Best Amarillo, Texas Auto Insurance in 2025 (Top 10 Companies Ranked)

State Farm, Geico, and Progressive provide the best Amarillo Texas auto insurance, with premiums starting as low as $85 per month. State Farm offers cheap local premiums in Amarillo. Geico is best for drivers with DUIs, while Progressive gives budget-friendly rates for a diverse population.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Jan 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Amarillo Texas

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Amarillo Texas

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in AAmarillo Texas

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best Amarillo, Texas auto insurance providers are State Farm, Geico, and Progressive with rates as low as $85 per month. State Farm is known for its competitive local rates tailored to Amarillo’s specific traffic and accident conditions.

Geico is ideal for drivers with DUIs, which you can learn more in our article titled “DUI Defined“, while Progressive offers its innovative tools like the Name Your Price® tool.

Evaluate and compare these various options in order to ensure that you obtain the most suitable coverage tailored to meet your specific requirements and preferences.

Our Top 10 Company Picks: Best Amarillo, Texas Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | B | Customer Service | State Farm | |

| #2 | 16% | A++ | Affordable Rates | Geico | |

| #3 | 8% | A+ | Budgeting Tools | Progressive | |

| #4 | 20% | A+ | Comprehensive Coverage | Allstate | |

| #5 | 15% | A | Coverage Options | Farmers | |

| #6 | 14% | A++ | Military Benefits | USAA | |

| #7 | 11% | A+ | Vanishing Deductible | Nationwide |

| #8 | 13% | A | Flexible Policies | Liberty Mutual |

| #9 | 9% | A++ | Comprehensive Discounts | Travelers | |

| #10 | 17% | A+ | Claims Service | The Hartford |

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool above.

- Amarillo auto insurance rates are lower than in other major Texas cities

- Factors like driving record, credit score, and local traffic impact insurance rates

- Compare quotes from multiple providers to find the best coverage and savings

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Market-Leading Rates in the Yellow City: State Farm offers the most competitive full coverage auto insurance in Amarillo at $185 monthly, well below the average premiums in the Texas Panhandle.

- Panhandle-Friendly Policy Bundling: Amarillo homeowners can leverage State Farm’s 12% multi-policy discount, a boon for those protecting both their prairie homes and vehicles under one insurer.

- Coverage Tailored to Amarillo’s Landscape: State Farm’s policies cover Amarillo’s urban and rural areas and severe weather. For more details, see State Farm auto insurance review.

Cons

- Palo Duro Canyon Coverage: State Farm’s standard policies may not cover the unique risks of driving in Palo Duro Canyon, potentially requiring add-ons for off-road enthusiasts.

- Fewer Amarillo-Specific Discounts: Compared to regional insurers, State Farm offers fewer location-based discounts, potentially missing opportunities to reward drivers for Amarillo’s lower traffic density.

#2 – Geico: Best for Affordable Rates

Pros

- Runner-Up in Amarillo Affordability: Geico’s $170 monthly full coverage rate is the second-cheapest option for Amarillo drivers, ideal for budget-conscious residents.

- Robust Multi-Policy Savings: Amarillo households can save 16% by bundling auto with other Geico policies. Check out our Geico auto insurance review to see how bundling can cut your costs.

- Forgiving of Amarillo’s High-Risk Drivers: Geico stands out for offering competitive rates to Amarillo drivers with DUIs, crucial in a state known for strict drunk driving penalties.

Cons

- Scarce Local Amarillo Representation: Geico’s primarily digital service model means fewer local agents in Amarillo, potentially frustrating residents accustomed to face-to-face Texan hospitality.

- Limited Amarillo-Specific Policy Customization: While affordable, Geico’s policies may lack tailored options for unique Amarillo needs, such as coverage for antique vehicles popular in the city’s car shows.

#3 – Progressive: Best for Budgeting Tools

Pros

- Budget-Friendly for Diverse Population: Progressive’s $180 monthly full coverage rate caters to Amarillo’s mix of blue-collar workers and young professionals seeking affordable protection.

- Innovative Tools for Amarillo’s Tech-Savvy: The Name Your Price® tool helps Amarillo’s tech sector employees find policies that fit both Texas requirements and personal budgets.

- Rewards for Amarillo’s Safe Drivers: Their Snapshot program offers potential discounts for cautious drivers. Our Progressive auto insurance review shows how to maximize savings with this program.

Cons

- Modest Amarillo Bundle Benefits: The 8% multi-policy discount falls short for Amarillo residents accustomed to Texas-sized savings when combining home and auto insurance.

- Inconsistent Panhandle Customer Service: Some Amarillo clients report varying service quality, a concern in a city that values consistent, neighborly interactions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Extensive Options for Amarillo’s Diverse Vehicles: Allstate offers varied coverage suitable for everything from downtown Amarillo commuters to rural ranchers with multiple vehicles.

- Best Bundle Savings: The 20% multi-policy discount can offset Allstate’s higher base rates, ideal for Amarillo homeowners. For detailed savings tips, read our Allstate auto insurance review.

- Strong Amarillo Agency Network: Allstate’s local presence ensures agents familiar with Amarillo-specific concerns, from hailstorm frequency to the impact of I-40 traffic on insurance needs.

Cons

- Premium Rates in a Budget-Conscious City: Allstate’s $200 monthly full coverage rate may strain budgets in Amarillo, where the cost of living is generally below the national average.

