans Farmers

#3 12% A Local Focus American Family

#4 10% A++ Reliable Service Auto-Owners

#5 20% B Local Agent State Farm

#6 12% A+ Competitive Rates Progressive

#7 14% A+ Accident Forgiveness Nationwide

#8 10% A Innovative Discounts Liberty Mutual

#9 13% A++ Broad Coverage Travelers

#10 15% A+ AARP Discounts The Hartford

Before you buy Alton, Illinois auto insurance, make sure you have compared rates from multiple companies. Enter your ZIP code above to get free auto insurance quotes in Alton, IL.

- The top auto insurance company overall is Allstate

- Compare auto insurance rates between married couples and single individuals

- The cheapest auto insurance company in Alton is State Farm

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Allstate: Top Overall Pick

Pros

- Excellent Mobile App: Allstate’s mobile app offers easy policy management, including features for paying bills, filing claims, and accessing digital ID cards. Dive into Allstate auto insurance review for complete details on their policies.

- Safe Driver Discounts: Alton residents who maintain a clean driving record can benefit from substantial discounts, rewarding responsible driving behavior.

- Bundling Benefits: By combining auto coverage with other policies, Alton residents can tap into Allstate’s generous multi-policy discounts for significant savings.

Cons

- High Entry-Level Rates: Allstate’s premiums for minimum coverage in Alton tend to be higher than some competitors, potentially deterring budget-conscious drivers.

- Unhurried Claims Process: While generally dependable, Allstate’s claims handling in Alton can be slower than some other top providers, potentially impacting overall satisfaction.

#2 – Farmers: Best for Customizable Plans

Pros

- Individualized Attention: Farmers’ Alton-based agents provide one-on-one guidance to help craft policies that fit each driver’s distinct needs and circumstances.

- Local Community Engagement: Farmers actively participates in community events and initiatives in Alton, fostering a strong local presence. See more details in our page titled Farmers auto insurance review.

- Steadfast Stability: Farmers’ robust financial footing instills confidence in Alton policyholders, ensuring dependable coverage year after year.

Cons

- Streamlined Digital Experience: Compared to tech-forward competitors, Farmers’ online tools may leave some Alton customers desiring a more robust digital experience.

- Lengthy Claims Processing: While Farmers provides personalized claims assistance, some Alton customers experience longer processing times compared to other insurers.

#3 – American Family: Best for Local Focus

Pros

- Bundling Advantages: By combining auto with home or life policies, Alton residents can maximize American Family’s industry-leading multi-policy discounts.

- Built-to-Fit Coverage: With an extensive selection of optional protections, American Family empowers Alton drivers to design policies that match their unique risk profiles. Learn more about their ratings in our American Family auto insurance review.

- Responsive Claims Support: American Family’s strong claims satisfaction record gives Alton policyholders peace of mind, knowing they’ll be in good hands after an incident.

Cons

- Pricier Solo Policies: For Alton residents purchasing auto coverage alone, American Family’s rates may be less competitive than bundled alternatives.

- Finite Discount Choices: Compared to some providers, American Family may extend fewer discount programs to Alton drivers, potentially constraining savings opportunities.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Auto-Owners: Best for Reliable Service

Pros

- No-Gap Coverage for New Cars: Auto-Owners provides coverage that ensures no gaps between the old and new vehicle when Alton drivers purchase a replacement car.

- Affordably Robust Protection: They offer competitive rates for comprehensive coverage, as detailed in the Auto-Owners auto insurance review, allowing Alton residents to secure top-tier protection without overpaying.

- Community-Oriented Support: Auto-Owners’ Alton-based agents possess the local knowledge and personalized touch to provide custom-tailored service and solutions.

Cons

- Streamlined Digital Tools: Compared to some competitors, Auto-Owners’ online policy management options may not be as robust or intuitive for Alton’s digital-first consumers.

- Narrower Discount Range: Auto-Owners may offer fewer cost-cutting programs than some Alton providers, potentially limiting opportunities for premium reductions.

#5 – State Farm: Best for Local Agent

Pros

- Locally Tailored Service: With an expansive network of Alton-based agents, State Farm excels at delivering personalized, one-on-one support to local drivers.

