Best Auto Insurance for Doctors in 2025 (Your Guide to the Top 10 Companies)

USAA, State Farm, and Geico provide the best auto insurance for doctors, with rates beginning at just $76 per month. Our goal is to simplify the process of comparing premiums from these reputable companies, ensuring you receive the best coverage options and personalized discounts that align with your specific vehicle requirements.

Read more

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Mar 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Doctors

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Doctors

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Doctors

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews- USAA provides competitive rates starting at $76 per month

- Leading insurance firms offer potential reductions

- Doctors’ auto insurance includes opportunities for discounts

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Geico is known for offering competitive rates, making it a cost-effective option for many drivers.

- Easy Online Tools: Geico provides convenient online tools for managing policies, filing claims, and obtaining quotes, enhancing customer experience. Read our Geico auto insurance review for details.

- Wide Range of Discounts: Geico offers a variety of discounts, including those for safe driving, vehicle safety features, and bundling policies, helping customers save money.

Cons

- Limited Coverage Options: Geico may have fewer coverage options compared to some other insurers, potentially limiting customization for certain policyholders.

- Mixed Customer Service Reviews: While Geico generally receives positive reviews for its customer service, some customers have reported issues with claims processing and responsiveness.

#2 – USAA: Best for Military Savings

Pros

- Excellent Customer Service: As mentioned in our USAA auto insurance review, USAA is renowned for its exceptional customer service, consistently receiving high ratings in customer satisfaction surveys.

- Competitive Rates: USAA offers competitive rates for auto insurance, particularly for military members, veterans, and their families.

- Financial Stability: USAA has a strong financial standing and a high credit rating, providing peace of mind to policyholders.

Cons

- Limited Eligibility: USAA membership is restricted to military personnel, veterans, and their immediate families, excluding the general public from accessing its services.

- Limited Physical Locations: USAA operates primarily online and through phone services, which may be inconvenient for individuals who prefer in-person interactions or live in areas with limited internet access.

#3 – State Farm: Best for Customer Service

Pros

- Personalized Service: State Farm agents offer personalized assistance, helping customers understand their coverage options and tailor policies to their specific needs.

- Extensive Network of Agents: State Farm boasts a vast network of agents across the country, providing accessibility and support to policyholders in various locations.

- Strong Reputation: State Farm has a long-standing reputation for reliability and financial stability, instilling confidence in its policyholders. Find out more in our State Farm auto insurance review.

Cons

- Potentially Higher Rates: State Farm’s rates may be higher compared to some other insurers, particularly for drivers with certain risk factors or demographics.

- Limited Discounts: While State Farm offers some discounts, such as those for safe driving and vehicle safety features, its discount offerings may be more limited compared to competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Add-on Coverages

Pros

- Diverse Coverage Options: Allstate offers a wide range of coverage options and add-on policies, allowing customers to customize their insurance plans according to their needs. Use our Allstate auto insurance review as your guide.

- Innovative Features: Allstate provides innovative features such as Drivewise, which tracks driving behavior to potentially earn discounts, and Claim Satisfaction Guarantee, ensuring customers are satisfied with claim outcomes.

- Strong Financial Strength: Allstate has a strong financial standing and a history of stability, giving customers confidence in the company’s ability to fulfill its obligations.

Cons

- Potentially Higher Premiums: Allstate’s premiums may be higher compared to some other insurers, especially for drivers with certain risk factors or coverage needs.

- Mixed Customer Service Reviews: While Allstate receives positive feedback for its innovative features and coverage options, some customers have reported issues with claim processing and customer service responsiveness.

#5 – Progressive: Best for Safe-Driving Discounts

Pros

- Variety of Discounts: Progressive offers a wide range of discounts, including those for safe driving, multi-policy bundling, and usage-based insurance programs like Snapshot.

- User-Friendly Tools: Progressive provides user-friendly online tools and mobile apps for managing policies, filing claims, and obtaining quotes, enhancing customer convenience.

- Flexible Payment Options: In our Progressive auto insurance review, progressive offers flexible payment options, including customizable payment schedules and automatic payments, giving customers greater control over their finances.

Cons

- Average Customer Service: Progressive’s customer service may receive mixed reviews, with some customers reporting issues with claim processing and communication.

- Potential Rate Increases: Progressive’s rates may increase over time, especially for policyholders who file claims or experience changes in their driving records, potentially leading to higher premiums.

#6 – Farmers: Best for Safe Drivers

Pros

- Personalized Coverage Options: Farmers offers a variety of coverage options and add-ons, allowing customers to tailor their policies to their specific needs.

- Strong Customer Support: Farmers provides dedicated customer support through its network of agents, offering personalized assistance and guidance.

- Extensive Discounts: Farmers offers numerous discounts, including those for safe driving, multi-policy bundling, and loyalty, helping customers save on their premiums.

