Best Auburndale, Florida Auto Insurance in 2025 (Find the Top 10 Companies Here)

The best Auburndale, Florida auto insurance features Allstate, Travelers, and Farmers, with rates as low as $89 per month. The top providers in this area offer incredibly low rates and extensive benefits that are far superior to those that regular car insurance companies in Auburndale, Florida typically offer.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage in Auburndale Florida

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsCompany Facts

Full Coverage in Auburndale Florida

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in Auburndale Florida

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews

For as low as $89 per month, the best Auburndale, Florida auto insurance providers are Allstate, Travelers, and Farmers. Among these, Allstate offers auto insurance quotes that are as good as the finest. Look into these choices and find what suits you.

With the city’s growing traffic on main routes like Havendale Boulevard and U.S. Highway 92, getting the right coverage is absolutely essential. Continue reading to discover the ideal coverage tailored to your lifestyle, as well as potential discounts to reduce your auto insurance premium.

Our Top 10 Company Picks: Best Auburndale, Florida Auto Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A+ Comprehensive Coverage Allstate

#2 8% A++ Competitive Rates Travelers

#3 20% A Broad Options Farmers

#4 20% A Personalized Service American Family

#5 25% A++ Affordable Premiums Geico

#6 10% A+ Excellent Value Erie

#7 20% B Nationwide Presence State Farm

#8 10% A++ Military Discounts USAA

#9 25% A Customizable Policies Liberty Mutual

#10 12% A+ Innovative Features Progressive

We’ll cover factors that affect auto insurance rates in Auburndale, Florida, including driving history, credit, commute time, and more. Get started on comparing full coverage auto insurance rates by entering your ZIP code above.

- How your driving record affects auto insurance rates in Auburndale, Florida

- Allstate is regarded as top auto insurance company in Auburndale

- How your location influences your car insurance premiums

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Allstate: Top Overall Pick

Pros

- Friendly Premiums: With an average monthly rate of $290, Allstate provides Auburndale drivers with affordably-priced coverage options compared to other local insurers. Learn more in our Allstate auto insurance review.

- Flexible Policy Customization: Allstate empowers Auburndale policyholders to tailor their coverage by selecting from a menu of optional protections, such as roadside assistance and rental reimbursement.

- Potential Savings Opportunities: Auburndale residents insured with Allstate may qualify for a variety of discounts, including price breaks for bundling policies or maintaining a safe driving record.

Cons

- Not for Budget-Conscious: Despite competitive pricing, Allstate’s $290 average monthly premium in Auburndale isn’t the lowest available, which may deter exceptionally budget-conscious consumers.

- Finite Local Footprint: Compared to some regional providers, Allstate’s local agent network in Auburndale may be less expansive, potentially resulting in a less personalized service experience.

#2 – Travelers: Best for Competitive Rates

Pros

- Competitively-Priced Premiums: As outlined in our Travelers auto insurance review, Travelers offers one of the more affordable rates in Auburndale, Florida, with an average monthly premium of $275, making them a competitive option for budget-conscious drivers.

- Extensive Policy Options: Travelers provides Auburndale residents with a broad selection of coverage choices, from basic liability to comprehensive and collision protection, making it simple to design a policy that fits their needs.

- Discount Variety: From safe driving discounts to multi-policy savings, Travelers extends numerous opportunities for Auburndale policyholders to trim their premium costs.

Cons

- Varying Customer Service Quality: Travelers’ policyholder support in Auburndale can be unpredictable, with some customers expressing frustration with the claims process and overall responsiveness.

- Narrower Local Presence: Travelers may have a more limited selection of local agents in Auburndale relative to other providers, potentially complicating the process of obtaining in-person assistance.

#3 – Farmers: Best for Broad Options

Pros

- Affordable Rate Options: Farmers’ average monthly premium of $287 makes them a competitively-priced choice for Auburndale drivers seeking economical auto insurance. See more details in our page titled Farmers auto insurance review.

- Adjustable Policy Selections: Farmers allows Auburndale policyholders to craft semi-custom coverage by choosing from an array of optional add-ons, such as roadside assistance and rental car coverage.

- Potential Rate Reductions: Auburndale’s Farmers customers may trim their premiums by taking advantage of numerous discounts, including price breaks for safe driving and multi-policy savings.