- Teen Driver Rates: State Farm’s affordable premiums and discounts make it a budget-friendly choice for Alton families with young drivers.

- Confidence-Boosting Resources: State Farm’s extensive educational tools and programs empower Alton motorists to sharpen their skills and drive more safely. For discounts, read our State Farm auto insurance discounts.

Cons

- Slimmer Low-Mileage Discounts: Compared to some Alton providers, State Farm’s premium reductions for limited driving may be less generous, potentially impacting savings for infrequent motorists.

- Slightly Steeper Basic Coverage: For bare-bones policies, State Farm’s rates in Alton trend marginally higher than some more budget-focused competitors.

#6 – Progressive: Best for Competitive Rates

Pros

- Accessible High-Risk Coverage: With some of Alton’s lowest rates for motorists with imperfect histories, Progressive is a top pick for drivers struggling to secure affordable coverage elsewhere. Learn more in our Progressive auto insurance review.

- Behavior-Based Discounts: Through its Snapshot program, Progressive rewards Alton’s safest drivers with substantial savings, incentivizing responsible habits behind the wheel.

- Robust Online Offerings: Progressive’s intuitive digital tools make it a breeze for Alton residents to manage policies, file claims, and access support from anywhere.

Cons

- Pricier Basic Policies: Alton residents seeking no-frills coverage may find Progressive’s standard rates less competitive than some other stripped-down options.

- Scarcer In-Person Support: With a leaner local presence, Progressive may not be the ideal fit for Alton motorists who prefer face-to-face interactions for insurance matters.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Accident Forgiveness

Pros

- Plentiful Savings Opportunities: From safe driving to multi-policy discounts, Nationwide extends a wide array of cost-cutting options to help Alton motorists save.

- Home and Auto Bundling: As outlined in Nationwide auto insurance review, combining home and auto insurance with Nationwide can lead to substantial savings through their bundling discounts.

- Practical Proven Providers: With a reputation for steady reliability and practical solutions, Nationwide brings a reassuring track record of service excellence to Alton customers.

Cons

- Additional Costs for Add-Ons: Optional coverage add-ons and enhancements may increase the overall cost of the insurance policy for Alton drivers.

- Reduced In-Person Availability: With a somewhat smaller brick-and-mortar footprint, Nationwide may have fewer local agents available to assist Alton residents.

#8 – Liberty Mutual: Best for Innovative Discounts

Pros

- Finely Tuned Coverage: With a robust selection of à la carte options and endorsements, Liberty Mutual empowers Alton residents to craft truly personalized policies.

- Rewarding Responsible Choices: Liberty Mutual’s extensive safe driving discounts help keep premiums affordable for Alton’s most conscientious motorists.

- Multi-Policy Savings: As mentioned in our Liberty Mutual auto insurance review, by bundling auto with home coverage, Alton customers can take advantage of Liberty Mutual’s considerable multi-policy price breaks.

Cons

- Costlier Young Driver Coverage: For Alton households with teen motorists, Liberty Mutual’s premiums may be a bit steeper than certain competitors’ rates.

- Room for Claims Improvement: While far from subpar, Liberty Mutual’s claims satisfaction scores leave room for refinement compared to Alton’s most celebrated carriers.

#9 – Travelers: Best for Broad Coverage

Pros

- Diverse Discount Selections: With everything from safe driver to multi-policy price breaks, Travelers makes it easy for Alton motorists to maximize savings.

- Adjustable Payment Plans: As outlined in our Travelers auto insurance review, their flexible billing options enable Alton residents to align premium payments with their individual budgets and cash flow needs.

- Financially Robust Provider: Travelers’ outstanding fiscal stability ratings assure Alton policyholders that the provider will be there for them when they need it most.

Cons

- Pricier High-Risk Policies: For Alton drivers with accidents or violations on their records, Travelers’ rates may be a bit steeper than those of certain competitors.

- Leaner Local Presence: Compared to some other Alton insurers, Travelers may have a slightly smaller network of agents, potentially limiting opportunities for face-to-face support.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – The Hartford: Best for AARP Discounts

Pros

- Unbeatable Senior Savings: The Hartford’s exclusive AARP member discounts help Alton’s older motorists unlock some of the most affordable premiums available.