Cons

- Potentially Higher Rates: Farmers’ rates may be higher compared to some other insurers, particularly for drivers with certain risk factors or demographics. Use our Farmers auto insurance review as your guide.

- Limited Online Tools: Farmers’ online tools and digital resources may be less robust compared to some other insurers, potentially impacting customer convenience and accessibility.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Add-on Coverages

Pros

- Comprehensive Coverage Options: Liberty Mutual offers a wide range of coverage options, including specialized policies for unique needs such as classic cars or rental properties.

- Customizable Policies: Liberty Mutual allows customers to customize their policies with add-ons and endorsements, providing flexibility to meet individual coverage needs. Check other details through our Liberty Mutual auto insurance review.

- Multi-Policy Discounts: Liberty Mutual offers discounts for bundling multiple policies, such as auto and home insurance, helping customers save on their premiums.

Cons

- Mixed Customer Service Reviews: Liberty Mutual’s customer service may receive mixed reviews, with some customers reporting issues with claims processing and communication.

- Potentially Higher Premiums: Liberty Mutual’s premiums may be higher compared to some other insurers, especially for drivers with certain risk factors or coverage needs.

#8 – Nationwide: Best for Accident Forgiveness

Pros

- Strong Financial Stability: As mentioned in our Nationwide insurance review, nationwide has a strong financial standing and a long history of stability, providing reassurance to policyholders about the company’s ability to fulfill its obligations.

- Wide Range of Discounts: Nationwide offers numerous discounts, including those for safe driving, vehicle safety features, and multi-policy bundling, helping customers save on their premiums.

- Nationwide Network: Nationwide operates across the country, providing accessibility and support to policyholders in various locations.

Cons

- Potentially Higher Rates: Nationwide’s rates may be higher compared to some other insurers, particularly for drivers with certain risk factors or demographics.

- Limited Coverage Options: Nationwide’s coverage options may be more limited compared to some other insurers, potentially affecting customization for certain policyholders.

#9 – Travelers: Best for Bundling Policies

Pros

- Flexible Coverage Options: Travelers offers flexible coverage options and add-ons, allowing customers to customize their policies to their specific needs.

- Enhanced Coverage Features: Travelers provides enhanced coverage features such as accident forgiveness and new car replacement, providing added protection and peace of mind to policyholders.

- Strong Financial Strength: Our Travelers auto insurance review reveals that, travelers has a strong financial standing and a high credit rating, ensuring stability and reliability for its policyholders.

Cons

- Potentially Higher Premiums: Travelers’ premiums may be higher compared to some other insurers, especially for drivers with certain risk factors or coverage needs.

- Limited Discounts: Travelers’ discount offerings may be more limited compared to some other insurers, potentially impacting opportunities for savings on premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – AAA: Best for Membership Discount

Pros

- Membership Benefits: AAA members may access additional benefits such as roadside assistance, travel discounts, and insurance coverage options, enhancing overall value.

- Multi-Policy Discounts: AAA offers discounts for bundling multiple policies, such as auto and home insurance, providing opportunities for savings on premiums.

- Excellent Customer Service: AAA is known for its exceptional customer service, providing dedicated support to members for their insurance needs, roadside assistance, and beyond.

Cons

- Membership Requirement: AAA insurance is typically available to AAA members only, limiting access to individuals who are not members of the organization. Read our AAA auto insurance review for your guidance.

- Potentially Limited Coverage Options: AAA’s coverage options may be more limited compared to some other insurers, potentially affecting customization for certain policyholders.

