Arkansas Minimum Auto Insurance Requirements in 2025 (AR Mandated Coverage)

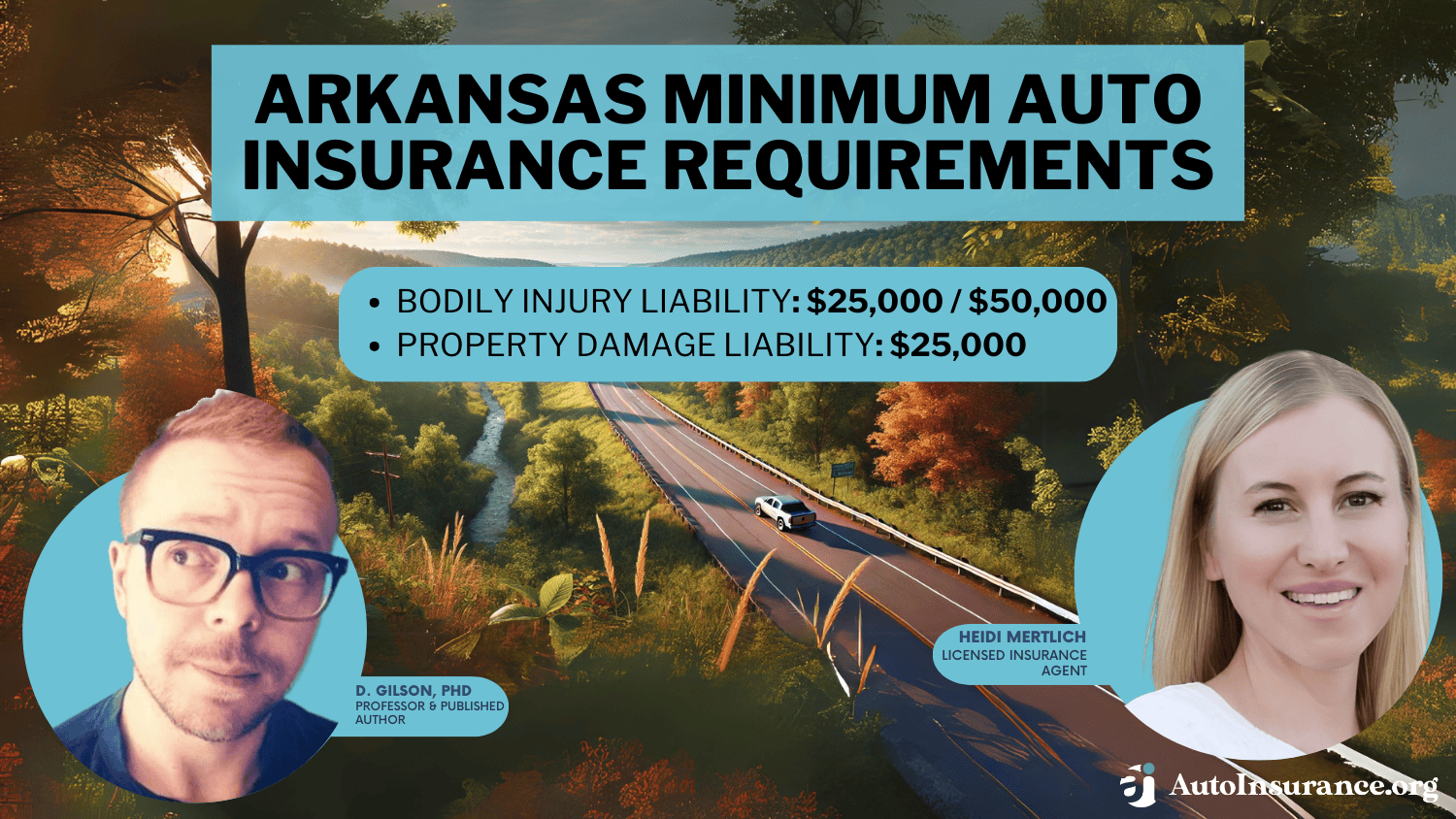

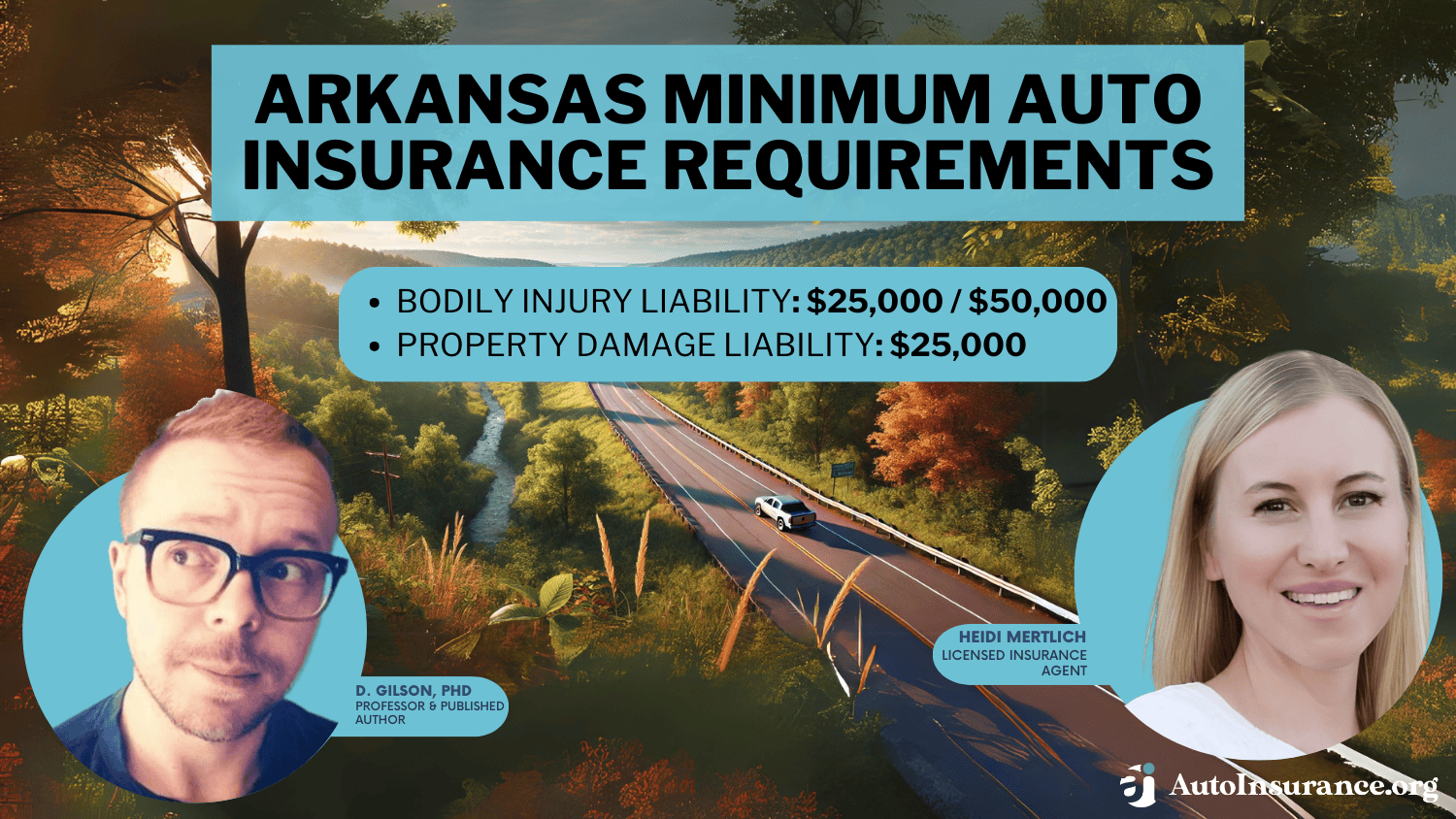

Arkansas minimum auto insurance requirements are 25/50/25, meaning drivers must carry coverage of $25,000 for bodily injury per person, $50,000 for all injuries in an accident, and $25,000 for property damage. Arkansas state minimum car insurance rates start at $22/month, making it affordable for AR drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Arkansas minimum auto insurance requirements ensure that every driver has essential liability protection, with set limits of $25,000 for injury per person, $50,000 per accident, and $25,000 for property damage.

USAA offers the lowest rates starting at $22 per month, followed by State Farm at $33 and Geico at $30. These companies meet Arkansas’s required minimums while providing comprehensive auto insurance and affordable options for drivers seeking to stay compliant without exceeding their budget.