- Extensive AARP Network: With special savings and benefits for AARP’s extensive membership, The Hartford provides senior-centric coverage solutions for Alton drivers.

- Top-Rated Service: The Hartford’s strong customer satisfaction record gives Alton policyholders confidence, from initial enrollment to the claims process. Learn more in our The Hartford auto insurance review.

Cons

- Costlier for Younger Motorists: For Alton drivers outside The Hartford’s target demographic, premiums may be less competitive than age-inclusive alternatives.

- Fairly Basic Digital Tools: Compared to certain tech-forward competitors, The Hartford’s online and mobile policy management options can feel a bit sparse.

Alton, Illinois Basic Auto Insurance

In Alton, Illinois, you need the basic auto insurance to drive. This keeps you covered if there’s an accident. Check out the required coverage so you stay within the law and protect yourself.

- Property Damage Liability: $20,000 per accident

- Bodily Injury Liability: $25,000 per person and $50,000 per accident

Read More: Best Property Damage Liability (PDL) Auto Insurance Companies

Picking the right coverage can change what you pay each month by a lot. Below is a table with monthly rates for minimum and full coverage from the best car insurance companies in Alton, IL.

Alton, Illinois Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $85 $180

American Family $88 $185

Auto-Owners $82 $175

Farmers $90 $190

Liberty Mutual $91 $195

Nationwide $86 $180

Progressive $87 $185

State Farm $80 $170

The Hartford $89 $190

Travelers $84 $180

Premiums can shift based on the coverage you choose. Opting for full coverage might raise your costs, but it offers greater protection.

Factors That Affect Auto Insurance Rates in Alton, Illinois

Auto insurance rates in Alton, Illinois, can vary significantly due to several local factors. For instance, the congestion on Broadway during peak hours and the higher vehicle theft rates near downtown play a big role in determining what you’ll pay for insurance. The presence of the Great River Road, which attracts a lot of traffic, also adds to the risk factors that insurers consider.

