American Family Auto Insurance Review for 2025 (Expert Evaluation)

This American Family auto insurance review covers the numerous coverage options and discounts available with AmFam. Monthly minimum auto insurance rates average $44/mo, and the company has an A rating from A.M. Best, but American Family reviews from customers report slow claim response times.

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Apr 8, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 8, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

American Family Insurance

Min. Coverage

$166A.M. Best Rating:

AComplaint Level:

LowPros

- Lower-than-average rates in your area

- Lower-than-average rates based on your driving record

- A variety of discounts

- Multiple coverage options

Cons

- Poor customer service reviews

- Poor reviews for handling claims

- Lack of availability in certain states

- American Family offers different types of car insurance coverage and options for discounts on policies

- American Family auto insurance is not available in every state

- The company received an A (Excellent) rating with A.M. Best

Our American Family auto insurance review found that the company is a solid choice for drivers looking for a new policy. You may find that rates with American Family are lower than rates with other top providers in your area, and American Family also offers several different options for car insurance.

So, as you search for the cheapest auto insurance companies in your area, you may want to consider American Family auto insurance.

American Family Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.1 |

| Business Reviews | 4.0 |

| Claim Processing | 4.8 |

| Company Reputation | 4.5 |

| Coverage Availability | 3.9 |

| Coverage Value | 4.0 |

| Customer Satisfaction | 4.0 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.7 |

| Plan Personalization | 4.5 |

| Policy Options | 3.4 |

| Savings Potential | 4.1 |

Keep reading this American Family auto insurance review to learn more about the options for coverage.

You can also enter your ZIP into our free quote tool to find the best auto insurance rates in your area.

- American Family offers different types of car insurance coverage for policies

- Car insurance with American Family is not available in every state

- The company received an A (Excellent) rating with A.M. Best

Cost of American Family Auto Insurance

Your American Family insurance payment will depend on several different factors that affect auto insurance rates. Insurance companies assess policyholders’ risk to determine how much they will have to pay for coverage. Here are some of the most common factors that impact a person’s car insurance rates:

- Age, Gender, & Marital Status

- Credit Score & Driving History

- ZIP Code

- Car Make and Model

- Coverage Type

Age is a big factor when it comes to American Family’s rate calculations, as younger drivers with less driving experience are charged more for coverage. The table below shows the average rates at American Family by gender, age, and coverage level.

American Family Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $230 | 590.41 |