- Complex Policies for Straightforward Texans: Amarillo drivers may find Allstate’s policy structures overly complicated compared to the straightforward approach preferred in this no-nonsense Texas city.

#5 – Farmers: Best for Coverage Options

Pros

- Customizable for Unique Needs: Offers policies suited to Amarillo’s urban and rural driving, from city traffic to highways. For details on their coverage, visit our Farmers auto insurance review.

- Local Expertise in the Texas Panhandle: Farmers’ Amarillo agents provide invaluable insights into local factors affecting insurance, such as the city’s weather patterns and road conditions.

- Forgiveness Program for Amarillo’s Occasional Mishaps: The accident forgiveness feature is particularly valuable in a city where sudden weather changes can lead to unexpected fender benders.

Cons

- Highest Premiums in Budget-Conscious Amarillo: At $210 monthly for full coverage, Farmers’ rates may be a tough sell in a city known for its affordable cost of living.

- Lagging Digital Options for a Modernizing City: As Amarillo embraces technology in sectors like healthcare and education, Farmers’ limited digital tools may frustrate forward-thinking residents.

#6 – USAA: Best for Military Benefits

Pros

- Top Choice for Amarillo’s Military Community: USAA’s $175 monthly full coverage rate is unbeatable for military families, crucial in a city with strong ties to nearby air force bases.

- Service Members Specialized Coverage: USAA’s deployment coverage benefits Amarillo’s active duty personnel. For more details on military auto insurance, see USAA auto insurance review.

- High Satisfaction in a Service-Oriented City: USAA’s renowned customer service aligns well with Amarillo’s community-focused culture, ensuring smooth experiences for local military families.

Cons

- Exclusive Eligibility in a Diverse City: USAA’s military-only policy excludes many Amarillo residents, including the city’s growing civilian professional class.

- Limited Physical Presence in Spread-Out Amarillo: The lack of local offices may inconvenience Amarillo’s military community, accustomed to on-base services and face-to-face interactions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Decreasing Deductibles for Cautious Drivers: The vanishing deductible feature rewards Amarillo’s generally safe drivers, a boon in a city with lower-than-average accident rates.

- Annual Reviews for Amarillo’s Changing Needs: Nationwide’s On Your Side® Review helps Amarillo residents adapt their coverage as the city grows and personal circumstances evolve.

- Usage-Based Savings: The SmartRide program benefits Amarillo drivers who depend on their cars. For more on how this program can help you save, check out our Nationwide auto insurance review.

Cons

- Above-Average Costs in an Affordable Market: Nationwide’s $185 monthly rate for full coverage may be hard to justify in Amarillo’s cost-conscious insurance market.

- Underwhelming Multi-Policy Discounts: The 11% bundling discount may disappoint Amarillo residents looking to maximize savings on their home and auto policies.

#8 – Liberty Mutual: Best for Flexible Policies

Pros

- Adaptable Policies for Amarillo’s Varied Lifestyles: Liberty Mutual’s flexible options cater to Amarillo’s diverse population, from downtown apartment dwellers to suburban families.

- Tech-Savvy Savings for Amarillo’s Good Drivers: The RightTrack program appeals to Amarillo’s increasing number of tech-savvy residents while rewarding the city’s safe driving trends.

- Educator Benefits: Offers special protections for Amarillo’s teachers, benefiting the city’s strong education system. Read our Liberty Mutual auto insurance review to see how they supports educators.

Cons

- Pricey Premiums in a Value-Driven Market: Liberty Mutual’s $190 monthly rate for full coverage may be a hard sell in Amarillo, where residents prioritize value for money.

- Inconsistent Service in a Hospitality-Focused City: Mixed customer service reviews may concern Amarillo residents, who typically expect consistently friendly, efficient interactions.

#9 – Travelers: Best for Comprehensive Discounts

Pros

- Affordable Full Coverage in Amarillo: Travelers’ $180 monthly rate for comprehensive protection appeals to Amarillo’s prudent drivers seeking thorough coverage without breaking the bank.

- Diverse Discounts: As mentioned in Travelers auto insurance review, they offer discounts for Amarillo’s diverse population, from young professionals with hybrids to seasoned homeowners.

- Telematics Program Suited to Amarillo’s Driving Patterns: The IntelliDrive program is well-suited to Amarillo’s mix of short city commutes and longer rural drives, potentially leading to significant savings.

Cons

- Lackluster Bundling Benefits: The 9% multi-policy discount may underwhelm Amarillo residents looking to maximize savings by combining their home and auto insurance.

- Minimal Local Presence in a Community-Oriented City: Travelers’ limited physical presence in Amarillo may disappoint residents who value local, personal connections with their insurance providers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – The Hartford: Best for Claims Service

Pros

- Tailored Coverage for Amarillo’s Senior Population: The Hartford’s AARP-member policies are ideal for Amarillo’s significant retiree community, offering age-appropriate coverage options.

- Post-Accident Support for Amarillo’s Older Residents: The unique RecoverCare coverage provides valuable assistance to Amarillo’s senior drivers, supporting independence after auto-related injuries.

- Long-Term Stability: The lifetime renewal guarantee provides peace of mind for Amarillo’s long-term residents, ensuring coverage as they age. For more details, see our The Hartford auto insurance review.

Cons

- Higher Rates in a Thrifty Texas Market: The Hartford’s $195 monthly full coverage rate may be steep for Amarillo’s cost-conscious insurance shoppers, including many on fixed incomes.