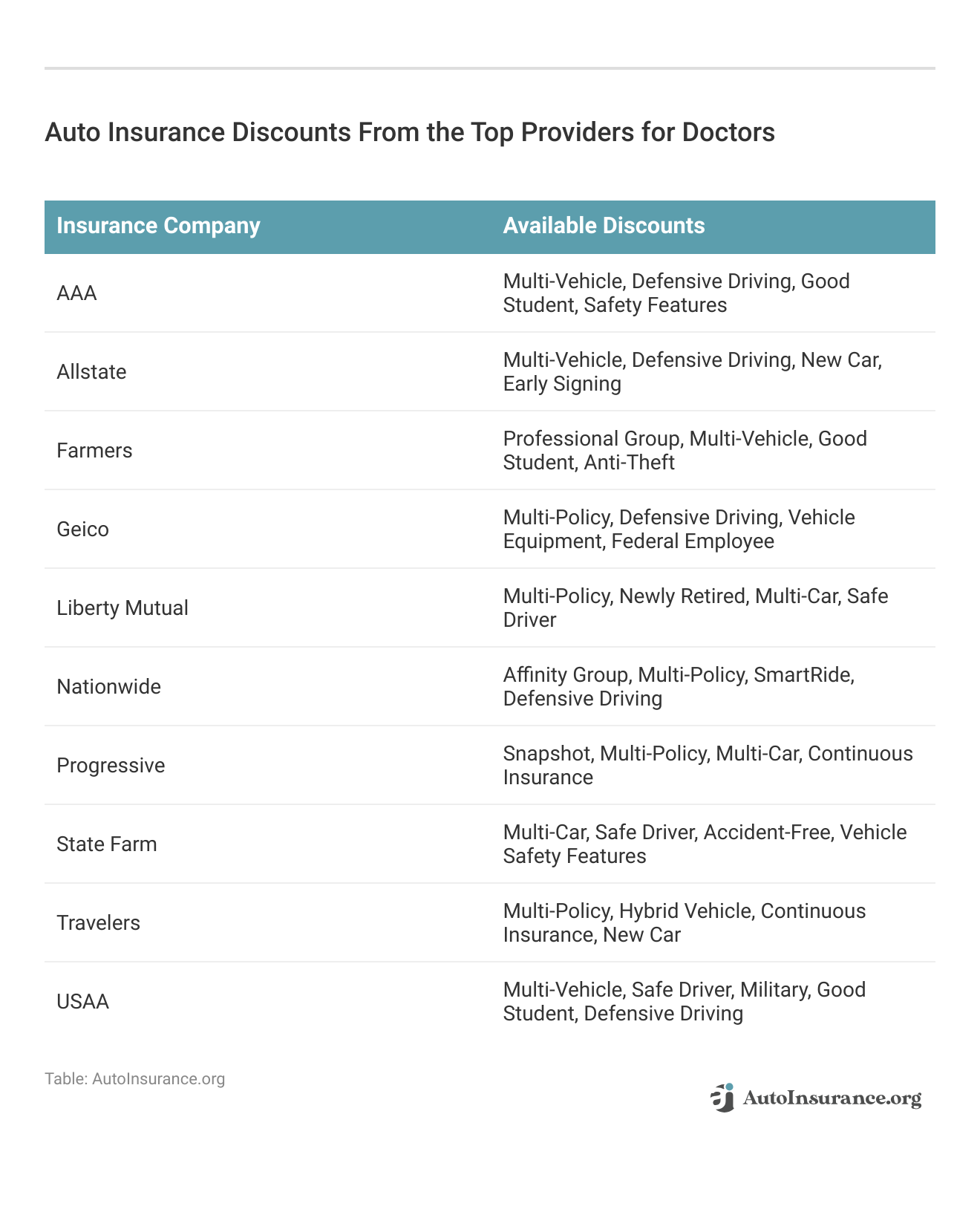

Auto Insurance Discounts For Doctors

Being a Doctor Affecting Auto Insurance Rates

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Determining Auto Insurance Rates for Medical Professionals

If you’re a busy doctor and in need of better auto insurance, save time by using our free online quote tool. Enter your ZIP code below to start comparing auto insurance rates.

Frequently Asked Questions

How often should doctors review and update their auto insurance policy?

Doctors should review and update their policy annually or when significant changes occur in their driving habits, vehicle usage, or personal circumstances.

Can doctors use personal auto insurance for business purposes?

Personal auto insurance usually excludes coverage for regular business use. Doctors may need to consider commercial auto insurance for business-related vehicle usage. Enter your ZIP code now.

What should doctors do if they’re in an accident while on duty?

Can doctors add multiple vehicles to the same auto insurance policy?

Yes, doctors can typically add multiple vehicles to the same policy, providing convenience and potential multi-vehicle discounts.

How can doctors ensure their auto insurance covers medical equipment?

Doctors should discuss their need for medical equipment coverage with their insurance provider and consider adding it as an endorsement or rider. Enter your ZIP code to start comparing today.

Can doctors be denied auto insurance coverage based on their profession?

Do doctors need umbrella insurance?

It’s recommended to have an umbrella policy between $1-$5 million and consider bundling with auto insurance for cheaper rates, doctors life insurance.

How much insurance do doctors need for their cars?

Depends on the car’s value. At minimum you should carry the state minimum liability coverage but most doctor’s should consider higher values on their vehicle unless you’ve got funds set aside to pay out of pocket for claims — including your health insurance for doctors. Enter your ZIP code now.

What car insurance coverages are available to doctors?

Doctors can get basic coverage options such as liability, collision, and comprehensive auto insurance.

Liability auto insurance has two elements: bodily injury and property damage liability. How much liability insurance covers depends on the state.

Collision and comprehensive auto insurance pay for two different types of damage. Collision coverage pays for property damage regardless of fault in an accident, while comprehensive coverage pays for property damage that doesn’t involve a collision.

How being a doctor affects auto insurance rates?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.