| Age: 16 Male | $296 | $726 |

| Age: 18 Female | $187 | $435 |

| Age: 18 Male | $253 | $591 |

| Age: 25 Female | $66 | $178 |

| Age: 25 Male | $78 | $210 |

| Age: 30 Female | $62 | $165 |

| Age: 30 Male | $73 | $195 |

| Age: 45 Female | $62 | $164 |

| Age: 45 Male | $62 | $166 |

| Age: 60 Female | $57 | $148 |

| Age: 60 Male | $58 | $150 |

| Age: 65 Female | $61 | $161 |

| Age: 65 Male | $61 | $163 |

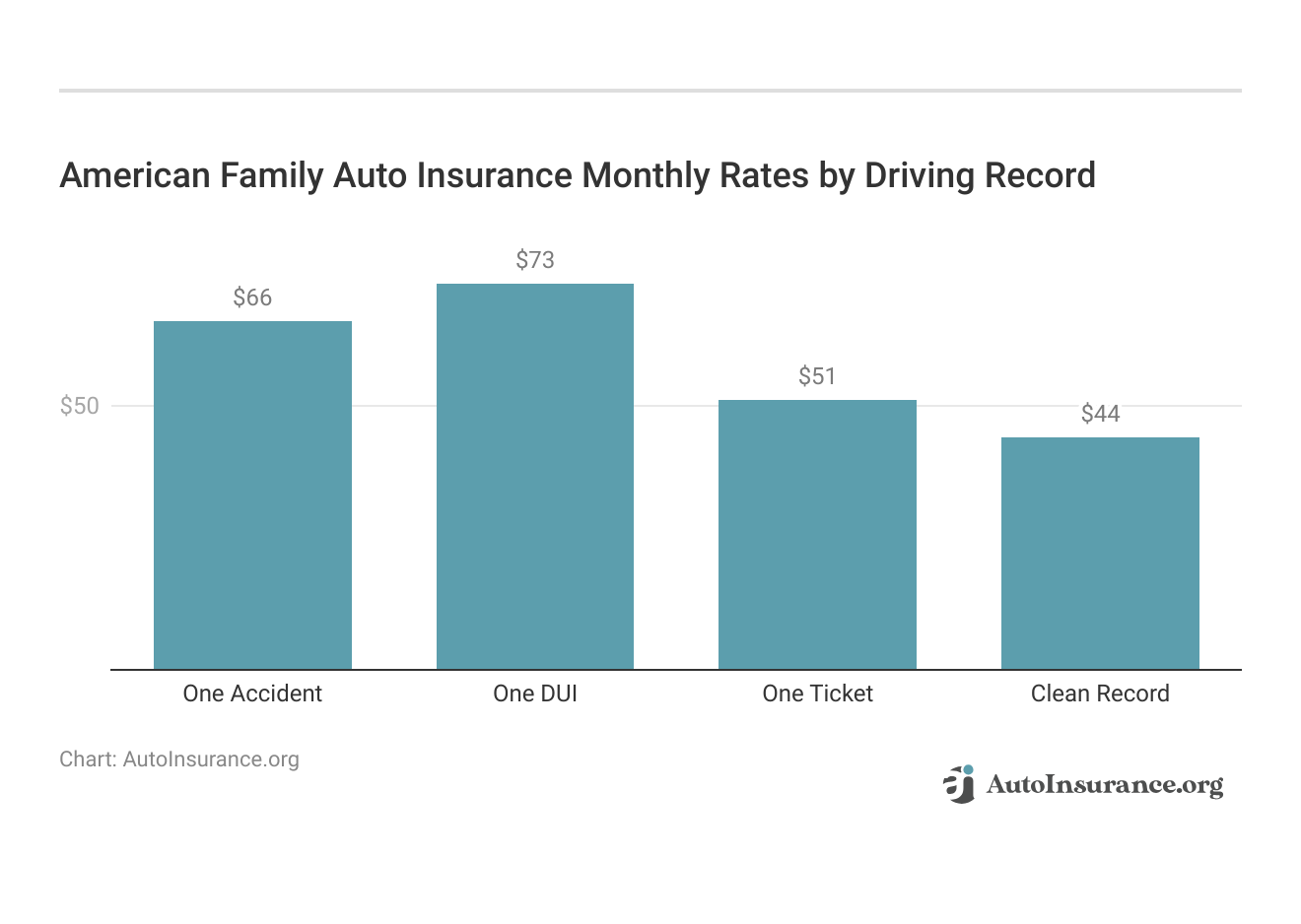

In addition to age and coverage level, American Family customers will see differences in rates based on their driving record.

Drivers with clean driving records will have significantly cheaper rates at American Family than drivers with an accident, DUI, or ticket on their record.

American Family Auto Insurance Rates by State

If you live in a state where AmFam offers auto insurance coverage, you can find the coverage required by your state’s minimum liability laws. You can also purchase an American Family Insurance full coverage policy for added protection. Below are the states where American Family is offered and the average full coverage rates for each state.

American Family Full Coverage Auto Insurance Monthly Rates by State

| State | Rates |

|---|---|

| Alabama | $139 |

| Alaska | $150 |

| Arizona | $158 |

| Arkansas | $191 |

| California | $216 |

| Colorado | $174 |

| Connecticut | $172 |

| Delaware | $153 |

| Florida | $252 |

| Georgia | $168 |

| Hawaii | $99 |

| Idaho | $127 |

| Illinois | $184 |

| Indiana | $167 |

| Iowa | $114 |

| Kansas | $139 |

| Kentucky | $199 |

| Louisiana | $204 |

| Maine | $120 |

| Maryland | $213 |

| Massachusetts | $142 |

| Michigan | $292 |

| Minnesota | $165 |

| Mississippi | $163 |

| Missouri | $162 |

| Montana | $178 |

| Nebraska | $159 |

| Nevada | $178 |

| New Hampshire | $110 |

| New Jersey | $164 |

| New Mexico | $139 |

| New York | $172 |

| North Carolina | $124 |

| North Dakota | $207 |

| Ohio | $86 |

| Oklahoma | $160 |

| Oregon | $153 |

| Pennsylvania | $174 |

| Rhode Island | $151 |

| South Carolina | $194 |

| South Dakota | $176 |

| Tennessee | $130 |

| Texas | $274 |

| Utah | $162 |

| Vermont | $121 |

| Virginia | $135 |

| Washington | $119 |

| Washington D.C. | $171 |

| West Virginia | $141 |

| Wisconsin | $89 |

| Wyoming | $112 |

Full coverage auto insurance is more expensive in some states. These states carry higher driving risks, such as heavy traffic or dangerous weather conditions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

American Family Auto Insurance Rates vs. the Competition

Comparing American Family Insurance auto quotes against other providers will help you know how much you can expect to pay for coverage. American Family tends to offer rates for coverage that are lower than most other well-known competitors.