- Younger Driver Limitations in a Family-Centric City: The focus on mature drivers may result in less competitive options for Amarillo’s younger residents and growing families.

Amarillo, TX Auto Insurance Requirements

By law, Amarillo residents must carry the Texas minimum auto insurance limits. Texas requires the following coverage levels:

- $30,000 per person and $60,000 per accident in bodily injury liability coverage.

- $25,000 per accident in property damage liability coverage.

Texas operates under an at-fault insurance system, which means that when an automobile accident occurs, the party deemed responsible for causing the incident is held liable for any resulting damages.

If you are deemed responsible for an accident, you will need to pay for the repair or replacement of any damaged property and cover medical expenses or compensation for injuries sustained by others involved.Daniel Walker LICENSED AUTO INSURANCE AGENT

This framework emphasizes the importance of safe driving and being aware of your surroundings while on the road, as your actions can have significant financial implications for yourself and others involved in an accident.

What Affects Auto Insurance Rates in Amarillo, TX

Amarillo drivers, it’s time to gear up for the best auto insurance rates in town. From the local expertise of State Farm to the reliable coverage from Farmers, explore how different providers stack up in monthly costs for both minimum and full coverage. Find out which insurer offers the right balance of protection and affordability for your Amarillo lifestyle.

Amarillo, Texas Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $100 | $200 | |

| $105 | $210 | |

| $90 | $170 | |

| $100 | $190 |

| $95 | $185 |

| $85 | $180 | |

| $95 | $185 | |

| $100 | $195 |

| $95 | $180 | |

| $85 | $175 |

USAA, Progressive, and Geico all have reasonable rates, so you should compare providers to see which one is best for you.

In Amarillo, Texas, auto insurance premiums are shaped by a mix of factors. The city has a low vehicle theft rate and manageable traffic, earning B grades in these areas.

Amarillo, Texas Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Vehicle Theft Rate | B | Lower-than-average vehicle theft rate compared to other Texas cities |

| Traffic Density | B | Medium traffic density, with manageable congestion most of the time |

| Weather-Related Risks | C | Moderate risk due to severe weather events such as thunderstorms and hail |

| Average Claim Size | B | Claims are generally average compared to other cities in Texas |

| Uninsured Drivers Rate | C | Higher-than-average rate of uninsured drivers, common in parts of Texas |

However, it faces moderate weather risks and a higher-than-average rate of uninsured drivers, both scoring C. Amarillo reports 750 accidents and 600 claims annually, with an average claim cost of $5,500 and 17% uninsured drivers.

Amarillo, Texas Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Accidents per Year | 750 |

| Claims per Year | 600 |

| Average Claim Cost | $5,500 |

| Percentage of Uninsured Drivers | 17% |

| Vehicle Theft Rate | 180 thefts/year |

| Traffic Density | Medium |

| Weather-Related Incidents | High |

Despite lower theft rates, the higher uninsured driver rate and frequent severe weather are important considerations for auto insurance.