Cons

- Marginally Higher Premiums: While competitively priced, Farmers’ average Auburndale rate of $287 per month trends slightly above the most budget-friendly options in the area.

- Inconsistent Service Quality: Some Auburndale policyholders have reported uneven experiences with Farmers’ support team, ranging from seamless interactions to frustrating delays in the claims process.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – American Family: Best for Personalized Service

Pros

- Moderately-Priced Options: At an average of $283 per month, American Family offers reasonably-priced coverage choices for Auburndale motorists. Learn more about their ratings in our American Family auto insurance review.

- Well-Rounded Coverage Selections: American Family provides an extensive menu of coverage options, including hard-to-find protections like accident forgiveness, allowing Auburndale drivers to obtain suitable coverage.

- Multiple Discount Opportunities: From safe driving discounts to price breaks for insuring multiple vehicles, American Family offers numerous ways for Auburndale policyholders to reduce their premiums.

Cons

- Not for Price-Sensitive Shoppers: While not exorbitant, American Family’s Auburndale rates are marginally higher than the lowest-priced alternatives, which may deter particularly price-sensitive shoppers.

- Varying Local Experiences: Some Auburndale customers have reported inconsistencies in the availability and attentiveness of local American Family agents.

#5 – Geico: Best for Affordable Premiums

Pros

- Unbeatable Base Rates: As mentioned in our Geico auto insurance review, Geico offers the lowest average monthly premium of $263 in Auburndale, Florida, making them a top choice for those seeking affordable auto insurance coverage.

- Impressive Discount Selection: Geico offers Auburndale policyholders a wide array of potential discounts, including price breaks for safe driving habits and customer loyalty, to further reduce already-low premiums.

- Acclaimed Digital Presence: Auburndale’s tech-savvy motorists appreciate Geico’s user-friendly online resources and mobile app for seamless policy management and claims filing.

Cons

- Fewer Coverage Options: Geico may not offer as many coverage options in Auburndale, Florida, as some other insurers do, which may restrict your ability to customize your policy.

- Unpredictable Claim Experiences: Some Auburndale policyholders have expressed dissatisfaction with Geico’s claims process, citing slow response times and unsatisfactory settlements.

#6 – Erie: Best for Excellent Value

Pros

- Reasonable Pricing Structure: As mentioned in Erie auto insurance review, Erie offers attractively-priced policies in Auburndale, with an average monthly premium of $270, allowing drivers to secure quality coverage at a fair price point.

- Well-Rounded Coverage Choices: Erie’s Auburndale policyholders can select from an extensive range of coverage options, including extras like pet injury protection and locksmith services, to craft a robust policy.

- Generous Discount Options: From multi-policy price breaks to premium reductions for installing anti-theft devices, Erie offers Auburndale drivers numerous ways to save.

Cons

- Higher Prices Than Rivals: While Erie’s average Auburndale premium of $270 is reasonable, certain competitors offer lower base rates, which may appeal to the most budget-conscious consumers.

- Isolated Service Frustrations: A handful of Auburndale customers have reported disappointing experiences with Erie’s claims processing and general responsiveness, though overall satisfaction remains strong.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – State Farm: Best for Nationwide Presence

Pros

- Economical Rate Options: State Farm offers moderately-priced auto insurance in Auburndale, with an average monthly premium of $275 that falls in line with other mid-tier providers.

- Policy Personalization Possibilities: Auburndale motorists can tailor their State Farm policy to their needs by choosing from an array of optional coverages, such as rental car and travel expense protection.

- Discount-Driven Savings: From safe driving discounts to savings for insuring multiple vehicles, State Farm provides Auburndale policyholders with a variety of rate reduction opportunities. For discounts read our State Farm auto insurance discounts.

Cons

- Service Quality Insights: While State Farm offers generally satisfactory support, detailed data on their customer service performance in Auburndale is limited, potentially giving some policyholders pause.

- Financial Stability: Detailed information on State Farm’s financial strength and long-term reliability is not readily supplied to Auburndale customers, which may complicate risk assessment for cautious consumers.

#8 – USAA: Best for Military Discounts

Pros

- Accident Forgiveness Program: USAA offers accident forgiveness, helping Auburndale drivers avoid premium increases after the first at-fault accident.