For example, the company often provides lower-than-average rates for people with DUIs, individuals with poor credit, teen drivers, and others who may be considered high-risk drivers (Learn More: Best Auto Insurance Companies for High-Risk Drivers). And AmFam rates for a liability-only policy are over $100 less per year than the national average. Read on to learn more about American Family’s rates versus those of its competitors.

American Family Teen Driver Rates vs. the Competition

Teen drivers have the most expensive rates on average, as they are the most likely to file a claim. However, Teen drivers can pay rates up to 21% lower than the national average with AmFam.

Teen Full Coverage Auto Insurance Monthly Rates by Provider

| Insurance Company | Teen Only | Teen Added |

|---|---|---|

| $638 | $538 | |

| $509 | $180 | |

| $773 | $315 | |

| $312 | $304 | |

| $785 | $255 |

| $476 | $259 |

| $814 | $375 | |

| $349 | $218 | |

| $910 | $538 | |

| $290 | $170 |

American Family’s rates for young adult drivers are typically around 4% lower than the national average. Rates at American Family will also be much more affordable if teen drivers join a parent’s policy rather than buying their own insurance.

American Family Senior Driver Rates vs. the Competition

Senior drivers will often have the cheapest auto insurance rates, and compared to other companies, American Family has some of the most affordable rates on the market.

Senior Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 55 Male | Age: 55 Female | Age: 60 Male | Age: 60 Female | Age: 65 Male | Age: 65 Female |

|---|---|---|---|---|---|---|

| $213 | $214 | $220 | $220 | $220 | $221 | |

| $131 | $131 | $126 | $122 | $135 | $136 | |

| $313 | $311 | $292 | $305 | $323 | $321 | |

| $100 | $103 | $111 | $111 | $103 | $106 | |

| $377 | $377 | $438 | $438 | $389 | $389 |

| $160 | $158 | $154 | $146 | $166 | $163 |

| $126 | $137 | $129 | $125 | $130 | $141 | |

| $154 | $154 | $145 | $145 | $158 | $158 | |

| $152 | $156 | $147 | $144 | $156 | $159 |

| $184 | $188 | $171 | $170 | $190 | $194 |

AmFam auto insurance rates for adult drivers are nearly $200 less annually than the national average. Senior driver rates at American Family are anywhere from 5% to 7% lower than the national average, though they are higher than some competitors like USAA. However, USAA is only for military and veteran seniors, so most customers won’t qualify for coverage.

American Family Speeding Ticket Rates vs. the Competition

If you have a speeding ticket, rates will be higher at both American Family and the competition, but some companies will offer better deals than others.

Full Coverage Auto Insurance Monthly Rates by Provider: One Ticket vs. Clean Record

| Insurance Company | One Ticket | Clean Record |

|---|---|---|

| $154 | $122 |

| $268 | $228 | |

| $194 | $166 | |

| $150 | $124 | |

| $170 | $138 | |

| $100 | $83 |

| $247 | $198 | |

| $151 | $114 | |

| $302 | $248 |

| $196 | $164 |

| $199 | $150 | |

| $137 | $123 | |

| $396 | $331 | |

| $194 | $161 |

| $192 | $141 | |

| U.S. Average | $203 | $165 |

American Family’s auto insurance rates for individuals who have received a speeding ticket are around 16% (or $300 annually) lower than the national average.

Drivers with a bad driving record should compare quotes from several different companies to find which company offers the best price on auto insurance coverage.

American Family At-Fault Accident Rates vs. the Competition

An at-fault accident will usually increase rates for at least three years, so it’s important to pick a company that’s affordable. See how American Family does compared to the competition below.

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | Clean Record | One Accident |

|---|---|---|

| $122 | $189 |

| $225 | $363 | |

| $164 | $247 | |

| $138 | $196 | |

| $330 | $621 | |

| $106 | $153 | |

| $397 | $496 |

| $169 | $238 |

| $133 | $219 | |

| $162 | $254 | |

| $161 | $235 |

| $194 | $308 | |

| U.S. Average | $165 | $244 |

Rates following a car accident are nearly $500 cheaper than the national average with AmFam, making the company one of the better options for drivers with accidents.