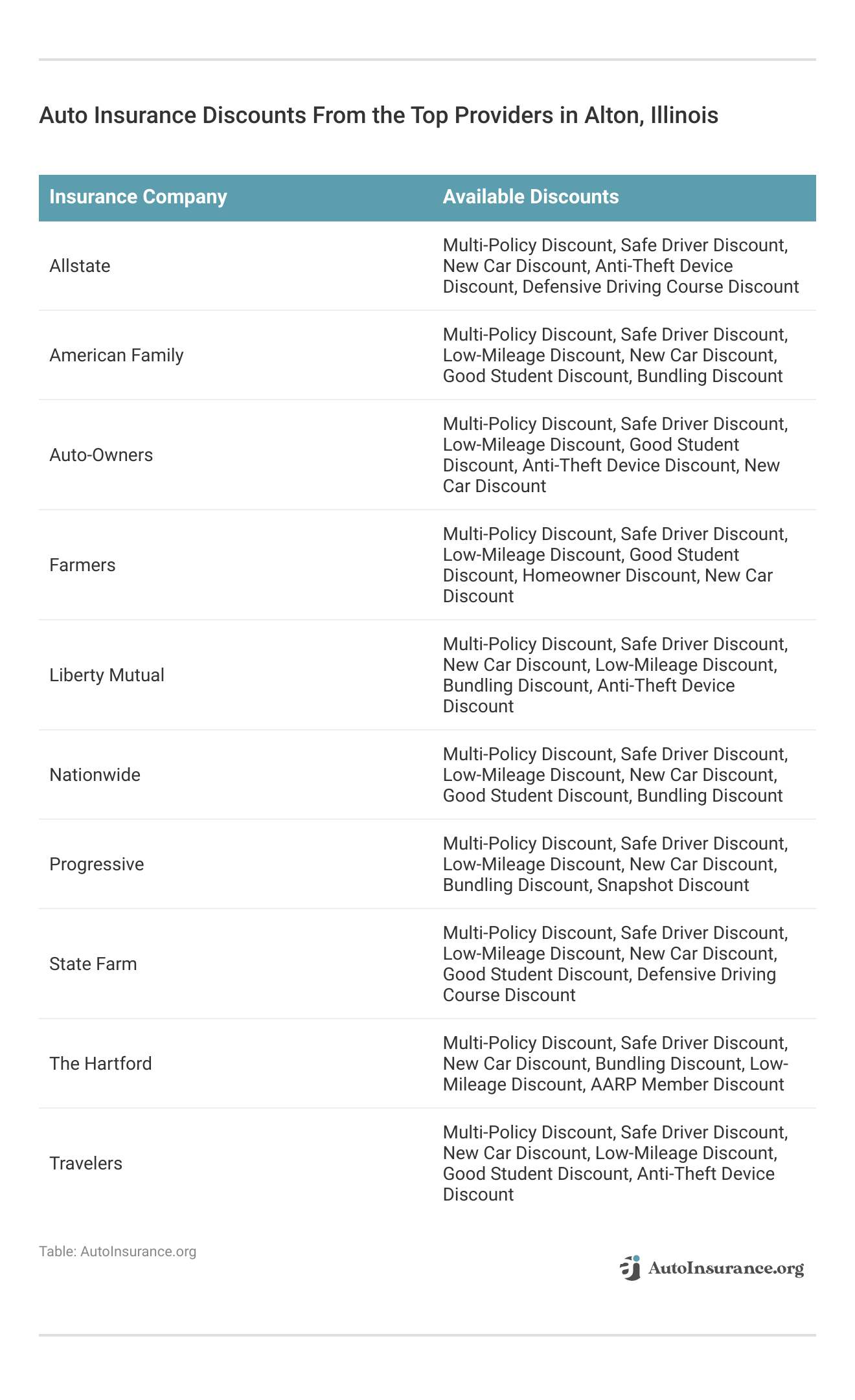

Insurance discounts can significantly reduce the amount you pay for premiums. Presented in the table below is a compilation of the various discounts provided by top auto insurance companies in Alton, Illinois.

These discounts are helpful in decreasing your total auto insurance expenses. Remember to ask about all possible discounts when shopping for insurance to make the most of your savings.

Read More: Auto Insurance Discounts to Ask

Commute Distance Impact on Auto Insurance in Alton, Illinois

Figuring out how your yearly mileage impacts your car insurance in Alton, Illinois can help you pick the right coverage. Check out the table below for the monthly costs from different mileage limits and insurance companies, so you can find the most budget-friendly plan that suits how much you drive.

Alton, Illinois Full Coverage Auto Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $478 | $478 |

| American Family | $334 | $343 |

| Farmers | $439 | $439 |

| Geico | $248 | $258 |

| Liberty Mutual | $231 | $231 |

| Nationwide | $405 | $405 |

| Progressive | $383 | $383 |

| State Farm | $196 | $206 |

| Travelers | $224 | $242 |

| USAA | $244 | $258 |

How far you drive each day can really affect your car insurance rates. As you can see in the table, if you have a longer commute in Alton, Illinois, you might end up paying more because there’s a higher chance of accidents. For more information, read our article titled “Most Expensive Commutes in America.”

Commute Duration and Its Effect on Auto Insurance in Alton

When it comes to commuting in Alton, Illinois, the average time spent on the road is approximately 23.6 minutes. This factor can have an impact on your insurance expenses.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Costs by Age and Gender in Alton, Illinois

Age and insurance provider greatly affect vehicle insurance costs. Please see the table below to see how these factors impact Alton, Illinois, price depending on your specific attributes.

Alton, Illinois Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $793 | $1,026 | $365 | $394 | $304 | $305 | $318 | $318 |

| American Family | $596 | $826 | $210 | $271 | $210 | $210 | $192 | $192 |

| Farmers | $1,024 | $1,070 | $263 | $273 | $231 | $231 | $204 | $217 |

| Geico | $489 | $510 | $195 | $185 | $155 | $158 | $150 | $183 |

| Liberty Mutual | $469 | $519 | $147 | $151 | $143 | $155 | $122 | $137 |

| Nationwide | $719 | $926 | $297 | $323 | $253 | $258 | $224 | $238 |

| Progressive | $812 | $912 | $260 | $281 | $219 | $206 | $181 | $190 |

| State Farm | $374 | $474 | $137 | $158 | $121 | $121 | $109 | $109 |

| Travelers | $431 | $545 | $153 | $162 | $145 | $153 | $133 | $142 |

| USAA | $485 | $535 | $197 | $217 | $149 | $152 | $139 | $137 |

These figures lay bare how age, gender, and insurance provider shape what you pay. Young drivers, especially teenagers, get hit with higher premiums. Their risk is greater, and the cost reflects it. Learn more in our article titled “Why is my auto insurance score going down?”