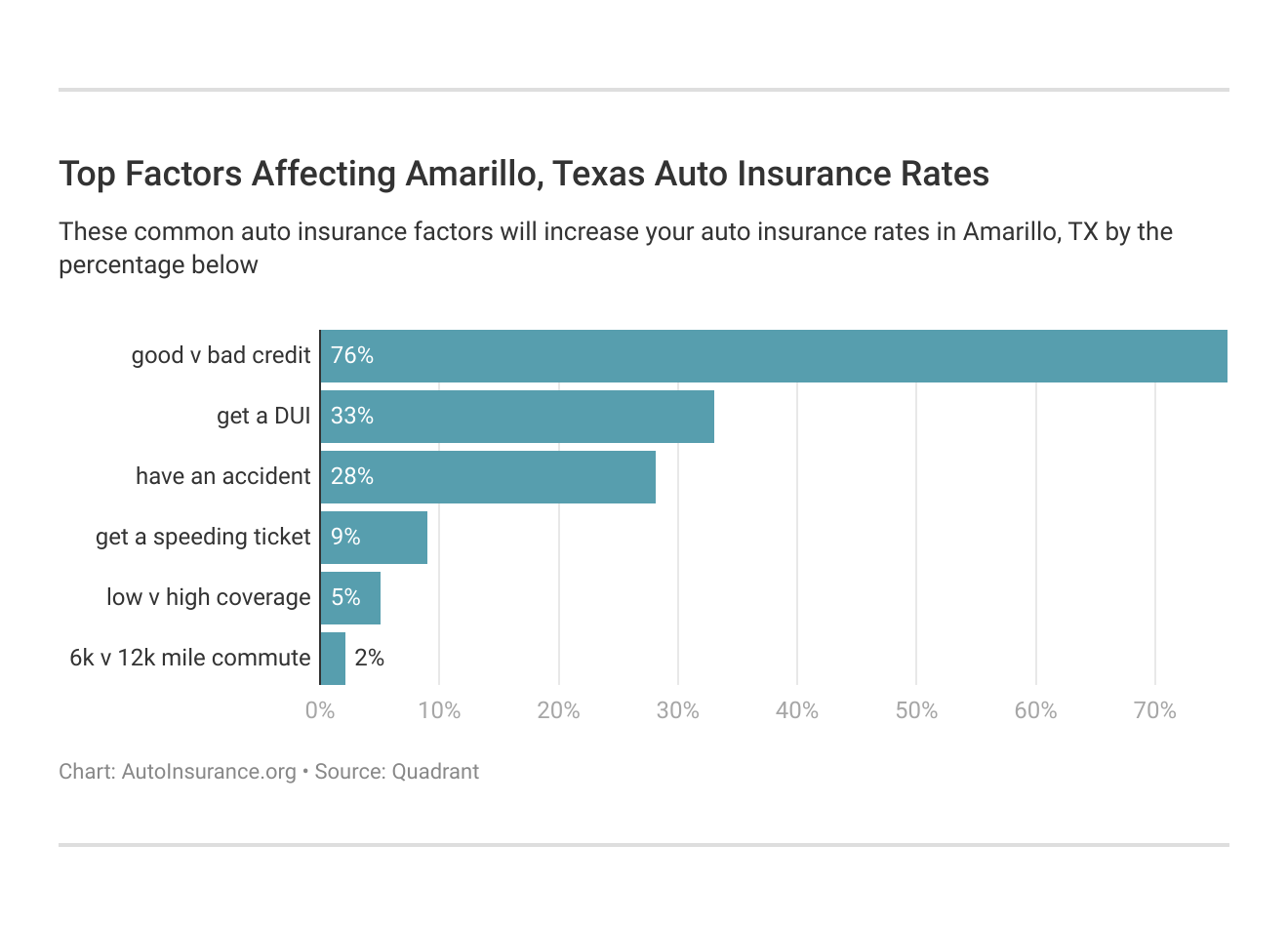

Factors affecting car insurance rates in Amarillo, TX may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Amarillo, TX car insurance.

On the bright side, the relatively low levels of traffic congestion and the average rates of auto theft in Amarillo have a positive impact on the city’s auto insurance providers. You can also get discount if your vehicle have an anti-theft device, read our article titled “How to Get an Anti-Theft Auto Insurance Discount” to know more.