Some drivers may be able to avoid increased rates after an accident at American Family if they qualify for the company's accident forgiveness.Dani Best Licensed Insurance Producer

If you have an at-fault accident on your record, keeping a clean driving record in the future will help keep your American Family rates affordable.

American Family DUI Rates vs. the Competition

An American Family car insurance quote after a DUI conviction is as much as 33% lower than the national average, which is great for most high-risk drivers.

DUI Full Coverage Auto Insurance Monthly Rates vs. Clean Record by Provider

| Insurance Company | Clean Record | One DUI |

|---|---|---|

| $122 | $211 |

| $228 | $385 | |

| $166 | $276 | |

| $138 | $237 | |

| $198 | $275 | |

| $114 | $309 | |

| $248 | $447 |

| $142 | $338 |

| $150 | $200 | |

| $123 | $160 | |

| $161 | $239 |

| $141 | $294 | |

| U.S. Average | $165 | $295 |

It can be helpful to see and compare average DUI rates from different companies. Still, the best way to get affordable DUI coverage is to compare car insurance quotes from multiple companies based on your personal information.

American Family Credit Score Rates vs. the Competition

If you have poor credit, getting a policy with American Family could help you save around $520 per year on coverage.

Full Coverage Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| $85 | $105 | $125 |

Accidents, DUIs, and poor credit will increase your risk as a driver. Depending on where you live, you might need to file SR-22 insurance to reinstate your driving privileges. Fortunately, if you need SR-22, American Family Insurance will file it with your local DMV on your behalf. American Family SR-22 might raise rates, but you’ll still pay less than the national average.

How American Family Insurance Ranks Among Providers

Read our American Family car insurance reviews and comparisons below to see how AmFam compares to the competition:

- American Family vs. State Farm Auto Insurance

- American Family vs. Geico Auto Insurance

- American Family vs. Progressive Auto Insurance

Comparing American Family Insurance car insurance against other popular companies is the best way to guarantee you get the best price. Keep reading this American Family car insurance review to learn more about the options for coverage in your area. Scroll down for American Family insurance ratings and customer reviews, then compare AmFam insurance rates by state and driver using our free tool.

American Family Insurance Coverage Options

American Family auto insurance allows policyholders to customize their policies and choose the coverage that will help them feel safe and secure on the road, but you can’t buy American Family Insurance in Florida. American Family offers several types of auto insurance coverage, including the following:

American Family Auto Insurance Coverage

| Coverage Option | Description |

|---|---|

| Accident Forgiveness | Prevents your rates from increasing after your first at-fault accident. |

| Collision Coverage | Pays for damages to your car resulting from a collision, regardless of who is at fault. |

| Comprehensive Coverage | Covers damages to your car from non-collision incidents like theft, fire, or natural disasters. |

| Gap Insurance | Pays the difference between your car's actual cash value and what you owe on it. |

| Liability Coverage | Covers bodily injury and property damage to others for which you are legally responsible. |

| Medical Payments Coverage | Covers medical expenses for you and your passengers after an accident. |

| Personal Injury Protection (PIP) | Covers medical expenses, lost wages, and other related costs after an accident. |

| Rental Car Reimbursement | Covers the cost of renting a car while your vehicle is being repaired after a covered accident. |

| Roadside Assistance | Provides assistance like towing, tire changes, and jump-starts when you're stranded. |

| Uninsured/Underinsured Motorist | Covers damages if you're hit by a driver with no or insufficient insurance. |

If you’re interested in American Family car insurance but are curious about how much you would pay for coverage, you can get a quote from the AmFam insurance website. An American Family auto quote can help you see what your rates would be based on your unique situation.

Along with vehicle coverage, individuals can buy other types of coverage, like an American Family Insurance business owners policy, farm coverage, life insurance, and more. You might also be interested in American Family motorcycle insurance, which provides full coverage and motorcycle gear protection.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

American Family Insurance Discounts Available

American Family offers auto insurance discounts to policyholders to help them save even more on coverage. Some of the company’s discounts include the following:

American Family Auto Insurance Discounts

| Discount Type | Savings Potential |

|---|---|

| Auto Safety Equipment Discount | 30% |

| Defensive Driver Discount | 10% |

| Early Bird Discount | 10% |

| Good Driver Discount | 20% |

| Good Student Discount | 25% |

| Low Mileage Discount | 10% |

| Loyalty Discount | 10% |

| Multi-Policy Discount | 29% |

| Multi-Vehicle Discount | 25% |

Drivers can stack multiple discounts when they pay American Family Insurance online. If you have American Family Insurance and pay online, you could save more on your car insurance premium. American Family also has a multi-policy discount for customers that can save drivers up to 29% on their insurance policies.