- Safe Driver Rewards: As outlined in USAA auto insurance review, the company rewards safe Auburndale drivers with discounts, helping them lower overall premium costs.

- Rental Car Reimbursement: USAA provides rental car coverage in Auburndale, Florida as an add-on, ensuring you’re covered if your vehicle is being repaired.

Cons

- Complex Policy Customization: Understanding and selecting the right coverage options with USAA can be complicated for drivers in Auburndale, Florida.

- Service Availability Issues: USAA’s customer service might be less accessible in more remote areas of Auburndale.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Reliable Financial Strength: Liberty Mutual’s solid financial standing ensures they can reliably pay out claims.

- Safe Driver Discounts: As mentioned in our Liberty Mutual auto insurance review, the company rewards drivers with clean records, Auburndale drivers can get this to reduce overall premium costs.

- New Car Replacement: Liberty Mutual offers new car replacement coverage, adding value for new Auburndale vehicle owners.

Cons

- Rate Increase Potential: Liberty Mutual policyholders in Auburndale, Florida may see premium increases upon renewal, which could be unexpected.

- Inconsistent Customer Service: Liberty Mutual’s customer service in Auburndale, Florida can be inconsistent, with some customers reporting issues with claims processing and support.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Progressive: Best for Innovative Features

Pros

- Affordable Rates: As mentioned in Progressive auto insurance review, Progressive offers affordable auto insurance rates in Auburndale, Florida, with an average monthly premium of $265, making them a good option for budget-conscious drivers.

- Multi-Policy Discounts: Progressive offers discounts for bundling multiple policies, such as home and auto insurance for Auburndale drivers, leading to savings.

- User-Friendly Digital Experience: Progressive’s website and mobile app are well-regarded for their ease of use in Auburndale, Florida and extensive features.

Cons

- Higher Deductible Options: Some policyholders in Auburndale, Florida may find Progressive’s deductible options to be on the higher side.

- Discount Eligibility Complexity: Qualifying for certain discounts with Progressive in Auburndale, Florida can be challenging due to specific criteria.

The Required Auto Insurance in Auburndale, Florida

In Auburndale, Florida, the table laid out the monthly insurance rates. It showed the costs for both minimum and full coverage, side by side, from different providers.

Auburndale, Florida Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $108 $290

American Family $103 $283

Erie $95 $270

Farmers $109 $287

Geico $93 $263

Liberty Mutual $104 $280

Progressive $97 $265

State Farm $100 $275

Travelers $101 $275

USAA $89 $255

Auto insurance laws in Auburndale, Florida state that you maintain financial accountability in the event of an accident by carrying at least the minimum amount of coverage required by the state. An overview of Auburndale’s mandatory auto insurance is provided below:

- $10,000 for property damage liability coverage

- $10,000 for bodily injuries per person

- $20,000 for total bodily injury per accident

Read More: Does auto insurance cover passengers in an accident?