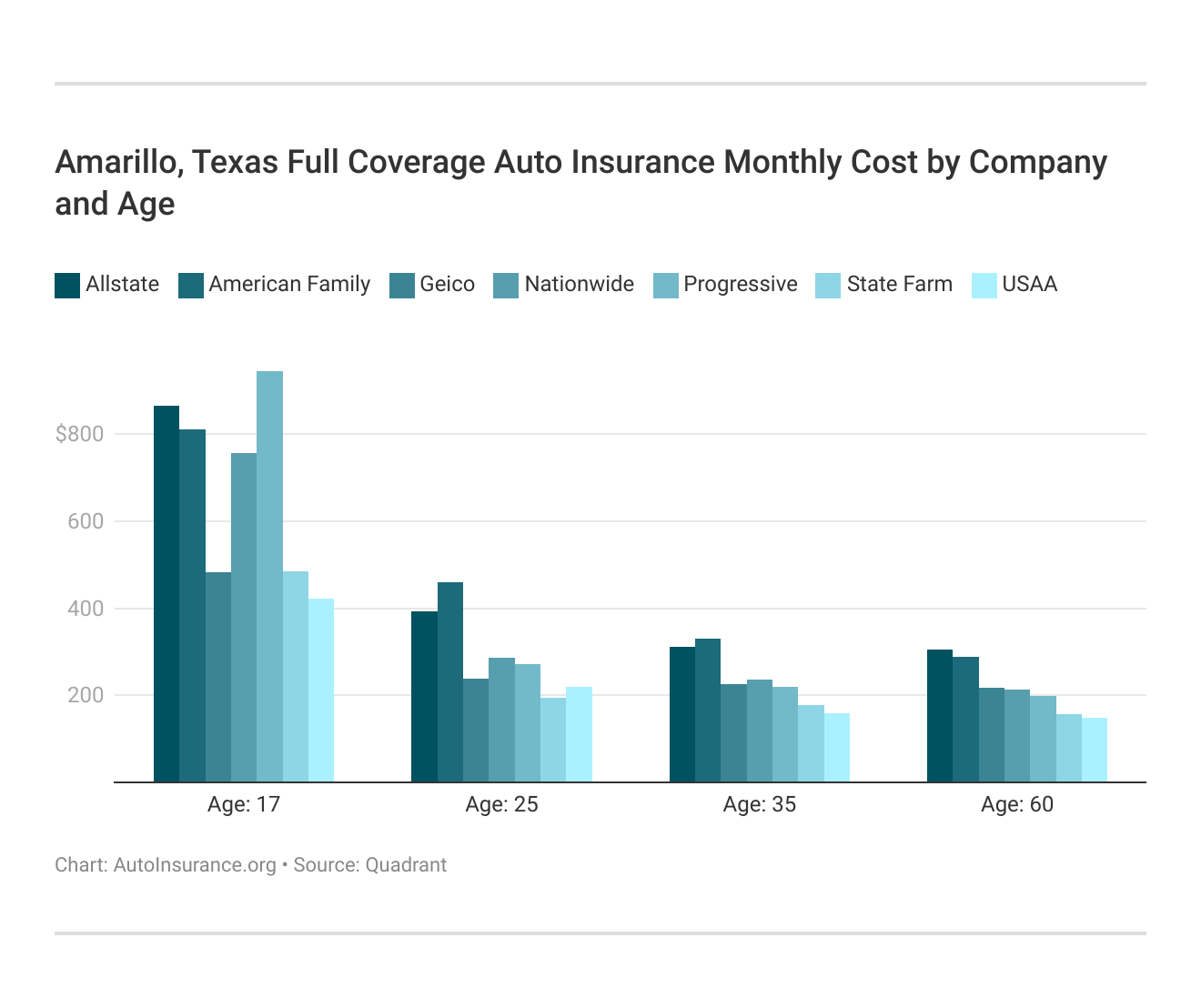

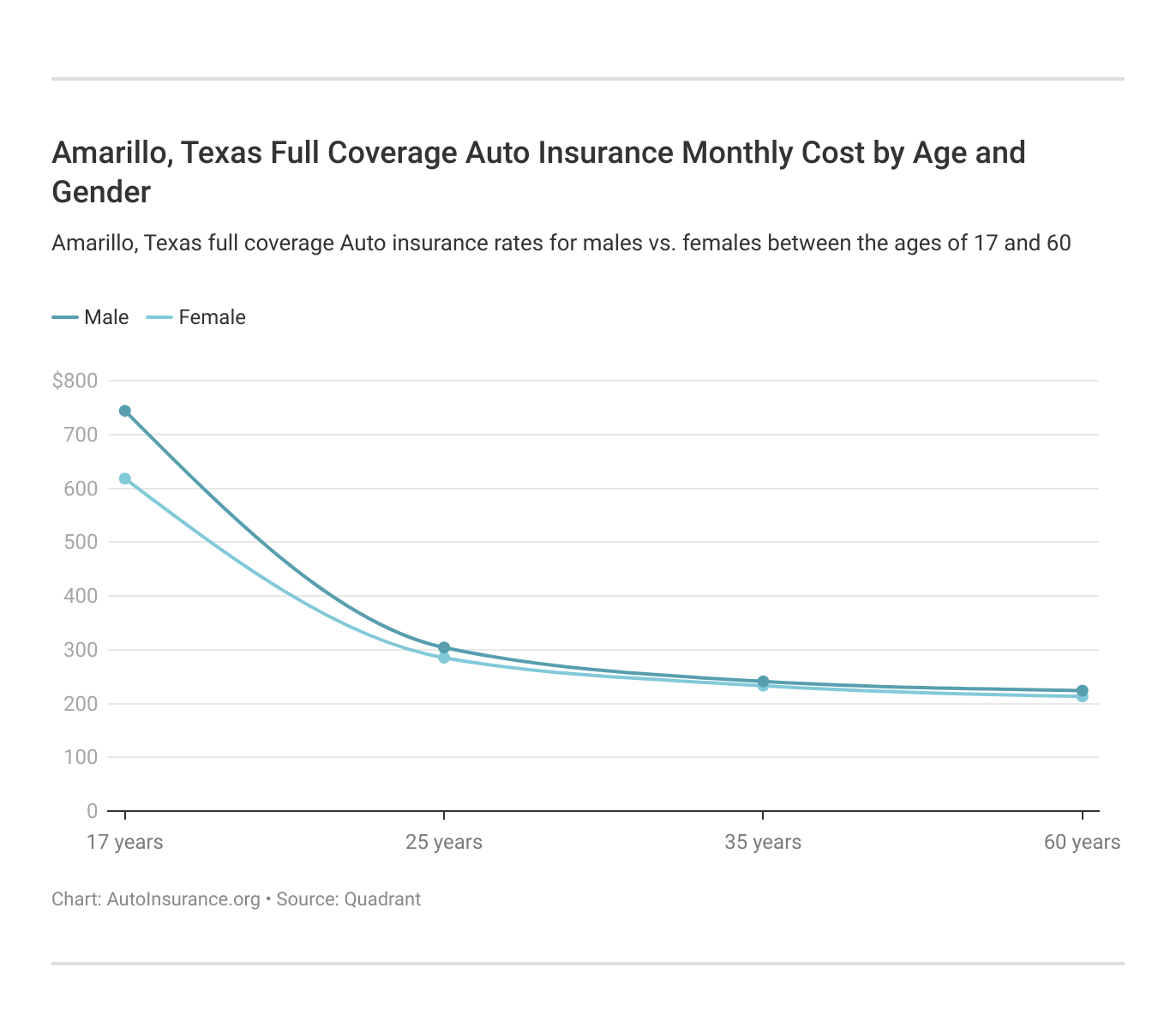

Amarillo, TX car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best for another age group.

Rates for teen drivers are higher overall, but State Farm and USAA remain the most affordable car insurance companies in Amarillo.