Driving Record Influence on Auto Insurance in Alton, Illinois

If you’ve kept a clean record driving through Alton, down Broadway, or down College Avenue, chances are your insurance costs less. But get into an accident, catch a DUI, or snag even a single ticket anywhere in town, and you’ll see those premiums climb. The risk, they say, demands more.

Alton, Illinois Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| Allstate | $338 | $584 | $448 | $540 |

| American Family | $249 | $352 | $282 | $470 |

| Farmers | $371 | $479 | $440 | $467 |

| Geico | $182 | $257 | $228 | $345 |

| Liberty Mutual | $191 | $274 | $218 | $239 |

| Nationwide | $324 | $423 | $374 | $499 |

| Progressive | $314 | $470 | $398 | $349 |

| State Farm | $183 | $218 | $201 | $201 |

| Travelers | $184 | $243 | $232 | $272 |

| USAA | $179 | $258 | $216 | $353 |

The table above highlights how various infractions can influence your insurance costs in Alton, Illinois. Understanding this data can help you see the cost difference between keeping a clean driving record and facing higher premiums due to accidents or traffic tickets.

As shown, having a clean driving record can significantly reduce your insurance costs. Conversely, incidents like accidents, DUIs, and speeding violations can lead to substantial increases in premiums.

Read More: What age group has the most fatal crashes?

Insurance Rates After a DUI in Alton, Illinois

Here’s a snapshot of how monthly auto insurance rates in Alton, Illinois, shift after a DUI. By comparing auto insurance quotes in Alton from various providers, you can identify the best coverage options and rates tailored to your needs.

Alton, Illinois Full Coverage Auto Insurance Rates After a DUI

| Insurance Company | Monthy Rates |

|---|---|

| Allstate | $540 |

| American Family | $470 |

| Farmers | $467 |

| Geico | $345 |

| Liberty Mutual | $239 |

| Nationwide | $499 |

| Progressive | $349 |

| State Farm | $201 |

| Travelers | $272 |

| USAA | $353 |

Getting a DUI can drastically increase your auto insurance rates. This information can help you anticipate the financial impact of such an incident on your insurance costs.

The rates indicate how a DUI offense can lead to a significant increase in your insurance premiums. It’s crucial to drive responsibly to avoid such high costs.

How Credit History Affects Insurance Rates in Alton, Illinois

Here is a breakdown of the monthly premiums offered by different providers, categorized by credit levels. Your financial situation can have an impact on the amount you pay.

Alton, Illinois Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $610 | $439 | $385 |

| American Family | $450 | $306 | $259 |

| Farmers | $498 | $420 | $399 |

| Geico | $407 | $198 | $154 |

| Liberty Mutual | $327 | $203 | $161 |

| Nationwide | $485 | $390 | $340 |

| Progressive | $435 | $370 | $342 |

| State Farm | $291 | $175 | $136 |

| Travelers | $284 | $229 | $186 |

| USAA | $335 | $230 | $190 |

The data demonstrates that drivers with higher credit scores pay far lower rates than those with lower scores. Staying on top of your finances lets you choose a rate that fits your budget and protects you on Alton’s roads.

Prior to purchasing auto insurance in Alton, Illinois, it is important to compare rates from multiple companies. Get fast and cheap auto insurance coverage today with our quote comparison tool below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is the effect of credit history on auto insurance rates in Alton, IL?

Credit history can have a major effect on the cost of auto insurance in Alton, IL. Poor credit may result in higher rates, while good credit can lead to lower rates. More information can be found in our article titled “How Annual Mileage Affects Your Auto Insurance Rates.”

How does driving record affect auto insurance rates in Alton, IL?

Driving record has a significant impact on auto insurance rates in Alton, IL. A clean driving record generally results in lower rates, while accidents, DUIs, and speeding violations can increase rates.

How do auto insurance rates for seniors in Alton, IL compare?

Auto insurance rates for seniors in Alton, IL can vary based on the insurance company and gender. Generally, rates for older drivers may be lower than those for younger drivers.