Arkansas Minimum Auto Insurance Requirements & Limits

| Coverage | Limits |

|---|---|

| Bodily Injury Liability: | $25,000 per person / $50,000 per accident |

| Property Damage Liability: | $25,000 per accident |

In the state of Arkansas, all drivers are required to carry current vehicle insurance. There are no exceptions to this rule and Arkansans must also take a record of their car insurance proof in the car with them at all times.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool to instantly compare prices from various companies near you.

- Arkansas minimum auto insurance requires 25/50/25 liability coverage

- USAA, State Farm, and Geico offer the most affordable rates in AR

- Compare quotes to secure coverage that meets Arkansas minimum limits

Arkansas Minimum Coverage Requirements & What They Cover

Understanding the car insurance requirements in your state is important. Knowing where to go for information is one of the most important things. You can bookmark this site on car insurance regulations to learn more about your state’s requirements.

There are many different types of auto insurance coverage. However, the ones listed below are the main types of insurance that you should be concerned with.

- Bodily Injury Liability: Bodily injury liability is auto coverage that covers any type of bodily injury or death that you cause due to negligence when on the highway.

- Property Damage Liability: Property damage liability covers damage to the property such as a vehicle or any kind that was damaged due to the driver who caused the damage. This type of insurance keeps you from having to pay for this high expense out of your own pocket.

If you need to know the basic insurance requirements in the state of Arkansas, this include a minimum of $25,000 in bodily injury liability per person, $50,000 in bodily injury liability per accident, and $25,000 in property damage liability per accident. These coverage limits ensure that drivers have a basic level of financial protection in the event of an accident.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Arkansas

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage in Arkansas

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage in Arkansas

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage in Arkansas

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsLet’s unveil the cheapest car insurance in Arkansas, which helps AR drivers save money while meeting required coverage. USAA is the cheapest option, with rates starting at $26 per month. It’s known for great customer service and benefits for military members and their families.

Following USAA, State Farm ranks as the second cheapest provider, with minimum rates at $33 per month. State Farm offers good prices, reliable service, and local agent support, making it a great choice for affordable coverage. Geico is another option with low rates and easy-to-use online tools, starting at $30 per month.

Monthly Minimum Auto Insurance Rates from Top Providers in Arkansas

| Insurance Company | Minimum Rates |

|---|---|

| $78 | |

| $66 | |

| $79 | |

| $43 | |

| $48 |

| $61 |

| $63 | |

| $38 | |

| $53 | |

| $26 |

When comparing other top providers in Arkansas, Geico and Progressive also deliver affordability, with rates starting at $30 and $39 per month, respectively.

Companies like American Family and Nationwide provide rates as low as $44 per month, making them competitive choices for drivers seeking balance between cost and quality. Travelers and Farmers offer affordable options as well, with rates at $37 and $53 per month, respectively.

View this post on Instagram

For drivers prioritizing customization and additional perks, Liberty Mutual offers coverage starting at $68 per month, while Allstate’s offerings begin at $61 per month. Comparing rates and features among these providers ensures AR drivers can secure the best Arkansas auto insurance that suits their coverage needs and budget.

Penalties for Driving Without Insurance in Arkansas

In Arkansas, while it is not required to insure or register a vehicle that is not being driven, the penalties for driving without insurance are severe. Even driving a short distance without proof of insurance can result in fines ranging from $50 to $250 for a first offense.

USAA offers the best value for Arkansas drivers with minimum coverage starting at just $22 per month, unmatched customer service, and military-focused benefits.Kristen Gryglik Licensed Insurance Agent

A second offense carries steeper penalties, including fines between $200 and $500 and vehicle registration suspension. For a third offense, drivers face fines of $500 to $1,000 and may even face up to one year of jail time. These strict penalties show why it’s important to have insurance when driving.

Read more: Best Auto Insurance Without Penalties for No-Fault Accidents

Other Coverage Options to Consider in Arkansas

Beyond the standard coverage, Arkansas drivers can consider several other coverage options:

- Personal Injury Protection (PIP)/Medical Payments: Personal injury protection (PIP) covers medical payments, lost wages, and rental car costs due to the fact that you are out of work or transportation due to an accident that was not your fault. It also covers your medical or other expenses in a “no-fault” state where the person at fault may not be liable for damages.