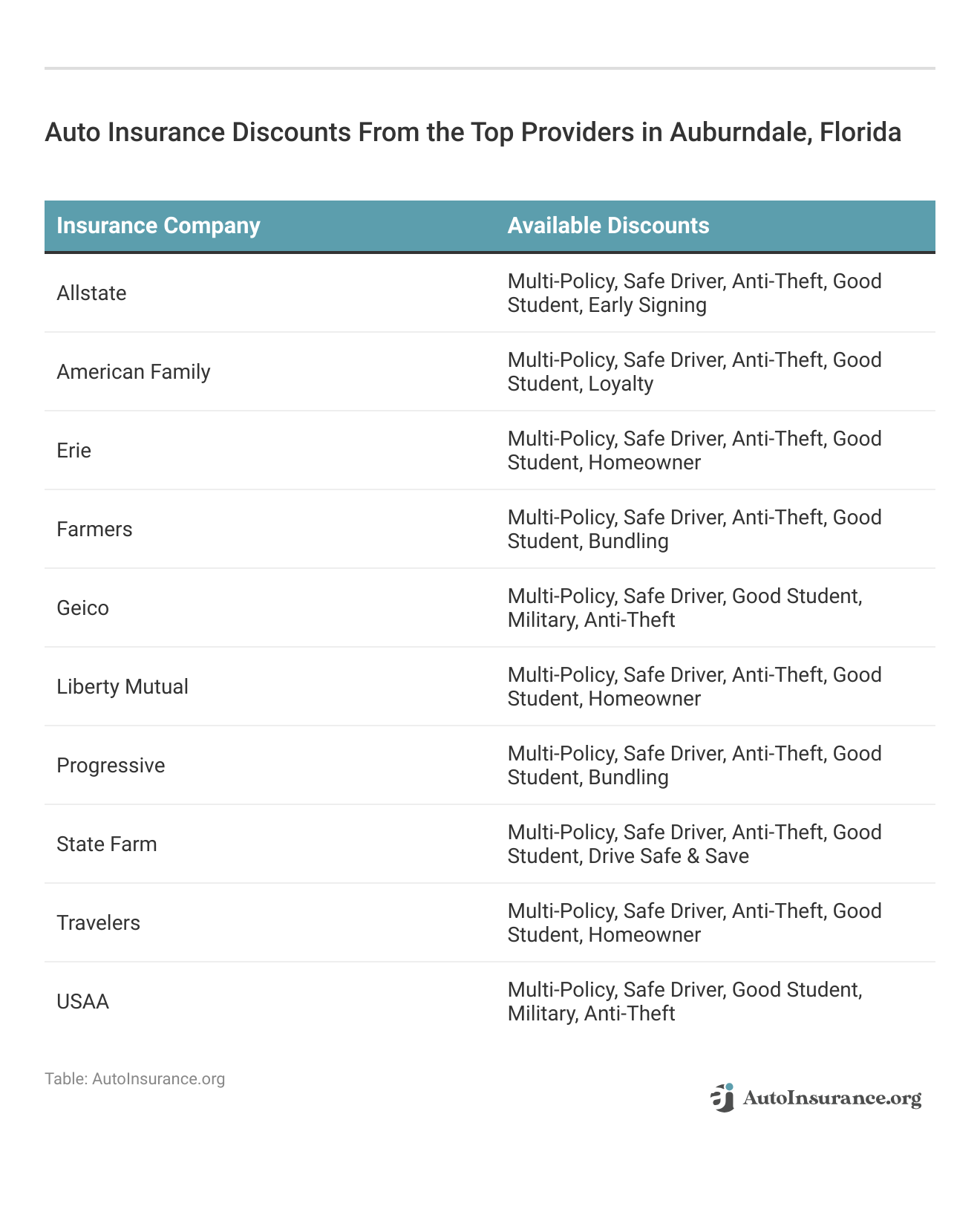

Learn about an array of car insurance discounts available from leading providers in Auburndale, Florida, intended to help you lower your premiums and save money.

Car owners in Auburndale, Florida, may utilize the discounts provided by top insurance providers to save money, advocating for protection on the road.

How Age & Gender Affect Your Rates in Auburndale, FL

In Auburndale, Florida, your insurance rates can vary significantly due to factors like age, gender, and the provider you choose. These elements play a crucial role in determining your premiums, with each provider offering different rates based on demographic profiles.

Auburndale, Florida Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $355 | $339 | $309 | $314 | $1,238 | $1,339 | $354 | $359 |

| Geico | $227 | $228 | $213 | $213 | $406 | $509 | $250 | $254 |

| Liberty Mutual | $284 | $284 | $260 | $260 | $598 | $920 | $284 | $384 |

| Nationwide | $232 | $229 | $207 | $214 | $554 | $682 | $255 | $265 |

| Progressive | $300 | $283 | $257 | $275 | $841 | $919 | $361 | $347 |

| State Farm | $160 | $160 | $145 | $145 | $441 | $567 | $177 | $189 |

| USAA | $139 | $137 | $130 | $129 | $479 | $556 | $174 | $187 |

Understanding how these factors impact your insurance costs can help you make more informed decisions and find the best coverage for your needs.

Read More: Best Auto Insurance for Drivers Under 25

Insurance rates for younger, single drivers are typically higher because of their increased risk factors, whereas older, married individuals often enjoy more favorable premiums.

The differences in rates between a young single driver and a more experienced married driver can be substantial.Eric Stauffer LICENSED INSURANCE AGENT

There are options for auto insurance that fit your driving style, age, and gender. In this manner, you obtain the appropriate coverage for your needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Your Driving Record Affects Auto Insurance Rates in Auburndale, Florida

Your driving record really affects your insurance costs. Check out how the monthly rates vary in Auburndale, Florida, between drivers with clean records and those who have past violations.