Contact a company representative to learn more about the discount options and learn whether you’re eligible for savings. You can also request American Family insurance quotes and discounts with our comparison tool below.

American Family KnowYourDrive Program

KnowYourDrive is a usage-based auto insurance option that offers customers the potential to get a cheaper American Family Insurance car insurance quote based on their driving habits. With KnowYourDrive, policyholders use a smartphone app that monitors different driving behaviors to assess how safe you are behind the wheel.

Some behaviors that American Family monitors include vehicle usage, braking, acceleration, speed, the time of day you typically drive, and any distracted driving habits.

American Family states on its website that it will honor drivers’ privacy with the KnowYourDrive app by never sharing personal information unless the company is required to by law.

Additionally, while some usage-based options allow policyholders’ rates to increase based on their driving behavior, American Family states its customers’ rates will never go up. Read American our American Family KnowYourDrive review to learn more about UBI discounts at the company.

American Family Customer Reviews

While the company’s professional ratings are high, American Family Insurance company reviews by customers suggest the company has room for improvement. Although there are few American Family claims complaints, some reviews state that the American Family insurance claims process is not as straightforward as it should be, although there are some satisfied customer reviews.

However, policyholders often say that American Family Insurance customer service is not always helpful, especially when they are trying to file claims.

Some clients find that reaching the American Family Insurance auto claims phone number does not always mean they will get the help they need.

For American Family customers, the biggest complaints are that claims took too long to be paid out or were denied when they should have been approved. Policyholders should be able to call the American Family Insurance claims phone number to file a claim or check the status of a claim.

Read More: Best Auto Insurance Companies for Paying Claims

While AmFam offers competitive car insurance rates, you should consider reading multiple American Family insurance reviews before purchasing a policy. This will give you a well-rounded look into the company, so you can make sure that its the right fit for your budget and your insurance needs.

American Family Business Insurance Ratings

Is American Family Insurance good? It is important to look at business reviews of American Family in addition to customer reviews for a full picture of the company when comparing online auto insurance companies (Read More: Where can I compare online auto insurance companies?). Take a look at the American Family insurance ratings from businesses below.

American Family Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 831 / 1,000 Avg. Satisfaction |

|

| Score: A Trustworthy Customer Service |

|

| Score: 78/100 Positive Customer Feedback |

|

| Score: 0.77 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

The company has a higher-than-average number of customer complaints based on the overall claims process but still ranks well for claims satisfaction, as you can see in the business ratings above. American Family has an A (Excellent) financial strength rating and a stable outlook with A.M. Best. Additionally, American Family ratings with the Better Business Bureau (BBB) are good.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

American Family Auto Insurance Pros and Cons

As you search for the best car insurance company in your area, you may want to consider American Family auto insurance. American Family offers multiple options for car insurance coverage, and the company also provides opportunities for discounts to help lower monthly or annual auto insurance rates.

American Family (AmFam) insurance quotes are competitive, and the company often offers cheaper rates than many other top-rated car insurance providers. These are some of the benefits of a car insurance policy with American Family:

- Lower Rates: American Family offers lower-than-average rates for drivers, including high-risk drivers.

- Discount Options: American Family has a variety of discounts, such as bundling discounts and good driver discounts.

- Coverage Options: American Family has multiple coverage options for drivers, such as roadside assistance or loan assistance.

American Family Insurance SR-22 filings are also a perk for those shopping for affordable high-risk auto insurance. However, auto insurance with American Family is not available in every state and American Family insurance complaints suggest AmFam may need to improve its customer service and claims handling process. Some of these cons may include the following:

- Customer Service Reviews: American Family has some poor customer service reviews, as its claim complaint ratio is higher than the national average.

- Lack of Availability: American Family isn’t sold in certain states, so customers who frequently move may want to choose a more widely available company.

Before making a final decision on car insurance coverage, be sure to consider everything about American Family. It’s also a good idea to find and compare American Family insurance quotes to multiple providers to ensure you get the best rates on the coverage you need.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How to File American Family Insurance Claims

You can reach an agent through the American Family Insurance claims number at 1-800-MYAMFAM. Before you call, make sure you have all the relevant information, such as the date, time, and location of the incident, as well as any other involved parties’ contact details.