- Collision: Remember that liability insurance is the minimum coverage required in the state of Arkansas. But you still need coverage for your vehicle to repair collisions that the other party does not pay for. In the case of an accident that was your fault, for example, you would be required to use your insurance to pay for the damages. You must carry collision insurance to do this.

- Comprehensive: This type of insurance has nothing to do with car accidents. Instead, it covers other incidents such as “acts of nature,” car theft, or accidents that don’t involve a car collision. Arkansas does not require this coverage, but it is important.

- Uninsured and Underinsured Motorist Coverage: Arkansas is a “fault” state. This means the person at fault will pay the liability damages to the injured party. In Arkansas, you would have to pay for the costs if someone hits you and damages your vehicle, which is not insured or underinsured motorist coverage. But, if you have this type of coverage, your insurance will pay for the damages.

- Gap Coverage: Gap insurance is a valuable choice for drivers with financed or leased vehicles, covering the difference between the car’s actual cash value and the remaining loan balance if the vehicle is totaled.

- Rental Car Reimbursement: Rental car reimbursement coverage can help cover the cost of a rental car if your vehicle is out of commission after an accident. Roadside assistance provides services like towing, tire changes, and fuel delivery, offering peace of mind for unexpected breakdowns.

In addition, for those using their personal vehicles for ridesharing or delivery services, rideshare coverage or commercial auto insurance may be necessary to fill coverage gaps during work-related driving.

Additionally, custom equipment coverage can protect any modifications or aftermarket additions to your vehicle, such as specialized tires or a sound system. Exploring these options allows Arkansas drivers to build a policy that fully addresses their lifestyle and potential risks.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Special Laws or Exceptions in Arkansas

There are no special laws or exemptions for auto insurance in Arkansas except when there is an unusual circumstance that requires unlicensed and uninsured drivers to drive in an emergency situation only.

For example, if you live in Arkansas and you had your license suspended and cannot get insurance due to a DUI or other circumstance, a local judge may grant you a temporary right to drive a particular distance for emergencies in a life-threatening situation.

Underaged drivers may qualify for similar exceptions for driving to school or work only when no other viable means of transportation are available. Standard insurance laws are waived in these cases.

Financial Responsibility Laws

There is no financial responsibility legislation in the state of Arkansas. These types of laws are reserved for states such as New Hampshire where they do not require drivers to carry insurance.

Instead, they need proof of financial responsibility to show they can afford to pay for an accident if one occurred without the benefit of insurance coverage.

Minimum Requirements vs. Recommended Coverage in AR

The state of Arkansas has reasonable requirements for drivers regarding car insurance. They require a large enough liability minimum that they should be covered for any incident involving the liability of an injured party if they cause the accident.

Arkansas Min. Coverage Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Benton | $65 |

| Bentonville | $66 |

| Cabot | $63 |

| Conway | $70 |

| El Dorado | $82 |

| Fayetteville | $74 |

| Fort Smith | $78 |

| Hot Springs | $73 |

| Jacksonville | $71 |

| Jonesboro | $76 |

| Little Rock | $85 |

| North Little Rock | $80 |

| Pine Bluff | $79 |

| Rogers | $68 |

| Russellville | $69 |

| Searcy | $67 |

| Springdale | $72 |

| Texarkana | $77 |

| Van Buren | $64 |

| West Memphis | $81 |

However, drivers may want to consider increasing their coverage amounts in case the standard amount is not enough.

You never know what type of accident or situation you will find yourself in. Industry-recommended coverage is a minimum of $100,000 bodily injury liability insurance per person and $300,000 per accident.

You can only buy as much insurance as you can afford but ask yourself if you could pay the difference between the state-mandated amount and these costs if you were in a serious accident.

If you are looking for the best auto insurance, do some comparison shopping and consider the risk factors you have when you drive.

Getting Car Insurance in Arkansas

Securing car insurance in Arkansas is not only a legal requirement but also a critical step in protecting yourself financially while on the road. Arkansas requires a minimum coverage of 25/50/25 to provide basic liability protection, but this may not be enough for major accidents or damages.

Exploring additional options like comprehensive and collision coverage, gap insurance, or higher liability limits can provide peace of mind and safeguard your finances against unexpected incidents.