Auburndale, Florida Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One Ticket | One DUI |

|---|---|---|---|---|

| Allstate | $495 | $595 | $551 | $662 |

| Geico | $200 | $256 | $313 | $381 |

| Liberty Mutual | $296 | $383 | $403 | $554 |

| Nationwide | $282 | $309 | $313 | $416 |

| Progressive | $353 | $523 | $475 | $440 |

| State Farm | $227 | $269 | $248 | $248 |

| USAA | $189 | $233 | $198 | $346 |

Maintaining a spotless driving record could substantially decrease your auto insurance costs in Auburndale, Florida.

Traffic violations and accidents can lead to higher rates, underscoring the importance of safe driving habits to manage your insurance costs effectively, especially when navigating busy routes like U.S. Highway 92 and Havendale Boulevard in Auburndale, Florida.

Auto Insurance Rates in Auburndale, FL Following a DUI

Once you have a DUI record in your profile, your car insurance rates will definitely go up. Take a look at the monthly costs from different companies to find the best deal for you.

Auburndale, Florida Full Coverage Auto Insurance Rates After a DUI

| Insurance Company | Monthly Rates |

|---|---|

| Allstate | $662 |

| Geico | $381 |

| Liberty Mutual | $554 |

| Nationwide | $416 |

| Progressive | $440 |

| State Farm | $248 |

| USAA | $346 |

After a DUI, you may have a hard time finding cheap rates for your auto insurance. Try to compare various providers thoroughly to find a policy that offers the necessary coverage without exceeding your budget.

Read More: Cheap Auto Insurance After a DUI

Credit History Impact on Auto Insurance Rates in Auburndale, FL

Having bad credit score can increase your auto insurance rates greatly, the table below shows how different credit scores affect your insurance costs.

Auburndale, Florida Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $804 | $510 | $414 |

| Geico | $419 | $253 | $190 |

| Liberty Mutual | $527 | $387 | $314 |

| Nationwide | $413 | $303 | $274 |

| Progressive | $584 | $414 | $345 |

| State Farm | $338 | $223 | $183 |

| USAA | $392 | $193 | $140 |

Now you have the gist of how your credit score impacts your insurance costs. Be sure to explore our top 10 providers mentioned above to find the best coverage that fits your credit profile.

Exploring Auto Insurance Costs Across ZIP Codes in Auburndale, Florida

Even ZIP codes will affect your insurance rates. The table below will let you understand how your location influences your car insurance premiums.

Auburndale, Florida Full Coverage Auto Insurance Rates by ZIP Code

| ZIP Code | Monthly Rates |

|---|---|

| 33850 | $250 |

| 33823 | $280 |

Where you live in Auburndale, specifically your ZIP code, plays a role in determining your auto insurance premiums. If you want more information, check out our article titled “Why did my auto insurance rates increase when I moved?” for more information.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Effect of Commute on Auto Insurance Rates in Auburndale, FL

Each day you drive adds to the miles you tally each year, and this can change what you pay for auto insurance in Auburndale, Florida. By looking at how different commutes hit your wallet, you can find the insurance that saves you the most money.

Auburndale, Florida Full Coverage Auto Insurance Monthly Rates by Annual Mileage

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $560 | $592 |

| Geico | $286 | $289 |

| Liberty Mutual | $396 | $422 |

| Nationwide | $330 | $330 |

| Progressive | $448 | $448 |

| State Farm | $239 | $256 |

| USAA | $239 | $244 |

From the table above, you can see that the miles you drive each year bear heavily on your auto insurance costs. For more information, read our article titled “Most Expensive Commutes in America.”

What Affects Auto Insurance Rates in Auburndale, Florida

In Auburndale, Florida, the cost of auto insurance can swing wildly. The heavy traffic on Havendale Boulevard during rush hour and the frequent car thefts near Lake Ariana play a big part in this. Knowing the lay of the land, especially the roads you often take, is key to figuring out and controlling your insurance expenses.

Auburndale Auto Theft Statistics

When cars get stolen more often, insurance costs go up because companies have to pay out more claims. The FBI says Auburndale, Florida, had 25 cars stolen last year. That’s why insurance rates are higher now.

Read More: If someone breaks into your car, does insurance cover it?