What are the auto insurance rates for teen drivers in Alton, IL?

Teen drivers in Alton, IL generally have higher auto insurance rates. The rates can vary depending on the insurance company and gender. Get started on comparing car insurance quotes in Alton, IL by entering your ZIP code below.

How does age, gender, and marital status affect auto insurance rates in Alton, IL?

Auto insurance rates in Alton, IL are affected by age, gender, and marital status. Different demographic groups may have varying annual costs of insurance.

What is the average auto insurance rate in Alton, IL?

The average auto insurance rate in Alton, IL is $321 per month. For more information, read our article titled “What is the average auto insurance cost per month?”

What minimum coverage is required by Alton, Illinois auto insurance laws?

Alton, Illinois auto insurance laws require at least 25/50/20 coverage to comply with state regulations. This means $25,000 for injury or death to one person, $50,000 for injury or death to more than one person, and $20,000 for damage to property.

How do commute length and annual mileage affect auto insurance rates in Alton, IL?

Commute length and annual mileage can impact auto insurance rates in Alton, IL. Generally, longer commutes and higher annual mileage can lead to higher premiums due to the increased risk of accidents.

What discounts are available for auto insurance in Alton, IL?

Various auto insurance discounts can help lower rates in Alton, IL. These may include multi-policy discounts, safe driver discounts, good student discounts, and discounts for installing anti-theft devices.

How do Alton, IL auto insurance rates compare to other cities in Illinois?

Auto insurance rates in Alton, IL can differ from rates in other Illinois cities like Springfield, Champaign, and Chicago. Factors such as local traffic conditions, crime rates, and accident frequencies contribute to these variations.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Which type of vehicle insurance is best?

The best type of vehicle insurance in Alton, Illinois, generally includes full coverage, which combines liability, collision, and comprehensive coverage. This type of insurance offers the most protection, ensuring you’re covered for a wide range of potential incidents, from accidents on Broadway to damage from Alton’s seasonal weather.

What is the most important type of car insurance you should buy in Illinois?

In Illinois, liability insurance is the most important type of car insurance to purchase because it’s required by law. The state mandates a minimum coverage of 25/50/20, meaning $25,000 for bodily injury per person, $50,000 per accident, and $20,000 for property damage. This coverage protects you financially if you’re responsible for an accident.

What is the most reasonable car insurance?

The most reasonable car insurance in Alton, Illinois, is often found with providers like Allstate, Farmers, and American Family. Learn how to find affordable auto insurance rates online here.

What are the 4 recommended types of insurance?

For drivers in Alton, Illinois, the four recommended types of insurance include liability insurance, collision insurance, comprehensive insurance, and uninsured/underinsured motorist coverage. Together, these provide a robust safety net, ensuring you’re well-protected in a variety of situations.

What auto insurance is required in Illinois?

Illinois requires drivers to carry a minimum of 25/50/20 liability insurance coverage. This means you must have $25,000 for injury or death to one person, $50,000 for injury or death to more than one person, and $20,000 for damage to another person’s property. This basic coverage is essential to legally drive in Alton and throughout the state.

Is Illinois car insurance expensive?

Car insurance in Illinois can be more expensive in areas with higher traffic or crime rates, such as Alton. However, with rates starting around $80 per month, it’s possible to find affordable coverage by comparing quotes from multiple providers.

Who has the most expensive car insurance?

In general, luxury or sports car brands tend to have the most expensive car insurance. In Illinois, companies like Allstate and Progressive may charge higher premiums for these high-value vehicles, reflecting the increased risk and repair costs.

What car brand has the cheapest insurance?

Economy cars, such as those from brands like Honda and Toyota, often have the cheapest insurance rates. In Alton, Illinois, these vehicles typically incur lower insurance premiums due to their safety features and lower repair costs.

What’s the most used car insurance?

State Farm is one of the most used car insurance providers in Illinois, including Alton. Known for its local agents and extensive coverage options, State Farm remains a popular choice among drivers in the area.

Which insurance is the most popular?

In Alton, Illinois, State Farm and Allstate are among the most popular auto insurance providers. These companies are favored for their customer service, comprehensive auto insurance options, and competitive pricing.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.