Read more: Collision vs. Comprehensive Auto Insurance

To find the best car insurance in Arkansas, compare rates from companies like USAA, Geico, and State Farm, starting at $22 per month. Choosing the right coverage is important for your safety and financial protection. See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What are the Arkansas car insurance requirements?

Arkansas car insurance requirements mandate all drivers to carry liability insurance with minimum coverage limits of $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $25,000 for property damage. These limits are often referred to as Arkansas minimum liability insurance or Arkansas state minimum auto insurance.

Read more: What is needed for adequate auto insurance coverage?

What is the minimal insurance coverage for Arkansas?

The minimal insurance coverage in Arkansas includes liability insurance that meets the state’s minimum limits of 25/50/25. Additional coverage like uninsured motorist protection or comprehensive insurance is optional but recommended for better financial protection. Get fast and cheap auto insurance coverage today with our quote comparison tool.

What do Arkansas auto insurance requirements cover?

Arkansas auto insurance requirements ensure that drivers have basic liability coverage to pay for damages or injuries caused to others in an accident. This includes coverage for bodily injuries and property damage up to the state-mandated minimums.

Do I need to take car insurance for a second car in Arkansas?

Yes, you need to insure every vehicle you own, including a second car, under Arkansas auto insurance laws. Each vehicle must have at least the Arkansas minimum car insurance requirements, and you should maintain proof of insurance for all vehicles.

What are Arkansas minimum insurance requirements, and how do they compare to other states?

The Arkansas minimum insurance requirements are 25/50/25 liability limits. These are comparable to many states but may be insufficient for covering serious accidents. Drivers are encouraged to increase their coverage limits and consider additional policies for more comprehensive protection.

Are there specific Arkansas insurance laws for uninsured drivers?

Yes, under the Arkansas statute for no insurance, driving without insurance can result in fines, license suspension, and registration revocation. Proof of insurance must be carried at all times when operating a vehicle.

Read more: Can you get auto insurance with a suspended license?

Is Arkansas a no-fault state?

No, Arkansas is not a no-fault state. This means drivers are responsible for damages and injuries they cause to others, making liability car insurance in Arkansas crucial for financial and legal protection.

What do Arkansas car insurance laws say about penalties for no insurance?

Arkansas car insurance laws impose penalties for driving without insurance, including fines starting at $50 for a first offense and escalating for subsequent offenses. Repeat violations can lead to license suspension and higher fines.

Read more: Does a suspended license affect auto insurance rates?

Where can I find an Arkansas auto insurance guide?

You can find information about Arkansas auto insurance coverage in resources like an Arkansas auto insurance guide. These guides typically outline coverage options, state laws, and tips for finding affordable insurance.

Do Arkansas insurance requirements include uninsured motorist coverage?

While not required, uninsured motorist coverage is often recommended under Arkansas insurance laws to protect against accidents with uninsured drivers. It can be added to a policy for enhanced protection.

What is liability car insurance that Arkansas drivers must have?

Liability car insurance in Arkansas drivers must have is coverage that pays for injuries and damages caused to others when the insured driver is at fault. The state requires minimum limits of 25/50/25.

How do Arkansas insurance laws address second vehicles or recreational vehicles?

Arkansas insurance laws require every vehicle, including second cars or recreational vehicles, to have at least the Arkansas minimum liability insurance. These vehicles must be covered under a separate policy or added to an existing one.

What is the difference between Arkansas minimum car insurance requirements and recommended coverage?

The Arkansas minimum car insurance requirements provide basic liability protection but may not cover all damages or medical expenses in severe accidents. Recommended coverage often includes higher liability limits, comprehensive, and collision auto insurance coverage for better financial security.

How does Arkansas auto insurance coverage apply to at-fault accidents?

In Arkansas, which is an at-fault state, the driver responsible for an accident must use their Arkansas auto insurance coverage to pay for damages and injuries caused to others. This makes maintaining adequate liability coverage essential.

What happens if I violate Arkansas insurance law?

Violating Arkansas insurance law can result in fines, suspension of your license and registration, and difficulty obtaining affordable insurance in the future. Ensuring compliance with Arkansas car insurance laws avoids these penalties.

Can I drive without insurance under Arkansas auto insurance laws?

No, driving without auto insurance violates Arkansas auto insurance laws and carries severe penalties. You must maintain proof of insurance that meets the Arkansas minimum liability insurance standards. Use our free comparison tool to see what auto insurance quotes look like in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.