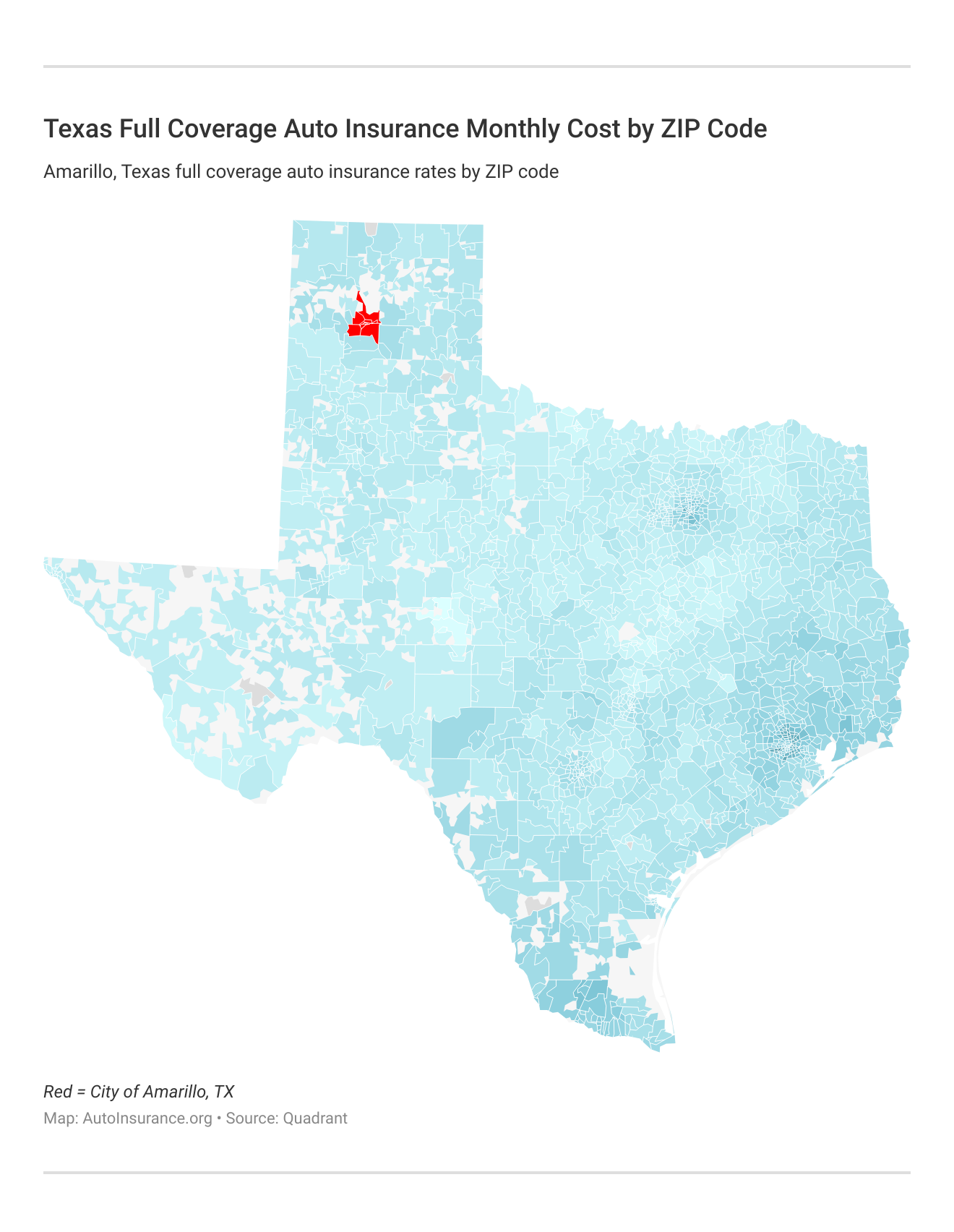

How ZIP Codes Impact Car Insurance Rates in Amarillo, TX

Calculating auto insurance rates by ZIP code will give you an average of what other drivers pay in your neighborhood. Check out the monthly Amarillo, TX insurance rates below:

ZIP code impacts your car insurance rates because factors like crime and traffic will increase your risk. Understanding this relationship can help you make more informed decisions about your car insurance and possibly even encourage you to consider relocating to an area with a more favorable risk profile.