Commute Time in Auburndale

Longer commutes often drive up auto insurance premiums, and in Auburndale, Florida, where the average commute down Havendale Boulevard or along U.S. Highway 92 is around 32 minutes, this trend holds true, according to City-Data.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool below to instantly compare prices from various companies near you.

Frequently Asked Questions

Who is the best car insurance company in Florida?

The best car insurance company in Florida can vary depending on individual needs, but companies like Allstate, Geico, and State Farm are frequently mentioned for their strong customer service, coverage options, and competitive rates in Auburndale.

What is the most basic car insurance in Florida?

The most basic car insurance in Florida is the state’s minimum required coverage, which is 10/20/10. This includes $10,000 for property damage liability, $10,000 for personal injury protection (PIP), and $20,000 for bodily injury liability per accident.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Who has the lowest auto insurance rates in Florida?

Geico and USAA are known for offering some of the lowest auto insurance rates in Florida. It’s important to compare multiple quotes to find the most affordable rates for your situation in Auburndale, FL. For more information, read our article titled “How to Save Money by Bundling Insurance Policies.”

Why is Florida insurance so expensive?

Florida insurance tends to be more expensive due to high accident rates, frequent natural disasters, and a large number of uninsured drivers. The state’s no-fault insurance system also contributes to higher premiums.

How much is normal car insurance in Florida?

The average cost of car insurance in Florida is around $197 per month, but this can vary significantly based on factors such as age, driving record, and the specific area within Florida, including Auburndale.

Read More: Cheap Auto Insurance for Drivers Over 60

Which insurance company has the highest customer satisfaction in Florida?

According to various customer satisfaction surveys, USAA and State Farm often rank highest for customer satisfaction in Florida. These companies are recognized for their responsive customer service and comprehensive coverage options.

Who is known for having the cheapest car insurance?

Geico is often recognized as one of the companies that consistently offers the cheapest car insurance rates, particularly in Florida, where competition among insurers is intense.

Get started on comparing full coverage auto insurance rates by entering your ZIP code below.

What auto insurance is required in Florida?

In Florida, drivers are required to carry a minimum of $10,000 in personal injury protection (PIP) and $10,000 in property damage liability (PDL). This minimum coverage ensures that drivers meet the state’s financial responsibility laws.

What are the two types of insurance in Florida?

The two main types of insurance required in Florida are personal injury protection insurance (PIP) and property damage liability (PDL). PIP covers your own injuries in an accident, while PDL covers damage you cause to other people’s property.

Is Geico a good insurance in Florida?

Yes, Geico is considered a good insurance option in Florida, known for its affordability, extensive coverage options, and strong customer satisfaction ratings. It’s a popular choice in Auburndale and other parts of the state.

Read More: Geico Auto Insurance Review

Who has the best auto insurance rates in Florida?

USAA, Geico, and State Farm are frequently cited for having some of the best auto insurance rates in Florida, offering competitive prices and robust coverage options to suit various needs.

How much is car insurance per month in Florida?

The average monthly cost of car insurance in Florida is approximately $197, but this can vary widely depending on factors such as location, driving history, and the type of coverage selected.

Which insurance company is best at paying claims?

USAA, State Farm, and Amica are often praised for their efficiency and fairness in paying claims, making them top choices for drivers who prioritize a smooth claims process.

Read More: Does cheap no-fault auto insurance exist?

What is the minimum auto insurance in Florida?

The minimum auto insurance required in Florida is 10/20/10 coverage, which includes $10,000 for property damage liability, $10,000 for personal injury protection (PIP), and $20,000 for bodily injury liability per accident.

What are the average auto insurance rates for senior drivers in Auburndale, FL?

The average auto insurance rates for senior drivers in Auburndale, FL are $219 per month. However, rates can vary depending on factors such as driving record, vehicle type, and coverage level.

What factors determine the cost of auto insurance in Auburndale, Florida?

Auto insurance rates in Auburndale, Florida are influenced by various factors including age, gender, marital status, driving record, credit history, commute length, ZIP code, and coverage level.

Is Progressive insurance good in Florida?

Yes, Progressive is considered a good option in Florida, known for its innovative coverage options, competitive rates, and strong customer service. It’s a viable choice for drivers in Auburndale looking for reliable insurance coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.