Read More: How to File an Auto Insurance Claim

If you choose to file online or via a mobile app, expect an adjuster to reach out to you over the phone to discuss the details of your claim. Be prepared to provide a detailed account of the incident and any supporting documentation, such as photos or police reports, to expedite the claims process.

There are very few American Family Insurance claims complaints. AmFam is among the top ten companies for claims satisfaction, and policyholders report fast response times and helpful agents.

Deciding if American Family Auto Insurance is Right For You

American Family offers several different options for car insurance, and rates are lower than other top providers. Drivers enjoy the mobile app, where it’s easy to make an AmFam payment and file claims, but report slower response times when calling the American Family Insurance claim number.

Some American Family auto insurance reviews suggest the company may need to improve its customer service and claims handling process, but many drivers report that very few American Family insurance claims are denied (Learn More: How to Dispute an Auto Insurance Claim).

If you’re looking for a new policy and considering American Family Insurance, get a quote to see how much it could cost you. Enter your ZIP code below to get started with free quotes from local companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Is American Family Insurance a good insurance company?

Our American Family insurance review found that American Family has strong financial ratings and excellent customer service and claims reviews. American Family auto insurance quotes are also very competitive in states where coverage is available.

How do I cancel my American Family policy?

The most convenient way to cancel an AmFam insurance policy is to contact a company agent. The American Family website has a tool policyholders can use to locate and contact an agent near them. Policyholders can also call the American Family Insurance customer service center to learn more about how to cancel a policy and explore options that could make a policy more appealing or affordable.

Can I cancel an AmFam policy online?

You have to call and speak with a company representative to cancel American Family Insurance (Learn More: How to Cancel Auto Insurance).

Does American Family cover car rentals?

Yes, add rental reimbursement to your policy for American Family Insurance rental car coverage. Reimbursements also cover Ride-shares, taxis, buses, and commuter trains.

What is AmFam insurance?

AmFam is just an abbreviation of American Family, so you may see AmFam auto insurance and similar terms come up when searching for American Family car insurance reviews.

Will AmFam car insurance pay for a car tow?

Yes, American Family Insurance roadside assistance covers car tows (Learn More: Do you need auto insurance to be towed?).

Where can I buy American Family car insurance?

American Family auto insurance is available in 19 states, including: Arizona, Colorado, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Minnesota, Missouri, Nebraska, Nevada, North Dakota, Ohio, Oregon, South Dakota, Utah, Washington, and Wisconsin. Use our free quote tool to get auto insurance quotes from companies in your state.

What is included with American Family roadside service?

Along with car tows, AmFam roadside assistance covers battery jumps, tire changes, gas delivery, locksmith services, and minor roadside repairs.

Does AmFam offer gap insurance?

If you need guaranteed auto protection (gap) insurance, American Family offers it as auto loan assistance coverage.

How much will AmFam auto insurance rates increase after an accident?

American Family Insurance rates increase around 24% after an accident, though the exact amount a person’s auto insurance rates increase will depend on several factors. With accident forgiveness, a person’s rates will not increase, even after an at-fault accident.

If you have an accident on your record and want to find cheap auto insurance, compare rates with our free quote tool today.

What is the American Family insurance claim phone number?

The American Family insurance claim phone number is 1-800-692-6326 (1-800-MYAMFAM). American Family customers can call this number to start the claim process. You can also reach the American Family insurance claims department online or via the free mobile app.

Does AmFam offer accident forgiveness?

If you’ve been accident-free for five or more years, you will qualify for accident forgiveness with AmFam and will avoid any rate increases after an at-fault accident.

Are American Family insurance claims denied?

Like any company, American Family may deny customers’ American Family auto insurance claims if customers don’t have the right coverages or are lying about the accident. However, American Family isn’t known for denying auto insurance claims, so as long as you have the right auto insurance coverage and are honest about the accident, there is no reason that your claim will be denied.

If you are dealing with a denied claim, read our article about what to do if your auto insurance company won’t pay a claim.

Is American Family Costco insurance?

American Family insurance can be purchased through Costco, as Costco partners with American Family to sell Costco auto insurance. Costco members who buy American Family auto insurance through Costco may also have access to special deals on their American family insurance policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Nate H

American Family Insurance review

TammyNelson

Great auto insurance for Costco Members through Connect

Doggy

Awesome

flip2score7

am fam review

timtone

Unexpected charges

ely135

American Family tops any other insurance company

snoopyhugs18

When a 90-minute Meeting Saved Us $596!

DomMar35

Boss

ruthjahncoz

a bright point in a dark time

LillyM

Young but excited about Insurance!