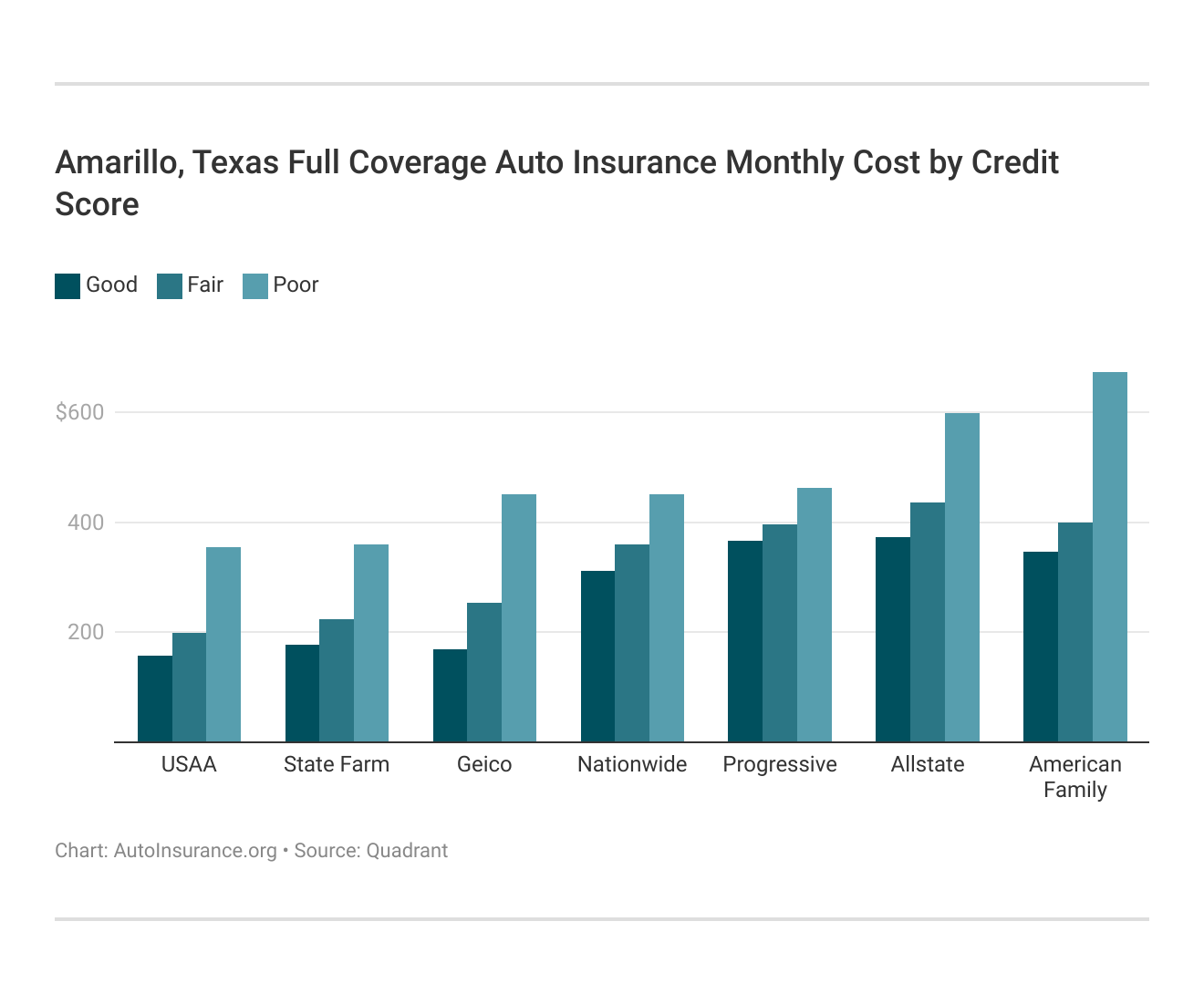

Understanding Credit Scores for Auto Insurance in Amarillo, TX

Discover the most competitive auto insurance rates available in Amarillo, Texas, tailored specifically to your credit score as indicated below. By inputting your credit score, you can receive personalized quotes that reflect your financial standing, allowing you to make an informed decision when selecting the best insurance coverage for your vehicle.

It’s essential to understand how different credit scores can influence insurance premiums, so take advantage of this opportunity to find cost-effective options that suit your needs. Learn how credit score impacts insurance rates.

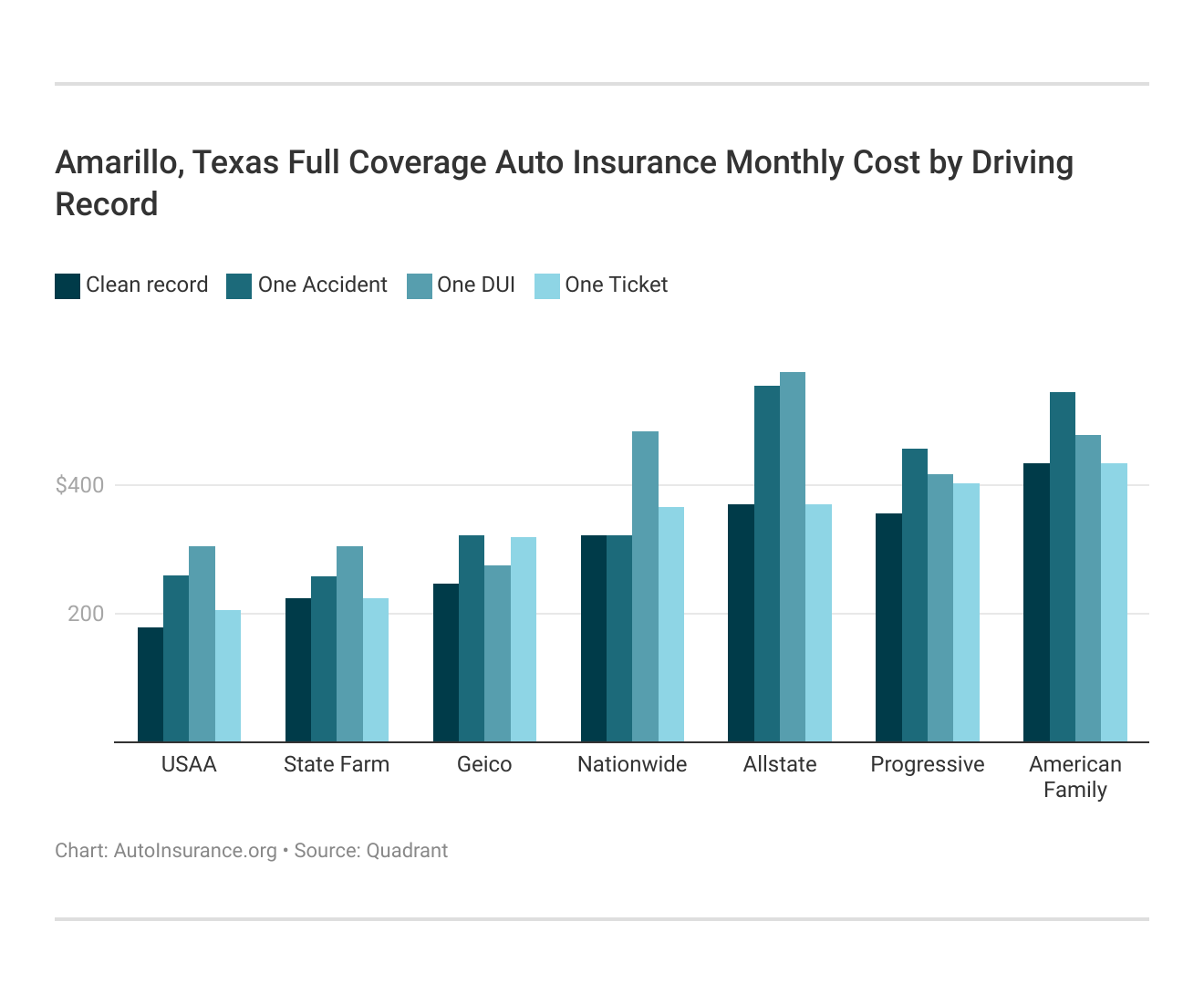

Amarillo, TX Auto Insurance Based on Driving History

Your driving record has the biggest effect on your Amarillo car insurance rates. For example, a DUI may increase your car insurance rates by 40%-50%.

This may lead you to wonder, is cheap auto insurance with a DUI possible? Find the cheapest Amarillo, TX car insurance rates by driving record.

Gender Differences in Amarillo, TX Auto Insurance Costs

Texas auto insurance companies use gender when determining rates, and teen male drivers often pay the highest Amarillo, TX car insurance rates.

More states are passing laws making it illegal to use gender in auto insurance, including Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Saving on Your Amarillo, TX Auto Insurance

Compared to other large Texan cities, Amarillo insurance prices are less, but your exact rate will depend on your age, driving record, and area of the city. Take a look at these premium providers’ discounts to see what you can obtain to reduce the cost of your insurance.

Auto Insurance Discounts From the Top Providers in Amarillo, Texas

| Insurance Company | Available Discounts |

|---|---|

| Multi-policy, Safe Driver, Early Signing, Anti-theft Device, Good Student, New Car, Paperless, Full Pay | |

| Multi-policy, Safe Driver, Good Student, Homeowner, Signal App, New Car, Affinity Group, Pay-in-Full | |

| Multi-policy, Good Driver, Good Student, Military, Federal Employee, Anti-theft Device, New Vehicle, Multi-car | |

| Multi-policy, Homeowner, Good Student, Military, Early Shopper, Paperless, Multi-car, Advanced Safety Features |

| Multi-policy, Safe Driver, Anti-theft Device, Paperless, Good Student, Accident-free, Affinity Group, Defensive Driving |

| Multi-policy, Snapshot, Homeowner, Continuous Insurance, Multi-car, Good Student, Pay-in-Full, Online Quote | |

| Multi-policy, Safe Driver, Good Student, Steer Clear, Accident-free, Defensive Driving, Drive Safe & Save | |

| AARP Member, Multi-policy, Safe Driver, Vehicle Safety, Defensive Driver, Anti-theft Device, Bundle & Save |

| Multi-policy, Homeowner, Safe Driver, Good Student, Multi-car, New Car, Hybrid Vehicle, Defensive Driving | |

| Multi-policy, Safe Driver, Military, New Vehicle, Family Discount, Annual Mileage, Good Student, Defensive Driving |

State Farm is one of the cheapest auto insurance company in Amarillo, with rates averaging 30% less than other companies. Military families in Amarillo will get the best rates from USAA.

Comparing auto insurance quotes online will give you the chance to see costs from multiple companies at once. Enter your ZIP code below to get free Amarillo, TX insurance quotes today.

Frequently Asked Questions

Is Texas a no-fault state?

No, Texas at-fault auto insurance laws require negligent drivers to pay compensation. It’s important to compare auto insurance quotes in Amarillo, Texas to find the best coverage for your needs.

How much is auto insurance in Texas per month?

Liability insurance costs around $190 per month in Texas, but full coverage auto insurance will raise your rates. Make sure to compare car insurance quotes in Amarillo, Texas to get the best rates.

How much are Amarillo, TX auto insurance rates?

Monthly Amarillo insurance rates average between $200-$300. You can save by comparing cheap car insurance in Amarillo, Texas from different providers. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Who sells the cheapest auto insurance in Amarillo?

State Farm has the cheapest Amarillo, TX auto insurance coverage for most drivers. However, it’s always smart to check with car insurance companies in Amarillo for more options. State Farm is mentioned in our article titled “Who are the reputable auto insurance companies?”

How much auto insurance do I need in Amarillo, TX?

Amarillo, TX auto insurance laws only require 30/60/25 in liability coverage, but you’ll want to add full coverage if you’re leasing or financing your vehicle. To find the right coverage, compare auto insurance in Amarillo, TX options.

Can I get auto insurance discounts in Amarillo?

Eligible discounts vary, but most auto insurance in Amarillo, TX companies offer savings to drivers who insure multiple vehicles, bundle policies, and avoid accidents.

Can I get auto insurance in Amarillo, TX if I have a poor driving record?

You can still buy car insurance in Amarillo, TX with a bad driving history, but your rates will be higher. Shop around to find cheap car insurance in Amarillo despite your record.

How can I save money on auto insurance in Amarillo?

Practicing safe driving habits and enrolling in discounts are the easiest ways to lower your cheap auto insurance in Amarillo, TX costs. Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

How does driving record affect auto insurance rates in Amarillo, TX?

Your driving record significantly affects your car insurance in Amarillo, TX rates. Maintaining a clean driving record can help you find the cheapest car insurance in Amarillo.

Read More: How Auto Insurance Companies Check Driving Records

How does the ZIP code affect auto insurance rates in Amarillo, TX?

Your ZIP code impacts your car insurance in Amarillo, TX rates. Crime and traffic in your area can influence your ability to find the best car insurance rates Amarillo.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.